Gianluca Benigno notes that the NY Fed’s GSCPI, used in this post on using a naive expectations augmented Phillips curve to predict inflation, can be used independently to predict inflation, as in Akinci, et al. “How much can GSCPI improvement help reduce inflation” (Feb 2023).

First, both global supply and global demand factors are associated with intermediate demand goods PPI inflation, consistent with the globally traded nature of the goods in this index. Second, the U.S.-specific demand factor becomes relevant in contributing to CPI inflation on top of supply components captured by the GSCPI. Third, as could be expected, the GSCPI is more associated with goods CPI inflation than with overall inflation.

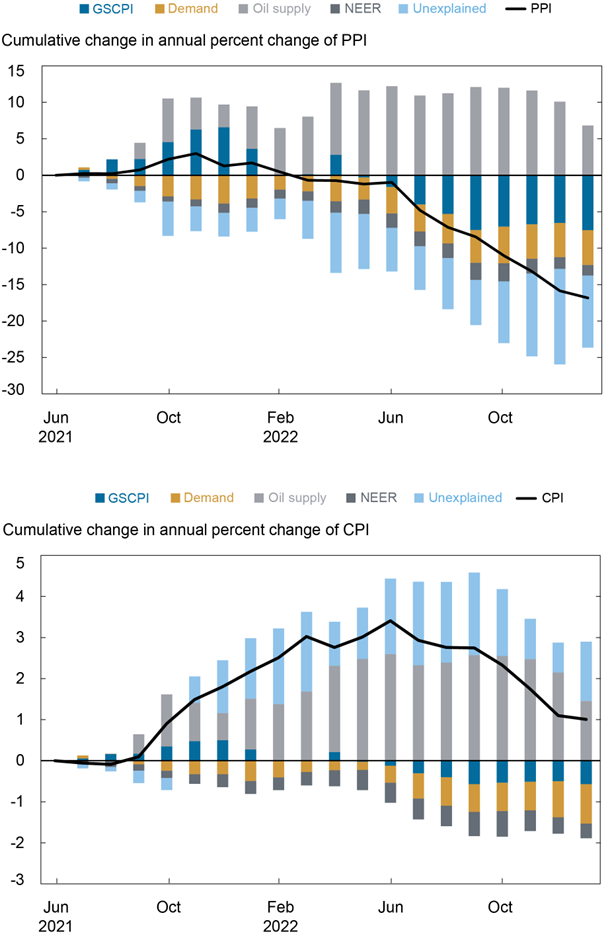

The following figure shows the impact of oil, supply chain pressures and what is unexplained.

It’s interesting to see how much oil has contributed to upward (CPI) inflationary pressures, while GSCPI contributed somewhat in 2021, moving to negative in second half of 2022. In other words, a substantial portion of current inflation is due to the upward movement in oil prices. While their approach does not include inflation expectations, Benigno observed to me that the Michigan measure is highly correlated with oil prices (see here).

As an aside, this point should inspire one to try purging the inflation expectations measure I used of its correlation with oil price changes, so as to mitigate the multicollinearity issue in the regressions used in this post.

OK, I like horror films as much as the next guy, but how exactly does one purge the oil price changes from the regression??

BTW, you could also Saw out the oil price changes from the regression. Just saying……

Cost push. Inflationary expectations Phillips curve. Back to the future as I feel 45 years younger!

Does that make this blog Twin Pines parking lot and Menzie is “Doc” in the DeLorean??

https://www.oreillyauto.com/flux-capacitor

Off topic, debt forgiveness –

https://www.politico.com/news/2023/04/11/china-lending-imf-world-bank-00090588

The rules of international lending include debt relief shared across lenders, when debt relief is needed. If any debt holder refuses to share in haircuts, it van prevent any debt relief. Just ask Argentina.

