A reader observes:

You were wrong because you did not consider the statistics more holistically. That’s the learning point for your students. Cross check your indicators if you have dials which are telling you different things. If jobs are increasingly rapidly, then GDP should also be up. If jobs are increasing rapidly, then mobility and gasoline consumption should also be up, because so many people need to drive to work in this country. Finally, if productivity is imploding when jobs are up, you really need to take a pause and put together some sort of narrative as to why that might be happening. It suggests something anomalous in the data which requires closer inspection.

So here, without further ado, is a series of snapshots of the aggregate economy, focusing first on indicators followed by the NBER BCDC, then some alternative indicators including one favored by Mr. Kopits, and finally, the labor market indicators we have.

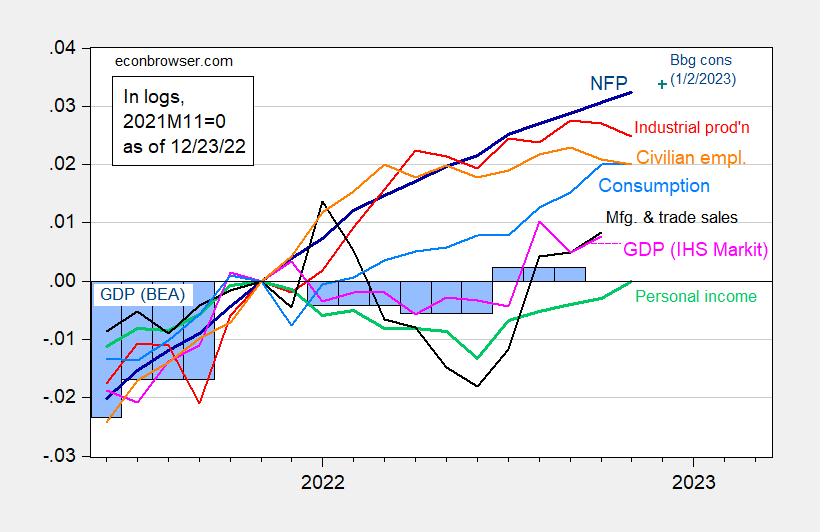

Figure 1: Nonfarm payroll employment, NFP (dark blue), Bloomberg consensus (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Q3 Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (12/1/2022 release), and author’s calculations.

Notice that through 2022H1 nonfarm payroll employment as officially measured is rising, as is industrial production and consumption. Civilian employment rose, while flattening off at the end, while GDP (both quarterly and monthly) along with personal income excluding transfers fell (before recovering). However, as noted on several instances, GDP will be revised over and over again over time.

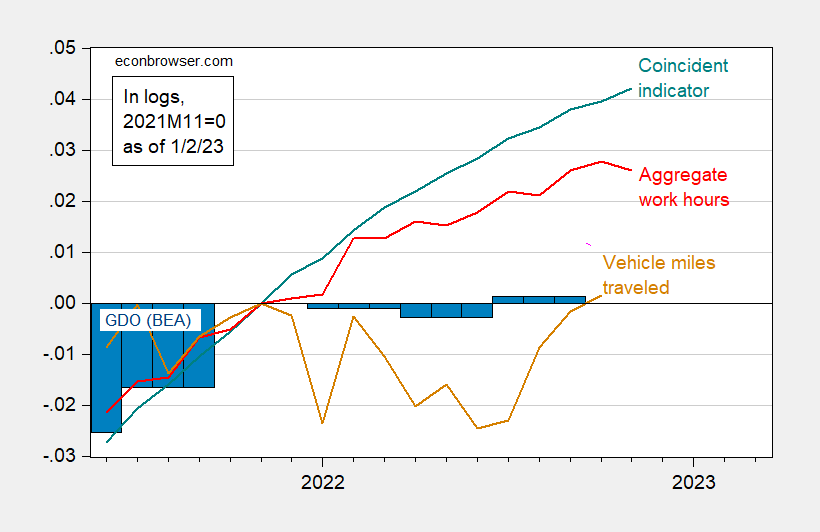

What about alternative indicators? The Philadelphia Fed provides a coincident indicator for the nation. I plot this, along with aggregate hours worked, and Mr. Kopits preferred measure, vehicle miles traveled, again normalized to 2022M11.

