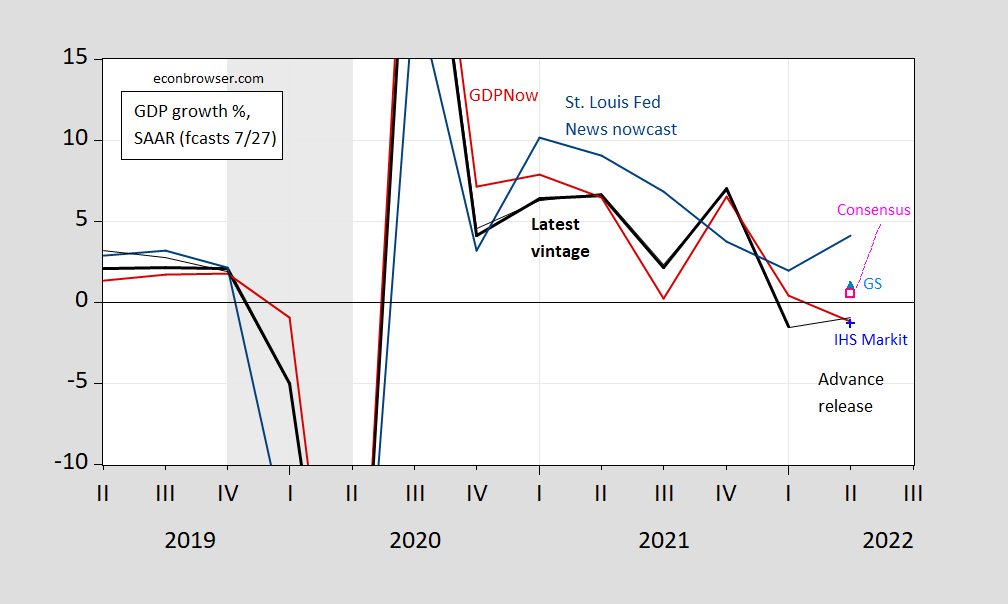

The quarter-on-quarter growth rate for Q2 at 0.9% was below consensus by 1.3 ppts (SAAR), but above GDPNow and IHS-Markit (0.4 ppts, 0.5 ppts respectively). While the mean revision for advance to third release is essentially zero over the 1996-2020 period (see BEA), over the last 5 quarters (2021Q1-22Q1), they have been 1.9 ppts (MAR 12.9 ppts, RMSR 6.8 ppts). That is, the characteristics of revisions from advance to 3rd seem to have changed (although I’ve not done a test for statistical significance), with the advance being revised upward over releases.

Figure 1: Actual advance GDP growth rate (bold black), latest vintage (thin black), Atlanta Fed GDPNow for 7/27 (red line), St. Louis Fed News index for 7/22 (teal line), IHS Markit for 7/27 (sky blue triangle), Goldman Sachs for 7/27 (blue +), Bloomberg consensus as of 7/27 (pink open square), all in %, SAAR. NBER defined peak-to-trough recession dates shaded gray. SAAR. Source: BEA, BEA via ALFRED, Atlanta Fed, St. Louis Fed via FRED, IHS-Markit, Goldman Sachs, Bloomberg, and NBER.

Five quarters is a small sample, so don’t take too much from the mean revision (that is, the uncertainty surrounding the point estimate is large given the small sample). But something to keep in mind.

And as for advance to final, for the 1996-2020 period, while mean revision was zero, the MAR was 1.2 ppts, RMSR 0.9 ppts. That suggests, to me at least, that advance to final revisions will be larger for the 2021-22 period.

https://fred.stlouisfed.org/graph/?g=RSSM

January 30, 2020

Gross Domestic Product and Gross Domestic Income, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=RwGj

January 30, 2018

Gross Domestic Product and Gross Domestic Income, 2007-2022

[ Gross domestic income is an alternative way of measuring the nation’s economy, by counting the incomes earned and costs incurred in production. In theory, GDI should equal gross domestic product, but the different source data yield different results. The difference between the two measures is known as the “statistical discrepancy.” BEA considers GDP more reliable because it’s based on timelier, more expansive data. ]

https://fred.stlouisfed.org/graph/?g=SlEu

January 15, 2018

Consumer Prices and Consumer Prices less food & energy for Japan, 1992-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=OyIX

January 15, 2018

Consumer Prices and Consumer Prices less food & energy for Japan, 2017-2022

(Percent change)

[ Japan has been growing minimally since 1992, much of the time caught in a liquidity trap and unwilling to use pronounced fiscal policy to escape. The inflation pattern in Japan however is now echoing ours, only to a more subdued degree, as the economy has been growing so poorly. ]

ttp://krugman.blogs.nytimes.com/2008/12/01/people-should-be-reading-adam-posen/

December 1, 2008

People Should be Reading Adam Posen

By Paul Krugman

Everyone’s looking back to the 1930s for policy guidance — and that’s a good thing. But we don’t have to go back that far to see how fiscal policy works in a liquidity trap; Japan was there only a little while ago. And Adam Posen’s book, * especially on, “Fiscal Policy Works When It Is Tried,” is must reading right now.