One of the things that China wants to change about the way the world does business is to end sharing of losses. Specifically, China doesn’t want its international lending to be subject to haircuts. What this would mean in practice is that China would be first in line for debt repayment. Often, that would mean funneling money from other lenders to China, through debtor nations. Again Argentina provides an example of what’s likely to happen when some creditors try to jumpto the head of the line.

China acts like a 9 year old, interrupting adults playing a game of monopoly: “Now I get all the hotels, all the Houses, I get the railroads and all the properties near the “Go” as you circle back around. No?? Why can’t I be a respected part of the world community?!?!?! This is unfair, quit interfering in our internal governance!!!”

They want to lustily observe the cake, eat the cake while they still lustily observe the cake, you to smile while they eat your cake, and then if you clear your throat audibly while they eat the cake you made, they go “You’re interfering in our domestic affairs!!!!” Adults acting like infants?? I’m not going to say it, you decide.

Professor Chinn,

Regarding: “As an aside, this point should inspire one to try purging the inflation expectations measure I used of its correlation with oil price changes, so as to mitigate the multicollinearity issue in the regressions used in this post.”

Is there a ratio of the oil variable to the correlated variable that could be used to minimize multicollinearity?

CPI comes out this morning. In other news, Tupperware’s stock is collapsing:

https://finance.yahoo.com/quote/TUP

A year ago this company was reporting strong sales and a decent operating margin. But somewhere along the way its debt got rated CCC. Stock up on containers as this company may not last.

As I understand it (which is not well) Tupperware benefited somewhat from the Covid stay-home thing, but as a result of the stat-home thing, everybody is now loaded up on kitchen ware. And low unemployment is bad for Tupperware’s sales model. So from good to bad in a short time.

It’s interesting to see how much oil has contributed to upward (CPI) inflationary pressures

According to BEA data (2022Q4) oil and gas extraction has a Domar weight of 2.75% even though real value added is only 1.54% of GDP.

https://www.bls.gov/news.release/cpi.nr0.htm

CONSUMER PRICE INDEX – MARCH 2023

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in March on a seasonally adjusted basis, after increasing 0.4 percent in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 5.0 percent before seasonal adjustment.

Well yr/yr may be 5% but month/month is less than half of that. OK, month/month may be noisy but over the past 9 months, the annualized inflation rate has been only 3.27%. Anyone who is forecasting 6% inflation has no clue what he is babbling about.

Now I will admit John Cochrane trashed market forecasting back on October 22, 2022 but his January 18, 2023 blog post (which of course liar JohnH never mentioned) did concede inflation has been moderating.

More on Dominion, Faux News, and RUDY!

https://www.thedailybeast.com/ex-fox-producer-abby-grossberg-claims-there-are-secret-rudy-giuliani-recordings-about-dominion

Abby Grossberg, the former Tucker Carlson producer accusing Fox News of pressuring her to give false testimony in the Dominion Voting Systems lawsuit, filed amended legal complaints on Tuesday claiming there are secret Fox audio recordings of Rudy Giuliani and other Trump allies. Grossberg, who is suing the conservative network for harassment and a toxic work environment, claims that the behind-the-scenes conversations with Giuliani, former Trump lawyer Sidney Powell and Trump campaign officials featured them admitting they had no evidence to support their Dominion election fraud lies.

Additionally, she says an adviser of former President Donald Trump pointed out the importance of January 6 weeks before the Capitol attacks, noting that the adviser said there were “no issues” with voting machines and January 6 was now the “backstop” for determining the election.

These recordings need to be turned over to the court.

