Alternate measures of conceptually similar to NFP and private NFP continue to rise.

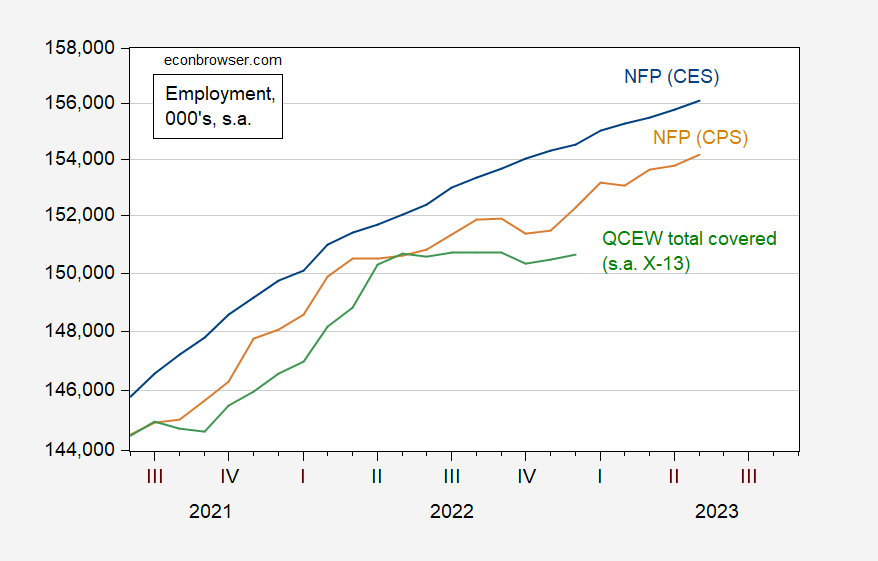

Figure 1: Nonfarm payroll employment from CES (blue), from CPS, adjusted to NFP concept (tan), and total covered employment from Quarterly Census of Employment and Wages, seasonally adjusted by author using X-13 (green), all in 000’s, s.a. Source: BLS via FRED, BLS, BLS (QCEW).

Note the CES NFP trend is matched in recent months by the research series drawn from the CPS (tan line). While the QCEW based series plateaued over the last half of 2022, the Philadelphia Fed’s Early Benchmark estimates through 2023Q1 indicate continued growth.

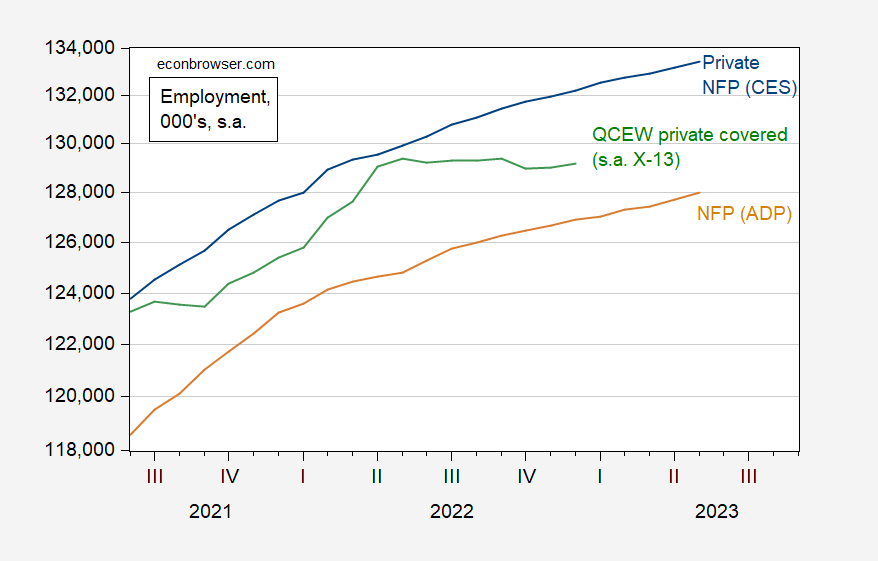

Figure 2: Private nonfarm payroll employment from BLS CES (blue), from ADP (tan), and total covered employment from Quarterly Census of Employment and Wages, seasonally adjusted by author using X-13 (green), all in 000’s, s.a. Source: BLS, ADP via FRED, BLS (QCEW).

