Michael Kiley (FRB) has recently circulated a working paper showing that various indicators have greater predictive power at different horizons. Other papers have shown this for different term spreads, for credit spreads, foreign term spreads; in this case, Kiley shows unemployment and inflation have more predictive power at long horizons than short.

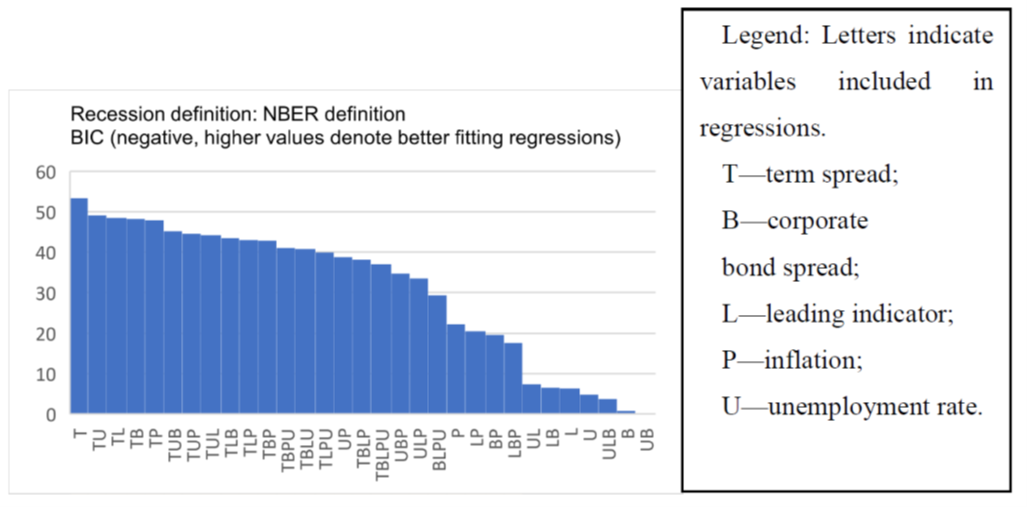

For four quarters ahead, a term spread works best.

Source: Kiley (2023), Fig 4, bottom panel. T is 10yr-Fed funds term spread, U is unemployment rate, and P is PCE y/y inflation rate.

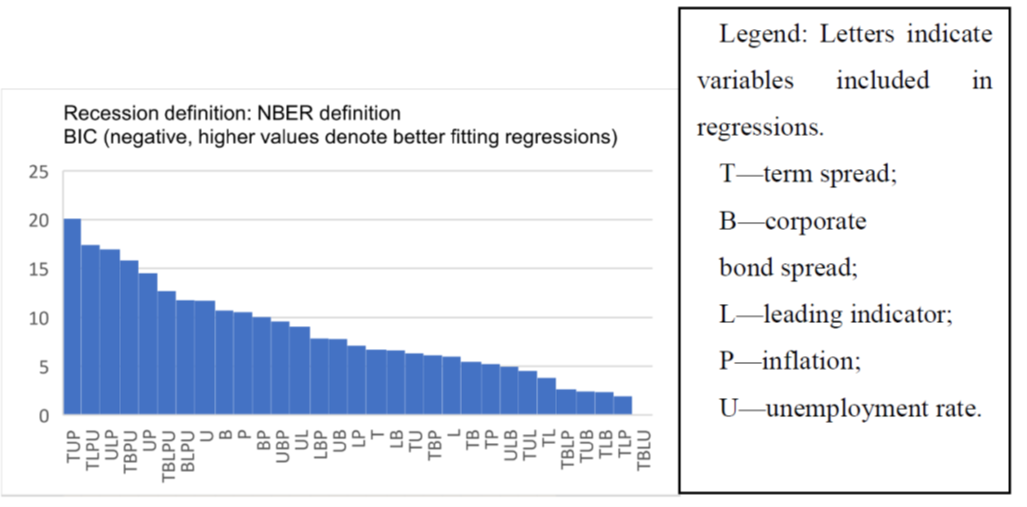

For a recession in the four quarters ahead of four quarters horizon, a specification including inflation and unemployment works best.

Source: Kiley (2023), Fig 5, bottom panel. T is 10yr-Fed funds term spread, U is unemployment rate, and P is PCE y/y inflation rate.

Note that Kiley also considered predictive power where recessions are defined as large increases in the unemployment rate, and large decreases in the per capita GDP. Here, I’ve focused on NBER defined recessions.

What do Kiley’s results imply for the current situation (i.e., do the current levels of inflation and unemployment imply a different estimated recession probability than using a term spread alone)? I do probit regressions on term spread at 12 months horizons, and term spread plus PCE inflation plus unemployment for 18 and 24 months ahead using data up to January 2023 (I assume UE rises to 3.6% and inflation is as indicated by the Cleveland Fed nowcast).

