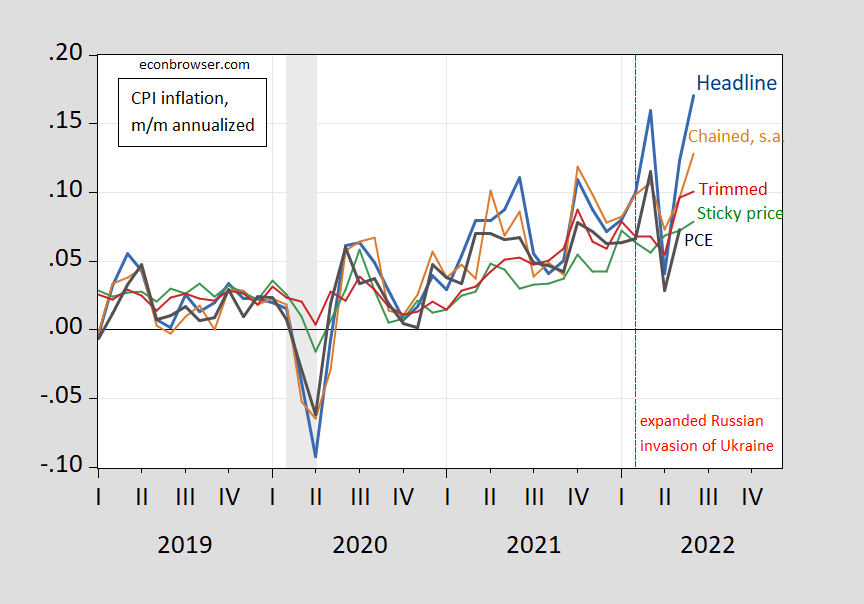

A little bit of old news, but it seems useful to see what various indicators show, month-on-month annualized. Chained, trimmed and sticky price inflation are all lower than headline:

Figure 1: Month-on-month inflation of CPI (blue), chained CPI (brown), 16% trimmed CPI inflation (red), sticky price CPI inflation (green), personal consumption expenditure deflator inflation (black), all in decimal form (i.e., 0.05 means 5%). Chained CPI seasonally adjusted using geometric Census X13 (brown). NBER defined recession dates (peak-to-trough) shaded gray. Source: BLS, BEA, NBER, and author’s calculations.

Trimmed inflation is up, but much lower than overall, suggesting that while broad based, it’s some high components pushing up overall. Lower sticky price inflation means a lot of the variation is coming in from flexible price movements, so that downward movement in headline could be reflected in overall noticeably.

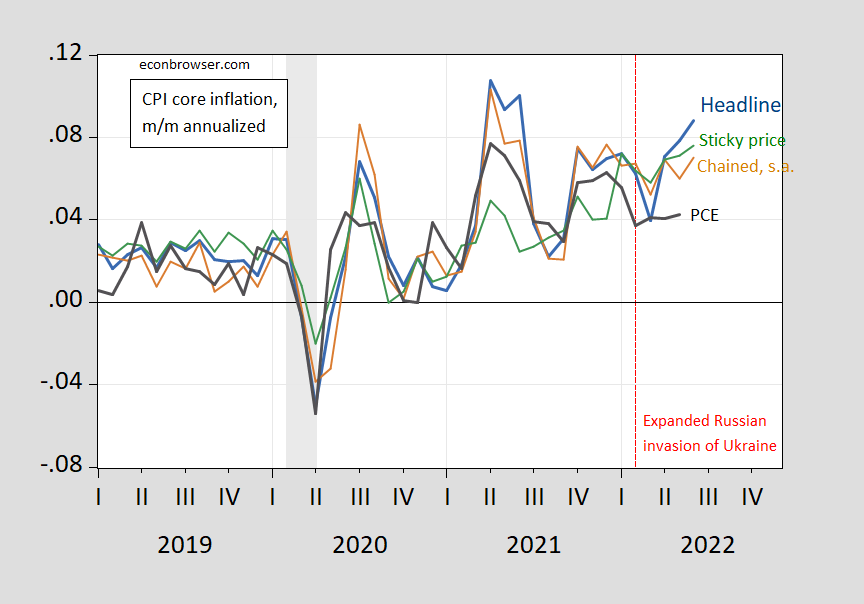

Sticky price core inflation is lower than headline — although not much lower. That’s because energy costs are one of the big flexible price categories.

