My colleague Kenneth West did a long interview on inflation, interest rates, and recession, on Wisconsin Public Radio’s Central Time on Monday [audio]

To paraphrase, for the outlook, pay attention to employment, unemployment, and job openings… and for inflation, look at core inflation rates.

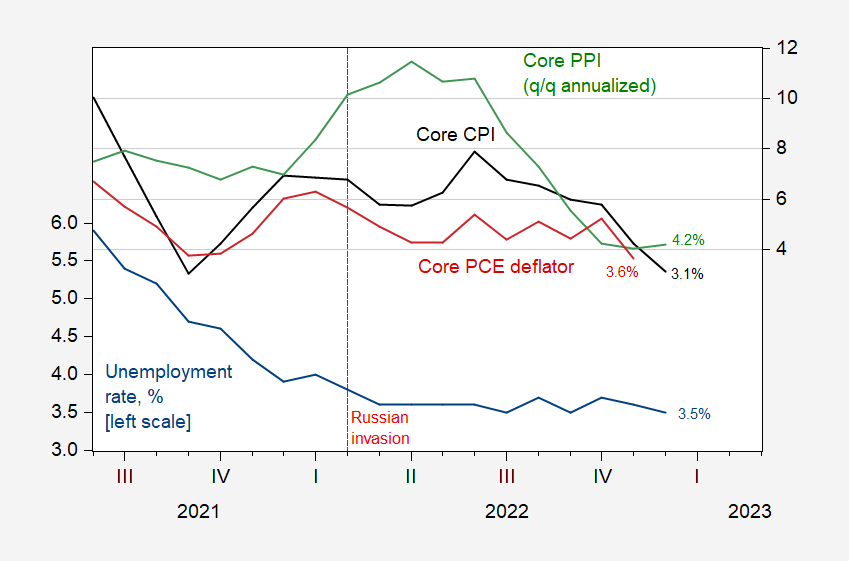

Figure 1: Unemployment rate, % (blue, left scale), quarter-on-quarter annualized core CPI inflation (black, right scale), PPI finished goods less food and energy (green, right scale), core PCE deflator (red, right scale), all in %. Source: BLS via FRED, BEA via FRED, and author’s calculations.

For the entire interview (about 20 min), go here.

“lower costs for consumers?” Or a deceleration of rising prices?

Gee – Bruce Hall disease is spreading! Maybe you are too blind to have noticed that CPI today is a mere 0.9% higher than it was 6 months ago. And BLS released its latest on PPI which fell so much that it is lower than it was 6 months ago. But Jonny boy is still licking his boots over how badly his forecasts of lumber prices turned out.

Hey troll – I would ask you to check the data first but little Jonny boy does not know how.

Lower prices have yet to actually materialize broadly. Services, which account for 2/3 of the CPI, were up 7.5% annualized last month.

But if prices actually do start to fall, which would be great for consumers and real wages, I expect we’ll have to suffer through Krugman’s yammering about the perils of deflation yet again! Apparently some think that it’s just not acceptable for ordinary people’s purchasing power to rise!

Hey Jonny boy – you do not have to work this hard. Everyone here knows you are a village idiot. Try to relax and enjoy the weekend.

“Lower prices have yet to actually materialize broadly. Services, which account for 2/3 of the CPI, were up 7.5% annualized last month.”

Of course Jonny boy could not be bothered to provide a source so let me help people out here:

https://www.bls.gov/news.release/cpi.t03.htm

OK this index rose 0.6% last month but Jonny boy does not want you to know its increase was not that higher in the previous months. Jonny boy does not want you to know that CPI goods has been declining. Jonny boy does not want you to know that the recent PPI news for final demand showed good prices falling and services prices rising more slowly.

Yes Jonny boy wants to lie to you 24/7. But hey – Jonny boy needs Putin to feed his pet poodle so hey!

This is so tedious.

“Services are nearly two-thirds of consumer spending. That’s where inflation is now raging. The Fed has been talking about services for months.

The CPI for services spiked by 0.6% in December from November, and by 7.5% year-over-year, the worst year-over-year increase since 1982. And it was the fourth month in a row over 7%.

The spike in the services CPI occurred despite the ongoing massive mega-downward adjustment of health insurance. Without that adjustment, services CPI would have been even worse.”

https://seekingalpha.com/article/4569682-services-inflation-spikes-to-4-decade-high-cpi-for-gasoline-and-durable-goods-plunges

Yet again, pgl pitches a fit and fails to disprove what I said: “ Lower prices have yet to actually materialize broadly. Services, which account for 2/3 of the CPI, were up 7.5% annualized last month.”

