Conference Board is on the former, while the U. Michigan sides with the latter.

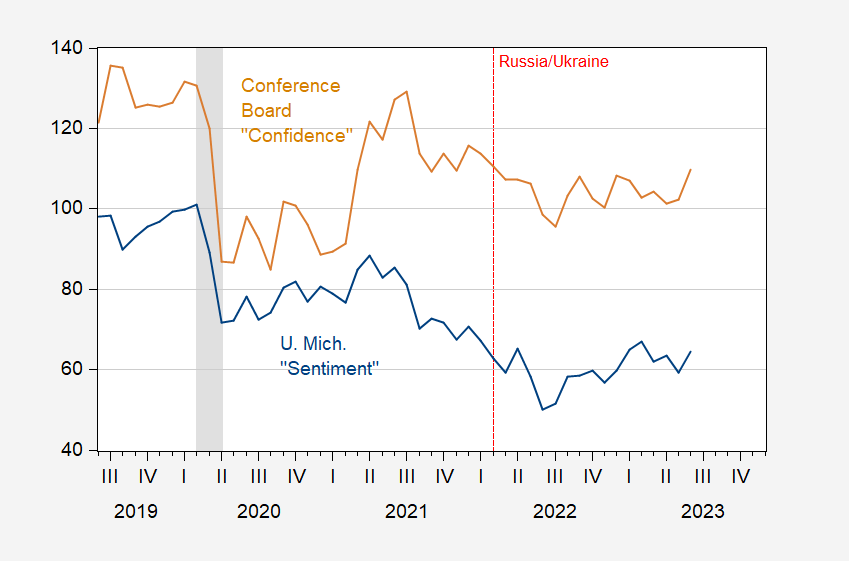

Figure 1: University of Michigan Sentiment Index (blue), and Conference Board Confidence Index (tan). NBER defined peak-to-trough recession dates shaded gray. Source: University of Michigan via FRED, Conference Board via investing.com, and NBER.

According to the Michigan index, sentiment is even lower than during the depths of the pandemic. The Conference Board index indicates confidence at levels seen at the beginning of 2021, and definitely above pandemic levels (110 in June, vs sample average of 94). Why the difference? A hint is provided by looking at the long time series of both indices.

Figure 2: University of Michigan Sentiment Index (blue), and Conference Board Confidence Index (tan). NBER defined peak-to-trough recession dates shaded gray. Source: University of Michigan via FRED, Conference Board via investing.com, and NBER.

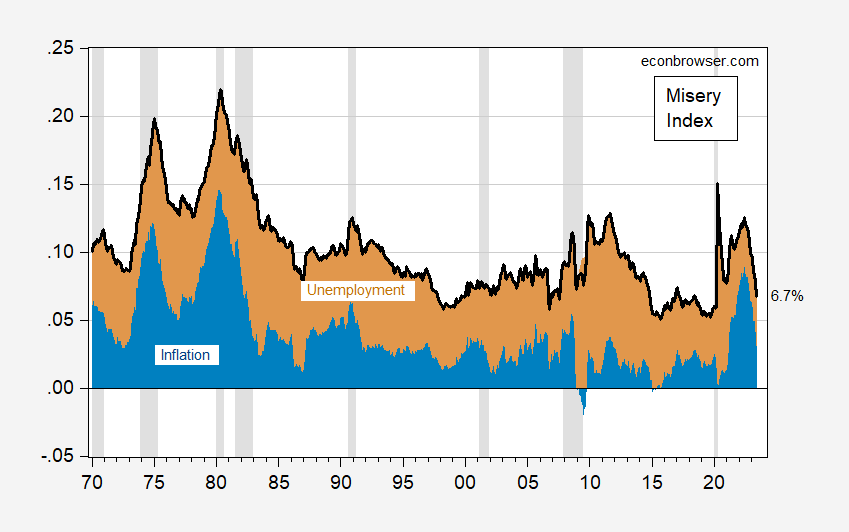

Folk wisdom as conveyed by Investopedia notes the higher linkage of the Conference Board index with employment, and the Michigan index with pocketbook issues (cost of living). This means that the two will not covary with the Misery Index the same way (see investigation of the correlation between Misery Index and Michigan sentiment in this post). Consider the components of the Misery Index in the unweighted version, shown below:

