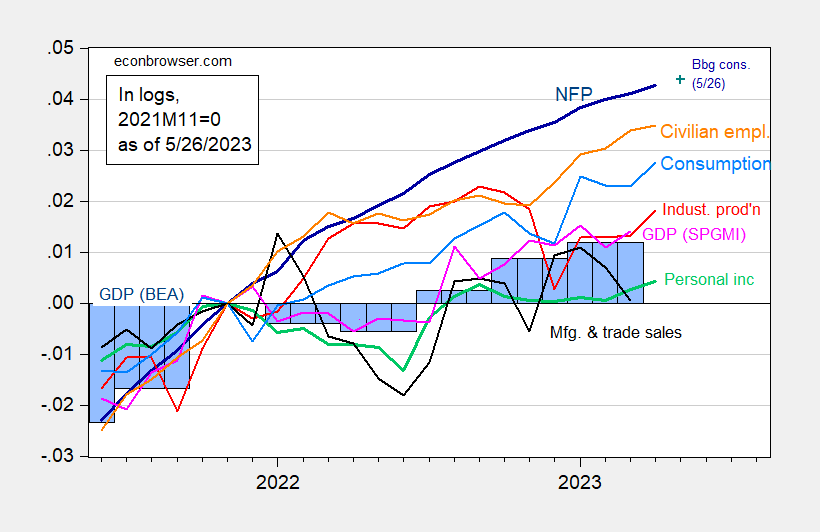

Monthly indicators of employment, consumption, personal income (ex-transfers) are all rising in April. But GDO and GDP+ show a decline for 2022Q4 and 2023Q1.

Figure 1: Nonfarm payroll employment, NFP (dark blue), Bloomberg consensus of 5/26 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Bloomberg consensus level calculated by adding forecasted change to previous unrevised level of employment available at time of forecast. Source: BLS, Federal Reserve, BEA 2023Q1 2nd release via FRED, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (5/1/2023 release), and author’s calculations.

Given the NBER Business Cycle Dating Committee’s emphasis on employment and personal income, one would be fairly confident that no recession was in place as of April 2023, of course keeping in mind all these numbers will be revised over time. GDP in particular will be revised numerous times so an increase in this series would not be decisive in ruling out a recession (just as the decline in 2022Q1-Q2 would not be decisive in ruling in a recession).

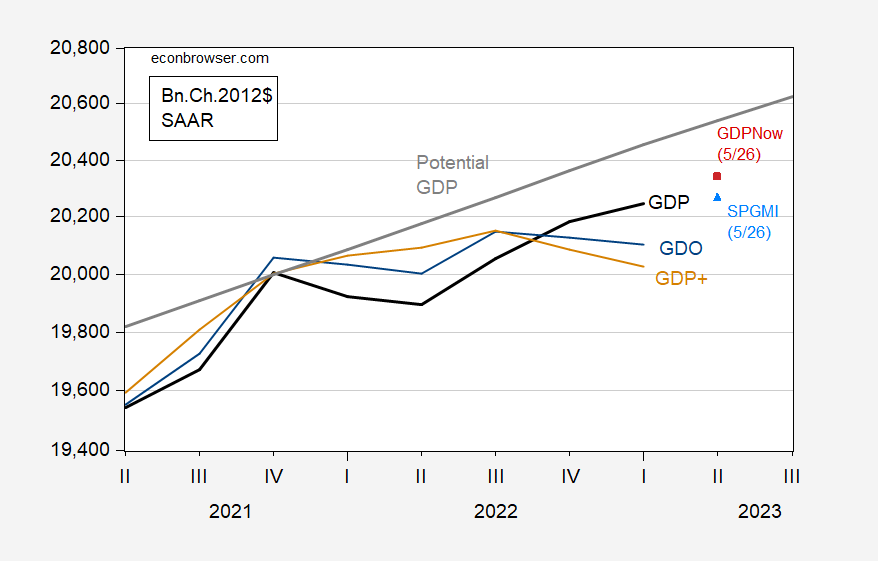

We know that reported GDP is actually not the best indicator of where GDP will eventually be revised to. GDO and GDP+ are two series are more likely to fulfill that condition. Here, we see some troubling signs.

Figure 2: GDP (black), GDO (blue), GDP+, scaled to 2019Q4 (tan), potential GDP (gray line), GDPNow of 5/26 (red square), SPGMI tracking of 5/26 (sky blue triangle) in bn.Ch.2012$ SAAR. Source: BEA, Philadelphia Fed, CBO (February 2023), Atlanta Fed, S&P Global Market Insights, and author’s calculations.

While GDP was revised up to 1.3% SAAR, GDO (the average of GDP and GDI) and GDP+ are at -0.5% and -1.2% SAAR, respectively. As Jason Furman has noted, the discrepancy between GDP and GDI is very large, highlighting the uncertainty we face discerning how economic activity trending. This shows up in a discrepancy in the bean counting exercises, with GDPNow at 1.9% SAAR, but SPGMI (formerly Macroeconomic Advisers and IHS Markit) at 0.4% — essentially zero.

