At least somebody still believes that as of a couple weeks ago.

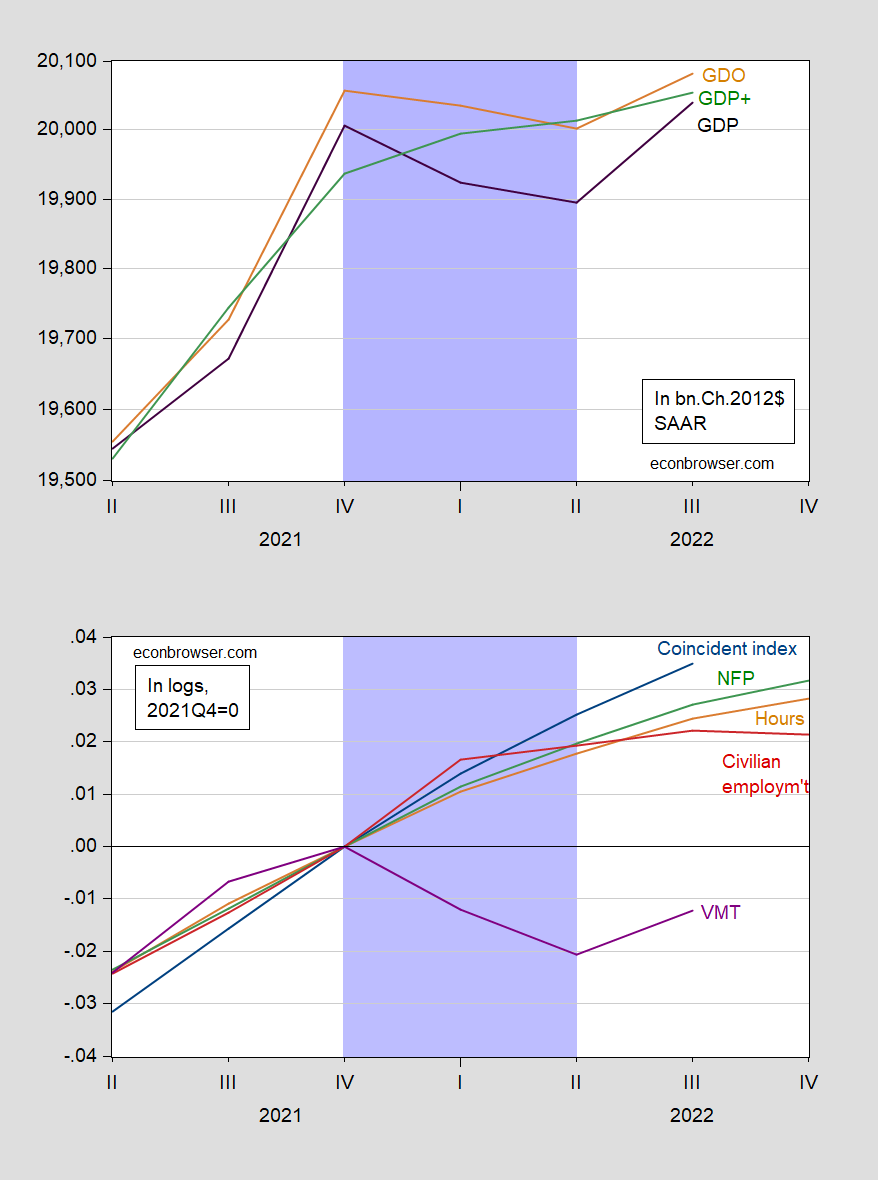

Figure 1, Top Panel: GDP (black), GDO (tan), GDP+ (green), all in bn.Ch.2012$ SAAR. GDP+ based on cumulated growth rates, scaled to 2018Q1. Bottom Panel: Coincident index (blue), nonfarm payroll employment (green), aggregate weekly hours (tan), civilian employment (red), vehicle miles traveled (purple), all in logs, 2021Q4=0. Q4 observations for employment, hours, based on October and November data. Lilac shading denotes peak-to-trough hypothetical recession. Source: BEA via FRED, BEA, Philadelphia Fed via FRED, Philadelphia Fed, BLS via FRED, FHA via FRED, and author’s calculations.

Note that GDP, GDO, and VMT are the three series that declined from 2021Q4. However, we know that GDP and GDO will subsequently revised (and GDP+ rose). (Recall, using the 2-consecutive quarter rule on current GDP data, there is no recession of 2001.) Note further that nonfarm payroll and aggregate weekly hours will likely be revised upward, given the preliminary benchmark revision.

Hence, I am still skeptical that the NBER Business Cycle Dating Committee will declare a recession in 2022H1. But since all the variables will be revised going forward (except perhaps VMT), one cannot be certain.

Addendum, 12/12:

See September assessment from Owyang and Stewart (FRB St Louis).

Why do error bars disappear when they don’t support your political point?

Somebody said a lot of nonsense starting with

H1 was a recession by the most commonly used standard

The most commonly used standard is what NBER Business Cycle Dating Committee and not the incessant BS Princeton Steve keeps rehashing.

Somebody is still using dumb terms like suppression and write really dumb stuff like this?

Thus, the H1 downturn plausibly could be explained by aggressively contractionary fiscal policy. Biden just yesterday crowed that he had reduced the budget deficit by $1.4 trillion in little over a year. That’s about 7% of GDP

One more time Stevie – the change in the actual deficit is not a proper measure for the change in fiscal policy. Everyone should know this by now but you still repeat this line? How idiotic can one be?

After reading what Princeton Steve wrote there, I thought of my favorite line from all of the Star Wars movies:

https://www.youtube.com/watch?v=dbCAvos8VBo

Every word of what you just said, was wrong

Let me reiterate what I said. Again:

1. H1 was a recession by the most commonly used standard

2. Nevertheless, the H1 downturn did not have some of the characteristics of many recessions, notably, unemployment did not rise

3. This sort of phenomena was last seen in 1945 when US defense spending collapsed, that is, a decline in GDP without a material decline in employment.

4. Thus, the H1 downturn plausibly could be explained by aggressively contractionary fiscal policy. Biden just yesterday crowed that he had reduced the budget deficit by $1.4 trillion in little over a year. That’s about 7% of GDP, so we might expect a contraction on the order of 4% of GDP (allowing for intervening, underlying GDP growth), and that’s about what we have seen.

5. Thus, from this perspective, H1 could be seen as a ‘technical recession’, but which I mean a formal downturn in GDP without an underlying business cycle.

So that’s fiscal policy. Let’s turn to monetary policy.

