As of today:

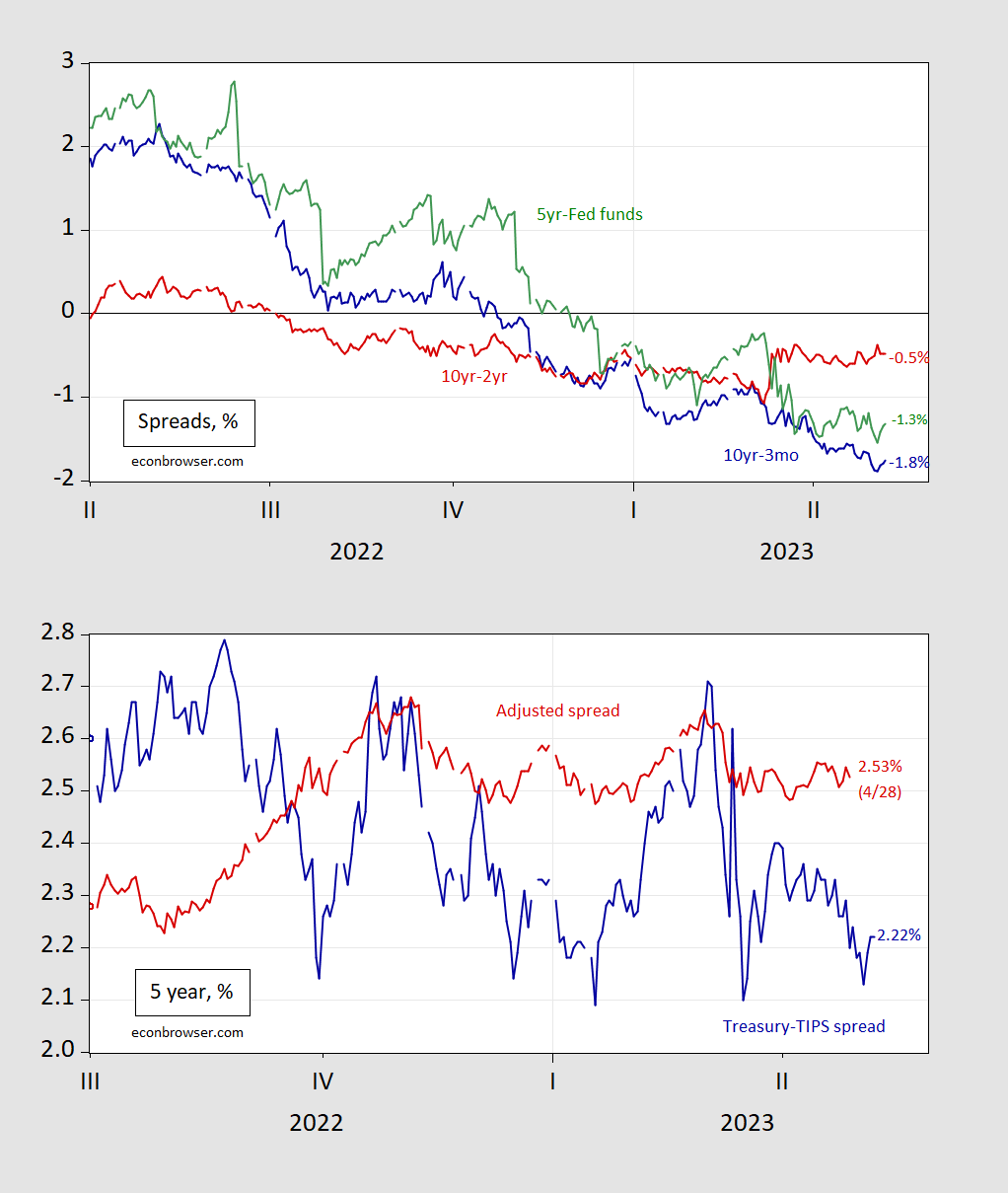

Figure 1, Panel A: Ten year-three month term spread (blue), ten year-two year (red), and five year-Fed funds (green), in %. Panel B: Five year Treasury minus five year TIPS spread (blue), and expected five year inflation (red), in %. Source: Treasury via FRED, KWW (accessed 5/9), and author’s calculations.

