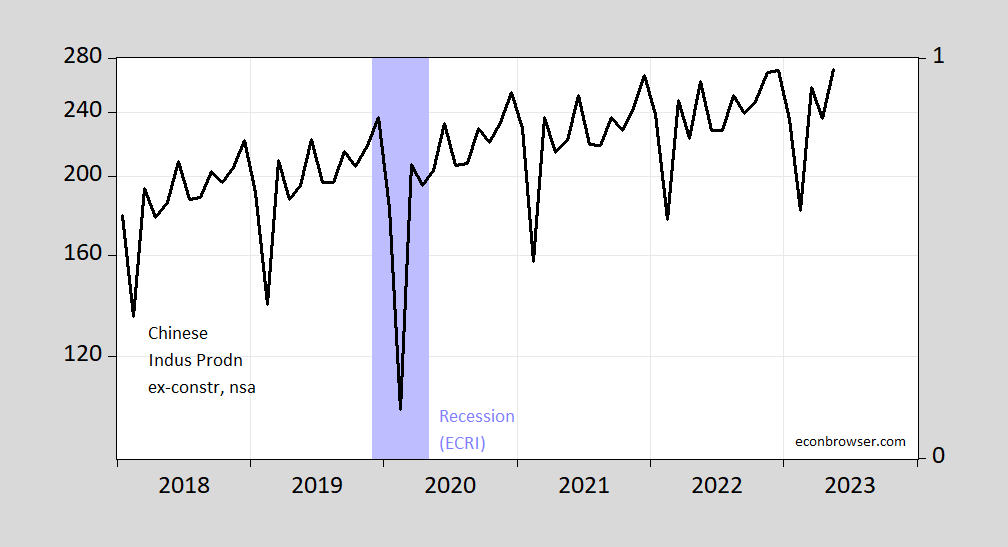

Interview on CNN with LingLing Wei today, she doesn’t say “recession”, but the idea is there (“struggling, ‘big time'”I think is the phrase). Here’s a picture of industrial production ex.-construction through May, and ECRI’s recession dates (peak-to-trough):

Figure 1: Chinese industrial production ex-construction (black, left log scale). ECRI defined peak-to-trough recession dates shaded light blue. Source: OECD MEI via FRED, ECRI.

It’s clear industrial production growth has slowed (IP is shown on log scale, so a decreasing slope indicates slowing growth rate). Incipient deflation is suggestive of recession, or at least a slowdown (if one believes in a Phillips curve, although an expectations and input augmented Phillips curve indicates caution). Does this mean we’re in a recession in China? And who gets to decide what’s a recession in China? (See discussion by Frankel here.) Consider ECRI as compared to OECD’s indicator.