Figure 3: Misery Index (bold black line), share due to y/y CPI inflation (blue bar), due to unemployment (tan bar). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

For the Michigan sentiment index, the regression results one obtains for 1970-2023M06 is:

UMCSENT = -0.415u – 0.479π

Standardized (“beta”) coefficients. Adj-R2 = 0.41, SER = 10.07, DW = 0.16, Nobs = 576, sample 1970M01-2023M06. Bold denotes significance at 10% msl, using HAC robust standard errors.

For the Conference Board confidence index, the regression results are:

CONFIDENCE = -0.725u – 0.095π

Standardized (“beta”) coefficients. Adj-R2 = 0.54, SER = 16.04, DW = 0.19, Nobs = 642, sample 1970M01-2023M06. Bold denotes significance at 10% msl, using HAC robust standard errors.

One can’t compare “beta” coefficients across regressions, but one can within regressions. The estimates confirm that for the Michigan index, unemployment and inflation enter about equally. For the Conference Board measure, unemployment is the key issue.

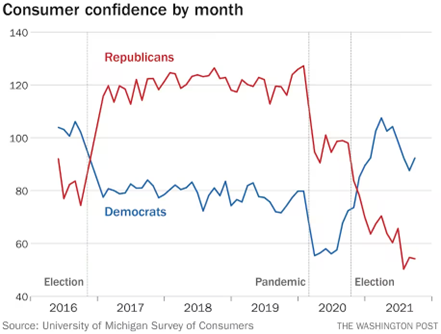

Notice that I have treated the data as if there is an average sentiment value. I do wonder (w/o knowing the distribution of responses) if there is actually one average value; this graph from Bump (WaPo, December 2021) illustrates this point.

Source: Bump,”The inescapable partisanship of how people view the economy,” Washington Post, December 15, 2021.

It would be interesting to see how the disaggregated sentiment indices comoved with the Misery Index (in other words, who was detached from reality), but I don’t have the data readily accessible. Mian (REStat, 2023) shows that these partisan-biased expectations affect economic decisions, like consumption. He also documents that these effects have been increasing over time.

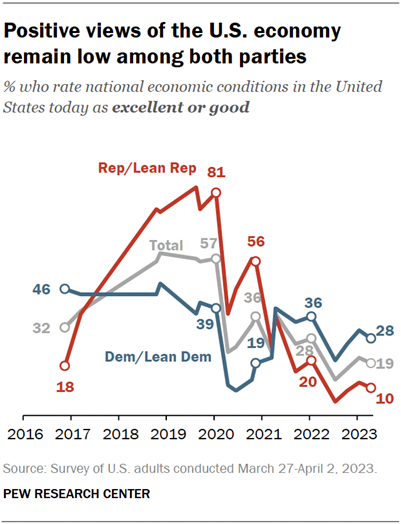

Interestingly, looking at overall economic optimism over the last seven years, it appears that Republicans/Lean Republican respondents have exhibit wilder swings than Democrats/Lean Democrat.

Source: Pew Research Center, April 7, 2023.

Republican/Lean Republican views on the economy range over 71 ppts, peaking in 2019, while those of Democrat/Lean Democratic range over 36 ppts. So while there is a partisan divide, at first glance it appears to me Republican/Lean Republican swing more wildly. If indeed behavior is driven by in part sentiment, then the average index might not appropriate for gauging the effect on the economy.

https://www.wsj.com/articles/cuba-to-host-secret-chinese-spy-base-focusing-on-u-s-b2fed0e0

Cuba to Host Secret Chinese Spy Base Focusing on U.S.