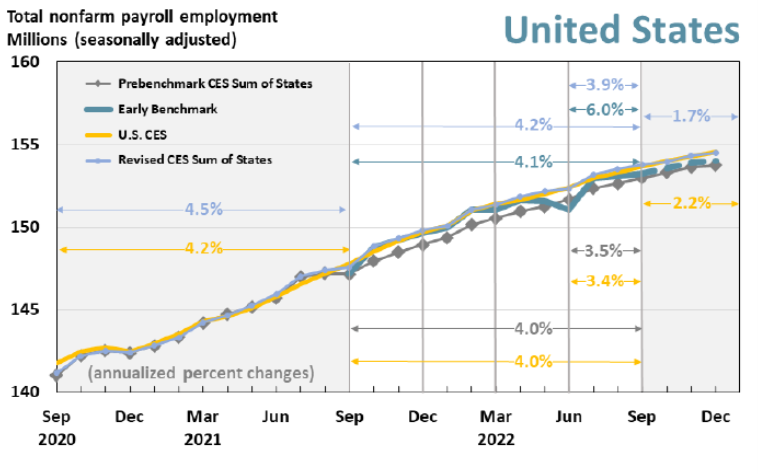

There has been substantial debate regarding whether the Philadelphia Fed’s early benchmark using QCEW data would yield a different picture of matters (reader Steven Kopits hinged an entire argument for recession in 2022H1 on this series). The latest reading indicates continued growth in 2023Q1.

Source: Philadelphia Fed (March 16, 2023).

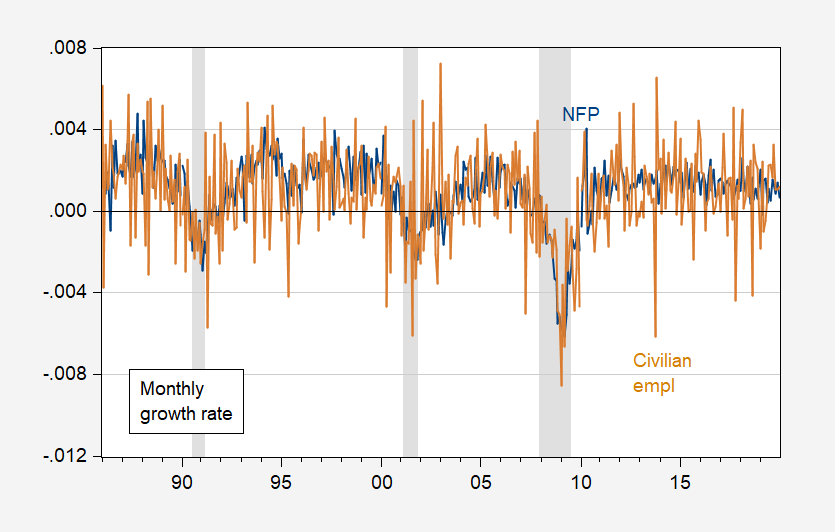

Why not pay more attention to the CPS civilian employment series? Because the variability of that series, relative to the CES NFP, as shown in Figure 3.

Figure 3: First log difference of NFP (blue), and civilian employment (tan). New population control months excluded. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER and author’s calculations.

The standard deviation is 0.0015 for NFP and 0.0023 for civilan employment.

While there is a folk wisdom that the civilian series turns down before the establishment, there is mixed evidence for this in real time (as noted in this post). Civilian employment has declined in May, while NFP has continued to rise. But civilian employment also declined in April, June and October of last year…

Off-topic

This incredible venom from “orthodox economists” towards isabella Weber is really rather an interesting study in psychology and a type of domain protection almost exceeding that shown between government agencies regarding regulatory territorial disputes. If “orthodox” economists become so locked into a tunnel vision of theory, they are no longer economists, but defenders of corporate status quo.

Is it not the most disingenuous argument to say “profits dropped” between year X and year Y of a respiratory disease pandemic and at that same time profit margins are widening?? These are the type of arguments economists make when their opinions are already bought and paid for by the likes of Goldman Sachs (as “consultants”) or given free travel holidays and the adoration of crowds some old profs on this blog have bragged about getting at banker hosted “symposiums” (“symposiums” read as: brainwashing clinics).

