Going back to intro macro, remember when we quickly impose the equilibrium condition Y=AD? What does it mean that Y doesn’t equal AD? Here’s a quick reminder.

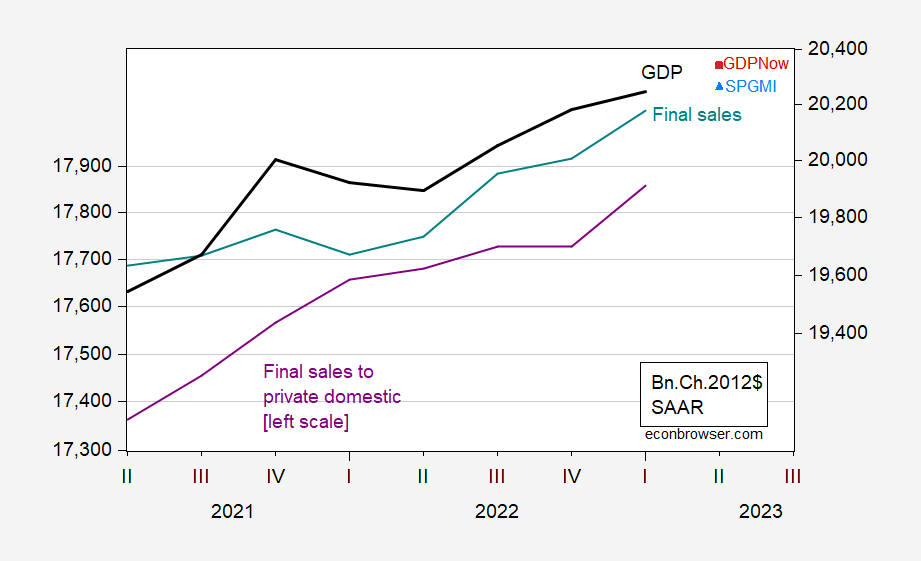

Aggregate Demand (AD) is typically measured by Final Sales. Income or output (Y) can be measured by the expenditure side or income side. The conventional picture is AD and GDE, shown in FIgure 1 below.

Figure 1: GDP (black, right log scale), final sales (teal, right log scale), final sales to private domestic purchasers (purple, left log scale), all in billions Ch.2012$ SAAR. Source: BEA 2023Q1 2nd release.

The difference is inventory accumulation/decumulation. If all the inventory change is desired, then final sales is a good measure of aggregate demand. The most recent reading indicates rapid growth for final sales, at 3.4% vs. 1.3% for GDP (SAAR). Final sales includes sales to foreign purchasers, and subtracts imports. A conjectured superior measure of domestic private demand is final sales to non-government domestic purchasers; this series is not necessarily more stable (the growth rate has a higher standard deviation than final sales). This series grew 2.9% in Q1.

Stressing Y (which can be measured in various ways) vs. final sales highlights that aggregate demand can deviate from income. As best we can tell, demand is still growing.

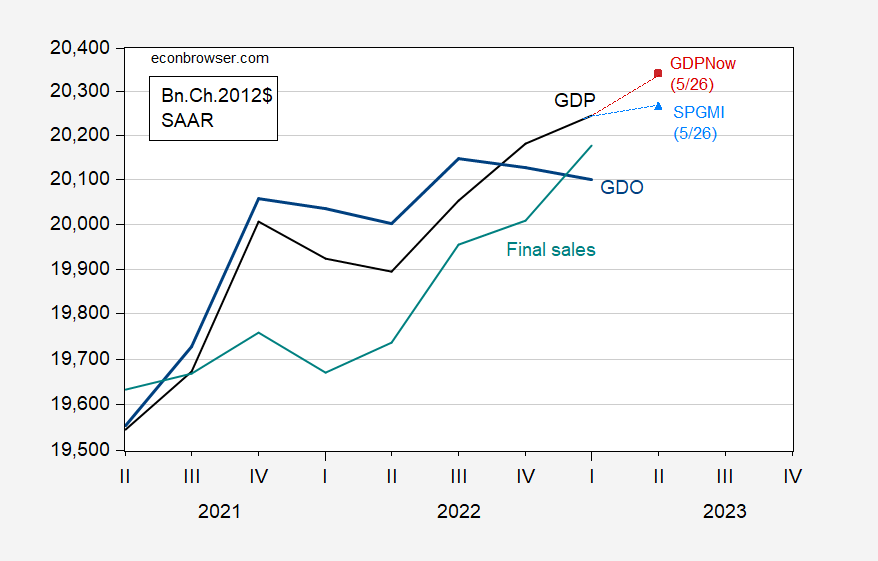

Figure 2: GDP (black), GDPNow (red square), SPGMI GDP tracking (sky blue triangle), GDO (bold blue), final sales (teal), all in bn. Ch.2012$ SAAR. Source: BEA 2023Q1 2nd release, Atlanta Fed, SPGMI.