1. The Fed mistook a suppression for a depression and therefore put interest rates to depressionary levels, that is, with the FFR near zero. This had only happened twice in the last century, both in depressionary circumstances, notably during the Great Depression and from 2008/2009 to around 2016. Because these latter two events were properly characterized as depressions, in my view — which means they were associated with compromised collateral — short term govt interest rates set to zero for seven years or more did not materially raise real estate values.

2. Because the covid downturn was a suppression, not a depression, the zero rate policy was inappropriate during the covid downturn. Collateral was not impaired, and therefore zero interest rates led to surging home values and equity prices.

3. The result of fiscal and monetary policy, in some combination, has led to historically high levels of inflation. The cause of this inflation is not entirely clear, or more precisely, I have not seen an allocation of it among all of fiscal policy, monetary policy, and supply chain bottlenecks.

4. The Fed’s current monetary policy is predicated on the notion that inflation has been caused principally by low interest rates (ie, a 40% increase in M2)

5. Therefore, the Fed is willing to put rates to levels not seen in some time, with 7%+ mortgage rates now on offer, twice the level of rates pre-pandemic.

6. This is leading the housing sector to collapse, with not only disinflation, but outright deflation, now gathering steam around the country.

7. This suggests next year might see outright deflation. This is what we saw in the 1920/1921 depression, which followed the Spanish flu pandemic and may therefore serve as a template for the coming 18-24 months (forward-looking, not backward looking, please)

8. If the 1920/1921 template is correct, then monetary policy is set far too tight and we may expect outright deflation next year, as we did 100 years ago.

9. On the other hand, if the more traditional M2 surge / excessively low interest rate thesis is right (per Summers), then interest rates have to continue to be raised.

10. In either event, a 2023 recession would seem to be in the cards.

You’d better know what you’re thesis is when you set rates.

https://www.youtube.com/watch?v=75FCOZjACco

https://www.calculatedriskblog.com/#google_vignette

https://www.youtube.com/watch?v=h3UGw8-4nNU&t=2s

“…most commonly used standard.”

You have never provided evidence that’s true. And you are notan authority on such matters.

Claims about whether the U.S. was in recession in H1 tndd to break down partisan lines*, and your comments here strongly tend to the right, whatever your claimed voting record may be. Writing bunches and bunches of words doesn’t absolve you of bias or errors.

*The press doesn’t count. Chicken little runs the place.

Two negative quarters is the common standard, and yes, I have demonstrated that.

You have demonstrated only one thing – that you are one arrogant moron. Come on dude – you have wasted enough time with your serial BS.

You have demonstrated it to…your own satisfaction. And I have listed several G7 countries which don’t use the 2-quarter definition. The 2-quarter thingie is not “the” common definition among the G7. You haven’t counted up middle-income and lower-income countries which used two-quarter rule – so as of now, “the common isn’t working out for you. Unless you have your own, made-up definition of “common”. Or “the”.

My pointing out that you are often wrong in your claims was in service of advising that you be ignored. Here you are, fighting the battle of “the common definition” when you’ve lost the battle of VMT, the battle of M2, the battle of the Fed’s thinking on inflation.

You’ve gotten the important stuff wrong and now you want to cling to a trivial assertion that you’ve also gotten wrong? Go for it.

Dr. Chinn has a new post on this topic. Of course Princeton Steve will not read it as he has his warped mind made up.

So, if a guy routinely makes assertions that are demonstrably wrong, do you need to check everything he says? No. It’s a better use of your time to ignore him. Are vehiclemiles traveled a reliable indicator of recession? Demonstrably not. Consumer confidence? Demonstrably not.

Is it true that the Fed is operating on the “notion that inflation has been caused principally by low interest rates (ie, a 40% increase in M2)”? Oh, let’s find out!

Here’s what Frederic Miskhin says on the subject on monetary targeting:

“In October 1979, the Fed changed its operating procedures to deemphasize the federal funds rate as its operating target and supposedly increased its commitment to the control of monetary aggregates by adopting a non-borrowed reserves, operating target. However, this change in operating procedures did not result in improved monetary control: fluctuations in M1 growth increased, rather than decreased as might have been expected, and the Fed missed its M1growth targets in all three years of the 1979-82 period. It appears (e.g., see Bernanke and Mishkin, 1992, and Mishkin, 2001) that controlling monetary aggregates was never the intent of the 1979 policy shift, but rather was a smokescreen to obscure the need of the Fed to raise interest rates to very high levels to reduce inflation.”

This quotation comes from “FROM MONETARY TARGETING TO INFLATION TARGETING: LESSONS FROM THE INDUSTRIALIZED COUNTRIES

Similar views, discussed at greater length, can be found here:

https://books.google.com/books/about/From_Monetary_Targeting_to_Inflation_Tar.html?id=QC41iDHUiTMC&source=kp_book_description

Now, as we all know, Mishkin has limited real experience with monetary … hang on … I need to check something; I’ll get back to you on that. Until I have time to look at Mishkin’s actual, real-life familiarity with Fed policy, perhaps we can rely on something easier to get a handle on. Let’s see what an eager high school student is likely to learn from the Khan Academy – kind of a homework helper. I won’t burden Menzie with reviewing a video, but if you check Khan’s YT video “Banking 16: Why target rates vs. money supply” you’ll glean that Mishkin is right, however obscure his claim to authority in these matters may be. Seems like a grown-a$$ consultant should know what any YT viewer can find out, but maybe that’s just theory.

If all that theory stuff is just so much blather, then what do today’s Fed policy makers actually talk about – money supply or some goofy notion like the Phillips curve or capacity? Here is the paragraph from the most recent batch of FOMC minutes which summarizes the Fed staff presentation to the Committee on Fed operations and their immediate impact:

“The manager pro tem turned next to developments in money markets and Federal Reserve operations. Usage of the overnight reverse repurchase agreement (ON RRP) facility remained fairly steady other than during the period surrounding quarter-end. In the period ahead, the relative pace of decline in ON RRP facility balances and reserve balances would depend importantly on shifts in money market conditions. Recent developments, including with regard to the relationship between ON RRP facility balances and money market rates, suggested that, over time, conditions could evolve in a manner that would lead to falling usage of the ON RRP facility. However, the manager pro tem noted that money market conditions could change somewhat more quickly in the lead-up to year-end because of normal factors, such as a Treasury tax payment date in December that could increase the Treasury General Account balance, and year-end position adjustments. This prospect could require money market participants to be more responsive to shifting liquidity conditions and to plan ahead for the coming period. Current market quotes suggested expectations of limited upward pressure on domestic money market rates around year-end. In offshore dollar funding markets, the premium associated with borrowing dollars was modestly higher than at similar points in previous years.”

