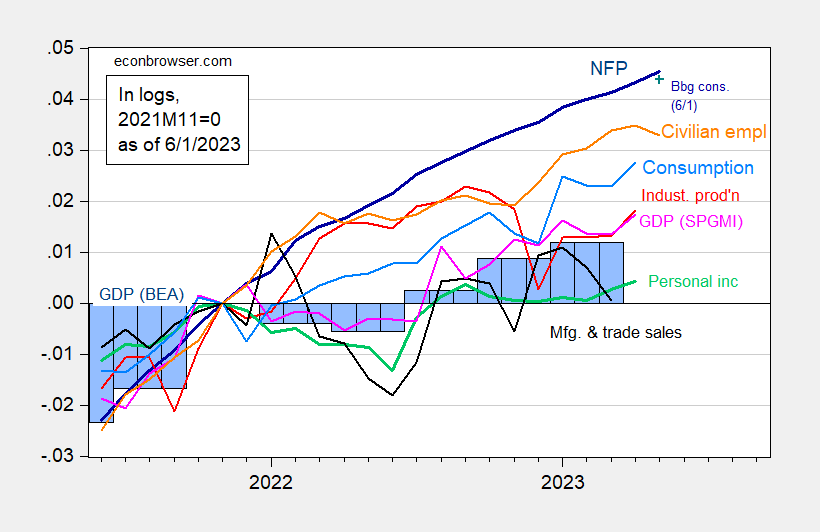

Nonfarm payroll employment growth far exceeded consensus, at 339K vs 180K. With April’s monthly GDP from SPGMI, we have the following picture of indicators followed by the NBER BCDC (along with monthly GDP):

Figure 1: Nonfarm payroll employment, NFP (dark blue), Bloomberg consensus of 6/1 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Bloomberg consensus level calculated by adding forecasted change to previous unrevised level of employment available at time of forecast. Source: BLS, Federal Reserve, BEA 2023Q1 2nd release via FRED, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (6/1/2023 release), and author’s calculations.

Nonfarm payroll employment in the latest release exceeds the implied level partly because of the surprise on employment growth and upward revisions to previous months’ levels.

GDPNow (today’s release) for Q2 is 2.0% SAAR. So GDP growth seems to be maintaining momentum. However, as noted in this post, other measures of aggregate output have trended sideways or downward.

“Nonfarm payroll employment growth far exceeded consensus, at 339K vs 180K.”

That sounds great but we need to figure out what that drop in the Household Survey was all about.

Remember all those time “self employed” was the wrong answer? Well this time, it’s the right answer:

https://fred.stlouisfed.org/graph/?g=15M0T

That’s a 412,000 decline in self employment in May, largest since the recession.

They were making that same point on NPR yesterday. Strikes this armchair economist as an easy data point to miss.

so far this year, the average workweek is falling faster than payroll jobs are rising, so total hours worked are down year to date…

at any rate, in re the business cycle, construction spending for both February and March were revised up 2.7% in this week’s report, mostly on non-residential construction…it’s as if they missed an entire city being built someplace…my rough estimate is that it’d add 48 basis points to 1st quarter GDP, with a wide margin of error on that estimate because i aggregated all construction into one figure, rather than breaking out the details

so far this year, the average workweek has been falling faster than payroll jobs has been rising, so total hours worked are down year to date…

at any rate, in re the business cycle, construction spending for both February and March were revised up 2.7% in this week’s report, mostly on non-residential construction…it’s as if they missed an entire city being built someplace…my rough estimate is that it’d add 48 basis points to 1st quarter GDP, with a wide margin of error on that estimate because i aggregated all construction into one figure, rather than breaking out the details

here’s the figures on that construction revision, if anyone is interested…

the annualized March construction spending estimate was revised 2.7% higher, from $1,834.7 billion to $1,885.0 billion, while the annual rate of construction spending for February was also revised 2.7% higher, from $1,829.6 billion to $1,878.8 billion…

here’s the archived March report: https://www.census.gov/construction/c30/pdf/pr202303.pdf

& the current report for April: https://www.census.gov/construction/c30/pdf/release.pdf

