Today, we’re pleased to present a guest contribution by Laurent Ferrara (Professor of Economics at Skema Business School, Paris and Director of the International Institute of Forecasters).

Against the current background of high inflation rates, questions arise on the way central banks can control inflation and their strategy to reach their objective. Since 1990, main central banks around the world have progressively adopted a framework of inflation targeting. This means that their objective of price stability is set through the evolution of the annual growth rate in general price level, i.e. inflation rate, around a targeted value (e.g. 2% for Fed and ECB).

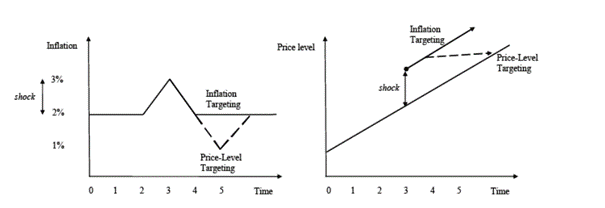

One of the well-known issues of this inflation targeting approach is that, by focusing on the growth rate of prices, it does not account for the value of past inflation rates. We say that “bygones are bygones”. Targeting an average of 2% over time, as the Fed does, is a way to alleviate this issue. An alternative would be to directly target the price level. This approach allows for more flexibility by accounting for deviations to the target after an unexpected shock. For example, assuming an inflation target at 2%, if inflation increases to 3% after a given shock, rational economic agents will expect a 2% inflation in the wake of this shock, while it would be only 1% under a price-level target regime. This is well explained in Figure 1 taken from this VoxEU post.

Figure 1: Inflation and price-level targeting compared

Source: Minford and Hatcher, 2014, VoxEU

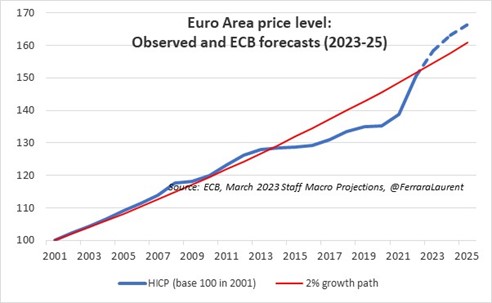

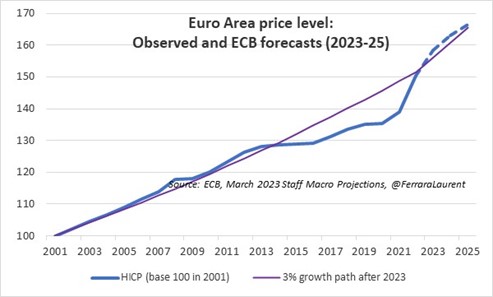

It is informative to have a look at the euro area through the lens of a price level analysis. After years of having a level of inflation below the price level implied by a 2% inflation since 2001, the observed price level has now almost reached this “theoretical” price level in 2022 (see Figure 2). The sharp increases in the level of prices in 2021-22 have thus erased 9 years of evolutions below the 2% trend.

Figure 2: Price level in the euro area and price level implied by the 2% path

Source: Eurostat and ECB March 2023 macro projections

What is interesting is to consider the inflation forecasts for 2023-25 released by the ECB in its March 2023 Staff Macro Projection Exercise (+5,3% in 2023, + 2.9% in 2024 and +2.1% in 2025): The price level is likely to persistently exceed the “theoretical” price level implied by a 2% growth path. For the first time in the history of the euro area, we will observe a significant and persistent gap between the two lines of Figure 2 (about 3.5% in 2025), suggesting that euro area citizens will permanently face high prices for goods and services. Moreover, if we assume that inflation will go back to the 2% target after 2025, then the two lines will evolve in parallel after this date (as in Figure 1, right panel).

