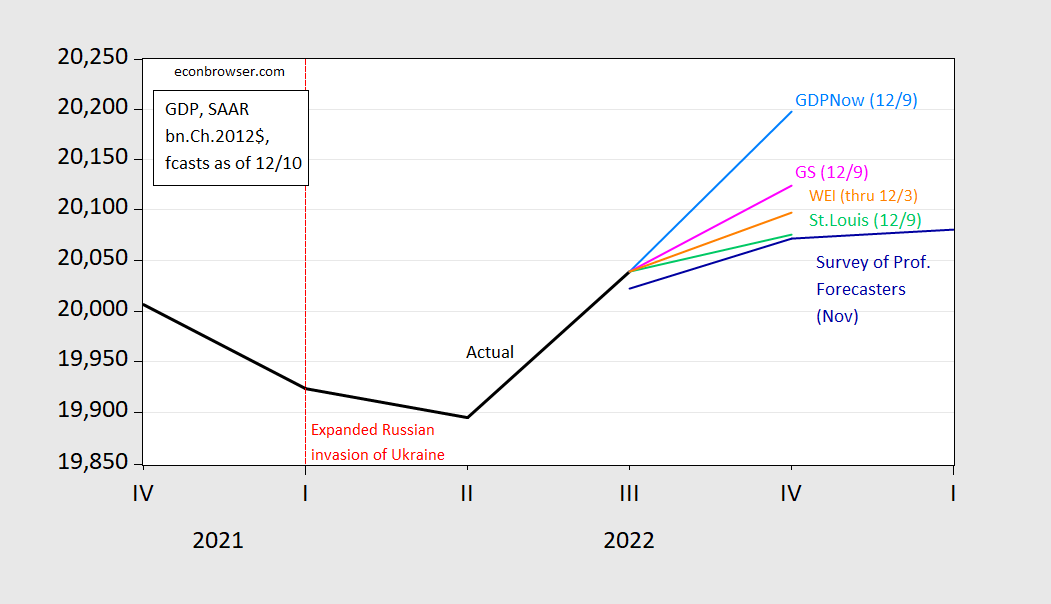

We have Q4 nowcasts and tracking estimates as of 12/9, and implied Q4 from Lewis-Mertens-Stock WEI.

Figure 1: GDP (black), GDPNow (sky blue), GS (pink), WEI implied (orange), Survey of Professional Forecasters (blue), in bn.Ch.2012$ SAAR. WEI uses average of y/y growth through 12/3 applied to 2021Q4 GDP. Source: BEA 2nd release, Atlanta Fed, Goldman Sachs, NY Fed via FRED, Philadelphia Fed, and author’s calculations.

Q4 Nowcasts range from 0.72% q/q SAAR (St. Louis Fed) to 1.32% (Atlanta Fed GDPNow).

Figure 1 places into context what the Lewis-Mertens-Stock WEI (through the first two months of Q4) implies for the level of GDP: 1.83% increase on 2021Q4 GDP. Continued deceleration (as discussed in this post) would place Q4 lower.

GDPNow’s simple adding up of monthly government data produces an estimate that would be the fastest growth in a year, while everything else forecasts something slower. GDPNow has only just over a month’s worth of data and can change pretty sharply with the release of additional data. That’s mostly true for the others, too.

GDPNow has a reputation for coming close to the actual first GDP report once it has most of the quarter’s data. I have no idea whether other forecasts do better on less complete data. I suppose we can check in with this post when the first round of Q4 GDP is released.

Dear host, any chance we could see more numbers to go with the chart?

Macroduck: At about 50 days before release, the Bloomberg consensus and GDPNow are about equally accurate, according to DB (pre-Covid sample). See here.