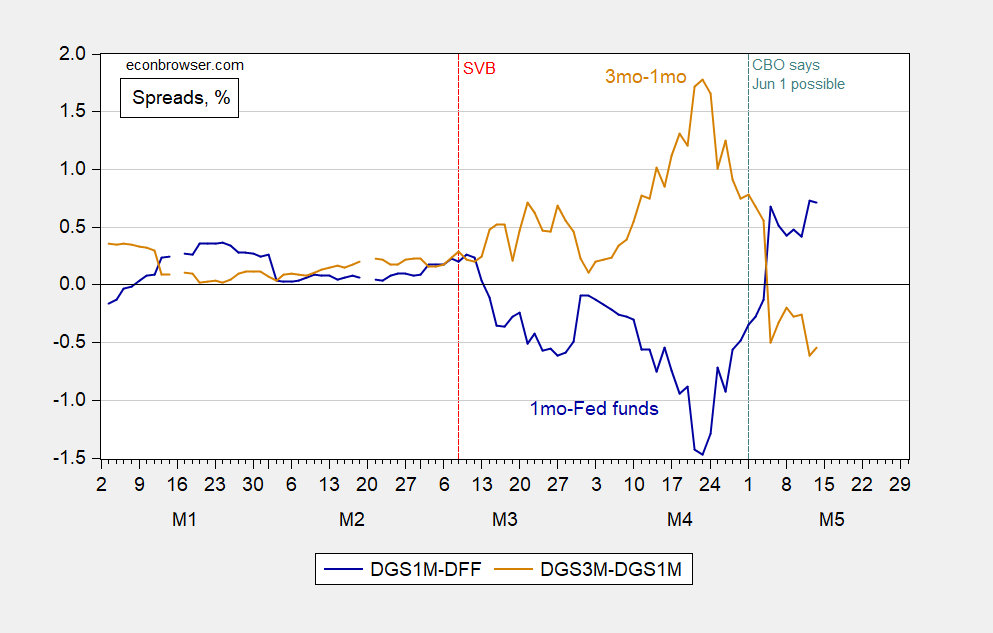

Inversion on the second, as the first rises, as likelihood of June 1 default rises.

Figure 1: 1 month Treasury – Fed funds spread (blue), and 3 month – 1 month Treasury spread (tan), both in %. Source: Treasury and Fed via FRED, and author’s calculations.

I interpret the rise in 1 month to Fed funds spread as an indication of risk associated with default.

For CDS spreads, see this post.

Gary Gensler is making waves as head of the SEC. He wants to regulate crypto-currencies, reduce hedge fund fees and reform stock and Treasury trading:

https://www.bloomberg.com/news/articles/2023-05-02/sec-s-gensler-blasts-hedge-fund-fees-as-agency-readies-new-rules

https://www.lexology.com/library/detail.aspx?g=220fe55c-d61a-469a-86f7-f0dec4f11646

https://www.politico.com/news/2023/05/12/jon-stewart-remake-stock-market-sec-00095526

You pick Gensler, you get action. It’s how you know a politician is serious about making the financial system fair and stable. Sarbanes picked him. Obama picked him. Biden picked him.

Huge Gensler fan here. He’s certainly better than most to fill that post. You can tell you got a good one when they start ruffling feathers.

There’s a rumor he’s a member of “the tribe” as well. You know, one of those guys that likes to eat “bubby” style potato pancakes. Ssssshhhh!!!! It’s our secret.

Off-topic

Highly recommended weekend (or whenever) viewing. AND IT’S FREE!!!! Want to spend 1-and-1/2 hours watching something great from your bed or lounge chair but not really “vegetating”, but massaging lightly the brain muscles?? Here is the one. What a great person. Tyrus Wong

https://www.pbs.org/wnet/americanmasters/tyrus-about-the-film/8917/

The Indomitable Spirit = Tyrus Wong If you have any empathy in your soul at all, you will feel this man’s arduous journey inside of you.

https://fred.stlouisfed.org/series/USGSEC

Treasury and Agency Securities, All Commercial Banks

Commercial banks hold $4 trillion in government bonds. If there is a debt default – one concern would be what happens to the market value of these bank assets.

Ever try to play “Who blinks first” with 222 people simultaneously down at the local insane asylum??

I completely agree that the current changes are due to default risk. This also point to why it is important to not just blindly using a specific index based on specified data to predict the future (or explain the present). Sometimes a data series has abnormalities caused by a rare event – that then throws a kink into the index. None of which would indicate what it may normally indicate. So even as you develop rules and understandings of how things normally work, beware of when the “this time is different” moniker is actually worth considering.

I thought this thread was the most appropriate place to put this. Thought it was interesting:

https://cepr.org/voxeu/columns/extraordinary-generosity-central-banks-towards-banks-some-reflexions-its-origin

“It is difficult to understand how regulators designed such a caricature of liquidity management. The common sense dictated that they would reactivate the only sound instrument of liquidity control, i.e. reserve requirements at the central bank. They did not do so, obsessed as they were about not damaging the efficiency (and the profits) of the banking sector. This also seems to be an example of capturing of the regulators by banks that want to have their cake and eat it – they want to have liquidity and make profits. The holdings of truly liquid assets should not be profitable. Here also there is a trade-off – between liquidity and profitability. Assets that are very liquid are not profitable; assets that generate profits are not very liquid.

By remunerating bank reserves, the central banks eliminated the trade-off between liquidity and profitability for the banks. In doing so, they created a land of plenty for the banks. They made it possible for banks to hold highly liquid risk-free assets and make a lot of profits. The rate of remuneration on bank reserves at the Fed (5.15%) is now (May 2023) substantially higher than the yield on 10-year US government securities (3.4%). Also, in the euro area, banks can earn more on their bank reserves (3.25%) than on 10-year German government bonds (2.25%). An extraordinary act of generosity towards bankers, at the expense of taxpayers and the stability of the financial system.”

“The rate of remuneration on bank reserves at the Fed (5.15%) is now (May 2023) substantially higher than the yield on 10-year US government securities (3.4%). Also, in the euro area, banks can earn more on their bank reserves (3.25%) than on 10-year German government bonds (2.25%). An extraordinary act of generosity towards bankers, at the expense of taxpayers and the stability of the financial system.”

here is where I get a little cranky about folks who talk like this. so which is wrong, the 5.15% rate dictated by the fed or the 3.4% dictated by the market? and which would you change? and how would you change it? and how would it impact the world?

this talks almost like there is a conspiracy in play. I don’t buy that.