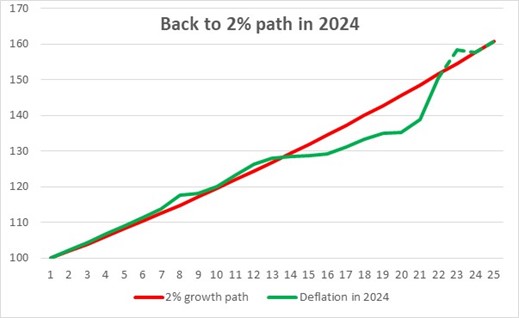

So how could policy-makers close this gap? The first option is to tighten the monetary policy stance in order to bring the price level back to the 2% path line. This is what the ECB is currently doing by increasing its main refinancing interest rate. But this monetary policy tightening can be done in two ways: hard or soft. A hard tightening would imply a rapid return to the 2% line, by generating a deflation of about -0.5% in 2024 (Figure 3). Very likely that this scenario would also imply an economic recession within the euro area in 2024.

Figure 3: Price level scenario with a deflation in 2024

Source: Eurostat and author’s computation

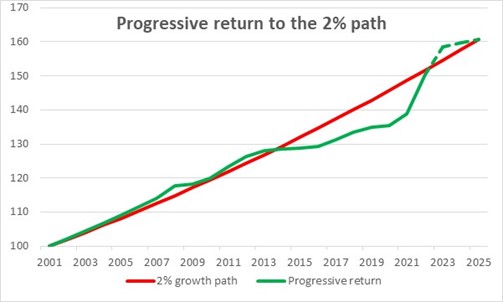

A soft monetary tightening would imply an inflation rate well below the target for both 2024 and 2025. For example, an inflation rate of 0.8% in 2024 and 0.7% in 2025 would send the price level back to the 2% path in 2025 (see Figure 4). This second scenario is certainly the preferred one, as the euro area would certainly escape an economic recession and all its associated costs in terms of employment and income.

Figure 4: Price level scenario with a progressive return to 2% path

Source: Eurostat and author’s computation

There is a second option, more complex to implement but often advocated by leading economists like Olivier Blanchard, that is to increase the inflation target. After all, there is no strong theoretical argument in favour of the 2% value. This value is mainly based on past periods considered by policymakers as periods of price stability. So why not using a target of 3% or 4%? Figure 5 shows a theoretical effect of a shift to an inflation target of 3% starting from 2023. We see that the expected price level will be aligned with the one implied by a 3% inflation target.

Figure 5: Price level scenario with a 3% target from 2023

Source: Eurostat and author’s computation

A price level analysis suggests that to avoid a persistent gap between observed general level of prices and the level of prices implied by a 2% inflation target in the euro area, the ECB is likely to continue to tighten its monetary policy stance in upcoming months. An alternative would be to increase inflation target but that’s another story that will fuel debates among academic and policy circles for the months to come …

This post written by Laurent Ferrara.

There is a third approach, not mentioned by Ferrara. Opportunistic disinflation might return inflation to its prior path without the ECB intentionally reducing the pace of growth. One thing we do not know is what the underlying rate of inflation in the (global) economy will be once the Covid-and-Putin shocks have worn off. Prior to Covid, the natural state of things was for inflation to run below target. If that is again the case, patience will solve the ECB’s problem. Recession might also solve the ECB’s problem, even if the ECB doesn’t cause it.

The ECB has to operate based on forecasts, but ought not lean too heavily on those forecasts right now. The inflationary environment of the next few years is a bit of a mystery.

Inflation gap? What’s to be gained by making up for past inflation under 2%? And, more to the point, what the cost of increasing the target to 3-4%? Yes, there are costs…the low real interest rates implicit in such a policy lower the interest rates received by Social Security, other pension funds, and tens of millions of retirees, tens of millions more trying to save for retirement, for a down payment on a house, for their kids college education, etc. How about implementing a policy that makes up the gap in real returns lost due to low interest rates?

Another problem is that such a policy forces a shift to more risky assets, which gives a boost to the portfolios of the wealthy, making them even wealthier. Could that be the Fed’s real goal?

And then there is the problem of corporate greed. When inflation was low, it was fairly apparent when companies were raising prices. As prices become less and less anchored, Corporate America had a field day, playing games with prices and diddling along on increasing wages. Profit margins reached record highs, almost an order of magnitude higher than 70 years ago.