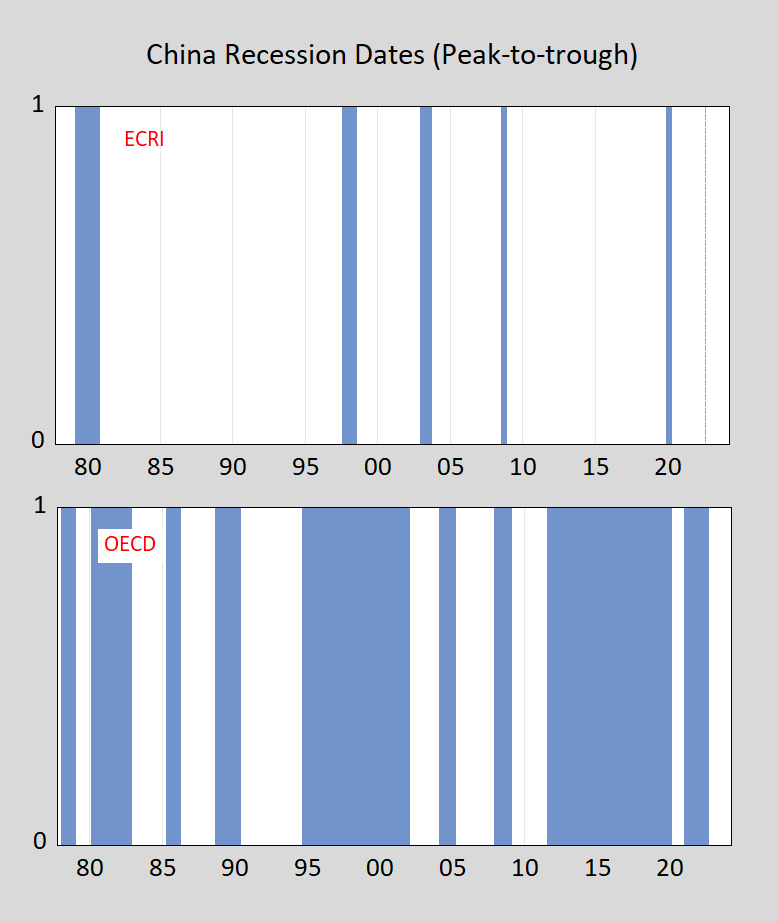

Figure 2: Recession dates (peak-to-trough) for China, from Economic Cycle Research Institute shaded blue (ECRI), top panel, from OECD shaded blue (bottom panel). OECD series ends in 2022M09, denoted by red dashed line. Source: ECRI, OECD via FRED.

Clearly, there is little congruence of views on what defines a recession (for a listing of sources for recession calls across countries, see this post).

We’ll know a bit more in a few hours (10pm ET), as a bevy of data for Q2 is released, including GDP and industrial production, fixed assets, etc. Growth in GDP y/y consensus is 7.3% vs. 4.5% previous, which sounds pretty good, although consensus for q/q is 0.5% vs. 2.2% previous (not annualized). June industrial production y/y growth is at 2.7% consensus vs. 3.5% previous, retail sales 3.2% consensus vs. 12.7% previous.

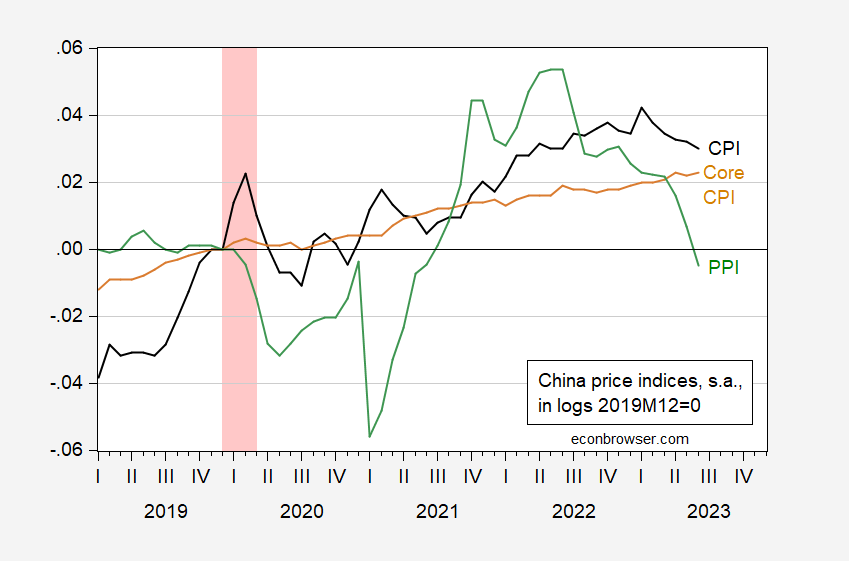

What we already know is that consumer prices are flat, and producer prices are falling.

Figure 3: China CPI (black), core CPI (tan), and PPI (green), all in logs, 2019M12=0. ECRI defined peak-to-trough recession dates shaded pink. Source: Kose/Ohnsorge – World Bank and IMF, IFS, both updated using TradingEconomics; and author’s calculations.

This is, of course, Wall Street Journal nonsense.

The Wall Street Journal, all Rupert Murdoch media are wildly prejudiced, and just as Murdoch media was determined to ruin Jeremy Corbyn as British Labour Leader, Murdoch media is determined to ruin China but will, of course, not be successful with China:

A small, small, small sample of the prejudice of the Wall Street Journal:

https://www.wsj.com/articles/china-is-the-real-sick-man-of-asia-11580773677

February 3, 2020

China Is the Real Sick Man of Asia

Its financial markets may be even more dangerous than its wildlife markets.

By Walter Russell Mead – Wall Street Journal

The mighty Chinese juggernaut has been humbled this week, apparently by a species-hopping bat virus. While Chinese authorities struggle to control the epidemic and restart their economy, a world that has grown accustomed to contemplating China’s inexorable rise was reminded that nothing, not even Beijing’s power, can be taken for granted.

