This is a corrected title of a mendacious (and typically statistically incompetent) article by Craig Eyermann in an Independent Institute blogpost (previously highlighted as Ironman of PoliticalCalculations). He writes:

After two years in power, President Joe Biden doesn’t have many positive accomplishments to brag about.

…

But while his economic legacy is not shaping up to be a good one, he has given Americans one enduring legacy. He’s grown the U.S. national debt by 11% in the two years he has occupied the Oval Office. That is really saying something because the national debt was already $27.76 Trillion on the day he was sworn in.

Mr. Eyermann’s title is, as far as I can tell, wrong. According to the Treasury Department’s Bureau of the Debt (accessed on 3/8/2023), on January 20, 2023, gross federal debt was $31454980005742.4, and on January 20, 2021, it was $27751896236414.7. Using excel (so as to ensure no mistyping errors), I find the change in the two years to be $3703083769327.70, and not $3,695,343,467,324.62 (as indicated in the PoliticalCalculations blogpost he references). Since the January 20, 2023 number matches my figure, and the figure in the Treasury website, I can only conclude that he made a subtraction mistake. He also made a mistake in calculating the percentage growth rate. I obtain 13.3% (and not 11%) change. My advice – don’t trust the math in Independent Institute pieces.

But there’s actually a bigger problem with Mr. Eyermann’s calculations. First, there’s no context in terms of what others have done in their first two years. In the two years going from January 20, 2017 to January 20, 2019*, gross federal debt rose by 11.7% – during a time of buoyant growth (January 2019 predates the pandemic by more than a year– take the two last years of Trump and it’s a blowout at 34.4%).

Second, we would probably want to think about the debt burden normalizing by something. One way to do that is to look at the debt to potential GDP ratio. Then, we have the following comparison (where I’m using end-of-month debt figures now).

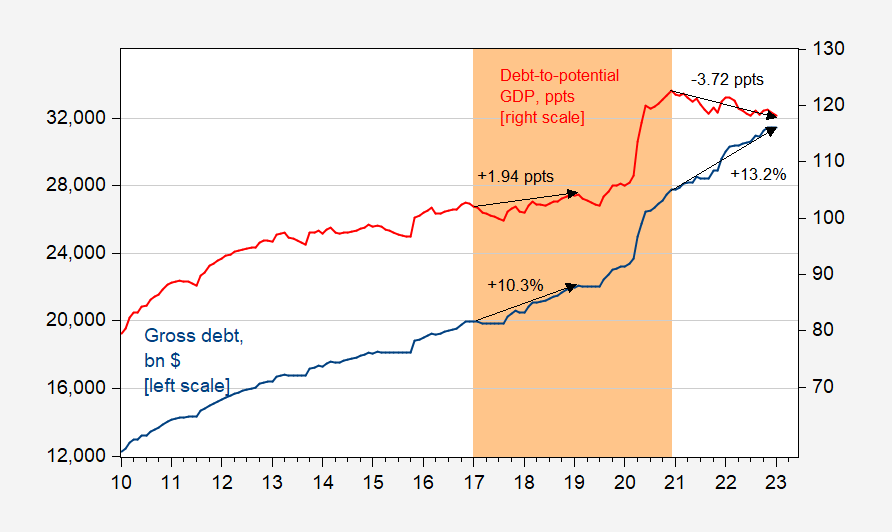

Figure 1: Gross federal debt in billions of $, end of month (blue, left scale), and gross federal debt in percentage points of potential GDP (red, right scale). Numbers attached to black arrows denote changes over 2 years. Quarterly estimates of potential GDP converted to monthly using quadratic interpolation procedure in EViews. Orange shading denotes Trump administration. Source: Dallas Fed, CBO, and author’s calculations.

While gross federal debt rose by 13.2% by January 2023 (using end-of-month data), as a share of potential GDP, it fell by 3.7 percentage points.

