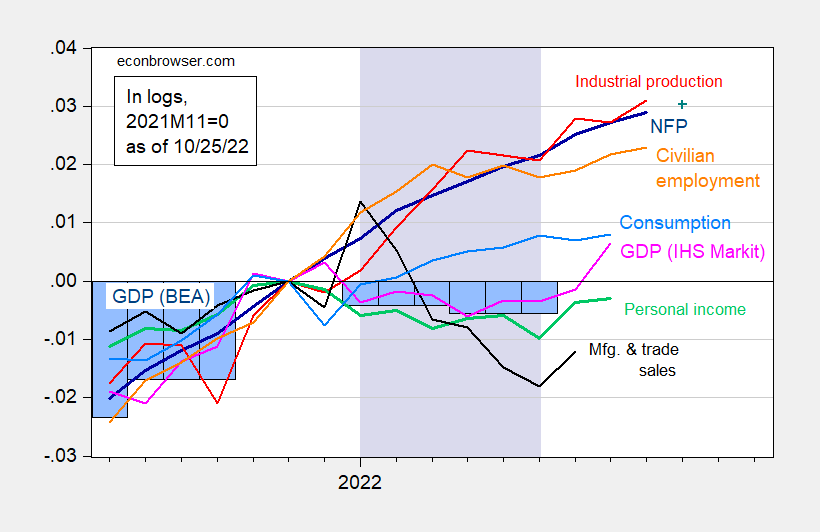

Monthly indicators followed by the NBER Business Cycle Dating Committee, plus GDP and GDO, plus IHS-Markit (nee Macroeconomic Advisers) monthly GDP:

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus as of 10/25 for NFP (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), official GDP (blue bars), all log normalized to 2021M11=0. Lilac shading denotes dates associated with a hypothetical recession in H1. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (10/4/2022 release), and author’s calculations.

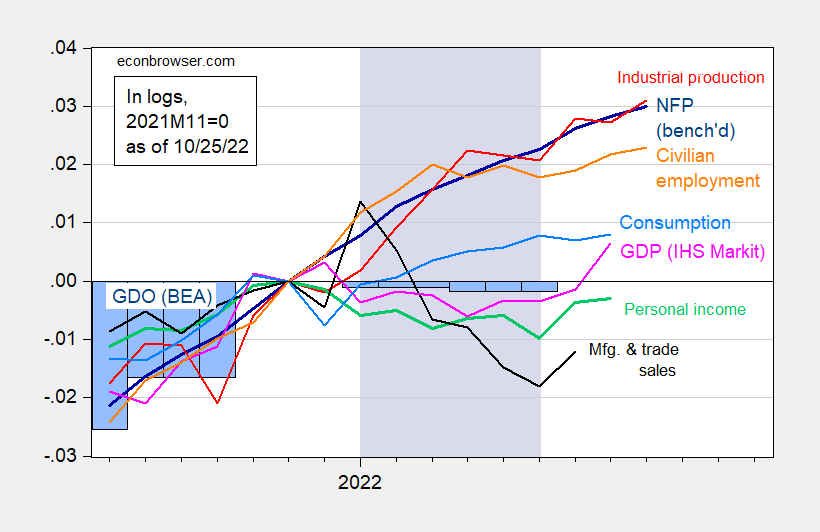

Figure 2: Nonfarm payroll employment as implied by preliminary benchmark revision (dark blue), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), official GDO (blue bars), all log normalized to 2021M11=0. Lilac shading denotes dates associated with a hypothetical recession in H1. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (10/4/2022 release), and author’s calculations.

