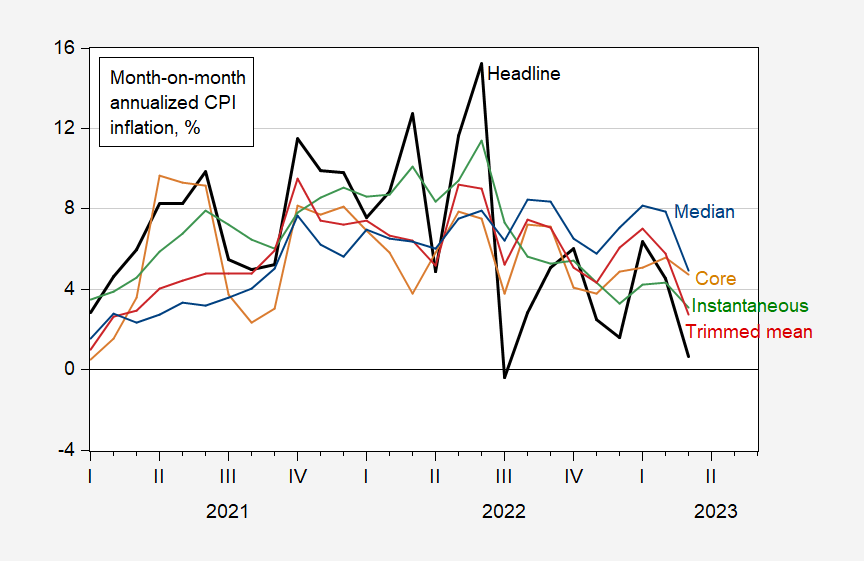

While year-on-year core rose, month-on-month fell, along with other measures of inflation that are aimed at getting the trend.

Figure 1: Month-on-month headline CPI inflation (bold black), core (tan), trimmed mean (red), and median (blue); and instantaneous inflation following Eeckhout, a=4, T=12 (green). Source: BLS, Cleveland Fed and Dallas Fed via FRED, and author’s calculations.

Median, trimmed mean, and instantaneous inflation all fell faster than core. This suggests to me inflationary pressures are perhaps cooling off faster than a look restricted to core would suggest.

I’l spare readers my usual spiel about how this isn’t true, what I would term “organic” inflation, but inflation caused by a mixture of 1) supply chain problems caused by a respiratory disease pandemic 2) shortages (mostly related to energy and food) caused by a war in East Europe 3) Opportunistic moment (see reasons 1 and 2 just stated) price gauging by American corporations and businesses.

But the off-topic news of this evening??

https://www.rollingstone.com/politics/politics-news/trump-official-rudy-giuliani-fox-recordings-voting-machines-1234714188/

Wanna know why I have stated for months (years) that Kopits is disingenuous about many of the fabricated lies he tells on this blog??~~~i.e. Kopits knows he’s lying before he even types many of his statements here on the blog. Look at all the FOX news personalities who have been busted in audio and phone messages they didn’t know would be found and made public later. donald trump talking about officials/staff crying at the New York courthouse and multiple people saying it never happened. ALL of them are very conscious of the fact that they trade in lies. Kopits, in his own head, doesn’t even believe 9/10ths of the crap he spews here. All Kopits cares is that he has an illiterate audience that he can monetize his lies to. THAT’S LITERALLY ALL KOPITS CARES ABOUT.

*price gouging I don’t know why I repeatedly make that error. Sorry

The supply shock component is (you noted) cooling off and was quite powerful. Housing costs are cooling, and we have strong reason to expect they’ll cool further. What do we see if housing costsare excluded? This:

https://fred.stlouisfed.org/graph/?g=12rS5

The shock is gone and inflation is, too, mostly.

Housing will be the bugaboo for a long time to come.

With extreme low mortgage rates, prices rose to the moon because people could afford the monthly hit. Now they can’t. However, housing prices are not very elastic because nobody want to sell ‘the biggest investment of your life” for less than they paid… or to sell out of a sub-3% mortgage to buy something new at twice that rate.

The only solutions, if we rule out drastic price cuts, are to wait until wages rise or the Fed lowers rates substantially. Either is likely to be a long wait.

