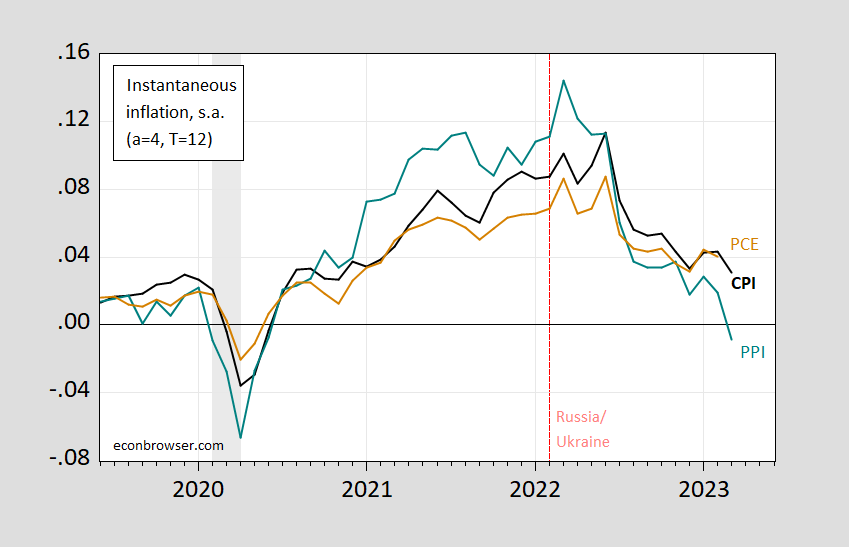

Based on Eeckhout, using a=4, T=12:

Figure 1: Instantaneous (a=4, T=12) CPI inflation (black), PPI (tan), PCE (green), following Eeckhout. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, BEA via FRED, NBER, and author’s calculations.

For trimmed, median and core CPI m/m annualized compared to instantaneous CPI, see this post.

Current practice to measure inflation for monetary policy uses the average annual inflation rate. When inflation changes fast, whether increasing or decreasing, the annual average rate is biased towards data from too far in the past and conveys the true price level with six months delay. I propose to use instantaneous inflation as a more adequate measure of the price change. The measure trades off noise in the data with the precision of the instantaneous price change. Using the latest

inflation numbers released in January, it shows that instantaneous inflation in the US is back to the target of 2%, and to 4% in the Eurozone, indicating the high inflation period has come to an end. Also US core inflation is declining, currently at 4%. In contrast, inflation remains high and shows no signs of decline in the UK, Japan and Australia.

I’m tempted to mock Bruce Hall for not only calling this all Biden’s fault and his misrepresentations of the data so he could get a spot on Fox and Friends. But little Brucie has taken a back seat to JohnH who insists inflation is expected to be 6%. MAGAQ!

pgl still can’t read. I stated the well known fact that the BLS reported 6% inflation in March. I never said that that represented expected inflation. I also said that the real interest rate was a function of current interest rates and current, observed inflation, not from some poorly performing forecast of future inflation.

pgl has this strange compulsion to misrepresent what others say. The influence of Trump U?

“I stated the well known fact that the BLS reported 6% inflation in March. I never said that that represented expected inflation.” Now you are lying about what YOU said. Come on dude – we all know you lie even more than Trump.

‘I also said that the real interest rate was a function of current interest rates and current, observed inflation, not from some poorly performing forecast of future inflation.’

Now you just flunked basic economics. Ex ante real interest rates are the current nominal rate minus expected inflation. Now ex post real interest rates would be the interest rate in time t0 minus the actual inflation in time t1. Your definition is clearly wrong. But leave it to our Village Moron not to understand the most basic definitions.

Dude – your stupidity has ticked off your entire family. You may wish to stop before your mother disowns you.

‘inflation remains high and shows no signs of decline in the UK, Japan and Australia.’

The interest rate on 10-year US government bonds is 3.45%. We have similar rates in Australia and the UK. Now are rates too low in the latter two nations or are US rates too high?

The headline over at AngryBear! “Even with today’s slowdown, profit growth remains a big driver of inflation..

What extreme profit bias of recent inflation means for economic policymakers is relatively complex. The Economic Policy Institute does provide some overview of these issues here. The most important takeaway being the measures aimed at dousing any presumed inflationary overheating in the labor market are absolutely not addressing the key drivers of inflation. Corporate profits being one and supply chain issues still being another belief.”

https://angrybearblog.com/2023/04/even-with-todays-slowdown-profit-growth-remains-a-big-driver-of-inflation#more-105485‘

It seems that the best way to deal with Corporate America’s contribution to inflation on a public policy blog is to simply ignore it or deny its existence!

Wait – the blog I used to write for has noticed this issue? Yea – we are all ignoring it according to two faced little Jonny boy.

Where’s the beef, pgl. Show us where you called out Corporate America for contributing to inflation.

That BS again? Do you have anything other than you childish little rants? I guess not. Damn – you are indeed the most worthless troll ever.

BTW – do you still think banks sell eggs and beer? Yea – you are also the dumbest troll ever.

“Figure A below shows one measure of profit “mark-ups” in the non-financial corporate (NFC) sector of the U.S. economy.”

Bivens wrote this and run noted it. Now little Jonny boy must have missed this a second time.

Or does little Jonny boy not know the difference between banks and nonfinancial companies?

Come on Jonny – stop making it so damn easy for us to point out what a lying idiot you are.

Yardeni is forecasting a flattening of corporate margins in 2022-2023 from their 2Q2021 record and then back up to their record in 2024. The record margins according to Yardeni are about 25% above what the customary margins were only ten years ago.

https://www.yardeni.com/pub/yriearningsforecast.pdf

But pgl, the corporate shill, wants you to believe that Corporate America is somehow suffering under the oppressive burden of “only” 12.2% margins…a level not seen before 2021. Yeah, pgl, higher interest rates are really taking their toll!!! In fact, what seems to have happened is that their price gouging of the past couple years has provided a cushion against forecast margins dropping by only 8%.

Corporate margins have been increasing since 1990, and we can expect more in the future, since nothing goes to heck in a straight line…

“Yardeni is forecasting a flattening of corporate margins in 2022-2023 from their 2Q2021 record”

From the troll who mocked economic forecasts? BTW if inflation is coming down but margins are still going up – there is probably something else going on which differs from your stupid rants.

Now has Yardeni written anything to go along with his forecasts? Huh – you forgot to tell us. Probably because his wisdom would contradict your gibberish.

“Corporate margins have been increasing since 1990”

Well documented things that little Jonny never got:

(1) rising market concentration from 1990 to 2016; and

(2) LOW inflation for the entire period.

Whoops – this does not fit little Jonny boy’s little thesis. Does it?

Keep it up troll – the more you post things you do not even remotely understand, tne more we get to mock your worthless trash.

“Corporate margins have been increasing since 1990, and we can expect more in the future, since nothing goes to heck in a straight line”

READ figure 3 dumbass. Margins vary. Yea – not a straight line indeed and there is nothing in his graphs that even remotely suggest margins will be 15% by 2025 or even 2030.

Look Jonny boy – stick to forecasting the weather as suck at economics.

“The record margins according to Yardeni are about 25% above what the customary margins were only ten years ago”

Jonny boy wants us to believe companies were earning “customary margins” during the Great Recession. Wait – that would make sense and according to FRED was not true:

https://fred.stlouisfed.org/series/A466RD3Q052SBEA

Jonny boy wants to make some point but poor little Jonny boy has to lie in order to do so. Once again a serious issue worthy of a real discussion mucked up by little Jonny boy’s utter stupidity and serial dishonesty.