In response to my summary for 2022 and argument that it was unlikely that 2022H1 would be called a recession, Mr. Steven Kopits writes:

So, for H1:

3. Civilian employment was flat to down

Well, it pays to look at actual data before pontificating.

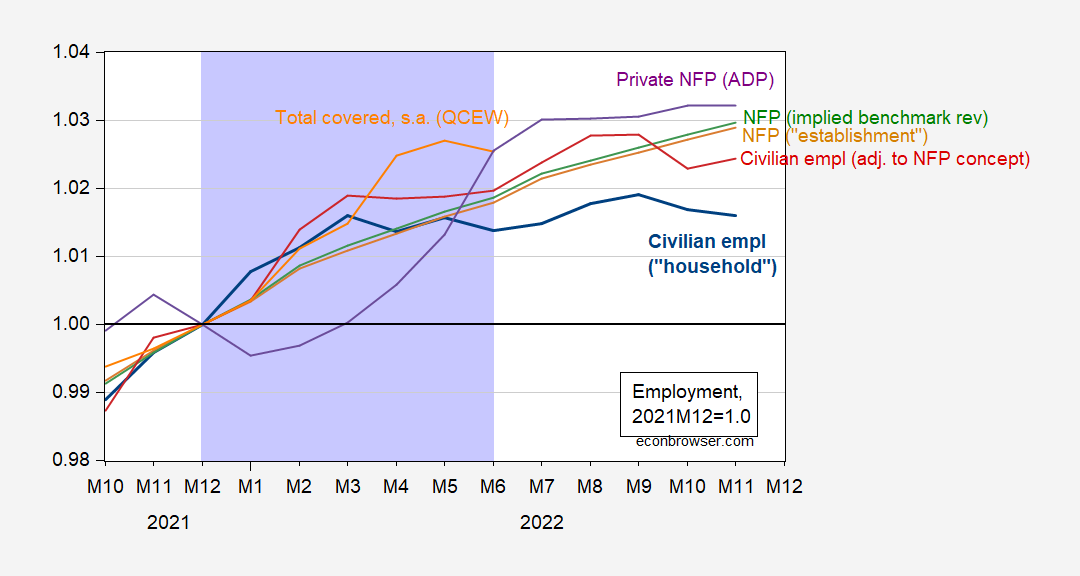

Figure 1: Civilian employment over age 16, FRED series CE16OV (bold blue), civilian employment adjusted to nonfarm payroll concept (red), nonfarm payroll employment, FRED series PAYEMS (tan), nonfarm payroll employment series adjusted to reflect preliminary benchmark revision by author (green), Quarterly Census of Employment and Wages total covered employment, adjusted by Census X-13 by author (orange), all expressed relative to 2021M12 values, all seasonally adjusted. Lilac shading denotes hypothesized (by Mr. Steven Kopits) 2022H1 peak-to-trough recession. Source: CE16OV, PAYEMS from BLS via FRED, preliminary benchmarked series constructed by author using data from BLS, civilian employment adjusted to NFP concept from BLS, QCEW from BLS.

Since Mr. Kopits and I have been debating this topic over the last five months, I thought that he would at least get this right. However, just for the record, let me reiterate, as of June (the end of H1), civilian employment as recorded by the household survey was 1.4% higher than it was in December 2021. Civilian employment adjusted to the nonfarm payroll concept was 2.0% higher than it was in December 2021.

As for his other points:

1. GDP was down

2. Inflation was up

3. Civilian employment was flat to down

4. Jobs were up

5. Productivity was down.

I will note:

- GDP was down, GDP+ and GDP++ were up. GDO was 0.3% lower than 2021Q4 levels.

- Inflation was up (but is not used in the NBER BCDC’s determination, since it’s not a measure of “economic activity”).

- Jobs were indeed up — see Figure 1 above.

- Productivity was indeed down (as measured by output per hour). However, this too is not used in the NBER BCDC determination.

If there were margins of errors in that graph, would he be just as right as you?

If there were margins of error in your life, would you still be a sentient being?