Figure 3: Implied recession probabilities using term spread at 12 month horizon (blue), at 18 months using term spread, unemployment rate, inflation rate (tan), at 24 months using term spread, unemployment rate, inflation rate (green). NBER defined peak-to-trough recession dates shaded gray. Source: NBER, author’s calculations.

These probabilities break the 50% threshold around 2023M04. (Note that I’m using a slightly different specification, of at 12 months, rather than within 12 months).

I think the Fed is fully committed to the 5 and 5 plan. They have promised 5% federal funds rate and 5% unemployment and the heck with the data. Wage earners must be punished so they don’t forget their place ever again.

Considering how irrelevant the Fed rate directly is to the economy, that plan does not exist. The Fed does not matter unless they raise its rate high enough to force banks via interest payments to really cut lending. Raising rates can also raise leverage and debt into loan originations. The Fed has been running this scam since 1951. Then the Volcker era politicised it to the nadir. The yield curve has always been a Fed “guess” based on over investment. Wow Greenspan 99-2000 interest rate hikes were political cover for the end of the capex boom based around Y2K. That was it. Keep the general rate lower and it’s exposed with no predictive power. In 1966-67 they guessed wrong…….

Monetary policy is ineffective? Gee – you and JohnH should write a paper on this topic and submit to the American Economic Review. The editor needs a good laugh.

Yup, because “Monetary policy” doesn’t exist. Its a fraud. A pure “animal spirits con” the bankers have direct control what is happening. Considering the market controls nominal consumer finance, well…..its true. Ok to admit it. Lets get back to pre-Volcker when the Federal Reserve was ignored.

Dude – this is an economist blog. Take your BS somewhere else.

I really side with you on this, but I have to stop myself, you know, on down that train of thought, and then I get angry, well………… you know what I would sound like. But I’m with you brother Joe.

Alas you are likely right. And BTW – ignore that nonsense from Gregory the Bot.

Prof. Chinn:

Thanks very much for posting this article, which I’ve already gone over twice and will bookmark to read more thoroughly later.

Several items come to mind. First, this reads to me as significant validation of work that was done a number of decades ago by Prof. Geoffrey Moore, who divided leading indicators into short and long time frames. It also more specifically reads like academic validation for the forecasting model that Robert Dieli has run successfully for the past several decades, which (my description, not his) is a relatively simple arithmetic system based on tradeoffs between the yield curve and the Phillips curve.

Second, this paper reads well in tandem with the opinion piece by Campbell Harvey that you highlighted yesterday. Harvey, like Kiley, noted the widespread acceptance of the recession signal given by the yield curve; but spotlighted that as his first reason why “this time it’s different;” and secondly compared the signal from other economic indicators as not confirming the information by the yield curve.

The first criticism by Harvey is Yuval Harari’s “Second Order Chaos,” which holds that whenever you observe the humans, the humans always observe back, and alter their behavior as a result. I would agree that the widespread belief by business elites that a recession is likely this year is the primary reason to think it will not happen (because they’ve acted on the information early).

The second prong of Harvey’s concern harkens back to Geoffrey Moore’s model, which does not make use of the yield curve. On of my big criticisms of much modern forecasting is its over-reliance on the yield curve, when during the entire period between 1932 and 1957 the Fed did virtually nothing with interest rates, and yet a number of recessions, several deep, occurred anyway.

Last year elsewhere I highlighted how much the immediate post-WW2 Boom and 1949 recession mirrored the situation in 2021-22. There was pent-up demand and plenty of stimulus. There was a shortfall in labor, which led to a Boom in wages and employment. Inflation hit a peak of close to 20% in early 1947. Housing starts increased by 50% in 1947, and house prices increased 23% between 1946 and 1948. Commodity prices increased as sharply as 10% in a single month, and 35% in 12 months as of early 1948. Retail sales after inflation adjustment rose 5% in 1947.

And what did the Fed do? Basically nothing, raising the discount rate from 1% to 1.5%. There was nothing even remotely close to a yield curve inversion, although long term government and corporate bond rates, and short term commercial paper rates, all rose somewhat. Corporate profits stalled and consumers pulled back by late 1948, and a recession (primarily an inventory adjustment) occurred in 1949.

The situation in 2021-22 was very similar to that in 1947-48. Non-yield curve longer term indicators were already suggesting by March of last year that a recession might happen this year (just as in 1949) even before the Fed started hiking rates, which indicator-wise looked like the icing on the cake.

Which is a long-winded way of saying that I appreciate that Kiley looked at other indicators besides the yield curve.