The top panel shows two familiar spreads, while the third (5 yr-Fed funds) has the highest AUROC for a six month ahead forecast of recession. As is clear, all the spreads remain inverted.

The bottom panel indicates that inflation expectations for the next five years have fallen, but perhaps not as much as indicated by simple break-even calculations would indicate.

Good news / bad news:

https://www.bls.gov/news.release/realer.nr0.htm

REAL EARNINGS – APRIL 2023

All employees

Real average hourly earnings for all employees increased 0.1 percent from March to April, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This result stems from an increase of 0.5 percent in average hourly earnings combined with an increase of 0.4 percent in the Consumer Price Index for All Urban Consumers (CPI-U).

That CPI rose by 0.4% in just a month is bad news. But at least nominal wages rose by a bit more so real wages continue to rise.

What pgl conveniently omits is the very basic fact that real average hourly earnings are exactly back to what they were at the start of the pandemic, February 2020. And, since it’s an average, it disregards the increasing skew of the average away from median due to wages of higher paid workers increasing faster than those of typical workers.

The technical notes to the release say as much: “The series are the average earnings of all employees or all production and nonsupervisory jobs, not the earnings average of “typical” jobs or jobs held by “typical” workers.” (pgl conveniently ignores technical notes when it suits him.)

For some reason economists here insist on propagating the illusion that the average American worker has been prospering over the last three years, when in fact their real earnings have at best been stagnating. https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/

So you really want to claim again that Dr. Chinn lied here?

https://econbrowser.com/archives/2023/05/real-wages-overall-and-leisure-hospitality#comments

Jonny boy – we have all had enough of your lies. Find another blog to pollute. Such as John Cochrane’s since you have a lot in common with him.

“since it’s an average, it disregards the increasing skew of the average away from median due to wages of higher paid workers increasing faster than those of typical workers.

Funny you raised this again since YOUR link showed that the lowest quartile had a higher real wage increase than the top 10%. Just the opposite of what you kept claiming.

Hey Jonny – thanks for reminding us that you are too stupid to check your own sources.

pgl conveniently ignores technical notes when it suits him.

Another pointless childish lie. I’m the one who has to point out technical notes to you. But there is a difference between you and me. I understand what they say. You clearly do not. But you know – you really need to focus on something like learning to tie your own shoe laces. Leave the technical stuff to the grown ups.

The FRED® Blog

What’s real about wages?

A look at the increases and decreases in wages

You still have not noticed how this graph used nominal wages for 3 of its 4 series but real wages for another. Of course they are different. I have pointed the stupidity of this blog post to you a dozen times. And you still do not get it? DAMN. YOU. ARE. INCREDIBLY. STUPID.

“What pgl conveniently omits is the very basic fact that real average hourly earnings are exactly back to what they were at the start of the pandemic, February 2020.”

Exactly? That is not what Dr. Chinn noted and his excellent graph shows this series was at $9.20 an hour in Feb. 2022 and is $9.40 now.

What’s going on Jonny boy? Is your preK teacher now telling you 9.4 is exactly 9.2? Damn – no wonder you are so dumb. Your teacher lies to little Jonny boy.

Or are you telling us Dr. Chinn lies to us? Which is it Jonny boy? Or you the dumbest 4 year old child ever? Or do you care to accuse our host of being dishonest? Go ahead troll – I dare you.

Dr. Chinn beat little Jonny boy on this one too. New post up. Let’s see $9.45 now v. $9.27 as of 2/2020. EXACTLY the same if one never passed preK arithmetic!