Beijing agrees to pay Havana several billion dollars for eavesdropping facility

So what’s to spy on in South Florida? Oh yea Maro Lago where Trump stashed all sorts of top secret documents.

pgl’s comment certainly is consistent with this thread’s subject–‘meh.’

Nothing like rehashing week old, readily available news!

More emotional problems for Jonny boy? You are a truly sick little man. Please get help.

for what it is worth, the Michigan sentiment reading has been increasing lately. not a strong indication we are in a recession, I would presume, even if it is coming off of lows.

your consumer confidence by month showing the partisan divide is fascinating. I wonder how many of those republicans continue to sell low and buy high?

https://data.giss.nasa.gov/gistemp/tabledata_v4/GLB.Ts+dSST.txt

January 15, 2023

Average Global Temperature

(Degrees Celsius)

2015

Jan ( 14.85) 2nd warmest *

Feb ( 14.90) warmest

Mar ( 14.96) warmest

Apr ( 14.76) 4th warmest

May ( 14.80) 2nd warmest

Jun ( 14.80) warmest

Jul ( 14.72) 2nd warmest

Aug ( 14.80) 2ndwarmest

Sep ( 14.85) 2nd warmest

Oct ( 15.09) warmest

Nov ( 15.06) warmest

Dec ( 15.16) warmest

Average ( 14.90) warmest to that year

2016

Jan ( 15.17) warmest

Feb ( 15.37) warmest

Mar ( 15.36) warmest

Apr ( 15.10) warmest

May ( 14.95) warmest

Jun ( 14.79) warmest

Jul ( 14.84) warmest

Aug ( 15.01) warmest

Sep ( 14.90) warmest

Oct ( 14.89) 2nd warmest

Nov ( 14.92) 2nd warmest

Dec ( 14.86) 2nd warmest

Average ( 15.01) warmest to that year

2017

Jan ( 15.02) 3rd warmest

Feb ( 15.13) 2nd warmest

Mar ( 15.116) 2nd warmest

Apr ( 14.94) 2nd warmest

May ( 14.91) warmest

Jun ( 14.71) 8th warmest

Jul ( 14.81) warmest

Aug ( 14.87) 2nd warmest

Sep ( 14.77) 3rd warmest

Oct ( 14.90) 3rd warmest

Now ( 14.88) 3rd warmest

Dec ( 14.93) 2nd warmest

Average ( 14.92) 2nd warmest to that year

2020

Jan ( 15.17) warmest

Feb ( 15.24) 2nd warmest

Mar ( 15.17) 2nd warmest

Apr ( 15.13) warmest

May ( 15.01) warmest

Jun ( 14.91) warmest

Jul ( 14.90) 2nd warmest

Aug ( 14.87) 3rd warmest

Sep ( 14.98) warmest

Oct ( 14.88) 5th warmest

Nov ( 15.10) warmest

Dec ( 14.81) 6th warmest

Average ( 15.01) warmest to that year

2023

Jan ( 14.86) 7th warmest

Feb ( 14.97) 4th warmest

Mar ( 15.20) 2nd warmest

Apr ( 15.00) 4th warmest

May ( 14.93) 3rd warmest

Jun ( 15.07) warmest

* Warmth of the month and year relative to that month or year at any time since 1880

The last 8 years, since 2015, each and all, have been the warmest years globally since 1880. This year promises to add to these warmest of years, and will likely be near the very warmest ever recorded.

June 2023, has just been recorded the warmest June globally since 1880.

https://www.nytimes.com/2023/07/14/opinion/inflation-economists-soft-landing.html

July 14, 2023

Wonking Out: In Economics, a Game of Teams

By Paul Krugman

HBO may have captivated millions with its series “Game of Thrones,” but economists have lately captivated, well, not millions — maybe a few hundred nerds — with their Games of Teams: noisy and sometimes testy public disputes between opposing factions over economic prospects.

