Self-declared policy analyst Steven Kopits comments:

According to the latest BLS data, multiple job holders represented 4.6% of the employed in March. In December, multiple job holders represented 5.1% of the employed. That difference is worth an incremental 684,000 multiple job holders on an increase of 916,000 employed. So, yes, multiple job holders are in fact material in the equation.

Part time workers are even more important, adding 886,000 such jobs in March-December on 916,000 incremental employed.

I can’t replicate the number multiple job holder number. Nor do I think Mr. Kopits is running the right comparison.

First point, summing multiple job workers — “full time, full time”, “full time, part time”, and “part time, part time” to get a total number of multiple job holders, I get 6922 thousands in December, vs. 6474 in March, for an incremental change of 448 thousand (compare to 684 thousand cited by Mr. Kopits).

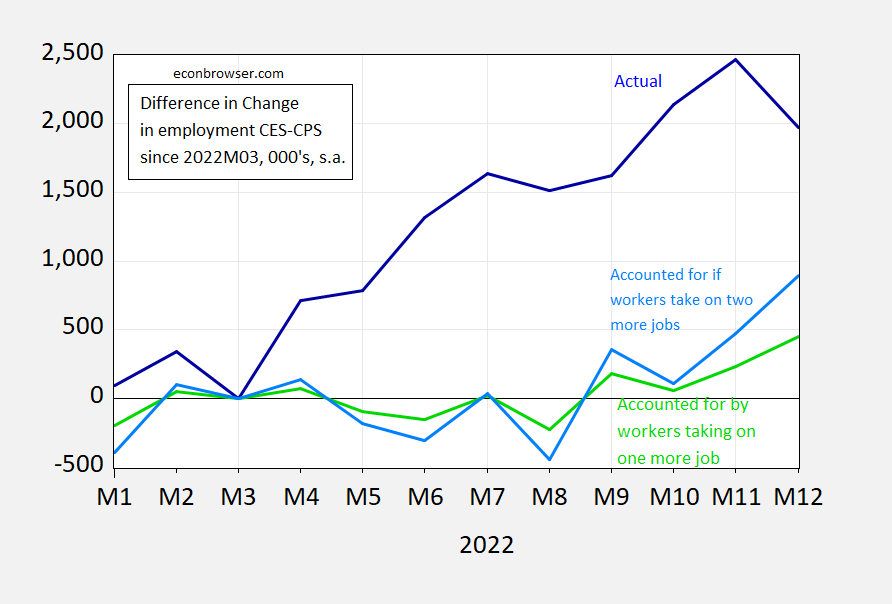

Second point, remember, originally Mr. Kopits was trying to explain the difference between the establishment series of NFP and the household series civilian employment as arising from the increase in job holders (see this long post on this point, using November release data) — so what we want to see is how the change in the gap between NFP and civilian employment can be explained. The change in the gap is 1917 thousand (rather than the change in civilian employment, which is 916 thousand). To see how the increase in multiple job holders compares against the change in the gap (relative to 2022M3), see Figure 1 below.

Figure 1: Difference in net job creation from nonfarm payroll series minus civilian employment series, since 2022M03 (dark blue), increase in multiple job holders since 2022M03, assuming workers increase from one to two jobs (green), and from one to three jobs (sky blue), all in 000’s, seasonally adjusted. Multiple job holder series are BLS series LNU02026625, LNU02026631, LNU02026628. Source: BLS via FRED, and author’s calculations.

In order for the multiple job holders to account for the entire increase in the gap, each additional multi-job holder would have to take on average 4.4 additional jobs instead of just one additional job.

Data in Excel format, here:

https://fred.stlouisfed.org/graph/?g=ypIv

January 30, 2018

Aggregate Weekly Hours of All Private Employees, 2017-2022

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=xudZ

January 30, 2018

Multiple Jobholders as a percent of Employed, 2017-2022

https://fred.stlouisfed.org/graph/?g=u12d

January 30, 2018

Employed Part-Time for Economic and Noneconomic Reasons, 2017-2022

“In order for the multiple job holders to account for the entire increase in the gap, each additional multi-job holder would have to take on average 4.4 additional jobs instead of just one additional job.”

Well the last time his absurd thesis was shown not to even remotely fit the data – the 4.4 was closer to 13.

“multiple job holders represented 5.1% of the employed.”

Well yea – but it also represented 5.1% as of Feb. 2020. Stevie loves volatility as it helps him cherry pick and totally distort the numbers.

So, Stevie has given us a definition of “hard reset” in response to my complaint about the ambiguity of the term. Here’s his definition:

‘Hard reset = dramatically’

That is helpful. Let’s see how that clarifies Stevie’s thinking for the rest of us by using some examples of Stevie’s use of “hard reset”:

– Dramatically all over the place.

