Today, we present a guest post written by David Papell and Ruxandra Prodan, Professor and Instructional Associate Professor of Economics at the University of Houston.

The Federal Open Market Committee (FOMC) raised the target range for the federal funds rate (FFR) by 50 basis points from 0.25 – 0.5 percent to 0.75 – 1.0 percent at its May 4 meeting and “anticipates that ongoing increases in the target range will be appropriate.” This followed a 25 basis point increase from the effective lower bound (ELB) of 0.0 – 0.25 percent in the March meeting, the first increase from the ELB in two years. In the press conference following the meeting, Fed Chair Powell went further by saying that “There is a broad sense on the committee that additional 50 basis point increases should be on the table for the next couple of meetings.”

The FOMC has been the subject of criticism for falling “behind the curve” by failing to raise the FFR in the face of rising inflation. In a recent paper, “Policy Rules and Forward Guidance Following the Covid-19 Recession,” we show how the FFR fell behind policy rule prescriptions and what it would take to get back “on track”.

Much of the discussion of the Fed being behind the curve depends on subjective analysis of when liftoff from the ELB should have occurred. We use data from the Summary of Economic Projections (SEP) from September 2020 to March 2022 to compare policy rule prescriptions with actual and FOMC projections of the FFR. This provides a precise definition of “behind the curve” as the difference between the FFR prescribed by policy rules and the actual FFR.

The FOMC adopted a far-reaching Revised Statement on Longer-Run Goals and Monetary Policy Strategy in August 2020. The framework contains two major changes from the original 2012 statement. First, policy decisions will attempt to mitigate shortfalls, rather than deviations, of employment from its maximum level. Second, the FOMC will implement Flexible Average Inflation Targeting where, “following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”

At its September 2020 meeting, the Committee approved outcome-based forward guidance, saying that it expected to maintain the target range of the FFR at the ELB “until labor market conditions have reached levels consistent with the Committee’s assessment of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.”

We consider six policy rules. The Taylor (1993) rule prescribes that the FFR equal the inflation rate plus 0.5 times the inflation gap, the difference between the inflation rate and the 2 percent inflation target, plus 1.0 times the unemployment gap, the difference between the rate of unemployment in the longer run and the realized unemployment rate, plus the neutral real interest rate. The balanced approach rule in Yellen (2012) raises the coefficient on the unemployment gap to 2.0 while maintaining the coefficient of 0.5 on the inflation gap. The Taylor and balanced approach (shortfalls) rules are identical to the original rules except that they do not prescribe a rise in the FFR when unemployment falls below longer-run unemployment.

Neither the original nor the shortfalls rules are consistent with the revised statement. We introduce two new rules in accord with the revised statement that we call the Taylor and balanced approach (consistent) rules. First, we replace the rate of unemployment in the longer run with the unemployment rate consistent with maximum employment and base FFR prescriptions on shortfalls instead of deviations. Second, if inflation rises above 2 percent, the rule is amended to allow it to equal the inflation rate “moderately” above 2 percent that the FOMC is willing to tolerate “for some time” before raising rates in order to bring inflation down to the 2 percent target.

Starting with the original Taylor rule, normative policy rule prescriptions are typically “non-inertial” as the prescribed FFR depends on the realized values of the right-hand-side variables. Following Clarida, Gali, and Gertler (1999), estimated Taylor-type rules are typically “inertial” to incorporate slow adjustment of the actual FFR to changes in the prescribed FFR. Policy rule forward guidance, however, involves normative policy rule prescriptions that need to be inertial when inflation rises quickly in order to be in accord with the FOMC’s desire to smooth out large rate increases over time. We follow Bernanke, Kiley, and Roberts (2019) and specify inertial rules with a coefficient of 0.85 on the lagged FFR and 0.15 on the target level of the FFR specified by the corresponding non-inertial rule.