Different topic but it seems Southern California had seen an enormous spike in natural gas prices but then this spike just disappeared:

https://www.latimes.com/california/story/2023-01-31/socalgas-bills-may-drop-soon-after-steep-rise

With astronomical natural gas prices squeezing the pocketbooks of Southern California Gas Co.’s 21.8 million customers, the company says relief may be on the way as soon as next month. In a statement, the company said the price of natural gas for its customers would be down 68% for February compared with January. “While we’re relieved that prices have dropped significantly since last month, they remain higher than usual for this time of year,” said Gillian Wright, a SoCalGas executive. The utility attributed the drop in consumer gas prices primarily to a commensurate drop in the wholesale price that SoCalGas will pay for gas in February compared with January.

Now we have all noted how US natural gas prices have avoided the EU volatility so what was up in Southern Cal? I saw this story in an update over at Kevin Drum’s place which has been all over this:

https://jabberwocking.com/heres-why-natural-gas-prices-are-so-high-in-california/

It seems having functioning pipelines is rather crucial when winters are colder than expected.

You noted credit spreads which reminds me of this series:

ICE BofA BBB US Corporate Index Option-Adjusted Spread

https://fred.stlouisfed.org/series/BAMLC0A4CBBB

At least the credit spread on investment grade corporate bonds is modest.

A follow-up:

The literature emphasizing the value of the corporate bond spread as an indicator useful for forecasting economic activity or recessions is not as large as the literature on the yield curve, but several recent pieces have suggested that such spreads are powerful indicators. Examples include

King, Levin, and Perli (2007), Gilchrist and Zakrajsek (2012), and Faust, Gilchrist, and Zakrajsek (2013), among others. An element of this literature has emphasized the importance of distinguishing between risk premiums in corporate bond spreads and default risk in spreads: the work of Gilchrist and Zakrajsek (2012) highlights this distinction and the forecasting ability of the risk premium component

Gilchrist and Zakrajsek gave a lot of credit to the work of Ben Bernanke in their 2012 classic.

Robert Reich’s latest on fiscal policy is so spot on that I wish he could have published in the US rather than in The Guardian:

https://www.theguardian.com/commentisfree/2023/feb/01/republicans-arent-going-to-tell-americans-the-real-cause-of-our-314tn-debt

Republicans aren’t going to tell Americans the real cause of our $31.4tn debt

It’s always the same when Republicans take over a chamber of Congress or the presidency. Horrors! The debt is out of control! Federal spending must be cut! When they’re in power, they rack up giant deficits, mainly by cutting taxes on corporations and the wealthy (which amount to the same thing, since wealthy investors are the major beneficiaries of corporate tax cuts). Then when Democrats take the reins, Republicans blame them for being spendthrifts. Not only is the Republican story false, but it leaves out the bigger and more important story behind today’s federal debt: the switch by America’s wealthy over the last half century from paying taxes to the government to lending the government money … One of the biggest reasons the federal debt has exploded is that tax cuts on corporations and wealthier Americans have reduced government revenue.

In the first full year of the Trump tax cut, the federal budget deficit increased by $113bn while corporate tax receipts fell by about $90bn, which would account for nearly 80% of the deficit increase.

Oh wait – it is this kind of honesty that explains why Reich had to send this to a London newspaper. The Trumpsters did not want their base to have anyway of reading it. But what a silly concern – we know that the likes of Bruce Hall and other MAGA hatters don’t even read American newspapers.

Yup, all Trump’s fault. LGB.

A picture is worth a thousand pgl’s words.

https://fred.stlouisfed.org/series/FGEXPND

You might remember this:

https://www.congress.gov/bill/116th-congress/house-bill/748/cosponsors?searchResultViewType=expanded&KWICView=false

H.R.748 – CARES Act

116th Congress (2019-2020)

LAWHide Overview

Sponsor: Rep. Courtney, Joe [D-CT-2] (Introduced 01/24/2019)

Committees: House – Ways and Means

Committee Meetings: 07/23/20 10:00AM

Latest Action (modified): 03/27/2020 Became Public Law No: 116-136.

… and the result:

https://en.wikipedia.org/wiki/CARES_Act

The Coronavirus Aid, Relief, and Economic Security Act,[b][1] also known as the CARES Act,[2] is >a $2.2 trillion economic stimulus bill passed by the 116th U.S. Congress and signed into law by President Donald Trump on March 27, 2020, in response to the economic fallout of the COVID-19 pandemic in the United States.[3][4] The spending primarily includes $300 billion in one-time cash payments to individual people who submit a tax return in America (with most single adults receiving $1,200 and families with children receiving more[5]), $260 billion in increased unemployment benefits, the creation of the Paycheck Protection Program that provides forgivable loans to small businesses with an initial $350 billion in funding (later increased to $669 billion by subsequent legislation), $500 billion in loans for corporations, and $339.8 billion to state and local governments.[6]

A picture is worth a thousand pgl’s words.? Seriously Bruce – your picture shows government spending rising under Trump, then temporarily spiking to offset the damage from Trump’s not addressing COVID, followed by Biden reigning in spending.

