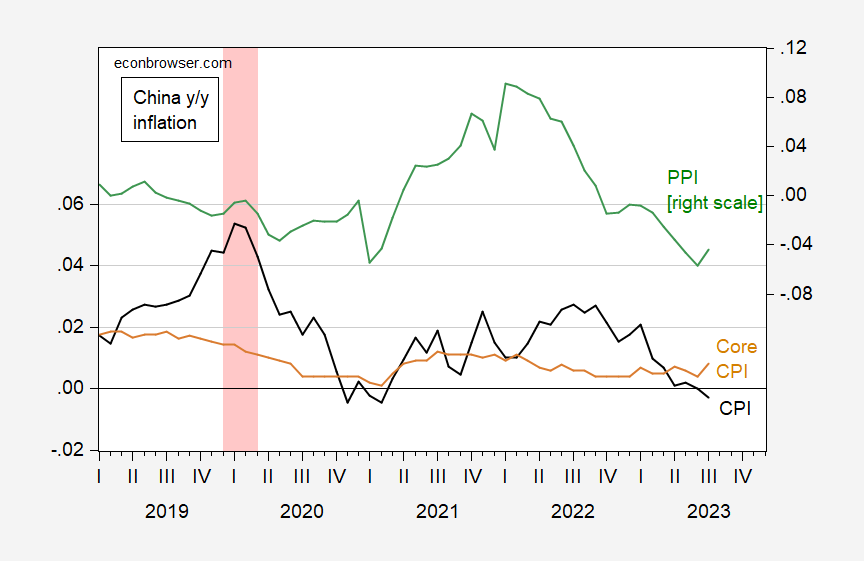

Year-on-year CPI inflation goes negative (-0.3% vs. -0.4% consensus), and month-on-month is positive.

Figure 1: China year-on-year inflation rate for CPI (black), for core CPI (tan), and for PPI (green). ECRI defined peak-to-trough recession dates shaded pink. Source: Kose/Ohnsorge – World Bank and IMF, IFS, both updated using TradingEconomics; and author’s calculations.

So, on a year-on-year basis, headline CPI is falling, i.e. there’s deflation.

The headline should be Chinese deflation in July not inflation as you eventually get round to.

@ Not Trampis

Kinda grumpy again, are we??

You don’t see that as a sub-topic of….. ??

Before we get another fact free victory lap from JohnH on how China is better than the US because zero inflation must mean China’s real interest rates must be higher than those in the US, let’s note how low China’s nominal interest rates are:

http://www.worldgovernmentbonds.com/country/china/#:~:text=The%20China%2010Y%20Government%20Bond%20has%20a%202.686%25,is%20A%2B%2C%20according%20to%20Standard%20%26%20Poor%27s%20agency.

Thanks for posting – I’m curious to see what impact this will have on U.S. prices/inflation. I’ve heard China described as the “factory floor to the world.” On a related topic: I think the Larry Summers/Powell – “we have to have a recession to fight inflation” crowd is incorrect and goods inflation was mainly transitory and caused by supply chain disruption, Russia’s war on Ukraine, and price gouging – and we are just starting to see the impact of higher rates (mortgage rates from the 1990s!) on housing etc. I was wondering what you thought of this opinion piece by James Galbraith: https://www.scmp.com/comment/opinion/article/3230609/how-us-can-manage-inflation-and-stem-obliteration-middle-class (I think he is correct)

Very interesting. I love the idea that increased interest rates is actually a stimulus, because it forces the US government to pay more money out in interest payments.

As usual, press folk have focused on year-over-year changes in U.S. CPI. That comparison misses a lot:

https://fred.stlouisfed.org/graph/?g=17Itp

In recent months, both headline and core CPI have been rising at slightly less than a 2% annualized pace. Note also that CPI excluding shelter is fairly tame y/y and rising at less than a 2% annualized pace in recent months:

https://fred.stlouisfed.org/graph/?g=17Iul

CPI emphasizes shelter prices more than does the PCE deflator, which Fed folk prefer.

Despite the headlines, progress on reducing inflation continued in July.

24% drop in meat prices …

Well that’s a middle finger to the vegetarians.

In my store, egg prices are back to normal and the price of chicken breasts hasn’t been this low since I moved to Brooklyn.

The NY Fed has published a two-handed-economist piece about r* – the natural rate of interest:

https://libertystreeteconomics.newyorkfed.org/2023/08/the-post-pandemic-r/

Turns out that two models for estimating lomg-term r* which have in the past agreed about r* not only disagree about the level of r*, but have disagreed about the direction of the trend – up or down – since the Covid recession.

The post-Covid-recession and after has been a trick period.

Thanks for this interesting post. Now as another one of my public services – permit me to repeat the first sentence of that 2003 seminal paper:

The natural rate of interest—the real interest rate consistent with output equaling its natural rate and stable inflation—plays a central role in macroeconomic theory and monetary policy.

‘Now the adults here knew that is what r* stands for. But then there are the mental midgets like JohnH who do not even know what the real interest rate is.’

On those two models, count me as a DSGE type of person.

“According to the DSGE model, long-run r* has instead risen by almost 50 basis points during this period, and is now about 1.8 percent.”

I believe that 5-year and 10-year TIPS rates are around this level.

Krugman the other day posted something on the long-run government debt level where he assumed long-term real rates should be seen as being near 1.6%. This and the long-run growth rate of GDP were sort of crucial to his argument.

more news on country garden and the worsening chinese real estate market:

https://www.cnn.com/2023/08/11/investing/china-country-garden-loss-warning-intl-hnk/index.html

internally, the pressure is mounting in china. as we saw with the financial crisis in the usa, real estate failures can lead to deflation. when home prices drop, people change their spending habits.