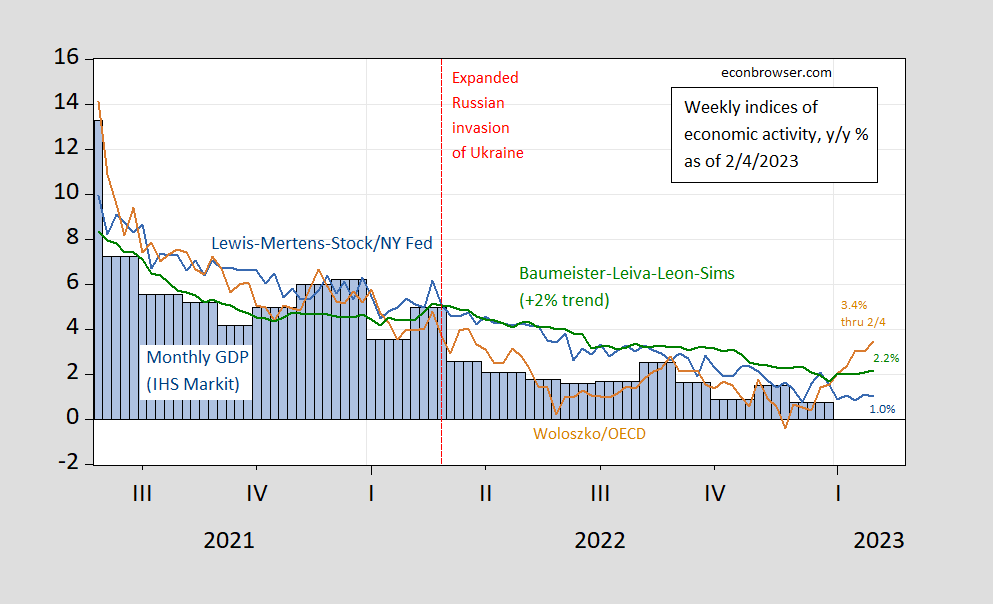

Weekly indicators from Lewis-Mertens-Stock (NY Fed) Weekly Economic Indicators, and Baumeister, Leiva-Leon and Sims WECI and Woloszko (OECD) Weekly Tracker through 2/4/2023, released today, compared against monthly GDP.

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green), and IHS Markit monthly GDP (blue bars). Source: NY Fed via FRED, OECD, WECI, IHS Markit/S&P Global, and author’s calculations.

There’s been a sharp rebound in the Weekly Tracker, which had dipped into negative for the week ending 11/26, now exceeding the WEI (1.0%) and WECI+2% (2.2%). The WEI reading for the week ending 2/4 of 1.0% is interpretable as a y/y quarter growth of 1.0% if the 1.0% reading were to persist for an entire quarter.The Baumeister et al. reading of 0.16% is interpreted as a 0.16% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 2.16% growth rate for the year ending 2/4. The OECD Weekly Tracker reading of 3.4% is interpretable as a y/y growth rate of 3.4% for year ending 1/14. The 95% interval for the US weekly tracker is [1.9%, 4.9%].

I’m gonna try to express this in the best way that I can. I am not a fan of Chairman Powell, I really just don’t like him, BUT……. no one is pulling for Powell to get a “soft landing” more than this dumb dork, here in middle America, “fly-over country”. Powell should have stopped the rate rises before now. But here is what I’ll tell Menzie’s and Prof Hamilton’s readers. If… IF…IF…. IF….. Chairman Powell eventually gets that right, I’ll tip my hat to him and the FOMC But, I doubt he’ll “get it right”. But I’ll give Powell the right to “prove” his “method”. I’ll do that as neutrally and objectively as I am able.

If we get the soft landing it will be in spite of the Fed, not because of them. From what I have seen from Governors “state-of-the-state” talks, public employees are not going to get pay increases that will match the inflation they have been facing. So the wage-price spiral these fools were so scared of is, predictably, not going to materialize. However, the drag from lower real wages in the mid-segment may be fully compensated for by increased income for the lowest paid private service sector employees – so it could be a wash.

I may pray for a soft landing. I have also said over and over that the FED should lower interest rates.

I completely agree. All the numbers suggests that they have already overdone it. The damage to housing has barely begun to show up and we can only hope it doesn’t spill over into consumption too fast.