Eric Trump wants to sue Rachel Maddow for telling the truth?

https://www.msn.com/en-us/news/politics/eric-trump-threatens-to-sue-rachel-maddow/ar-AA1aZI53?ocid=msedgdhp&pc=U531&cvid=bed23a5bfacd4692bec31fb4e312e777&ei=18

Eric Trump is threatening to sue Rachel Maddow for highlighting his appearance alongside anti-Semites at an event at Trump National Doral in Miami. The former president’s younger son will speak at an event this weekend with his wife Lara, who was a Fox News contributor until her father-in-law entered the 2024 presidential race, and right-wing influencers Scott McKay and Charlie Ward, who have spread anti-Semitic conspiracy theories and praised Adolf Hitler, reported The Daily Beast. “I can’t really believe they are going ahead with it,” Maddow said during her Monday night broadcast on MSNBC. Trump complained on his Twitter account Tuesday night that Maddow was “walking a fine line,” adding that his family is “the most pro-Israel family in American political history” and pointed out that Ivanka Trump, Jared Kushner and their children are Jewish.

Awwww! Poor little Eric is mad that his racial antisemitic garbage is being talked about. Little Eric reminds me of how Bruce Hall whines when his racism is called out. MAGA?!

CPI services excluding owners equivalent rent is running pretty soft, back down around what we saw prior to Covid. OER is cooling, but remains high:

https://fred.stlouisfed.org/graph/?g=13nvs

Wolfe Street (yeah, I know…) is poo-pooing the idea that CPI’s housing component will cool, but seem a bit confused, adding: “The incremental increases (in OER) slowed in March, and will likely slow further…”

https://wolfstreet.com/2023/05/08/why-im-skeptical-of-powells-claim-red-hot-rent-cpi-will-just-vanish-landlords-report-the-opposite-even-for-april/

So OER will and won’t help slow the increase in headline CPI? Well, there’s a housing shortage, so rent gains probably won’t slow to the pace of overall inflation, but seriously, the guy needs to figure out what he’s saying.

Grandstanding on the debt limit –

The GOP’s wnts to refuse to pay for stuff we’ve already bought if we don’t decide to buy less than we’ve already decided to buy. Josh Hawley wants, instead, to refuse to pay for stuff we’ve already bought unless we agree to pay more for what we buy from China:

“Hawley’s bill would direct the president to publish the total value of goods imported from China as well as the U.S. exports to China. If there’s a trade deficit, the bill would require an additional 25 percent tariff on all Chinese imports. The president would be allowed to remove those tariffs if the United States records a surplus.”

https://www.politico.com/minutes/congress/05-10-2023/hawleys-china-tariffs-bid/

“Hawley’s bill would direct the president to publish the total value of goods imported from China as well as the U.S. exports to China. If there’s a trade deficit, the bill would require an additional 25 percent tariff on all Chinese imports. The president would be allowed to remove those tariffs if the United States records a surplus.”

Let’s see. We export goods to Australia who uses those goods to export stuff to China who ends up exported goods to us. Yes bilateral trade comparisons can be so misleading.

It is guaranteed that we will have a trade deficit with China so Hawley wants to that stupid trade war? If this little salute the Proud Boys before he runs like a scared little girl clown bothered to read this blog, he might have known that never worked out. OK we got more tariff revenue but the incidence of the tax was on American consumers more than Chinese producers.

And by the way, we already publish figures on imports from and exports to China. Either Hawley doesn’t know that – not a shock – or is pretending that he doesn’t know it – not a shock. Ignorant or dishonest- it’s one or the other with these guys.

You have to forgive him as 1/6/2021 was so hard on this scared little girl. He salutes the Proud Boys but then an hour later he had to run from them to save his pathetic little life.

Isn’t Mitch McConnell’s father in law a shipping mogul?

https://tsscorp.us/2021/01/21/taxation-could-be-the-coming-game-changer-in-global-shipping/

Subjecting shipping to a minimum global tax will undo the sector’s decades of tax evasion. By allowing their shipowners to register their vessels in tax havens, policymakers have encouraged the trend. They then attempted to regain lost revenue by employing taxes on the quantities of freight carried on ships, referred to as tonnage taxes, which are usually very beneficial to shipping firms. As a consequence, many transportation firms pay no tax on corporate profits. On average, for bulk trade, 3 percent for the tanker industry and 0 percent for cruise shipping firms, the effective corporate tax rate is 6 percent. Other sections of the freight transport market are far below the average rate of corporate income tax. The average rate for freight forwarders is 27 percent.