The Wall Street Journal editorial page is not the same thing as the reporters for the WSJ. Sometimes I have to wonder why any of their real reporters work there given how pathetically right wing the editorial page is.

Lingling Wei is the chief China correspondent for The Wall Street Journal and co-author of “Superpower Showdown.” She covers China’s political economy, focusing on the intersection of business and politics. Born and raised in China, she has a M.A. in journalism from N.Y.U., got her start covering U.S. real estate, and has won many awards for her China coverage. In 2021, she’s among a team of reporters and editors whose work was a Pulitzer Prize finalist.

In other words a real reporter. I would advice you not to trash her reputation.

That’s very interesting… I did not know that the World Bank, International Monetary Fund, OECD, Federal Reserve, and ECRI were all part of the Murdoch media empire.

Lingling Wei relied on these credible sources. She strikes me as a good reporter. That ltr attacked her this way is an insult to the rights of all professional women.

https://english.news.cn/20230713/d8b449f476634ba8bae9dc2f37ad5510/c.html

July 13, 2023

China’s economy capable of steady annual growth through 2035: former VP of World Bank

By Justin Yifu Lin

BEIJING — The world is currently undergoing changes unseen in a century. The economy is the foundation of these changes. In the 21st century to date, the most important factor in this dramatic change in the world economic landscape is the rise of China.

In 2000, measured by purchasing power parity, China’s economic aggregate accounted for 6.9 percent of the world’s total. The proportion rose to 16.8 percent in 2018, an increase of 9.9 percentage points. The share of G8 fell from 47 percent to 34.7 percent.

The rise of China has caused concern about a possible Thucydides Trap with the United States. China is now the world’s largest trading nation, the largest trading partner of more than 120 countries and regions, and the second-largest trading partner of more than 70 other countries. The U.S. rivalry with China is a source of uncertainty for all countries in the world.

I believe that when China’s per capita GDP reaches 50 percent of that of the United States, the world will enter a new stable pattern.

There are three reasons. First, China’s population quadruples that of the United States, and the Chinese economy will be twice the size of the U.S. economy by then.

Second, China’s developed regions — Beijing, Tianjin, and Shanghai, as well as the Shandong, Jiangsu, Zhejiang, Fujian, and Guangdong provinces along the eastern coast with a combined population of more than 400 million — will have a per capita GDP equivalent to that of the United States, and their economic volume, industry and technology will also be at the same level, and then the United States will lose its technological supremacy over China.

Third, if large U.S. enterprises do not have access to the Chinese market, they will change from high profitability to low profitability or even fail to produce a profit, and lose their leading position because they will be unable to maintain high investment in research. American jobs and people’s livelihoods are inseparable from trade with China, and the United States must have a good relationship with China for the sake of its own economic development, employment success and social stability.

In terms of development potential, China has three advantages.

First, the advantage of latecomers. In 2019, China’s per capita GDP in terms of purchasing power parity was only 22.6 percent of that of the United States. From the advantage of latecomers, China will still have an average annual growth potential of 8 percent from 2019 to 2035, judging from the records of successful catching-up countries at a similar level of development.

The second is the advantage of overtaking others by using new lanes. After the emergence of the new economy based on digital technology, China not only stands on the same starting line as developed countries, but also boasts favorable conditions. As a large country with 1.4 billion people, China has the advantage of talent. China also has a large domestic market and many application scenarios, and the world’s most complete industrial support system. From ideas to products, the production time and cost will be shorter and lower than in any other country.

The third is the new system for mobilizing resources nationwide to make key technological breakthroughs. As a major emerging country, China may face temporary containment by some developed powers in terms of a few cutting-edge technologies, such as lithography machines, chips, and computer operating systems. However, with the active organization and coordination of the government, China can concentrate nationwide efforts and resources to make breakthroughs in these technologies.

At the current stage of development, China still has a potential growth rate of 8 percent in the coming decade. Taking into account the need to address climate warming, narrowing the gap between urban and rural areas, an aging population, and bottlenecks, China is capable of achieving an average annual growth rate of 5 to 6 percent through 2035. With an average annual growth potential of 6 percent from 2036 to 2050, China should be able to achieve average annual growth of 3 to 4 percent during this period….