* http://www.petersoninstitute.org/publications/chapters_preview/35/2iie2628.pdf

September, 1998

Restoring Japan’s Economic Growth

By Adam S. Posen

Correcting the reference link:

http://krugman.blogs.nytimes.com/2008/12/01/people-should-be-reading-adam-posen/

The Atlanta Fed’s GDPNow estimate for Q3 is 2.1%. The GDPNow estimate evolves with the data, and we don’t yet have a full set of Q2 data, so there is plenty of room for change.

I am unable to see components for the Q3 estimate, so I’m in the dark about final domestic demand components vs inventory and trade. Components should be available soon if they aren’t already.

“The Atlanta Fed’s GDPNow estimate for Q3 is 2.1%. ”

Watch out for the next Princeton Steve flip flop. He used to claim this was highly reliable but now he will say they have no clue what they are doing.

I can now see GDPNow components. Inventories and housing investment down, everything else up.

Consumption up (sorry Stevie – you got this wrong).

Business investment up – maybe the FED tightening is not going to kill us.

Government purchases up – fiscal policy on the right track (Stevie is wrong here too).

Net exports up – do not get me started on the latest from Joseph.

https://www.msn.com/en-us/news/politics/republicans-top-ally-says-jews-arent-welcome-in-conservative-movement-this-is-an-explicitly-christian-country/ar-AA102h0E

Republican’s top ally says Jews aren’t welcome in conservative movement: ‘This is an explicitly Christian country’

Hey dude – if you want Jews, Muslims, etc. to vote for Democrats as they are not welcomed in your racist world, fine by me.

I would like to see what these various forecasters have to say about what will happen with inventories, with not being able to see what they say one reason I have not felt at all able to evaluate any of their forecasts.

As I have noted elsewhere, it really does look like that item, the change in the change of inventories, will be solidly negative this coming quarter, as we almost certainly move from a regime of rising inventories to one of declining ones. That will probably push GDP more sharply downward than this important-if-too-widely-ignored item, including here, was the previous two quarters when it played the key role in the negative GDP observations that set off all those people who do not know what defines a recession into whining about others “redefining recession.”

Of course, we may well be moving into a real recession, even without a negative change in the change of inventories.. Plenty of indicators moving in that direction, with much of the world economy slowing.

Barkley,

The FRED series, CHNGNETINVENTCONTRIBNOW, may be helpful in your conundrum about the effect of inventory changes on GDP. The Atlanta Fed shares its estimate. For 2022Q2, the Atlanta Fed estimated the inventory effect on GDP at (2.30) % compared to the reported actual effect of (2.01) %.

As of 7/31/2022 FRED viewing, the Atlanta Fed inventory effect on GDP is shown as (0.71), still negative, so far for 2022Q3, but the estimate for GDPNow 2022Q3 is shown as 2.1% as of 7/29/2022.

https://fred.stlouisfed.org/series/CHNGNETINVENTCONTRIBNOW

https://www.atlantafed.org/cqer/research/gdpnow.aspx?panel=1

“the characteristics of revisions from advance to 3rd seem to have changed, with the advance being revised upward over releases.”

How does this map to the recent divergence of GDP and GNI?

Gwyan Rhabyt: I’d need to download a whole set of 3rd release numbers, and GDI associated with second release, in order to do a systematic study. But I do know that GDI has been at record levels relative to GDP in last few quarters – so suspect that when the annual benchmark revision comes in, GDP level will be noticeably revised upward.

the first GDP revision comes with this morning’s report; construction spending for June was down $19.6 billion from May, which was revised $2.1 billion higher, and spending for April was revised almost $1.6 billion lower… the Excel file with key source data and assumptions accompanying the 2nd quarter GDP report indicated on line 86 that they had estimated that the value of June’s nonresidential construction would be $1.3 billion smaller than that of the previously reported May figure, that June’s residential construction on lines 110 and 111 would be $10.1 billion less than that of the previously reported May figure, and that the value of June’s public construction shown on line 200 would be $1.2 billion greater than the previously published May figure…hence, the total of the figures used by the BEA for total June construction in the 2nd quarter GDP report were $10.2 billion less than the previously published May figure…with June construction now reported down $19.6 billion from a May figure that was revised $2.1 billion higher, that means that the BEA had overestimated annualized June construction spending by $7.3 billion when reporting 2nd quarter GDP…thus, after averaging the revisions to construction spending for the three months of the 2nd quarter, we find the total revised annualized figure for 2nd quarter construction spending would thus be $2.67 billion less in current dollars than the figures used by the BEA when computing 2nd quarter GDP, implying we’ll see a net downward revision of about 0.05 percentage points to 2nd quarter GDP to the construction components when the 2nd estimate is released on the 25th of August…

NB: i should be identifying all those figures as annualized….my computation takes that into account, but before that i’m citing numbers as if they were monthly