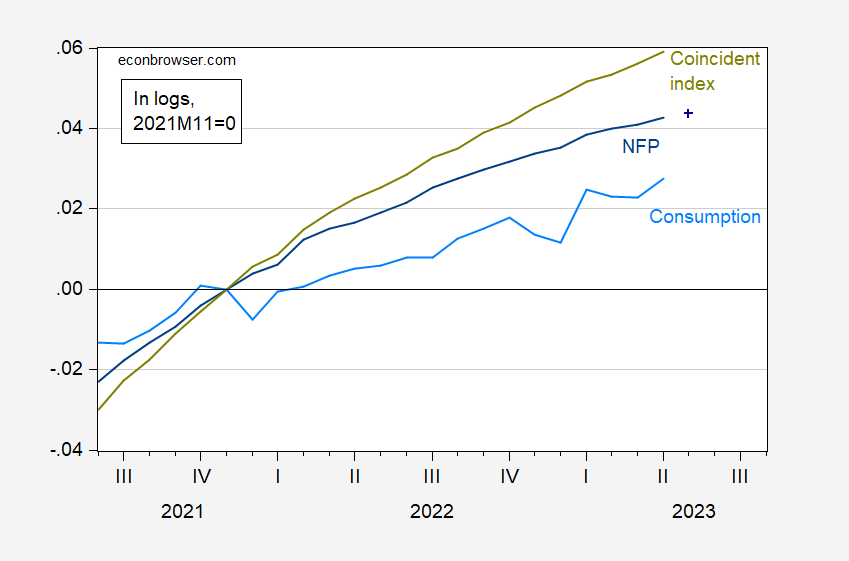

As Furman notes, if GDP and GDI were the only series we observed, we’d look to GDO. But, to stress again, we have lots of evidence regarding the strength of the labor market. One summary measure is the Philadelphia Fed coincident index for the US. In Figure 3, I show the coincident index, compared to nonfarm payroll employment, and to consumption.

Figure 3: Coincident index (chartreuse), nonfarm payroll employment (blue), Bloomberg consensus of 5/26 (blue +), consumption (sky blue), all in logs, 2021M11=0. Source: Philadelphia Fed, Bloomberg, BLS and BEA via FRED, and author’s calculations.

The coincident index is based on mostly labor market indicators, and has continuously increased, even during 2022H1, when some observers argued that a recession had arrived. Consumption, which is mostly sustained by salary and wage payments, has also largely risen over the last year and half, and suprised on the upside in April.

So, in sum, uncertainty reigns!

Rats! I’m too slow!

Here’s what I cobbled together on the same subject:

The second release of Q1 national accounts data shows real Gross Domestic Income fell 2.3% (SAAR), with the average of real GDP and GDI fell 0.5% (SAAR):

https://fred.stlouisfed.org/graph/?g=15wmo

That’s two quarters of decline in a row for both series, while real GDP has risen in each of the last three quarters.

Meanwhile, today’s data have knocked the Atlanta Fed’s Q2 GDPNow estimate down to 1.9% from a prior 2.9%, due to reduced numbers for net exports and investment – not a surprise, really. That 1.9% estimate has a lot of adjustment still to come, adjustment which could go either way, For now, that’s a bit better than the growth rate of potential.

https://www.atlantafed.org/cqer/research/gdpnow?panel=3

For those curious about real GDI in Q2, we have real person income data for April as a start. Real income fell slightly, all because of a decline in transfers. Real personal income excluding transfers rose at a 2% rate (SAAR), the fastest in any month since last September:

https://fred.stlouisfed.org/graph/?g=15woE

Given that output leads inflation, and output has been slowing in two of three aggregations of national output, the Fed has reason to expect inflation to continue cooling, despite a one-month pick-up.

And we wonder how people like “ltr” = Let Tyranny Reign arrive on this blog long since braindead:

https://www-qstheory-cn.translate.goog/dukan/hqwg/2023-05/26/c_1129646686.htm?_x_tr_sch=http&_x_tr_sl=zh-CN&_x_tr_tl=en&_x_tr_hl=en-US&_x_tr_pto=wapp

Gack! How can anyone write like that? It reads like bad ad copy.

In fairness, the author (single person I believe) can’t be completely blamed for that, as it was a Google translate version. But still, even with the gist intact it seems rather insipid. Many of the ideas expressed seem empty and based on circular logic (or circle jerk logic). Part of it seems borderline racist, but I suppose that takes some nerve for an American to say (me or whoever) based on all of America’s blathering on about “American exceptionalism”, so I suppose we are nearly as guilty as China’s Government on that front.