JohnH

January 20, 2023 at 10:25 am

This is so tedious.

Well quoting my link to BLS may seem tedious to a Know Nothing lying troll like you but our host took the time to draw us some informative graphs. I get you hate reality but do try to keep up.

Wow – Jonny sees health care costs going down and basically says this should not count? This from the troll who said we all had to be Medicare for All types. Of course, most of the increase in services costs came from this:

The CPI for housing as a service (shelter)

The CPI for “rent of shelter,” which accounts for 32.6% of total CPI, tracks housing costs as a service, not as an investment, and is based on rents

Ah Jonny – you have not kept up with the discussion as to why the BLS accounting may actually be overstating this factor. Then again you never get into the details until it helps you misrepresent reality. Do check out the new post which I think was motivated by your usual stupidity.

I have not seen deflationary periods that were economically positive for the average joe. They usually coincided with poor economic outcomes for the population. John, you seem to think deflation and middle class prosperity occur together. That may be mistaken.

It was ProLiberalGrowth who attempted to mock me for using inflation from points in time when the November numbers came out. At that time, I suggested that from January, 2021 to June, 2022 inflation was about 13%. Oh, can’t do that stupid because we use yr/yr or mo/mo. I also suggested that from June to November inflation was quite low. Again the mocking. But now that it suits his purposes, ProLiberalGrowth uses exactly the approach that he previously mocked.

So, JohnH, we know who the troll really is.

“I suggested that from January, 2021 to June, 2022 inflation was about 13%.”

Unlike Jonny boy – you actually own up to your previous stupidity. Of course the source you used to come up with 13.3% forgot to use seasonal adjustments. The increase over a 17 month period was actually 12.6%. But as Macroduck noted in his mocking of confusing 17 months with a year, why didn’t you take the price level change over 17 years? Come on Brucie – since your day job is to mislead – go big or go home.

BTW when discussing prices changes during a period such as the last 6 months – do pay attention to that excellent piece by Alan Blinder which had all sorts of wisdom that seems to allude. Oh wait – you offered one of your patently retarded comments after I put this piece. I guess once again Bruce Hall forgot to READ it.

Maybe you do not realize it but I coined the term Bruce Hall disease which is failing to READ links he has commented on. Be of good cheer troll – JohnH has also caught Bruce Hall disease.

So do keep reminding me that you are just as dumb as JohnH. It makes my day!

Exactly…pgl lies, misrepresents, and moves the goal posts with the sole goal of disparaging others to boost his own self esteem. And since he never gets held accountable for his ad hominem attacks and smears, he just keeps doing it.

Oh gee – I moved those goal posts again. Well when you put them on the 30 yard line, the refs demanded they be put in the right place before they started the game. Dude – you may want to find a new line to describe your little boo hoo hoo’s as this one has the other kiddies laughing at you.

“boost his own self esteem” from the troll who has spent his whole life saying households are stupid, economists are stupid, everyone is stupid except Jonny boy. Dude – you are the most pathetic little clown in the history of blogging.

BTW – your BFF Bruce Hall is a full blown MAGA Trump racist Republican. I guess you have to join this group so no one else believes a single word you have ever said. But be of good cheer as Trumpians are fan boys of Putin too.

I had to check when he said mortgage rates had declined to around 6% since they were over 7% as of November 2022. Well – FRED is reporting 6.15%, which is of course only a tad higher than 6%:

https://fred.stlouisfed.org/series/MORTGAGE30US/

I also checked and it seems interest rates on long-term government bonds have fallen by a similar amount since Nov. 2022. Maybe there is hope that the earlier FED tightening does not lead to an investment led recession. Of course I would still advocate a little more easing of FED policy.

Yeah, mortgage rates are down….but not to the point where pgl claimed last August that they weren’t rising!

The mortgage spread on the 30 year mortgage is still extremely high: 2.7%–around a full percent higher than its long term average. The 10 year treasury has fallen almost twice as much since the peak as the spread. At this point, the mortgage spread represents 44% of the 30 year mortgage rate. but nobody seems to explain why!

Well Fargo, the biggest bank mortgage lender, recently announced it’s quitting the business.

It’s clearly too early to sing “Happy Days are Here Again!”

JohnH

January 20, 2023 at 5:32 am

Jonny cannot go two minutes without blatantly lying. Dude – you are already the most despised troll ever so do learn to relax.

“Well Fargo, the biggest bank mortgage lender, recently announced it’s quitting the business.”