The third quarter collapse with oer will be epic. I am starting to think Jerome Powell doesn’t last the year. Fund Managers and primary dealers want him out fwiw. There is a old phrase “the Fed follows the market”. Oh boy, the Powell Fed did not and the “market” is pissed.

“This suggests to me inflationary pressures are perhaps cooling off faster than a look restricted to core would suggest.”

It would also suggest – at least to me – that anyone saying expected inflation is 6% has guessed and guessed badly.

Two faced Lindsey Graham used to hate Saudi Arabia’s MBS but he has changed his mind:

https://www.msn.com/en-us/news/world/lindsey-graham-changes-his-tune-on-saudi-arabia-after-a–billion-south-carolina-contract-with-boeing/ar-AA19LnpF

After the brutal death and dismemberment of Washington Post columnist Jamal Khashoggi, Sen. Lindsey Graham (R-SC) proclaimed he would never go to Saudi Arabia as long as Saudi Crown Prince Mohammed bin Salman was in charge …. Graham’s price was “$37 billion worth of Boeing 787s — which are made in South Carolina — for the new Saudi airline,” he said. “Investments like this are game changers,” he explained.

Is the facade that Corporate decisions don’t fuel inflation finally starting to crack? Fortune Magazine: “‘We may be looking at the end of capitalism’: One of the world’s oldest and largest investment banks warns ‘Greedflation’ has gone too far.” https://fortune.com/2023/04/05/end-of-capitalism-inflation-greedflation-societe-generale-corporate-profits/

Josh Bivens is one of the few economists to have studied this and been all over it for some time: “ Even with today’s slowdown, profit growth remains a big driver of inflation in recent years. Corporate profits have contributed to more than a third of price growth.”

The “circular flow” diagram that is in chapter one of most macroeconomic textbooks highlights something profound: one person’s cost is another person’s income. So, when the price of eggs rises by 30%, that extra money out of shoppers’ pockets doesn’t disappear into thin air, instead it lands someplace. In the case of eggs, that someplace could be in chicken farmers’ incomes, or the profits of middle-men brokers, or the profits of grocery stores.”

https://www.epi.org/blog/even-with-todays-slowdown-profit-growth-remains-a-big-driver-of-inflation-in-recent-years-corporate-profits-have-contributed-to-more-than-a-third-of-price-growth/

https://www.semanticscholar.org/paper/Oligopoly-and-Inflation-Heusz/b4f9d5270bae20aeb1f6c25c085515b97844ce54

Oligopoly and Inflation

Ernst Heusz

Published 1977

Economics

The simple fact that prices under monopoly are higher than under competitive conditions has led some people to associate the continuous rises in price-levels during the postwar period with the existence of non-competitive markets. Numerous empirical studies on administered prices are based on this hypothesis. It was, however, the obvious flaw that monopolies do account for higher prices but not for their continuous rise. This phenomenon cannot be explained by conventional analysis of monopolized markets. If we still want to maintain this approach to inflationary processes, it has to be supplemented by taking into consideration additional factors that might close the gaps mentioned above. This will be attempted in two stages: after dealing with the problem on a rather abstract level using strongly simplifying assumptions, we shall try to show the relevance of our analysis to present-day reality in the final part.

“one of the few economists to have studied this”. I noted this 1977 paper to you the last time you claimed economists do not analyze such issues. Is JohnH too stupid to know what “numerous studies” mean? Is he too lazy to read the actual literature? Or is he doing what he does best – LYING.

Yes Josh Bivens has commented on this. But he is not the lying sack of garbage you continue to be as he references what other economists have written.

But I guess if the laziness most incompetent troll ever did not bother to read the literature – it does not exist.

I may have noted that microbrews like Sam Adams (Boston Beer) kept prices low in 2021 even as costs rose. My concern was that they could not do this forever. So a little exercise, let’s check their operating profits per their 10-K filings (I get this is unfair as little Jonny boy does not know how to do this).

Profits in 2020: Over $244 million

Profits in 2021: Only $8 million

Profits in 2022: Less than $91 million

OK – this is only company which may be different from other companies. But at least I did the hard work for this single company. To date – Jonny boy has done zero work. He never does.

