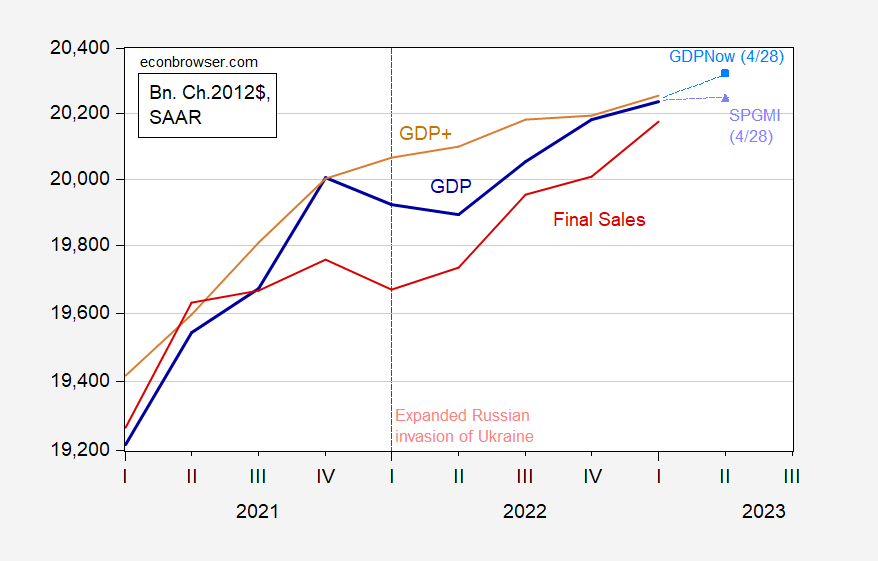

Jim noted recurrent delays in the long heralded recession in his Thursday post. Here are some additional reflections on where economic activity has been, and where it is heading, relying on additional data. GDPNow (which hit the mark for Q1 growth) indicates continued growth through Q2. S&P Global Market Insights (nee Macroeconomic Advisers) indicates a plateau has been reached. Final sales (i.e., GDP ex. inventories) suggests continued growth.

Figure 1: GDP (bold dark blue), GDP+ (tan), Final sales (red), GDPNow nowcast of 4/28 (sky blue square), S&PGMI tracking as of 4/28 (lilac triangle), all in bn. Ch.2012$ SAAR. Source: BEA 2023Q1 advance, Philadelphia Fed, Atlanta Fed, S&PGMI, and author’s calculations.

My interpretation of these data, including the fact that GDO and GDP+ seem to better reflect the eventually described trajectory of GDP (given the numerous revisions that GDP receives over time), is that economic activity decelerated (and aggregate demand actually fell) in 2022H1, but no recession occurred, in the wake of the expanded Russian invasion of Ukraine and the ensuing cost-push shock. Economic activity is likely to continue to rise into 2022Q2, although growth will be anemic. As noted in a previous post, many forecasts peg a decline in 2022Q3 or 2022Q4.

Fitch has downgraded France:

https://www.fitchratings.com/research/sovereigns/fitch-downgrades-france-to-aa-outlook-stable-28-04-2023

Neither bond yields nor CDS have shown much response that I can find.

Downgraded from AA to AA-. The 10 year French government bond rate is near 2.93% as compared to Germany’s 2.33%. So a credit spread near 0.6% sounds about right.

Sounds like Macron tried to pull “a Trumpy”. He’s not very smart, and he’s proven that multiple times, including taking Xi Jinping’s bait to present Xi as Ukraine’s knight in shining armor waiting in the wings. Dumbsh*t.

Inventories were a drag on GDP in Q1. Consumer demand was strong, suggesting that some part of the inventory drag was involuntary. GDPNow anticipates that inventories will add to GDP in Q2.

So here’s an odd picture:

https://fred.stlouisfed.org/graph/?g=131jS

The retail inventory ratio is through the floor while the factory ratio is still quite high. Wholesale inventories are middling-high. Anyone know how Amazon/Target kind of warehouse operations are categorized? Could be the shift away from brick-and-mortar has skewed accounting for inventories away from retailers, maybe?

