Today, we are pleased to present a guest contribution by Miklos Vari (Banque de France). The views expressed herein are those of the author and should not be attributed to the Banque de France or the Eurosystem.

In the middle of SVB’s demise, some details got lost, and with them, potentially a lot of taxpayers’ money. The seemingly innocuous detail was announced by the Fed when it introduced its latest program, Bank Term Funding Program (BTFP) which intended to stem the panic:

“The additional funding will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par.” (emphasis added).

What may seem like a small accounting convention that most people would not notice, could be a turning point for the Fed, and central banking in general. Indeed, the usual practice in central banks is to value bonds brought as collateral not at par, but using their market value, or the best estimate about their market value when they are not traded on liquid markets. This is because when central banks lend to banks, they ask for protections in case banks default. In case a bank fails, the central bank becomes the owner of the pledged collateral. Central banks recover the value of the asset by selling it on the market, or keeping it until maturity. Because currently the market value of bonds is generally strictly lower than their par value (also called face value), if a bank defaults, the central bank would make losses equal to the difference between par and market value. This difference can be attributed to unexpectedly fast increase of Fed interest rates since 2022, which mechanically depresses the market value of all bonds. To use the word of US authorities themselves:

“ As a result of the higher interest rates, longer term maturity assets acquired by banks when interest rates were lower are now worth less than their face values. “ (FDIC, 6 March 2023)

Some estimates allow us to get a sense of the magnitude of the gap. For instance data form the Federal Reserve Bank of Dallas show that the market value of the stock of privately held gross federal debt stood $1.5 trillion below its par value, as of February 2023. The FDIC stated that US banks unrealized losses on securities stood at $620 billion as of end 2022.

When BTFP was introduced who could predict how many banks would borrow from it, fail to repay and leave collateral with market value strictly lower than the loans they contracted from the US central bank? Since its introduction, take-up at the facility has increased steadily, and stands above $68bn as of April 6th. So while it is impossible to know if the Fed will eventually make any loss, it is certain that it explicitly takes the risk of doing so by valuing collateral at par, and that this loss may reach around 8 cents (the difference between market and par value as of February 2023) on each dollar lent.

To be sure, these are no potential “paper losses”, “accounting losses” or “subjective losses” the Fed is exposing itself to. If failing banks leave only par-valued collateral in exchange for their defaulted loans, this would correspond to a loss of real economic resources for the US central bank.

The Fed would obviously make losses if it sells the acquired collateral on the market, but this would also be the case if it holds the debt until maturity. Stating that the market value of debt is below its par value, is equivalent to say that US debt is paying interest coupons that are below market rates (coupon/par value < market interest rates).

For example, in the events of a default, the Fed could own debt that yields 1% of the par value per year, while the Fed pays interests on its newly created liabilities (created to “fund” the loans to banks), currently between 4.8% and 4.9%. This negative interest rate carry over the life of the bond is equivalent to the difference between par value and market value.

This difference would cost the Fed, a public institution dearly. But does it matter that the Fed makes losses? I argue it does. The Fed enjoys a backing of $25 bn from a Treasury fund, also a taxpayer’s property.[1] Beyond these $25 bn, things get slightly more complicated, but not any better.