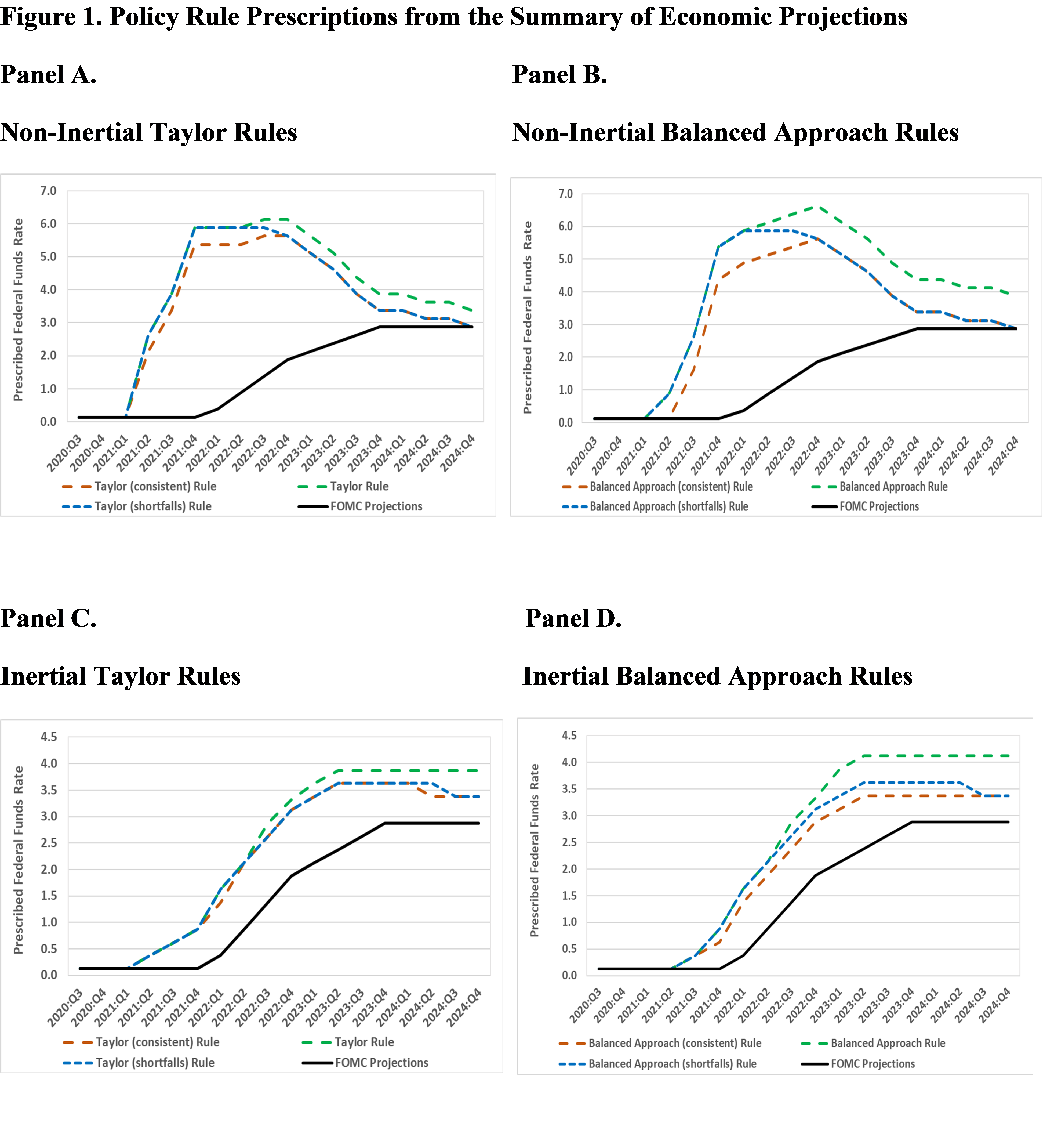

Figure 1 depicts the actual FFR for September 2020 to March 2022 and the projected FFR from the March 2022 SEP for June 2022 to December 2024. Following liftoff from the ELB in March 2022, the FOMC projected six more 25 basis point rate increases (one each meeting) in 2022, four 25 basis point rate increases (one every other meeting) in 2023, and a constant range of the FFR of 2.75 – 3.0 percent in 2024. The FOMC has already exceeded that pace by increasing the FFR by 50 basis points on May 4.

Panels A and B illustrate prescriptions from the non-inertial rules. Five of the six rules prescribe liftoff from the ELB in 2021:Q2, three quarters earlier than the actual liftoff. All of the non-inertial rules prescribe unrealistic jumps in the FFR. For the Taylor rules, there are prescribed jumps of at least 200 basis points in 2021:Q2 and 2021:Q4 and, for the balanced approach rules, there is a 275 basis point jump in 2021:Q4. The prescribed rate increases peak by the end of 2022 and, for the shortfalls and consistent rules, which are more in accord with Fed policy than the original rules, the prescriptions are equal to the FOMC projections at the end of 2024.

Panels C and D show prescriptions from the inertial rules. The prescribed liftoff from the ELB is slightly later than with the non-inertial rules, 2021:Q2 for the Taylor rules and 2021:Q3 for the balanced approach rules. The inertial rules prescribe much more realistic paths for the FFR than the non-inertial rules. Almost all of the prescribed rate increases are 25 basis points and there are no increases greater than 50 basis points. In March 2022, the prescribed FFR’s were 1.25 percent higher than the actual FFF for the original and shortfalls rules and 1.0 percent higher for the consistent rules. The prescribed FFR’s with the inertial rules continue to increase but much more slowly than those with the non-inertial rules. At the end of 2024, the prescribed FFR’s with the shortfalls and consistent rules are 50 basis points higher than the FOMC projections.