Not a single mention of money supply or money supply growth. There is a much longer section on financial market conditions which I will not quote and which also includes no mention of money supply.

But that’s just staff. Who listens to them? Check out what the big guys are saying. Here’s the most concise statement of the issues which participants think will guy future policy:

“Participants mentioned a number of considerations that would likely influence the pace of future increases in the target range for the federal funds rate. These considerations included the cumulative tightening of monetary policy to date, the lags between monetary policy actions and the behavior of economic activity and inflation, and economic and financial developments.”

No explicit mention of money supply, though “financial developments” could encompass money supply. However, after reading every word of the minutes (for a second time – the things I do for you people!), I can find not a single mention of money supply nor money supply growth.

Do whoughe know what Jay Powell thinks about M2? I have been unable to find the quote, Steve H. Hanke and Nicholas Hanlon quote Powell telling Congress “the growth of M2 . . . doesn’t really have important implications for the economic outlook.”

https://www.wsj.com/articles/powell-printing-money-supply-m2-raises-prices-level-inflation-demand-prediction-wage-stagnation-stagflation-federal-reserve-monetary-policy-11645630424

So it kinda seems like the “ie” part of this is wrong: “The Fed’s current monetary policy is predicated on the notion that inflation has been caused principally by low interest rates (ie, a 40% increase in M2)”

But let’s ignore the bit about M2 growth. Is there any evidence Fed officials believe monetary policy in some other sense is mainly responsible for the acceleration of inflation? None that I can find. For instance, there’s this bit from the SF Fed attributing higher inflation in the U.S. relative to other G7s to fiscal expansion:

https://www.frbsf.org/economic-research/publications/economic-letter/2022/march/why-is-us-inflation-higher-than-in-other-countries/?amp=1

John Williams at the NY Fed recently gave a speech focused on the mechanics of inflation:

https://www.newyorkfed.org/newsevents/speeches/2022/wil221128

No mention of low interest rates.

Here’s the latest from Governor Lael Brainard:

https://www.bloomberg.com/news/articles/2022-11-28/brainard-says-string-of-supply-shocks-keeps-inflation-risks-high

Supply shocks. Not easy monetary policy.

Even ignoring the antiquated claim that M2 growth interests Fed officials, the idea that Fed guys blame easy monetary policy for current inflation is still wrong. Just like the claim that all you need in order to know if you are in a recession is data on vehicle miles traveled or GDP.

Wrong is wrong. No amount of words can fix it.

If M2 growth were “the” issue in monetary policy, in a MV = PQ sense, the there should be a tight positive relationship between M and PQ. Here’s a picture of changes in M2 and in PQ, where PQ = nominal GDP:

https://fred.stlouisfed.org/graph/?g=Xxlt

Looks like the relationship is negative instead of positive. Those who understand how monetarism died understand why that relationship looks negative.

Much more important in assessing whether the Fed gives a single, solitary hoot about M2 growth right now is the y/y change in M2 and the Fed’s latest policy guidance. The latest y/y gain in M2 is 0.8%, the lowest since 1995, and the Fed says more rate hikes are coming. If M2 growth mattered, the Fed’s policy guidance would not be for continued tightening.

That could work if V is both low and constant. It has turned up, which we would expect.

https://fred.stlouisfed.org/series/M2V

Everytime you say the dumbest thing ever – you turn around and break that record. That little defense of the Quantity Theory of Money makes blood leaching look like good medical practice.

Hmm – if we ignore all observations before 2020QII, we might come up with the Princeton Steve version of the Quantity Theory of Money where the normal GDP/M2 is around 1.2.

Hey Stevie – write this up as a submission to the Journal of Political Economy. I hear the editors need a good laugh!

In mentioning “V”, you have identified your own error.

Velocity isn’t constant. And because V is inconstant, the growth of neither M2 nor any other M is an important feature in the Fed’s thinking.

I am not sure what you are arguing. Are you arguing that MV = PY is wrong? That identity is reasonably accepted. But if you have a better formula, by all means, let’s see it.

If M increases by 40%, which it did, then PY must increase by 40% if V is constant. Since Y can only increase by, say, 2% / year, the rest should have to come out of P, that is, inflation.

Now, you can argue that V could collapse, and it did. But you seem to be arguing that V will remain low and constant forever, ie, that it is not mean-reverting. Well, V is rising, so the notion that it will stay constant and low forever is already disproven. But maybe it won’t recover all the way to the pre-pandemic level of 1.5, and maybe will stay closer to the latest reading of 1.19. Maybe. It would be nice to see the reasoning behind that notion.

“Steven Kopits

December 13, 2022 at 8:25 am

I am not sure what you are arguing. Are you arguing that MV = PY is wrong? That identity is reasonably accepted. But if you have a better formula, by all means, let’s see it.”

This is perhaps the best evidence of how UTTERLY STUPID you are. Identities are just that. Yes velocity is defined as GDP/M. But no one except a village idiot thinks this describes anything remotely related to macroeconomic theory. It is sort of like saying I have a formula for 2 plus 2. Of course that sum equals 4. Does that mean inflation this year will be 4%? Of course not.

Stevie – everyone here knows you have no clue what macroeconomics even is. So stop advertising your worthless consulting business by proving over and over again that YOU ARE A MORON. We all knew that a long time ago.

you can argue that V could collapse, and it did. But you seem to be arguing that V will remain low and constant forever, ie, that it is not mean-reverting. Well, V is rising, so the notion that it will stay constant and low forever is already disproven. But maybe it won’t recover all the way to the pre-pandemic level of 1.5, and maybe will stay closer to the latest reading of 1.19.

You have no idea what mean reverting even means. So could you stop using this term? Yea – it hovered around 1.8 for a while and then it hovered around 1.45 for a while. And you think you have a QTM version 3.0 where it will hover around 1.2 for the next generation.

Now this comes across as the dumbest thing ever but do write up your paper on your QTM version 3.0 and send it to the Journal of Political Economy. I bet the editors laugh so hard they have to go to hospital.

“So, if a guy routinely makes assertions that are demonstrably wrong”

Thanks for taking the time to write this comment. Stevie boy does just that and even when we take the time to point out his laundry list of assertions are all very very wrong – he never bothers to acknowledge his claims have issues. No – this arrogant know nothing just repeats the debunked claims over and over and over again. A total waste of time indeed.

Macroduck linked to this under another post:

https://www.brookings.edu/interactives/hutchins-center-fiscal-impact-measure/

The Hutchins Center Fiscal Impact Measure shows how much local, state, and federal tax and spending policy adds to or subtracts from overall economic growth, and provides a near-term forecast of fiscal policies’ effects on economic activity.