Alvin Bragg goes after Jim Jordan:

https://int.nyt.com/data/documenttools/bragg-v-jordan-complaint-23-cv-3032/b7f1a0e43619867d/full.pdf

Plaintiff District Attorney Alvin L. Bragg,Jr. brings this action in response to an unprecedently brazen and unconstitutional attack by members of Congress on an ongoing New York State criminal prosecution and investigation of former President Donald J. Trump. Beginning on March20,2023 ,Representative Jim Jordan, Chairman of the House Committee on the Judiciary (the Committee ), began a transparent campaign to intimidate and attack District Attorney Bragg, making demands for confidential documents and testimony from the District Attorney himself as well as his current and former employees and officials. Two days after Mr. Trump was arraigned on 34 felony counts in New York State Supreme Court, Chairman Jordan

and the Committee served a subpoena on Mark Pomerantz, a former Special Assistant District Attorney who participated in an investigation of Mr. Trump and his businesses. The subpoena seeks to compel Mr. Pomerantz to testify in a deposition on April 20, 2023. Chairman Jordan’s demands, including his subpoena to Mr. Pomerantz, seek highly sensitive and confidential local prosecutorial information that belongs to the Office of the District Attorney and the People of New York Basic principles of federalism and common sense, as well as binding Supreme Court precedent, forbid Congress from demanding it.

You get the feeling that Jim Jordan used to play “reach around” with Richard Strauss whenever the latter couldn’t find any freshman wrestlers to rape that day??

https://www.esquire.com/sports/a35120040/richard-strauss-ohio-state-wrestling-sexual-abuse/

https://www.msn.com/en-us/news/world/ukraine-vows-to-punish-murderers-after-video-of-an-apparent-pow-beheading-surfaces/ar-AA19LZWH?ocid=msedgdhp&pc=U531&cvid=fd1e784b04eb4a63a8477808f4d73d96&ei=17

Ukrainian President Volodymyr Zelenskyy on Wednesday condemned a video circulating online that the country’s security services said showed a Ukrainian being decapitated by “Russian occupiers.” “There is something that no one the world can ignore,” Zelenskyy said in Ukrainian in a video posted to his Telegram channel. “We are not going to forget anything,” he added. “There will be legal responsibility for everything.” The footage viewed by NBC News features a man repeatedly saying “it hurts” as another man wielding a small knife appears to saw into the man’s neck.

No one should ignore these war crimes but we know Putin poodle JohnH would have us ignore and forget such brutal war crimes. After all Jonny boy begs for his bones from Putin on a daily basis.

Let’s say you run a major multinational like Caterpillar that has the IRS accusing you of shifting massive amounts of profits to Switzerland. Hey hire Bill Barr just before he joined the Trump White House and you will be fine:

https://www.reuters.com/article/us-usa-barr-caterpillar-exclusive-idUSKBN27Y2PO

WASHINGTON (Reuters) – Before William Barr became President Donald Trump’s choice to lead the U.S. Department of Justice, he represented Caterpillar Inc, a Fortune 100 company, in a federal criminal investigation by the department. The decision, the email said, came from the Justice Department’s Tax Division and the office of the deputy attorney general, who was then Rod Rosenstein.

“I was instructed on December 13, 2018,” wrote the agent, Jason LeBeau, “that the Tax Division and the Office of the Deputy Attorney General jointly came to the decision that no further action was to be taken on the matter until further notice.” LeBeau, an inspector general agent at the U.S. Federal Deposit Insurance Corporation, declined interview requests from Reuters. Since then, a source close to the case says, the investigation has “stalled.” The order to freeze the Caterpillar investigation has not been previously reported.

Reuters was unable to determine why Justice issued the “no further action” directive. It was not issued by Barr, as it came before he was confirmed. A Justice Department spokesperson said Barr recused himself from any Caterpillar discussions once he became attorney general, but declined further comment. Barr, in testimony during his confirmation hearings, said rules of legal privilege precluded him from discussing his work for the company. Rosenstein, who left the government in May 2019, did not respond to a phone message and emails seeking comment. The IRS declined to comment about the case.

Caterpillar, for its part, has reported to investors that the grand jury investigation is ongoing. The company told Reuters the DOJ’s Tax Division is reviewing the investigation. Caterpillar has said for years that it did nothing wrong. Potential conflicts of interest, whether real or apparent, often arise when high-powered lawyers switch between private practice and government service. Bruce A. Green, a former federal prosecutor who teaches at Fordham Law School, said it is not unheard of for attorney generals to have clients who had business before the DOJ. He noted that in 2009, President Barack Obama’s attorney general, Eric Holder, recused himself from a case involving Swiss Bank UBS, a prior client. But Green said he could not recall a case where agents were told to take no further action on a matter involving an incoming attorney general’s former client without some kind of explanation. “Why would you just stop?” he asked.