Figure 2: Month-on-month inflation of core CPI (blue), chained core CPI (brown), sticky price core CPI inflation (green), personal consumption expenditure core deflator inflation (black), all in decimal form (i.e., 0.05 means 5%). Chained CPI seasonally adjusted using geometric Census X13 (brown). NBER defined recession dates (peak-to-trough) shaded gray. Source: BLS, BEA, NBER, and author’s calculations.

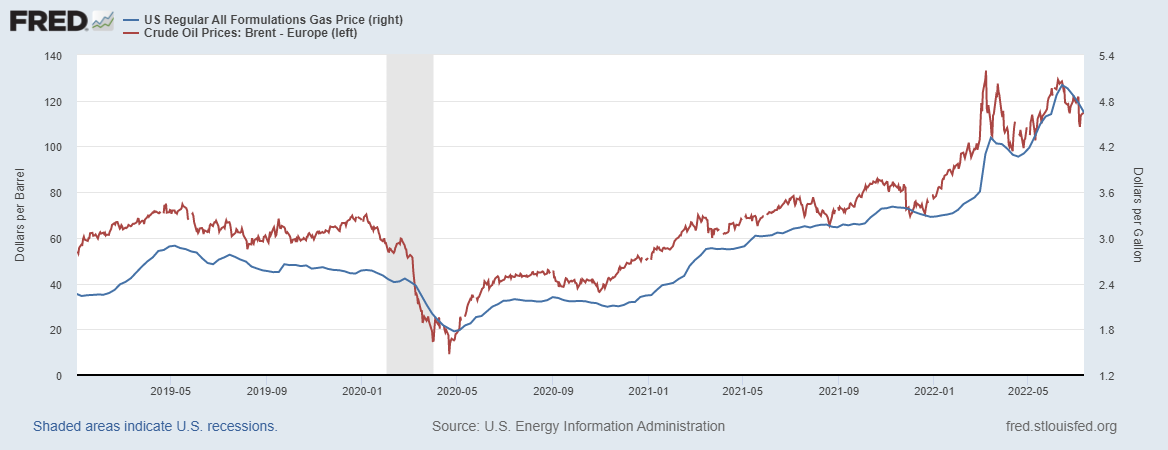

Looking forward, one notes that gasoline prices have fallen in tandem with oil prices.

Source: FRED.

By the week ending July 11, the price of gasoline had fallen to 4.646, down 7.2% from week-ending-June 13th. Taken literally, with a 3.75% weight on gasoline, then that implies a quarter percentage point reduction in July m/m inflation, or over 3 ppts on an annualized basis, not taking into account other ways in which gasoline prices feed into overall prices.

gasoline prices in texas are now under $4 per gallon. Costco even cheaper.

Trivial/anecdotal data point for today. Gasoline at the pump, around 10am this morning (Monday) $3.91. Though not unusual to see it 20cents to 30 cents higher. Would have loaded up but still had slightly over half a tank. So just got me 5 gallons worth. Just gotta hope it stays in the ballpark until the next time I load up.

They just went up by 2 cents today in Harrisonburg. Crudes back over $100 per barrel. Ddecline might be over for now.

Welll, today the 2 cent increase that appeared for gasoline yesterday was retracted, back to $4.27.

However, crude prices continue to rise, up by more than a dollar again today, with Brent now over $107 and WTI over $104 per barrel, up about $9 since its recent low. If this pattern of increasing crude oil prices continues, we shall indeed soon see a bottom to the retail gasoline prices in the US very soon, if it has not already arrived, with the danger even of renewed increases.

So, yes, Biden needs to do his bragging now while he can.