Let’s see what they said about fiscal policy:

“FEDERAL, STATE AND LOCAL FISCAL POLICY AND THE ECONOMY

By Eli Asdourian, Nasiha Salwati and Louise Sheiner

Fiscal policy reduced U.S. GDP growth by 2.7 percentage points at an annual rate in the third quarter of 2022, the Hutchins Center Fiscal Impact Measure (FIM) shows. The FIM translates changes in taxes and spending at federal, state, and local levels into changes in aggregate demand, illustrating the effect of fiscal policy on real GDP growth. GDP increased at an annual rate of 2.9% in the third quarter, according to the government’s latest estimate.

The fiscal drag on economic growth in the third quarter was driven largely by declines in real transfer payments by federal, state and local governments, which lowered growth by 2.3 percentage points. This reflects, in large part, the waning effects of the pandemic’s unemployment insurance benefit expansions and higher inflation. A rise in tax collections further contributed to the decline in the FIM, lowering GDP growth by 0.6 percentage point. Purchases by federal, state, and local governments raised the FIM by 0.2 percentage point.

As the FIM shows, fiscal policy provided significant support to economic growth when large swaths of the economy were shut down in 2020 during the COVID-19 pandemic. The FIM turned negative in the second quarter of 2021 as fiscal support waned, and we expect it to remain so through the end of our projection period (the third quarter of 2024).”

One might hope that we would have some fiscal restraint if aggregate demand was pushing up beyond potential GDP. Now had the fiscal drag been 7% of GDP was Stevie boy keeps insisting – that would be too much fiscal restraint. But as I have noted MANY times to this loud mouth incompetent who refuses to listen to anyone who get these things, his measure of fiscal policy makes NO SENSE.

Now the grown ups who do know how to measure fiscal policy puts the negative impact on aggregate demand growth closer to 2% of GDP.

Look – we have been over this many times before and I have asked Stevie boy to go back and read E. Cary Brown’s 1954 AER classic. He hasn’t until he does – could he at least stop writing the same old stupid intellectual garbage?

Professor Chinn,

Do I read correctly that GDO is the average of GDP and GDI? https://obamawhitehouse.archives.gov/sites/default/files/docs/gdo_issue_brief_final.pdf

Did you average GDP and GDI? I could not find a published data series for GDO.

Thanks.

Although the information from GDP and GDI could be combined in a variety of ways, in practice the simple arithmetic average of the two—as BEA is now publishing—is a reasonable way to combine into a single measure that is more accurate than either component is

individually. In fact, the NBER’s Business Cycle Dating Committee includes the average of GDP and GDI in its official determination of peaks and troughs in economic activity.3 CEA has also had a long-standing practice of monitoring and discussing GDO.4 A number of other

countries feature measures of economic output that are derived from both product-side and income-side estimates.5 For example, Canada features both income and product estimates, referred to as “GDP by Income and Expenditure Accounts.”

I noted this because Princeton Steve has yet to acknowledge GDI or GDO. Of course Stevie thinks he is smarter than even NBER’s Business Cycle Dating Committee even though Stevie’s writings are typically dumber than rocks.

https://fred.stlouisfed.org/series/a261rx1q020sbea

Real gross domestic income

I don’t think the average of real GDP and real GDI is published but each series individually is. I also recall there being a literature on the optimal weighting of these two series which is not necessarily 50/50.

From an early September Econbrowser post where Menzie provided a link to a Jason Furman written article (I lift Furman’s words verbatim, though abbreviated from the article in its entirety):

“In the first quarter of 2014, GDO increased 0.4 percent, while non-farm employment rose by 1.5 percent. (Both figures are annualized rates.) In theory, both of these could be correct – businesses may have stepped up their hiring while workers became less productive, thus decreasing total output. As a matter of accounting, these two concepts are reconciled in the productivity statistics, which show that productivity fell by 3.7 percent at an annual rate in the first quarter of 2014. Measured labor productivity growth is, in fact, extremely volatile, as shown in Figure 1 earlier. That reflects a combination of measurement error in both the numerator (output) and denominator (hours worked) and undoubtedly overstates the true volatility of productivity.

This suggests that, when output and employment are sending diverging signals, the truth is likely somewhere in between – again, implying that combining different measures may be superior to viewing each in isolation. In this case, it is reasonable to put substantially more weight on early estimates of employment growth than on early estimates of output growth, in part because GDP growth is typically subject to larger revisions. Even after a more accurate measure of output like GDO arrives, one should still place more weight on employment growth than output growth.”

https://www.milkenreview.org/articles/extracting-the-signal-from-the-noise-7-tips-for-interpreting-macroeconomic-data

Best explanation I can find. I assume Menzie will make a short comment if this is factually incorrect or misleading. Similar to our boy Kevin Drum, I don’t think Yglesias is trained in Economics, but he’s semi-reliable:

https://www.vox.com/2015/7/31/9076859/gdo-gross-domestic-output

Hell, your own WH link might even explain it better.

AS: GDO is now published on the BEA website in one of the tables for national income accounts. It’s simple to calculate as simple arithmetic average of GDP and GDI (but is not, to my knowledge in FRED, although GDP+ growth is).

Thanks. I guess I missed finding GDO on the BEA website.

From “COUNCIL OF ECONOMIC ADVISERS ISSUE BRIEF

JULY 2015

A BETTER MEASURE OF ECONOMIC GROWTH: GROSS DOMESTIC OUTPUT (GDO)

“Though the information from GDP and GDI could be.

combined in a variety of ways, in practice the simple arithmetic average of the two—as BEA is now publishing—is a reasonable way to combine into a single measure that is more accurate than either component is individually.”

That was after the good professor’s time at the CEA, but I’d bet the math is the same. A quick check of BEA national income tables, Appendix A, related measures, reveals GDI, but no GDO. Maybe BEA stopped publishing.

Crud. I’m late to the party.

Macroduck: It’s kind of buried. See interactive data table 1.7.6, line 12.

Awesome thanks. Now what one reasonably sees is that GDI and GDO barely moved quarter to quarter from 2020Q4 to 2022Q3. Even though Princeton Steve’s BFF JohnH criticized all of us for making such a big deal out of these numbers, it is Princeton Steve who keeps making a REALLY BIG DEAL out of the real GDP numbers. But they were the RECESSION CHEERLEADERS.

When I was a kid and my wise dad took me to games he would insist we buy a program to keep all the players straight and that we just ignore the cheerleaders. Good advice for economic debates!