That shipping companies can escape income taxes on a global basis has been true for many generations. Then again McConnell never met a tax cut for rich people he did not like.

I guess my computer feed realized I had not read anything on liquid natural gas pricing in a while so it fed my this:

https://seekingalpha.com/article/4601916-cheniere-energy-saves-the-world?mailingid=31440865&messageid=must_reads&serial=31440865.3056875&utm_campaign=Must%2BReads%2Brecurring%2B2023-05-10&utm_content=seeking_alpha&utm_medium=email&utm_source=seeking_alpha&utm_term=must_reads

Cheniere Energy Saves The World

OK – the title is stupid. But a lot of useful information.

Consumer Alert – homeowners insurance –

Just had a chat with an roofer who told us about changing behavior among home insurance companies. The upshot is that they are aggressively denying claims or are trying to wiggle out of covering damage. Home owners don’t know the law or don’t understand their coverage, and insurers take advantage of that ignorance.

The roofer said his firm is no longer accepting jobs for damage unsured by All State because All State s so resistant to paying. He also said State Farm is doing everything it can to deny claims or pay only a small part of insured damage. Our claim with Farm Bureau has run into smilar problems.

Insurance claims have always had these problems, but recent high costs due to increased to fire, flood and storm is causing an increase in bad behavior by insurers.

Another problem is the unsurance equivalent of “shrnkflation”. Insurers redue coverage at renewal of contracts, without telling the customer of the reduction. For instance:

“Some insurance carriers in Minnesota are making changes to policy language that eliminate coverage for wind and hail damage except when siding or shingles are punctured or torn, a trend that is emerging across the country driven by increases in extreme weather due to changing climate.”

https://www.duluthnewstribune.com/business/are-severe-storms-fueling-changes-in-homeowner-insurance-policies

I’ve mentioned that I’m worried insurers are sufferings some of the same problems as banks – a long period of low yields followed by a sharp drop in asset values – along with climate-change-driven costs. Insurance is essential to many types of credit – mortgages, business loans, etc. – and to business in general. Don’t know if business insurance is turning shabby in the same way as homeowners insurance, but it woul be a bad development.

I don’t know about All State, but I can tell you State Farm has been that way FOREVER. No change on that front. You’re paying for adjusters to come to your home and tell you that 3/4ths of your roof being torn off after a tornado is a 1″-by-1″ squirrel infestation that “isn’t covered by your policy”. Insurance is the only racket on planet Earth that screws you more than your local commercial banker. Where else, what other industry, takes huge portions of your yearly salary for no service??

We just got through talking about idiots who get into crypto currency and idiots who think when Ford hasn’t built a good car in 43+ years that the Ford they buy tomorrow is going to be the good one. I could take a class of mentally disabled children and talk to them for 20 minutes, and they could pick out a car better than the moron consumers wandering a Ford dealership lot. Find the cheapest policy you can buy—because guess what??~~they aren’t paying your claim anyway. Make a bank account while you’re young, any payment you would have made to an insurance outfit, put it in a special bank account labelled “self insurance funds”. Put so much as a dollar in the account, and you’ll be $1 ahead what you would have lost from State Farm premiums.

this past December the wind dropped a large oak on the garage new rafters, sheathing and shingle set covered……

hail is whim0y

I’ve had (several times) a roofer come by, who promised me to get roof repair done, covered by insurance. The roof is getting old, but has pretty standard wear. It was after a (pretty standard for the Southeast) thunderstorm, and no reason to think any damage was from that storm specifically, versus the many others the roof has seen over the years (plus age). He was very “sales-y” about wanting to fix my roof under insurance.