Moses,

You may want to give Powell a bit of a break.

The BLS just revised CPI data and this resulted in an increase in the December 2022 monthly change from -0.1% to +0.1%. So annualized CPI All for the month of December has increased to 1.6% from negative. In addition, the Bloomberg consensus forecast for January is 0.4% or compound annualized at 4.9% for January’s CPI forecasted change.

CPI All monthly % change

https://fred.stlouisfed.org/graph/fredgraph.png?g=ZTDC

CPI All month, annualized.

https://fred.stlouisfed.org/graph/fredgraph.png?g=ZTJ6

Core CPI for the month of December increased to 0.4% from 0.3% due to the data revision. The December monthly change is also up from November’s monthly change of 0.3% and October’s monthly change of 0.3%.

For Core CPI, the Bloomberg consensus forecasts a monthly increase of 0.4% for January or an annualized increase of 4.9%.

Core CPI monthly % change

https://fred.stlouisfed.org/graph/fredgraph.png?g=ZTGC

Core CPI month, annualized.

https://fred.stlouisfed.org/graph/fredgraph.png?g=ZTIW

Core commodities inflation may not help much in the future to keep Core CPI down.

https://fred.stlouisfed.org/graph/fredgraph.png?g=ZTJS

Core services showed a monthly increase of 0.61% for December, which is 7.6% compound annualized.

Core services monthly % change

https://fred.stlouisfed.org/graph/fredgraph.png?g=ZTKR

Core services, annualized.

https://fred.stlouisfed.org/graph/fredgraph.png?g=ZTLa

Maybe Professor Chinn can revise the Eeckhout instantaneous kernel, bandwidth model. I’m still having trouble evaluating the model on page 5 of Eeckhout’s paper.

I’m gonna tell you (very seriously, no joke,……..) ( my sorry maths ass WISHES it was a joke) if YOU didn’t get page 5. and, I sure as hell didn’t “get” page 5 either…….. (My Ex Chaoyang GF WOULD get the maths, but that’s ANOTHER sad story of my personal melodrama) Uhm, all of your above great web links…….. I’ll just say I HOPE you’re right, “AS” : )

If this is just the result of new seasonal adjustment factors – I dunno? but timing suggests it is – then the “new” inflation reported for December was moved from some other month, so the overall amount of CPI inflation would be the same in 2022, just arriving in a different pattern.

And if we look at the PCE deflàtor(s), which the Fed folk prefer, we see inflation cooling toward target. If policy is forward-looking, with a good bit of the effect of Fed tightening still to come, the Fed could reasonably anticipate inflation returning to target without further tightening.

https://fred.stlouisfed.org/graph/?g=ZUrM

The Fed’s own Summary of Economic Projections shows that a real 0.5% funds rate is assumed to be neutral:

https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20221214.htm

With the effective funds rate at 4.3% and inflation expectations running around 2.2%, the real funds rate is currently around 2.1%:

https://fred.stlouisfed.org/series/FEDFUNDS

https://fred.stlouisfed.org/series/T5YIFR

That’s 1.6% above neutral, while the Fed has reason to expect inflation to return to target. We don’t need to cut the Fed any slack.

MD,

Thanks for the links.

I can’t argue with the implied inflation and neutral interest rate assumptions other than to say that there could be variance in the actual future results from the projections.

My main purpose in the CPI update was to tie into the article by Eeckhout given the recent CPI revisions by the BLS. Also, CPI is reported a week prior to PCE. In addition, I was just considering short-term results that Powell may be looking at currently.

I notice that the Bloomberg consensus forecast of Core PCE, Fred series, PCEPILFE for January is 0.3% same as actual for December 2022, both in line with the FOMC projections.

I looked at both Core PCE, Fred series, PCEPILFE and Core CPI to see what correlation may exist. Looking at a relatively calm monthly change period, 2002 to 2019 there was a 60% correlation in monthly percent change in each index. From 2002 to 2022 there was an 81% correlation, and looking at a turbulent period, 2020m11 to 2022 there was a 72% correlation. For the annual period from 1959 to 2022 there was a 97% correlation in percent changes.

