Foreign term spreads in several major financial centers have inverted (you can see the yield curves here). What is the probability of a recession 12 months ahead, using the 10yr-3mo term spread, the foreign (Germany, UK, Japan, Canada) 10yr-3mo term spread, and the national Financial Conditions Index (FCI), as suggested by Ahmed and Chinn (2022)? Answer: High

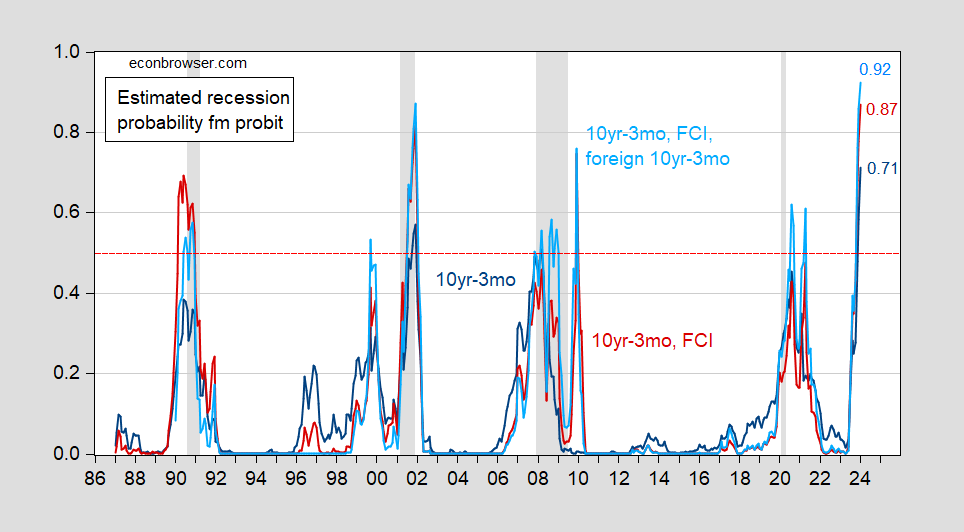

Using the these variables, and forecasting recession in 12 months (not within 12 months), we find the following:

Figure 1: Forecasted probability of recession from 10yr-3mo term spread (blue), from 10yr-3mo term spread augmented with FCI (red), 10yr-3mo term spread augmented by FCI and foreign term spread (sky blue). All models estimated over 1986M01-2023M01, except foreign term spread augmented, 1989M04-2023M01. January observation for FCI thru 1/27; foreign term spreads as of 1/31/2023. NBER defined peak-to-trough recession dates shaded gray. Red dashed line at 50% probability. Source: NBER, and author’s calculations.

These estimates all pass the 50% threshold by November 2023 (October 2023 for the plain vanilla term spread model). The FCI augmented specifications also predict a recession month in 2009M12, but this seems to be an artifact driven by the inclusion of the FCI, which spikes year earlier (2008M11). (Also, changing the specification to “within next 12 months” instead of “at 12 months ahead removes this spike).

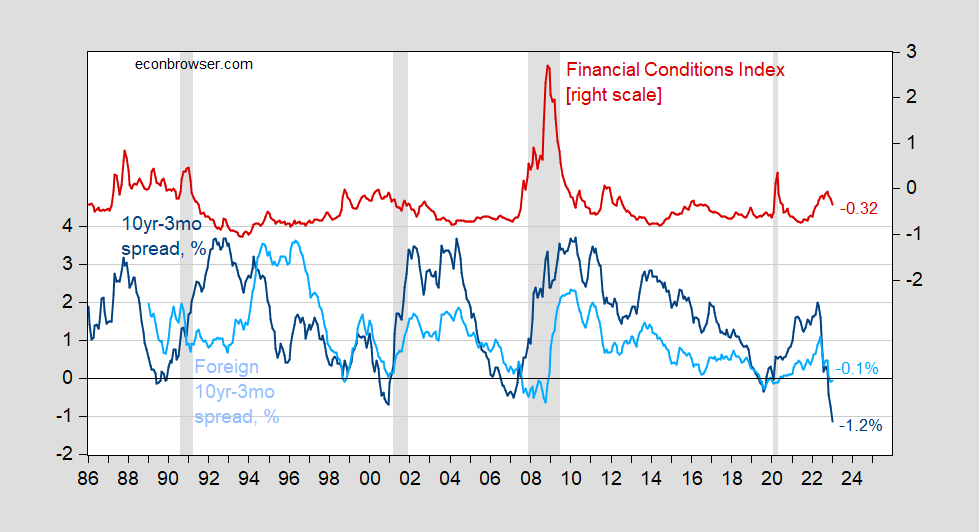

Here are the spreads and the Chicago national Financial Conditions Index.