Following the 50 basis point increase in the FFR at its May 4 meeting, how can the FOMC eliminate the gap between the inertial policy rule prescriptions and the FFR in its five remaining meetings by the end of 2022? For the Taylor rules, it would take five 1/2 percent rate increases to close the gap for the original rule and four 1/2 percent rate increases and one 1/4 percent rate increase to close the gap for the shortfalls and the consistent rules. For the balanced approach rules, it would take five 1/2 percent rate increases to close the gap for the original rule, four 1/2 percent rate increases and one 1/4 percent rate increase to close the gap for the shortfalls rule, and four 1/2 percent rate increases to close the gap for the consistent rule.

The Fed fell behind the curve by not following prescriptions from policy rules that are consistent with its own goals and strategies. Raising the FFR by 50 basis points on May 4 and signaling more increases was a good first step, but it will take at least four more 50 basis point increases to get back on track.

This post written by David Papell and Ruxandra Prodan.

The authors do not seem to blame the rapid pick-up of inflation on Fed policy. That’s wise, under the circumstances. Powell rightly noted in his comments today that the Fed is responding to a supply shock with demand-management tools. That’s a risky proposition.

Fed policy probably did no more than accommodate inflation that is caused by non-monetary factors. The authors are pointing out that the Fed is still exercising judgement rather than operating by rule. If the Fed had operated by rule, we’d still have inflation, but the Fed wouldn’t be in the cross-hairs and inflation might be slower.

It would be interesting to see analysis of the strength of response to Fed stimulus through various channels. We certainly didn’t see a huge inventory response because that doesn’t happen any more. We haven’t seen a huge rise in investment in productive capital. We did see a big wealth response, which is also to say we saw a big rise in leverage, distortions in housing and increased wealh disparity. If the wealth effect on output isn’t large, but other wealth distortions are large, that would argue against extreme monetary stimulus once the jobless rate is no longer high. Government spending and transfers to households, while adding to supply/demand imbalances, don’t create private leverage and wealth distortions to the extent monetary expansion does.

The “plucking” view adopted by the Fed, which the authors mention but don’t name, seems wise, given the economy’s demonstrated ability to operate without excess inflation when unemployment is low. That view does not, however, tell us that monetary policy ought to remain easy, or that monetary expansion is less distortionate than fiscal policy.

What will help us understand whether the Fed’s continued extra-easy policy stance was justified is the Fed’s ability to unwind that stance without inducing recession. Recession following on the heels of recession is really tough on people who work for a living.

Your not totally right. Money supply boomed in 2020-21 due to the 3 Covid relief bills. Businesses now are starting to create overcapacity compared to price in stocked goods. So the supply shock side appears over and demand is lowering back to normal. That means anymore price increases will be wrong and anti-market. Matter of fact, some areas may have to cut back on price. The market has always been a lazy tool for pricing. It was the Industrial Revolution that gave the illusion they were good at it because credit levels always came back because of new innovation in human living. That is over.

I view 250 points normalization. 300-350 the Feds long term preferred level in a post-2000 economy that is naturally slower. So 4 more 50 point hikes is about right.

Gregory Bott: You write: “Money supply boomed in 2020-21 due to the 3 Covid relief bills.” And here I thought the Treasury was responsible for fiscal policy, and not monetary. I thought increases in money base were undertaken by the Fed. I must be wrong…

Botts do not do macroeconomics.

The Fed is behind the curve. Surely interest rates should be near the neutral rate

Oh, NT, and just what is that right now, mate?

https://voxeu.org/article/overheating-conditions-indicate-high-probability-us-recession

April 13, 2022

Overheating conditions indicate high probability of a US recession

By Alex Domash and Lawrence H. Summers

As inflation accelerates in the US, the Federal Reserve will raise interest rates in the hope of achieving a soft landing for the economy. This column uses historical data on unemployment and inflation to evaluate the likelihood that the Fed can lower inflation without causing a recession. The authors find that low levels of unemployment and high inflation are both strong predictors of future recessions, and that overheating indicators today suggest a very high probability of recession over the next two years. The likelihood of the Fed achieving a soft landing in the economy appears low.

https://news.cgtn.com/news/2022-01-22/The-case-for-strategic-price-policies-171AF24WDgk/index.html

January 22, 2022

The case for strategic price policies

By James K. Galbraith

With a single commentary * in The Guardian (and an unintended assist ** from New York Times columnist Paul Krugman), economist Isabella Weber of the University of Massachusetts injected clear thinking into a debate that had been suppressed for 40 years. Specifically, she has advanced the idea that rising prices call for a price policy. Imagine that.

