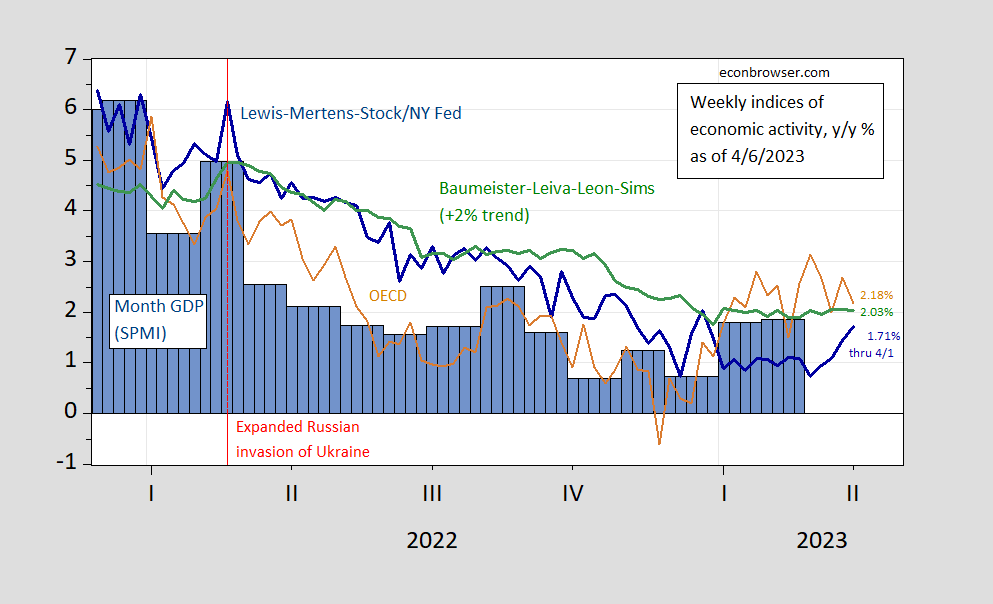

Here’re some indicators at the weekly frequency for the real economy.

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green), S&P Market Intelligence monthly GDP (blue bar), all growth rate in %. Source: S&P Market Intelligence, NY Fed via FRED, OECD, WECI, accessed 4/6, and author’s calculations.

The Weekly Tracker continues to read growth at 2.18%, for the week ending 4/1, about the same as the WECI+2% (2.03%). The WEI reading for the week ending 4/1 of 1.71% is interpretable as a y/y quarter growth of 1.71% if the 1.71% reading were to persist for an entire quarter.The Baumeister et al. reading of 0.03% is interpreted as a 0.03% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 1.97% growth rate for the year ending 4/1. The OECD Weekly Tracker reading of 2.18% is interpretable as a y/y growth rate of 2.18% for year ending 4/1.

Recall the WEI relies on correlations in ten series available at the weekly frequency (e.g., unemployment claims, fuel sales, retail sales), while the WECI relies on a mixed frequency dynamic factor model. The Weekly Tracker is a “big data” approach that uses Google Trends and machine learning to track GDP. As such, it does not rely on actual economic indices per se.

The WEI reading, if applied to Q1, implies 1.64% (q/q SAAR). As of 4/5, GDPNow was 1.5% (q/q SAAR). while S&P Market Insight (nee Macro Advisers/IHS Markit) tracking was at 1.9%.

The progressive drop in GDPNow estimates since around the 3rd week in March is mostly due to lowered estimates of consumer spending:

https://www.atlantafed.org/cqer/research/gdpnow/archives.aspx

New Deal Democratic has recently pointed out the unhappy implication of the slowing of consumer demand:

“There is also a 75 year history that, with the exceptions of 1951 and 1967, whenever the 3 month average of real retail sales have turned negative YoY – as they did in Q4, where they were down -0.4% YoY – a recession has followed shortly or already begun.”

The Fed’s own SEP median estimates for real GDP growth and the jobless rate strongly suggest recession this year.