Something I also noticed is for the short period, 2020m11 to 2022m12, CPILFESL and PCEPILFE seem to be cointegrated (corrections welcome). Using annual data from 1959 to 2022, there appears to be no cointegration.

Looking at the December 14, 2022, FOMC Projections report that you linked, I see the 2023 forecast for Core PCE at 3.2% to 3.7%. If all goes right, then perhaps there is nothing to see here and no worries.

Morning Joe’s pretend economist Steve Rattner brought his usual charts with one claiming real labor income for lowest quartile was up 10% over the past 3 years. He had some vague reference to Blanchett et al. I guess he was referring to this but I do not see Rattner’s chart:

https://eml.berkeley.edu/~saez/blanchet-saez-zucman22slides.pdf

Maybe someone else could help us out with WTF Mr. Charts was trying to show. In the meantime, could Morning Joe find a real economist?

I did find their NBER paper:

https://www.nber.org/system/files/working_papers/w30229/w30229.pdf

Analyzing the Covid-19 pandemic, we find that all income groups recovered their pre-crisis pretax income level within 20 months of the beginning of the recession. Although the recovery was primarily driven by jobs rather than wage growth, real wages experienced significant gains at

the bottom of the distribution in 2021 and 2022, highlighting the equalizing effects of tight labor markets. After accounting for taxes and cash transfers, real disposable income for the bottom 50% was nearly 20% higher in 2021 than in 2019, but fell in 2022 as the expansion of the welfare

state during the pandemic was rolled back.

What Steve CHARTS Rattner told the Morning Joe audience was not quite what these authors wrote. Then again – this is not exactly the picture that JohnH has portrayed either. Hey maybe Fox and Friends should invite Rattner and JohnH to debate this issue. Only their audience would be impressed.

From another source, through March 2022:

https://www.dallasfed.org/cd/communities/2022/0808

And there’s this, which is not disaggregated by income:

https://fred.stlouisfed.org/graph/?g=ZToC

Note especially the effect of January’s job growth. No CPI reading yet, but CPI will have to have risen by 1.5% m/m to outpace the rise in payroll income.

There has been a lot of cherry-picking of end-points in order to blame Biden (Brucey, et al) or blame Democrats, the U.S. or economists or anybody but Putin (Johnny). The simp!e fact is that while inflation was running high, real incomes fell, and now that inflation has receded, real incomes are rising. Both effects are, to some extent, the effect of the Covid recession and the food-and-fuel price shock resulting from Russia’s re-invasion of Ukraine, so of course it’s Biden’s fault. Or economists’s fault. Or my fault.

“There has been a lot of cherry-picking of end-points in order to blame Biden (Brucey, et al) or blame Democrats, the U.S. or economists or anybody but Putin (Johnny).”

Now we are citing data that covers the period from late 2019 to 2022 but Jonny boy cites EPI data that covered only 2021. Now I get it – Jonny boy will accuse our studies of “moving the goal posts”. Funny thing – the NFL refuses to take Jonny boy’s idea of placing the goal posts at the 30 yard line for the Super Bowl!

“Did earnings for all quintiles of worker grow faster than inflation? Consumer price index from the BLS suggest overall inflation of 10 percent in the period of study—between fourth quarter 2019 and first quarter 2022. Using this measure, earnings growth for the four lower quintiles outpaced inflation, though only narrowly for the 40–60 and 60–80 percentile earners.”

Well for the period of high inflation, low income earners did see significant real earnings increases. Consistent with what TV economist Steve Rattner told Morning Joe. Inconsistent with JohnH’s ramblings.

Oh wait – Jonny boy might want to see what has recently happened. Recently however inflation has been low and Jonny boy keeps peddling this nonsense that low inflation must always be accompanied by rising real wages. Trapped by his own spin.

This is also not the picture that EPI, FREDblog, the BLS and the Dallas Fed present.

https://www.epi.org/publication/inequality-2021-ssa-data/

https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/

https://fred.stlouisfed.org/series/LES1252881600Q

But, hey, you have to count progress when you see it…some economists are actually starting to pay attention, though most would prefer to gloss over 45 years of wage stagnation, just as they downplay record corporate profit margins.

This is also not the picture that EPI, FREDblog, the BLS and the Dallas Fed present.