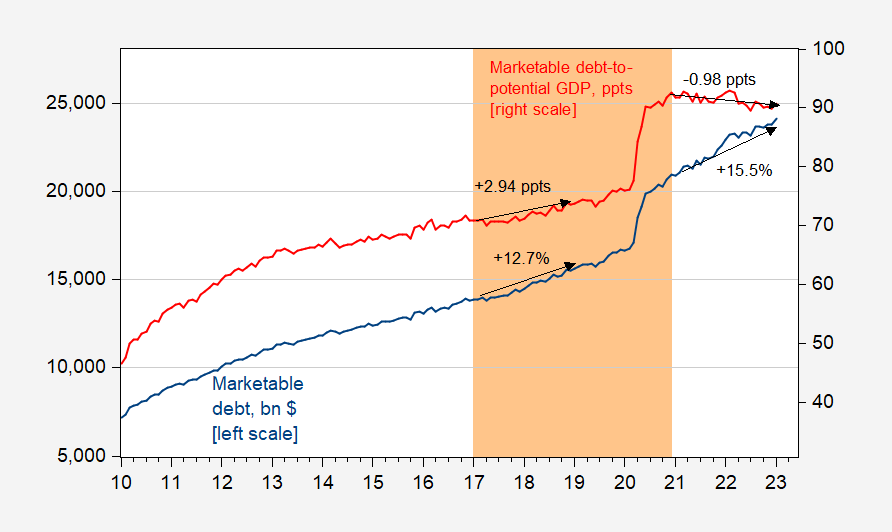

Gross federal debt includes intra-government holdings (so debt that Social Security trust fund holds, for instance). A more appropriate series to look at is debt held by the public (FRED series FYGFDPUN). I don’t have this series on a monthly basis, but I have marketable federal debt, which over the past two decades moves very closely with FYGFDPUN at the quarterly frequency (see Figure 4). Here’s the analogous graph using marketable debt.

Figure 2: Marketable federal debt in billions of $, end of month (blue, left scale), and marketable federal debt in percentage points of potential GDP (red, right scale). Numbers attached to black arrows denote changes over 2 years. Quarterly estimates of potential GDP converted to monthly using quadratic interpolation procedure in EViews. Orange shading denotes Trump administration. Source: Dallas Fed, CBO, and author’s calculations.

While nominal marketable debt rose by 15.5%, as a share of potential GDP it fell by almost a percentage point.

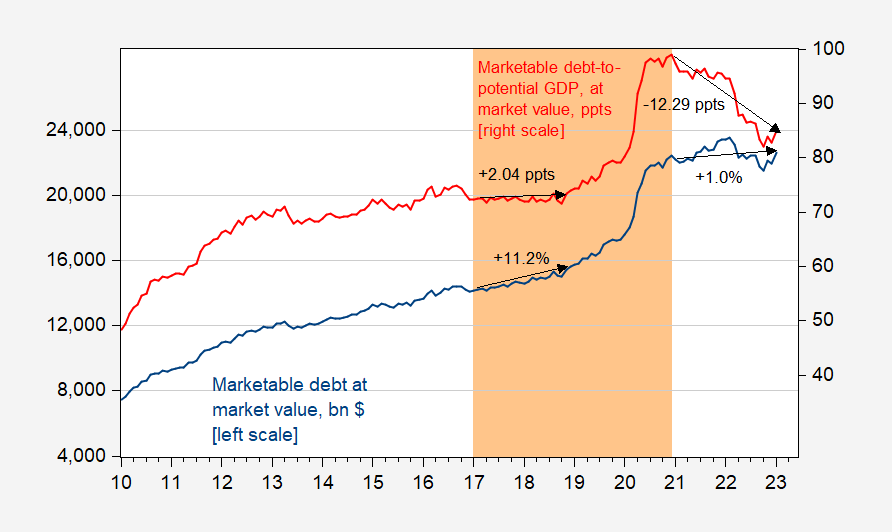

In terms of assessing debt burden, one might want to use the market — rather than par — value of debt. The par value represents the interest rate at issue, while market value represents the interest rate prevailing at the time of observation. Using the market values of marketable debt (roughly, debt held by the public), we have the following picture.

Figure 3: Marketable federal debt at market value in billions of $, end of month (blue, left scale), and marketable federal debt at market value in percentage points of potential GDP (red, right scale). Numbers attached to black arrows denote changes over 2 years. Quarterly estimates of potential GDP converted to monthly using quadratic interpolation procedure in EViews. Orange shading denotes Trump administration. Source: Dallas Fed, CBO, and author’s calculations.

In other words, the Trump administration ramped up debt to potential GDP in a period of economic boom, and was a true fiscal profligate even before the Covid response.

Other analyses by Mr. Eyermann, regarding the definition of externalities, what metrics are most useful for tracking state level economic activity, time series econometrics, adding/subtracting chain-weighted volumes I, adding/subtracting chain-weighted volumes II, and reporting nominal vs. real magnitudes.