Off topic , liquidity risk –

The OECD’s annual pension fund report thinks funds ought to be careful with liquidity risk. Would have been more useful before the UK meltdown – now a lecture about barn doors after the horse escaped.

https://www.oecd-ilibrary.org/finance-and-investment/oecd-pensions-outlook-2022_20c7f443-en

The FT crib notes are here:

https://www.ft.com/content/145b2294-ca5f-4c1d-96c2-d47b20497126

Just consider the 5 assertions Stevie made:

1. GDP was down

2. Inflation was up

3. Civilian employment was flat to down

4. Jobs were up

5. Productivity was down.

Jobs were up but employment were down? OK this Know Nothing thought some people were working 13 jobs but that was not true.

But wait – he claims on the one hand that real GDP fell (it didn’t by any meaningful way) and employment was down. OK productivity is measure as real GDP divided by employment so one would think that if he were right about (3) and (1) then measured productivity would have risen.

Look Stevie writes a lot of claims that would appear to any reasonable person to be contradictions to each other but little Stevie never self reflects on the garbage he writes and we know his ability to do 1st grade arithmetic is nonexistent.

“And that helps explain the otherwise inexplicable collapse in productivity and the inconsistent VMT and gasoline consumption numbers.”

Stevie actually thinks examining WMT helps explains the noise in labor market measurement? I’m sorry but this utter confusion from this insane troll needs to be ignored as he is wasting our time with his incredible confusion.

One of the great disappointments of 2022 was that this turned out not to be true:

Menzie Chinn Post author

September 23, 2022 at 2:16 pm

pgl: However, to Steven Kopits’s credit, he has ceased sharing his thoughts on this weblog.

“he has ceased sharing his thoughts on this weblog”. Alas, however, he’s BAAAAACK.

Chuck TODD showed a clip from 25 years ago where he was explaining the concept of blogging to Timmy Russert. You would have cracked up. I was just waiting for Russert to ask Todd “why do these bloggers hate me so much?” Of course Timmy was the one who was parroting that canard that the Social Security Trust Fund was bankrupt way back in 1997. But I digress.

Off topic, Covid weakening financial power –

For those with some time on their hands, this is a good read:

https://newleftreview.org/issues/ii138/articles/cedric-durand-the-end-of-financial-hegemony

For those put off by the “New Left Review”, go ahead and remain ignorant. No skin off my nose.

Much of the article is a tour of recent economic and financial events. Most of us are already familiar with the broad strokes, but the writing is good and nothing in it is tilted to suit a bias.

As to the “financial hegemony” of the title, it comes in two parts. One is simply that financial turmoil and declining asset prices erode the power of finance. We’ll see. If there is any sort of threshold effect in terms of turning wealth into power – and I sort of think there is – the financial sector is still wealthy enough and entrenched enough to exert loads of power.

The author, Cedric Durand, recognizes there is no single metric of hegemonic power, or its loss, but does offer this:

“As a share of gdp,…total market capitalization in the us fell from 200 per cent of gdp to 150 per cent, below its pre-pandemic level.”

Sadly, no mention of bonds or other assets, which represent a far larger share of managed (and unmanaged) assets than do equities. Any perpetuation of the idea of equities as “the market” is no favor to readers.

Durand also notes that financial sector profits as a share of total profits have fallen, which he takes as further evidence of a loss of power. I dearly hope Durand is right. Finance, when too large, exerts a drag on prosperity.

The second part of the hegemony claim, delivered in fewer words, is quite different. The idea is that the financial sector has long been seen as supporting “hard money”, but that view is too simple to be right. A large part of today’s financial industry is paid a share of assets under management, and easy money drives up AUM. Fund managers, wealth managers, money managers – they all benefit from easy money. Durant doesn’t catalog all the other beneficiaries of easy money, perhaps because they are outside the scope of his thesis.

I’m not sure that this division between hard and soft money preferences among financial professionals has much to do with hegemony, but it does give us a better understanding of the motives of the players.