– I think the ‘dramatically’ is underway and will continue.

– A dramatically suggests a deepening recession. Buckle up.

– Based on the indicators I track, yes, I think we are in continuing recession, and I expect a dramatically of the economy in H2.

I think there is still some ambiguity in these statements, even after Stevie’s clarification. This new definition leaves us at continued high risk of “palpable mistakes and misunderstandings”.

Not to mention that:

Adjective-noun = Adverb

Never had much hope of making sense.

“originally Mr. Kopits was trying to explain the difference between the establishment series of NFP and the household series civilian employment as arising from the increase in job holders”

A difference that closed in the latest BLS not because people were working 13 jobs and not because the household survey was the more reliable measure as the household survey reported a 717 thousand increase in December as opposed to the 223 reported increase in the payroll survey.

It seems Stevie does not want to address the elephant in the room as that elephant just sat on his BS and crushed it.

I have add the excel file to facilitate your analysis.

https://www.princetonpolicy.com/ppa-blog/2023/1/6/us-employment-trends-march-december-2022

Is this like your chart on productivity that had zero explanation? Why did you go into consulting – did Deloitte Hungary fire you for incompetent work?

Oh wait – we have seen your writing. Maybe me asking you to articulate what you did here is my mistake.

https://www.vox.com/policy-and-politics/2023/1/5/23540554/kevin-mccarthy-speaker-offer-republicans-concessions

The sell outs to the right wing nutcases McCarthy agreed to.

“”But for whatever reason, Republicans are … more willing to take a stand against their own party, against their own leadership, and I think we all recognize that.” Republican Rep. Chris Stewart of Utah

I know a reason. even the squad is reasonable. the right wing of the republican party is filled with unreasonable people. example is matt gaetz. simply different qualities of human beings. gaetz would burn down the house with children inside to get what he wants. and too arrogant to apologize for being wrong. reminds me of econned.

There are two separate questions here.

The first pertains to the credibility of sources. Which should we believe? The CES or the HH survey? Menzie argued for the CES. This seemed somewhat problematic in H1, as we saw decreasing productivity and falling GDP. If we were adding so many full time jobs, why was both productivity collapsing and GDP declining?

The HH (CPS) survey, by contrast, was showing that 1) employment was flat after March, and 2) that more than 100% of the job gains were coming from part time work or multiple jobs, suggesting a surge in lower wage work resulting in a negative effect on productivity. That seemed more plausible to me.

At the same time, I thought it possible that both surveys were in fact correct, but garbled with the effect of the recovery from the suppression, thereby creating misleading impressions because we were misinterpreting the data. That still seems possible, though I’ve read that others think the CES was manipulated to provide a more rosy picture heading into the election. In any event, if one thought that both surveys might be in some sense correct, perhaps the discrepancy could be reconciled by multiple job holders. As it turns out, though, multiple jobs only account for 314,000 of 2.7 million jobs per the CES in the March-Nov. period, the period I believe we were debating. So that supposition proved incorrect, as Menzie pointed out and I acknowledged.

Then we learned that the CES was fundamentally incorrect, with the Fed reducing the increases in jobs from 1.1 million to 10,500 from March to June. For that period, it rendered the whole reconciliation issue moot, for it asserted that the CES had been producing phantom jobs. No reconciliation was needed.

As such, the HH survey appears to be the more credible source, certainly through June and probably through most of the rest of the year. And that suggests that the growth in employment has come entirely from part time and multiple job holders.

Steven Kopits: First, please recognize that “the Fed” did not demonstrate the CES survey series was wrong. What some researchers at the Federal Reserve Bank of Philadelphia showed is that updating using less detailed QCEW data than BLS uses, the found the sum of states employment was much less than what CES was reporting. The results they obtained were not definitive; in fact if one reads the notes, one finds that their results depend (substantively I would guess) on the method of seasonal adjustment used. I used QCEW data at the aggregate level to track changes. I found that depending on the seasonal adjustment method used, either the CES series was over- or under-counting. The Philadelphia Fed approach is more detailed — taking adjustments to the state level — but then involves more estimation. Which one is going to be more precise in terms of tracking the CES nonfarm payroll series? I don’t know. But you can’t say “the Fed” has provided the answer.

By the way, you are ignoring the predominant view in the economics profession (academic, practitioner, policymaker) that the establishment series contains almost all the relevant information for business cycle fluctuations.

So you’re saying the Philly Fed screwed up its analysis and we should ignore its work? That’s your view?

The modern day Jack Welch needs to stop his parade of intellectual garbage. We certainly should ignore your trash.

Steven Kopits: My view is provided here.