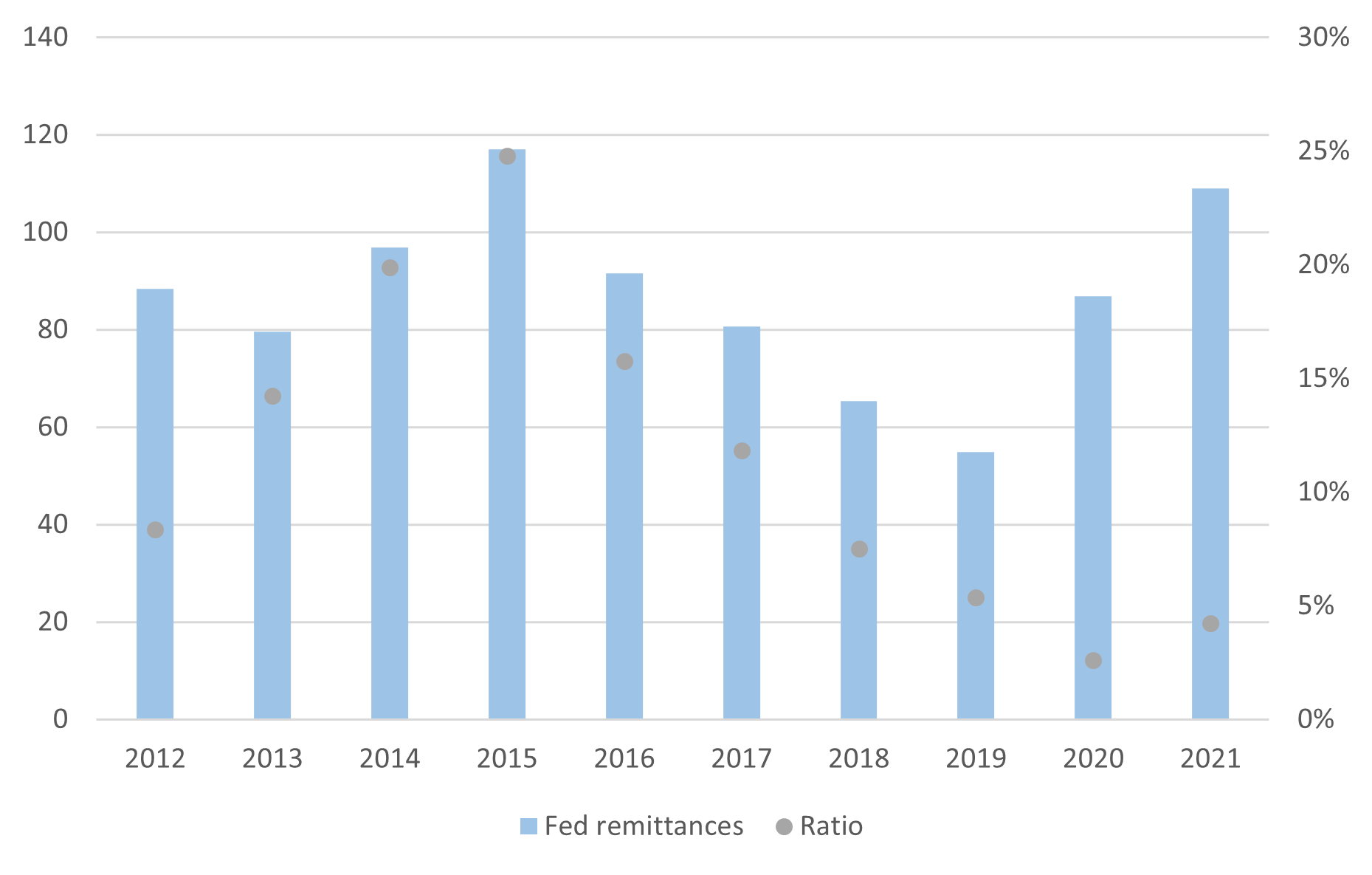

Over 2012-2021, the Fed remitted on average $87 bn per year (figure 1), or 11% of the total annual deficit, and up to 25% of the deficit in 2015. In other words, in 2015, absent any income from the Fed, the Federal deficit of the United-States would have been 25% higher. Higher deficit implies higher borrowings on the market, and more interest payments being made by the taxpayer to bondholders. In simple words: any Fed loss reduces payments to the Treasury by the same amount, increases the Federal deficit, forcing the Treasury to borrow more and pay more interests to creditors. The Federal Reserve System has already suspended payments to the Treasury after making losses on its bond portfolio in 2022. Any additional loss will push back the date at which it will resume the practice.

Valuing collateral at par is not potentially harmful only to the US taxpayer. It also sets a precedent for central banks in the rest of the world. The IMF promotes for all countries “Adequate valuation and risk control measures” when dealing with monetary policy collateral.[2] The Fed example might be replicated abroad. Beyond central banking, the Fed, an independent agency of the executive branch has taken a decision that may have important fiscal ramifications, and by this may be interfering with Congress’ “power of the purse”, a cause of concern for central banks independence and the division of power. I would conclude by invoking a moto I heard during my career in central banks : “In god we trust, all the others must bring (good) collateral”

Figure 1: Fed remittances to the Treasury (left-axis, in billion) and how it compared to the US Federal deficit over the same period (right-axis, percentage points)

Source: Fed annual reports for remittances, assuming that reported figures are for the calendar year (i.e. not the US fiscal year) and FRED monthly series for the deficit over the calendar year.

Notes

[1] The Congressional Research Services stated that “This could be controversial given that it is not the originally intended use of the fund and similar actions were prohibited in the past”.

[2]IM Staff Chailloux et al. (2008), also states that “valuation at face value is a simplified approach which is likely to significantly overvalue bank loans’ net present value”, which is basically true of any asset.

This post written by Miklos Vari.

Stem what panic??? We have a idiot that can’t tell the difference between deposits and bank liabilities. The fact this so called program really isn’t worth much. Matter of fact, it looks to completely gone by summer.

A banking panic is 1873 or 2008. This was a micro 1931. Panicking depositors in banks they didn’t want to be in after the crypto bust.