Did little Jonny boy look at:

Figure A: Profit markups spiked during COVID-19 economic recovery

Profits per unit of output divided by unit labor and unit nonlabor costs in the NFC, 2017–2022

Yea markups spiked in 2021. But maybe Jonny boy does not want you to know they have come back down a bit in 2022.

Since I have two eggs every morning I appreciate Josh’s concern over the price of my breakfast but this?

“when the price of eggs rises by 30%, that extra money out of shoppers’ pockets doesn’t disappear into thin air, instead it lands someplace. In the case of eggs, that someplace could be in chicken farmers’ incomes, or the profits of middle-men brokers, or the profits of grocery stores.”

I doubt it is the wholesale food distributor or the local grocery story that is driving up the price of my eggs. Something called the Avian flu – hello? Yea – chicken farmers are getting higher prices and this crew claims they are using some form of collusion:

https://smallbiztrends.com/2023/01/farmers-group-egg-price-gouging-investigation.html#:~:text=In%20a%20letter%20to%20the%20FTC%2C%20Farm%20Action,and%20other%20unfair%20or%20deceptive%20acts%20of%20practices.%E2%80%9D

The farmers, however, deny that. Now Bivens provided nothing to address this controversy. But thanks for caring Josh!

” But the soaring costs haven’t prevented corporations from raking in record profits. The companies in last year’s Fortune 500 alone generated an all-time high $1.8 trillion in profit on $16.1 trillion in revenue.”

Now I get little Jonny boy is incapable of reading his own links and certainly never follows the links in his own stories. But I did and this line is referring to 2021 profits. Let’s see – it is mid April 2023 and this post notes how inflation has been coming down for almost a year.

On top of that – the 2022 financials for a lot of companies just came out. But do not expect Jonny boy to update this information. He does not know how to.

“Biggest U.S. Banks Report Bumper Profits Amid Industry Turmoil”

https://www.nytimes.com/2023/04/14/business/jpmorgan-citi-wells-fargo-earnings.html

Naturally pgl tried to justify near record corporate profit margins by intimating that they would be worse in 1Q23!

Besides being a Democratic partisan hack, pgl is obviously a corporate shill, constantly excusing Corporate America’s record profit margins and exploitative behavior during the pandemic.

Jonny boy’s emotional issues on full display! Did you want to have a serious conversation over the profits of megabanks?

Then put forth some sensible economic discussion of what drove this profit increase? I might happen to agree with a sound analysis. Oh wait – Jonny boy does not do economics. Jonny boy flunked Money and Banking 101. So all Jonny boy does is attempt to insult people who might actually get these issues because Jonny boy does not.

Wow! pgl had to dig back half a century for the Heuss paper! Always trying to defend corporate misbehavior…typical “liberal” economist.

I guess you never figured out what the Great Moderation was. Dude – inflation had been low for 40 years so maybe this issue was not top of the research agenda. Look dude – your are a worthless troll who has no clue what economic research is about as you incapable of understanding what it is about.

key word ‘had.’ Inflation had been low for 40 years so maybe this issue was not top of the research agenda.

Problem is, it’s still not of interest to mainstream economists, who prefer to drink the aged Kool-Aid that exculpates Corporate America from any contribution to inflation today.

Fortunately, there are still a few economists–largely marginalized–who care to do honest analysis of what drives inflation.

Hey worthless little moron. Yea – everyone knows inflation spiked in late 2021 and early 2022. And everyone with a brain (which excludes little Jonny boy) knows inflation has been much lower over the past 9 months.

BTW – why do you insist on embarrassing your poor mother when these dumb emotional rants? Have some respect for your family.

“it’s still not of interest to mainstream economists”

The economists you cite have been marginalized? Damn – you are one dumb troll.

“Always trying to defend corporate misbehavior”

Ah little Jonny’s feelings were hurt. I have noted the issues of market power, insider trading, transfer pricing abuse, and a host of corporate misbehavior. But yea – you missed all of it as you are just too stupid to what actual economics even is.

Responding to comments about bank failures:

There were an average of 600 bank failure a year through the 1920s. There were 10,000 bank failures between 1929 and 1932.