Moses Herzog: Helpful to all of us if you provide link to the debate. Had not heard of Dr. Weber until Krugman’s apology. /s/ former consultant, Banque de France, World Bank. Once attended a conference funded by Monte dei Paschi di Siena.

I think the reason why you said that, is because subtextually (is that a word?? you get my meaning), you know I respect you, I see you as 98% objective and not one to be influenced by money matters (at least in a way which would effect your professional integrity). But not every economist is like Menzie Chinn (takes personal integrity as seriously). I think sometimes you are a little (I said a little) too easy to write off Fed Res mistakes sometimes. Not because of money, but because of collegial fraternity (not per se “good ol’ boy” but as in like how you would feel if one of your biological brothers didn’t look both ways when crossing the street and had his knee hit by a car fender). You’d be angry at the car driver more than your brother not looking both ways, right?? Possibly?? Collegial emotions effect people’s view.

I will hunt down some links and put them in this same thread, but there was definitely some scoffing at Weber.

Moses Herzog: I wasn’t asking for links because I doubted the existence of criticisms; just that I didn’t want to have to hunt them down. Thanks for the links.

They were semi-hard to fish for, and I’m pretty good at hunting links. Even though my parents didn’t have a computer in the house until I had left home and gotten a real job (heaven forbid my parents doing anything to help us on our educational journey other than just scream lecture) , my university gave pretty good access to computers and internet around…. ’97??? Internet was not a household deal even then. And my information systems class instructor was obsessed with making up sh*t for us to hunt down. So I got pretty good at web searches. This was when Yahoo was still a big deal, and before Microsoft bought out Netscape just so Bill Gates could destroy a better product than his blue screen of death crap. And they succeeded in destroying the best browser on the market at that time. Maybe one of Bill Gates better accomplishments, destroying the best browser in the world, and then screwing around on his wife. Great guy. Gates “knew and ‘warned'” there would be a pandemic. But Gates thought making a backlog of masks was for the dirty people I guess. Maybe Gates expected the original creators of Netscape to supply the backlog of masks?? Bill Gates was too important to make masks, even though he “foresaw” and “warned” on the pandemic, Creation of mask reserves was for dirty people or something. People who could create/write good quality software that didn’t make your computer shutdown 20 seconds after you turned it on, not just buy DOS and then sit on their can cashing checks. Maybe Bill Gates did create something new ???~~a new American cultural tradition~~Planned obsolescence of products. Or was that a GM/Ford/Chrysler idea? I forgot now. But as usual, I digress……

But I want to say, even those links were mildly hard to fish for, I suspect there were/are some more “gems” attacking Weber from Masters/PhD economists that I couldn’t find that are located on Twitter.

Justin Wolfers, even if you want to argue did it in a “polite” fashion, did rather straightly fluff off her arguments in a short snippet on WBUR

https://www.wbur.org/onpoint/2023/06/02/greedflation-a-once-fringe-theory-of-inflation-gains-momentum

From the corners of Mercatus and George Mason University (have you quoted or allowed to guest post some Mercatus folks here in non-derogatory way??~~or is my brain playing “fooled yeh!!!” with me again??)

https://www.econlib.org/library/columns/y2022/candelapricecontrols.html

Dominic Pino “journalism fellow” at National Review

https://www.nationalreview.com/corner/no-we-shouldnt-use-price-controls-to-fight-inflation/

University of Chicago exam question, aimed at, who would you guess??

https://twitter.com/neocentrist/status/1491587498245558274

Menzie, how would you like to be publicly mocked on an exam question, at say Stanford, or UCLA, or University of Cali at San Diego?? Call me a sensationalist Menzie, I don’t think you would care at all for receiving that type of treatment. Possibly, it might even tick you off.

This is one of Weber’s better written defenses of herself. I got through the Project Syndicate paywall so I would think you have at least a 60% chance of getting past it as well.

https://www.project-syndicate.org/magazine/inflation-targeted-price-controls-alternative-to-interest-rate-hikes-by-isabella-m-weber-2023-03

I would say Menzie (and say respectfully towards you) that I don’t think the German government is in the habit of hiring/paying women for important nation-wide resource distribution decisions who don’t know what the hell they are doing or subscribe to “naive”….. “hasn’t taken Economics 101” theories~~or even who produce “stupid” ideas according to some MIT/NYU orthodox economist. But that’s just me. I never worked/consulted at Banque de France, and it’s pretty doubtful they’d hire me for janitor.

https://news.cgtn.com/news/2022-01-22/The-case-for-strategic-price-policies-171AF24WDgk/index.html

January 22, 2022

The case for strategic price policies

By James K. Galbraith

With a single commentary * in The Guardian (and an unintended assist ** from New York Times columnist Paul Krugman), economist Isabella Weber of the University of Massachusetts injected clear thinking into a debate that had been suppressed for 40 years. Specifically, she has advanced the idea that rising prices call for a price policy. Imagine that.