Bott, if you had bothered to look at the data, you’d have seen that deposits were far more stable at small banks during your real bank panic in 2008 than in your “what panic?” of 2023. Most policy makers rely on real information, thank goodness.

I realize you have planted your flag on the hill of “Bott knows stuff about stuff, and bank regulators don’t” but it’s wearing thin.

If you paid attention, you missed my point. 2023 was a mirage. So was the early 1930’s which was a massive corporate bust turned into depositors flight. When economic sectors fail.people rush to the exits. Crypto fail, depositors leave.

Bott, I did pay attention. What I saw is you posturing, pretending that your unsupported opinion is fact. You’re just a guy on a barstool.

Greg’s got me confused because I was always under the impression that deposits were/are bank liabilities. See how much you can learn in the comments section of this blog?? I got my Master’s in Soybeans taking classes from CoRev. Master’s in Oil prices and death statistics from Kopits. Master’s in Kremlin espionage, geopolitics, how to read Rand McNally maps, racial genetics, and Putin military strategy from Rosser. Master’s in trade policy and immigration control from Bruce Hall. “Econned” taught me how to worship an authoritarian leader while simultaneously being a critical thinker. Why haven’t I put the RSS for comments in my reader?? I gotta do that tonight.

https://fred.stlouisfed.org/graph/?g=12rsz

Along with the repeated ethnic prejudice:

“We have a idiot…”

“We have a idiot…”

“We have a idiot…”

https://sites.google.com/site/miklosvariws/

Miklos Vari

Welcome to my research page!

I am currently an Economist in the Monetary Policy Research Division of the Banque de France….

1931 was a micro panic? The ghost of Milton Friedman will rise from his grave and put your worthless existence away.

“We have a idiot that can’t tell the difference between deposits and bank liabilities.”

JP Morgan records their deposits as their liabilities. So does every other bank. You are the idiot.

IM Staff Chailloux et al. (2008), also states that “valuation at face value is a simplified approach which is likely to significantly overvalue bank loans’ net present value”, which is basically true of any asset.

I get that bankers hate mark to market accounting but come on – adopting a sensible accounting standard is needed as this excellent discussion notes.

Gita Gopinath is supposed to talk this mid-afternoon for those interested. I’m sure it will be freely shown on both the IMF site and YT. Something to do with debt levels of nations er something. Sure to be fun in more ways than one (wink wink).

Excellent post!

Excellent post!

The whole trick to the Fed’s discount window stabilization effort in response to SVB is par valuation. That’s neither a good or bad decision, in itself. The question is whether the benefits of par valuation of collateral is worth the cost or risk.

Let’s keep in mind that market valuation of collateral is only one practice which the Fed has now adopted which in the past was frowned upon. When the Fed hands over interest to Treasury from Fed operations, that is monetization of Treasury debt. So, for that matter, is the acquisition of Treasury debt in the first place. The goal of Fed asset purchases isn’t monetization, but that’s the effect.

Vari is right to raise this issue and to warn us that it can get out of hand. We should not, however, take a hide-bound approach to policy. Weigh the risks against the benefits. Impose costs along with benefits. Which in this case may mean boosting the cost of FDIC insurance to cover the transfers resulting from par valuation.

Ducky said it perfectly: “ We should not, however, take a hide-bound approach to policy. Weigh the risks against the benefits. Impose costs along with benefits.”

So why is Ducky so reluctant to discuss the costs of zero and negative real interest rates to tens of millions of small savers and the benefits to wealthy shareholders?

Johnny, Johnny, Johnny…still throwing tantrums. So sad.

Ducky still can’t talk about the enormous benefits to shareholders and the punitive costs to savers…his Wall Street patrons might get offended!

Jonny boy cannot be bothered to considered the impact of a recession. Or even a prolonged depressed economy such as the UK under Cameron. Yea – Jonny boy thinks that helped UK real wages even though the facts showed they fell a lot.

Dude – you have been a running joke for over a decade.

I do trust you realize how utterly worthless you have become.

it is true that there is a cost to valuing at par. however, there is a bigger cost in letting bunch of bank runs get out of control. there should be some penalty for accessing these funds, so banks cannot simply use it as a do over for poor investment decisions. but that is a small price to pay for minimizing the potential of bank runs.

Yep. When management messes up, others end up holding the bag. Unless regulators intervene. When regulators intervene, some folks who would have suffered end up not having to suffer.

That’s when the finger-pointing starts. (For examples of finger-pointing, see anything JohnH ever wrote.) Our economy is massively financialized, massively leveraged. It’s a grift. Sadly, letting the grift fall apart would be a disaster. Dismantling the grift in a controlled way is the safe option. Katy Porter, Elizabeth Warren, Sheldon Whitehouse, Sherrod Brown – all worth listening to.