The 1920s was a time of continual recession or worse in farming, which was far more important in terms of relative population dependency than soon thereafter. The price of farmland fell continually through the decade.

While the stock market crashed in 1929, there was no run on banks till fairly late in 1930.

Roosevelt declared a bank holiday in March 1933, just after inauguration. Banks reopened in a week, with depositors immediately beginning to return funds that had been withdrawn.

https://fred.stlouisfed.org/graph/?g=Fn2B

January 15, 2020

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2020-2023

(Percent change)

https://fred.stlouisfed.org/graph/?g=HKys

January 15, 2020

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2020-2023

(Indexed to 2020)

https://www.latimes.com/business/story/2023-04-11/anti-vaxxers-loved-to-cite-this-study-of-covid-vaccine-deaths-now-its-retracted

there are some folks on this blog who would defend skidmore. he conducted statistical malpractice and his research article is retracted. but the damage is done, because there are idiots out there who will continue to site this bogus piece of work.

Yes, indeed. Inflation has been coming down, but corporate margins are still very close to their record high for the last 70 years…almost an order of magnitude higher than they were in the 1950s. The drop in inflation can probably be explained by the abatement in supply chain issues and a drop in money supply, barely touching corporate margins.

Maybe forecasts of inflation and inflation adjusted interest rates would be a lot better if forecasters could acknowledge a major driver of inflation. I mean, how can economic forecasters just ignore pricing decisions by companies that have the means, motive and opportunity to exploit their customers. (Oh, I know! Blame it on consumers and their expectations, since economists’ magical thinking postulates that consumers’ expectations materialize! LOL!!!)

“Inflation has been coming down, but corporate margins are still very close to their record high for the last 70 years”

The graph in Furman’s post show that these margins fell in 2022. Maybe you were too dumb to read it or maybe you are just lying as usual.

“Maybe forecasts of inflation and inflation adjusted interest rates would be a lot better if forecasters could acknowledge a major driver of inflation.”

Since you have no effing clue how to forecast inflation and certainly do not know how the professionals do this, then how can you even began to comment on what models they use? Oh wait – you do not even know what an economic model even is.

You can count on pgl to find a corporation—Samuel Adams—that serves as the exception that proves the rule.

pgl must work for the US Chamer of Commerce of Commerce.

Do this for any single company you want to choose. I dare you to even try. Oh wait – you do not do so because you do not know how. What was my original point – moron.

I just checked out the financials for GM. OK little Jonny may not know who this company is but everyone else knows. Their operating margin for 2021 was a whopping 7.3%. Not bad even if Toyota persistently does better.

2022? Operating margin dropped back to 6.6%.

It does not seem GM is driving up car inflation either.

Yea I have looked at only two companies – two more than our lazy Village Idiot has done.

https://fred.stlouisfed.org/graph/?g=CgJo

January 15, 2020

Sticky Consumer Price Index and Sticky Consumer Price Index less Shelter, 2020-2023

(Percent change)

https://fred.stlouisfed.org/graph/?g=10aMb

January 15, 2018

Sticky Consumer Price Index and Sticky Consumer Price Index less Shelter, 2020-2023

(Indexed to 2020)

An op-ed in the Kyiv Post

https://www.kyivpost.com/opinion/15716

Your ugly fact in a Kyiv publication. Now that will care the hell out of those Russian invaders. BTW – I refuse to read your garbage no matter where you put it.

” I always try to close my posts with some interesting insight. Here I struggle.”

You always struggle. Yea we write a lot of trash and to date you have never had a single insight let alone anything remotely interesting. Trust? From the most dishonest consultant ever?

Yea I read your babble there. No meaning to anything whatsoever. Standard Stevie’s bloviating.

Gotta keep that gravy train going!

“ Seymour Hersh: the CIA Knows Ukrainian Officials Are Skimming US Aid

Hersh says the CIA estimates at least $400 million was embezzled last year in funds earmarked for diesel payments.” Zelensky is buying Russian oil. harsh sanctions at work…very effectively!