Figure 2: Coincident index for US (teal), aggregate weekly hours index for private nonfarm payroll employees (red), vehicle miles traveled (tan), and GDO in Ch.2012$ (blue bars), all seasonally adjusted, in logs 2021M11=0. Source: Philadelphia Fed, BLS, FHA via FRED release), BEA, and author’s calculations.

It is true that vehicle miles traveled dipped in H1. I don’t think this is a big mystery.

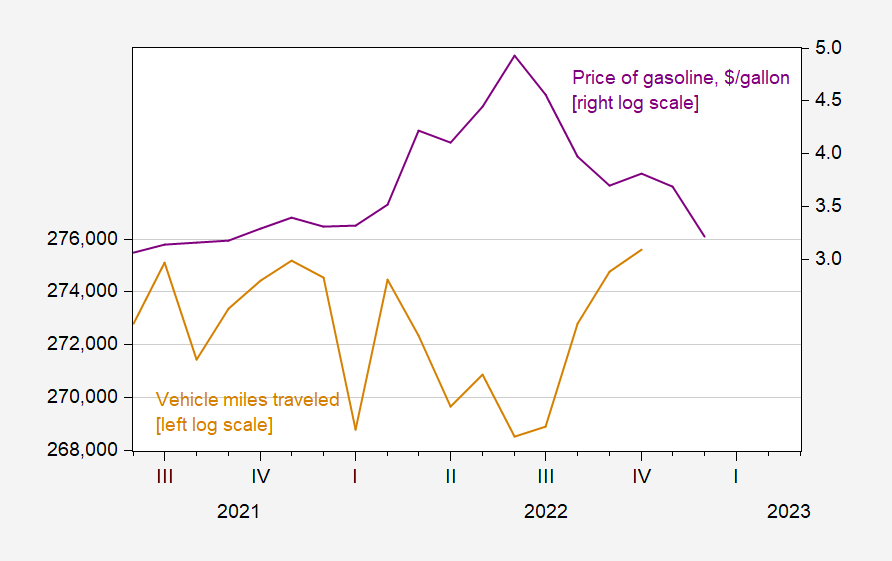

Figure 3: Vehicle miles traveled, s.a. (millions/mo) (tan, left log scale), and price of gasoline ($/gallon) (purple, right log scale), n.s.a. Source: FHA, EIA both via FRED.

I’d guess the dropoff in H1 was more due to gasoline prices being elevated (remember, in basic microeconomic analysis, there is usually a income and price motivation for demand), while the January dropoff was due to the omicron variant surge. So, I view VMT as an unreliable indicator (and in any case, works lousy as a coincident indicator of recession as defined by the NBER, using a probit framework).

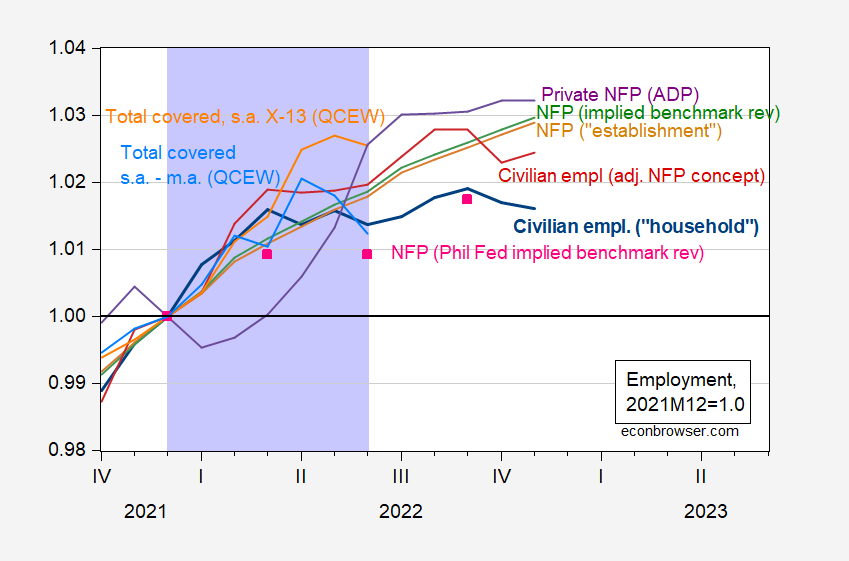

What about viewing labor market developments “holistically” as Mr. Kopits has suggested. I have plotted in Figure 3 a set of indicators that have been referenced, including the Philadelphia Fed’s implied benchmark revision.