The current situation can be broken down into 2 quite different looking components; one focusing on goods, the other services:

(1) real personal consumption of services and services employment, still rising strongly, plus real GDP, still rising; and

(2) goods (industrial) production, real sales (retail and manufacturing and trade), real personal consumption of goods, GDI and GDO, all down from recent peaks, plus real income less transfer receipts (only 0.1% above its previous peak last September) and goods employment (only up 0.2% since January).

Both of the last two could easily get revised below their prior peaks, and in fact real personal income for the past 6 months was revised down sharply in this morning’s report. While it isn’t that likely, if it were to happen, only the NBER knows if they would stick with nonfarm payrolls or else name January as the cycle peak.

In that regard, the record going back 50+ years shows that when all three coincident indicators of industrial production, real income less transfer receipts, and real manufacturing and trade sales, have been at their current YoY levels, a recession has *always* already been underway.

The “recession” had better hurry, or someone will start looking like a jackass. Someone’s thoughts back in December:

https://econbrowser.com/archives/2022/12/gs-recession-watch-odds-at-35#comment-290425

“Every single one of my 7 long leading indicators, which forecast 1 year out, is negative, and have been negative for months.

I have about 2 dozen short leading indicators. Only a very few – initial claims, new factory orders, durable goods orders, manufacturing jobs, and housing units under construction – are not negative. Of these, the most important – initial claims – looks likely to turn negative YoY with several weeks to 2 months.

The coincident indicators are worsening almost every week, especially as to employment. I’ve previously mentioned tax withholding, which worsened again this week. As I forecast this morning, the poor tax withholding over the past three months correctly forecast (yet another) negative number in the household jobs survey. The temporary staffing index looks likely to turn negative within 2 weeks.

I don’t think we’re in a recession now, but I don’t think we’ll have to wait for Q3 2023 either. I suspect we’ll roll over most likely in Q1. I would watch manufacturing production in the industrial production report. If initial claims turn up YoY and that turns down, that’s likely the turning point right there.”

I’m sorry, New Deal Democrat, factual errors while being vehement in assertions has dropped drastically here on the blog since roughly mid-January, and I just had to scratch the itch.

Thanks for citing my January comment. It gave me a chance to go back and update. Let’s take a look at the short leading indicators that I said hadn’t turned negative yet:

– initial claims – has turned negative

– new factory orders – has turned negative

– durable goods orders – just made a new high

– manufacturing jobs – turned negative, then revised higher by 3,000 last month

, housing units under construction – has turned negative

In re “I would watch manufacturing production in the industrial production report. If initial claims turn up YoY and that turns down, that’s likely the turning point right there”

Manufacturing production has turned negative YoY ever since February

The 4 week average of initial claims has been higher YoY consistently since the beginning of March.

I went back and checked. With the exception of autumn 1989 and most of 2019, in the past 50+ years, this situation has only occurred during or just before recessions.

On the coincident indicators, temporary staffing turned down at the beginning of February and has been negative ever since. Redbook consumer spending continued to decelerate and has been up only about 1.5% *nominally* for the last 7 weeks. The bright spot has been tax withholding, which abruptly stopped declining in January and has been positive, with the exception of the month of April, ever since. That may have to do with a big increase in stock options vesting this year vs. last year.

I’m not seeing any factual errors as to the data I cited. The conclusion could certainly be wrong. After all, no system is perfect.

But as indicated above, most of the data has indeed worsened since January. I suspect the economy is still benefitting from gas prices now vs. one year ago, plus a continued shortfall in jobs compared with increased demand for services.

I am glad I helped you scratch your itch.

@ New Deal Democrat

I fairly strong retort. A pretty strong retort. You’ve done a man’s job in the sense you’ve almost left me speechless.

See, you don’t know how to do this the “proper” way like Barkley Rosser did. You’re supposed to include some sharp personal remark towards me, based on conjecture of my IRL daily situation, and unrelated to my original offensive. You’ve sucked the life out of this whole exercise.

[ joke ]

Oh.

In that case please consider this a vitriolic, totally random, and completely irrelevant personal insult.

Hope that helps.

: )

On the subject of jobs data and revisions, I should add that the “gold standard” of employment data, the QCEW, was reported for Q4 of last year on Wednesday.

It indicated YoY employment through December of last year decelerated from 4.3% at the end of Q3 to 2.6%, and a total of 152,318,000 jobs, vs. the monthly jobs report which was up 3.2% YoY (red, left scale) at 154,535,000 jobs. The sharp deceleration in the QCEW YoY implies that, if seasonally adjusted, q/q jobs may actually have declined.

There was a similar discrepancy for Q2 that was largely resolved by a very large upward revision to the QCEW number for June. All of the 2022 QCEW data remains preliminary, so the same thing could happen again. Or Q4 nonfarm payrolls data could be revised sharply lower. (At this point the NBER casually pulls out its calendar and pencils in a meeting date well into 2024 ….)