Maybe, but components of spending during the 2020-22 period either overshot potential or undershot potential(like new auto sales/fleet sales). Figuring out how it turns out is not going to be as easy as “New Deal” suggests. I also don’t see why unemployment would go up much if any. Unlike yourself, there is little over employment right now. Little over investment. Not much debt in the main banking sector. A pretty sideways picture. Which isn’t a bad thing.

Fed forecasts are political back patting, like they control something. When they are just a cog. Never have followed them much.

@ Karen James

You don’t think the federal funds rate or shrinking reserves effects the general economy??

I think her “Little over investment” suggests we are not saving and investing too much, which is a different proposition from some claim that higher interest rates do not discourage investment demand. But I’ll let our new valued commentator speak for herself.

I wouldn’t think what New Deal does is easy. The point you’re making, though, is correct. The economy has been through a bunch of things that have changed relationships and magnitudes of effects, sold predictive tools are less reliable now, and most were only moderately reliable in the past.

Welcome to Sideways Land! If you don’t like Sideways Land, please write a letter to the Fed explaining why we need to hike rates another 400 BP.

You can also move to Russia. Or Great Britain. The rest of us will go about our business in a Sideways fashion and not freak out.

republican leadership in Tennessee shows partisan hackery by expelling state members of congress rather than addressing the issue of gun violence in school. it is a breakdown of democracy on a major scale. authoritarianism at work here. but what makes it worse? three members of the legislature were voted on for removal, for the same protest. one white female remained. two black males where voted out of the legislature. racism at work, pure and simple. let me hear one single republican defend this racist action in Tennessee.

https://www.cnn.com/2023/04/07/us/tennessee-democrat-house-representatives-expelled-friday/index.html

southern republican states have the lowest life expectancy in the nation. republican leaders ignore medicaid expansion, discourage vaccines and discourages efforts to spread a deadly virus. what other result would you expect?

https://www.cnn.com/2023/04/07/us/tennessee-democrat-house-representatives-expelled-friday/index.html

republicans are silent on the major ethical violations from the Supreme Court. they worry more about an inconsequential leak, than the gifting of hundreds of thousands of dollars worth of travel and gifts to a polarizing supreme court figure who feels entitled to hear Supreme Court cases which involve his partisan hack wife.

https://www.washingtonpost.com/politics/2023/04/06/clarence-thomas-trips-republican-donor/

how much more corrupt and partisan can the Republican Party become before they tear to shreds the idea that represents the United States of America as a free and fair democracy for all?

What is more dangerous than a black man with a bull horn? Two black men with bull horns!

For what its worth those two will almost certainly be reinstated. Since they cannot be expelled again for the same offense the only thing accomplished by the TN GOPsters is that they revealed their real color.

I am actually quite optimistic that the GOP has overdone it this time and may be hit with the curse of gerrymandering. When you have designed a district to be 60% GOP the assumption of “safe” is based on normal voting patterns. If your opponents put up a moderate candidate and substantial numbers of your usually safe voters either stay home or vote for that person – all of those “safe” districts are at play.

Employment in March hit a bit of a drag, relaive to January and February, due to weather. The number of people unable to work due to weather in February has higher than in an February in the past five years. In January and February, that figure was lower than average for the past five years.

There have been anecdotal reports that firms are cutting back on temp and contract workers in order to hold on to permanent workers, a switch from the practice of recent decades. BLS provided tentative confirmation of that, with temporary employment down, but it rose in January and February, so not all that convincing. A cutback in non-full-time employment would be a sign of cooking demand for labor. Initial joblesss claims remain low, another sign of labor hoarding, but have picked up since early February.

A worrying feature of the report is that work missed due to illness was the second highest of any February since 2007, just behind 2020.

The workweek is down 0.3 hours from a year ago, and is down 0.1 hour in each of the past two months, further sign of softening labor demand.

“… cooling demand for labor.”

Not “cooking.”