The last vestige of a systematic price policy in America, the White House Council on Wage and Price Stability, was abolished on January 29, 1981, a week after Ronald Reagan took office. That put an end to a run of policies that had begun in April 1941 with the creation of Franklin D. Roosevelt’s Office of Price Administration and Civilian Supply – seven months before the Japanese attack on Pearl Harbor.

U.S. price policies took various forms over the next four decades. During World War II, selective price controls quickly gave way to a “general maximum price regulation” (with exceptions), followed by a full freeze with the “hold the line order” of April 1943.

In 1946, price controls were repealed (over objections from Paul Samuelson and other leading economists), only to be reinstated in 1950 for the Korean War and repealed again in 1953. In the 1960s, the Kennedy and Johnson administrations instituted pricing “guideposts,” which were breached by U.S. Steel, provoking an epic confrontation. In the following decade, Richard Nixon imposed price freezes in 1971 and 1973, with more flexible policies, called “stages,” thereafter.

Federal price policies during this period had a twofold purpose: to handle emergencies such as war (or, in the cynical 1971 case, Nixon’s re-election) and to coordinate key price and wage expectations in peacetime, so that the economy would reach full employment with real (inflation-adjusted) wages matching productivity gains. As America’s postwar record of growth, job creation, and productivity shows, these policies were highly effective, which is why mainstream economists considered them indispensable.

The case for eliminating price policies was advanced largely by business lobbies that opposed controls because they interfered with profits and the exercise of market power. Right-wing economists – chiefly Milton Friedman and Friedrich von Hayek – gave the lobbyists an academic imprimatur, conjuring visions of “perfectly competitive” firms whose prices adjusted freely to keep the economy in perpetual equilibrium at full employment.

Economists with such fantasies held no positions of public power before 1981. But in the 1970s, the practical conditions for maintaining a successful price policy started to erode. Problems multiplied with the breakdown of international exchange-rate management in 1971, the loss of control over oil prices in 1973, and the rise of foreign industrial competitors (first Germany and Japan, then Mexico and South Korea).

Relations with organized labor started to go bad under Jimmy Carter, who also appointed Paul Volcker to run the US. Federal Reserve. But even as late as 1980, Carter imposed credit controls – a move that won public acclaim but also arguably cost him his re-election, because the economy slipped into a brief recession.

Reagan and Volcker succeeded against inflation where Carter had failed, because they were willing to pay an enormous price: unemployment above 10 percent in 1982, a global debt crisis that nearly brought down the largest U.S. banks, and widespread deindustrialization, particularly in the Midwest. A new economic mainstream defended all this by falsely proclaiming that price policies had always failed. The era of TINA (“there is no alternative”) had begun….

* https://www.theguardian.com/business/commentisfree/2021/dec/29/inflation-price-controls-time-we-use-it

** https://twitter.com/paulkrugman/status/1477247341212184577

https://twitter.com/paulkrugman/status/1477247341212184577

Paul Krugman @paulkrugman

Deleting, with extreme apologies, my tweet about Isabella Weber on price controls. No excuses. It’s always wrong to use that tone against anyone arguing in good faith, no matter how much you disagree — especially when there’s so much bad faith out there.

6:56 AM · Jan 1, 2022

it’s also wrong to call somebody a racist, with no evidence. and that is exactly what ltr has done to me. follow the krugman example and apologize. or just act like a bully and pretend it never occurred.

https://fred.stlouisfed.org/graph/?g=Gb0g

January 30, 2018

Consumer Prices for China, United States, India, Japan and Germany, 2017-2022

(Percent change)

[ The sector by sector price control developed by the Chinese, especially use accumulated reserves of production materials and consumer goods, has resulted in China having ample policy space for bolstering growth from here. ]

https://fred.stlouisfed.org/graph/?g=OULh

January 30, 2018

Consumer Prices for China, Indonesia, Brazil, France and United Kingdom, 2017-2022

(Percent change)

Were also seeing the problems with government data and the “employment mandate” in basics. The small business/new creation model of bls was using has likely missed millions of jobs being created in 2021 and that is just bad. BEA has likely underestimated GDP growth since the summer of 2020 as well. I love continuing jobless claims because they imo, give you a clear picture of the real economy in a snapshot. Adjusted for growth and size of the the labor force, I can positively say the economy’s labor market in late 2018-early 19 worth. Spring of 1997 adjusted. Why the Fed didn’t start moving rates up slowly in October I have no idea. They could be up to 250 points by now. Less uncertainty. Inflation with the real money supply dropping is coming down. The underpinnings of it are going bye bye. The Fed could have helped, but chose not too.

The Fed needs to follow its rules.

WTF is this babbling even about. Do you just write word salad 24/7?

You never seem to tire of pretending to know things. You’ve got the whole “grandpa is gonna tell you what’s what” schtick to perfection. Got any evidence for anything you claim here?