The Fed already has a problem with credibility. Pulling off yet another stunt to comfort the comfortable will only exacerbate it.

“Millions of Americans are beginning to ask themselves this question: Is the Federal Reserve (the “Fed”) a competent central bank or a terminally compromised regulator that simply does the bidding of Wall Street’s mega banks to the peril of average Americans and the U.S. economy? Millions of other Americans have already made up their minds on this point.”

https://wallstreetonparade.com/2023/04/a-growing-lack-of-confidence-in-the-fed-is-spilling-over-into-a-lack-of-confidence-in-u-s-banks/

I get you are a classic gold bug but come on dude – read Irving Fisher’s A Theory of Interest Rates. After all, it was a classic that was originally penned in 1907.

Oh wait Fisher was an economist and little Jonny boy does not do economics. Never mind.

The question is: why does pgl refuse to acknowledge the downsides of low rates? Why does he just promote low rates?

pgl sounds like someone with a vested interest in low rates—“ It Is Difficult to Get a Man to Understand Something When His Salary Depends Upon His Not Understanding It.” —Upton Sinclair.

Where did Irving Fisher ever say that it was good public policy to hold real interest rates at or below zero for decades?

Do you even know who Fisher was? Didn’t think so. Of course Keynes wrote his General Theory some 39 years later. Oh wait – Jonny boy has no clue who Keynes was. Or what the Great Depression was. Yea – Jonny boy writes a lot of garbage as he knows not a damn thing.

“for a down payment on a house”

Like high real mortgage rates make buying a house more affordable? Damn – we knew Jonny boy was stupid but DAMN!

Like low mortgage rates don’t drive up prices and make houses even more unaffordable…and require even higher down payments?

Low rates are self defeating phenomenon for people buying a house.

But pgl thinks that low rates are the best thing since sliced bread…which they are for wealthy people and their stock portfolios.

Gee – you and Princeton Steve should write a text on housing economics. It should be great for lining our bird cages.

After tax, real mortgage rates are below zero….that’s not a helluva deal? Essentially people are being paid to buy houses, but pgl thinks that’s not good enough—they should be paid even more to buy houses. But people trying to save for a down payment on a house, for their kids college education, or for their retirement should be punished with taxable, negative real interest rates!

From a public policy standpoint this sounds like Alice in Wonderland

“After tax, real mortgage rates are below zero….that’s not a helluva deal?”

I would challenge you to show your data and actual work on this but we do not want you to have to take off your shoes.

Gee Jonny seems to have ducked my challenge until I did the hard work. Oh wait – Jonny boy does get nominal rate = 6.3% but claimed expected inflation = 6%. Really Jonny boy? Market measures say expected inflation = 2.3%.

Oh – you were using the rise in CPI after the PAST 12 months. Which is a really stupid way of capturing expected inflation. Come on Jonny boy – tell us your advanced forecasting model that says expected inflation is 6%. If you do not – you are not only lazy, a liar, but also the dumbest troll ever.

This couple is Jonny boy’s new heros?

Wall Street On Parade is a financial news site created, owned and maintained by Russ and Pam Martens. Since its inception, it has received no outside funding of any nature. Mr. Martens’ career spans four decades in publishing and printing management, including magazine and music publishing and the non-profit sector. Mr. Martens has received numerous awards in publishing and graphic design. Prior to co-creating Wall Street On Parade in 2011, he spent a decade each as General Manager of United Artists Music (Print Division); Director of Printing and Purchasing at American Lung Association; and Executive Vice President of Commercial Envelope. Ms. Martens worked for two large Wall Street firms for a total of 21 years. She personally managed investment portfolios for individuals for 11 years at Shearson American Express (which became Salomon Smith Barney). She spent the following decade at A.G. Edwards & Sons as Vice President/Investments, also personally managing the life savings of individuals.

A rich dude with a wire working for a bunch of Wall Street rich dudes. Jonny boy is not a progressive. He is a bought and paid for fraud.

Why doesn’t pgl refute or counter the data from the Martens about the Fed’s sketchy behaviour on behalf of the rich and powerful?