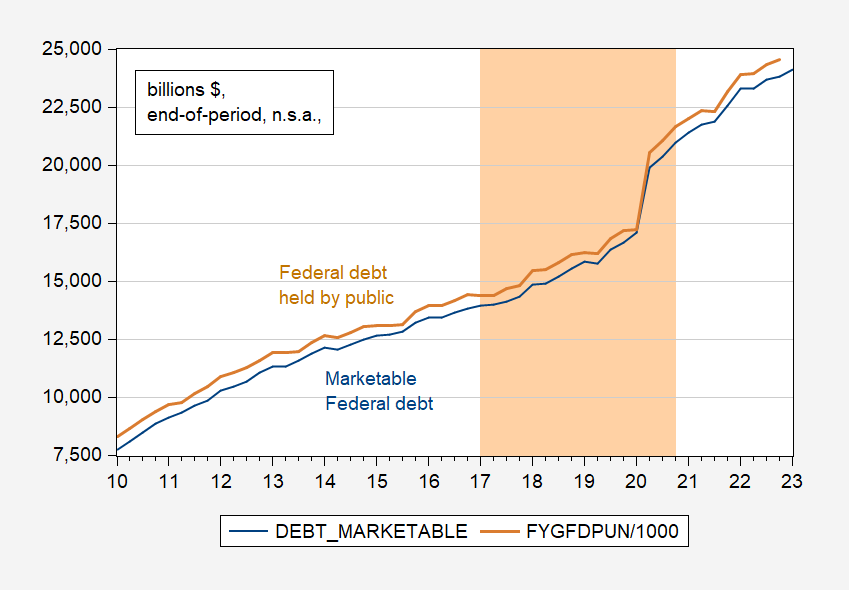

Appendix: Comparison of Marketable Federal debt and Federal debt held by public.

Figure 4: Marketable federal debt (blue), federal debt held by public, FRED series FYGFDPUN (tan),in billions of $, end of quarter. Orange shading denotes Trump administration. Source: Dallas Fed, CBO, and author’s calculations.

* Actually refers to average of January 18 and January 22, 2019, since no data reported for January 20.

.

You do know you shouldn’t even link to the bastard, right?? Just give readers some keywords and tell them they can search if they feel masochistic.

I think it’s interesting that wheat is at its lowest price since July of 2021.

https://www.uswheat.org/wheatletter/washington-state-university-economist-expects-u-s-wheat-prices-will-fall/

Do Bruce Hall, Larry Summers and the like just eat eggs all day?? Seems like they must go searching for the most expensive item in the store just so they can mimic their favorite Fox host. Remember when Stevie Kopits was lecturing all of us during the donald trump years that arbitrage was going to make soybean prices stay constant?? How did that prediction work out??

Hey – I had eggs for breakfast this morning. Of course the price of a dozen eggs in my local store is down by 20% from a month ago.

That’s an interesting discussion. Let’s detailed but longer time frame:

https://www.macrotrends.net/2534/wheat-prices-historical-chart-data

Wheat Prices – 40 Year Historical Chart

Interactive chart of historical daily wheat prices back to 1975. The price shown is in U.S. Dollars per bushel. The current price of wheat as of March 09, 2023 is $7.5599 per bushel.

Back to where wheat prices were before Putin invaded Ukraine!

‘Wheat prices “probably won’t be quite as good [for farmers]” in 2023 as they were last year, a top grain economist says.’

Correct me if I have him wrong but isn’t CoRev supposed to be the friend of the American farmer? If so, check out my Macrotrends link which shows wheat prices were quite low during the Trump years. Huh – and CoRev thought Trump walked on water.

Oil and natural gas has also stabilized to before invasion levels. That’s what happens when you have a competent President – problems are solved.

I gave up my electric bill derived from natural gas futures last February. Cant get that deal back today. My electric bill would have been half the price today. Then again, i never foresaw the freeport lng plant going down for over half a year, stranding natural gas glut in the usa. I have learned several times, not to invest in the natural resources area. None of it seems to go as planned.

Yup, keto diet all the way. Like to keep my 6′ and 195lbs. nice and lean. Still wearing those 34″W x 32″L after all these years. Enjoyed my 3 egg omelet with steak this morning. Had a couple of eggs with sausage last night. Lean pork roast coming up tonight. However I cheat a little with fresh citrus. Wheat? Poison. Don’t care what the price is.

Be honest – you are a crudité fan:

https://www.latimes.com/entertainment-arts/story/2022-08-17/dr-oz-crudite-respond-backlash-john-fetterman

.

Let’s stop using the term “debt” as though it’s a bad thing, especially on an economics blog. How about using the term “money” instead?

Financial liability is a little more clear than “money”. Of course one person’s financial liability is another person’s financial asset.

‘one person’s financial liability is another person’s financial asset’

only if the ‘asset’ holder gets paid…..

Why do you insist on writing such worthless little chirps?

apparently you doubt the concepts of markets and capitalism.

After two years in power, President Joe Biden doesn’t have many positive accomplishments to brag about. That may be why the President has made so many “false and misleading” claims in recent economic speeches.