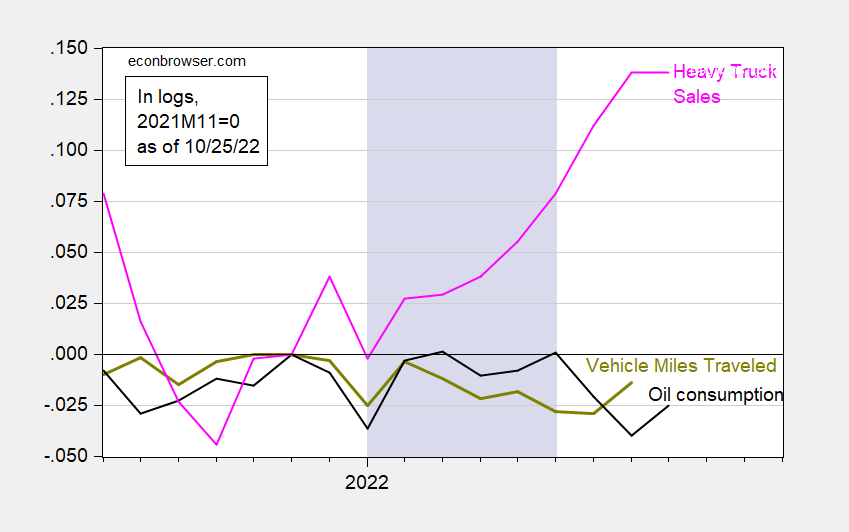

It’s of interest to recall what prompted the claims of recession for H1 2022. For some it was the negative read on GDP. For others, it was vehicle miles traveled, or oil consumption (both from Steven Kopits). Here’s the evolution of these two indicators (which I think of contemporaneous or lagging), and heavy truck sales (suggested by Calculated Risk).

Figure 3: Vehicle miles traveled, seasonally adjusted (chartreuse), oil consumption in millions barrels per day (black), and heavy truck sales millions of units at annual rate (pink), all log normalized to 2021M11=0. Lilac shading denotes dates associated with a hypothetical recession in H1. Source: BTS, EIA, BEA via FRED, and author’s calculations.

As I showed in this post, vehicle miles traveled, regardless of transformation, is a pretty lousy indicator, and certainly outperformed by heavy truck sales. Hence, the flat trajectory for VMT and oil consumption seem interesting, but not dispositive for me. The rise in heavy truck sales does seem to counter the argument of a recession in H1.

What about the GDP series? First, note that NBER BCDC does not place primary weight on GDP. Second, GDO exhibits much shallower drop than GDP. Third, GDP will continue to be revised over time; hence, the contours of GDP may look quite different in a couple years, much like what happened with the recession of 2001 (which in the end did not conform to the “two-consecutive quarter” rule of thumb).

Looking forward, Bloomberg consensus as of today is 2.4%, GDPNow is at 2.9% (10/19), St. Louis Fed “news” index is 1.3% (10/21).

As a former semi-truck driver, I knew heavy truck sales was somewhere at the core of human existence, along with a subset of human existence~~recession prediction. (Sorry, I never can seem to resist making these dumb jokes).

https://www.nytimes.com/2022/10/24/us/math-reading-scores-pandemic.html

October 24, 2022

Math Scores Fell in Nearly Every State, and Reading Dipped on National Exam

The results, from what is known as the nation’s report card, offer the most definitive picture yet of the pandemic’s devastating impact on students.

By Sarah Mervosh and Ashley Wu

U.S. students in most states and across almost all demographic groups have experienced troubling setbacks in both math and reading, according to an authoritative national exam released on Monday, offering the most definitive indictment yet of the pandemic’s impact on millions of schoolchildren.

In math, the results were especially devastating, representing the steepest declines ever recorded on the National Assessment of Educational Progress, known as the nation’s report card, which tests a broad sampling of fourth and eighth graders and dates to the early 1990s.

In the test’s first results since the pandemic began, math scores for eighth graders fell in nearly every state. A meager 26 percent of eighth graders were proficient, down from 34 percent in 2019.

Fourth graders fared only slightly better, with declines in 41 states. Just 36 percent of fourth graders were proficient in math, down from 41 percent.