Not so many words to properly interpret your little picture.

CARES act passed under Trump to address Trump’s incompetent response to the pandemic. But of course Brucie says this was all Biden’s fault.

LOL! Rewriting recent history already.

All the information needed is in the links from my comment.

• Democrat sponsored the bill

• Democrat Congress passed the bill

• Trump signed the bill

• CDC guidelines led states to shut down economies

• CARES act was designed to offset the economic harm from the shutdowns

• Democrats complained loudly that the shutdowns were not long enough or broad enough which would have crippled the economy more

https://www.theatlantic.com/politics/archive/2021/05/liberals-covid-19-science-denial-lockdown/618780/

Yeah, Trump’s fault. Oh, btw, who pushed for rapid development of the COVID vaccines?

From 2020 without benefit of hindsight:

https://news.yahoo.com/how-much-credit-should-trump-get-for-the-coronavirus-vaccines-204632392.html

You have to do a better job re-writing history.

Please detail the “incompetent response”. Should he have ordered the infected elderly in all states to be returned to nursing homes to infect others as did Cuomo and Whitmer? Should have have shut down the nation completely like the Chinese did only to see COVID run rampant as soon as they gave up on that strategy? Should he have restricted air travel with China and Europe (oh, he did that)? Should he have pushed for rapid development of vaccines and supported that with government funding (oh, he did that)? Should he have worked with pharmaceutical companies to try to find effective anti-virals against COVID (oh, he did that)? Should he have had Dr. Fauci stand up in front of television cameras and tell everyone to wear one or two masks (Fauci did that)?

Please detail the “incompetent response”.

‘Please detail the “incompetent response”.’

We have been over this many times. And I see you are still rehashing your usual pathetic little lies. Dude – you really need to stop drinking bleach on a daily basis as what little you used to have for brain cells have disappeared.

Now go back to preK and apologize to your teacher. Maybe she will give you those crayons back.

“Should he have had Dr. Fauci stand up in front of television cameras and tell everyone to wear one or two masks”

Maybe he should have served as an example by wearing one. And there was a plan to give everyone early on but your boy Trump killed that too.

Of course telling morons like you that bleach was a cure was a really bad idea – even though you followed this advice religiously.

BTW – Trump is now suing Bob Woodward for letting us know the garbage Trump told him during those recorded interviews. Suing a reporter for accurately reporting on what was known to be recorded interviews. Not exactly very bright.

Little Brucie boy has been using FRED to draw a lot of pictures that Brucie does not even remotely understand. Now why is he doing this?

Well it seems his preK teacher has taken away Brucie’s crayons and other art supplies until her worst stupid ever applies himself and finally taking his reading assignments seriously.

Sorry you don’t like FRED’s art. I’ll talk to him about it.

God – you are truly a moron. FRED stands for the Federal Reserve Economic Database. FRED is not a person. Although that bleach has made you so insane – you are probably trying to date Alexi or Siri.

https://www.msn.com/en-us/news/us/tucker-carlson-mocks-murder-of-tyre-nichols-wheres-george-floyd-when-you-need-him-video/ar-AA16YjWU

Tucker Carlson smirks when he talks about the murder of George Floyd? Now the thesis is this disgusting rant from the little girly man seems to be that it is hard to find white racism. I guess Tucker wants to alleviate this alleged shortage by hosting a nightly hour long racist rant.

So, no links to economic articles/analyses, but racial politics? Go get ’em, pgl.

Yea – a KKK member like you would consider mourning the death of an innocent man nothing more than politics. I was about to suggest JohnH has the lowest moral center ever but even that disgusting troll is no match for you.

aside from the .25% fund rate announcement….

eia report for 27 jan is pretty even.

first report in months us is not net exporting million barrels per day, this one is net import about 34 k per day. net crude imports up week on week, with product net exports about recent average.

crude less the reserve is up 4 mbbl week on week, no recorded draw on reserve. the reserve is at 371 million barrels

what does the groundhog say tomorrow?

gasoline and distillate also up modestly.

Lets note these less 12 months ahead spreads tell us we should be in recession already. A failure like any other unable to put it together. Look at the ISM, take away imports and its impact on “new orders” and the ISM is easily positive. As the inventory glut recedes later in the year, orders will start pumping out and indeed that part of the ISM will accelerate as will “new orders”. Boom, back above 50. Contraction in imports because of a glut is a positive for GDP in 3023 while exports stay mostly steady and 2022 needs its GDP back.

@pgl: I get the impression that lots of Americans read The Guardian. Well, at least a certain profile of Americans.

Sometimes The Guardian publishes controversial pieces that American news sites do not want to touch. And do a good job. I see it as good value.