I assume this is the Cedric Durand at University of Geneva and Centre d’Économie Paris Nord, but haven’t confirmed it.

Off topic, in anticipation of the next of ltr’s tdious, dishonest tallies of Chinese Covid statistics –

https://todayuknews.com/economy/xi-jinpings-credibility-badly-wounded-as-chinas-covid-death-toll-mounts/

“As an unparalleled coronavirus outbreak swept through China in December, President Xi Jinping remained mostly silent on the health crisis in the world’s most populous country.”

“’We can see very clearly that Xi Jinping is badly wounded in the sense that his prestige and authority have suffered tremendously,’ said Willy Lam, an expert in Chinese politics at the Chinese University of Hong Kong. ‘His claim that the Chinese system is the best in the world is now subject to serious questioning.'”

“Before Saturday’s speech, Xi had not directly addressed the pandemic’s impact over the past three weeks even as infections hit new records and hospitals and crematoria across the country overflowed with the sick, dying and dead.

Instead, as hundreds of millions of people came down with Covid-19, China’s military conducted naval war games with Russia, launched its third-largest air force incursion around Taiwan and flew a fighter jet within metres of a US military aircraft in the South China Sea. On Friday evening, Xi held a virtual meeting with Russian president Vladimir Putin and reaffirmed his support 10 months after Moscow’s invasion of Ukraine.”

So apparently, Xi is using adventurism and militarism to distract public attention from his failure to prepare for the lifting of Covid controls.

So, let’s look at the numbers:

All BLS.

Labor Force Statistics from the Current Population Survey

LNS11000000: (Seas) Civilian Labor Force Level

Materially unchanged since March

LNS12000000: Seasonally Adjusted Employment Level

Materially unchanged since March

LNS13000000: Seasonally Adjusted Unemployment Level

Materially unchanged since March

LNS14000000: (Seas) Unemployment Rate

Materially unchanged since March

PRS85006092: Nonfarm Business Labor productivity (output per hour)

A surreal collapse

2021 Q3: -2.4%

2021 Q4: +4.4%

2022 Q1: -5.9%

2022 Q2 -4.1

2022 Q3 (p): +0.8%

So in H1, we were facing an implosion of productivity through mid-year, declining GDP to mid-year, declining VMT, declining gasoline consumption and yet 1.1 m new jobs per Establishment Survey from March to June. Those numbers do not square. Something is out of whack. The other numbers we might use to cross check the Establishment Survey don’t line up with it. That suggests the HH survey was probably closer to the truth.

Now, this is not my area of expertise, much less an area of interest. But I can look at the basic numbers and say that the other metrics we might check suggest the Est Survey was wrong.

You, Menzie, held the Est Survey was more likely right. You wrote: So: (1) I put more weight on the establishment series, and (2) the gap between the two series is more likely due to increasing, and biased, measurement error in the household series, rather than, for instance, primarily increases in multiple-job holders. https://econbrowser.com/archives/2022/12/the-household-establishment-job-creation-conundrum

Dead wrong, as it turned. And predictably so.

You were wrong because you did not consider the statistics more holistically. That’s the learning point for your students. Cross check your indicators if you have dials which are telling you different things. If jobs are increasingly rapidly, then GDP should also be up. If jobs are increasing rapidly, then mobility and gasoline consumption should also be up, because so many people need to drive to work in this country. Finally, if productivity is imploding when jobs are up, you really need to take a pause and put together some sort of narrative as to why that might be happening. It suggests something anomalous in the data which requires closer inspection.

Had you done that, Menzie, you might have concluded as did the Philly Fed (from my earlier comment):

From the Philadelphia Fed:

Early Benchmarks for All 50 States and the District of Columbia

Estimates by the Federal Reserve Bank of Philadelphia indicate that the employment changes from March through June 2022 were significantly different in 33 states and the District of Columbia compared with current state estimates from the Bureau of Labor Statistics’ (BLS) Current Employment Statistics (CES). Early benchmark estimates indicated higher changes in four states, lower changes in 29 states and the District of Columbia, and lesser changes in the remaining 17 states.