The winners at SVB: “ Management are out, shareholders wiped out. I’ll stick with the idea that uninsured depositors did a great job of monitoring — they monitored that the bank had the political chops to demand and get a bailout of uninsured depositors!”

https://johnhcochrane.blogspot.com/2023/03/on-marking-to-market-and-risk-management.html

Better yet, SVB didn’t have to pay for FDIC insurance for large deposits, so the interest rates offered could be higher…not to mention the effects of Ducky’s beloved discriminatory pricing which surely meant that large depositors got competitive returns while small depositors had to bear significantly negative returns.

Since you are so excited to cite right winger John Cochrane – let us give you a challenge. When has Grumpy ever complained that fat cats are getting better returns than the average dude. Knock yourself out trying to find a progressive post from John Cochrane.

pgl can’t refute the argument, so he attacks the author! pgl studied well at Trump U.

That’s all you got? You are a joke.

please put this into context. how much higher were the interest rates being offered by svb than other banks, when it failed?

From the minutes of the March FOMC meeting:

“Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.”

“Financial conditions tightened considerably over the intermeeting period as a whole. Market contacts observed that the recent developments in the banking system will likely result in a pullback in bank lending, which would not be reflected in most common financial conditions indexes.”

https://www.federalreserve.gov/monetarypolicy/fomcminutes20230322.htm

I been wondering when exactly we would know Buffett had gone senile. He praised Powell in the last few days. Well, we knew it was coming.

That is doa. Why would a recession occur over a nonexistent bank run????

Not only that, core consumer spending went above potential why new auto sales went below potential, with fleet sales, which is untied to the credit system, booming after 4 years of pent up demand. Yet we see nothing about that. Their forecasts make no sense and appear completely esoteric.

Financial conditions did not tighten though as Morgan pointed out. This is out dated drivel from a board of governors who are clearly out of touch. If anything, they loosened.

Evidence?

I assumed she meant JP Morgan. I can’t find it though. I don’t doubt the authenticity of her words, but I was still wondering the link/reference. I was going to ask the same question as you then stopped because the ghost of Barkley Rosser screamed in my ear I was an extreme misogynist to ask such a thing.

In other news, Elvira Nabiullina still has her job as chair of Russia’s Central Bank. Well, I’ll be a monkey’s uncle. I thought Rosser said…… nevermind.

Anyone on this blog know anything about lawnmowers?? I’m thinking on getting a new one but don’t know hardly anything about lawnmowers. Right now my best candidate is a Ryobi lithium battery powered mower (roughly $350), but I am still a long ways from deciding. I’m looking for something cheap and that can last.

I have a $200 electric mower. My brother has a $700 mower. Same sized lawn. His is faster. Mine is more exercise. That’s all I know.

Your brand and are you relatively happy with it?? I can probably afford the ones where the motor moves the wheels, but I am cheap and the exercise would do me good anyway. My Dad was big on Toro, but I’m guessing there’s others that rival it now.

depends on the size of the yard. the smaller the yard, the better the electric option, in my opinion. I have a small yard that uses ryobi lithium 18v batteries. I have the whole ecosystem, so I use leaf blower, mower, trimmer and hedger on same battery system. it works for a small yard. no extension cords and messy gas/oil products. and a little more quiet in operations. still have to sharpen the blades frequently, so no difference from that perspective.

if you have a larger yard, then you need the 40v system. and for either 18v or 40v, you need enough battery power to get through the lawn in one sitting. not worth it if you need to pause for 6 hours to recharge your one battery. since I run a lot of stuff on battery, not a problem on my end. but a consideration. each battery is not cheap.

I remember wasting a lot of time keeping a gas motor up and running. don’t have that frustration with the electric version.

@ baffling

This is extremely helpful, edifying, and I appreciate it greatly. I’m not really big on “being modern” in the electric battery sense (I have sentimental affection to gasoline, even though I know it’s the wrong decision for society). But Consumer Reports claims you’re not giving up much on batteries vs gasoline = lawn cutting performance is now nearly the same. So here I am. And my Dad’s words (who died about 11 years ago) seem to come back to me on everything. My Dad was very against keeping gasoline mowers in an enclosed garage because of fire/explosion danger. He felt there was a small possibility, but a legit possibility for “auto ignite” of gasoline in an enclosed garage in the hot summer time. So, I want to keep the lawn mower inside for theft reasons (I could tell you some politically incorrect thoughts on that and my immediate east side neighbors), and I just can’t do that, with-uh gasoline mower, with my Dad’s voice haranguing in my ears….. so Ryobi is looking stronger and stronger until someone tells me there’s a better value on the battery style mower.

Again, I appreciate your thoughts very much baffling Especially the 40v–18v thing, making me think more/