Figure 4: Civilian employment over age 16, FRED series CE16OV (bold blue), civilian employment adjusted to nonfarm payroll concept (red), nonfarm payroll employment, FRED series PAYEMS (tan), nonfarm payroll employment series adjusted to reflect preliminary benchmark revision by author (green), nonfarm payroll employment adjusted by Philadelphia Fed to reflect preliminary benchmark revision (pink squares), Quarterly Census of Employment and Wages (QCEW) total covered employment, adjusted by Census X-13 by author (orange), QCEW adjusted by geometric moving average (sky blue), all expressed relative to 2021M12 values, all seasonally adjusted. Lilac shading denotes hypothesized (by Mr. Steven Kopits) 2022H1 peak-to-trough recession. Source: CE16OV, PAYEMS from BLS via FRED, preliminary benchmarked series constructed by author using data from BLS, Philadelphia Fed, civilian employment adjusted to NFP concept from BLS, QCEW from BLS, and author’s calculations.

Mr. Kopits has relied heavily on the calculations by the Philadelphia Fed to support the argument that incremental job gains from March to June were small. As the Philadelphia Fed authors note, their adjustment was not as detailed as that undertaken by the BLS, while it is generally more timely (the BLS revision takes place once a year, in March). It’s interesting to me that, as noted in the brief, and in the longer article underlying the brief, the focus is on getting more accuracy in the state level estimates. In addition, to fit the most recent data, the Philadelphia Fed made an adjustment to the seasonal adjustment method.

To reduce potential impacts of extreme employment changes during the pandemic period on our seasonal adjustment processes, we included data only through December 2019, switched from a multiplicative to an additive seasonal adjustment process, and forecast seasonal factors for 2020 through 2022.

That suggests to me some sensitivity to the method of seasonal adjustment, something that is consistent with the differing estimates I obtain for QCEW covered employment (compare the orange line in Figure 4 with the sky blue one, with the former using Census X-13 throughout and the latter using a geometric moving average throughout).

I am also a little surprised that the preliminary benchmark revision for March 2022 data (published in August) and iterated forward using CES monthly data places nonfarm payroll employment so far away from the Philadelphia Fed’s estimate for June (March 2022 matches pretty closely). Here I have no sure answer; QCEW employment additions might come close — but it (again) depends on seasonal adjustment.

I will note that taking the civilian employment series and adjusting it to the NFP concept (dark red) shows similar growth in the establishment series (tan). The ADP private NFP — based on a different data set and methodology — shows an acceleration in employment in Q2.

So, in this holistic assessment, I view the question of whether employment actually grew in Q2 (it clearly rose by all accounts in H1) as an open one. On the other hand, given the evolution of macro variables — and discounting the usefulness of VMT as signalling NBER-defined recession — I think the argument for recession in 2022H1 is extremely weak. (On the other hand, an argument that the economy is weakening as we enter 2022Q4 is stronger, given the trajectory of industrial production, aggregate hours, and high frequency (weekly) indicators.

Aside: Mr. Kopits writes:

Finally, if productivity is imploding when jobs are up, you really need to take a pause and put together some sort of narrative as to why that might be happening. It suggests something anomalous in the data which requires closer inspection.

Well, mechanically speaking, increased employment, stagnant output (GDO) growth in 2022H1, exactly implies negative productivity growth. Literally, (real) output per hour in the nonfarm business sector (NFB) is (real) output in the NFB sector divided by NFB employment. Man, you can’t make up this kind of stupidity. There is an interesting question why productivity is down; but that wasn’t the issue that puzzled Mr. Kopits.

This same reader (Princeton Steve) began his latest with

‘So, let’s look at the numbers’

Followed by his usual babbling and misrepresentations. He is not discussing this issue in good faith. Then again – what issue has Princeton Steve ever discussed in good faith?

“It is true that vehicle miles traveled dipped in H1. I don’t think this is a big mystery.”

Followed by your noting the rise in gasoline prices. Brilliant but there’s more. Didn’t the pandemic lead to more people working at home and less of us traveling. Seriously – this VMT drop is so easily explained by anyone living in reality.

It is only January 2, 2023 and it seems Princeton Steve has taken a commanding lead with respect to Year in Review, 2023

Of course he is only rehashing and rehashing and rehashing his recession/labor market BS from 2022. So have faith Bruce Hall and JohnH – you still have a chance. So get to work!

