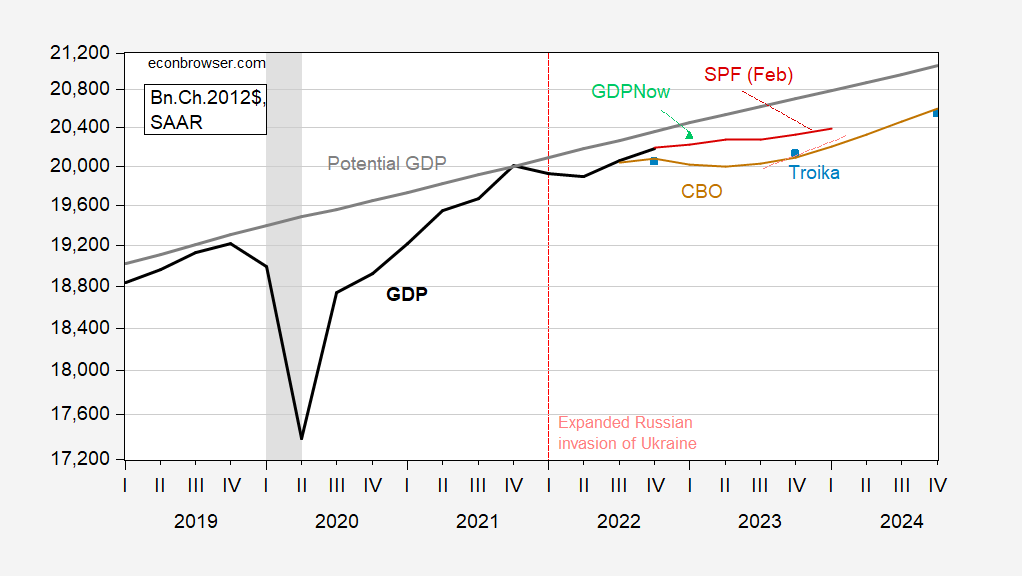

The FY 24 Budget was released today. Because the forecast was locked down in late November, and the macro outlook has changed so much, the administration felt compelled to add an “Update on the Administration’s Economic Assumptions”. Here’s the forecast (based on Table S-9 in the Budget).

Figure 1: GDP as reported (black), Administration forecast (sky blue squares), CBO projection (brown), Survey of Professional Forecasters median (red), GDPNow (3/8) (light green triangle). NBER defined peak-to-trough recession dates shaded gray. Source: BEA 2022Q4 2nd release, FY 2024 Budget, Table S-9, CBO, Philadelphia Fed, Atlanta Fed, NBER, and author’s calculations.

The Troika (OMB-CEA-Treasury) forecast is pretty similar to the CBO projection finalized in January, and slightly less optimistic than the February Survey of Professional Forecasters median (for end-2023).

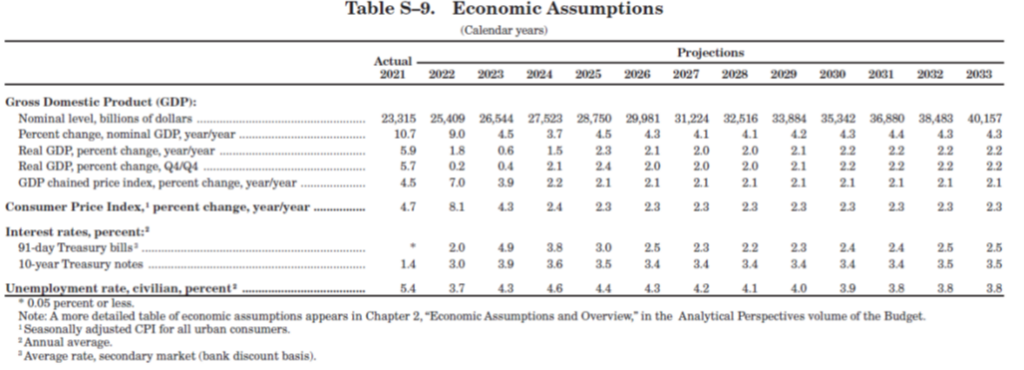

Table S-9 is reproduced below:

Going back to r > g. This forecast has g = 2.2% and r = 1.2%. Assuming I’m reading this correctly.

Nope, you’re reading the ’24 Budget booklet all wrong.