Wow – this might be news if it were true. But once again Jonny sees a blurb here or there and completely gets it wrong.

https://www.cnn.com/2023/01/10/investing/wells-fargo-mortgage-market/index.html

Wells Fargo, long one of the biggest players in the mortgage business, is taking a big step back. The scandal-ridden bank announced a significant shift on Tuesday to focus its mortgage business on serving bank customers and minority homebuyers instead of acquiring new customers. Wells Fargo said it will also exit its correspondent business, which buys loans made by other lenders, and reduce the size of its mortgage servicing portfolio.

This is a far cry from what Jonny boy said. And that scandal?

The move comes as Wells Fargo continues to be in trouble with regulators. Last month, the Consumer Financial Protection Bureau ordered Wells Fargo to pay a record fine of $1.7 billion for “widespread mismanagement” over multiple years that harmed 16 million customer accounts. In an interview with CNBC, Santos said the bank’s legal problems helped cause the decision to step back from the mortgage market along with the spike in interest rates. “We are acutely aware of Wells Fargo’s history since 2016 and the work we need to do to restore public confidence,” Santos told CNBC. “As part of that review, we determined that our home lending business was too large, both in terms of overall size and its scope.”

Maybe it is a good thing they are restructuring their mortgage business. Of does Jonny boy want more of the mismanagement?

Oh gee – Jonny did not know about this. Go figure!

In fact Wells Fargo is the bank holding the largest portfolio of mortgages…but pgl will use any excuse to accuse others of lying, especially when he’s the one doing the lying! https://www.americanbanker.com/list/20-banks-and-thrifts-with-the-largest-portfolios-of-first-mortgages

Question is, does pgl know what a mortgage spread is? He certainly can’t explain why it’s so high, despite his being a self-proclaimed genius in charge of judging others’ comments.

That has to be the most nonresponsive and utterly retarded reply I have ever seen. Did you READ what I linked to. It appears you did not. As I just told your fellow retarded troll (Bruce Hall) Jonny boy has caught Bruce Hall disease big time.

“In fact Wells Fargo is the bank holding the largest portfolio of mortgages”

Firs you tell us Wells Fargo has exited this market and how you note this?

Thanks Jonny boy for proving how utterly STUPID you are. BTW when I said they were still involved in this market, showing that they are still involved in this market big time does not make me a liar.

DAMN! YOU. ARE. DUMB!

pgl thinks that it’s a sign of an improving mortgage market when the biggest bank lender exits!!!

pgl’s brain is getting more and more addled every day. Time for him to start taking aducanumab, but only if he can Romberg to take it!

pgl thinks that it’s a sign of an improving mortgage market when the biggest bank lender exits!!!

Well that was your first take. But then you said Wells Fargo was still the largest in the market but now you are back to this? Seriously dude – how effing dumb are you? Make up your mind before you hurt yourself.

https://fred.stlouisfed.org/series/MORTGAGE30US

Let’s be clear what I said. FRED reported a mortgage rate just below 5% as of August 4, 2022 which I noted. Each week after that – I noted the new reporting which showed interest rates were rising in August. So when Jonny boy wrote:

‘where pgl claimed last August that they weren’t rising!’

He was doing what Jonny boy always does – he is lying Sarah Palin style. Now I get Jonny boy does not like it when people calls him out for being a liar but then it is not my fault, it is not the fault of Macroduck or the fault of Moses that Jonny boy is a pointless liar.

After all we have asked him to for once in his pointless little life to at least be honest for a change. But he won’t.

“Well Fargo, the biggest bank mortgage lender, recently announced it’s quitting the business.”

This was Jonny boy’s original claim. When I noted they are still in this market, Jonny boy wanted to call me a liar by …. wait for it … having The American Banker note that this bank has the largest portfolio of first mortgages.

Seriously people – can a troll be more incredibly stupid? DAMN!

pgl: As far as I can tell, JohnH’s comments are a contra-indicator. If he/she writes something, it is almost invariably wrong.

True. But he also has this habit of following “the earth is flat” with “the earth is round”. Eventually he will get something right. After all, a stopped clock is right twice a day.

Oh gee – Jonny is back to the claim that the earth is flat as in Wells Fargo left the mortgage market? Can we get him some serious mental help????

OK, so I admit that Wells Fargo is only shutting down a major segment of its mortgage business, not the entire business.

But the point, which seems to be intentionally disregarded, is still the same: it’s not a good sign that the largest bank mortgage lender is exiting a major chunk of its mortgage business.

And yet, pgl can’t seem to explain why the mortgage spread is so high!