(that revision was so out of line that i had to check my old figures by digging out the archived report)

this report is the source data, and the only source data, for 3 subcomponents of GDP; investment in private non-residential structures, investment in residential structures, and state & local government investment outlays

check that; investment in private non-residential structures also includes oil & gas well drilling on a per foot basis, and investment in residential structures also includes manufactured homes, improvements (based on building material and garden equipment and supplies dealers’ retail sales and aggregate weekly payrolls of production workers for residential remodelers) and brokers’ commissions and other ownership transfer costs

While the household survey, BLS series LNS12000000, shows a decline of employment by310K, the adjusted household survey, BLS series, LNS16000000, shows an increase in jobs of 394K for May closer to the change in the establishment survey (nonfarm payroll) which was 339K. The monthly differences between the adjusted household summary and nonfarm payroll are wildly different by month for the past year, however. I was not aware of the adjusted household survey in the past.

Comparison of household, adjusted household and the payroll (nonfarm) reports.

https://www.bls.gov/web/empsit/ces_cps_trends.htm

Household (Employment Situation)

LNS12000000

https://data.bls.gov/timeseries/LNS12000000

Adjusted Household Survey

LNS16000000

https://data.bls.gov/timeseries/LNS16000000&from_year=1994

Nonfarm Survey (FRED Series PAYEMS)

https://fred.stlouisfed.org/series/PAYEMS

If you place the .00 mark at January 2023 instead of January 2022, the trajectory of the graphs looks rather different. Not only are 2 of the “big 4” coincident indicators down from their peaks, but real personal income ex-transfer payments is only up 0.1% since last September. As I wrote last week, when the three together have been at current levels, that has *always* meant a recession.

Meanwhile, since 1968 continuing jobless claims being up 10% or more YoY on a monthly basis has a *perfect* record as a recession indicator. *Zero* false positives. *Zero* false negatives. Three weeks through May, they are up 26% from one year ago. And the unemployment rate, as per its 55 year pattern, just followed jobless claims higher YoY as of this morning’s report.

Also remember that GDI and GDO as of Q1 were recessionary.

The indicators keeping the economy positive are real spending on services, and nonfarm payrolls. As to which, there’s QCEW for Q3 2022 released last week, showing a much weaker picture than nonfarm payrolls through that period (pending revisions!).

While I’m not saying the economy is in recession now, I think it is a much closer case than most are acknowledging.

While I’m not saying the economy is in recession now, I think it is a much closer case than most are acknowledging.

[ An interesting comment, in that Robert Shiller would argue that what most acknowledge in such a circumstance is decisive. I have learned to agree with Shiller. ]

Here’s a link to a FRED graph approximating what I wrote above:

https://fred.stlouisfed.org/graph/?g=15MPH

The graph includes all of Prof. Chinn’s metrics, plus real GDI. Data is normed to 100 as of January 2023, except for the 2 quarterly series where I used December 2022, and industrial production and real income less transfer receipts, where I used their September 2022 peaks.

Not quite as good as I wanted, because FRED displays Q1 data as cutting off in January.

But the bottom line is that only employment and real personal consumption (mainly services) are the only series making meaningful new highs since January.

Nice graph. Quite helpful.

Odd thing – I hit the link and had a problem with rendering. Two of the series were not indexed to January, 2023, even though the legend shows that they should be. Those familiar with FRED are probably aware of this glitch.

If the rendering goes awry, just hit the “copy to all” button in the “Settings” menu and everything will correct…maybe.

Along with development of a highly efficient technique to produce green hydrogen by electrolysis of seawater, China has now developed a sheet-of-paper-thin flexible-foldable highly efficient solar cell. This solar cell development is important enough to warrant the cover of Nature.com:

https://www.nature.com/articles/s41586-023-05921-z

May 24, 2023

Flexible solar cells based on foldable silicon wafers with blunted edges

By Wenzhu Liu, Yujing Liu, Ziqiang Yang, Changqing Xu, Xiaodong Li, Shenglei Huang, Jianhua Shi, Junling Du, Anjun Han, Yuhao Yang, et al.