The big red alarm going off in the corner is the amount of money financial institutions are borrowing from the Fed. In January, it was $4.4 billion, almost 10 times the amount of January 2022. In February, the uplift was 6.7 times, but in March as the Silicon Valley Bank tanked, borrowings were 96 times higher, at $146.4 billion.

https://fred.stlouisfed.org/series/TOTBORR

You need to get in touch with current news Mr. Rear. That boat sailed awhile back. And most of that scare (American based anyway) has subsided.

JohnH has a real talent for 2 things: (a) writing so much BS he contradicts himself, and (b) writing claim he cannot back up.

Little Jonny used to tell us how incredibly and shamefully high mortgage rate were but now this flip flop chef (IHop is hiring) he wants us to applaud high interest rates.

So little Jonnny declares that the real mortgage rate is negative. Oh wait – the nominal rate is around 6.3% and Dr. Chinn’s lates on inflation put it at 4%:

https://econbrowser.com/archives/2023/03/pce-inflation-for-february

Wait, wait, wait – Jonny boy wants to say that the after-tax real rate is negative. Really?

Let’s see 6.3%(1 – tax rate) is less than 4%? Not if the tax rate is only 30%. Now if the tax rate were 40% then maybe.

Now as stupid as Jonny boy is, maybe he is paying a 40% tax rate. Otherwise the arithmetic does not work out. Oh wait – little Jonny boy flunked preK arithmetic. Now I get it!

How pgl relishes misrepresenting what others say…but he never provides citations, which would only reveal his BS.

When did JohnH ever claim that mortgage rates were shamefully high? In fact, at 6.3%, they are barely above inflation (6.0%). After tax mortgage rates are well below inflation—IOW negative real rates. A helluva deal!

Now compare that to how small savers are faring. With deposit yields under 1% (-5% in real terms), their assets are losing purchasing power. To add insult to injury, their paltry earnings are taxable. Talk about getting screwed! And this has been going on for more than a decade!

Yet pgl and many other mainstream economists advocate even lower rates and glibly ignore the harm being done to the tens of millions of Americans trying to save for a down payment, for their kids’ college education, and for retirement.

Despite these significant issues, pgl and other mainstream economists can only rarely even acknowledge that there are downsides to low rates! In fact they have no problem advocating for lower rates, whose immediate and significant effect is to raise profits of banksters and prices of stocks, which are mostly held by the wealty.. It seems pretty obvious that mainstream economists know which side their bread is buttered on!

Oh, for goodness sake! Johnny has done it again! He has identified one of the main issues in monetary economics over the past two decades – longer if we don’t ignore Japan – and claims economists “rarely even acknowledge” that issue. Here we go:

“…pgl and other mainstream economists can only rarely even acknowledge that there are downsides to low rates!”

Johnny must take perverse satisfaction in being wrong. It’s hard to believe that someone could be wrong as often as Johnny at random. Here’s a tiny taste of what economists have had to say about low rates – truly tiny relative to the entire literature:

https://read.oecd-ilibrary.org/finance-and-investment/the-economic-impact-of-protracted-low-interest-rates-on-pension-funds-and-insurance-companies_fmt-2011-5kg55qw0m56l#page1

https://www.imf.org/en/Publications/fandd/issues/2020/03/what-are-negative-interest-rates-basics

https://www.imf.org/en/Blogs/Articles/2021/03/03/blog-the-evidence-is-in-on-negative-interest-rate-policies

https://www.frbsf.org/economic-research/publications/economic-letter/2021/august/how-do-low-and-negative-interest-rates-affect-banks/?amp=1

https://cepr.org/voxeu/columns/impact-negative-interest-rates-banks-and-firms

https://link.springer.com/article/10.1007/s10368-022-00547-4

https://ideas.repec.org/b/wfo/wstudy/67204.html

https://www.adb.org/publications/implications-ultra-low-and-negative-interest-rates-asia

Anyone interested to know the facts can find thousands more examples other internet, in academic journals, college syllabi and so on. Johnny can only be this wrong because he doesn’t care to know, or because he’s willfully lying.