Justin Yifu Lin is the former senior vice president and chief economist of the World Bank and dean of the Institute of New Structural Economics at Peking University.

‘China’s economy capable of steady annual growth through 2035: former VP of World Bank’

Well yea if it can avoid macroeconomic mistakes. But will it?

So, a guy on China’s payroll says China is the light of the world. Same old Chinese happy talk, same old ltr.

Here is the fundamental reason China can grow faster than the rest of the world:

https://fred.stlouisfed.org/graph/?g=176VF

China remains far behind the OECD average in output per person. China is relying on technology and management practices developed elsewhere to catch up. That’s not WSJ bias. It’s not racism. It’s not China being better than everybody else. It’s a simple fact. Math. Reality.

Macroduck,

Have a look at Justin Yifu Lin’s background, before you trash his reputation.

Fair enough:

https://www.nse.pku.edu.cn/en/people/professor/245722.htm

Justin Yifu LIN

Dean of Institute of New Structural Economics at Peking University

Justin Yifu LIN is Dean of Institute of New Structural Economics, Dean of Institute of South-South Cooperation and Development and Professor and Honorary Dean of National School of Development at Peking University. He was the Senior Vice President and Chief Economist of the World Bank, 2008-2012. Prior to this, Mr. Lin served for 15 years as Founding Director and Professor of the China Centre for Economic Research (CCER) at Peking University. He is Councillor of the State Council and a member of the Standing Committee, Chinese People’s Political Consultation Conference. He is the author of more than 20 books including Beating the Odd: Jump-starting Developing Countries; Going Beyond Aid: Development Cooperation for Structural Transformation, the Quest for Prosperity: How Developing Economies Can Take Off, New Structural Economics: A Framework for Rethinking Development and Policy, Against the Consensus: Reflections on the Great Recession, and Demystifying the Chinese Economy. He is a Corresponding Fellow of the British Academy and a Fellow of the Academy of Sciences for Developing World.

you mean the Justin Yifu Lin that defected from the Taiwanese army to mainland china, leaving behind his pregnant wife and toddler child? I want to make sure I have the right name, before passing judgment.

baffling,

Is there something about his economic credentials that you suspect, or are you just going to go straight for the ad homme fallacy?

david, it has more to do with his decision making. and perhaps it shows that he is emotionless in his actions, making decisions not biased by family or national ties. perhaps his decision to desert his post and family is quite logical, in the long run, and a positive for him. i do not know, hence the questions. so no, that is not an ad homme fallacy.

are you, or him, embarrassed by those actions taken years ago? or do we only build a reputation from selective actions?

macroduck was questioning the credibility of somebody posting from a ccp propaganda site. not nature.

“China has the far-sighted leadership of the Communist Party of China, the unremitting efforts of all the people for national rejuvenation, a vast domestic market, and a huge potential for development. The Chinese nation has ushered in an unstoppable rejuvenation.

In a global political and economic structure full of uncertainties, the stability and development of China will be a certainty.”

david, this is from the article. of course, no propaganda here. you have my apologies for raising any suspicions. this article could have just as easily come from a top economics journal in the usa.

I’m afraid [ uuuuuhh, not really ] I have to side with Macroduck on this one. Yifu Lin does have solid educational credentials. I’m forced to give the man that much. But his morals/ethics are found to be wanting. And yes, Yifu Lin is on Beijing’s parole.

https://web.archive.org/web/20151109172221/http://www.weeklystandard.com/weblogs/TWSFP/2008/02/world_banks_chief_economist_is.asp

Mr. O’Rear, you must have provided endless amusement to Chinese colleagues as an easy target for gags if you were as naive then as you are now. Did you take your blindfold off only to find your Chinese colleagues had left the party 3 minutes ago after convincing you to play “pin the tail on the donkey”??

*Beijing’s payroll, not parole, oh brother. I guess Yifu Lin might be on parole if he ever wiped that brown smudge off his nose.

I know where he worked. I also know how he got his job. Before China got him that World Bank job, and after, he has worked for Chinese government institutions. You don’t build that sort of resume in China by delivering an unbiased assessment of China’s economy in public.

Beyond that, the article cited here is glib, not real economics.

“I believe that when China’s per capita GDP reaches 50 percent of that of the United States, the world will enter a new stable pattern.” Why? There is no magic in 50%, but citing 50% allows him to sneak in an unsupported assumption of continued strong growth.