It would be interesting to know when BCDC has meetings?? I mean like in person or Zoom conference?? How many per year? I think most people would assume quarterly, but I have no idea what the answer would be there. BCDC seems to like to keep things mysterious and only one person apparently chooses their members. That seems like an intelligent process~~one person choosing the members. I wonder how many other very minute membered committees (eight people) have a married couple there?? They want the very best people working there, and just by coincidence two of them are married to each other. Cool. Saves on mailing costs I guess.

https://econbrowser.com/archives/2023/05/x-date-estimate-june-5-or-so#comment-299419

May 24, 2023

These must be happy days for commenter —–, Xi Jinping’s China becoming more like Nazi Germany as each day passes:

Is —– short for “Let Tyranny Reign” ??

These must be happy days for commenter —–, Xi Jinping’s China becoming more like Nazi Germany as each day passes:

Is —– short for “Let Tyranny Reign” ??

These must be happy days for commenter —–, Xi Jinping’s China becoming more like Nazi Germany as each day passes:

Is —– short for “Let Tyranny Reign” ??

[ Such is racism. Such is the need to destroy a people. ]

ltr, you scum, what’s with this constant lying about racism? Moses has more experience in, and quite apparently, more affection for China than any commenter on this blog. That includes you. Your devotion isn’t to China, but rather to its self-appointed king-for-life.

The Chinese were not the target of Moses’s comment – Xi was. Xi, who practices slavery, who disenfranchised Hong Kong Chinese and is itching to disenfranchise the Taiwanese , who is snatching islands and trying to snatch millions of square miles of ocean from China’s neighbors to aggrandize himself.

And there you are, you sniveling apologist, whining and dissembling any time the truth about China shows up in comments.

No one ever links back to my comments here except ltr =Let Tyranny Reign Positively or negatively they very rarely put the permalinks up to my prior comments. And I was starting to get an inferiority complex over this. [ I was about to say that Menzie has probably been tempted to link back to my thoughts on Brexit two or three times, but let’s all try to keep Menzie’s thoughts averted from that horrid idea, shall we?? ] But ltr = Let Tyranny Reign loves my comments so much he shows me affection by highlighting my unappreciated wisdom. Do you have a snail-mail addy I can send a thank you card to Let Tyranny Reign??

Meanwhile in Europe Germany’s economy is falling as several other countries are teetering. Also consistent in comments so far is the point ” real income less transfer receipts,” so, apparently Govt transfers have been propping up the US economy. The immense growth of the Federal Debt and the ensuing fight over raising it without spending constraints has both legs and teeth.

Both the US and the EU have followed similar policies, Pandemic relief, Climate control via energy, subsidies reinforcing these policies Climate policies, and both have similar negative economic impacts, inflation, recession or threats thereof, war, and little positive results.

Why is this so hard to decipher for the liberal mind? It is an amazement.

The shortest recession on record, a rapid rise in employment and in consumption, a sharp drop in child poverty all amount to major benefits from these policies. You’re simply lying about the impact of these Covid-era government actions.

McQuack, only in the religiously zealous liberal mind does a “shortest recession on record,,… amount to major benefits”? Which Trump policies did Biden change to achieve: “….a rapid rise in employment and in consumption, a sharp drop in child poverty…”?

BTW, the Debt Limit Negotiations are over with an agreement in principle. A cursory report is that the GOP got most of what it wanted.

Now the liberal minds can start the rants on how this agreement will cause t5he next, latest. greatest economic collapse. It is an amazement.

Your defunct ChatGPT wrote that trash? You need to turn it off as it has embarrassed your entire family.

Not a single source for all your little taunts. Dude – everyone here knows you do nothing but troll. No one here trusts a word you write as we all know you are a worthless liar. Find some other blog to pollute with your stupid trash.

https://fred.stlouisfed.org/series/CLVMNACSCAB1GQDE

Real Gross Domestic Product for Germany

One would think CoRev would have checked with FRED before writing this incredibly stupid LIE:

‘Germany’s economy is falling as several other countries are teetering.’

What is hard is deciphering whether little CoRev even has a mind. Based on his worthless comments – it appears he does not.

“Pandemic relief, Climate control via energy, subsidies reinforcing these policies Climate policies, and both have similar negative economic impacts, inflation, recession or threats thereof, war, and little positive results.”

When I read such utter gibberish – I am reminded of Chris Christie’s diet which consists of massive amounts of Krispie Kreme doughnuts. After all in the minds of rightwing morons like CoRev habits such as eating healthy and working out are recipes for being really really fat. MAGA!

This brings up an important question. Haven’t Republicans told us multiple times that “uncertainty” is really bad for markets?? And yet here Republicans do what?? I feel so confused now. Always confused.

