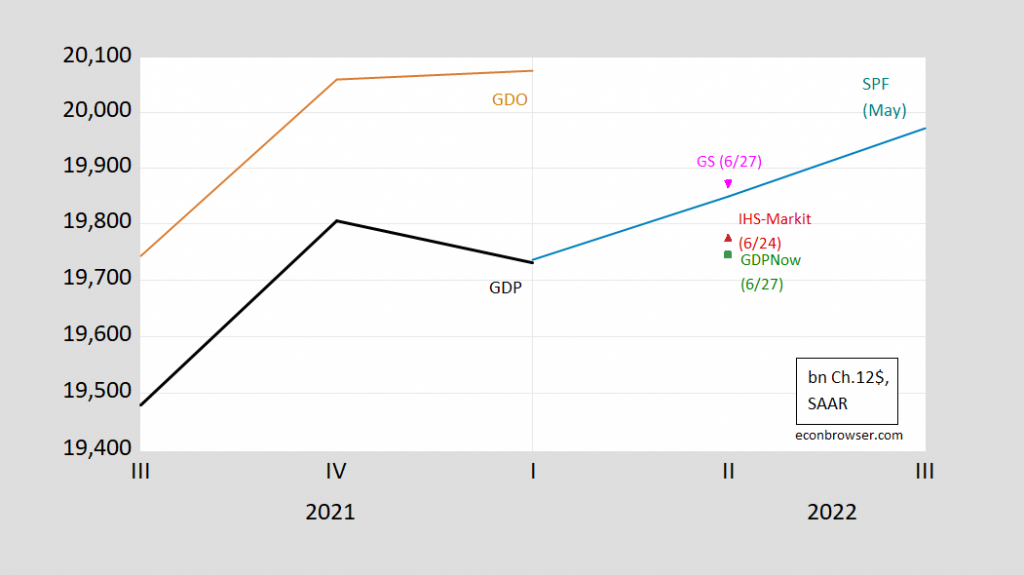

of GDP, along with current Gross Domestic Output (average of GDP and GDI):

Figure 1: GDP (black), Gross Domestic Output (tan), IHS-Markit tracking (red triangle), GDPNow (green square), Goldman Sachs (pink triangle), Survey of Professional Forecasters median (teal), all in bn. Ch.2012$, SAAR. Source: BEA, Philadelphia Fed (May), IHS-Markit (6/24), Atlanta Fed (6/27), Goldman Sachs (6/27), and author’s calculations.

Both IHS-Markit and Atlanta Fed are under (0.9%, 0.3% SAAR) the Survey of Professional Forecasters mark of Q2, using survey responses at end-April. On the other hand, GDPNow is in its latest assessment indicating positive growth rather than zero. Goldman Sachs is at 3.9%, while St. Louis Fed’s economic news based nowcast (of 6/24) is for 3.7% growth (last one not shown).

Note that GDO was flat in 2022Q1 (see Furman (2016) for discussion).

GDPNow and tracking forecasts are based upon higher frequency data that come in before the relevant quarter’s advance release. The fact that they are in the positive range is suggestive that the first print for Q2 GDP will not be negative. However, as with all such macro data, there will be subsequent revisions which will very likely change the contours of the time series, thus explaining why the NBER BCDC usually waits a long time before making a determination on trough (or peak, for that matter).

For various other indicators, see here and here.

‘GDPNow and tracking forecasts are based upon higher frequency data that come in before the relevant quarter’s advance release. The fact that they are in the positive range is suggestive that the first print for Q2 GDP will not be negative. However, as with all such macro data, there will be subsequent revisions which will very likely change the contours of the time series, thus explaining why the NBER BCDC usually waits a long time before making a determination on trough (or peak, for that matter).’

The discussion by Furman is a must read. Of course, Princeton Steve will not read before the confidently declares we are already in a recession.

https://www.wsj.com/articles/fed-interest-hikes-unintended-consequences-powell-basis-points-capital-recession-11655309406?st=godp2617c3tm7bo&reflink=share_mobilewebshare

Menzie, you’re going to send me your copy of “Money Meltdown” when you’re done reading it, right??

These don’t look like recession numbers to me:

https://www.reuters.com/markets/us/us-core-capital-goods-orders-increase-solidly-may-2022-06-27/

the first quarter GDP revision just put up a bigger inventory wall for the 2nd quarter to climb…growth of real private inventories was revised from the previously reported $149.6 billion in 2012 dollars to growth at a $188.5 billion rate…anything less than that for real 2nd quarter inventory growth will subtract from reported GDP..