“China still has a potential growth rate of 8 percent in the coming decade. Taking into account … China is capable of achieving an average annual growth rate of 5 to 6 percent through 2035. With an average annual growth potential of 6 percent from 2036 to 2050, China should be able to achieve average annual growth of 3 to 4 percent….”

China has a potential growth rate of 8%, so can grow at 5% to 6%? China will have a potential growth rate of 6%, so can grow at 3% to 4%? Why is potential growth two to three percent faster than realized growth for long periods? Really, that makes no sense unless “potential” reflects massive unused resources. I’m not sure they count as potential if you know they won’t be put to use.

I don’t accept these kinds of claim, fancy resume notwithstanding.

“China’s developed regions — Beijing, Tianjin, and Shanghai, as well as the Shandong, Jiangsu, Zhejiang, Fujian, and Guangdong provinces along the eastern coast with a combined population of more than 400 million — will have a per capita GDP equivalent to that of the United States”

WTF? This is like comparing the average income for someone who lives in Manhattan to that of someone who lives out on the farm. This is such a stupid comparison one might think he got this from JohnH.

ltr, your link is from a ccp propaganda page. not a real news outlet.

BTW, the article ltr = let tyranny reign references of Yifu Lin salivating all over Xi Jinping’s privates reads like a long-version non-college rural mainland Chinese villager’s mating call “China numbaw one!!!! China numbaw one!!!! China numbaw one!!!” Tired of being typecast, pigeonholed, and stereotyped?? Are you genuinely tired of that?!?!?! Grow up from prepubescent stage for five minutes just to watch the general room reaction. It’s apt to be a modicum of respect that was just preceded by fall to the floor shock.

https://www.globaltimes.cn/page/202307/1294404.shtml

July 14, 2023

China’s Q2 GDP growth expected to see fastest pace in 2 yrs; challenges ‘normal’ during recovery

By Wang Cong and Liu Yang

Chinese officials said on Friday that China’s economic recovery remains on track, with positive improvements in the economic cycle, residents’ income and consumption, and has effectively coped with changes in the external environment amid an intricate and complex global geo-economic situation.

During a press conference in Beijing, officials from the People’s Bank of China (PBC), the central bank, also said that challenges cannot be avoided and are normal during the economic recovery process, which usually takes about a year, and China is only halfway through. They also vowed further policy support to boost growth in the second half of the year, including possible cuts to the reserve requirement ratio (RRR).

Despite persistent downward pressure, China’s GDP is still expected to record the fastest pace in two years in the second quarter, according to forecasts from domestic and foreign institutions and analysts. Pointing to sufficient room for policy support, many analysts also expect growth to further stabilize in the second half of the year and full-year growth will meet the official target and become a bright spot in global growth.

China is slated to release a slew of key economic indicators on Monday, including the second-quarter economic data and GDP in the first half of the year. Amid slowing pressure at home and downward pressure externally, many, especially foreign media outlets, have been casting doubts over the robustness of China’s economic recovery.

https://www.globaltimes.cn/Portals/0/attachment/2023/2023-07-13/d087ba5a-5f18-44bf-b720-adbd2112bab6.png

‘Challenges normal’ …

https://english.news.cn/20230714/47d50e0e14274cf3a90f9703675c2302/c.html

July 14, 2023

China’s auto industry rides new wave of smart, electric innovation

* China’s auto production and sales have ranked first in the world for 14 consecutive years, and those of NEVs topped the global market for the eighth year in a row.

* As China’s auto industry is going through a transformation of unprecedented magnitude, traditional automakers are revving up NEV production.

* Some domestic NEV brands, such as BYD, have gained a foothold in overseas markets.

CHANGCHUN — At a smart factory of China’s leading automaker FAW Group Co., Ltd., over one hundred automated guided vehicles shuttle back and forth, while vision-guided robots apply silicone sealants on car windows, just like in a sci-fi movie.

A rare scene in the past, this is now a common sight at the FAW Jiefang J7 complete-vehicle smart factory in Changchun City, northeast China’s Jilin Province.

The construction of the First Automotive Works, China’s first automotive manufacturing plant and predecessor of FAW Group Co., Ltd., was launched in Changchun on July 15, 1953, marking the beginning of the nation’s auto industry.