True, economists’ games have been rather lacking in sex and, at least so far, violence. The teams playing these games are also, I’m sorry to say, almost entirely devoid of beautiful people. But while I’m tempted to use the old line about how academic disputes are so vicious because the stakes are so small, these debates matter. As John Maynard Keynes argued at the end of his magnum opus, “The General Theory of Employment, Interest and Money,” economic ideas can eventually have large real-world impacts:

Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back.

A current case in point is the determination of central banks across the world to get inflation down to 2 percent. Why 2 percent? That target emerged in large part from academic research suggesting (probably wrongly) that inflation at that rate would be more or less optimal. But that fixation has since taken on iconic status, with monetary officials insisting that failing to achieve it would fatally undermine their credibility.

Which brings me to the disputes of the past few years.

In 2021, as inflation took off, the big debate was between Team Transitory — which argued that we were mostly seeing temporary disruptions from the Covid-19 pandemic, which would fade away over time — and Team Permanent, which placed the main blame for inflation on the combination of large government spending and low interest rates. I was on Team Transitory, but as inflation went far higher for far longer than I had imagined possible, I admitted that I got it wrong.

By the summer of 2022, however, a new dispute had erupted. This pitted what we might call Team Soft Landing against Team Stagflation. Team Stagflation argued that getting inflation down would require years of high unemployment, just as it had in the 1980s. Here’s a chart from my May article * on the subject:

https://static01.nyt.com/images/2023/07/14/opinion/krugman140723_1/krugman140723_1-jumbo.png?quality=75&auto=webp

Larry Summers, with admirable explicitness, suggested that we would need two years of 7.5 percent unemployment to get inflation under control.

Team Soft Landing, on the other hand, argued that the 1980s were a bad model for our current situation and that we might well be able to get inflation down without severe unemployment.

Are we just talking about the same teams under different names? No and yes. The intellectual basis for the dispute about rising inflation was very different from that of the dispute about the possibilities of getting inflation down. But the membership of each team was pretty much the same people.

This says something uncomfortable about the economics profession: We’re supposed to be doing dispassionate analysis, but the fact that most economists are consistently either inflation optimists or inflation pessimists whatever the circumstances suggests that somebody is suffering from motivated reasoning. (But not me. I, of course, am totally objective. OK, I do sometimes catch myself engaging in motivated reasoning. But I try to fight it.) …

“noisy and sometimes testy public disputes between opposing factions over economic prospects.”

Ritualistic, tribal disputes that could be well-suited to AI? The outputs could even have pen names, like Gary Winters or Tall Plugman!

Only slightly off-topic, China’s economic and market troubles aren’t responding well to official policy chatter, with the press reporting considerable doubt that policy action will amount to much –

IIF has released data on foreign demand for Chinese financial assets in June:

https://www.scmp.com/economy/economic-indicators/article/3227559/chinas-debt-offloaded-foreign-investors-sixth-straight-month-june-emerging-asia-enjoys-strong

The pace of foreign sales of China’s debt slowed in June, but the six-month period of net bond selling is just about exactly coincident with the latest slide in the yuan:

https://fred.stlouisfed.org/series/DEXCHUS

The question is always “what is driving what?” in situations like this. Are lower rates driving outflows and yuan weakness, or are outflows driven by weak economic prospects? Chinese policy rates were steady from late Q3 of last year until mid-June, so rates don’t seem a good explanation at first glance:

https://ycharts.com/indicators/china_loan_prime_rate

Credit market stress seems a more likely cause of outflows:

https://www.bloomberg.com/graphics/china-credit-2023-07/

And while outflows from bonds have slackened, domestic caution about riskier debt seems high:

https://www.bloomberg.com/news/articles/2023-07-12/china-state-fund-moves-to-cut-exposure-to-weak-lgfvs-builders#xj4y7vzkg

Since the credit market is part of the problem, the working assumption is that China’s policy response will be limited:

https://www.monitor.co.ug/uganda/news/china-s-market-slump-heaps-pressure-on-xi-to-deliver-support-4303018

(Kudos to the Ugandan press for running this. WSJ? NYT? Guys?)