If one literally believed GDO as output (see discussion here of GDO vs GDP+ vs GDP) and final sales as aggregate demand, then demand would seem to be strong. However, GDO (as the average of GDP and GDI) is not going to be constructed in a manner consistent with the calculation of final sales – after all, final sales is just Gross Domestic Expenditure (which we call GDP) minus inventory accumulation. If the biggest measurement error were in C, fixed I, and G, then one might think final sales looked more like GDO minus inventory investment.

As it is, inventory investment is a highly volatile component of GDP. Over the last business cycle (2009Q2-19Q4), the standard deviation of inventory accumulation was about the same as the standard deviation of GDP (in billions of Ch.2012$) – 60bn vs 62bn Ch.12$ SAAR. Unfortunately, I don’t know how big revisions to inventories are in recent times; the last study I found is Howrey (REstat 1984).

In any case, I think it useful to consider our best estimates of both output/income and aggregate demand, when thinking about where the economy is going.

“Unfortunately, I don’t know how big revisions to inventories are in recent times; the last study I found is Howrey (REstat 1984).”

Doesn’t this strongly imply this would make a great research topic/paper some 39 years later?? Just asking. Either that or Menzie needs a new browser.

Here’s a ’92 paper I found while looking for a non-paywall version of the paper Menzie mentioned:

https://deepblue.lib.umich.edu/bitstream/handle/2027.42/30214/0000604.pdf%3Bsequence=1 <<—-only 8 pages long

Maybe not specific to revisions, but was just scouring over inventory papers on Google. Alan Blinder seems to have done a ton of papers on inventories. With a couple impactful ones around 1986.

A classic from Blinder’s Princeton colleague:

https://academic.oup.com/qje/article-abstract/66/4/545/1938624?redirectedFrom=fulltext&login=false

“The Transactions Demand for Cash: An Inventory Theoretic Approach” William J. Baumol

The Quarterly Journal of Economics, Volume 66, Issue 4, November 1952

I DL’ed it. I found a free version on NYU site. Of course I had to get it because Baumol co-authored the textbook I studied in college. I used to hitchhike on a dirt road to the local university and Walter Brennan would pick me up in his wagon. Those were the days. No burnt gasoline pollution from those wagons.

I was just scatterbrained thinking while running through these inventory investment papers, that if Kuznets was still alive, he’d have solved this dilemma of the herky-jerky inventory numbers by now. I’d go to Vegas and bank on it that he would have anyway. Dude was amazing.

The contributions of Kuznets are very underappreciated.

This seems like an interesting one. Could give a jump or lead ahead of the number or even a revision of a number, I would think. I think our gracious Prof Hamilton has been known for awhile now as a fan of “News Event Studies”

https://www.econstor.eu/bitstream/10419/217035/1/cesifo1_wp8284.pdf

https://www.msn.com/en-us/news/politics/mccarthy-s-next-challenge-sell-debt-ceiling-deal-in-congress/ar-AA1bNhGH?ocid=msedgdhp&pc=U531&cvid=a0238183db01495ac410e8fc88f31f6f&ei=11

After tough negotiations to reach a tentative deal with the White House on the U.S. borrowing limit, the next challenge for House Speaker Kevin McCarthy is pushing it through the House, where it may be opposed by both hardline Republicans and progressive Democrats. As Democratic and Republican negotiators iron out the final details of an agreement to suspend the federal government’s $31.4 trillion debt ceiling in coming days, McCarthy may be forced to do some behind-the-scenes wrangling.

Almost there even though Marjorie Taylor Greene will do her best to screw this up.

Kevin Drum is on fire today. First blog post contains some sage comments on Vehicle Miles Traveled that you will never see on Princeton Steve’s worthless blog:

https://jabberwocking.com/commuters-are-back-on-the-commute/

Kevin Drum gives us what little we know so far about the debt ceiling deal:

https://jabberwocking.com/debt-ceiling-deal-cuts-domestic-spending-about-5/

The reporters note that defense spending was exempt from any spending limitations and SocialSecurityMedicare were not touched either. The rest of domestic spending will be frozen in nominal terms which means significant real cuts.