From its first car rolling off the production line to being one of the world’s top 500 companies, the FAW has become the epitome of China’s auto industry development.

Showing resilience and a strong momentum of rapid development, China’s auto production and sales have ranked first in the world for 14 consecutive years, and those of new energy vehicles (NEVs) topped the global market for the eighth year in a row.

Particularly, China’s vehicle exports soared to around 1.07 million units in the first quarter of 2023, data from the General Administration of Customs showed, indicating that China had become the world’s largest auto exporter in the period, outpacing Japan.

INTELLIGENT AND DIGITAL EMPOWERMENT …

https://fred.stlouisfed.org/graph/?g=16TkI

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=16TkM

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2022

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=175oe

August 4, 2014

Real per capita Gross Domestic Product for China and United States, 1977-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=175oi

August 4, 2014

Real per capita Gross Domestic Product for China and United States, 1977-2022

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=176RB

August 4, 2014

Real per capita Gross Domestic Product for China, Indonesia, Brazil, United Kingdom and France, 1977-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=176RL

August 4, 2014

Real per capita Gross Domestic Product for China, Indonesia, Brazil, United Kingdom and France, 1977-2022

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=176Tb

August 4, 2014

Real per capita Gross Domestic Product for China, Turkey, Italy, Mexico and Korea, 1977-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=176Tn

August 4, 2014

Real per capita Gross Domestic Product for China, Turkey, Italy, Mexico and Korea, 1977-2022

(Indexed to 1977)

While ltr treats every mention of China as a threat to China’s official propaganda, the rest of us are at liberty to take China’s data and outlook seriously. Monetary policy is so far being employed sparingly, while the familiar tools of directed credit and fiscal expansion face payback from over use. Lowering borrowing rates could ease payment burdens for borrowers, but that could lead to more bad credit. Mal-investment is a big problem when credit tools are a main feature of economic policy.

China needs to move to new economic tools, including a better social safety net, better retirement insurance, lower personal income tax rates – policies aimed at improving improving personal welfare.

One good thing I could say about Chinese media. I can’t ever recall them demonizing lower consumer prices and portraying lower prices as the end of the world like American media exerts itself strenuously in doing. But beings my readings were limited to English publications, my view of that was probably rather small. I think Google translate existed while I was in China, but its performance and quality were pretty poor at that time.

Off topic, but (no offense, Menzie) more important than China –

Methane (natural gas) is often argued to be a cleaner source of energy than coal. At the smokestack, that’s true, but it is never enough to evaluate environmental harm at the smokestack. Exploration, development, production, use, waste disposal and plant decommissioning are all part of life-cycle environmental accounting. A new study examining methane leakage due to methane and coal extraction as well as combustion effects finds that the life-cycle impact of natural gas on climate may be just as bad as that of coal.

“Evaluating net life-cycle greenhouse gas emissions intensities from gas and coal at varying methane leakage rates”

In terms of climate-change, the authors “..find that global gas systems that leak over 4.7% of their methane (when considering a 20-year timeframe) or 7.6% (when considering a 100-year timeframe) are on par with life-cycle coal emissions from methane leaking coal mines.”

This raises the question of leakage rates. The authors report: “Recent aerial measurement surveys of US oil and gas production basins find wide-ranging natural gas leak rates 0.65% to 66.2%, with similar leakage rates detected worldwide.”

https://iopscience.iop.org/article/10.1088/1748-9326/ace3db

For those surprised at the 66.2% leakage figure for some methane production operations, note that the UN estimates that methane accounts for 25% of anthropogenic climate change (https://www.unep.org/news-and-stories/press-release/un-announces-high-tech-satellite-based-global-methane-detection). Some of that is from cows and rice production, the rest from wells, pipelines and storage. Fracked wells leak heavily, but so do sloppy conventional wells.

Worse, it is pretty clear that official estimates of leakage are too low:

https://www.science.org/doi/10.1126/science.abj4351

Oh, and blowouts are tremendously bad:

https://www.pnas.org/doi/full/10.1073/pnas.1908712116

By the way, most current hydrogen fuel projects use methane as their feedstock, and the energy used to extract hydrogen from methane adds to the methane leakage tally for hydrogen.