Reposting, ’cause it’s just too good. Here’s prima face-plant evidence that Stevie knows he was wrong and is trying to weasel out of it:

“Steven Kopits

November 5, 2022 at 8:37 am

So, for H1:

…

3. Civilian employment was flat to down”

https://econbrowser.com/archives/2023/01/how-many-ways-can-one-be-wrong-on-employment-steven-kopits-edition

You were wrong. Civilian ( household survey) employment rose by 2.1 million.

Then, you repeated your error and claimed again that Menzie was wrong:

“Steven KopitsJanuary 1, 2023 at 8:54 am

…

Menzie ChinnPost author

November 5, 2022 at 8:46 am

Steven Kopits: You do know civilian employment rose by 2.1 million from 2021M12 to 2022M06?

But it turns out is wasn’t, was it?”

Then, you moved the goalposts:

“Steven KopitsJanuary 2, 2023 at 8:56 am

So, let’s look at the numbers:

All BLS.

Labor Force Statistics from the Current Population Survey

LNS11000000: (Seas) Civilian Labor Force Level

Materially unchanged since March.”

https://econbrowser.com/archives/2023/01/how-many-ways-can-one-be-wrong-on-employment-steven-kopits-edition

Since March. MARCH? You first said H1. Now March? You were wrong about H1 and Menzie corrected you about H1. Now, you claim he’s wrong and you’re right because household employment hasn’t risen much since MARCH? Everybody got that? Menzie is wrong because Stevie changed the dates? Holy Hackery, Batman!

Pants on fire.

Now, about those vehicle miles and gasoline use…has any else heard this rumor about people working from home?

Not that working fom home has increased since October of 2021, or decreased. We have data, but not a long enough history to understand the reliability of those data. What is certain, though, is that the (weak) relationship between GDP and VMT/gasoline consumption has changed in ways that make it unwise to draw conclusions from miles and gallons. An holistic assessment of the data would have revealed this wrinkle.

“Now, about those vehicle miles and gasoline use…has any else heard this rumor about people working from home?”

One of the reasons VMT may have declined. Another reason as noted by Dr. Chinn:

US Regular All Formulations Gas Price

https://fred.stlouisfed.org/series/GASREGW/

Stevie had to notice the increase in gasoline prices during 2022H1 as he mentioned oil price increases quite often. I guess Princeton Steve does not understand demand curves.

Okay, so you’re saying there were 1.1 m more jobs and gasoline consumption and VMT were falling at the same time? So not only did those extra 1.1 m workers not drive to work, those with jobs were also driving less. It’s possible, sure. But if I have to adjudicate between the CES and the HH survey, the data is more consistent with the HH survey. But that’s not what Menzie did. And neither did you. But I did, and as it turned out, that inference appears to have been correct.

“Okay, so you’re saying there were 1.1 m more jobs and gasoline consumption and VMT were falling at the same time? So not only did those extra 1.1 m workers not drive to work, those with jobs were also driving less.”

Hey Stevie – there is this new advanced technology call public transportation. And for those who like traveling in cars – there is some new idea called car pooling. And yea – some people are working at home.

Now if you slowed down your bloviating – you might have noticed these real world things.

Whenever we get off center comments such as being ‘Holistic”, I check with Urban Dictionary in the hope it can explain WTF Stevie is babbling about:

https://www.urbandictionary.com/define.php?term=holistic

‘Some stupid hippy bullshit.’

THAT’S IT!!!!

Now why did people think Stevie meant the parts of something are interconnected and can be explained only by reference to the whole? You people must not know Stevie all that well!

Could Hakeem Jeffries be the next Speaker rather than Kevin McCarthy?

https://www.msn.com/en-us/news/politics/moderate-republican-doubles-down-on-threat-to-work-with-democrats-to-elect-a-house-speaker-if-gop-rebels-tank-mccarthy/ar-AA15U3fw?ocid=msedgdhp&pc=U531&cvid=5612d3357906469a8927edf42d9f36a6

Nebraska Republican Rep. Don Bacon published an op-ed in the right-wing Daily Caller on Monday explaining why he is willing to work with Democrats in the event the five GOP rebels attempting to block Rep. Kevin McCarthy (R-CA) from becoming House speaker refuse to budge.