This is his opening? First sentence is clearly a lie. And then this liar decides to call someone else a liar? The man is a waste.

big accomplishment in national security. the fas has moved the nuclear clock closer to midnight.

the last time i worried this much about being nuked i lived a mile from a sac alert facility.

it was better then bc i knew it would be fast!

Biden Grows GDP by 20.45% in first two years.

While we are ginning up big numbers by using nominal growth.

Oh wait little Brucie boy Hall tried to tell us that we were worse off because the price level rose by some 13%. Of course Brucie just assumed nominal GDP did not change. Yea – there are a lot of really stupid people wearing MAGA hats.

Nothing much to brag about…except the strongest employment growth in memory, the first infrastructure bill in decades, remaking of U.S. foreign policy, withdrawal from Afghanistan, a (very limited) gun safety law, lower prices on some drugs for Medicare beneficiaries, increased funding for mental health.

Ironman (ooo!, how masculine!) has always been dishonest. In an environment of increased partisan lying, Ironman has managed to go with the flow.

Some orange colored blowfish talked about a price cap on insulin for 6 years~~then sat on his fat orange butt and threw ketchup across the room like a 4 year old.

Biden got the $35 per month insulin price cap well on its way to being DONE. That’s being an adult. That’s leadership—vs an orange fatso blasting farts into the wind.

https://www.whitehouse.gov/briefing-room/statements-releases/2023/03/02/fact-sheet-president-bidens-cap-on-the-cost-of-insulin-could-benefit-millions-of-americans-in-all-50-states/

Trump tried to claim he lowered insulin prices during the 2020 debates but that was not quite the whole story:

https://www.tampabay.com/news/health/2020/10/01/trump-says-he-brought-down-the-cost-of-insulin-but-thats-not-true-for-all-americans/

so we have evidence that conservative talking heads think of their marks as jokes. while tucker Carlson publicly fawns after trump, in private he claims to hate the idiots with a passion. one can be certain he feels the same level of contempt towards the viewers of fox news. but he continues to publicly fawn after them anyways, because he knows they are easy marks. anybody willing to by expensive pillows from a used car salesman on television is a rube with money to lose.

ironman is probably on the same level. these articles he writes are nothing more than clickbate to monetize the ignorance most of the conservative readership holds. he is not worried about the integrity of these articles. they are meant to appeal to the ignorance of folks like corev, bruce and others. faux news hosts understand how to treat their marks for further profit.

Menzie Chinn,

It’s strange that I don’t see any comment attributed to you on the original piece. Did you at least email the author?

No one commented on this stupid post. And so why should Dr. Chinn waste his time commenting on this dumb blog? Now if you want to be Mr. Smarty Pants – why don’t you comment there?

prof. chinn is under no obligation to do so. did the author consult prof. chinn before publishing?

baffling,

I’m baffled by your comment because no one suggested that Menzie is under an obligation to do so. It comes across as cowardly to disparage another’s blogging and not do so in that blog’s comment section (or by contacting the author directly which I can only assume Menzie did not do because Menzie didn’t state such.) It’s yet another ego ploy – Menzie knows that his fanboys will eat up this type of attack-post. Menzie isn’t interested in a discussion of the topics else he would attempt to engage with the author.

I’m further baffled by your comment because why on earth would the author consult Menzie before publishing their blog post? The author’s original blog post did not mention anything about Menzie that I saw.

You do realize that everyone here sees you as a worthless idiot I hope.

“It comes across as cowardly”.

Did you have the courage to post a comment there? Huh – I guess the blog host deleted your comment as worthless. Do you have the courage to make a real point here? Huh – you have not yet. COWARD!

“It comes across as cowardly to disparage another’s blogging and not do so in that blog’s comment section ”

Econned, you act like ironman is some innocent blogger. No. He is either willfully ignorant or intentionally misleading in his posts. What prof chinn has done is not disparaging. It is pointing out directly the poor behavior of ironman. And the rest of the world does not think of it as cowardly. Only thin skinned snowflakes would come up with such an incorrect description. Whine on with the continued professional jealousy.

Baffling,

I didn’t suggest anyone was an innocent blogger and there’s zero professional (or personal) jealousy – I’m just pointing out the obvious. The obvious point that Menzie is too cowardly to confront the suspect to their face. This isn’t surprising as Menzie is typically hyper-focused on his ego.

Econned: Mr. Eyermann responds to my posts on his blog, and I respond to his posts on my blog. Works for us. I don’t know why we should conform to your views of appropriate modes of discourse.