Total business inventories are not extreme either way:

https://fred.stlouisfed.org/series/ISRATIO

total business inventories and sales are a simple sum of the other three you cite…i’m not sure if it’s the case with the figures you cite, but sometimes those aggregate inventory ratios in current dollars get skewed by differences in the price changes of the components, which include energy and agricultural components, and which are a different proportion of the whole in each report..

detailed tables for the components of factory shipments (ie sales) and inventories are here: https://www.census.gov/manufacturing/m3/prel/pdf/s-i-o.pdf

detailed tables for the components of wholesale sales and inventories are here: https://www.census.gov/wholesale/pdf/mwts/currentwhl.pdf

there have been some big changes in the producer price indexes for some of those components recently..

“2022Q3 or 2022Q4”

2023?

Off topic but comical:

Why Is ROCE Significant? Return on Capital Employed is a measure of yearly pre-tax profit relative to capital employed by a business. Changes in earnings and sales indicate shifts in a company’s ROCE. A higher ROCE is generally representative of successful growth of a company and is a sign of higher earnings per share in the future. A low or negative ROCE suggests the opposite. In Q1, Eli Lilly posted an ROCE of 0.12%.

https://www.msn.com/en-us/money/taxes/eli-lilly-s-return-on-capital-employed-overview/ar-AA1aAZSv

This is something JohnH might write. Return on capital employed is an important concept but whoever wrote this is beyond dumb. The link suggests 0.12% is a high return. Seriously? Now Eli Lilly is a very profitable company but people who know what they are doing would put its return closer to 25%. Being off by a factor of 200 is quite the accomplishment – one only JohnH could pull off.

For reasons unknown to me, MSN links don’t work with my browser. But I bet 10-to-1 odds that was authored by a female author or Jim Cramer.

Post the name and tell me I’m wrong. I’d swear on a Bible as I am writing this comment I have not seen the article or the author as of yet.

The layout was paragraph/ad/paragraph/ad/paragraph/ad. Really thin on content. So my guess is, it was assigned to a contractor writer with no real editorial interest. Journalim is a dismal thing these days.

This article Eli Lilly’s Return On Capital Employed Overview originally appeared on Benzinga.com.

That is all I know.

pgl is breathlessly awaiting LLY’s donanemab. His signs of confusion and memory loss are pretty obvious.

Dude – your emotional tantrums are embarrassing your entire family. I know CoRev goes barking whenever he sees my name but damn – your little boo hoo hoo here is even more pointless than CoRev’s barking.

Jonny boy – I get that when we call out your stupidity it must hurt your little feelings. But a better approach than throwing stupid tantrums like this one might be to do something really simple – STOP making STUPID comments.

Who was stupid enough to say:

‘Because what the West wants to do is precisely to get China to refinance the debt owed to it so that Third World debt repayments go to private lenders. And China is basically questioning the terms of all of this, because for example China is saying, “Why should the IMF and the World Bank have priority? Why should its debt not be canceled?”

Followed by questioning what debt covenants and subordination of debt has to do with the conversation.

Oh yea – Jonny boy – THE DUMBEST troll God ever created!

Industrial production, perhaps the most important coincident indicator, remains about -0.5% below its September peak. On a YoY basis, real personal income less government transfers is up 2.1%, real manufacturing and trade sales are up 0.1%, and industrial production is up 0.5%. The only one of these at a new high as of its last reading is real income less government transfers. The historical record going back over half a century shows that when all three of these coincident indicators have been at the YoY levels they are now, with the exception of 1989 a recession had already started. Note also that most post WW2 recessions have started in a Quarter that featured real GDP growth of more than 1.1%.

As to real final sales, the monthly data on real personal consumption expenditures suggests that extra seasonal distortions around the post-pandemic Holidays gave us a big downdraft in November and December, and a big updraft in January. Compared with September and October, February and March were only up +0.6%. The big increases since July 2021 have been on services, and on durable goods (mainly cars), which declined sharply in November and December and then rose sharply in January, then declined again in February and March.

So I am taking the 3.4% gain in real final sales number in Q1 GDP with a grain of salt, as it may mainly reflect a spike in January offsetting a relatively poor November and December.

That being said, the huge downdraft in energy prices and producer inflation continues to buoy some important metrics.

“Note also that most post WW2 recessions have started in a Quarter that featured real GDP growth of more than 1.1%.”

Real PCE in March was down from January. So March is not out of the question, but payroll employment rose in March (so far, anyway). Tough call.

“…extra seasonal distortions around the post-pandemic Holidays…”

Imagine being on the business cycle dating committee and having to work with post-Covid data. Yuck.