But let’s get serious – nominal spending on defense will continue to rise and given the total inaction on taxes means Kevin McCarthy just agreed to deficits for the next several years.

Now I bet little CoRev is begging McCarthy to let little CoRev help write the bill. But it seems the Speaker wants this stupid troll to get out of his damn way so he can declare victory.

Wow! From the vehemence of your comment you preferred no debt ceiling negotiations?

The cobwebs in this head and the emotional insecurities are an amazement. 😉

WTF? I guess who have decided that you are JohnH Jr. Come on CoRev – try writing your little paper on soybean economics.

Well, that what a partisan weasel might read into pgl’s comment.

McQuack and Ole Bark bark, failing to pass seems to be your last best hope of debt ceiling failure. (NOTE: that does not mean default).

Looks into these sick, angry and denying minds is an amazement.

10 or 15 republicans need to vote with McCarthy

https://www.bbc.com/news/world-europe-65732194

Turks have finished voting in a historic presidential run-off to decide whether or not Recep Tayyip Erdogan should stay in power after 20 years. His challenger Kemal Kilicdaroglu, backed by a broad opposition alliance, called on voters to come out and “get rid of an authoritarian regime”. The president, who is favourite to win, promises a new era uniting the country around a “Turkish century”. But the more pressing issue is rampant inflation and a cost-of-living crisis.

Inflation soared under Erdogan’s watch but some of Erdogan’s supporters think only Erdogan can fix the problem. How dumb are these people? Oh – as dumb as our idiots who wear MAGA hats.

The problem Kevin McCarthy has is that he is the weakest Speaker in history. He needed 15 rounds of voting to get his job and in turn had to make a concession to a new rule that allows any single member to require a vote for his removal. This means McCarthy is beholden to the demands of the 438th craziest member of Congress — and there’s a lot of contenders for 438th!

The White House has reportedly been working with House Democrats to round up as many as 100 votes to get the debt ceiling bill passed.

So what happens to Mccarthy? Is he really going to risk his gavel? I never believed he would, but that seems the logical outcome of using Democratic votes to pass the bill over the objections of House nutsos.

What ever happened to that Problem Solving Caucus?

After all I was always told that the MAGA morons who would undermine this deal were a small part of the GOP presence. If 100 Democrats shallow their price and vote for this, McCarthy could at least to deliver 120 Republicans.

The nutsos will never be able to get a majority behind any alternative to McCarthy. Sure they can make a big stink and force a vote – but the reality will be that the deal will pass and McCarthy will will be forced through a dozen rounds of voting before he remains one of the weakest speakers in history. This will probably be seen as one of the most brilliant moves of many brilliant moves in Biden’s first term.

McQuack, Ole Bark, bark and Ivan what part of bipartisan is such anathema to PARTISAN liberals? Doing what is good for the entire country’s economy seems to go against your US hating wishes.

Many conservatives realize your anger is due to self loathing, because you realize (but can’t admit) that your policies are abject failures. Otherwise that list of successful progressive/Biden policies would be readily available.

The angry, self loathing, denying liberal mind is an amazement.

Slightly good news on the gasoline front:

https://www.nasdaq.com/articles/column-u.s.-refinery-margins-set-to-remain-high%3A-kemp-0

LONDON, May 19 (Reuters) – U.S. oil refinery margins have halved since the middle of 2022 but they are still at historically high levels and will be supported through the summer of 2023 by high operating rates and low fuel stocks. Gross margins for producing two barrels of gasoline and one barrel of distillate fuel oil from three barrels of crude have retreated to $33 per barrel from a record $60 at the start of June 2022. Even at this reduced level, however, margins are in the 95th percentile for all trading days since 2001, which is underpinning refinery profitability and encouraging high levels of capacity utilisation. After adjusting for the impact of inflation, real margins are at the highest levels for almost eight years since July 2015. Gross margins have to cover operating expenses, including fuel, electricity and catalysts, as well as labour and capital costs.