Reading scores also declined in more than half the states, continuing a downward trend that had begun even before the pandemic. No state showed sizable improvement in reading. And only about one in three students met proficiency standards, a designation that means students have demonstrated competency and are on track for future success.

National proficiency levels in math and reading in 2022

https://static01.nytimes.com/newsgraphics/2022-09-19-naep-results-2021/3da0032013fb4416128f14ede9614f0c2973cb11/_assets/nat-proficiency-600.png

And for the country’s most vulnerable students, the pandemic has left them even further behind. The drops in their test scores were often more pronounced, and their climbs to proficiency are now that much more daunting.

“I want to be very clear: The results in today’s nation’s report card are appalling and unacceptable,” said Miguel Cardona, the secretary of education. “This is a moment of truth for education. How we respond to this will determine not only our recovery, but our nation’s standing in the world.”

The exam, which is administered by federal officials and is considered more rigorous than many state tests, sampled nearly 450,000 fourth and eighth graders in more than 10,000 schools between January and March. The results are detailed for each state, as well as more than two dozen large school districts.

The findings raise significant questions about where the country goes from here. Last year, the federal government made its largest single investment in American schools — $123 billion, or about $2,400 per student — to help students catch up. School districts were required to spend at least 20 percent of the money on academic recovery, a threshold some experts believe is inadequate for the magnitude of the problem….

https://fred.stlouisfed.org/graph/?g=tRJR

January 4, 2018

Local and State Government Education Employment, 2017-2022

https://fred.stlouisfed.org/graph/?g=yp2d

January 4, 2018

Local and State Government Education Employment, 2017-2022

(Indexed to 2017)

GDP, VMT and oil (notably gasoline) consumption still speak to an H1 recession. A two-quarter decline in GDP is the common definition of a recession. Now, you may argue that H1 was actually an expansion, in which case you would be happy with a continuation of trends of those two quarters. I don’t believe I would be happy with falling GDP, oil consumption and GDP, even with flat civilian employment.

“A two-quarter decline in GDP is the common definition of a recession.”

You know that is not true unless you are dumber than a rock. Or did you even bother to read this post before writing more intellectual garbage?

Stevie? Are you really pretending to be in a position to decide what is or isn’t a “common definition”? You get so much wrong, but here you are, wearing your “I know things” mask and telling us what words mean. I realize that’s a favored debating trick, but insisting on your on definition makes for arguments both circular and biased – I win because I say I win. It’s a symptom of a weakness. You can’t win a debate without begging the question, so away you beg!

Let’s check on your claim of commonness:

“In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster (e.g. a pandemic).”

“In the United States, a recession is defined as “a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.” The European Union has adopted a similar definition. In the United Kingdom, a recession is defined as negative economic growth for two consecutive quarters.

https://en.m.wikipedia.org/wiki/Recession

So in reality, you have claimed a particular definition, one used by the UK, is a common definition. Of the 27 EU countries, the U.S. and UK, only the UK employs your “common definition”. Not so common.

Not surprising, either. You assume the “I know things” pose is a big part of your business plan as a consultant. That and using Econbrowser as free ad space. At least when you go on Steve Bannon’s program, you can expect to get away with cheap bebating trcks. Not here, Stevie. Not here.

What Is a Recession?

A recession is a significant, widespread, and prolonged downturn in economic activity. A popular rule of thumb is that two consecutive quarters of decline in gross domestic product (GDP) constitute a recession.>/i>

https://www.investopedia.com/terms/r/recession.asp

In 1974, economist Julius Shiskin came up with a few rules of thumb to define a recession: The most popular was two consecutive quarters of declining GDP.

https://www.forbes.com/advisor/investing/what-is-a-recession/

If the economy shrinks for two consecutive quarters, it is said to have gone into recession.

https://www.santander.com/en/stories/economic-recession

So what constitutes a recession?