What I find interesting is that in the face of a $23.3 trillion GDP – the extremist and fiscally irresponsible House Republicans would rather crash the U.S. economy and make it harder for older adults and individuals with disabilities to get SNAP than to just increase the corporate tax rate back to 35% as it was in 2017 before the disastrous Trump tax cuts. Or even 46% as it was in 1986. BTW – Corporations are currently earning record profits – https://thehill.com/business/3756457-corporate-profits-hit-record-high-in-third-quarter-amid-40-year-high-inflation/ It seems like they can invest some of that back into infrastructure and education for their workforce.

Real PCE in March was below the Q1 average:

https://fred.stlouisfed.org/graph/?g=131A1

Assuming no big revisions, that’s reason enough to expect soft GDP growth in Q2.

Then comes April……PCE isn’t going to grow a bunch after a high first quarter. Final Sales will be slower, but not overall gdp.

We had a decent amount of gloomy weather here recently. For the most part gloomy weather doesn’t bother me, but it was starting to get to me a little. But, If this dry weather holds up I can finally put my Ryobi mower to its first use. Gotta keep the battery mowers away from the water.

Ever see one of those clever newspaper headlines and wished you’d thought of it?? One of the banker note headlines referring to the current economic situation.

“The end of the beginning or the beginning of the end?”

Brooklyn got almost 8 inches of rain. Now this will make you happy. After Steven A. Smith starting chirping orange and blue skies, New York stand up, the rapid Knick fans who entered MSG had to leave in the rain after blowing their heroes a game they should have won. New York SIT DOWN.

Meanwhile Stefan Curry dropped 50 to beat the Kings in a game 7.

I do strongly dislike “Steven A” Smith, but am neutral on both the Knicks and Nets after Durant went to Phoenix. So I don’t wish either NYC area team bad (I hated the Knicks when Pat Riley was there because they were violent and cheap shot artists while Riley coached them). But yeah, I do like when “Steven A” (the “A” is for ass??) makes a fool of himself (which happens pretty regular). And by the way, I have no problem with “strong opinionated” Black men or Black men with strong personalities (I like Kendrick Perkins for example, a huge fan, among others, he just came immediately to mind) But I think when people open their mouths, they need to get it right at least half the time. “Steven A” does not, not to mention the fact he’s a closet sexist. Now just to give Menzie a couple chuckles (or anger??) as he regards me, I prefer “honest sexists” to “closet sexists”. Have the courage of your convictions, or better stated, be honest in stating your thoughts.

Pulling for the Phoenix Suns now (as you may have guessed)

Suns are a good team but they are going against the best team still standing. Pat Riley was at MSG but he and his wife sneaked out before the game ended. Maybe he was smart enough to realize Knick fans might turn on him.

“I like Kendrick Perkins”

Me too. When Pardon the Interruption has him on Five Good Minutes, it is must see TV.

Perk and I are both big Doc Rivers fans. Sixers outplayed the Celtics in game 1. We’ll see.

As of today, the Atlanta Fed’s GDPNow estimate for Q2 is 1.8% (SAAR). If that proves close to right, then the FOMC’s 0.4.% real GDP growth estimate for 2023 implies a 0.3% decline in output through H2 (assuming my math is right). Odds are, though, the SEP is going to show a higher growth estimate in its next edition, simply as a matter of accounting for realized economic performance. The SEP jobless rate estimate is likely to rise for the same reason. Unless, of course, there’s a recession.

Two interesting stories:

https://www.themarshallproject.org/2022/03/10/no-light-no-nothing-inside-louisiana-s-harshest-juvenile-lockup

https://www.readfrontier.org/stories/a-mans-death-in-jail-was-ruled-a-homicide-family-and-friends-are-still-waiting-for-someone-to-be-charged/

https://econbrowser.com/archives/2023/04/guest-contribution-restructuring-debt-of-african-commodity-exporters#comment-298070

May 1, 2023

Dilma Rousseff was impeached in 2016. Do you want to let us know why she was impeached? Didn’t think so.