Our estimates incorporate more comprehensive, accurate job estimates released by the BLS as part of its Quarterly Census of Employment and Wages (QCEW) program to augment the sample data from the BLS’s CES that are issued monthly on a timely basis. All percentage change calculations are expressed as annualized rates.

In the aggregate, 10,500 net new jobs were added during the period rather than the 1,121,500 jobs estimated by the sum of the states; the U.S. CES estimated net growth of 1,047,000 jobs for the period.

So, for March through June 2022, the CES estimated 1.1 m new jobs. The Fed’s revision took that down to 10,500.

Looks like the Philly Fed is supportive of my suppositions.

https://www.philadelphiafed.org/-/media/frbp/assets/surveys-and-data/benchmark-revisions/early-benchmark-2022-q2-report.pdf

And by the way, don’t we also suspect that the additional 1.6 m jobs adds after June per the Est Survey may also be a phantom. If the HH survey proves right again, then those H2 jobs gains (through November) will evaporate, just as the March to June numbers did.

‘ this is not my area of expertise’

Well that is clearly true. Then again you tried to peddle that monopsony power cannot exist. Dude – do not write on Labor Economics as this is another topic where you do not have a clue.

“Dead wrong, as it turned. And predictably so.”

Wait… you’re claiming that Menzie is the one who was “dead wrong” about multiple job holders? What happened to “You did the math and I acknowledge that it shows that the increase in multiple job holders is insufficient to account for the material part of increased jobs per the Establishment Survey.”

You were dead wrong. And the claim that Menzie doesn’t check other “dials” is just dishonest. A good many of his posts have been devoted to checking other “dials” (dials?) since lightweights like you began squawking about recession.

You bring up the unemployment rate, but the unemployment rate doesn’t support your view. The Sahm rule, much discussed here, does not indicate recession. The unemployment rate, calculated from household survey data, is of no use in determining whether the household survey is more accurate than the establishment survey – a moment’s thought should have told you that.

A pile of arguments which are wrong don’t make you right. Such a pile is either evidence of your ego thrashing around to avoid admitting your mistakes, or worse, conscious dishonesty; you’ve made these points before and been revealed to be wrong. Now you’re doubling down, striking a ridiculous pose.

This debate ( to elevated a term for your side of the exchange) won’t tell us which jobs series is right. Revisions will do that. All this debate tells us is the abilities and character of the participants. Stevie, you are not coming off well.

He was dead wrong about this statement, and predictably so.

So: (1) I put more weight on the establishment series, and (2) the gap between the two series is more likely due to increasing, and biased, measurement error in the household series, rather than, for instance, primarily increases in multiple-job holders.

https://econbrowser.com/archives/2022/12/the-household-establishment-job-creation-conundrum

The Philly Fed analysis concludes that the HH survey was essentially right, and the Establishment Survey, which Menzie championed, was dead wrong.

Hey troll. New post up just for your latest BS. Old adage – when one is deep in a hole, stop digging. Damn!

Anybody else notice Stevie trying to change the dates? He was wrong about job growthin H1, so now he pretends we were talking about jobs from March onward. And after pulling his little trick, he gets up on his hind legs and declares Menzie to be “predictably wrong”. What a liar. Here’s the record:

“Steven Kopits

November 5, 2022 at 8:37 am

So, for H1:

…

3. Civilian employment was flat to down”

…

https://econbrowser.com/archives/2023/01/how-many-ways-can-one-be-wrong-on-employment-steven-kopits-edition

You were wrong. Civilian ( household survey) employment rose by 2.1 million.

Then, you repeated your error and claimed again that Menzie was wrong:

“Steven KopitsJanuary 1, 2023 at 8:54 am

…

Menzie ChinnPost author

November 5, 2022 at 8:46 am

Steven Kopits: You do know civilian employment rose by 2.1 million from 2021M12 to 2022M06?

But it turns out is wasn’t, was it?”

Then, you moved the goalposts:

“Steven KopitsJanuary 2, 2023 at 8:56 am

So, let’s look at the numbers:

All BLS.