The mid-year economic policy gathering is later this month, so we may hear detail that is so far missing from statements by China’s economic policy leaders. In the normal run of things, disappointment at what comes out of that gathering could put Chinese risk assets under additional pressure.

A surprising point about preparation for the effects of climate change in Europe and Canada and the United States, is that for all the discussion of the matter there has been a significant lack of investment in preparation. New York Times reports have stressed that lack of investment in preparation. So that for all the Green Party election success in Germany, Germany is little prepared, Canada for all the forest growth has cut and limited protection against fire. Simple private insurance availability in California and Florida has been limited rather than expanded:

https://www.nytimes.com/2023/07/14/world/europe/europe-heat-wave-italy.html

July 14, 2023

New Heat Wave Descends on Europe, as It Struggles to Adapt

European governments have been slow to put in place broader mitigation strategies for extreme heat, allowing deaths to increase. This year may be no different.

By Gaia Pianigiani

https://www.nytimes.com/2023/07/10/climate/heat-waves-europe-deaths.html

July 10, 2023

Summer Heat Waves Killed 61,000 in Europe Last Year, Study Says

Researchers suggest that strategies to cope with higher temperatures aren’t keeping pace with global warming.

By Delger Erdenesanaa

By the way, the yuan has strengthened this week, but most if not all of that gain reflects a broad dinecline in the dollar. The DXY is down 3% on the week.

By the way, Moses recently mentioned stepped up intervention to support the yuan. Back in April, China announced an end to regular intervention to support the yuan. Didn’t work out that way, apparently.

https://news.cgtn.com/news/2023-07-14/Core-module-of-first-commercial-small-modular-reactor-passes-acceptance-1lqLjRienXa/index.html

July 14, 2023

Core module of world’s first commercial small modular reactor passes acceptance

The core module of the world’s first commercial small modular reactor (SMR) passed the final acceptance in China on Thursday, marking a breakthrough in the SMR technological innovation and the localization of major technical equipment for nuclear power.

The multi-purpose, small modular pressurized water reactor, known as Linglong One (ACP100), features outstanding advantages including short manufacturing cycle, high security, wide use, flexible deployment, high equipment maturity, and good engineering implementation.

With a power generation capacity of 125 megawatts, Linglong One can generate 1 billion kilowatt-hours of electricity per year once completed, which can enable the need of 526,000 households, and is equivalent to reducing carbon dioxide emissions by 880,000 tonnes, or planting 7.5 million trees, said the developer China National Nuclear Corporation (CNNC).

It can meet the diverse energy demands in multiple scenarios like seawater desalination, urban district heating, industrial steam supply and oil extraction.

The promotion of the SMR can optimize China’s energy structure, reduce the consumption of fossil energy and greatly promote energy conservation and emission reduction, facilitating the efforts towards the country’s goals of reaching peak carbon emissions by 2030 and carbon neutrality by 2060, said CNNC.

As the world’s first such type of nuclear reactor approved by the International Atomic Energy Agency, Linglong One reactor is another major achievement of independent innovation after “Hualong One,” a China-designed third-generation nuclear reactor.

SMRs, including microreactors, are expected to play an increasingly important role in ensuring energy security, as well as the global energy transition to net zero carbon, according to IAEA.

“Taking Hainan Island as an example, we used to rely on coal, oil and gas, and we got a relatively higher cost of transporting them. Nuclear energy offers a new option. During the global energy crisis in recent years, many countries have been considering using the SMR technology,” Qu Yong, deputy chief engineer at Hainan Nuclear Power Co., Ltd. told CGTN.