Abstract

Flexible solar cells have a lot of market potential for application in photovoltaics integrated into buildings and wearable electronics because they are lightweight, shockproof and self-powered. Silicon solar cells have been successfully used in large power plants. However, despite the efforts made for more than 50 years, there has been no notable progress in the development of flexible silicon solar cells because of their rigidity. Here we provide a strategy for fabricating large-scale, foldable silicon wafers and manufacturing flexible solar cells. A textured crystalline silicon wafer always starts to crack at the sharp channels between surface pyramids in the marginal region of the wafer. This fact enabled us to improve the flexibility of silicon wafers by blunting the pyramidal structure in the marginal regions. This edge-blunting technique enables commercial production of large-scale (>240 cm2), high-efficiency (>24%) silicon solar cells that can be rolled similarly to a sheet of paper. The cells retain 100% of their power conversion efficiency after 1,000 side-to-side bending cycles. After being assembled into large (>10,000 cm2) flexible modules, these cells retain 99.62% of their power after thermal cycling between −70 °C and 85 °C for 120 h. Furthermore, they retain 96.03% of their power after 20 min of exposure to air flow when attached to a soft gasbag, which models wind blowing during a violent storm.

I like when Barry Ritholtz talks about NFP as the most over-analyzed, over-emphasized, least-understood data point https://ritholtz.com/2023/06/change-your-perspective/ To me, the media talks about NFP for one day each month usually with minimal amount of overall context.

I would note this about the 25 to 54 Years Old Labor Participation Rate – “Both are slightly above the pre-pandemic levels and suggest all of the prime age workers have returned to the labor force.” https://www.calculatedriskblog.com/2023/06/comments-on-may-employment-report.html

The U.S. desperately needs some immigration reform – give people an opportunity at a better life and grow the U.S. work force – much more sensible solution than the GOP idea of forcing children to work in bars and slaughterhouses https://boingboing.net/2023/05/25/state-lawmakers-want-children-to-work-in-bars-on-school-nights-to-fill-labor-shortage-caused-by-people-refusing-to-work-for-a-pittance.html

NPR reported the increase in participation and the rise in the jobless rate, treating the combination as a sort of mystery. Somebody needs a smack on the backside.

The debt ceiling drama magically disappeared after weeks of mainstream economists’ handwringing and angst. Jaimie Galbraith was right: it was all stagecraft.

As Thomas Ferguson, Paul Jorgensen, and Jie Chen note in “No Bargain: Big Money and the Debt Ceiling Deal,, “ the high noon showdown between Republicans and Democrats over the debt ceiling was pre-programmed from the start. The reason is simple: The dominating fact about American politics is its money-driven character. In our world, both major political parties are first of all bank accounts, which have to be filled for anything to happen. “

https://www.ineteconomics.org/perspectives/blog/no-bargain-big-money-and-the-debt-ceiling-deal

Now Galbraith observes: “ The Debt Deal Is a Tragedy. The debt-limit agreement entrenches long-term austerity. It was a huge GOP win.”

https://www.thenation.com/article/economy/debt-ceiling-deal/

Interesting, isn’t it, how most business friendly, mainstream economists, after all their hand wringing, have shown practically no interest in the economic and distributional effects of the deal. Apparently they gladly fell for the ruse of a threatened default, so any deal was great, no matter how bad it was for ordinary Americans. Fortunately, a few economists like Galbraith are willing to explain what just happened.

hand wringing? Not from me. I guess I’m not mainstream. And I am also not responding to the latest long winded worthless rant from little Jonny boy.

I am also not responding to the latest long winded worthless rant from little Jonny boy.

I am also not responding to the latest long winded worthless rant from little Jonny boy.

I am also not responding to the latest long winded worthless rant from little Jonny boy.

[ Whomever I might disagree with must be shamed and disdained. ]

Just another sign of his immaturity and insecurities.

The liberal mind is an amazement.

With so much of interest to discuss,all Johnny can manage is to repeat his same-old, dshonest, ignorant drone.

Yes, poliical parties love bathing in money. If you think that’s a revelation, you need to spend more time with grown-ups. If you think the debt ceiling is all about political fund-raising, you need to spend years listening to adults before you speak again.

The debt ceiling fight is meant to stir up the rabble, yes, but not merely to raise money. Republicans have built an outrage machine and have to gin up regular new outrage episodes. Otherwise, their audience will tune in to some other outrage show.