[ Lula da Silva, the preceding and current President of Brazil was actually imprisoned after the superb Dilma Rousseff was removed from the Presidency. Rousseff had also been imprisoned by the military governors of Brazil before being elected President, and Rousseff was removed from office by those who would again turn Brazil to a dictatorship. Lula was in turn imprisoned by those who would again turn Brail to a dictatorship. ]

Yea – I suggested you would not tell us why she was impeached and you didn’t.

http://www.chinadaily.com.cn/a/202304/16/WS643b9492a310b6054facdda7.html

April 16, 2023

New Development Bank set to renew its commitment to sustainable development

BEIJING/SHANGHAI — Amid increasing global economic uncertainty, the New Development Bank (NDB) — under new leadership — is set to further unleash its potential to support emerging economies and developing countries, and renew its commitment to sustainable development.

The Shanghai-headquartered bank, established by Brazil, Russia, India, China and South Africa (BRICS) in 2015, is aimed at mobilizing resources for infrastructure and sustainable development projects in BRICS and other emerging economies.

Dilma Rousseff, a well-known Brazilian politician and economist, on Thursday assumed office as the president of the multilateral institution. The former president of Brazil is expected to build upon the achievements of her predecessors and write a new chapter of South-South cooperation and global sustainable development.

In an interview with Xinhua, Rousseff said investing in infrastructure development, addressing social inequality, curbing climate change and meeting sustainable development goals will be the priorities during her term of office, while emphasizing the importance of local currency for financing.

The new NDB president said the bank can make contribution to fighting climate change and meeting the sustainable development goals, for instance, by investing in alternative energy sources.

The bank’s 2022-2026 General Strategy, approved by the board of governors last year, aims to provide $30 billion over the next five years. Over this period, the bank will expand operations with the private sector, multiply development impact and direct 40 percent of its approvals to climate change mitigation and adaption.

“As a former President of Brazil, I know the importance of the work of multilateral banks to support developing countries, particularly the NDB, in addressing their economic, social and environmental needs,” Rousseff said at her inauguration ceremony in Shanghai Thursday.

Brazilian President Luiz Inacio Lula da Silva, who attended Rousseff’s inauguration ceremony during a state visit to China, expressed his confidence in the bank’s promising future under the new leadership….

https://www.chinadaily.com.cn/a/202304/27/WS6449cc4aa310b6054fad00c2.html

April 27, 2023

BRICS set to be bigger, stronger amid push for unity

By Djoomart Otorbaev

A remarkable event occurred at the beginning of the year, to which few gave much attention. The GDP of the BRICS countries (Brazil, Russia, India, China and South Africa) surpassed that of the G7 countries (Canada, France, Germany, Italy, Japan, the United Kingdom and the United States) in terms of purchasing power parity. In addition, BRICS’ share of world GDP reached 31.5 percent, while the G7 accounted for 30.7 percent, according to data published by the UK-based economic research firm Acorn Macro Consulting. This gap is expected to be broadened by 2030.

The gap between these groups and the economic influence of BRICS will widen even further as more countries join BRICS.

Ahead of the 15th BRICS Summit, which will be held from Aug 22 to 24 in Durban, South Africa, the host country’s Foreign Minister Naledi Pandor said 12 countries are interested in joining the group, including Saudi Arabia, the United Arab Emirates, Egypt, Algeria, Argentina, Mexico and Nigeria, and this will be considered at the upcoming summit. Among others willing to join are Indonesia and Turkiye….

Djoomart Otorbaev, a former prime minister of Kyrgyzstan, is a distinguished professor at the Belt and Road School at Beijing Normal University.

Tim Scott teasing a Presidential bid. What percentage of Republicans does #UncleTim think are voting for HIM?!?!?!? The dumb-asses just keep falling out of the American sky.

I’ll tell you Scott’s ceiling (if EVERYTHING goes great for him on the campaign trail) right now, is 15% of any Republican vote. Dude is dead in the water and he’s so stupid he doesn’t even know it yet. Andrew Yang promising checks in the mail for each and every George Costanza had a vastly better shot, and he was also dead in the water before day 1 of his Presidential run. But hey, get the popcorn out. The greatest self-delusional Presidential candidate since Lindsey Graham is about to give us months of sustained laughter.

Off topic and apologies if you addressed this: What is your take on the chip subsidy bill/policy? Seems to have been supported by the administration and the Democrats and the (increasingly sized) populist part of the Republicans. Opposed by the libertarian tinged Republican minority (and I are one of them).

Just curious since it is “industrial policy”. I get the impression you are pretty left lying. But at the same time, come forward with classic econ influenced views at times (e.g. free trade). So just honestly curious where you are on this chip stuff? I honestly don’t know how you’d roll here.