Now that the election season is over – can we all focus on the semi-finals of the World Cup. Go ARGENTINA!

Pulling for France to win all the marbles. (there’s a phrase I never thought I’d type through my entire life).

I can’t pull for Argentina. Too much cheap shots and too much flopping. If you need to rely and cheap shots at defenseless players and flopping to get to the semis then you don’t belong there to begin with. Messi belongs together with Cristiano, in a seniors home listening to The Best of Lionel Richie and The Best of Barry Manilow.

BTW, did you notice Trae Young taking another page from the Russell Westbrook playbook?? Put on your adult diapers while your teammates are playing a game and ignore your head coach. NO titles, and a team offering him out to the ENTIRE NBA league and not a single NBA team that wants him, so the Lakers let Westbrook off the back-up bench to flail threes into the crowd seats for 28 minutes with a negative 2.8 +/- ratio. Trae’s’s going to be where Westbrook is now in 10 years.

https://www.si.com/nba/hawks/news/nate-mcmillan-explains-trae-youngs-absence

Many thanks.

Somebody alert FRED.

I’m reading the very first few pages of the Yellen biography. It’s good so far. As many readers may have guessed, I skipped to the photo section of the book before getting that far. Menzie, I thought you in particular might get a light-hearted chuckled out of Yellen’s neurotically neat notes she took in James Tobin’s class—shown in the photo section of Hilsenrath’s book. Legendary.

Tobin’s classes were a true delight. He may have stuttered but the sheer brilliance of his lectures made it all worth it. Tobin also had this brilliant idea of having some of his students who had already taken his graduate class in macroeconomics sit in again and take notes that were distributed to the other students so the newbies could relax and better absorb the logic of each lesson. Gary Smith was one of Tobin’s best students and had at times considered turning his notes into a graduate text. Too bad he never did.

“The Fed’s current monetary policy is predicated on the notion that inflation has been caused principally by low interest rates (ie, a 40% increase in M2)”

I was struck by this claim, which struck me as an endorsement of the discredited Quantity Theory of Money and best and misleading in the presentation of the data on the money supply:

https://fred.stlouisfed.org/series/M2SL

Stevie forgot to tell us over which period the money supply grew by this amount. Oh wait – if we go from February 2020 to the end of 2021, M2 grew by this 40%. But that is a two year period which is sort of odd for a proponent of the Quantity Theory of Money.

I took the change from October to October for the last 3 years (ending 10/2020, 10/2021, 10/2022). For the first year, M2 grew by 23.72%. Did we see 20% inflation? Oh wait!

For the 2nd year, M2 grew by only 12.85%. For the latest year, M2 grew by only 1.28%. So this fantasy that the Quantity Theory of Money explains inflation is just that.

And leave to Stevie to even get the growth rate of the money supply all wrong.

But what do we expect from someone who thinks there is some “suppression” theory of macroeconomics?

Lags, lags. M2 is predicting disinflation. Which is happening.

What you wrote the first time was beyond STUPID for reasons we have explained over and over. Rewriting it only makes it dumber.

Could you slow down your pathetic bloviating long enough to read the critiques of your numerous incredibly incorrect comments? You might learn something. DAMN!

up to this line i was going to compliment you…….

manners.

Here you go:

GDO from FRED

https://fred.stlouisfed.org/series/LB0000091A020NBEA

Even better, all of the indicators used by the NBER business cycle dating committee on one page from FRED:

https://fredaccount.stlouisfed.org/public/dashboard/84408

Good man! Thank you.

“GDO from FRED”

Cool! In inflation adjusted terms as well. Alas this series presents annua data not quarterly data.

And here is GDO quarterly which might be more useful that annually cumulative above:

https://fred.stlouisfed.org/series/LB0000091Q020SBEA

And also GDO quarterly percent change:

https://fred.stlouisfed.org/series/PB0000091Q225SBEA

FRED has everything. Data that historically was extraordinarily difficult to access is now at everyone’s fingertips. And tools to combine series and manipulate presentation. Quite an advancement in economics.

Real GDO quarterly – just awesome!

https://krugman.blogs.nytimes.com/2014/12/13/is-our-economic-commentators-learning/

December 13, 2014

Is Our Economic Commentators Learning?

By Paul Krugman

We are now in our seventh year at the zero lower bound. Over that period we’ve seen massive deficits rise and fall, aggressive monetary expansion and ill-advised monetary tightening, extreme fiscal austerity, and more. At this point we should therefore have a pretty good idea of how things work in this environment. And as I’ve often pointed out, everything has been more or less exactly what you would have expected from IS-LM (with the central bank controlling the monetary base, but not the endogenous money supply).

It’s remarkable, then, how much commentary in the media involves assertions that are completely at odds with everything we’ve seen since the financial crisis. I made fun of belief in invisible bond vigilantes and the confidence fairy in mid-2010, and sure enough, there have been no sightings of either in all the years since. Yet you’d never know that from the media commentary.

Simon Wren-Lewis offers a depressing example: he finds Robert Peston of the BBC continuing to talk about interest rates by invoking the invisible bond vigilantes – when as Wren-Lewis notes, France now pays much lower interest rates on its debt than the UK, and as he doesn’t note, so does Japan, with its very large debt and aging population. Worse still, however, Peston describes his fantasies – OK, I guess you could call them “speculations”, but anyway there is no evidence that they are driven by anything outside his own imagination – as the message being conveyed by “Mr. Market.” Through telepathy?

But belief in the invisible bond vigilantes and the confidence fairy isn’t the only faith that seems oddly impervious to evidence. Ambrose Evans-Pritchard, in an otherwise coherent description of Europe’s deflation risk, approvingly quotes Tim Congdon blithely declaring that monetary reflation in a liquidity trap is no problem:

“The interest rate is totally irrelevant. What matters is the quantity of money. Large scale money creation is a very powerful weapon and can always create inflation.”

Sure….

https://fred.stlouisfed.org/graph/?g=Xx9V

January 15, 2018

M2 Money Supply and Personal Consumption Expenditures excluding food & energy Price Index, 2007-2014

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=Xxau

January 15, 2018

M2 Money Supply and Personal Consumption Expenditures excluding food & energy Price Index, 2007-2022

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=Xxb0

January 2018

Real average of Gross Domestic Product & Gross Domestic Income and Real GDP, 2000-2021

(Indexed to 2000)

Joseph figured out how to pull this quarterly!