I kind of blew his mind, when I said that I didn’t think there was any casualty loss…and that even if he could get away with it, I didn’t want to stick it to USAA. He chimed in that USAA would pay it, had seen this. And I pushed back and said “that’s the point…I don’t like the idea of pushing claims that I don’t deserve, just because they are likely to be approved.” I asked him if he just wanted to sell me roof repairs, direct. And he said no (guess he doesn’t want the hassle or maybe he’s not price competitive).

Anyhow…this stuff is going down…not just me…

https://www.forbes.com/advisor/homeowners-insurance/roof-repair-scams/

————

I’ve done a small amount of consulting in insurance (and had an offer to work in corporate from Liberty Mutual). And I generally dislike the industry. The companies have incentives to sell you insurance you don’t need (e.g. life insurance for people with no dependents). And then to deny claims when they come in. Even if ethical, everyone in the industry knows theses incentives are packed in. (Like real estate agents and I-bankers have incentives to close sales, more than getting the best price.)

The industry does attract a fair amount of math/econ/finance types. But I also don’t care for it because it’s an intangible and I just viscerally don’t like intangible products. True wealth comes from the ground. Yeah, yeah there are reasons for the industry to exist, reasons for a service economy to exist. But at the end of the day, we can’t all swap derivatives and provide services and move bits of information. There has to be a bedrock of physical production…and my non-finance interests (physical sciences, engineering) are attuned to the production…and a competitive advantage versus liberal arts people who think that the shrink-wrapped meat in the grocery store was born that way.

Is Ducky acknowledging that there are downsides to long periods of ultra-low interest rates? “I’ve mentioned that I’m worried insurers are sufferings some of the same problems as banks – a long period of low yields followed by a sharp drop in asset values.”

Menawhile Wolf Richter notes that the Fed Funds Rate is still below the core inflation rate and concludes: “The Fed’s Interest Rates Are still Fueling Inflation rather than Dousing it.” https://wolfstreet.com/2023/05/11/the-feds-interest-rates-are-still-fueling-inflation-rather-than-dousing-it-and-people-getting-used-to-this-inflation/

I doubt Wolf Richter is as dumb as you clearly are. Macroduck is discussing insurance rates and little Jonny boy tries to tell us contractionary monetary policy causes inflation. Oh that’s right – you are John Cochrane’s BFF. Got it,

“Is Ducky acknowledging that there are downsides to long periods of ultra-low interest rates? ”

John, I still can’t figure out what you are complaining about. if rates are low, you complain they should be higher. if rates are higher, you complain they should be lower. and you back it up by arguing that it is caused by some giant conspiracy theory, although you refrain from saying it directly because you know it will make you look like a nut job. other than complain, what is your point?

My son has a house with a slate roof installed in 1940.. Big tree fell and damaged the front half. Roofer said need to replace the whole roof and the copper flashing to do it right. State Farm resisted at first but with a little effort on my son’s part they agreed to pay $84,000 to do the job right. I was impressed. This happened in 2022.

It is the nature of insurance that most of us do not get back what we pay in claims, but a few get back much more.

You never worked for an insurance company or as an agent??

I would be most surprised if the US is not in recession by June 2023.

Incidentally, the term structure for Canadian GICs is inverted. Would guess that US GIC term structure is also inverted. Have started buying 1-year GICs at near 4.8% yields. I expect the real rate of return to be slightly positive with Canadian headline inflation well below 4% by 2023 year end.

Might be the first time in my active investment career going back to the turn of the century that I have purchased GICs. From what I am observing via my discount broker, the quoted yields are quite volatile. I believe they are responding more to what is going on in the US fixed income market rather than Canada.

Markets are twitchy if not spooked. I cannot tell if it is persistent inflation and the fear of additional Fed fund rate hikes or the fear of additional bank failures that is primarily driving the angst. All this has me wondering about the impact of the ‘wealth effect’ on inflation expectations and real wages. Off on I don’t recall any useful stylized facts.