Oh, do be aware that Johnny’s fallback position in cases like this is to change his claim, saying that the potential harm of negative rates, or whatever, didn’t make it into the popular press. Two things: 1) economists don’t run popular press outlets; 2) don’t make me prove that the downside to low rates regularly made it into the popular press! I can do it. You know I can.

But, really, should I have to? Readers here presumably read economics in the popular press. Y’all know this, right?

Impressive reading list. Permit me to reproduce just one abstract:

Policy rate cuts in negative territory have increased credit supply and improved the macroeconomic environment similar to cuts in positive territory. Dreaded disruptions to the monetary policy transmission channels as well as adverse side effects on bank profitability have so far largely failed to materialise. Thus, the evidence available today shows that the negative interest rate policy is an effective policy tool. However, systemic risks, including in the non-bank sector, should be closely monitored as negative rates are expected to remain low for longer.

Whoops – sort of contradicts many of Jonny boy’s rants.

But suppose we wanted both full employment in the Euro area and higher interest rates. They are ways to accomplish both but that would require the European fiscal authorities to stop pursuing fiscal austerity.

Oh wait – little Jonny boy routinely argues against fiscal stimulus as he fears the D word – DEFICITS. Eeeeek!

I see – Jonny boy caught in his serial contradictions practices deny, deny, deny. Your comments are worthless. Your denials are dishonest and hollow. Do us all a favor – find a different blog to pollute. Princeton Steve needs readers.

“After tax mortgage rates are well below inflation”. Dr. Chinn noted inflation is 4% and not 6%. Another blog post Jonny boy forgot to read. Now with the correct figures, Jonny boy flunks preK arithmetic. Surprise, surprise, surprise!

“In fact, at 6.3%, they are barely above inflation (6.0%).”

This is clearly an incorrect statement. Is Jonny boy lying again or is he really this effing STUPID. If you borrowed long-term at a nominal rate = 6.3%, the calculation of real rates never takes past inflation but inflation going forward. Everyone knows that except for village idiot JohnH I guess.

Now I used the recent 4% inflation rate as one proxy for inflation for the next year. Some would say that is an overestimate. But I guess Jonny boy has some magic crystal ball that says expected inflation is his stupid 6%.

But wait we have a market measure for expected inflation over the next 30 years and the market is telling us that expected inflation = 2.3% not 6%. But what does the market know? Jonny boy has declared we will have 6% inflation for the next 30 years. Jonny has spoken.

Ya gotta love this one! ” the market is telling us that expected inflation = 2.3% not 6%.” Yes, indeed. That’s what the market is saying. And it has been incredibly wrong for years now. Yardeni compares inflation to TIPS breakeven. LOL!

https://yardeni.com/pub/expectinflat.pdf

Funny how the peddlers of bad forecasts rarely tell us how they performed.

Hey little Jonny boy – check out the latest post dedicated to your little claim about after tax real mortgage rates. It seems our host used the market measure and not your stupid backward looking measure. Now I dare you to call Dr. Chinn stupid. ai dare you!

Jonny boy claimed Dr. Chinn did not cite his sources of data? Oh yes – he did little Jonny boy.

Dr. Edward Yarden would be insulted that you abused his information to spin your lies. It seems for the most part the forecast errors were not biased or that large. Yea recently inflation went above expected.

OK Jonny boy – please point to your superior forecast model that accurately forecasted inflation. Oh – you can’t because you have no clue how to forecast what you are eating for dinner.

“Funny how the peddlers of bad forecasts rarely tell us how they performed.”

Back in the adaptive expectations days (whoops I just went past little Jonny boy’s knowledge) people were using past inflation to forecast future inflation. And then came Rational Expectations (back about 50 years ago but little Jonny never heard of that). The only stupid enough to do adaptive expectations now is little Jonny boy.

OK big shot – use your pathetic model to forecast inflation. I’ll bet the ranch your forecast errors would be massive.

“And it has been incredibly wrong for years now.”

20 years of data and only in the last couple of years has actual inflation been above expected inflation. And guess what – the most recent measures of actual inflation have it near this market measure of expected inflation.

Look little Jonny can write such bozo sentences only because no one ever expects this fool to get our of preK.