Saturday, Nikkei ran a report about $461 billion in new credit to be made available to China’s real estate sector:

https://asia.nikkei.com/Business/Markets/China-debt-crunch/China-banks-throw-460bn-credit-lifeline-to-real-estate-sector

In reading through pre-open Asian financial reporting, I see no mention of this new credit. Lots of chit-chat about the “China re-opening trade” and about surging Covid cases in China. A bit of a mystery.

Re-opening with an under-vaccinated population and too few hospital beds creates big risks, regardless of he initial market response. A $461 billion credit infusion to a credit-troubled sector, on the other hand, is a clear kick of the can down the road; not necessarily salvation for China’s real estate sector, lenders or economy, but an unambiguous delay of the reckoning. If the Nikkei report is correct, where’s the notice?

It would be interesting to know what Xi’s economic advisers are telling him. Are they only telling him what he wants to hear, out of sheer fear?? Or are they giving him solid advice and he’s just ignoring it. I tend to think the former. Winnie the Poo is mesmerized by his own navel. The only good #1 leaders they’ve had post-1949 were Deng Xioaping and Zhao Ziyang. And right now, the chain of leadership is corroding very quickly, like, by the day.

Those who claimed the Keystone Pipeline would have no adverse effects may need to work overtime dismissing this news:

https://abcnews.go.com/US/keystone-pipeline-oil-spill-investigators-search-cause-kansas/story?id=95048959

Federal and state environmental officials worked over the weekend to mitigate the fallout from last Wednesday’s Keystone Pipeline rupture that leaked about 14,000 barrels of crude oil into a Kansas creek. Officials hadn’t yet determined the cause of the incident, TC Energy, the Canadian pipeline operator, said on Sunday. The spill near Mill Creek, in Washington County, Kansas, had been “contained” by about 250 people working at the site, TC Energy said in a statement.

I am always grateful when Dean Baker emails me his latest:

https://cepr.net/the-november-jobs-report-was-not-as-strong-as-advertised/?emci=9aa20c58-457a-ed11-819c-000d3a9eb474&emdi=84321103-467a-ed11-819c-000d3a9eb474&ceid=4616197

I confess I am a card-carrying member of Team Transitory, and I have been wrong about the extent to which inflation would be persistent. This was largely due to subsequent rounds of Covid, China’s zero Covid policy, and the Russian invasion of Ukraine, all factors which the inflation hawks did not anticipate either. But regardless of how we got here, the question is what things look like going forward.

We saw much more job growth in the November jobs report than most analysts, including me, had expected. By any measure, 263,000 new jobs in an economy near full employment is strong growth. It is not plausible that the economy can continue to add jobs at this pace. Furthermore, we had a 0.6 percent jump in the average hourly wage in November. Annualized, that comes to over 7.0 percent wage growth. That is clearly not consistent with the Fed’s 2.0 percent inflation target, or anything close to it. The 1.4 percent three-month increase annualizes to 5.6 percent, which is not all that much better. Taken together, the stronger than expected job growth, coupled with the big jump in wages, seems to indicate that we have a serious problem with inflation. The consensus seems to be that the Fed may have to keep the rate hikes in overdrive.

Now I am totally on board with Dean’s initial comments regarding how inflation is being propped up by transitory cost plus factors. And he is also correct that the labor market is booming – despite all the intellectual garbage we hear from Princeton Steve. My big difference with Dean, however, is I’m afraid the damage from tight money might come fast and furious. I can live with 6% nominal wage growth if that translates into 4% continuing inflation. After all – we do need to see some of the recent real wage declines reversed.

the pressure on prices from war, and other emergencies takes some time to wring out, see the 10% added to the 2023 dod appropriation over the request, and that is not likely to replace everything military that needs to be increased.

other pressures include wringing out cash accumulated by consumers

and as el erian occasionally suggests, employment to population is not up to pre covid level.

and how much wage increase (or the investment in retaining) is required to whittle down the job openings?

and subsidized green is a long way from having a positive roi……

I see little inflation since July. Trying to use lagging wage growth as a excuse is sad. What will you say when yry cpi dropped to 1.9%???

Putting Marjorie Taylor Greene’s latest on 1/6/2021 in context:

https://www.msn.com/en-us/news/politics/marjorie-taylor-greene-s-jan-6-joke-has-been-a-long-time-coming/ar-AA15c6Gq

An early high water mark in the GOP’s efforts to minimize the events of Jan. 6, 2021, came in early February 2022: The Republican National Committee not only voted to censure two members who had joined the committee investigating the insurrection, it decided to insert a phrase into the censure resolution practically dripping with provocation: “legitimate political discourse.” Supporters of the measure quickly sought to assure that the phrase didn’t refer to those who stormed the Capitol and got violent, but the resolution itself made no such distinction. And it was little mystery why: Republicans had spent the past year downplaying the events of that day and trying to rewrite a story that didn’t reflect particularly well on the party. The resolution invited those who believed this attack on the seat of government wasn’t that bad, or even that it was justified — that is, a significant portion of the GOP — to go right on believing that.

This weekend saw another such event: Rep. Marjorie Taylor Greene (R-Ga.) “joking” about how Jan. 6 could have turned out differently had she been in charge, while mocking those who have cast blame on her and Trump ally Stephen K. Bannon. “I want to tell you something: If Steve Bannon and I had organized that, we would have won,” Greene said. “Not to mention, they would’ve been armed.” The statement carries with it all the plausible deniability that the RNC resolution did, since Greene was telling jokes onstage at an event for young Republicans in New York. The provocateur congresswoman is inviting journalists to write this up as if it were an entirely serious comment, at which point she can claim persecution — a valued commodity. But consider the game Greene is playing. She’s making Jan. 6 a punchline and inviting extremists in her party to believe that there’s more than a hint of truth in her quip — even that she’s expressing common cause with the insurrectionists (“we would have won”). And given her priors, it’s no secret what the intent is, no matter how much she’ll claim otherwise.

It’s a remarkable moment, but also one that’s been a long time coming.

there are more ways to ru a coup than a few craziness wanfdering around the capitol

what ever musk tells……

Make sure you have a designated driver.

Kevin Drum does something that is really simple but for some reason is beyond the capabilities of the world’s most incompetent consultant (Princeton Steve):

https://jabberwocking.com/raw-data-the-m2-money-supply-2/

‘Raw data: The M2 money supply’

Kevin as always presents the data in inflation adjusted terms.

https://www.longtermtrends.net/m2-money-supply-vs-inflation/

One of Kevin Drum’s readers provided this link showing M2 Growth v. inflation by year all the way back to 1870. The correlation between the 2 series looks mighty weak to me but I’m sure Princeton Steve can use this series to write his great defense of the Quantity Theory of Money for the Journal of Political Economy!