BTW is it time to discuss how the Russian economy did last year? Putin is claiming, contrary to some wild predictions last year, that it fell only 2.5%.

JohnH

January 20, 2023 at 7:16 pm

OK, so I admit that Wells Fargo is only shutting down a major segment of its mortgage business, not the entire business.

FINALLY – an admission from Jonny that he got one thing wrong. Of course there are at least 5 million other things this waste of time got wrong. Lumber prices. Medical services costs, UK real wages, … I would continue but gee by now I have grown bored with this worthless troll.

“BTW is it time to discuss how the Russian economy did last year? Putin is claiming, contrary to some wild predictions last year, that it fell only 2.5%.”

Jonny makes another claim without providing a single source. Why did he not link to this?

https://www.ceicdata.com/en/indicator/russia/real-gdp-growth

The Gross Domestic Product (GDP) in Russia contracted 3.4 % YoY in Sep 2022, following a negative growth of 3.4 % in the previous quarter.

Real GDP Growth YoY data in Russia is updated quarterly, available from Mar 1996 to Sep 2022

Hey Jonny boy – tell your boss Putin he needs to cook the books for 2022Q4.

I remember My Dad’s feelings, around the early 1980’s after he lost his job in a major city of Iowa, he bought a motel, along a US route/”highway” in Kansas. Being unemployed is like a disease, and it hurts men and families very bad, and very deeply. Thank you for this blog post Professor Chinn.

Belated topic, recession indicators –

In the prior post, the chart of NBER recession indicators is mostly healthy, but with industrial production looking bad. IP is a coincident indicator, a is consistent wirh its use by the NBER. Average weekly hours in manufacturing is a leading indicator, as are capital goods orders, ex-military and aircraft. There may be some trouble brewing:

https://fred.stlouisfed.org/graph/?g=YY9c

Utilities don’t account for the drop in IP, so we can’t dismiss the decline. I haven’t been paying close enough attention, so I don’t know what’s behind the recent slowdown. I’m not aware of any Increase in supply problems. The slowing in orders, combined with general concern about the economy, might be enough.

ADP reported a drop in factory employment in December, while BLS reported a modest rise. A decline is consistent with a shorter work week. A rise would only be consistent with a shorter work week if overtime hours were high and being remedied with hiring – not currently the case.

Any notions?

Completely off topic, China’s declining population-

https://www.reuters.com/world/china/chinas-population-shrinks-first-time-since-1961-2023-01-17/

The caveman view of population decline is that it’s bad. Who’s gonna keep the lights on, make debt payments, provide soldiers, kept the economy growing?

The limits-to-growth/population-bomb view is very much the opposite.

Either way, the difference between slow population growth and decline, over time, is profound. Japan’s ability to finance a massive government deficit is partly a reflection of its high saving rate and high income per capita, both of which are in part the result of an aging population; kids are expensive and non-productive.

I don’t know what current population projections for China look like, but they probably don’t account for the recent increase in Covid deaths. I also don’t know when (if?) the shortage of females od child bearing age will be resolved. So I’m guessing China’s population will continue to fall for a while. No clue after that.

Maybe lockdowns on a grand scale reduced household formation enough to slow reproduction.

This issue has been studied for years. Nothing new here, except the specific timing of the decline.

Ducky could always read up and get informed…

https://link.springer.com/article/10.1007/s12546-008-9004-z

That’s funny, coming from you, Johnny.

Another unintentionally funny comment JohnH??? You enjoy being a D*ickhead, don’t you?? My friend Macroduck tolerates your personal attacks, I won’t

“Inflation begins to slow, signaling lower costs for consumers”

May I rewrite the blog post title?

Inflation begins to slow, signaling lower cost increases for consumers.

Negative inflation (deflation) would signal lower costs for consumers.

Thanks for making this point. I thought about saying that but I do not want to accuse our host of catching Bruce Hall disease.

You mean accuracy? Yes, I was going to comment about the decreasing rate of increase, but “we all knew what was meant”. Didn’t have to get snarky about a technicality on that point.

It’s good news in that consumers won’t be falling behind as quickly and may eventually recover somewhat if wages/income increases faster than future inflation.

You pal, Larry Summers, had something to say about that.

https://finance.yahoo.com/news/summers-warns-1970s-crisis-central-100153098.html

Let me remind you of what Bruce Hall disease is. Posting links you have not read followed by making comments that are contradicted by one’s own link. You have that disease big time. And professional tip – drinking bleach once a day does not cure the disease.

#1 “Larry” is not my “pal”. Yea – we get you want to date Lawrence Kudlow but the rest of us are not as sick as you are.