Ya know how medical insurance co-payments and deductibles are sold as ways to reduce overall health-care costs by reducing unnecessary use of medical care? Looks like that may be wrong. From a new study JAMA study out of Canada:

“These findings suggest that eliminating out-of-pocket medication costs for patients could reduce overall costs of health care.”

https://jamanetwork.com/journals/jama-health-forum/fullarticle/2805494?

So maybe it’s just insurance companies and medical care providers that benefit from out-of-pocket expenses?

I notice that real personal consumption for services, FRED series, PCESC96 shows an increase of 2.7% for April 2023compared to April 2022. This is down from the Y/Y percent change of 7.6% as of February 2022 compared to February 2021.

The April 2023 Y/Y percent change for services of 2.7% compares to the March 2023 Y/Y percent change of 2.5%. So perhaps the monthly Y/Y percent change for services has stabilized. I think Macroduck made a similar observation in a past post.

Real goods consumption, FRED series DGDSRX1 is up 1.5% for April 2023 compared to April 2022. The Y/Y percent change has increased since the March 2022 percent change from March 2021. The March 2022 percent change from March 2021 was (7.6) %.

The Y/Y goods percent change seems to be increasing, as the change was 0.3% as of January 2023 compared to January 2022 and was 1.5% Y/Y as of April 2023 compared to April 2022.

https://fred.stlouisfed.org/graph/fredgraph.png?g=15yRR

Bloomberg reported on a big trade in the Treasury market about a week ago. The article is behind a paywall, but you can read it here:

https://m.economictimes.com/markets/stocks/news/hedge-fund-trade-with-a-history-of-blowups-is-back-again/articleshow/100236488.cms

This is a basis trade, long cash Treasuries, short futures. Two points made in the article are that this trade makes short-term moves in Treasury yields a poor guide to market participants’ economic views, and that this trade caused a serious liquidity problem back in 2020.

The long side of this trade, cash Treasuries, is less liquid than the short, derivatives, side. When the trade unwinds, the futures’ short can be covered quickly. That leaves an overhang of cash Treasuries to sell in the less-liquid cash market. Yields can spike, the falling-knife problem exacerbates liquidity problems. A positive feedback spiral can get started, as happened in 2020.

Note that this is not a debt-ceiling issue per se, but could add to any disruption caused by the debt ceiling.

Little CoRev is allergic to linking to news stories like this and I can see why:

https://www.cnn.com/2023/05/25/economy/germany-recession-q1-2023/index.html

“We think consumers’ spending is now rebounding as inflation eases,” Vistesen said in a note. “We doubt that GDP will continue to fall in coming quarters, but we see no strong recovery either.” In a sign that Germany’s recession may prove short-lived, timelier survey data showed earlier this week that business activity in the country expanded again in May, despite a sharp downturn in manufacturing. German Chancellor Olaf Scholz described the outlook for the economy as “very good,” pointing to measures his government has taken in recent months to expand renewable energy production and attract foreign workers. “There is a lot of investment in Germany in terms of battery and ship factories, which is increasing significantly, and we can therefore be confident,” he said at a press conference in Berlin.

Yea – a slight drop in real GDP for a quarter or two and little CoRev starts telling us the sky is falling. CoRev does not deal with facts or reality as that gets in the way of his worthless trolling. What a moron!

Even Ole Bark bark admits: ” In a sign that Germany’s recession may prove short-lived,…”

Also note Green Party German Chancellor Olaf Scholz described the outlook for the economy as “very good,” pointing to measures his government has taken in recent months to expand renewable energy production and attract foreign workers. “

Mean while in the real world of Germany: “Germany’s Greens punished in polls over plans to ban gas heating

Story by Jorg Luyken • 15 May” https://www.msn.com/en-gb/news/world/germany-s-greens-punished-in-polls-over-plans-to-ban-gas-heating/ar-AA1bczwi

and Germany is finally getting serous about its climate activists: “Germany conducts raids against climate activists, alleging criminality” https://www.msn.com/en-us/news/world/germany-conducts-raids-against-climate-activists-alleging-criminality/ar-AA1bDcjW

Remember this is occurring UNDER same Green Party leadership Ole Bark, bark believes.

The evidence denying liberal mind is an amazement.

I bet CoRev’s MAGA diseased brain was hoping these climate change activists would be gunned down. After all CoRev got all excited on 1/6/2021 when Trump screamed “we’re going down to the Capitol”. Then little CoRev returned with Trump hiding in the safety of the White House.

“Germany’s Greens punished in polls over plans to ban gas heating”

CoRev offers this fluff as his evidence that climate change policies will read to a large recession? Dude – not a single bit of this story suggests anything along these lines. And this is the best little CoRev could come up with? Dude – we knew you were incompetent boob but DAMN!

Ole Bark, bark, your insecurities are showing. It was your reference that claimed Germany was in recession. My references were there to show what is actually happening in Germany re: Climate Change under Green leadership.