Figure 2: US 10yr-3mo term spread (blue, left scale), foreign 10yr-3mo term spread augmented (sky blue, left scale), both in %, and national FCI (red, right scale). January observation for FCI thru 1/27; foreign term spreads as of 1/31/2023. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, Chicago Fed, OECD, NBER, and author’s calculations.

Interestingly, the WSJ October 2022 survey of economists pegged the probability of recession at 49%; that rose to 63% in its January survey. (See a comparison of 3m10s probit model and WSJ probabilities here).

Interesting.

The Fed raises its FF target 25 bp and the BoE raises its 50 bp.

And, the UST 10-year market rate decreases 10 bp.

Go figure.

The 10-year rate is reflecting the prospect of a weaker economy, which of course is hastened by this FED tightening. Now if you tried to rise above being a troll – you might have figured that out.

Just the facts, Karen.

You are quoting Joe Friday dude. Get your TV history right troll.

Get a life, Nancy.

Nope. Weakened inflation is why the 10/30 year nominal yield base has fallen. Not the prospect of a weaker economy. But keep selling the monetary story. Central banks exposed themselves to a long held lie.

Different topic but of interest. FRED Blog provides an explanation for why chicken prices have come back down but egg prices are still very high:

https://fredblog.stlouisfed.org/2023/01/egg-and-poultry-price-inflation/

Egg and poultry price inflation

Why did the chicken cross the road? To get a better deal on the high price of eggs

The discussion is even cornier than the title but at least this was an informative and honest account. So forgive me for all of the bad jokes as I needed at least a silly laugh now that we are having to endure the childish dishonest and incredibly stupid rants from Bruce Hall.

Good try… not. I thought you detested charts from FRED. But I’m delighted that I still reside in your head 24/7. Now give your crayons to someone else.

How effing stupid are you Brucie? I use FRED data routinely. Of course I actually understand the data. You? When you do try to use FRED data, your total lack of understanding basic economics is very apparent. Then again you rely on some high schooler website for CPI data that is not seasonally adjusted, which of course you blame on me for the simple reason being that I was the one who pointed that out.

BTW – I do need a good laugh now and then but come on – you are a 24/7 source of hilarious stupidity. Which makes me feel sorry for your poor mother who really wants you to stop embarrassing her family.

Some good news on the election denier front starring Kari Lake who must be one dumb lady:

https://www.msn.com/en-us/news/politics/it-looks-to-me-like-that-s-a-felony-election-expert-says-kari-lake-could-face-jail-over-tweet/ar-AA172MBG?ocid=msedgdhp&pc=U531&cvid=a8d4c82f64f4485e891fd838b2e97d08

Failed Republican Arizona gubernatorial candidate Kari Lake landed herself in hot water last week after tweeting an image of 16 voter signatures. Arizona’s Democratic Secretary of State Adrian Fontes on Monday asked Attorney General Kris Mayes to investigate whether Lake broke the law by publicly sharing voter signatures in another effort to deny the validity of the midterm election, which she lost to Democratic Gov. Katie Hobbs. “Arizona statute is very clear about when and where a voter signature can be shared or replicated or reproduced, or put online or used in social media,” Tammy Patrick, chief executive for programs at the National Association of Election Administrators, told KPNX. “The answer to all of those things basically is, ‘Never’ and ‘Not’ and ‘It can’t be,’ with very few exceptions,” explained Patrick, who formerly served as a Maricopa County elections official. “When I read the law, it looks to me like that’s a felony,” she said.

LOCK HER UP!

Lol, WSJ is a rag. Debt into RE is expanding. What recession???? This isn’t 2000 buds. You don’t have the excess capex.

The yield curve con is just that. On the dust bin of history it will go.