The last vestige of a systematic price policy in America, the White House Council on Wage and Price Stability, was abolished on January 29, 1981, a week after Ronald Reagan took office. That put an end to a run of policies that had begun in April 1941 with the creation of Franklin D. Roosevelt’s Office of Price Administration and Civilian Supply – seven months before the Japanese attack on Pearl Harbor.

U.S. price policies took various forms over the next four decades. During World War II, selective price controls quickly gave way to a “general maximum price regulation” (with exceptions), followed by a full freeze with the “hold the line order” of April 1943.

In 1946, price controls were repealed (over objections from Paul Samuelson and other leading economists), only to be reinstated in 1950 for the Korean War and repealed again in 1953. In the 1960s, the Kennedy and Johnson administrations instituted pricing “guideposts,” which were breached by U.S. Steel, provoking an epic confrontation. In the following decade, Richard Nixon imposed price freezes in 1971 and 1973, with more flexible policies, called “stages,” thereafter.

Federal price policies during this period had a twofold purpose: to handle emergencies such as war (or, in the cynical 1971 case, Nixon’s re-election) and to coordinate key price and wage expectations in peacetime, so that the economy would reach full employment with real (inflation-adjusted) wages matching productivity gains. As America’s postwar record of growth, job creation, and productivity shows, these policies were highly effective, which is why mainstream economists considered them indispensable.

The case for eliminating price policies was advanced largely by business lobbies that opposed controls because they interfered with profits and the exercise of market power. Right-wing economists – chiefly Milton Friedman and Friedrich von Hayek – gave the lobbyists an academic imprimatur, conjuring visions of “perfectly competitive” firms whose prices adjusted freely to keep the economy in perpetual equilibrium at full employment.

Economists with such fantasies held no positions of public power before 1981. But in the 1970s, the practical conditions for maintaining a successful price policy started to erode. Problems multiplied with the breakdown of international exchange-rate management in 1971, the loss of control over oil prices in 1973, and the rise of foreign industrial competitors (first Germany and Japan, then Mexico and South Korea)….

* https://www.theguardian.com/business/commentisfree/2021/dec/29/inflation-price-controls-time-we-use-it

** https://twitter.com/paulkrugman/status/1477247341212184577

With this NY Times headline, it looks like the alternative narrative that skyrocketing corporate profits drive inflation has finally broken through the Overton Window: “Companies Push Prices Higher, Protecting Profits but Adding to Inflation.” A large amount of the credit goes to Isabella Weber, who started pushing this idea well over a year ago, while most mainstream economists pooh pooed the very thought of corporations driving inflation!

And the problem is not going away anytime soon: “The average company in the S&P 500 stock index increased its net profit margin from the end of last year, according to FactSet, a data and research firm, countering the expectations of Wall Street analysts that profit margins would decline slightly. And while margins are below their peak in 2021, analysts forecast that they will keep expanding in the second half of the year.” https://www.nytimes.com/2023/05/30/business/economy/inflation-companies-profits-higher-prices.html?action=click&module=Well&pgtype=Homepage§ion=Business

While the idea that “corporations drive inflation” may have become an accepted public narrative, it will probably be a long, long time before most mainstream economists are willing to juxtapose the words inflation and profits. And many won’t even recognize the name Isabella Weber!

Gee Jonny boy – our host put up some recent data on this. Now take a deep breathe before you decide to go off on another one of your silly rants.

That story still repeats the claim that PepsiCo has seen higher profit margins? Dude – we have exposed your3 lies about this over and over. And you go back there? Seriously?

And the other two examples given are Dollar Tree and Micky D’s? Damn Jonny boy – we knew you sucked at research but come on man!

BTW Jonny boy. Your article talked about how McDonald’s is enjoying ever rising profits. But their 10-K shows that profits fell from $10.4 billion in 2021 to only $9.4 billion in 2022.