Gasoline prices include more than the cost of oil and in fact at current prices, oil prices contribute just over half of the price of gasoline. Refinery cost represent 22.6% of the price of gasoline according to that informative gasoline pump provided by the EIA,

The ink on the debt ceiling deal has not dried and the extremists on both sides are very unhappy:

https://www.yahoo.com/finance/news/mccarthys-next-challenge-sell-debt-060223850.html

Members of the hardline House Freedom Caucus said they would try to prevent the agreement from passing the House in a vote expected on Wednesday. “We’re going to try,” Representative Chip Roy, a prominent Freedom Caucus member, said in a Sunday tweet. But McCarthy dismissed threats of opposition within his own party, saying “over 95%” of House Republicans were “overwhelmingly excited” about the deal. “This is a good strong bill that a majority of Republicans will vote for,” the California Republican told reporters in the U.S. Capitol. “You’re going to have Republicans and Democrats be able to move this to the president.” To win the speaker’s gavel, McCarthy agreed to enable any single House member to call for a vote to unseat him, potentially making him vulnerable to ouster by disgruntled Republicans. The speaker said he was “not at all” concerned about that possibility. Republicans control the House by 222-213, while Democrats control the Senate by 51-49. These narrow margins mean that moderates from both sides will have to support the bill, if the compromise loses the support of the far left and far right wings of each party. “I’m not happy with some of the things I’m hearing about,” Representative Pramila Jayapal, who chairs the Congressional Progressive Caucus, told CNN’s “State of the Union.” House Democratic leader Hakeem Jeffries said he expected Democratic support for the deal on CBS’s “Face the Nation,” but declined to estimate how many of his party members would vote for it.

Little Lindsey Graham wants even MORE defense spending and less taxes along with a balanced budget:

https://www.msn.com/en-us/news/politics/graham-blasts-defense-spending-in-debt-ceiling-deal-as-a-joke/ar-AA1bNCuq?ocid=msedgdhp&pc=U531&cvid=fc7d8a386fd64cfdb73bbd85d965254e&ei=10

Lindsey Graham (R-S.C.) took aim at the defense spending proposed in the debt ceiling deal, saying on Sunday that adopting what he labeled as President Biden’s defense budget would be a “joke.” “I want to raise the debt ceiling, it would be irresponsible not to do it,” Graham told Shannon Bream on “Fox News Sunday.” “I want to control spending, I’d like to have a smaller IRS, I’d like to clawback the unused COVID money. And I know you can’t get to perfect, but what I will not do is adopt the Biden defense budget and call it as success.”

Seriously did little Lindsey flunked first grade arithmetic. Hey Lindsey- what’s 2 plus 2? DAMN!

What Graham has said, after all the extra words are removed, is “When a version of Biden’s military spending plan passes, I won’t say nice things about it.” I tremble at the thought.

Little Lindsey ala 1998 – I got Clinton on a blow job. Impeach him. Little Lindsey now – serial adultery and even rape are fine as long as the President is a Republican who only committed treason. The Rule of Law my rear end.

For kicks I Googled aggregate demand and national income and Dr. Chinn’s post was the 2nd result. Here is the 1st result which is not a bad explainer:

https://www.khanacademy.org/economics-finance-domain/ap-macroeconomics/national-income-and-price-determinations/aggregate-demand-ap/a/lesson-summary-aggregate-demand

Menzie, I read a relatively sharp private economist, we might call him “semi-retired” and he says it is highly probable inventories will rise over the next few quarters. Does that stand to reason?? (I understand you are always busy, so I never take offense if you don’t answer these, you can’t blame a lazy guy for trying can you??)

Until Menzie replies, I’ll chime in. First, inventories rise in most periods, because the economy grows in most periods. However, whether inventory growth will add to GDP strikes me as a tricky question:

https://fred.stlouisfed.org/graph/?g=15C1Z

Retailers are light on inventories, by historical standards, manufacturers heavy and wholesalers just about normal. A three bears arrangement.

Put the three together and inventories are roughly normal, but that doesn’t mean one of those two imbalances won’t drive inventories’ contribution to GDP in the short run – but which direction?

https://fred.stlouisfed.org/graph/?g=15C30

Inventories are cyclical, so if demand slows, inventories will follow, and will be a drag, even to the point of inventories falling outright. So one’s view of the growth outlook strongly determines one’s expectations for inventories; ask you economist for his growth forecast. The carrying cost of inventories is also, in theory, a driver of inventory levels and carrying costs are high, but as I understand it, there isn’t strong empirical support for that. Cyclical effects, including demand and profits, apparently overwhelm carrying costs.