CoRev’s latest confused chirping over energy prices reminded me if his insistence that the low soybean prices back in the heyday of the Trump trade war with China could not be blamed on Trump’s trade war. I bet it was this dust up that convinced a lot of you that CoRev had to be the STUPIDEST MAN ALIVE. So let’s review how soybean prices have behaved in the last two year:

https://www.macrotrends.net/2531/soybean-prices-historical-chart-data

A boom in soybean prices aka the Biden soybean boom! No wonder CoRev never wrote his thesis on the economics of soybean prices!

It was a trade war invented by Trump China together. Don’t forget that.

Can you remind all of us who was it that PAID for the subsidies (i.e. social welfare) to American soybean farmers during trump’s clusterf*ck?? HINT: The same people who paid for donald trump’s completely useless “border wall”. It wasn’t “the Mexicans” and it wasn’t “the Chinese” who paid for social welfare to U.S.A. soybean farmers going bankrupt. These masochistic and functionally illiterate peoples who PAID FOR donald trump’s wall and soybean farmer bankruptcies live south of Canada and north of Mexico.

Feel free to use a Lensatic compass and Barkley Rosser’s map of extreme southern Belarus if you feel it might help answer the question.

Driniking to excess again, Moses?

Better yer, folks, feel free to use Moses’s map of southeastern Romania.

@ Washed-up and Sad in Harrisonburg VA

Remind me, who, claiming they were a “expert on Russia” said Russia wasn’t going to invade Ukraine?? Happy to pull up the comment again. Along with my own thoughts on it prior to the bloody invasion. There’s Ukrainian women and men starving now with no electricity, nevermind the ones murdered and raped, wondering why anyone had said such a thing. Wondering what kind of idiot would have said such a thing, mid-to-late February.

Does it pain you to think “a winebibber” and non-expert on Russia made the correct call on the war while you said your “Russian insiders” told you Russian soldiers were playing Charades and “Pictionary” on Belarus’ southern border?? Or just a bitter man 24/7/365??

Moses Herzog: This is Dr. Rosser’s comment I recall:

@ Menzie

You have forgotten how much Mr. Rosser likes to move the goalposts. And, literally, changes his thoughts on very solemn topics between (check the dates) Wednesday and Saturday of the same week:

“Do keep in mind I am the one here with access to Russian media. That has now been blaring for several days that the troops will go home after the exercises are done, and exercises are exactly what they are doing now. This has more recently been reinforced by statements from Putin in press conferences, such as the one just held after the visit of German Chancellor Scholze [sic].

There is not going to be an invasion, even if some of the details of what Zelensky and Ukraine may agree to are not fully settled, and Victoria Nuland has been shooting her mouth off too much, somebody I wish was not part of this administration.”

https://econbrowser.com/archives/2022/02/risk-and-uncertainty-before-the-open#comment-268219

Rosser had other hilarious statements, one in which he expressed Russian ice skaters would help avoid a war in Ukraine. That was a new low in idiocy, even from Rosser, I have to say. I know Rosser will deny ever saying it, and LIE again, (he stated it in not one, but two different comments) so let’s save some time and add that link:

https://econbrowser.com/archives/2022/02/risk-and-policy-uncertainty-measures-gulf-war-i-and-today#comment-268128

Mr. Rosser stated, same blog thread, Putin “had no meeting with Scholze [sic]” which he had, Putin’s meeting with Scholz meeting was plastered over every website and TV screen in existence.

Then we have the entire post on Yves Smith’s site back in January:

https://www.nakedcapitalism.com/2022/01/dare-i-disagree-with-david-ignatius.html

Barkley went on to say that when he was moving the goalposts and changing his thoughts (after war shells and rockets in Ukraine had already started) that between February 16 and February 23 was “more than just a few days” that Mr. Rosser had started to backpedal and reverse his statement on the possibility of invasion.. Right when the sun shot over the morning horizon into Barkley’s eyes he knew that the sun would indeed come up that morning. And just because Barkley said the sun would not come up that morning, 20 minutes ago, did mot mean Barkley was wrong or had reversed his statements. As a great orange colored authoritarian leader often said “Everybody knows that.”

Then, as is often the case with Barkley Rosser, like a grade school child he lashed out to try to end the argument on his version of a high note. He told me I was wrong about oil not going above $100. I had to remind the man who can’t even remember his own words, much less anyone else’s that I had stated multiple times in writing on the blog that my strong prediction (which I was right about) was conditioned to anytime before December 31, 2021. So I also had to teach Barkley Rosser how a Gregorian Calendar is read.

And I know Menzie felt a needed to apply an economic model before making such a correct prediction on oil prices not exceeding $100 before end of 2021, but I felt is was self-evident. Oh well

I can list more of Mr. Rosser’s errors, more trivial I suppose, if you consider international news trivial~~related to how Eastern parts of Ukraine would be partitioned and managed by Putin. Other of Mr. Rosser’s errors related to the safety of an American embassy in Ukraine (Kopits voiced his support to Barkley there, and both Kopits and Rosser were ready to sign up for guard duty at the U.S. embassy, I’m sure) . I know Menzie is a much busier man than I, Menzie’s life is more pressure filled, so I understand why he might remember a comment Mr. Rosser made February 19th and forget a comment Rosser had made February 16th. As the kiddies say “it’s all good”.

Moses,

The real question is why are you so intent on scoring points on this matter now on this thread at a point that has nothing to do with this topic and when i was not even making any comments? You just came out of nowhere with all this stuff and messed up your initial stab by making it look like my mistake had something to do with looking at maps when in fact it was you that was making erroneous statements about maps in the region. I admit when I make goofs, and did so here again, but you studiously ignore your hilariously wrong “southeast Romania” remark. But this is hardly the first time that in an effort to show up my goofs you remind people of ones you have made some of them much worse than mine.

“moving goalposts”? I change my mind as new information appears. For months my view looked pretty much like what Dr. Chinn quoted. But I was hoping that the Ukrainians would prove right and that this would be yet another time that Putin moved troops to the border and made threatening noises, only to back off. Did you forget about all those earlier bluffs?

When there was this Russian media report that was being taken seriously in Russia, and it was, but not being reported here, although eventually it was, I thought I would provide a service to people here by letting them know about it. i admit I took it seriously, which you have now reminded people of more times than I can count and now again often at completely irrelevant times. But it is a fact that I held that view for only a few days and switched back to Putin might invade BEFORE his invasion after Lukashenka came out with his bizarre statement, as I noted here. We have been over this before. Your claim that somehow I lied about any of this is itself is false, a; lie by you. Why are you acting like JohnH?.