In short, a period of significant decline in economic activity. A recession typically leads to drops in output and investment, falling profits for businesses and rising unemployment. The global financial crisis of 2007-09 shaved almost 4% off economic growth worldwide. In some countries, including Britain, France and Germany, the convention is that two quarters of negative gdp growth indicates a recession.

https://www.economist.com/the-economist-explains/2022/08/12/what-is-a-recession

The rule of thumb is two quarters. I would imagine I could probably find Menzie having written something to that effect at some point in the past.

Steven Kopits: I’ve said it’s a rule of thumb, for sure. Of course, I’ve also said that’s a problematic and not universal definition — partly because (as highlighted in the 2001 recession), it depends *what vintage* you see the 2 quarters, and that because GDP is oft revised, you might not want to rely upon it until long after the hypothetical trough. However, you have skipped over all those points which have been made to you over and over again, with no effect.

“you have skipped over all those points which have been made to you over and over again, with no effect.”

Stevie ignores other people routinely. No – he is too busy trying to get on Fox and Friends to engage in any real discussion.

A popular rule of thumb? Popular for whom? You MAGA hat wearing racists on Fox and Friends?

“a period of significant decline in economic activity. A recession typically leads to drops in output and investment, falling profits for businesses and rising unemployment.”

There has been no decline in GDI. Real GDP fell by a very small amount. And profits are up. I guess you just ignore inconvenient facts as you spin your utter nonsense.

…and VMT…

And apparently, the public is none too enamored of macro indicators, either, given recent polling heading into November.

Steven Kopits: The issue was RECESSION, not sentiment. Get your terms straight.

Well – he does make up his pet terms as he goes.

If reality doesn’t fit with the terms, then you redefine the terms – or “redefine” reality. If all fails just change the subject to another term. Unfortunately for Steven this is not the dumb ass forum of Fox news; knowledgeable professionals are not impressed by rhetorical idiocy.

Well said but Stevie only cares what his Fox and Friends buddies think.

I guess it is all politics to you. How is that MAGA hat fitting these days?

Here we see Stevie’s real point. He doesn’t care about economics so much as he does about politics. Which means we can all gnore what Stevie hqs to say about economics. Saying dishonesty things about economics in service of his preferred political outcome is just dandy with Stevie. Heck, he just did it, then more or less admittd to it.

No wonder Steve Kopits and Steve Bannon share bandwidth.

What polling???? My guess those Republican NYT/Siena scams were paid by you know who.

Those are two separate topics. One of my comments pertains to the past, the other to the future.

A decent third quarter announced just before the 2022 elections is SO going to disappoint the RECESSION CHEERLEADERS. Yea they were praying for a recession for purely partisan reasons. If the BEA release has good news for the economy I fully expect these trolls to start screaming that the BEA has tilted the numbers.

“Yea they were praying for a recession for purely partisan reasons.”

Case in point – all that intellectual garbage from Princeton Steve.

I learned a new term reading an interesting post by Kevin Drum.

Pink-slime journalism is a practice in which dedicated news outlets publish poor-quality news reports which appear to be local news, often to push a right-wing agenda and gather user data. The reports are either computer-generated or written by poorly-paid outsourced writers, often using fake names. Many such networks have been linked to American conservative news businessman Brian Timpone.

We see a lot of this garbage in the comment section here. We have always wondered who was paying the Usual Suspects including Bruce Hall and CoRev. I guess Brian Timpone has decided the compensation for these two trolls should be low as in “poorly-paid”, Of course given the low quality of their spin, Brian is being ripped off.

The Feds increased rates are directly increasing OER and inflation.

https://ritholtz.com/2022/10/fed-causes-inflation/

So their rate increases meant to drive down inflation is driving it up instead.

I was wondering what on earth Barry was trying to say until I got here:

‘It is an oddity of how BLS assembles its CPI model, trying to figure out how to measure shelter which is both a cost and for millions of homeowners, an asset. Understanding this will help you understand why inflation appears to be so sticky, despite a huge swath of falling prices.’

OK this price of housing services depends on interest rates but let’s not too carried away. Maybe we should be reporting on each sector’s price changes along with their weights to be clearer.