The inability to read with understanding in an insecure psychotic liberal mind is an amazement.

My insecurities? Oh my – did I hurt baby CoRev’s little feelings? Awwww!

Insecurities? Dude – you are doing nothing but lying about everything. I would ask little CoRev to grow up but it seems the baby boy is incapable of doing so. Maybe you should ask your mommy to change your stinky diaper.

Russia is bombing its own territory:

https://www.msn.com/en-us/news/world/footage-appears-to-show-low-flying-russian-su-34s-dropping-bombs-on-anti-putin-militias-and-missing-the-target-says-report/ar-AA1bLEdX?ocid=msedgdhp&pc=U531&cvid=dea44d85210e441e8466eeaa1647bba9&ei=11

Aerial footage appears to show Russian Su-34 Fullback jets dropping bombs from a low level within the Russian Federation on the border of Ukraine earlier this week, says a report. At the Grayvoron border checkpoint, the video shows two Russian jets dropping high-level explosives from an “ultra-low altitude.” The video appears to show the jets missing the target, a building at Russia’s own checkpoint. According to reporting and analysis by The War Zone journalists Thomas Newdick and Tyler Rogoway, the footage demonstrates “the difficulties of delivering unguided weaponry” at low altitudes, as well as “desperate measures” by the Russian military to thwart a border incursion by Ukrainian-backed Russian militias.

It seems Putin has quite the mess on his hands. Maybe it is time for him to cease with his war crimes in Ukraine.

AS recently cited a WSJ editorial claiming that Social Security benefits payments can create additional room under the debt ceiling, asking whether this makes sense. My answer was that it doesn’t, under normal circumstances. What the authors of the article might have argued, as others have done, is that Social Security benefits payments can be made without increasing the debt under limit.

Before I continue, I’ll point a lie that CoRev has spouted in comments here. CoRev claimed that I have said Social Security benefits payments will be missed. I have never said any such thing. When I challenged CoRev to find an instance in which I did, he made up a bunch of hooey about how other things I’ve said amount to me saying that SS benefits will be missed. CoRev compounded his initial lie with more lies. Nothing new about that.

So, Here’s the background on whether SS benefits payments to can be reliably made once the X date is reached, probably around June 5 –

A 1996 law allows increases in debt under limit in order to pay Social Security benefits. That same law prohibits the use of Social Security assets to pay for any other government obligation. As of 1996, that law could have worked pretty smoothly, because SS benefits were all paid on the same day each month; digging out SS benefits from among other payments wasn’t a problem. In 1997, the Social Security Administration began paying benefits throughout the month. As a result, digging out benefits payments is a problem.

If Congress had not forbidden the use of Trust assets to pay for other government obligations, there wouldn’t be a problem, but there it is – a problem exists.

So, the Social Security Administration can certainly try to make sure benefits are paid. The question is whether it will succeed in every case, given the complexity and constraints under which it must operate after the X date arrives.

For more detail, read this:

https://www.concordcoalition.org/issue-brief/social-securitys-debt-limit-escape-clause/

My guess is that the WSJ editorialists had the 1996 law in mind, but didn’t make it clear – at least not to me.

As to CoRev’s behavior, keep in mind that he is a climate-change denialist. One long-standing tactic among denialist is to cast doubt on views denialists find inconvenient and on people who rely on facts, to cast doubt on the very facts themselves. It’s a dishonest job, but somebody has to do it. So, in comments here, you can routinely read CoRev bad-mouthing other commenter, “the liberal mind” and, well, you name it, because his own positions lack credibility. The best he can do is attack the credibility of others.

McQuack, is showing a modicum of discomfort as facts are presented: “… because his own positions lack credibility. ” This is a frequent position taken by the religious zealots. Questions are NOT ALLOWED, as they may show holes in the belief structure. This is a familiarly consistent level of insecurity of the religious zealotry.

New religions are continuously founded to answer difficult quests. One of the latest foundings is Climate Change/Global Warming/Catastrophic …, etc. masquerading as science. Science is based upon asking skeptical questions, while religion is based upon faith without question. For the zealots the end result is increased emotional insecurity, anger, and denial of truth/facts.

Zealotry is seldom a positive, and the case of these Climate Change/Global Warming/Catastrophic …, etc. but the negative economic results of these religious believers efforts has been increased energy prices, reliance on unreliable energy sources, deaths (246 in Texas alone), and INFLATION. Although there are other negatives that could be added, these negatives are readily quantifiable.

The proof of the denial and religious zealotry is the failure to define Climate Change, nor how much their ballyhooed solutions will lower or change the Climate.

The insecure. in denial zealotry of the liberal mind is an amazement.

WTF does any of that babble has to do with the discussion. OK – ChatGPT 2.0 is writing complete sentences for you but it still is irrelevant gibberish.