Yea – you rely on some of the dumbest sources.

Now if you actually tried to look up their financials, you might notice that http://www.sec.gov makes this easy and free. But poor little Jonny never learned how to. Huh!

When pgl accuses me of lying–or in this case Pepsi’s CFO–you can pretty much take it to the bank that pgl is the one who’s lying.

Here’s what the article says about Pepsi: ““Companies are not just maintaining margins, not just passing on cost increases, they have used it as a cover to expand margins,” said Albert Edwards, a global strategist at Société Générale, referring to profit margins, a measure of how much businesses earn from every dollar of sales.

PepsiCo has become a prime example of how large corporations have countered increased costs, and then some.

Hugh Johnston, the company’s chief financial officer, said in February that PepsiCo had raised its prices by enough to buffer further cost pressures in 2023. At the end of April, the company reported that it had raised the average price across its snacks and beverages by 16 percent in the first three months of the year. That added to a similar price increase in the fourth quarter of 2022 and increased its profit margin.

“I don’t think our margins are going to deteriorate at all,” Mr. Johnston said in a recent interview with Bloomberg TV. “In fact, what we’ve said for the year is we’ll be at least even with 2022, and may in fact increase margins during the course of the year.”

Get that pgl? Pepsi’s CFO thinks that margins will “be at least even with 2022, and may in fact increase margins during the course of the year.”

What a lying troll!

“Hugh Johnston, the company’s chief financial officer, said in February that PepsiCo had raised its prices by enough to buffer further cost pressures in 2023.”

This alone shows what lying moron Jonny boy is. Unless he and this CFO has a crystal ball, they can only FORECAST the eventual 2023 profit margin. Gee Jonny boy – are you really that good at forecasting?

That is mighty rich as you falsely claimed that its 2022 margin (13.3%) was higher than its 2020 margin (14.3%). Jonny boy can’t get the historical past numbers right but he knows how to forecast the future? SERIOUSLY?

imagine if they froze the price of f-35, or ford class carriers…..

Price controls in a monopolistic markets you ask? Well, standard economics predicts the supply of these goods would INCREASE. Of course, a retarded bot would never know that.

https://www.theguardian.com/business/commentisfree/2021/dec/29/inflation-price-controls-time-we-use-it

December 29, 2021

We have a powerful weapon to fight inflation: price controls. It’s time we consider it

To prevent inflation after World War II, America’s leading economists recommended strategic price controls. Is there a case for doing so today, too?

By Isabella Weber – Guardian

Inflation is near a 40-year high. Central banks around the world just promised to intervene. However, a critical factor that is driving up prices remains largely overlooked: an explosion in profits. In 2021, US non-financial profit margins have reached levels not seen since the aftermath of the second world war. This is no coincidence. The end of the war required a sudden restructuring of production which created bottlenecks similar to those caused by the pandemic. Then and now large corporations with market power have used supply problems as an opportunity to increase prices and scoop windfall profits. The Federal Reserve has taken a hawkish turn this month. But cutting monetary stimulus will not fix supply chains. What we need instead is a serious conversation about strategic price controls – just like after the war.

Today economists are divided into two camps on the inflation question: team Transitory argues we ought not to worry about inflation since it will soon go away. Team Stagflation urges for fiscal restraint and a raise in interest rates. But there is a third option: the government could target the specific prices that drive inflation instead of moving to austerity which risks a recession.

To use a metaphor: if your house is on fire, you would not want to wait until the fire eventually dies out. Neither do you wish to destroy the house by flooding it. A skillful firefighter extinguishes the fire where it is burning to prevent contagion and save the house. History teaches us that such a targeted approach is also possible for price increases….

https://twitter.com/paulkrugman/status/1477247341212184577

Paul Krugman @paulkrugman

Deleting, with extreme apologies, my tweet about Isabella Weber on price controls. No excuses. It’s always wrong to use that tone against anyone arguing in good faith, no matter how much you disagree — especially when there’s so much bad faith out there.

6:56 AM · Jan 1, 2022

Thanks for this.

According to the Philadelphia Fed, they will update their early benchmark through Q4 on June 15.