A source familiar with the progress of the investigation, which is being conducted out of the U.S. Attorney’s Office for the Central District of Illinois, said that since December 2018, “it’s slowed, it’s stalled, it’s languishing. Not a lot of action is being taken.” But the source stressed the probe is not technically closed, and couldn’t be called “dead.”

The government’s questions about Caterpillar’s tax structure started with a whistleblower lawsuit in 2009 that laid out what it said was a complex “tax dodge” to route Caterpillar profits on parts sales through a company in Switzerland. Then, in 2014, the U.S. Senate Permanent Subcommittee on Investigations dug into the issue, and alleged the company adopted a sales strategy that “shifted billions of dollars in profits away from the United States and into Switzerland, where Caterpillar had negotiated an effective corporate tax rate of 4% to 6%.” The Senate investigators quoted company insiders who said the system was structured for “tax avoidance.”

At the time, Caterpillar said the transactions, and tax strategy, were entirely legal. A Caterpillar vice president testified to the committee that having an offshore subsidiary collect profits and pay taxes was “nothing more than the standard business operations and tax planning that any prudent multinational enterprise would employ.”

The next year, a federal grand jury in Illinois launched a criminal investigation. In March 2017, federal agents raided three Caterpillar offices, wheeling out evidence in large black plastic boxes. In a report written for the government, a consultant for the investigators, Leslie Robinson, called the tax strategy “fraudulent rather than negligent.”

Two weeks after the raid, Caterpillar Chief Executive Jim Umpleby announced the hiring of Barr as company counsel. Barr would “take a fresh look at Caterpillar’s disputes with the government, get all the facts, and then help us bring these matters to proper resolution based on the merits.”

Robinson, the investigative consultant who had questioned Caterpillar’s tactics, told Reuters she met with Barr in May 2017, briefing him on why she thought the tax strategy was illegal, and to hear why the company thought it was not. Robinson said she would not discuss the meeting details or the basis for her conclusion in the government’s report.

In November 2018, as the White House scanned potential lawyers to take the job of attorney general, Barr’s name was among those floated. On December 7, the White House announced his selection. “He was my first choice from day one,” Trump said. Barr has emerged as one of Trump’s most aggressive aides, most recently authorizing federal prosecutors to investigate the counting of votes in this month’s presidential election, which Trump lost to Democrat Joe Biden.

In January 2019, Robinson, a professor at Dartmouth College’s Tuck School of Business, sent a note to FDIC agent LeBeau asking if the case was “dead or progressing.” Robinson wrote, “From a personal standpoint, it is a bit peculiar to have spent so much of my time and energy on something and then to have no idea if it will amount to anything concrete.”

“Quite frankly I am somewhat in the dark as well,” LeBeau replied. He said he had understood that a new U.S. attorney was in discussions with Caterpillar, but knew little more. “I know the process is going incredibly slow.”

This October, Robinson communicated again with the investigators. In emails reviewed by Reuters, she asked what had happened to the case, explaining that a Reuters reporter had inquired. That’s when LeBeau explained, copying other agents and a prosecutor on the email, that they had been told to take no further action a week after Barr’s nomination 20 months ago. “We were given no additional explanation,” he wrote.

——-

This story was from late 2020 when Trump was still President. Now two years later apparently the government convinced Caterpillar to pony up not $2.3 billion but only $740 million.

What a gutless wonder Rosenstein was. You got the idea he spent nearly all his time at home and in the office terrified he was going to be bludgeoned if he got too close to his own shadow. WOW. The coward’s coward. Never saw such a timid man in all my life. He must have thought toy poodles were the original Freddy Kruger.