From WSJ:

“It’s the ‘Godot’ recession,” said Ray Farris, chief economist at Credit Suisse. Mr. Farris found himself among a small minority of economists last fall who predicted the economy would narrowly skirt a downturn this year. Every six months, economists have predicted a recession six months later, he said. “By the middle of the year, people will still be expecting a recession in six months’ time.”

The article refers to a set of indicators (you can see monthly in this post), but here are the latest weekly indicators – the Lewis-Mertens-Stock Weekly Economic Index, the Baumeister-Leiva Leon-Sims WECI, and the OECD Weekly Tracker, for data through 2/25.

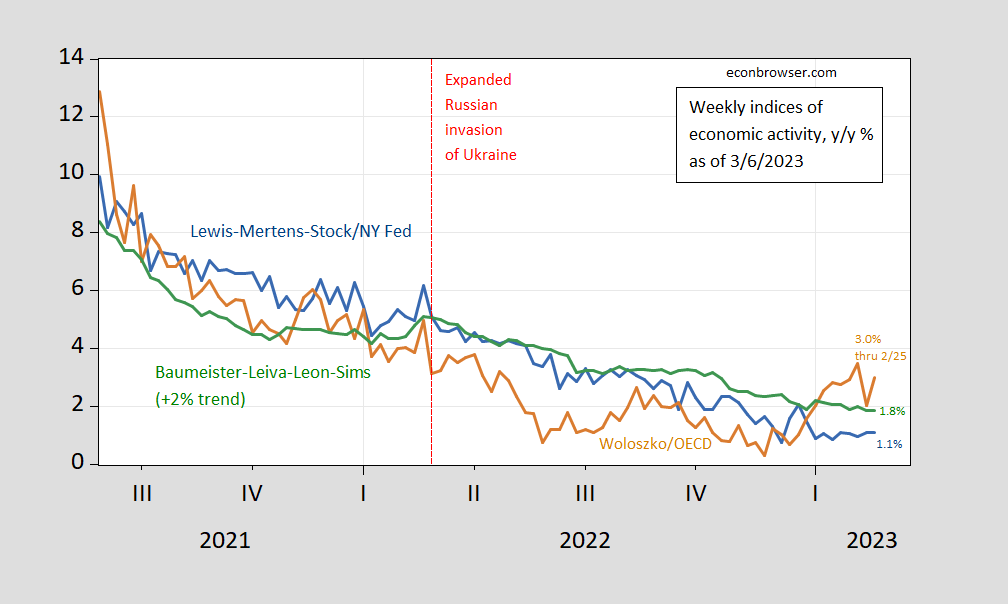

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green).. Source: NY Fed via FRED, OECD, WECI.

The Weekly Tracker, which had dipped into negative for the week ending 11/26, now at 3% exceeds the WEI (1.1%) and WECI+2% (1.8%). The WEI reading for the week ending 2/25 of 1.1% is interpretable as a y/y quarter growth of 1.1% if the 1.1% reading were to persist for an entire quarter.The Baumeister et al. reading of -0.2% is interpreted as a -0.2% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 1.8% growth rate for the year ending 2/11. The OECD Weekly Tracker reading of 3.0% is interpretable as a y/y growth rate of 3.0% for year ending 2/25.

The OECD Weekly Tracker continues to rise, even as the other two series slowly decline. It’s important to remember the WEI relies on correlations in ten series available at the weekly frequency (e.g., unemployment claims, fuel sales, retail sales), while the WECI relies on a mixed frequency dynamic factor model. The Weekly Tracker — at 3.0% — is a “big data” approach that uses Google Trends and machine learning to track GDP. As such, it does not rely on actual economic indices per se.

Returning to the recession forecast, Prakken and Herzon at S&P Global Market Intelligence (nee IHS Markit) write in today’s US Forecast Flash:

− S&P Global Market Intelligence revised up its forecast of real GDP growth for 2023 from 0.7% to 1.0%, meas-ured year-over-year.1 The revision mainly reflects an upward revision in our estimate of Q1 growth, from – 1.3% last month to -0.4% this month, driven by unex-pectedly strong consumer spending in January that was only partly offset by downward revisions in net ex-ports and inventory investment.

We expect the economy to contract just 0.1% in Q2, when a countercyclical rebound in vehicle production will add approximately 0.6 percentage point to GDP growth. While the base forecast does show two con-secutive quarterly declines in GDP, the episode might be better characterized as a pause in activity rather than an outright recession, as output falls just 0.1%over the two quarters. Positive but below trend growth resumes in the second half of the year.

“Every six months, economists have predicted a recession six months later, he said.”

It’s “Friedman units” all over again.

Two observations –

Ignoring (as one should) politically motivated 2022 “We’re in a recession now!” idiocy, the most common forecast was for a considerable time a recession starting in Q2 or Q3 of this year. Forecasts may have changed, bit we don’t know what will happen yet in Q2/Q3.

Even if the description of rolling 6-month-out recession forecasts was correct – which I don’t think it is – that is not evidence against current forecasts.

OK, more than two observations –

Recession forecasting is a mug’s game.

Commonly, the error is to forecast growth and be proven wrong. If this time, it’s the other way around, then the world is cattywonkers right now. Big surprise.

If the Q2/Q3 recession forecast is proven wrong, then that’s points against the yield curve as a forecasting tool and points for the policy response to Covid and Russia’s war and (by sheer luck) the policy response to inflation.

Oops. That was 3 more.

I am amazed that yanks would know what waiting for godot means. Isn’t beckett banned in florida?

We’re eager for the next Wonder Woman movie.

What are you talking about?? I’ve been anticipating any Australian making an intelligent comment on this blog for a long time. I’m certain in my mind it’s going to happen but the wait has been rough.

not trampis: Yeah, Beckett is probably soon to be banned in Florida. But at least my wife knows about Beckett. [article]

you will be waiting a long time maybe like waiting for godot.