Hydrocarbon fuels are all serious sources of climate change. Switching from one hydrocarbon fuel to another isn’t a solution.

https://news.cgtn.com/news/2023-07-17/China-s-GDP-expands-5-5-year-on-year-in-H1-1lvpBaAZ58A/index.html

July 17, 2023

China’s GDP expands 5.5% year on year in H1

China’s gross domestic product (GDP) grew 5.5 percent year on year in the first half year of 2023 at constant price, data from the National Bureau of Statistics showed on Monday.

So, a guy on China’s payroll says China is the light of the world.

So, a guy on China’s payroll says China is the light of the world.

So, a guy on China’s payroll says China is the light of the world.

[ Notice the viciousness, over and over and over prejudiced viciousness. ]

Justin Yifu Lin is the dean of the Institute of New Structural Economics at Peking University.

He’s not being paid for this? Macroduck got this right. Get over it.

So, a guy on China’s payroll says China is the light of the world.

So, a guy on China’s payroll says China is the light of the world.

So, a guy on China’s payroll says China is the light of the world.

[ This is just where a Joseph McCarthy took America. Just where America has been taken again. ]

The Ministry of Education of the People’s Republic of China is a cabinet-level department under the State Council responsible for basic education, vocational education, higher education, and other educational affairs across the country. It funds Peking University.

Your accusing Macroduck of being Senator Joseph McCarthy is dishonest, disgraceful, and should be a reason to have you banned from this blog.

in America, ltr is given the voice of dissent. how would that play out with my voice in china?

Your voice would be silenced as you would likely be executed.

https://www.nytimes.com/2023/07/12/magazine/semiconductor-chips-us-china.html

July 12, 2023

‘An Act of War’: Inside America’s Silicon Blockade Against China

The Biden administration thinks it can slow China’s economic growth by cutting it off from advanced computer chips. Could the plan backfire?

By Alex W. Palmer

https://news.cgtn.com/news/2023-07-17/China-s-GDP-expands-5-5-year-on-year-in-H1-1lvpBaAZ58A/index.html

July 17, 2023

China’s GDP expands 5.5% year on year in H1

China’s gross domestic product (GDP) grew 5.5 percent year on year in the first half year of 2023 at constant price, data from the National Bureau of Statistics showed on Monday.

https://news.cgtn.com/news/2023-07-14/PBOC-expects-no-deflation-in-Chinese-economy-stable-exchange-rate-1lqN8nhOEhy/index.html

July 14, 2023

PBOC expects no deflation risk in Chinese economy, stable yuan exchange rate

China’s central bank on Friday shed light on the country’s inflation outlook, the trajectory of the Chinese currency’s exchange rate and dynamics within the real estate market.

At a press conference announcing financial data for the first half of 2023, Liu Guoqiang, deputy governor of the People’s Bank of China (PBOC), said that the challenges currently faced by the Chinese economy are a normal phenomenon in the era following the global COVID-19 pandemic.

However, he said that over the long term, the Chinese economy is shifting towards high-quality development.

CPI close to 1 percent at year-end, no deflation risk

“We don’t see deflation at present and there will not be a deflationary risk in the second half of this year either,” Liu said, pointing out that the Chinese economy has recovered steadily with the M2 broad money supply maintaining relatively sound growth, which differs from historically typical conditions for deflation.

In response to the country’s softening price growth in recent months, Liu predicted that China’s consumer price index (CPI), the main gauge of inflation, will see a U-shaped trajectory this year and will be close to 1 percent at the end of 2023.

China’s CPI remained unchanged in June in year-on-year terms, compared with the 0.2-percent annual gain seen in May, the National Bureau of Statistics said on Monday.

Chinese yuan exchange rate retains stability ….

PBOC expects no deflation risk in Chinese economy, stable yuan exchange rate

https://fred.stlouisfed.org/series/DEXCHUS

Chinese Yuan Renminbi to U.S. Dollar Spot Exchange Rate

Stable exchange rate? Sorry but these wide swings are not exactly what I would call stable.

For those that may not know, Prof Michael Pettis is an excellent source on China’s economy. He is very active on Twitter. FYI

Couldn’t agree more, so is Brad Setser, who’s name I often have a strange inability to recall but just popped into my head right now. I am sure there are some Chinese who are better versed on China’s economy, but those are the two white dudes who are the best ones to follow on China.

*whose name

I swear, some day, I’m going to learn how to write English.