“reliance on unreliable energy sources, deaths (246 in Texas alone)”

Where did you get this lie from? No link CoRev copying and pasting from the Dark Web.

I found the story CoRev alluded to and yes CoRev is a very disgusting liar:

https://insideclimatenews.org/news/05022022/texas-storms-extreme-weather-renewable-energy/#:~:text=About%204.5%20million%20Texans%20lost%20power%2C%20many%20of,to%20the%20Texas%20Department%20of%20State%20Health%20Services.

During the crisis, when many Texans were still without power, Abbott said on Sean Hannity’s Fox News show that failures in wind and solar “thrust Texas into a situation where it was lacking power [on] a statewide basis.” This framing was widely repeated across Fox News’ schedule. On the Fox & Friends morning show, images from the state were shown above a chyron saying, “Frozen wind turbines cause blackouts in Texas.” Fossil-fuel industry groups and sympathetic think tanks also trumpeted this message….“There are definitely a lot of people that believe the misinformation, but I think most people understand what happened,” he said.

The real story?

“The idea that wind and solar were the problem, when our grid is dominated by fossil fuels, doesn’t add up in any way,” said Michael Webber, an energy resources professor at the University of Texas at Austin. In the aftermath of the 2021 storms, Gov. Greg Abbott, a Republican, oversaw a complete change in the leadership of the Public Utility Commission of Texas and the grid operator, the Electric Reliability Council of Texas, or ERCOT. But he and other state officials did much less to require changes to the gas industry, which is regulated by the Railroad Commission of Texas. Meanwhile, various reports have confirmed the central role of the gas industry in the power outages. These include a joint investigation from the Federal Energy Regulatory Commission and the North American Electric Reliability Corporation; a detailed timeline of events by the Energy Institute at the University of Texas at Austin; and a paper in the journal Energy Research & Social Science, the authors of which include energy researchers from Texas and across the country, including Webber. The reports showed that every major energy source, including wind, had problems that contributed to a shortage of electricity, but that the grid’s heavy reliance on gas meant that the breakdowns in the gas delivery system were a leading factor. Much of the gas system was not winterized, so many parts of it couldn’t function in extreme cold. “I’m concerned that our regulators over the natural gas industry don’t appear to even be interested or curious about the capabilities of the system they have oversight of,” said Beth Garza, a Texas-based senior fellow with the R Street Institute, a think tank that promotes open markets. Until 2019, she was head of the office that serves as the independent watchdog for ERCOT.

CoRev has been told about the real cause before but this sniveling little liar continues his parade of disinformation. CoRev the weasel could care less about the 246 people who died. No – CoRev is nothing more than a partisan hack for the Koch Brothers.

Ole Bark, bartk now admits to how many deaths storm Uri caused just in Texas: CoRev the weasel could care less about the 246 people who died. ” The ignorance is astounding. How many deaths will it take for liberals to publicly admit their policies are wrong?

Ignorance is obvious by the failure to answer fundamental questions. Y’ano, like how much will/has the world cool due to this marvelous policy change? Or how much electricity does it take to run these dino-windmills?

The answers to these simple questions are obvious to the knowledgeable. The faith-based climate change believers can’t even provide the sign (+/-) of the change let alone the amount. s for electric power REQUIRED to run wind mills: “…*Wayne Gulden has analyzed the daily production reports of a Vestas V82 1.65-MW wind turbine at the University of Minnesota, Morris, from 2006 to 2008. Those records include negative production, i.e., net consumption, as well as daily average wind speeds. The data suggest that the turbine consumes at a minimum rate of about 50 kW, or 8.3% of its reported production over those years (which declined 2-4% each year). ” http://www.aweo.org/windconsumption.html

From where does this 50 k, come when they fail for extended periods?

The ignorance of these negative impacts concerning the details of their preferred policies is an amazement of these liberal minds.

CoRev: So you’re reduced to quoting blogposts from 11 years ago or so, from a person who last published a peer reviewed paper about 11 years ago (can’t find many other papers in any case). I’m not into credentialism, but I do worry about citing stats from data 15 years ago in a field where we know unit costs of production have declined substantially.

Ole Bark, bark further show his ignorance of real world electricity generation conditions: “In the aftermath of the 2021 storms, Gov. Greg Abbott, a Republican, oversaw a complete change in the leadership of the Public Utility Commission of Texas and the grid operator, the Electric Reliability Council of Texas, or ERCOT….

and

CoRev has been told about the real cause before…”

To translate for the faith-based deniers, Texas political leaders have replaced the ERCOT leadership which created the conditions for the 246 storm Uri deaths. and, even though these same faith-based deniers can not admit that their renewable energy policies weakened the fossil fueled backups, an admitted and desired effect, REQUIRED for those renewable electricity sources to even exist on a grid.

It is an amazement on an economics blog that the liberal minds can/will not accept the fact that adding renewables to a grid adds costs.