#2 – this struck me as Dr. Summers forgeting what he used to say:

‘The remark is a response to suggestions from economists including Olivier Blanchard, a former International Monetary Fund chief economist, who have suggested lifting inflation targets from 2% to 3% to avoid recessions.’

Summers along with Brad DeLong actually advocated a 5% inflation target 10 years ago. I would remind you of their excellent reading but: (a) you would never bother to read it; and (b) you would never understand the logic if by chance you did read it.

“To suppose that some kind of relenting on an inflation target will be a salvation would be a costly error, it would ultimately have adverse effect as it did in a spectacular way during the 1970s,” Summers, a professor of economics at Harvard and a Bloomberg TV contributor, told a panel at the World Economic Forum’s annual meeting in Davos, Switzerland.

Davos? Could someone ask Summers if he spent too much (as in $7500) for that “lady” last night.

Federal Reserve Chair Jerome Powell has repeatedly made clear that the US central bank has no plans to change its 2% inflation target. Inflation peaked in double digits across much of the industrialized world but is expected to drop rapidly this year on the back of falling energy and commodity prices. However, core inflation will remain elevated as wage behavior and companies’ price setting has fundamentally changed, Swiss National Bank Chairman Thomas Jordan said on the same panel. “It will be much more difficult to bring inflation from 4% to 2%,” he said. “We will see if that comes with a recession or not. Firms do not hesitate any more to increase their prices. That is different from two or three years ago and is a signal that it is not that easy to bring inflation back to 2%.” “We also see a change in the behavior regarding wages. If you look at wage formation, this is very backward looking. Basically we take inflation from last year and we use this to set future salaries – the kind of fairness argument. Once inflation is high, the pressure from wages is here.”

Damn – these folks are stuck in the 1970’s. Maybe the music is Crosby, Nash, and Young or the Bee Gees. But Macroduck would be glad to know that economists still talk about expected inflation when thinking about wage behavior. At least they are smarter than our trained monkey known as JohnH in this regard. I would ask Bruce Hall to explain this to Jonny boy but then Brucie has no clue what this discussion was about either.

All the new found fiscal responsibility from the House Republicans left me wondering about this ratio:

https://fred.stlouisfed.org/series/GFDEGDQ188S

Federal Debt: Total Public Debt as Percent of Gross Domestic Product

Obama left Trump with a debt/GDP ratio near 105%. Trump left Biden a debt/GDP ratio near 128%. As of the last quarter – this ratio is back down to 120%.

So if the House Republicans really gave a damn about fiscal responsibility – they are should shut the eff up and let the grown ups in this White House show these clowns how it is done.

Yeah, Trump was spending recklessly and the Democratic Party controlled Congress didn’t have anything to do with it, eh? Interesting how “Trump” decided to jump the spending shark for no good reason when prior to Q1 2020 debt was about the same percentage of GDP as when Obama left office.

Yeah, really a mystery.

https://fred.stlouisfed.org/series/GFDEGDQ188S

But I’ll bet if you struggled mightily, you could come up with a plausible explanation.

Gee Brucey – I put up that FRED chart before. Take a closer look Mr. Magoo. Debt/GDP exploded under Reagan-Bush41, fell under Clinton, exploded under Bush43 and the aftermath of his mishandling of financial markets in 2007/8, stabilized under Obama, exploded under Trump, and is falling under Biden.

Gee – a clear pattern is emerging. But dumb cluck Bruce Hall has never figured this out.

Of course that 2017 tax cut for rich people was passed without even let Democrats know what was in this horrible tax legislation. And we had tax cuts for rich people under Reagan and under Bush43.

Hey Brucie – keep this up and Kelly Anne Conway will have to fire your confused little rear end.

“Trump” decided to jump the spending shark for no good reason” when talking about 2020?

No good reason? A pandemic. A massive fall in economic activity. I guess Brucie would have let the Great Depression reoccur all over again. Damn Brucie – you are really, really DUMB.

Could someone please remind Brucie boy what those gray bars on FRED graphs indicate? This incredibly dumb troll seems to have forgotten about the massive economic turn down in 2020QII even though FRED takes the time to remind us of recessions and things like that.

Oh wait – Brucie was Herbert Hoover’s economic advisor advocating fiscal restraint during the Great Depression!

If the country’s government pays attention to some measures to reduce inflation, then the economic situation in the country will be under control.

The most effective way to influence the level of inflation is to apply a policy of influence on the interest rate or the refinancing rate of central banks in a modern market economy. “https://fluix.io/“