“I support Kevin McCarthy, but a small handful of people are holding us hostage,” Bacon writes to kick off the op-ed, which also has a “counter point” column published on the website.

“The vast majority of the conference knows we can’t cave to the few when the demands are unreasonable. The immediate gridlock by this handful threatens the entire GOP, the House and will delay the operations of the 118th Congress,” Bacon adds, referring to demands that include passing a rule allowing any single member to call for a vote of no confidence in the speaker.

Bacon goes on to cite his history as a “retired brigadier general who served nearly 30 years in the Air Force” to explain his stance:

I know how important it is to rally the team behind a common goal. Teams can’t make perfection the enemy of good.

Bacon, who won reelection in a district carried by Joe Biden in 2020, goes on to explain that McCarthy has the support of the GOP conference, regardless of his imperfections.

“When Conference voted, 85% stood beside McCarthy and declared they wanted him as the next speaker. Now that number stands around 95%,” he writes, adding:

Much has been made of me saying I would work with moderate Democrats to elect a more moderate speaker. But my actual words were that if the five refused to coalesce around what the vast majority of the conference wants, I’m willing to work across the aisle to find an agreeable Republican.

We cannot be held captive by a small number and run the risk of delaying the formation of committees and working on the agenda we promised Americans this past November.

The five GOP members Bacon refers to are Reps. Andy Biggs, Bob Good, Matt Rosendale, Ralph Norman, and Matt Gaetz.

“We should not set a bad precedent and allow a few people to undercut the entire team of 222 members. Further, of the 16 new Republicans elected, 13 are affiliated with the Mainstreet GOP. It was the governing conservatives who got us the majority,” Bacon continues, highlighting the moderate members of the House GOP.

“The real complaint here should be with the small faction who refuse to work with the rest of the conference. They are putting our majority in the House at risk,” Bacon adds, concluding:

My point is that if a few won’t be part of the 218 members we need to govern, we’ll then find other ways to get to 218!

The post Moderate Republican Doubles Down on Threat to Work With Democrats to Elect a House Speaker if GOP Rebels Tank McCarthy first appeared on Mediaite.

https://www.epi.org/publication/inequality-2021-ssa-data/

December 21, 2022

Inequality in annual earnings worsens in 2021Top 1% of earners get a larger share of the earnings pie while the bottom 90% lose ground

By Elise Gould and Jori Kandra

Key findings

In 2021, annual wages rose fastest for the top 1% of earners (up 9.4%) and top 0.1% (up 18.5%), while those in the bottom 90% saw their real earnings fall 0.2% between 2020 and 2021. Workers in the 90th–99th percentile of the earnings distribution also experienced real losses in 2021.

The top 1% earned 14.6% of all wages in 2021—twice as high as their 7.3% share in 1979.

The bottom 90% received just 58.6% of all wages in 2021, the lowest share on record, and far lower than their 69.8% share in 1979.

From 1979 to 2021:

Wages for the top 1% and top 0.1% skyrocketed by 206.3% and 465.1%, respectively, while wages for the bottom 90% grew just 28.7%.

On an annualized basis, bottom 90% wages grew only 0.6% per year, compared with 2.7% and 4.2% annualized wage growth for the top 1% and top 0.1%, respectively.

https://fred.stlouisfed.org/graph/?g=lMkk

January 15, 2018

Real Median Weekly Earnings for men and women, * 1980-2022

* All full time wage and salary workers

(Percent change)

https://fred.stlouisfed.org/graph/?g=lMkl

January 15, 2018

Real Median Weekly Earnings for men and women, * 1980-2022

* All full time wage and salary workers

(Indexed to 1980)

https://fred.stlouisfed.org/graph/?g=lT8Q

January 15, 2018

Real Median Weekly Earnings and Nonfarm Business Productivity, * 1980-2022

* All full time wage and salary workers & output per hour

(Percent change)

https://fred.stlouisfed.org/graph/?g=lT8R

January 15, 2018

Real Median Weekly Earnings and Nonfarm Business Productivity, * 1980-2022

* All full time wage and salary workers & output per hour

(Indexed to 1980)

Now, about that productivity stuff. There’s this “composition” notion that has been mentioned by more than one commenter here. If one wants to take a a hippy dipped holistic view of productivity, one really ought to consider the composition of employment.