Larry Summers says the correct readout for “r” is 16.66% and “g”=15%. And Larry says higher wages for the working class are the bane of Americans’ existence and eventual certain doom. Larry also says all of these nightmarish things never would have happened if he was the current Treasury Secretary instead of Janet Yellen. And, lastly, any pictures of Larry standing together with Jeffrey Epstein, grinning big, seemingly as if he was a frat brat on his way to a kegger is pure yellow journalism. News at 11.

All of the above is satire, except the part about the pictures of Larry grinning wide in photos with Jeffrey Epstein, which did occur.

Larry does have an oversized ego. What cracked me up about that podcast was when Larry just sat back when Blanchard said the ideal expected inflation rate at least used to be 4%. Didn’t Larry once say that?

I can’t say for certain, to be straight with you, I’d have to google it. I just remember when I was in college 2% to 2.5% seemed to be the magic number, but I could never hear a definitive reason why it “had” to be 2% to 2.5%, just that was the “magic number” to avoid deflation.

Larry has many things that annoy me, raise my blood pressure, and sometimes when I think about him talking against wage increases and high employment border on anger and hate, and some things that just crack me up. One of my favorite things Larry does in the humor dept, as in crack me up, is when Larry is giving speeches behind a podium, where he’s standing still, and he does this upper body “bob”. Not even just a “head bob”~~it’s like his entire torso bobs. Now you can say “lots of people have nervous ticks”. OK, but that’s not a nervous tick. Like if I’m giving a speech in front of any more than say 40 people, I may tap my right heel up and down quickly in a nervous energy fashion, and my knee is going up down 3 times per second. That’s not what Larry is doing with his torso bob. Larry is so arrogant, he’s doing a standing still “I’m the cock of the walk” torso bob. That’s what that is, he’s such an uninhibited prick, he thinks people are impressed with watching him bob. “Arrogant” doesn’t cover it for Larry. Larry is at the point, where he’s 1/4 point away from sociopath.

he did not get booted from Harvard presidency for no reasons…

Wow – nominal GDP to pass $40 trillion by 2033 as compared to only $21 trillion in 2000! Someone call

Craig Eyermann to let him know this would be a 90% increase in just 13 years.

Yea I get some of this is higher price levels but does Eyermann understand this distinction?

Seems like all parties assume a continued shortfall in output relative to potential, without a recession built into the GDP estimate. However, there is a recession recession this year built into the unemployment rate. A 3.7% rate for 2022 (acknowledged in the Update to be at 3.4%), rising to 4.3% in 2023. Claudia Sahm advises us that this means recession. So something isn’t quite right.

The failure of the output gap to close is the result of a 0.6% real GDP growth forecast for 2023 (without a recession?), presumably the result of Fed tightening.

This was all in a cocked hat to begin with and the Update recognizes that the hat is a big one, but still, something isn’t quite right.

Probably still to low, maybe previous years upward revisions will make it work???I

Note: all government data from January should be ignored. Seasonal adjustments were a mess and everything was over inflated……including cpi and pce. I fear this is leading to a dump and pump scheme on open markets. The trade has it wrong and somebody is going to take advantage of it and squeeze people that sold right out of the market

My company is trying like hell to catch up our production. 6/7 day weeks. Maybe by summer??? I don’t see how a recession occurs with so much lagging capex still to do.

I don’t know if “the Troika” nickname is a good idea myself. I realize the term can be used in a somewhat generic or arbitrary way, but when I think “the Troika” I think of Europe’s Troika, which in my subjective opinion is largely composed of corrupt, callous, evil bureaucrats (especially the European Commission). I wouldn’t want that to be associated with OMB etc if I were them,

https://images.transparencycdn.org/images/TI_GCB_EU_2021_web_2021-06-14-151758.pdf

https://www.theguardian.com/business/2015/jul/28/greek-crisis-brussels-rejects-yanis-varoufakist-claims-troika

Moses Herzog: “Troika” in the usage adopted here (OMB-CEA-Treasury) predates the use of the term in the context of Europe.

Fair enough. It’s not incorrect, I just feel the term is “tainted” now. Like it has “ick” on it now, er something. I’m probably a party of one on that perspective though.

I was trying to think of a good lexicon analogy. Give me a few hours maybe my slow-working will think of a cute one. Shouldn’t be too hard in today’s atmosphere of murdering the English language. A murdering you do not partake in, but nonetheless is there.

Maybe quicker-minded readers would like to contribute and beat me to the punch?? Basically a word that used to have an innocent or bland meaning before, but now makes you slightly grimace if used in conversation. OK, have I OCD’ed enough on something no one else cares about yet?? Let me know. ha.