@ Ivan —Interesting find, still digesting,

Doubly interesting, when many of us have been screaming to the Larry Summerses of the world that this is more supply caused inflation than demand caused. Yet the applauders of rate increases keep insisting on playing with what they perceive to be demand levers of inflation.

Yes, but, and it’s a big but (I cannot lie), that’s a measurement problem, not an inflation problem. If the Fed’s concern is with real inflation rather than measured inflation, which is to say with reality rather than perception, then monetary policy will not respond to the quirk that Barry has pointed out.

The good news is, the Fed prefers the PCE deflator to CPI in part because of the OER problem. Recently, the difference between the rise in core

CPI and the core PCE deflator has looked like this:

https://fred.stlouisfed.org/graph/?g=VgqH

Thanks pgl and Macroduck. I know Berry is an investment guy not an economist.

So we would expect the next number on PCE to divert a lot from CPI (as the OER problem increase). The press will be focussed on CPI (the scary number) whereas, presumably, the Fed will look at PCE and be comforted – I hope.

For an investment guy – he still is a worthy read.

I agree 100%.

He has always been fact driven and willing to change his narratives if they collide with facts. That is one of the main themes in his investment advice.

or powell is raising too meekly?

https://www.nytimes.com/2022/10/25/business/coca-cola-q3-earnings.html

October 25, 2022

Coca-Cola Keeps Raising Prices, Driving Profits Higher

The soft drink giant’s latest quarterly earnings defied worries about consumer cutbacks amid rising inflation and fragile economic growth.

By Isabella Simonetti

Coca-Cola generated better-than-expected earnings as consumers continued to pay higher prices for soft drinks and juices, further evidence that shoppers are willing to keep spending in the face of record inflation and rising interest rates.

The company, whose brands include Sprite and Minute Maid, said on Tuesday that third-quarter revenues increased by 10 percent and profit grew by 14 percent versus the same period last year.

The biggest driver was a 12 percent jump in growth linked mostly to raising prices, alongside shifts in the mix of products sold in the quarter. At the same time, the volume of products sold rose by 4 percent, showing consumers’ willingness to pay more for the company’s products. When Coca-Cola’s rival PepsiCo reported its third-quarter earnings this month, price increases were accompanied by weaker growth in volumes.

Coca-Cola’s results highlighted consumers’ willingness to continue buying their favorite products despite being squeezed by higher prices at the grocery store and the gas pump.

“In the face of these pressures, consumers stayed resilient,” James Quincey, Coca-Cola’s chief executive said on a call with investors. He added later, however, that he saw emerging changes in consumer behavior as “the impact of inflation running ahead of wages is starting to come through.” That led to shoppers putting off purchases of “more discretionary, higher-ticket” items, Mr. Quincey said, and seeking out cheaper options for other products.

“Their ability to make sure that they have affordable options in these price-sensitive consumers’ hands is critical,” Bonnie Herzog, an analyst at Goldman Sachs, said of Coca-Cola. “That is something that they have done very well.”

Investors are watching closely as big companies begin to report their latest quarterly earnings to get a sense of the health of the economy and the path of inflation. The Federal Reserve is on a campaign to bring down stubbornly high inflation by increasing interest rates, which raises the cost of borrowing for companies and consumers.

Food and drink giants like Coca-Cola, Pepsi, Procter & Gamble and Nestlé all reported significant price increases in earnings reports this month, a sign that the cost of food — a major factor lifting overall inflation in recent months — is set to remain high. While some companies have warned that their profit margins have been coming under pressure, they have mostly been able to pass on higher costs to consumers in the form of higher prices….