So you are now accusing these progressive economists of being corporate homeys just one day after you praised their work? Damn – you do have malleable fact free opinions.

Not to criticize FRED blog but come on dude – we already pointed out to you that their graphs are trying to compare the nominal value of one measure of earnings to the real value of another measure. I guess Jonny boy still has not learned to read a damn graph.

OK, pgl, I’ll try to help your reading skills. NBER: “we find that all income groups recovered their pre-crisis pretax income level within 20 months of the beginning of the recession…Rattner told the Morning Joe audience was not quite what these authors wrote….I said, “This is also not the picture that EPI, FREDblog, the BLS and the Dallas Fed present.”

The data sources I cited all show that real incomes are back to 2019 levels, not exactly what NBER is reporting.

What’s interesting is that NBER’s contributors do not show up on Schedule B of its IRS 990 at the IRS website. In fact, there is no Schedule B at all. Over at ProPublica Schedule B is shown with no data, but instead the word “restricted” has been inserted. NBER gets about $30 million each year from private donors and another $30 million from the government, but the public is not allowed to know who’s funding the folks who determine when recessions start and end?

NBER’s own website lists a few donors who have given less than $25K, totaling nowhere near $30 million.

Such lack of transparency always raises questions and could even lead to conspiracy theories. Who knows, maybe some of their funding comes from the Koch brothers, the Trumps, or maybe the Saudis? What about three letter intelligence services?

The first rule of politics is to follow the money…and here access has been denied. And yet we’re expected to trust what they publish?

the Dallas Fed present?

Hey dumbest troll ever. FRED is put out by the St. Louis FRED. Get a map as these two cities are not the same.

Are you really this stupid, pgl? I linked to the Dallas Fed’s report repeatedly recently.

“The Dallas Federal Reserve found that the decline in real wages is at a severity not seen in 25 years. Simply put, when adjusted for inflation, American’s paychecks are down despite wages going up. The median decline in real wages surpassed 8.5% this September.

“How severe are the losses for workers experiencing negative real wage growth? For the 53.4 percent of such workers in second quarter 2022, the median decline (that is, half of the declines were larger and half smaller) in real wage growth was 8.6 percent.”

After examining real wages over the course of 12 months, the Dallas Fed found that 53.4% of all workers experienced real wage declines. Additional taxes under Biden have added to real wage decline as well. Peter C. Earle of the American Institute for Economic Research estimates that someone earning $70,000 annually now has $4,500 less in buying power in New York. “The bill for the Covid mitigation policies is due,” Earle said. “Record levels of fiscal and monetary policy expansion in the first half of 2020 are wrecking the purchasing power of the dollar. Thus even without a pay cut, wage earners are effectively earning less over time.”

The average median decline over the past 25 years has been 6.5% with real wage declines reaching between 5.7% to 6.8%. Inflation is simply too severe to compensate for any additional wages. The Fed continued to say:

“Despite the stronger wage growth due to the tightness of the labor market, a majority of workers are finding their wages falling even further behind inflation. For workers who experienced a decline in their real wage in second quarter 2022, the median decline was 8.6 percent.

While the past 25 years have witnessed episodes that show either a greater incidence or larger magnitude of real wage declines, the current time period is unparalleled in terms of the challenge employed workers face.”

https://www.dallasfed.org/research/economics/2022/1004

Of course, Duckly and pgly love to cherry pick the data, using average and aggregates to gloss over what’s really happening. And poor “lunch box” Joe has no clue why American’s are unhappy (apparently he only looks at GDP!!!)

But the good news is that at least a couple unidentified “economists” are starting to look at the numbers. And maybe one day they’ll come to realize that the purpose of the economy should be shared prosperity, not just positive GDP numbers.

I linked to the Dallas Fed’s report repeatedly recently.

Hey dunce head – you provided 3 links there none of which were the Dallas FED. I cannot help it that you are that incompetent.

“After examining real wages over the course of 12 months”

Ah Jonny boy – your Dallas FED source (which was not one of your links) covered a shorter time period that what the grown ups are discussing. You know moving those goal posts to the 30 yard line might end up your lying rear end in jail.

“In 2021, annual wages rose fastest for the top 1% of earners (up 9.4%) and top 0.1% (up 18.5%), while those in the bottom 90% saw their real earnings fall 0.2% between 2020 and 2021. Workers in the 90th–99th percentile of the earnings distribution also experienced real losses in 2021.”