I suggest instead of pontificating on what you view as appropriate behavior, you “get a life”. Perhaps write a paper.

Menzie Chinn,

You sound “upset”. Did I strike a nerve???

How do you tell if someone is nothing more than a worthless troll? Comments like this maybe?

Econned

March 11, 2023 at 2:32 pm

Menzie Chinn,

You sound “upset”. Did I strike a nerve???

well econned, based on the reply from prof. chinn, you are wrong. as usual.

professional jealousy is often times overlooked by those who practice it. econned, you exhibit it in spades.

baffling,

What was I “wrong” about? Menzie neither a) replied on the blog post he selected for criticism nor b) suggest he contacted the blog author directly.

So it’s possible that you’re wrong. As usual.

Off topic, but an interesting discussion of the nuances of EIA C&C reporting:

https://rbnenergy.com/whats-your-name-explaining-the-eias-huge-unaccounted-crude-oil-imbalances#comment-6211

Net, net is that there’s a sizable amount of production/consumption mismatch that is misreported (almost a half million bpd, but ~4%). They did some analysis and figured out that about half was under-reported production (mostly “drip gas” that happens between the lease and the gas processing plant…those two sources were well reported, but the in between was not measured.) The other half was misreported consumption. Essentially refineries (or exporters) calling “crude” hydrocarbons that were really “products” of gas plants (or refineries). The potential for these issues has always existed, but the growth of US wet gas production (NGLS have been a rocket to the moon, even faster growing than oil or gas) and of oil exports have made them more noticeable/significant.

Not the end of the world and nothing nefarious. I just like the analytical work to figure out what was going on.

The national debt to GDP ratio in 2022, 129%, was virtually the same as 2020, 128.4%. So no real change from Trump to Biden.

OTOH, the real debt was reduced since CPI inflation from 01/2021 to 01/2023 was 14.4% versus 13.3% increase in nominal debt.

The inflation of the past 2 years has not only reduced the national debt, it has also made real interest rates on that debt negative.

“The inflation of the past 2 years has not only reduced the national debt, it has also made real interest rates on that debt negative.”

I trust you get that the two parts of that sentence are saying the same thing.

“It’s an ill wind that blows no good.”

As my Dad (an econ prof for 40 years) would say about economic phenomena. Inflation has reduced our WWII debt 94% and is hammering the bond rentiers on Wall Street. The latest example is Silicon Valley Bank.

Did your Dad just assume nominal interest rates should have been zero for all that time? Maybe a copy of Irving Fisher’s 1907 book would be useful to check out.

The SVB episode is worth watching. The speed of the failure is astounding. My guess is there was some illegal short selling going on during this episode. If so, throw the book. This was a solvent bank until an undisciplined bank run, like a stampede, took it down. Fdic policy is supposed to make this a near impossibility. But it happened.

I understand this bank is the lifeblood of many tech startups. Not only have they lost a major source of loans, many have lost VC cash that they as stored in the bank. This is going to impact tech startups for a few years to come. In a very negative way.

More low quality “research” from this “independent” institute:

https://blog.independent.org/2023/02/28/the-ftc-is-guilty-of-violating-the-laws-that-authorized-its-creation/

The FTC is Guilty of Violating the Laws that Authorized Its Creation

‘Illumina, the market leader in DNA-sequencing technologies, created Grail in 2015 to develop technologies for detecting certain cancers in human blood but later spun the company off as an independent business entity. Grail’s subsequent successful devising of blood-testing methods for uncovering “big C” with 76 percent accuracy—even in asymptomatic patients—prompted Illumina to reacquire Grail for $8 billion in September 2020.’

William F. Shughart II is upset that the FTC and the European authorities want to prevent this clearly anti-competitive merger offering no economic analysis. Just a lot of legal babbling that basically says monopoly power is AOK as long as it crosses national boundaries.

I’ve made the mistake of reading too much of the trash from this “institute” so permit to offer just a couple of thoughts here. Over the 2-year period this clown noted that massive increase in the nominal value of the debt, the consumer price index rose by 14.4% so real debt fell. But you knew that.

Almost everyone of these rightwing bloggers think inflation follows the M2 money supply. Dr. Chinn has smashed this little “model” many times. But “did you know” M2 rose by almost 25% from March 2000 to March 2021 but only rose by 9.5% over the following 12 months. Since March 2021, M2 has declined. Only a rightwing hack would praise Trump and bash Biden over this. But that’s what these clowns do.

I’m traveling, so no quick access to data.

Anyone want to work out what the deficit would be if revenues had followed the pre-Covid trajectory?

Or, the pre-HeWhoWeDoNotName?

Wild guess: Far, far smaller, despite Covid spending..