Labor Force Statistics from the Current Population Survey

LNS11000000: (Seas) Civilian Labor Force Level

Materially unchanged since March.”

https://econbrowser.com/archives/2023/01/how-many-ways-can-one-be-wrong-on-employment-steven-kopits-edition

Since March. March? You first said H1. Now March? You were wrong about H1 and Menzie corrected you about H1. Now, you claim he’s wrong and you’re right because household employment hasn’t risen much since MARCH? Everybody got that? Menzie is wrong because Stevie changed the dates? Holy Hackery, Batman!

Stevie and JohnH are a lot a like regarding claiming others have moved the goal posts when the two of them tend to put the goal posts on the 30 yard line. Watching the Rose Bowl right now (good game) and the goal posts in Pasadena are not on the 30 yard line. Hmmm – now who moved those goal posts?

I’ll take just one item from this absurd bloviating:

‘So, for March through June 2022, the CES estimated 1.1 m new jobs. The Fed’s revision took that down to 10,500.’

As Macroduck already noted – one paper from someone who works for the Philly FED is not the Federal Reserve. And the difference between this 10.5 thousand number which you misrepresent and the 1.1 million increase ala the BLS’s CES has already been discussed.

And yet Princeton Steve bloviates his usual BS without addressing what others have correctly noted.

Look dude – your rehashing your incoherent spin over and over is not being engaged in an adult productive conversation. And yet you persist.

We should not assume that Stevie actually believes what he writes or cares whether his claims are valid. His misuse of data, puffed-up style and choice to represent the economy with a negative bias all meet Republican propaganda needs. Stevie may be auditioning.

The House is now (tomorrow) in Republican hands by a slim majority. The presidential election season is underway. There will be huge demand for slick economic babble aimed at claiming “it’s Biden’s fault”. Stevie’s regular use of comments here as free ad space suggests the consulting business isn’t thriving. Time to expand his side gig – telling Republicans what they want to hear.

“His misuse of data, puffed-up style and choice to represent the economy with a negative bias all meet Republican propaganda needs. Stevie may be auditioning.”

Stevie’s one goal in life does seem to be getting inviting onto Fox and Friends. He actually thinks this is same great achievement. Well at least they enjoy his Stephen Miller ideas of how to keep Latin immigrants from moving into his neighborhood.

To get the italics right:

Dead wrong, as it turned. And predictably so.

You were wrong because you did not consider the statistics more holistically. That’s the learning point for your students. Cross check your indicators if you have dials which are telling you different things. If jobs are increasingly rapidly, then GDP should also be up. If jobs are increasing rapidly, then mobility and gasoline consumption should also be up, because so many people need to drive to work in this country. Finally, if productivity is imploding when jobs are up, you really need to take a pause and put together some sort of narrative as to why that might be happening. It suggests something anomalous in the data which requires closer inspection.

Had you done that, Menzie, you might have concluded as did the Philly Fed (from my earlier comment):

From the Philadelphia Fed:

Early Benchmarks for All 50 States and the District of Columbia

Estimates by the Federal Reserve Bank of Philadelphia indicate that the employment changes from March through June 2022 were significantly different in 33 states and the District of Columbia compared with current state estimates from the Bureau of Labor Statistics’ (BLS) Current Employment Statistics (CES). Early benchmark estimates indicated higher changes in four states, lower changes in 29 states and the District of Columbia, and lesser changes in the remaining 17 states.

Our estimates incorporate more comprehensive, accurate job estimates released by the BLS as part of its Quarterly Census of Employment and Wages (QCEW) program to augment the sample data from the BLS’s CES that are issued monthly on a timely basis. All percentage change calculations are expressed as annualized rates.

In the aggregate, 10,500 net new jobs were added during the period rather than the 1,121,500 jobs estimated by the sum of the states; the U.S. CES estimated net growth of 1,047,000 jobs for the period.

So, for March through June 2022, the CES estimated 1.1 m new jobs. The Fed’s revision took that down to 10,500.