And here’s little Johnny, auditioning for a part in some outrage reality show. But just like the GOP, Johnny is playing a part in a “reality” show, not in reality. That’s the only reasonble explanation for his conclusion that “have shown practically no interest in the economic and distributional effects of the deal.” Less housing support for prime-age low-income workers and unemployed, more support for lower-income veterans, the homeless and and older folk – widely discussed. Cut in funding for the IRS as a boon to rich tax cheats – widely discussed. Small overall hit to GDP growth – I recall mentioning Zandi’s estimate in comments here, and they don’t come much more mainstream than Zandi. Once again, the only explanation for Johnny’s rant is ignorance or dishonesty. Or both…both is a pretty good explanation.

I read Freguson, Jorgensen and Chen piece yesterday and concluded that the auhors were waiting for an excuse to moan about money in politics.

Important analysis, for which I am grateful:

https://www.thenation.com/article/economy/debt-ceiling-deal/

May 30, 2023

The Debt Deal Is a Tragedy

The debt-limit agreement entrenches long-term austerity. It was a huge GOP win.

By James K. Galbraith

Two men emerged from the Oval Office. One of them, President Joe Biden, said of the deal they’d just reached that it “reduces spending while protecting critical programs for working people and growing the economy for everyone.”

The other, House Speaker Kevin McCarthy, said that the deal will bring “historic reductions in spending, consequential reforms that will lift people out of poverty into the work force, rein in government overreach.”

Contrary to the president, the deal will not “grow the economy.” Contrary to the speaker, it will not “lift people out of poverty.” It spares the military, veterans, Social Security, and Medicare, focusing cuts and caps on non-defense, discretionary spending—which, as the Center for American Progress has explained, includes many of the most “essential programs.” Those cuts accumulate, and—as population grows and prices rise—they will be steep. True, the spending caps apply for only two years, but then the debt ceiling will come up again, and they will likely be renewed. The precedent has been set. Speaker McCarthy is right: The cuts are historic. The deal means austerity for the long term. It is a huge Republican win.

The deal, according to Peter Baker in The New York Times, contains “important changes in environmental permitting, work requirements for social safety-net programs, and Internal Revenue Service tax enforcement.” * These are all gains for the Republican side. They benefit the oil and minerals industries and wealthy tax-evaders—bipartisan constituencies, though not the voting base of the Democratic Party. The “work requirements” for SNAP will make life harder for some of the poorest people in America.

What did the president get? An increase in the debt ceiling, until the next election is over, at which point the game gets to be played again. For this, Biden gave away the following previously held points of principle: (1) that the debt ceiling should be raised, when needed, without conditions; (2) that safety-net programs and tax enforcement are good and necessary; and (3) that domestic discretionary spending is not actually excessive but should be at levels required to meet public purpose and national needs. If Biden is reelected, these gifts will hobble his next administration. If he’s defeated, they set up the incoming president to use the debt ceiling to effect the full Republican agenda.

Were the concessions needed because of the gravity of the impending crisis? That is the biggest lie, shared by both parties, repeated by Wall Street, and amplified by the media, which loves a crisis and plays the public for fools….

* https://www.nytimes.com/2023/05/28/us/politics/debt-ceiling-deal-takeaways.html

Hey Jonny boy – did you read past the headline? It seems not as had you done so, you might have seen this:

No wonder Paul Krugman voiced skepticism about what was behind the White House’s calculations. “More and more it looks as if there never was a strategy beyond wishful thinking. I hope that I’m wrong about this…But right now I have a sick feeling about all of this. What were they thinking? How can they have been caught so off-guard by something that everyone who’s paying attention saw coming?”

Krugman called this a bad deal. And he seems to be your number one “mainstream” economist who allegedly never takes a progressive position. Oh but once again he did and you just ignored it.

Treasury has schedule $225 billion in bill sales for Monday and Tuesday. Because so many maturing notes have been rolled over into bills while Treasury has been operating under the ceiling, that’s not unusually large. Those auctions will raise $68 billion in new money. That’s not particularly large either – bills cover swings in Treasury cash holdings. What we can’t see yet, because Treasury hasn’t had time to issue auction schedules, is what notes and bonds will be issued in coming days, nor what size bill auctions will be scheduled for coming weeks. Got some catching up to do. Could he fun.

Putin may have a rebellion on his criminal hands:

https://www.msn.com/en-us/news/world/anti-kremlin-rebels-are-back-marauding-inside-russia-and-triggering-fears-putin-s-forces-can-t-defend-the-homeland/ar-AA1c38ac?ocid=msedgdhp&pc=U531&cvid=a2c81ec02e104f408a7c0febc0b181d6&ei=8

A small group of anti-Kremlin Russians with armored vehicles crossed into the Belgorod region of Russia.