Apparently the reason the QCEW remains preliminary for all of 2022 is that the “death” part of the birth/death model won’t be updated for several more months.

pgl noted another attack by Russians against Russian targets in Russia:

pgl

June 3, 2023 at 12:11 pm

Putin may have a rebellion on his criminal hands:

https://www.msn.com/en-us/news/world/anti-kremlin-rebels-are-back-marauding-inside-russia-and-triggering-fears-putin-s-forces-can-t-defend-the-homeland/ar-AA1c38ac?ocid=msedgdhp&pc=U531&cvid=a2c81ec02e104f408a7c0febc0b181d6&ei=8

A small group of anti-Kremlin Russians with armored vehicles crossed into the Belgorod region of Russia…

The article notes the limited damage caused by such attacks. So what’s the point? Here is what looks like a perfectly sensible explanation for the recent drone attack against Moscow, which seems applicable to ground attacks inside Russia:

https://worldcrunch.com/focus/drone-attack-moscow-counteroffensive

The Kremlin ends up diverting resources away from its defensive lines in Ukraine to defend territory inside Russia against attack. Good idea for Ukraine at any time, and particularly good ahead of a counterattack.

The one-sided nature of this war has been an obvious problem for Ukraine from the beginning. Everyone has tip-toed around the idea of attacking Russia, because Russia is soooo scary. But aside from Russia’s nukes, Russia’s military capabilities are under considerable doubt these days. So the question eventually became, how does one attack Russia? At least for now, the answer is, “With Russians!”

One aim is getting Russian citizens to demand protection. Attacking border towns – especially those involved in supplying materiel to Russian forces in Ukraine – and Moscow itself ought to do for a start. Unless this leads to some bad outcome for Ukraine, attacks within Russia seem likely to continue, to convince the citizenry that they are at increasing risk of harm from Putin’s egotistical land-grab.

There might even be an advantage in convincing Russian citizens that a long-term low-grade conflict with Ukraine is a bad idea. Such conflicts are part of Russia’s standard playbook, so might as well get busy doing something about it. Kick hornets’ nest, get stung.

The main public argument against attack on Russian territory has been the fear of the nuclear trigger.

However, a more important strategic issue has been that of effects on the commitment to the war from Russians and their soldiers. Putin has been desperate in trying to convince his people that this war is an existential fight for defending Russia against NATO. Nut he has not yet dared to institute a general mobilization. At this time Russia has a much larger number of soldiers, but they are much less motivated than the Ukrainians. Russian industries have also not been switched to wartime mode. Attacks on Russia have to be done with extreme caution so it doesn’t give Putin cover and ability to accelerate the conflict.

However, the current approach to attacks on Russia is brilliant. It has been done in a way and at a time that gives maximal advantage to Ukraine and with minimal risks and benefits to those in Russia that are pressing for converting the “special military operation” to a full force all out war.

field marshal zelenski should order a cross border incursion into belgorod to cut the ho China Minh trail with russian identifying euro neo nazis

Hopefully, you won’t be able to find your car keys, and you’ll spend a pleasant day at home posting more gibberish.

We certainly don’t want this drunk to be out driving.

As for the apology of Paul Krugman to Isabella Weber, the apology did not allow for carefully considering the argument that Weber was presenting. Krugman prejudicially dismissed an argument on dealing with the current episode of inflation, and the notable dismissal remains unfortunate beyond the meanness. James Galbraith was unable to rescue Weber’s argument.

Thinking to Weber’s argument and New Deal price policy would possibly have been useful in the way in which the matter of the debt ceiling was approached. The point here is that Franklin Roosevelt set aside large American debt right after becoming President. Defaulting on the price of gold worked brilliantly for the broad economy, but President Biden chose to significantly limit policies Democrats had proposed and supported rather than look to the precedent set by Roosevelt. Galbraith thinks that in turning away from precedent Biden made an unfortunate decision.

Suggested by John H:

https://www.thenation.com/article/economy/debt-ceiling-deal/

May 30, 2023

The Debt Deal Is a Tragedy

The debt-limit agreement entrenches long-term austerity. It was a huge GOP win.