For these renewables sources can, and Texas shows, will need backup to nearly 100% fr extended periods.

Only the liberal minds claim it is a failure of the backups, and that is an amazement.

I should not have to repeat this but CoRev is now citing some 2006 blog post alleging back then wind was not a net contributor to energy. Of course the story was about Texas during the winter of 2021 some 15 years later. And if the stupidest little liar ever took a look at the graph of what generated electricity in Texas, wind played a minor role with natural gas being the leading source:

‘various reports have confirmed the central role of the gas industry in the power outages. These include a joint investigation from the Federal Energy Regulatory Commission and the North American Electric Reliability Corporation; a detailed timeline of events by the Energy Institute at the University of Texas at Austin; and a paper in the journal Energy Research & Social Science, the authors of which include energy researchers from Texas and across the country, including Webber. The reports showed that every major energy source, including wind, had problems that contributed to a shortage of electricity, but that the grid’s heavy reliance on gas meant that the breakdowns in the gas delivery system were a leading factor. Much of the gas system was not winterized, so many parts of it couldn’t function in extreme cold.’

Is CoRev so stupid that he cannot read clear English? Or is he just the most dishonest troll ever?

Menzie what conditions have changed in the past 11 years? The whole point of the article is to show that these added costs were and are still today not included in operational costs. Where do those ~50kW come from when the wind does not blow for extended periods. BTW, I prefer this paper “Full Cost of Electricity ‘FCOE’ and Energy Returns ‘eROI’” https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4000800 It show how current LCOE cost estimates are seriously flawed.

Since Winter Storm Uri caused 246 deaths in Texas, 1) ERCOT management which set up the conditions for these deaths has been replaced, (source Ole Bark, bark’s above comment)

2) Texas House passes bill to curb renewable energy growth https://www.washingtonexaminer.com/policy/energy-environment/texas-house-passes-bill-curb-renewable-energy-growth

3) House approves bill capping what Texas consumers would pay for new tool to boost power plants https://www.texastribune.org/2023/05/22/texas-electricity-power-plants-performance-credits-bill/

” Under the bill, the money would go to companies that operate gas and coal plants, along with those that operate batteries, as an incentive to build more plants or extend the lives of existing ones.”

In an attempt to add reliability to the TX grid. Finally some common sense is being shown re: renewables.

If only we had the list of Biden’s/progressives’ successful policies. Surely the lowering cost examples where there have been renewable implementations, like in Germany, Australia and California would be cited. Oh! Their costs have not gone down.

How many more deaths need occur before the liberal mind accepts their policy failures? It is an amazement.

The fool, who fancies himself an expert on all subjects discussed here, pities those who do not share his insights.

Those pitied chuckle. Repeatedly.

Share his “insights”. CoRev once again flat out lied. But what’s new?

Foolish insights.

“To translate for the faith-based deniers, Texas political leaders have replaced the ERCOT leadership which created the conditions for the 246 storm Uri deaths. and, even though these same faith-based deniers can not admit that their renewable energy policies weakened the fossil fueled backups, an admitted and desired effect, REQUIRED for those renewable electricity sources to even exist on a grid.”

What dishonesty from little CoRev. ERCOT was made up of people loyal to Abbott. Yea ERCOT underfunded fossil fuel maintenance not because they were greenies but because they were corrupt right wing jerks. CoRev’s kind of people.

Uh CoRev – keep digging your own grave as we will gladly bury your lying arse.

“CoRev compounded his initial lie with more lies. Nothing new about that.”

It might be easier counting up the number of CoRev comments that were honest contributions. My count so far – zero.

Even JohnH is more honest than little CoRev. A very low bar.

Krugman on Bernanke and Blanchard –

Krugman has summaried a new paper by Ben and the Juice about the sources of inflationary pressure through 2021 to the present. For lazy people, this is useful. Here is a summary of the outlook offered:

“The paper is actually fairly optimistic on that question, suggesting that “immaculate disinflation,” inflation coming down without any significant rise in unemployment, may be possible, and that even if it isn’t, those grim projections we were hearing a year ago about the need for many years of high unemployment no longer seem plausible.

“Why the optimism? Bernanke and Blanchard, as I’ve already noted, use the ratio of vacancies to the unemployed as their measure of labor market tightness. And what has been really striking since late 2022 is that vacancies have come way down without any rise in unemployment.”

So while inflation is running ahead of the Fed’s 3.6% target for 2023 (5.0% SAAR in Q1 for the core PCE deflator), Bernanke and Blanchard don’t think the Fed’s year-end inflation target of 4.5% is necessary to bring inflation down to the longer-term target of 2.0%, give or take.

The B&B paper, along with a paper on the same subject from Eggertsson and Kohn, can be found here:

https://www.brookings.edu/events/the-fed-lessons-learned-from-the-past-three-years/