Instead all pgl can do is his usual trash: shooting the messenger with ad hominem attack and character assassination using rumour, innuendo and smears, most likely learned at Trump University.

I don’t refute meaningless babble – except when it comes to your incessant intellectual garbage. Life is short.

“Wall Street On Parade is also the only media outlet to crunch the numbers”

I love it when marketing people lie like this. Of course this is the kind of dishonest BS JohnH has perfected for a decade.

Where’s the beef? Prove your claim that other, mainstream media are reporting on Martens’ allegations

Where’s the beef? Prove your claim that other, mainstream media are reporting on Martens’ allegations

MediaBiasFactCheck is my go to place when I see some outfit puffing its stuff:

These media sources have a slight to moderate liberal bias. They often publish factual information that utilizes loaded words (wording that attempts to influence an audience by using appeal to emotion or stereotypes) to favor liberal causes.

Nothing wrong with a moderate liberal bias but come on – drop the loaded words, emotions, and stereotypes and do actual analysis. Oh wait – we are dealing with Jonny boy who thinks emotions matter and analysis is for corporate homeys.

Johnh, your problem seems to be with capitalism itself. you do not seem to agree with it. you will continue to be unhappy, because the United States is and will remain a capitalist society. if you prefer to not be in a capitalist society, there are other locations around the globe you may find more acceptable. they may not, however, provide you with the same rights and privileges that you find in the United States. such as the ability to voice your displeasure on a blog such as this.

Remember – Jonny boy lives in the Kremlin. Putin built little Jonny his own dog house.

Clarence Thomas needs to be removed from the Supreme Court:

https://www.msn.com/en-us/news/politics/clarence-thomas-has-reportedly-been-accepting-gifts-from-republican-megadonor-harlan-crow-for-decades-and-never-disclosed-it/ar-AA19xtUR?ocid=msedgdhp&pc=U531&cvid=acb09fbd984449babbbc3e62627379ba&ei=12

Supreme Court Justice Clarence Thomas has been accepting trips from Republican megadonor Harlan Crow for more than 20 years without disclosing them as required, ProPublica reports—including trips on private jets and yachts that could run afoul of the law—the latest in a series of ethical scandals the conservative justice has faced amid calls for justices to follow an ethics code.

I always thought Eric Trump was kind of slow but did he learn counting from Princeton Steve? After all a single block of Manhattan does not normally mean there are ten of thousands of people:

https://www.msn.com/en-us/news/politics/eric-trump-roasted-for-falsely-claiming-tens-tens-of-thousands-of-americans-supported-his-father-on-day-of-arrest-numbers-aren-t-his-strong-suit/ar-AA19ye1A?ocid=msedgdhp&pc=U531&cvid=272e54bb7129494da97139ed10b6a478&ei=7

Eric Trump Roasted For Falsely Claiming ‘Tens & Tens Of Thousands’ Of Americans Supported His Father On Day Of Arrest: ‘Numbers Aren’t His Strong Suit’

Eric Trump was called out for miscounting how many people supported his father, Donald Trump, on the day of his arrest and arraignment. “When we got off the plane and you saw tens and tens of thousands of people lining the streets all the way from Palm Beach International airport to Mar-a-Lago waving American flags and Trump 2024 flags, Sean the love is incredible,” the 39-year-old told host Sean Hannity. “No one has ever seen that kind of love and this is coming off of the day that the 45th president of the United States was indicted and the streets are lined with people literally singing ‘god bless America.'” Of course, people were baffled over Eric’s remark, as the crowd was not that big. “I think he meant tens and tens of people,” one person tweeted, while another said, “Where were they? The camera missed them? All of them?”

Great read, thanks Laurent Ferrara!

Great read, thanks Laurent Ferrara!

https://fred.stlouisfed.org/series/PWHEAMTUSDMe

Global price of Wheat

The price of grains shut up when Putin invaded Ukraine. The good news is that Ukraine is once again exporting grain so global prices have fallen to pre-pandemic levels.

Another read linked to an interesting story of how there is grain glut in Eastern Europe but alas the reason is that grain exports are still not going to Africa.