Jonny looks at what EPI says about 2021 and he wants to compare wants to say this is what happened from late 2019 to early 2022?

Come on Jonny boy – no one can be this STUPID. Oh wait – you can be this incredibly STUPID.

https://www.mining.com/trafigura-faces-577-million-loss-on-alleged-nickel-fraud/

Commodities trader Trafigura Group will take an almost half a billion dollars charge in first half of 2023, after discovering that some nickel cargoes it bought didn’t contain the metal they were supposed to. The Geneva-based company said the “systematic fraud” was committed by a group of companies connected to and controlled by Indian businessman Prateek Gupta, including TMT Metals and companies owned by Gupta’s UD Trading Group.

Now nickel prices passed $30,000 per ton a year ago so one would hope that Trafigura would sure it was shipping nickel before paying Gupta.

Nickel is a rough market. Battery demand has apparently led to an increase in corrupt dealing. Price is up 26% from a year ago:

https://ycharts.com/indicators/nickel_price

Remember the nickel trading halt on the London Metals Exchange last March? There’s litigation:

https://www.lme.com/en/LME-Nickel-litigation

And there was this guy, who cooked up a $1.2 billion nickel scam:

https://www.straitstimes.com/singapore/courts-crime/man-allegedly-linked-to-nickel-trading-scam-gets-12-more-charges

And this one:

https://www.gtreview.com/news/asia/forged-documents-and-misled-banks-edf-man-awarded-us282mn-in-nickel-fraud-case/

The Gupta guy is from India (another India corruption accusation?), but TMT is headquartered in London, probably because the LME is there.

Ng, the former director of Envy Asset Management and Envy Global Trading, is said to be linked to a nickel trading scheme that allegedly cheated investors of at least $1.2 billion.

Who would be dumb enough to do business with an outfit whose name started with Envy?

So another success for the sanctions against Russia. They cannot sell their oil and have been forced to cut production by 500,000 bpd.

https://www.reuters.com/business/energy/russia-cut-oil-output-by-500000-bpd-march-2023-02-10/

Their government has already lost half of its income from hydrocarbons and now we see that one of the reasons is they cannot sell enough of it (in spite of certain countries being willing buyers).

Don’t you love this?

“As of today, we are fully selling the entire volume of oil produced, however, as stated earlier, we will not sell oil to those who directly or indirectly adhere to the principles of the ‘price cap’,” Novak said in a statement.

Well duh – try ending all production. I’m sure you can then say you sold all you produced.

https://www.msn.com/en-us/news/crime/turley-fires-back-at-democrat-for-attacking-his-credibility-at-house-hearing-completely-absurd/ar-AA17kW2e

Jonathan Turley is upset that anyone would question his credibility? Just wow – it is sort of like Bruce Hall whining that people question his integrity. Lokk both of you – if you do not want us to question your credibility – try being honest and objective for a change.

Yes, poor guy. Pathetic to see him whine about unfairness in a segment that gave the person he attacked no change to rebut. Faux had to give him a whole segment to try and change the subject from his lies to being called out on them.

His postulates on Faux were way over the top lies; but in the safe environment of Faux he knew he would not be challenged.

Remember this?

https://www.thenation.com/article/archive/turley-impeachment-hypocrisy/

The Republicans’ Star Impeachment Scholar Is a Shameless Hack

Jonathan Turley’s testimony was so inconsistent, it contradicted his own previous statements on impeachment.

Three of the professors agreed that Trump should be impeached: Noah Feldman of Harvard Law School, Pam Karlan of Stanford Law School, and Michael Gerhardt of the University of North Carolina School of Law. The fourth professor, requested by Republicans on the committee, was Jonathan Turley from George Washington University Law School. Republicans know that all they have to do to outflank the Democrats is serve up talking points Sean Hannity can use on his show. They tapped Turley to do the easy work of poisoning the well with more misinformation. Turley did not disappoint. He told Republicans what they wanted to hear right from his opening statement: “I’m concerned about lowering impeachment standard to fit a paucity of evidence and an abundance of anger. I believe this impeachment not only fails to satisfy the standard of past impeachments, but would create a dangerous precedent for future impeachments…. This would be the first impeachment in history where there would be considerable debate, and in my view, not compelling evidence, of the commission of a crime.”