“MeTV’ took off the re-airs of “The A-Team”. Recount!!! Uncle Moses is getting verklempt now. [ discontent sigh…… ]

Yellen says June 1 is the latest Congress safely has to raise the debt limit:

https://thehill.com/homenews/senate/3982225-yellen-says-drop-dead-date-for-debt-ceiling-is-june-1/

Very likely,some Republicans will accuse her of lying. (Imagine, a Republican caring about facts.) Probably some of our egomaniacal commenters will claim to know for sure, for sure that she’s wrong. They don’t.

Tax day revenues came in short. New Deal Democrat has noted weakness in FICA payments (I think) which should go hamd in hand with income tax payments. Time to raise the debt ceiling.

fwiw, in today’s construction spending report, the annualized February construction spending estimate was revised 0.8% lower, from $1,844.1 billion to $1,829.6 billion, while the annual rate of construction spending for January was revised 0.6% lower, from $1,845.4 billion to $1,835.5 billion…

with those downward revisions to January and February figures, construction spending for all three months of the 1st quarter was lower than was reported by the BEA in the advance estimate of GDP….in reporting 1st quarter GDP, the BEA’s key source data and assumptions (xls) indicated that they had estimated March residential construction would be $4.4 billion less (at an annual rate) than that of the previously reported February figure, that March nonresidential construction would be valued $5.0 billion more than that of the reported February figure, and that March public construction would increase by $0.6 billion from previously reported February levels…totaling those figures, the 1st quarter GDP used figures showing March construction spending to be at an annual rate $1.2 billion higher than previously reported February levels…since this report shows that March construction spending actually rose at an $5.1 billion annual rate from February figures that were revised $14.5 billion lower, that means the total annualized construction figure used for March in the GDP report was $10.6 billion too high….averaging that overstatement with the the overstatements in the annual rates of construction spending used for January and February in the GDP report, we thus find that this report shows that construction spending was overestimated at an $11.7 billion annual rate in the 1st quarter GDP report, implying a downward revision to the related GDP components at a rate that would result in a subtraction of about 0.13 percentage points from first quarter GDP when the 2nd estimate is released on May 25th…i’d caution that since my estimate is based on the aggregate change in spending, an imbalance of inflation adjustments among the revised construction components might also have a material impact on the final revision…

in addition, the BEA’s Key source data and assumptions (xls) for the advance estimate of first quarter GDP indicates on line 151 that they had estimated that the value of manufactured nondurable goods inventories would decrease by $1.7 billion on a Census basis (ie, before price adjustments) in March, while this morning’s full factory report shows total non-durable goods factory inventories decreased by $2.0 billion…the change in the value of February’s non durable goods factory inventories was revised from -$1.6 billion to -$1.7 billion…hence, the first quarter’s inventory decrease was underestimated by $0.4 billion in the GDP report, which would work out to around $1.6 billion in current dollars on an annualized basis, and somewhat greater than that on an inflation adjusted, 2012 dollar basis…that would suggest that 1st quarter GDP would have to be revised downwards by around 0.03 percentage points to account for what this morning’s factory report shows….

looks like we’ll see further downward revisions to GDP based on today’s international trade report…

In the advance estimate of 1st quarter GDP published last week, our March trade deficit in goods was estimated based on the sketchy Advance Report on our International Trade in Goods, which was released the day before the GDP release…that report estimated that our seasonally adjusted goods trade deficit was at $84,576 million on a Census basis in March, on goods exports of $172,732 million and goods imports of $257,308 million…in Exhibit 5 of the trade report, this report revises that advance and shows that our actual Census basis goods trade deficit in March was at $85,548 million, on adjusted goods exports of $172,753 million and adjusted goods imports of $260,902 million…at the same time, the February goods trade deficit was revised from the $91,987 million indicated in that advance report to $92,976 million…combined, those revisions from the previously published figures indicate that the nominal trade in goods deficit used in the first quarter GDP report was $1,961 million too low, which work out to be around $7.9 billion short on an annualized basis…in the advance GDP report, a $7.9 billion nominal change in goods trade worked out to a $11.3 billion change in 2012 inflation adjusted goods trade, and hence the revision to our trade in goods indicated by this report should indicate a 0.18 percentage point subtraction from 1st quarter GDP when the 2nd estimate is released on the 25th of May..

there’s also a bias for a downward revision to services trade, but the margin of error in my crude estimate for that includes zero, meaning it could go either way, so i won’t bother transcribing that…