I think you are way overstating how hopeful I was about how having Russian skaters at the Olhmpics would prevent war. At that time I was clearly worried we might see war after the Olympics ended, which indeed happened. I think anybody who reads the link you provided can see that. I was at that point most definitely NOT forecasting that Putin was definitely not going to invade. You are really sick with your ongoing distortions of things I write.

As it is, Moses, I am much more willing to admit my errors, and I make them when appropriate, more than you are. Right here on this thread you have just completely degenerated into really bad conduct, but I realize that you are frustrated that Dr. Chinn has taken you to the woodshed. You should have just shut up after that. Instead, you have just dug yourself deeper into a pit of misrepresentations. I have not lied about anything here, and your claim I did is disgusting and calls for an apology from you, although I am not expecting one, from you, given your abysmal track record on this. Gag. Oh, I admit that you have apologized a small handful of times, but way too few.

But, hey, since you started out going on about maps, you can remind us again of how brilliant you were with that “southeast Romania” remark. Or are you pretending you never said that? Or maybe there really were Russian troops in southeast Romania, and they did what?

Moses,

I did at one point after it was announced IN RUSSIA ON RUSSIAN MEDIA that their troops in Belarus would be withdrawn from Belarus rather than invade Ukraine, which was inaccurate. A few days later when Belarusan President Lukashenka declared there was a danger of Uktaine invading Belarus and Russian troops should stay, I changed my tune to saying “Uh oh, Russia might still invade Ukraine.” You have repeatedly focused on something I said at one point in response to something that Putin said to his own population that by all reports they were believing, including the troops in Belarus and their mothers back in Russia, as well as the Ukrainian leadership, for that matter. When the new report came in a few days later I reverted to what had been my line for many moths, which Dr. Chinn found a pretty good summary of, with me in fact calling for many months to worry about Putin due to his off-the-wall nationalist essay in July , 2021, as well as his isolation.

Regarding this current exchange, I note that you recommended people look at my “map of extreme southern Belarus,” which, of course, had absolutely nothing to do with whether or not Russian troops there were going to invade Ukraine or go home as Putin said on Russian media they were. I did not claim there were no Russian troops there, and I made no errors regarding maps. It was you who made an error about where Russian troops were and an ignorant comment about maps when YOU claimed that Russian troops were in “southeast Romania,” which they most certainly were not.

So, you were the one making a stupid and ignorant comment about maps and the locations of Russian troops, not me. Hence my wisecrack about you drinking, which maybe you were not, although that would have provided an excuse for your off-the-wall remark.

Moses,

BTW, I shall point out that you popped up with this screwed up sicko dumb comment out of the blue when nobody was talking about any of this. So, it is you who are filled with a sick obsession of constantly gong after me when I am not even posting anything and the topic under discussion has nothing to do with the stupid point you are about to try to make that you end up bungling while doing it.

Which in fact is why I wondered if indeed you had been drinking to excess again. You were just way out of line and off the wall, both.

Moses,

Just to really hammer how utterly ridiculous it was of you to even remotely bring this up, especially in terms of maps, while my mistake was believed by many Russians, including troops that would soon be invading Ukraine, as well as most of the top Uktainian leadership, your claim that there were Russian troops in “southeast Romania” would not be believed by anybody even remotely knowledgeable about matters in Europe. Why not?

BECAUSE ROMANIA IS A MEMBER OF NATO AND THERE ARE NO RUSSIAN TROOPS IN ANY NATO NATION!

Got that? So, do you want to fill us in on just how drunk you were when you brought up this nonsense?

Barkley Junior says: “I note that you recommended people look at my “map of extreme southern Belarus,” which, of course, had absolutely nothing to do with whether or not Russian troops there were going to invade Ukraine or go home as Putin said on Russian media they were.”

A lot of humor here in your statements. I notice a long-running theme in your comments going back years on this blog and I assume a long-running theme throughout your entire life. What other people refer to as being wrong on something, you refer to as “I changed my mind” or “I changed my tune”. Barkster, my dear pre-adolescent boy, I now see how you have attained your internal view of self-perfection. Congrats Sir.

Shall I pull up also your comments on Kharkiv?? Some of my favorites. Although I’m not sure if you ever confessed to “changing your mind” on what would happen in Kharkiv. Nope, you’re never wrong Barkley Junior, just always and ever “changing your mind”. From February 23. I seem to remember February 23 was less than a week before the invasion in Ukraine started. Here are your words verbatim, the “expert on Russia” discussing Kharkiv:

“According to a long story in today’s WaPo, people there are pretty calm, although according to you [Moses Herzog] they should be running around freaking out. It may be that they are all a bunch of fools. But in fact I suspect another element of this is that because the city is dominated by ethnic Russians, they figure that life will go back to normal if they get conquered. But all accounts they do not support Putin or an invasion. But if it happens, they will move on.”

https://econbrowser.com/archives/2022/02/predictions-oil-prices-and-recoveries-and-recessions#comment-268846

Well folks, literally 5 days later, in the video at the top of this BBC link, you can watch the residents of Kharkiv “move on” as Barkley Rosser so “gracefully” expresses the mood people take on after having their homes demolished by missiles and shells.

https://www.bbc.com/news/live/world-europe-60542877?ns_mchannel=social&ns_source=twitter&ns_campaign=bbc_live&ns_linkname=621d3803ec502b53cd4802af%26WATCH%3A%20Kharkiv%20and%20Chernihiv%20hit%20by%20heavy%20shelling%262022-02-28T21%3A02%3A10.066Z&ns_fee=0&pinned_post_locator=urn:asset:269e8029-b4fa-4d24-af60-7fb6e42cbf6e&pinned_post_asset_id=621d3803ec502b53cd4802af&pinned_post_type=share

There they are in Kharkiv back in late February. “Moving on”. Perhaps Barkley Rosser would like me to share more recent video and pics of Kharkiv, where Mr. Rosser, “expert on Russia” can inform us he’s “changed his mind” what “moving on” means to the residents of Kharkiv after having their homes destroyed by shells and missiles.

Yes……. certainly……. “changed his mind”. Not wrong mind you. Mr. Rosser just “changed his mind”.

Gee Stevie has responded to only 2 of the many critiques from Macroduck and to none of the other critiques from the rest of us. I might say he is a complete gutless weasel but consider his two responses:

(1) Stevie has demonstrated that the good folks at NBER have no clue how to define a recession. Only the might Stevie has that right.

(2) Stevie has revived the Quantity Theory of Money noting in his version GDP/M2 mean reverts to 1.2.

Seriously this blow hard really believes what he writes has an ounce of credibility? HELLO!