@ Menzie

I finally thought of an obvious one (of many, my mind is just having a hard time referencing them). It’s one I use jokingly here sometimes. “Uncle”. Uncle used to be a term of affection. Now, to young people, “Uncle” implies a “creepy” middle aged or older guy, not in tune with current political culture, possibly racist, homophobic etc.

Here is the funny thing, I don’t remember the Mandarin Chinese term for “uncle” but I do know “uncle” (in the slang version) in China basically translates to “sugar daddy”. So “uncle” in China may have taken on a negative connotation before it did here.

Here’s another funny thing (to me) about the ways people look at China (true or false, the stereotype). Chinese writers, at least in the translations, are really not very well known for their prose. There’s few mainland Chinese novels that get much respect in the west. There’s a few rare rare exceptions (“Balzac and the Little Chinese Seamstress” pops to mind, others I’m sure) But….. Chinese people love word games and puns very much. So it seems highly ironic that a people who are so great at word games and double meanings, the prose rarely seems to translate well.

That’s my perception anyway, maybe you can point me in the right direction on what I’ve been missing here.

Now we have seen a lot of lousy analysis on economic matters from our Usual Suspects but Lauren Boebert has them all beat:

https://www.msn.com/en-us/news/politics/whoops-witness-notes-boebert-s-obsolete-data-on-federal-workers-you-re-basing-that-from-2020-which-is-in-the-last-administration/ar-AA18qpuN?ocid=msedgdhp&pc=U531&cvid=ebcc3480c9384f1fafcb349e7877b906&ei=15

Lauren Boebert (R-CO) attempted to use pandemic-era data to claim that 25% of federal employees are not logging on to do their jobs. She cited a January 2021 report that reflected data from the previous year when the pandemic was still raging, Covid vaccines were not widely available, and many public and private sector employees were working remotely.

So, with over 25% of department employees not logging into work without agency officials or even the director of the OMB noticing, can you tell me, Director Ahuja, are the American taxpayers paying bureaucrats thousands of dollars to vacation under the guise of agencies’ telework policies?”

AHUJA: Well, congresswoman, I actually take issue with the characterization that there’s a change in policy. I’ll tell you at OPM, individuals have to document their hours every pay period. And so, I’m not aware of the policy change that you’re speaking of.”

BOEBERT: You’re not aware of any employee taking something one would consider a vacation time and bringing their computer and maybe logging in just a portion of that time or not at all? We have more than 25% of federal employees not logging into work, and they’re teleworking.

AHUJA: Congresswoman, I do take issue with the characterization that 25% of individuals are not logging in.

BOEBERT: It’s in this leaked document right here that we just submitted into the record.

AHUJA: You’re basing that from 2020, which is in the last administration. And I can’t speak to that particular incident.

give her a break, she is going to be a grandma soon. the brain slows as we age. ironically, she is becoming a 36 year old grandma by her 17 year old son, right after criticizing schools for offering sex education. you just can’t make this sh!t up, folks.

That’s funny as hell. Nice find pgl. Boebert’s gonna have to be careful. Usually when you get into these public verbal duels you wanna pick someone less intelligent than yourself. That’s gonna be a constant problem for Boebert unless she invites Beaker from the Muppets to give testimony. That last line from Ahuja was a howler, but I wish she would have gone on ahead and said the MAGA administration.

Obviously Ahuja has more social graces than I do. Kind of like some traditional women in their senior years can jab a sharp spear right through your solar plexus by going “Well….. God bless your little heart”. That’s a kind of “killing with kindness” Ahuja displayed here in delicious fashion.

This is exactly what we need with these right wing morons. Aggressive fight back and revealing their stupidity in public. Those are things that makes the local news at home so voters get reminded how humiliatingly dumb their representatives are. Boebert won with a razor thin margin and would have been kicked out, if the Dems had put a little resources into helping her opponent.

Real net interest expense on the federal deficit is forecast to average 0.9% of GDP over the next decade. End of the world. Someone alert the news media.

That’s with positive real interest rate beginning this year (bills) and next (tens).

Real net interest expense is the right metric here. But of course it does not provide the doomsday scenario Kelly Anne Alternative Facts Conway wants Bruce Hall to portray so Brucie boy always abusing nominal interest expenses. Brucie never did understand INFLATION after all.

You’ll appreciate this from Jason Furman:

https://economics.princeton.edu/events/jason-furman-on-when-if-ever-should-we-worry-about-the-debt/#:~:text=Furman%20says%20looking%20at%20real%20interest%20payments%20as,GDP%20should%20be%20less%20than%20150%25%20or%20200%25.