Images captured the damage they caused inside Russia, and triggered debate and skepticism of Putin’s regime.

The melee adds to fears that Russia’s troops are not up to the task of stopping a looming Ukrainian counter-offensive.

Heavy smoke rose over the town of Shebekino, one of the latest Russian border towns to fall prey to a band of heavily armed partisan fighters.

Their latest border raid began Thursday when a small group of fighters in armored vehicles crossed into the Belgorod region of Russia, a key staging ground for the ammunition and supplies needed to fuel the invasion of Ukraine nearby.

Scenes captured on social media suggest the militants, who go by the Freedom of Russia Legion, have hardly delivered on their pledge to “bring freedom, peace and calm” to Russian citizens. But their operation has succeeded in one critical aspect: Creating images of wreckage inside Russia’s borders that are reigniting debates among hardliners deeply skeptical of Russian officialdom.

Ducky makes plenty of assertions about how business friendly, mainstream economists explained the effects of Biden’s austerity-ridden debt deal to the American people…but couldn’t manage to find a single link to support his contention!

Meanwhile that Very Serious Economist, Krugman, was singing Biden’s praises, finding almost nothing to criticise in Biden’s charade or in its outcome.

But what’s most hilarious is that Ducky feels free to denigrate me but refuses to respond to any of the serious insights offered by Galbraith. Good job of distracting from the issues, Ducky. Your business buddies will be proud of you for glossing over distributional aspects of Biden’s debt ceiling deal and generally ignoring its impact on ordinary Americans.

“Meanwhile that Very Serious Economist, Krugman, was singing Biden’s praises, finding almost nothing to criticise in Biden’s charade or in its outcome.”

Gee Jonny boy – you know this is not true as your own link noted Krugman’s recent oped. Yep – little Jonny boy lies and lies.

Since pgl is “link challenged” and provides almost none to support his trolling, I have no idea what “recent” Krugman column he is referring to. What Krugman said was, “Overall, the administration made hardly any major concessions; this debt standoff ended up being far less consequential than the debt ceiling crisis of 2011.

So how did Biden, whom right-wingers constantly deride as senile and incompetent despite a series of remarkable legislative achievements, pull this off?” https://www.nytimes.com/2023/06/01/opinion/debt-ceiling-republicans-kevin-mccarthy.html

I would say that this quote validates my statement that that “Very Serious Economist, Krugman, was singing Biden’s praises, finding almost nothing to criticise in Biden’s charade or in its outcome.”

Fortunately Galbraith dared to provide serious commentary while the liberal punditry was backslapping each other for the outcome not being worse. Since when does the death by a thousand cuts process deserve such enthusiastic applause?

You conveniently forgot what Krugman wrote back on May 18. Now did you not read that oped? Or did dishonest little Jonny boy simply decided that oped never existed?

Here’s Krugman account:

Like many — I think most — observers, I didn’t see this coming. In the spring Republicans seemed to be converging on demands for harsh spending cuts, especially to Medicaid. The Biden administration was counting on self-proclaimed centrists and business groups to lean on Republicans to back off; they didn’t. And publicly at least, Biden officials repeatedly rejected all possible end runs around the debt ceiling. Republicans seemed to be in a strong bargaining position.

Yet in the end we got some spending caps that would probably have happened even without the attempt to take the economy hostage, since “discretionary” spending would have had to pass the House in any case. We got an extension of work requirements in the food stamp program for Americans in their 50s, which will cause some loss of coverage — not because they refuse to work, but because they’ll be stymied by extra red tape. And we got a side agreement to cut $20 billion from the $80 billion in additional funding for the I.R.S. that was included in the Inflation Reduction Act. But that $80 billion was for a decade. In practice, efforts to crack down on wealthy tax evaders will probably be little changed in the next few years, and the I.R.S. will simply come back for more money later. Overall, the administration made hardly any major concessions; this debt standoff ended up being far less consequential than the debt ceiling crisis of 2011.

It sounds like Krugman got this correct. Now Jonny boy may have his own version of reality. It is what Jonny boy do – he makes up trash as it goes.