I just read something bizarro on LinkedIn on how inflation is lower profit margins. Leave it to LinkedIn to not understand what is happening in the real world.

https://fred.stlouisfed.org/graph/?g=CgJo

January 15, 2020

Sticky Consumer Price Index and Sticky Consumer Price Index less Shelter, 2020-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=w3Wk

January 15, 2018

Sticky Consumer Price Index and Sticky Consumer Price Index less Shelter, 2017-2022

(Percent change)

[ There would seem to be no reason to assert the Federal Reserve is driving inflation by raising interest rates so raising the cost of homeownership or rents. ]

Editing and adding:

There would seem to be no reason to assert the Federal Reserve is driving inflation by raising interest rates, so raising the cost of homeownership or rents:

https://fred.stlouisfed.org/graph/?g=UQEV

January 30, 2018

Case-Shiller National Home Price Index and Owners’ Equivalent Rent of residences, 1992-2022

(Indexed to 1992)

Owners’ Equivalent Rent of residences does not seem to have increased that much. Housing prices yes but Barry’s entire discussion noted how it is the former not the latter than matters. Something needs reconciling with Barry’s thesis. Of course, these data series tend to lag what’s going on.

MAGA types in Arizona using intimidation to make sure only white people get to vote:

https://www.msn.com/en-us/news/crime/lawsuit-asks-federal-judge-to-block-e2-80-98vigilantes-e2-80-99-from-gathering-at-ballot-drop-boxes-to-e2-80-98intimidate-e2-80-99-arizona-voters/ar-AA13moEc

Two armed vigilantes dressed in tactical gear watch a drop box site in this photograph disseminated by the Maricopa County Elections Department. Advocacy groups asked a federal judge in Arizona to stop armed “vigilantes” from gathering in front of drop boxes on guard for so-called “ballot mules,” an effort that the plaintiffs characterize as thinly veiled “voter intimidation.” The non-profit groups Arizona Alliance for Retired Americans and Voto Latino filed their lawsuit in the federal court on Monday against an entity going by the name Clean Elections USA, whose founder Melody Jennings appeared on the podcast of recently sentenced ex-White House strategist Steve Bannon. “At least five times last week, supporters of defendant Clean Elections USA (‘CEUSA’), an organization founded by Defendant Melody Jennings, gathered at ballot drop boxes in Maricopa County with the express purpose of deterring voters — who Defendants irrationally fear are ‘ballot mules’ — from depositing their ballots,” their 40-page complaint begins. “And things are getting worse: on Friday, two of the drop box watchers were armed and wearing tactical gear, and again on Saturday, armed and masked individuals were gathered near drop boxes. Defendants’ activities have already prompted three voter intimidation complaints that have been referred to the Department of Justice, as well as responses and investigations by the Maricopa County Sheriff’s Department. ”The lawsuit quotes Jennings as stating in a radio interview that the group’s “goal is to be a deterrent.” “To achieve that goal, Defendants engage in conduct that is clearly meant to intimidate,” the lawsuit continues. “In addition to sending crowds to loom over voters, Defendant Jennings has threatened to use the images and video captured by those crowds to ‘dox’ people; that is posting online a person’s personal information, opening them up to harassment by the general public.”

According to the lawsuit, Jennings openly boasted of those tactics on Bannon’s podcast War Room. “We can zoom right in we can get your face, so we’ve got you,” Jennings is quoted saying on the show.

Clean Election’s goal is to make sure no black or Hispanic person gets to vote. MAGA!

I just read something I thought was pretty astounding. Would anyone here (hosts included) like to guess what percent of EUR IG corporate bonds the ECB owns now, of the EUR market (without googling it)?? The number seems so crazy to me it has me thinking I mis-perceived it somehow.

Now you’ve got me curious. Large European businesses rely more on bank loans than big U.S. business, which borrows more with bonds. Gonna tell us?

Economic performance in H1 got a D- instead of an F, yet some are celebrating!

And your comments are consistently graded F-. Well done troll.

Off topic, Russian domestic propaganda –

Click this link and hit “translate” for a taste of the scary stories being served up to Russia’s citizens ahead of Halloween:

https://m.vz.ru/world/2022/10/24/1183495.html

Here’s the headline:

“The United States showed readiness to launch a nuclear strike on Russia”

Sounds like Johnny.