“ Hersh said according to one estimate by CIA analysts, at least $400 million in funds were embezzled last year. Sources told Hersh that Ukrainian officials are also “competing” to set up front companies for export contracts to private arms dealers around the world.”

https://news.antiwar.com/2023/04/12/seymour-hersh-the-cia-knows-ukrainian-officials-are-skimming-us-aid/

Mexican drug cartels must be drooling at the prospect, though they’d probably prefer Russian equipment.

It makes wonder how much is flowing back into US’ politicians campaign coffers.

@ kopits

You say Biden “owns” what happens in Russia’s aggression against Ukraine. You don’t remember Fiona HIll’s Congressional testimony?? You don’t remember Marie Yovanovitch’s Congressional testimony??? You don’t remember Giuliani in Ukraine (publicly shown masturbation, real and figurative masturbation??) You don’t remember a phone call with Zelensky on military defense and extortion of USA allies that was attempted to be buried in the trump White House?? You don’t remember John Bolton’s thoughts about trump’s foreign policy??? John F. Kelly’s thoughts on trump?? You don’t remember Mark Milley saying it was a “mistake” to be trump’s bitch at the St. John’s Church?? Trump’s St. Johns publicity stunt and gassing of U.S. citizens??? You don’t remember Mark Esper’s firing because he didn’t want to start nuclear war?? You don’t remember Christopher C. Miller being trumps’ chosen replacement for Sec of Defense Esper???

There’s special reserved place in Hell for amoral people like you are Kopits. The sooner you go to that special place in Hell, the happier I’ll be/

Micheal Pettis has a new piece on China’s growth prospects, with emphasis on rebalancing toward consumption:

https://carnegieendowment.org/chinafinancialmarkets/89466

This is a popularization of his recent academic (mathy) writing. Pettis nicely summarizes what is widely understood about China’s economic choices – note his mention of Albert Hirschman – and he writes with his usual clarity.

The upshot is that households can do well as growth necessarily slows, but only if local government officials surrender resources. Also that a shift from high investment to higher consumption would have big effects on the economies of trading partners.

It strikes me that rebalancing to the benefit of consumers also assumes that Beijing won’t soak up any resources that are diverted from investment and local government. The recent pattern suggests militarization will absorb substantial new resources.

https://www.bls.gov/news.release/ppi.nr0.htm

PRODUCER PRICE INDEXES – MARCH 2023

The Producer Price Index for final demand declined 0.5 percent in March, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices were unchanged in February and increased 0.4 percent in January. (See table A.) On an unadjusted basis, the index for final demand advanced 2.7 percent for the 12 months ended in March. In March, two-thirds of the decline in the index for final demand can be attributed to a 1.0 percent decrease in prices for final demand goods. The index for final demand services moved down 0.3 percent.

Again – anyone who is telling us expected inflation is 6% is just nuts. BTW – this same nutjob is telling us about rising markups even if the high markups in 2021 came down in 2022.

I still think that the media gets the inflation story wrong by focusing on 12-month inflation rates. The overall rate of inflation has been low for the past 9 months, while the core rate has been steady. We have had 9 straight months of monthly rates no greater than 0.5%, yet everyone continues to focus on the 12-month rate, which this month includes the 0.9% monthly rate in May 2022 and the 1.2% monthly rate in June 2022. The average rate of overall inflation for the past 9 months is only 3.25%, much below the 12-month rate of 5%. So, I think it is more accurate to say that the average overall rate really came down some time ago and has held fairly steady (until the recent increase in gasoline prices shows up in the April number). Of course, the slower rate during the past 9 months is largely because of falling rates of inflation in energy prices. The average rate of core inflation in the past 9 months is 5.6%, the same as the 12-month rate, so not much change there, although it is lower than what it was in the first half of 2022 and in 2021.

Agree. Better articulated than I could have done in my best of dreams.

Welcome abroad. Nicely put and entirely accurate.

Thank you for a fact-based and insightful comment. We need more commenters who can clearly dissect the numbers in an unbiased way. So welcome.