Debt to GDP is a misleading metric for assessing the sustainability of fiscal trajectory and policymakers should instead look at real net interest as a share of GDP. Furman walks through several reasons why debt to GDP is a poor metric. First, this measure divides a stock by a flow variable, since debt is a stock, while GDP is a flow variable. Second, it does not reflect interest rates. Third, the metric is backward-looking and doesn’t include what’s coming. Furman says looking at real interest payments as a share of debt is a much better metric as it reflects debt that is inflating away. Furman’s “tentative framework” for fiscal policy works toward a goal where real interest does not exceed 1% of GDP in the coming decade.

Following the Dominion tapes and Fox Email scandal is just joyful. Even some Fox news anchors are complaining they have been banned from covering it.

https://www.yahoo.com/entertainment/fox-news-bans-dominion-lawsuit-143602311.html

Turns out that Fox is to news what WWE is to wrestling. Except that in professional wrestling the audience is in on the joke, but on Fox the audience and the guests are the joke.

Fox news actual motto is not “Fair and Balanced” but “Fake and Baloney”

Like a broken clock being right twice a day, Trump managed to say the truth and call Fox News “Fake news” the other day.

the contempt that Carlson, ingraham and hannity have for their audiences must be astounding! but it shows how much they love the dollars! if their viewers so easily buy pillows on tv, you can just imagine how much cash those propagandists rake in from their marks each week.

Tens of millions annually is the low figure. Would you spew lies to work around 15 hours on camera per week for say $12 million per year (a low number). Be honest with yourself…….

I bet even Professor Chinn (don’t misunderstand me here, I respect Menzie, and see him as no less moralistic or ethical , actually probably more so, than me) might want one day to “sleep on it” to decide if he’d host a TV show where he told audiences he thought Modern Monetary Theory was the greatest invention since the Stradivarius violin, for a $12,000,000 annual salary for 25 hours office time per week.

“Would you spew lies to work around 15 hours on camera per week for say $12 million per year”

Of course i would, especially if i had contempt for the fools watching the show. Faux news hoss can sleep at night not just because they are bad human beings, but they could also care less about their audience.

It would be a different story if you actually cared about your audience. And other people’s welfare, in general.

Norfolk Southern has been accused of putting profits ahead of safety. I was curious what its 10-K said. Last year their revenues were near 12.745 billion and operating profits were $4.8 billion. Quite profitable even considering its has over $32 billion in fixed assets.

Consider their stock price:

https://finance.yahoo.com/quote/NSC

It soared after Trump came into office. I guess deregulation will do that. But then the seeds of deregulation has come back to bite them with their repeated train crashes. So over the last year, their stock price has declined. I guess that MAGA hatters will blame Biden.

BLS speaks, you listen:

https://www.bls.gov/news.release/empsit.nr0.htm

THE EMPLOYMENT SITUATION — FEBRUARY 2023

Total nonfarm payroll employment rose by 311,000 in February, and the unemployment rate edged up to 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, retail trade, government, and health care. Employment declined in information and in transportation and warehousing.

Strong employment growth so why did the unemployment rate rise? Oh yea – the labor force participation rate rose from 62.4% to 62.5%.

Commenter AS was pretty prescient compared to other forecasters with his 284k call.

Watch, now the guy’s going to go tell everyone he’s the reincarnation of Michel de Nostredame!!!! What’s with this guy?!?!?!?!?!Remember this from a year ago?

https://www.reuters.com/legal/litigation/jbs-reaches-icebreaker-settlement-beef-price-fixing-claims-2022-02-02/

JBS SA (JBSS3.SA) agreed to pay $52.5 million to settle litigation accusing meat-packing companies of conspiring to limit supply in the $63 billion-a-year U.S. beef market in order to inflate prices and boost profit.

I check FRED’s reporting of wholesale beef prices:

https://fred.stlouisfed.org/series/PBEEFUSDQ/

They certainly shot up a lot from 2020 to 2022 but the good news is that they have lately been moderating. Hmmm – a steak for dinner!

Off topic, fun and games in banking –

The deposit run at Silicon Valley Bank, which caused so much trouble for bank shares generally for the past couple of days, has resulted in the FDIC taking the bank into receivership:

https://www.cnn.com/2023/03/10/investing/svb-bank/index.html

It’s Friday, which is normally the day that bank regulators move on troubled banks, so that insured deposits can be available on Monday, as is the case with SVB. SVB was the 16th largest U.S. bank.