But the underlying message is one I’m not sure Johnny could think up, nor would his masters allow him to publish it here. The message is that, militarily, Russia has fallen behind the U.S. to the point that Mutually Assured Destruction is no longer a reliable deterrent to a nuclear strike from the U.S.

No question that Russia has fallen behind militarily, but ask yourself, who is this message meant for? Western intelligence? Not likely, at least not as a simple assessment of relative capability. My guess is that it’s meant first for the Russian public, with at least a two-fold intent: build up fear of an external enemy and create a tolerance for diverting spending from civilian welfare to the military.

Of course, the indirect message to Western intelligence is “Wanna have an expensive arms race?”

Funny thing about European natural gas markets:

https://tradingeconomics.com/commodity/eu-natural-gas

MD, take a look at the 5Yr history to get a realistic view of the LNG price impact. Or take a gander of the annual records in your referenced chart.

Remember, you support your Prez who is following these same energy policy paths. Only the willfully ignorant can not see the future economic impacts while commenting on a recession article on an economics blog.

The voters are not so ignorant.

Gee prices are higher than they were in 2017. Your point ??? Hey CoRev – those soybeans are waiting for you to get them to market.

everything is higher than in 2017

not real wages……

” you support your Prez who is following these same energy policy paths”,

This proves what a moron CoRev is. Macroduck notes EU natural gas prices and CoRev goes into Biden bashing totally unaware that Henry Hub natural gas prices are MUCH lower.

The build up of NG storage this spring/summer was partially helped by Russian supplies. Next spring/summer it will be done without anything from Russia. However, there will be more capacity to import from other sources so it should not be a problem. Putin was waffling long enough on cutting NG to ensure that it will hurt him more than Europe.

On the demand side, good old capitalism is at work. Having seen prices explode, consumers are hard at work reducing their need for natural gas. One more year of insulation projects will help reduce consumer demands even further. Alternative energy projects are becoming even more competitive and industrial users are hard at work on how to cut NG use (profit or bankruptcy). Sure NG prices will not get back to the good old days – but that is actually good for the planet. Thank you Biden for competent leadership in a multidimensional crisis.

I had read this right before seeing your comment

https://www.cnn.com/2022/10/26/energy/europe-natural-gas-prices-plunge/index.html

ukraine is in for a difficult winter. they will need the full support of Europe. this should certainly assist in the matter this winter.

“Europe has more natural gas than it knows what to do with. So much, in fact, that spot prices briefly went negative earlier this week.”

This is pretty stunning. Now the story goes on to say Europe expects a warmer than usual WEATHER. And we thought CoRev was the expert on WEATHERWEATHERWEATHERWEATHERWEATHER. Apparently not in this case.

I actually got past the WSJ firewall to read this:

https://www.wsj.com/articles/russian-oligarch-bridgewaters-sanctions-offshore-network-11665767178?mod=hp_lead_pos5

I assume this story will be in Wednesday’s hardcopy for anyone who doesn’t have a web subscription.

Russian Oligarchs Obscure Their Wealth Through Secretive Isle of Man Network

The web of shell companies and middlemen managed by services firm Bridgewaters makes it hard for authorities to track assets and enforce sanctions

So many tax havens so little time.

I thought the story was so well done and so important, I would have put it up on Prof Chinn’s and Prof Hamilton’s blog anyway, but I thought of you when I was reading it that you might take interest.

Check this BBC story from 2017:

https://www.bbc.com/news/world-europe-41878961

https://jabberwocking.com/raw-data-how-we-get-from-place-to-place/

Kevin Drum plots some data on how we commute. The good news I guess is that car and airline travel has fully recovered from the pandemic but the bad news is that public transportation is still way down.

Of course me noting this will likely get dumb angry rant from Bruce Hall that I support Xi. I guess all that bleach he has taken during the pandemic has had some adverse side effects.