If the PRC is not given Taiwan maybe they will just take the moon:

https://www.msn.com/en-us/money/other/china-could-start-building-a-moon-base-with-lunar-soil-bricks-in-5-years-amid-nasa-fears-of-a-moon-territory-dispute/ar-AA19Pqc4?ocid=msedgdhp&pc=U531&cvid=36b8c67e44f94df695ace4e8b6721f7d&ei=7

China could start building a moon base with lunar-soil bricks in 5 years, amid NASA fears of a moon territory dispute

On the subject of supply shocks,West Coast container ports are looking Rocky. Labor stuff:

https://www.seatrade-maritime.com/ports/tension-mounts-us-west-coast-ports-labour-talks

“Even though freight costs for boxes have cooled off significantly from their late 2021/early 2022 heights, the cargo shifts to the East Coast have stuck. Recent data shows overall cargo volume in March, 2023, at 622,233 teu, down substantially from the year earlier 959,674 teu. Frequently, “labour concerns” are cited by cargo shippers when asked why they’ve not shifted their activity back from the Atlantic ports to the major hubs at Los Angeles/ Long Beach.”

I appreciate market data but shouldn’t this discussion discuss how the real wages of these workers have evolved? If the data is there, please tell us as I did not see it.

Apparently, it’s complicated:

$33,587

https://www.ziprecruiter.com/Salaries/Longshoreman-Salary-in-Long-Beach,CA

$93,000

https://mint.intuit.com/salary/longshoreman/long-beach-ca

$70,000 to $136,000

https://www.payscale.com/research/US/Job=Longshoreman/Hourly_Rate/98250cdc/Long-Beach-CA

$66,717

https://www.salary.com/research/salary/posting/longshoreman-salary/long-beach-ca

WOW, Esther Duflo is (was?? I’m last guy on the deal team AGAIN???) giving a FREE “openware” MIT course on Developement Economics!!!!!!! Very exciting peoples. She is SO AWESOME!!!!!!

https://ocw.mit.edu/courses/14-771-development-economics-fall-2021/

There are YT links for this. God bless.

[Fed member Christopher] Waller said stronger growth and job creation than expected has also been a surprise, in his view.

“This growth would mean that, so far, tighter monetary policy and credit conditions are not doing much to restrain aggregate demand,” he said.

Translation: what we’re doing is ineffective so lets keep doing it.

Amid concerns over the health of the US banking system, the news this morning was the profits of JPMorgan, Citigroup, and BlackRock were all above expectations.

I have yet to read anyone saying why profits rose but we see the usual emotional temper tantrums from JohnH as he hurls stupid and pointless insults that some of us are somehow corporate home boys. Did little Jonny tell us any reason why profits for these three financial institutions went up? Of course not because little Jonny boy has no clue why these profits were up. Of course little jonny boy clearly has never taken a Money and Banking course.

Look – I generally do not advocate banning even stupid trolls. But seriously – is an economic blog the appropriate place for the temper tantrums of an emotionally disturbed little child?

Funny! pgl throws a tantrum because I pointed out that he had just predicted that 1Q23 earning would be down…immediately before three of the largest companies in the world had just reported bumper profits. Yet another brilliant forecast!

Says the baby boy who is constantly throwing a tantrum. You predicted something? Seriously? Yea inflation is soaring right now just as little Jonny boy told us it would.

“because I pointed out that he had just predicted that 1Q23 earning would be down…immediately before three of the largest companies in the world had just reported bumper profits.”

Oh wait – I get what this stupid statement may be about. I did not predict anything. I noted that the markups for firms selling consumer goods were lower in 2022 (a year not a quarter) than in 2021 – per Jonny boy’s own link.

Yea JPMorganChase (a bank) reported quarterly earnings that exceeded forecasts.

I guess Jonny boy thinks banks sell consumer goods. Yea – he is the dumbest troll God ever created.

Keep it up Jonny boy – as everyone is laughing at your incredible stupidity.

‘Figure A below shows one measure of profit “mark-ups” in the non-financial corporate (NFC) sector of the U.S. economy.’

We have noted how little Jonny boy fails to read his own links. Does little Jonny boy understand why Josh Bivens looked at the markups for nonfinancial companies not banks? Or does Jonny boy even know that the 3 companies that had positive earnings for 2023QI were banks and not companies in the sector Bivens used?

Yea Jonny boy thinks he is clever when he pulls these little gotchas but at the end of the day Jonny only proves once again that he is the dumbest troll God ever created.