The discussion goes on but I had to stop thinking about Turley’s cooking advice – something about marinating.

https://www.mediaite.com/politics/goldman-grills-jordan-over-claim-he-met-with-dozens-of-whistleblowers-claiming-feds-are-biased-no-notes-no-nothing/

Goldman Grills Jordan Over Claim He Met with ‘Dozens’ of Whistleblowers Claiming Feds Are Biased: ‘No Notes, No Nothing?’

Watch the clip. Jordan is a liar and Goldman shows us how to deal with this creep.

We look forward to see those whistleblowers in front of the committee being grilled by Goldman. Anybody can find some idiot who is willing to claim that their agency is “biased” – the question is what they are basing that postulate on. So far the best I have seen is postulates of “there is a guy in our department who is a leftist”. Actual political bias require documentation that a person acted in conflict with professional criteria to serve another (political) goal. The Trump administration had hundreds of documented cases of right wing bias – I have yet to se a single well-documented case of left wing bias.

I love the fact that democrats are taking the gloves off when faced with this kind of Faux news BS. I hope the administration will train its top officials to do the same. GOP is counting on having cherry-picked clips from these hearings to be used in support of their narratives on Faux news. We must make sure that the soundbites for the actual news is an aggressive, insulting “pull-your-pants-down” answer to the innane questions from the nutcases.

Don’t forget that there was a lot of right wing political bias under the Trump administration. When they just talk about political bias and don’t get it out in the open for further examination it is almost always because they use their own corruption to prove corruption. They should always be called on by a question of “was that right wing bias under Trump?” “I could call in hundreds of witnesses regarding the right wing bias and political influence under Trump, if you let me”.

“Don’t forget that there was a lot of right wing political bias under the Trump administration.”

Twitter is already quite right wing. It’s just it is not right wing enough for the MAGA hatters.

The latest house hearing on Twitter has made sure it got read into the congressional record that Trump is a “pussy ass bitch” who tried to have that postulate removed from twitter. Apparently at twitter the question of whether to obey the demand from Trump that this “state secret” was removed, hinged on whether those three words would be counted as 3 separate insults (and you are out) or it was just one.

Kenya’s oil production has not been that substantial but Tullow Oil says this is about to change:

https://kenyanwallstreet.com/kenyas-crude-oil-production-to-hit-46000-bpd-in-2023/#:~:text=In%20its%20report%20titled%20Oil%20outlook%3A%20Growth%20to,growth%20of%20261.1%20per%20cent%20over%20the%20period.

NGO Oxfam International pegs the breakeven price for Lokichar oil at US$42/bbl. In its report titled Oil outlook: Growth to soften in Africa, RMB Global Markets Research says Kenya’s oil production is expected to reach 2,000 barrels per day in 2020 same as 2021 before increasing to 12,000 barrels per day in 2022 and 46,000 bpd in 2023, an average growth of 261.1 per cent over the period. Meanwhile, Kenya’s oil consumption is projected at 133,000 barrels per day in 2020, rising to 141,000 bpd in 2021, 149,000 bpd in 2022 and 158,000 bpd in 2023, a growth of 6.1 per cent.

It does appear that Kenya will remain a net importer of oil. Now I do not have a magic crystal ball for forecasting the world price for oil but this story also notes:

A study by the Oxford Business Group indicates that there is a relatively high wax content in the oil, which could put a dampener on the final production price — likely to trade less than the global benchmark of Brent crude.

OK – not exactly going to make Kenya the next Saudi Arabia but the story also notes Kenya may ramp up natural gas production.

I’m loving how McConnell had to attack Rick Scott over the latter’s desire to cut Social Security. Of course back in 2012 part of the Romney-Ryan platform was also about cutting Social Security. So which is truer to the GOP agenda? Oh wait – what is the GOP agenda? Let’s see:

(1) We must massively cut the deficit

(2) We cannot raise taxes on rich people and it seems McConnell wants to rule out tax increases on poor people

(3) We cannot cut defense spending, Social Security, or Medicare

Huh – I get the plan. Magic fairy dust!