One might note that labor productivity shot up as Covid resulted in a sharp drop in service employment as a share of all employment, and that as service employment recovered, labor productivity dropped:

https://fred.stlouisfed.org/graph/?g=Ym6y

If, on the other hand, one were auditioning for a paycheck from Republican backers, one might ignore composition, while also getting the math of productivity and employment wrong.

Stevie is auditioning. Ingenue parts, perhaps?

Okay, I agree with the data. What’s the interpretation? Here’s one:

https://www.princetonpolicy.com/ppa-blog/2023/1/4/us-non-farm-labor-output

Stevie thinks drawing a chart is an interpretation?

OK since little Stevie cannot be bothered to WRITE WTF his chart is saying I shall. Everyone with a brain knows output per employment is a noisy series. And it seems it initially jumped way above trend but is not back to trend – at least the way little Stevie drew his little chart.

Which is to say the recent decline was nothing more than a return to trend. Huh that is contrary to the nonstop bloviating we have endured from little Stevie.

Now maybe Stevie had a different interpretation but alas this troll was too lazy to articulate WTF his interpretation is now. Then again I could care less what this loud mouth nutcase has to say given the garbage he has written in the past.

Russian nationalist bloggers are angry that Putin’s war criminals are incompetent at protecting themselves?

https://www.msn.com/en-us/news/world/anger-in-russia-as-scores-of-troops-killed-in-one-of-ukraine-war-s-deadliest-strikes/ar-AA15TVhh

KYIV (Reuters) -Russia acknowledged on Monday that scores of its troops were killed in one of the Ukraine war’s deadliest strikes, drawing demands from Russian nationalist bloggers for commanders to be punished for housing soldiers alongside an ammunition dump. Russia’s defence ministry said 63 soldiers had died in the fiery blast which destroyed a temporary barracks in a former vocational college in Makiivka, twin city of the Russian-occupied regional capital of Donetsk in eastern Ukraine. HIMARS launchers, claiming two rockets had been shot down. Kyiv said the Russian death toll was in the hundreds, though pro-Russian officials called this an exaggeration. Russian military bloggers said the huge destruction was a result of storing ammunition in the same building as a barracks, despite commanders knowing it was within range of Ukrainian rockets.

I have a suggestion for these Russian bloggers. Take a holistic approach. Blame Putin and demand this insane President to end this disgusting war.

story going around the blog-o-sphere is the whole six rocket pod (200# high explosive each) was shot at a new years’ celebration…..

it would be amazingly inept to have a munitions pile near a dormatory.

donated weapons, layered intel, etcl!

moving up from bombing weddings.

“story going around the blog-o-sphere is the whole six rocket pod (200# high explosive each) was shot at a new years’ celebration”

That is a stupid little lie but par for the course for you.

Ukraine targets military positions, Russia is wasting its missiles on civilian targets. Putin is incompetent in so many ways. To even have a chance of terrorizing Ukrianes people into submission he would need at least 10 times as many missiles as he has been using so far.

https://fred.stlouisfed.org/series/DCOILWTICO/

One of my favorite exchanges was between Princeton Steve and Moses back in 2021 over what might happen to oil prices. From literally the day Biden took office Stevie was screaming about prices hitting $100 a barrel which would haven be twice the price at the time. Moses pressed back asking Stevie to be specific when and why this would happen. Stevie kept saying before the end of the year.

Now oil prices did reach $85 by the end of October but then declined for the rest of the year. Gee oil prices are volatile. And credit to Moses for mocking Stevie the last 2 months of 2021.

But wait by February 2022 we saw oil prices finally passing the $100 mark. And of course Stevie moved thos goal posts so he could include the Putin attempt to hit a 60 year field goal kick by placing the goal posts 40 yards closer.

No, no, no I score this one for Moses game, set, and match!

Of course pgl and Team Transitory thought that lumber prices were going to fall like a rock in Summer 2021, a sure harbinger of low inflation to come.

The attached article illustrates the conventional wisdom of Team Transitory at the time. https://fortune.com/2021/08/02/lumber-prices-down-cash-market-wholesale-retail-home-depot-lowes/

Well, guess what? They were wrong. Big time. LOL wrong! At the time I linked to an article by an industry insider, who explained why he thought prices were about to rise again. But some experts seem to think that people who understand the dynamics of their industry aren’t worth listening to—beyond contempt.