Now Russia is having trouble to exporting their grain to any place except China. Maybe the Chinese should facilitate more grain exports to Africa.

What’s former Trump attorney Ty Cobb is saying:

https://www.tapatalk.com/groups/politicalconundrum/former-trump-lawyer-jack-smith-has-slam-dunk-evide-t19503132.html

Former Trump lawyer says Jack Smith has slam-dunk evidence on documents case

Story by Matthew Chapman • 2h ago

Special counsel Jack Smith’s criminal investigation into classified documents at Mar-a-Lago is compelling, and a bigger legal threat to former President Donald Trump than the Manhattan Stormy Daniels hush payment prosecution, argued former White House lawyer Ty Cobb on CNN Wednesday evening.

“There is so much attention on the Alvin Bragg indictment,” said anchor Erin Burnett. “I do know, though, that you think that there is another and a bigger charge more significant charge about to come in the special counsel’s investigation into the classified documents at Mar-a-Lago, and that you think that Jack Smith will charge Trump with obstruction, and he’s going to do that likely within 60 days. Why that specific charge and why that, at this point, accelerated timeline?”

“I think … the evidence is falling into place so neatly on those offenses,” said Cobb. “On the false statements to the FBI, to the Department of Justice on the attempts to conceal documents both in connection with the grand jury subpoena and in connection um what with the post search events. So I think that case is coming together rapidly and in a way that is virtually unassailable, and it may well overtake, I think it will well overtake, the January 6th investigation. Keep in mind, there are two different grand juries on those two matters, and there’s no obligation that they be brought at the same time.”

“So I think that case is accelerating,” Cobb continued. “I think the evidence, you know, it’s coming over the transom in waves, and it’s all falling neatly into place. And it should not be difficult, given the fact that ever since the government noticed big gaps in the documents that Trump had left at the White House and what he had previously known to have, including the letters from his, you know, friends in North Korea ever since they started trying to get those documents and retrieve the classified documents, there has been false statement after false statement. There have been, you know, failures to cooperate. There has been an attempt to have employees lie to people. So the evidence is building brick by brick, and there isn’t a good brick in there for the former president.”

Newly hired Trump toadie JohnH is touting the standard line that this is a political issue where the Democrats have nothing of substance. No Jonny boy – this is not a political issue and Jack Smith has the goods on two serious felonies that your boy Trump committed.

Steve Bannon’s guy to challenge Biden in the 2024 primaries!

https://www.msn.com/en-us/news/politics/steve-bannon-spent-months-recruiting-anti-vaxxer-rfk-jr-to-run-against-biden-as-chaos-agent/ar-AA19ytY2?ocid=msedgdhp&pc=U531&cvid=bbb6e35a499b4405ac56eba0ec7d3160&ei=33

Former chief Trump strategist Steve Bannon spent “months” encouraging anti-vaxxer Robert F. Kennedy Jr. to run against President Joe Biden in the 2024 election, according to a report from CBS News. People familiar with the matter told the outlet that Bannon hoped Kennedy could serve as a “useful chaos agent” in the election while also spreading “anti-vaccine sentiment around the country,” according to CBS News’ Robert Costa.

Now that JohnH has joined Team Trump in mocking anyone who would accuse Trump of a crime, I bet he got all excited when Trump after Fani Willis calling her a racist:

https://www.wsbtv.com/news/local/atlanta/exclusive-interview-fulton-da-dismisses-trump-comments-ridiculous-after-calling-her-racist/7RVDEE5BEVAKFNCSLFD54YJ27E/

ATLANTA — Former President Donald Trump accused Fulton County District Attorney Fani Willis of being a racist and of pursuing her investigation into him as a way to interfere with the 2024 election. Trump made those comments just hours after his arraignment on 34 felony counts in New York City. Here in Fulton County, District Attorney Fani Willis’ own investigation continues and she told Channel Action News in an exclusive interview on Wednesday that she doesn’t care what Trump thinks. “I don’t have any comment on what his opinions are of my investigation,” Willis said.

Willis has a point we should remember. Like why care about the babble from JohnH as he has proven over and over again he is both dumb and dishonest.