A recent Krugman oped began with

Paul Krugman: War is peace; freedom is slavery; Democrats are radicals

It is the Republicans, not the Democrats, who are out of touch.

https://www.sltrib.com/opinion/commentary/2023/02/10/paul-krugman-war-is-peace/#:~:text=Paul%20Krugman%3A%20War%20is%20peace%3B%20freedom%20is%20slavery%3B,not%20the%20Democrats%2C%20who%20are%20out%20of%20touch.

Part of his oped called out the Republicans insanity on fiscal policy. Part of it mocked Sarah Yukabee Sanders claim that wokeness led to high gasoline prices (good to know Sanders has hired Bruce Hall as her chief economist. But permit to focus on the other garbage from Ms. Yuckabee:

Delivering the Republican response, Arkansas Gov. Sarah Huckabee Sanders claimed that the United States is divided between two parties, one of which is mainly focused on bread-and-butter issues that matter to regular people, while the other is obsessed with waging culture war. This is also true. But she got her parties mixed up — Republicans, not Democrats, are the culture warriors who’ve lost touch with ordinary Americans’ concerns … Sanders’ speech was a diatribe against wokeness. This is standard GOP fare these days and exactly what you’d expect in, say, an address at the Conservative Political Action Conference. But this wasn’t a CPAC speech; it was meant to address the nation as a whole and rebut the president of the United States … Just to be clear, there are culture warriors on the left, and some of them can be annoying even to social liberals. But few have significant power, and they certainly don’t rule the Democratic Party, which isn’t locked into a closed mental universe, impervious to inconvenient facts, whose denizens communicate in buzzwords nobody else recognizes. Republicans, however, do live in such a universe — and what Sanders showed us was that they can’t step outside that universe even when they should have strong political incentives to sound like normal people and pretend to care about regular Americans’ concerns.

Watch Rick Scott blame Jake Tapper for Scott’s dishonesty on Federal health care spending:

https://www.msn.com/en-us/news/politics/rick-scott-invoked-jake-tapper-8-times-in-a-10-minute-interview-hear-tapper-s-response/vi-AA17l0eb?ocid=msedgdhp&pc=U531&cvid=0ab06e939d5a4b618fafbd5a9f64249b

Tapper fired back at Scott’s lying.

From my blog:

https://www.princetonpolicy.com/ppa-blog/2023/2/10/washington-examiner-highlights-legalize-and-tax-for-to-end-illegal-immigration

Washington Examiner highlights legalize-and-tax for to end illegal immigration!

The Washington Examiner has run a lengthy piece on market-based visas — a legalize-and-tax system — calling it a potential compromise to close the border to illegal immigration. Based on one of my earlier notes rounded out with additional commentary, How Biden could fix the border and get taxpayers $100 billion has a ‘like’ to ‘dislike’ ratio of 9:2 as republished on MSN. That’s an 82% approval rate from the public for an approach which most of my professional readers consider radical.

It is hard to overstate the importance of this article, considering how it closes:

[Legalize-and-tax] might offer a compromise for both political sides by pushing illegal immigrants to enroll in the visa program or face deportation. “Long-term undocumented will face a choice: Take a work permit at a price they can afford or be deported. This is not a hard decision,” [Kopits] said, adding, “As the precedent of California’s botched marijuana legalization shows, closing the border to contraband, whether marijuana or undocumented labor, is not enough to end the internal black market — in our case, the employment of undocumented residents without work permits. The prohibition on both new and existing migrant labor must be lifted to regain control over the border and bring order to the internal U.S. labor market.”

This is the stalwartly conservative Washington Examiner stating that we — both the left and right — need to formally consider a comprehensive solution using market-based mechanisms to end illegal immigration across the border and contemplate the near universal granting of work permits to long-time undocumented residents to clear the internal market. That’s a big deal. A very big deal. This is vastly more ambitious than DACA or the Dreamers, and yes, you are reading about it in a hard-nosed, socially conservative paper.

Why, and why now?

The article’s author, Paul Bedard, writes the “Washington Secrets” column for the Examiner. I’ve known Paul for several years now, and he regularly covers my monthly border apprehensions reports. He is the quintessential Washington insider (hence the ‘secrets’) and has his finger on the pulse of the conservative base. He has read most of my work on illegal immigration for the last five years and knows the legalize-and-tax thesis. I think he has focused on the idea for a number of reasons.