By James K. Galbraith

https://www.cadtm.org/Debt-celling-Radio-Silence-Concerning-United-States-President-Franklin

May 28, 2023

Debt ceiling: Radio Silence Concerning United States President Franklin Roosevelt’s Repudiation of Debts

By Eric Toussaint

During your education, did you learn that during the 1930s the government of the USA unceremoniously repudiated a central provision of debt contracts that represented phenomenal sums? Do any history books analyze that act? Historical narratives are fashioned by mainstream thought, whose aim is to induce the belief that governments like that of the USA respect the sacred character of contracts, in particular those involving debts and property. However that belief is far from reality. The repudiation of the gold clause in debt contracts in the name of public order, of the general interest and of necessity is an important episode in “contemporary” history. Yet it is an episode that has been kept quiet, including in the USA itself. The unilateral repudiation of debt contracts, in whole or in part, to which various governments have resorted over the past two centuries is currently a highly important topic, at a time when more and more countries are approaching a new major debt crisis.

On 19 April 1933, six weeks after the start of his term as president, the Democrat Franklin Roosevelt announced that the United States would no longer repay its debts in gold, but rather in paper money – in dollars in the form of banknotes.

This decision was of very great importance, since many loan contracts stipulated that creditors could require that debts be repaid either in gold or in dollars at the rate of 20 dollars for a troy ounce of gold.

Loan contracts containing the provision (a “gold clause”) represented a colossal sum for the time: USD 120 billion, including 20 billion in debts contracted by the public authorities and 100 billion in private-sector debt. That sum was greatly in excess of the market wealth produced in one year in the USA (according to Sebastian Edwards, debt contracts containing a gold clause represented 180% of the GDP of the United States at the time)….

We keep hearing the old refrain from economists “we are the experts, if you want deeper knowledge, go to the experts” What happens when a credentialed economist goes off the corporate/banksters screenplay script?? What happens then??~~ The “experts”, Krugman, U of Chicago, U of Michigan, Mercatus do what Lions do. They partake in cannibalism of fellow experts. Message~~don’t go off the corporate CEO movie script, you will be eaten, and your version of the storyline thrown into the trash. The CEOs won’t feed the “expert” economists “endowed chairs” etc, if they don’t stick to CEOs’/banksters’ favorite genre~~of fiction~~”Oh darn, because of wage spiral, and too many employed Americans, we must raise prices and raise profit margins”-~~it’s like corporate/bankster coach Britney Spears says~~”Oops, I think we raised price~price inflation and had high profit margins again“

Thanks Menzie.

I am currently reading Pathogensis – A History of the World in Eight Plagues by J. Kennedy. Among the economic impacts of plagues is a large wealth transfer between generations and increase in low wage workers wages. Interesting to look at GDP per capita in the U.S. where we had million+ excess deaths the past two years. https://fred.stlouisfed.org/series/A939RC0A052NBEA It was 62,000 to $63,000 during Trump admin and is now $72,000 and growing under Biden ( I find it interesting that few want to consider this as a framework in discussing our economy – certainly not the GOP – which try to pass off their anti-science policies as a “GOP win”

https://www.vox.com/policy/23682263/ron-desantis-covid-19-vaccines-joseph-ladapo)

Here are my policy suggestions to grow our economy – encourage and welcome immigration to grow our workforce and increase the corporation tax rate back to or above what they were before the Trump tax giveaway to corporations.

Ever read “Plagues and Peoples” by McNiell? From back in 1917. Very readable.

McNiell had the limited access to economic and demographic data that was the way of things prior to the internet, but managed quite well.

And then there’s the auto industry–limiting supply to keep prices high! Business Insider: “Car companies have a new way of keeping prices up: limiting options on the dealer lot.” https://www.businessinsider.com/automakers-low-inventory-maximize-profits-supply-chain-constraints-car-buyers-2023-5?op=1

“The COVID experience showed both automakers and dealers the upsides related to higher margins and reduced sales,” Karl Brauer, executive analyst at iSeeCars.com, told Insider. “I suspect there’s a realization that having fewer, well-moneyed buyers has its advantages — at least in the near term.” https://www.businessinsider.com/automakers-low-inventory-maximize-profits-supply-chain-constraints-car-buyers-2023-5?op=1

Yet most mainstream economists refuse to acknowledge that Corporate America is driving inflation, although at least one has acknowledged that while corporations are profiting, it’s still mostly labor’s fault…even though real wages are barely about what they were before the pandemic! Moral of the story? Business friendly economists are always going to find a way to blame labor and exonerate the folks who have the means,, the motive, and the opportunity to keep raising prices faster than costs.