Looks like the Philly Fed is supportive of my suppositions.

https://www.philadelphiafed.org/-/media/frbp/assets/surveys-and-data/benchmark-revisions/early-benchmark-2022-q2-report.pdf

And by the way, don’t we also suspect that the additional 1.6 m jobs adds after June per the Est Survey may also be a phantom. If the HH survey proves right again, then those H2 jobs gains (through November) will evaporate, just as the March to June numbers did.

“You were wrong because you did not consider the statistics more holistically. That’s the learning point for your students.”

Seriously dude? So let us get this straight. You write all sorts of false, misleading, and totally incoherent garbage because you are holistic?

Do you even have a clue what holistic means? Don’t answer that as we have had way too much of your intellectual garbage.

https://www.worldometers.info/coronavirus/

January 2, 2023

a ) There were 5,226 coronavirus deaths in China on May 26, 2022.

b ) There were no coronavirus deaths from May 26, for nearly 6 months, through November 19.

c ) From November 20 through January 1, 2023 there have been 23 coronavirus deaths in China, bringing the total from 5,226 to 5,249.

d ) During the nearly 6 months of no coronavirus deaths in China, there were 300 to 500 coronavirus deaths each day in the United States.

e ) Coronavirus deaths in the United States continue at 200 to 400 each day.

f ) There have been 1,118,376 coronavirus deaths in the United States through January 1, 2023.

https://www.worldometers.info/coronavirus/

January 1, 2023

Coronavirus

United States

Deaths ( 1,118,376)

Deaths per million ( 3,340)

China

Deaths ( 5,249)

Deaths per million ( 3.6)

https://www.worldometers.info/coronavirus/

January 1, 2023

Coronavirus

New York

Deaths ( 75,260)

Deaths per million ( 3,869)

China

Deaths ( 5,249)

Deaths per million ( 3.6)

https://www.worldometers.info/coronavirus/

January 1, 2022

Coronavirus

Germany

Deaths ( 161,465)

Deaths per million ( 1,925)

China

Deaths ( 5,249)

Deaths per million ( 3.6)

https://news.cgtn.com/news/2023-01-02/China-s-COVID-19-fight-in-numbers-Vaccinations-in-2021-2022-1ggdPCevs8U/index.html

January 2, 2023

China’s COVID-19 fight in numbers: Vaccinations in 2021-2022

By the end of 2022, nearly 3.48 billion doses of COVID-19 vaccines had been administered to the Chinese mainland’s 1.4 billion people.

https://news.cgtn.com/news/2023-01-02/China-s-COVID-19-fight-in-numbers-Vaccinations-in-2021-2022-1ggdPCevs8U/img/2a7c77081e4843c4896a39dd5b50ab9d/2a7c77081e4843c4896a39dd5b50ab9d.jpeg

“Dead wrong, as it turned. And predictably so.”

Wait… you’re claiming that Menzie is the one who was “dead wrong” about multiple job holders? What happened to “You did the math and I acknowledge that it shows that the increase in multiple job holders is insufficient to account for the material part of increased jobs per the Establishment Survey.”

You were dead wrong. And the claim that Menzie doesn’t check other “dials” is just dishonest. A good many of his posts have been devoted to checking other “dials” (dials?) since lightweights like you began squawking about recession.

You bring up the unemployment rate, but the unemployment rate doesn’t support your view. The Sahm rule, much discussed here, does not indicate recession. The unemployment rate, calculated from household survey data, is of no use in determining whether the household survey is more accurate than the establishment survey – a moment’s thought should have told you that.

A pile of arguments which are wrong don’t make you right. Such a pile is either evidence of your ego thrashing around to avoid admitting your mistakes, or worse, conscious dishonesty; you’ve made these points before and been revealed to be wrong. Now you’re doubling down, striking a ridiculous pose.

This debate ( to elevated a term for your side of the exchange) won’t tell us which jobs series is right. Revisions will do that. All this debate tells us is the abilities and character of the participants. Stevie, you are not coming off well.