A year and a half later, lumber prices are finally down to 2019-20 levels.

Now pgl will fabricate something that he claims I said back then, his usual lies and standard BS.

“pgl and Team Transitory thought that lumber prices were going to fall like a rock in Summer 2021”

Another pointless lie. OK troll – name one person who predicted the date when lumber prices would fall. I never pretended to have that kind of forecasting ability so who in Team Transitory did. Oh you can’t. But yea – lumber prices did eventually fall. Something you must never have realized.

It is really amusing that Jonny boy’s link starts with “Lumber prices are down 68%” in an August 2021 when he is trying to tell us that people predicting lumber prices might fall in the summer of 2021.

Yea Jonny boy – everyone on the planet knows commodity prices are volatile. Everyone on the planet knew that they had risen a lot earlier in the year. But it was Jonny boy who told us that the staggering high prices would never drop it all. Of course you deny you made such a claim but then you lie about what even you have said in the past.

Come on Jonny – this is no point to your emotional tirades here. Well – there is a point which everyone concedes. You are the dumbest troll ever. Get over it.

“A year and a half later, lumber prices are finally down to 2019-20 levels.”

Jonny boy does stupid emotions. Jonny lies about what others have said. Jonny boy denies his previously discredited comments. Me? I provide data:

https://www.macrotrends.net/2637/lumber-prices-historical-chart-data

Huh – lumber prices at the end of 2022 fell BELOW their 2019 levels. Something Jonny boy said never would happen. And now Jonny boy is a mad that someone called him on this past BS. Boo hoo – Jonny boy is MAD.

Now in the adult world where Jonny boy never goes – there is an interest in things like timber prices. Why? Well there are timberland REITs who get to reap their profits tax free but it the REIT owns a sawmill – that income is taxable. Which raises a transfer pricing question with respect to whether the REIT is charging its sawmill affiliate intercompany prices above the arm’s length standard.

Now I get this is above Jonny boy’s little brain – after all this is an adult world consideration. Here is an interesting link for a few reasons:

https://www.statista.com/statistics/1322994/global-timber-price-worldwide-by-type/#:~:text=Throughout%20the%20timeline%2C%20hard%20sawn%20wood%20has%20had,at%20approximately%20230%20U.S.%20dollars%20per%20cubic%20meter.

It seems market prices for timber never skyrocketed. But this link provides another link to lumber prices which confirms what I have said in response to all those childish emotional wastes of time from Jonny boy. Now if lumber prices spiked in 2021 as they did but timber prices did not – one would think that taxable income from the sawmills would have risen. Yea the adults here get the basics but not poor little Jonny boy.

The issue for the IRS as it examines the tax returns for these timber REITs should be did they pay their fair share of taxes. Now I just hope the folks at the IRS are a lot smarter than little Jonny boy as he would never be able to figure this out.

Covid cases in China could reach 3 million per day later this month.

https://www.bbc.com/news/59882774

The health care system is already strained. Again the Chinese government has failed its people. They could and should have done much better.

This obsession with H1 GDP never ceases to amaze and entertain. Fact is, 2022 GDP grew at the daunting rate of 0.24% through the third quarter.

https://fred.stlouisfed.org/series/GDPC1/

Why not just agree that 2022 growth was really weak and call it a day? Instead, folks are making a mountain out a a mole hill, which is what was 2022 growth really amounted to through 3Q.

What better way to divert attention from the workers recession (gasp! That phrase is verboten.) Median usual real weekly earnings are back to where they were three years ago, but nobody wants to talk about that. Bettter to have an endless debate about a few hundredths of a percent of GDP growth…well with most any margin of error!!!

Or maybe economists could start arguing about how many angels fit on the head of a pin!

Lord – such big words for such utter BS. I hope you get that we are more bored with your BS than we are with the BS from Princeton Steve.

Do you think that, on a credentialed economist’s blog, a know-nothing will hop on board in the comments section proclaiming VMT and gasoline consumption as leading indicators of a recession, that there would be no scholarly pushback?? Go back to reading your Stalin biography apologetics.

Go gentle. Jonny has completely embarrassed himself on the real reason lumber prices went up. So he has to find some back door so as to slip away.

BTW Bruce Hall chimed in on the lumber issue but talking about things like Electric Vehicles. Sometimes I wonder if our favorite trolls even understand simple English.