First, my border apprehension forecasts have proved accurate over the last several years, and certainly, that helps one’s credibility.

Second, I think Paul has become more comfortable with the notion of illegal immigration as a black market in labor, one which can be addressed as we have other black markets, notably for alcohol, gambling and marijuana. That insight, that illegal immigration is like other problems which we have successfully resolved, I think has been central to Paul’s thinking.

Third, no one has a compelling alternative. This is no surprise, because legalize-and-tax is materially the only proven approach to end black markets. Neither more enforcement nor greater leniency will solve the issue, and we know because it has not for the last 58 years. For all the vitriol, protesting, and editorial ink spilt over illegal immigration in recent decades, the border situation today is the worst ever by a substantial margin. We need a collective solution. Legalize-and-tax is the only one on offer.

My takeaway therefore is that Paul believes conservatives are willing to take a serious look at a market-based solution to illegal immigration. The approval rating on the article suggests that the public agrees.

It’s time to move forward, and time for the pro-migrant side to weigh in.

https://www.msn.com/en-us/news/us/how-biden-could-fix-border-and-get-taxpayers-100-billion/ar-AA17ay9b

Chinese “weather” balloon II?

https://www.msn.com/en-us/news/us/u-s-shoots-down-high-altitude-object-over-alaskan-airspace-white-house-says/ar-AA17l98B?ocid=msedgntp&cvid=bc2a0f50807c4f06a99defa8cf658d21

The U.S. military on Friday afternoon shot down a “high-altitude object” flying over Alaskan airspace that the Department of Defense was tracking over the last 24 hours, National Security Council official John Kirby confirmed at the White House. “The object was flying at an altitude of 40,000 feet and posed a reasonable threat to the safety of civilian flight. Out of an abundance of caution, and at the recommendation of the Pentagon, President Biden ordered the military to down the object and they did and it came inside our territorial waters and those waters right now are frozen,” Kirby told reporters at the White House briefing. Fighter aircraft assigned to U.S. Northern Command took down the object “within the last hour,” Kirby said around 2:30 p.m. ET.

both objects/balloons were successfully engaged using the newest aim 9x, a souped up sidewinder with radar guidance.

last week they were so successful, that this time they left the f-15’s with their guns on the runway.

f-22 has no guns.

next question: did the spec for the aim 9x include a probability of kill on a weather balloon. has almost no heat/infrared signature and very little metal to reflect radar.

so far 2 successful shots on weather balloons!

Speakng of climate change, Texas is having another power outage due to what some commenters will demand we refer to as “weather, not clmate”. Two tears ago, the whole Texas grid was threatened. This time, just some unlucky locations.

Texans are talking about he need for adaptation to climate change, and recognizing the cost involved:

https://undark.org/2023/02/07/hit-with-extreme-weather-texas-cities-debate-cost-of-adaptation/

The event two years ago was not due to above-ground power lines, so the discussion described in the link falls short. Remember, a big part of the probpem two years ago was that Texas is not on the inter-state grid – Texas is able to buy very little electricity from elsewhere. Y’all know why Texas isn’t on the grid? ‘Cause it’s Texas! And because inter-state agreements require regulation that Texas, and only Texas, doesn’t want to implement:

https://www.texastribune.org/2022/02/14/texas-national-power-grids/

Mostly, as I understand it, the regulations in question are environmental. It’s OK for children in Texas to eat mercury, antimony, arsenic and lead, ’cause they’re from Texas!

There has been some talk about how companies are abusing high inflation to increase their profit margins. Anyone who buys beer knows this is not universally true. I just checked the financials for Boston Beer (Sam Adams) who spend about 37% of their net revenues (excluding excise taxes) on selling and marketing which is good to know as I will present gross margins by year.

2019: 49.1%

2020: 46.9%

2021: 38.8%

So this microbrew is keeping its price increases well below the increase in the cost of its ingredients and workers. Of course Jonny boy is going to whine why I did not report 2022 data. OK their 4th quarter is not yet reported but for the first 9 months, the gross margin has exploded to 42.4%.

So hey – have a beer on me during the Super Bowl and stop reading the worthless trash from JohnH.