With the delivery of Linglong One’s core module, China’s nuclear power technology and equipment manufacturing has achieved “a historic leap from a follower to a leader,” which will drive the high-level development of China’s nuclear-related industrial clusters, China Media Group reported.

Was the Wagner Group attempted coup just the beginning?

https://www.msn.com/en-us/news/world/defiance-within-russian-military-grows-following-wagner-mutiny/ar-AA1dSROR?ocid=msedgdhp&pc=U531&cvid=9a9317cc0a9b4a2c8b7e37c956bb3aa1&ei=12

The firing this week of a veteran battlefield general in Russia’s ongoing war with Ukraine is poised to unleash as much – if not more – of a disruption to Vladimir Putin’s fragile hold over his armed forces than an aborted mutiny just weeks ago staged by mercenary troops intent on dismantling his military command structure.

Maj. Gen. Ivan Popov, a veteran commander with experience in Russia’s campaigns in Chechnya and Georgia who is known for taking care of his troops and appeared on a promising command path, was dismissed this week by Russian Defense Minister Sergei Shoigu. An audio recording subsequently leaked on Telegram in which he blasts Russian military leadership for insufficient support to front-line forces, lamented the desperate need for supplies and reinforcements in the southeastern region of Ukraine in which he was leading operations and – perhaps most grievously – said he was removed for voicing his concerns among Russia’s top military leaders.

“The Ukrainian army could not break through our ranks at the front but our senior chief hit us from the rear, viciously beheading the army at the most difficult and intense moment,” Reuters quoted the general as saying in the audio tape.

Several analysts believe Popov, a 48-year-old well-regarded soldier who goes by the call sign “Spartacus” after the accomplished Roman military leader who headed a slave rebellion, made a calculated risk and orchestrated the leak himself – perhaps in an attempt to draw attention to the unsustainable conditions facing Russia’s forces.

But regardless of the intention, the damage – chiefly to Putin – is grievous.

At worst, the release of Popov’s comments represents an overt act of defiance to Russia’s top decision-makers overseeing Putin’s Ukraine invasion. The independent Institute for the Study of War speculated in an analysis note Thursday that Popov might have been looking to follow the example of Mikhail Teplinsky, a Russian general who temporarily resigned in protest in January over senior leadership’s handling of forces – only to be reinstated and promoted by Putin.

Nevertheless, the repeated breaches of the chain of command are perilous, while the troubling implication for the Russian leader is that he is – or is perceived even by his own forces to be – insulated from or misinformed about the course of the war.

At best, it shows that if this particular military commander ever feared the wrath of his superiors for saying what he really thinks, he no longer does.

What began with Wagner Group chief Yevgeny Prigozhin’s surprise and dramatic decision to march on Moscow in an apparent coup attempt has now, predictably, metastasized into growing acts of defiance against Putin’s senior war planners – namely Shoigu and Chief of the Russian General Staff Gen. Valery Gerasimov.

“Popov’s case hints at the deepening fault lines and growing tensions within the Russian Armed Forces,” Hudson Institute Senior Fellow Can Kasapoglu wrote in his weekly Ukraine Military Situation Report this week. “While Wagner’s mutiny did not reach Moscow, Yevgeny Prigozhin’s message is still alive: the invasion is not going well, and commanders are increasingly angry at the Shoigu and Gerasimov – who hold their posts thanks to their loyalty to Vladimir Putin, not their warfighting prowess.”

The resources that those commanders rightfully demanded for their troops, simply are not available without taking them away from other soldiers (who need them just as desperately). Russia simply cannot produce all that they need to fight this war in Ukraine. Putin’s military and its leadership is so dysfunctional that it can’t even tell him about this problem. The low number of actual missiles fired in the past month is a reflection of that problem. Ukraine has at the same time targeted the weapons depots of Russia so when their offensive gets going full speed, the Russian defenders will have very little ammo left. That was how Ukraine took back the west bank of the Dnipro – it’s likely going to be how they take back the northwest bank of the Sea of Azov.