In March of last year, the FDIC added $119 billion to its list of bank assets at risk. The FDIC does not publish the names of troubled banks, and bank watchers have been speculating about the “whale” that was in trouble since then. SVB held $210 billion in assets, so the size is about right.

This is the second bank to shut down in two days. Silvergate announced a voluntary liquidation yesterday. Silvergate is (was) a big cryptocurrency lender.

Both banks were niche lenders, one to tech start-ups, the other to crypto. Banking in general appears to be fairly secure, with the “unofficial” list of troubled banks still quite small:

https://www.calculatedriskblog.com/2023/01/q4-2022-update-unofficial-problem-bank.html?m=1

Big bad Jim Jordan is shooting blanks!

https://www.msn.com/en-us/news/politics/vacuous-jim-jordan-s-popgun-hearings-roasted-by-former-doj-officials/ar-AA18sCGH?ocid=msedgdhp&pc=U531&cvid=1de7709c8847499690f600d98fa2809d&ei=12

Following the second of two highly-anticipated House Judiciary Committee televised hearings on the “weaponization” of the Department of Justice against conservatives, two former DOJ prosecutors came to the conclusion that Chair Jim Jordan (R-OH) is shooting blanks at a target that doesn’t even exist. Writing for the Bulwark, former director of the Executive Office for National Security in the Department of Justice, Frederick Baron and former assistant U.S. attorney Dennis Aftergut were both left unimpressed at what Jordan witnesses have had to offer and suggested that, if Jordan’s next round of hearings flop as badly as his initial offerings, then he’ll be exposed as a paper tiger. According to two attorneys, the “Twitter Files” hearing demonstrated, “once again, Jordan’s investigative weapon was loaded with blanks. And he was hunting dead game anyway.”

I think its time that witnesses selected to be roasted by GOP representative say: “Don’t be such a fucking moron, the fact is that ……” We need aggressive hostility inserted into these clown shows.

Collateral damage from the rate hikes:

https://www.cnn.com/2023/03/10/investing/svb-bank/index.html

From rate hikes and a risky business plan. A large share of the deposited base was uninsured, creating an elevated risk of runs. And maybe bad assets, even before the Fed’s first hike. And a narrow loan portfolio. Rotten banking, through and through. Bet the officers were taking home oodles.

And Republicans wonder why we need banking regulations.

Agree, a large uninsured deposit base was what created the run. Someone identified the underlying problem and spoke out. At this point a lot of businesses and rich people are likely looking closely at their own banks and we might get another handful of similar runs.

As I understand it treasuries (and agency bonds) counts as “solid” and liquid assets, but currently they are not worth what you paid for them a few years back. So as the Fed hikes rates, a lot of banks become less well capitalized than they used to be. I am not sure how public that “decapitalization” of banks are. The Fed better take it into account when they decide the next rate hike (and asset sales).

My understanding is this was driven by long term treasuries that had lost value due to interest rate hikes. It was not simply poor loans-although they do play in a riskier pool. I think there may be some malfeasance occurring in this bank run. We have alot of uninsured deposits. That in itself should not lead to such a stampede. This bank collapsed in less than 48 hours. Very troubling.

One of the problems was supposedly that the bank made some poorly executed moves trying to make the next quarter(s) look better, but in the process ended up making the bank look shakier.

https://www.nytimes.com/2023/03/11/business/dealbook/silicon-valley-bank-collapse.html

They sold those long-term treasuries at a loss to get the money into something more profitable, but unless you clearly communicate that reason; the markets may think that you must be desperate (to sell at a loss) – hence panic. Its a lot easier to start an avalanche than to stop it.

sounds like the fed is going to cover all deposits on Monday. that is probably a good thing, to stem contagion. why punish all those startups for somebody else’s failings. I think we should investigate the behavior of some of those VC firms during this failure. something does not seem right there…

Did anyone notice that Wal Mart is now sticking its fingers into the very syrupy sweet and gooey “medicare advantage” pie??~~WHICH IS NOT MEDICARE IN ANY SENSE OF THE WORD AND IS A SCAM CREATED BY INSURANCE COMPANIES, HOSPITALS, AND HMOs/PPOs TO SCREW SENIORS OUT OF THEIR LIFE SAVINGS

https://www.npr.org/sections/health-shots/2021/11/11/1054281885/medicare-advantage-overcharges-exploding