Headline and core y/y CPI inflation undershoots slightly Bloomberg consensus (by 0.1%) (and below Cleveland Fed nowcast for headline of 0.4% m/m, see yesterday’s post). Overall, trend is down even if headline y/y is ticks up slightly.

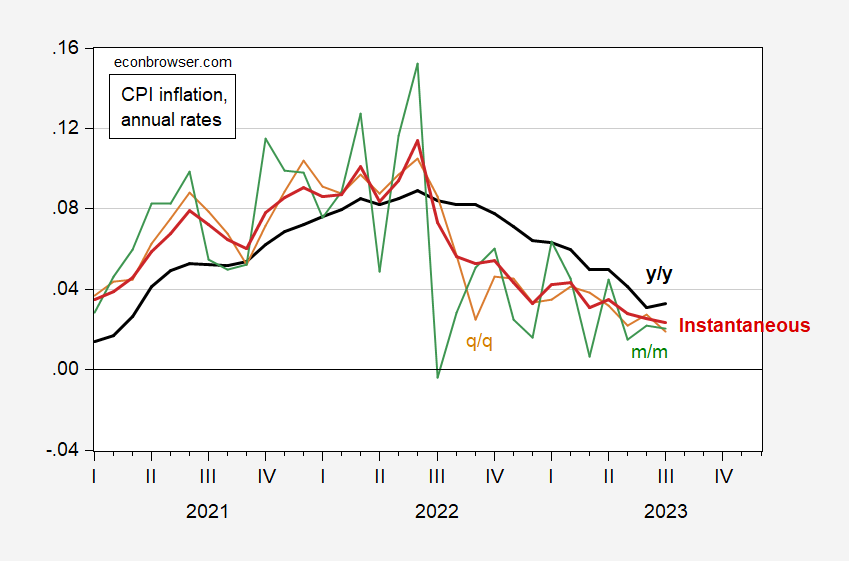

Figure 1: Annualized CPI inflation, year-on-year (bold black), quarter-on-quarter (tan), month-on-month (green), and instantaneous per Eeckhout, T=12, a=4 (bold red). Source: BLS, and author’s calculations.

As discussed in Justin Ho’s Marketplace piece yesterday, the year-on-year calculation doesn’t show everything. In particular, q/q and m/m are down, as is the Instantaneous inflation measure (essentially a weighted average with higher weights on recent m/m inflation).

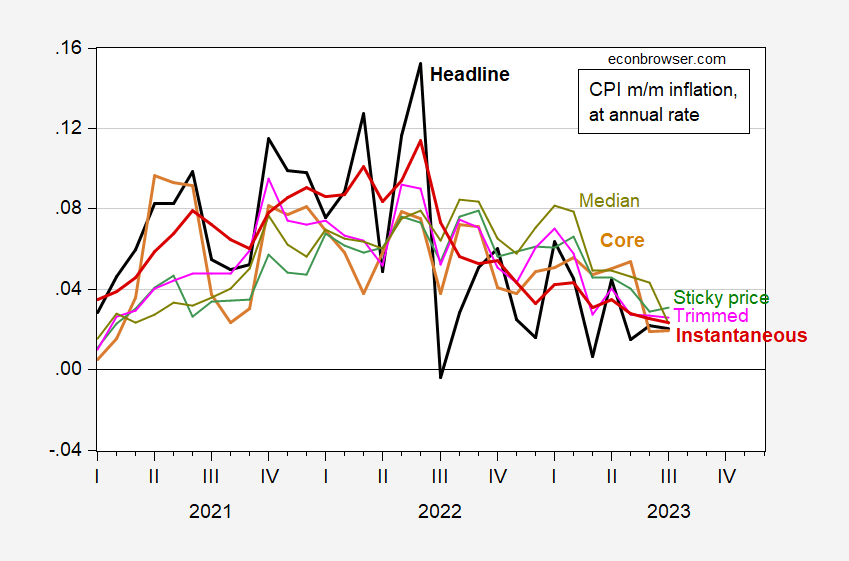

On a month-to-month basis, other measures that attempt to get at trend inflation are also down, including the Cleveland Fed’s Trimmed and Median CPI rates. The Atlanta Fed’s stick price measure showed a slight uptick.

Figure 2: Annualized month-on-month headline CPI inflation (bold black), core (bold tan) sticky price (green), 16% trimmed (pink), instantaneous per Eeckhout, T=12, a=4 (bold red). Source: BLS, Atlanta Fed, Cleveland Fed, and author’s calculations.

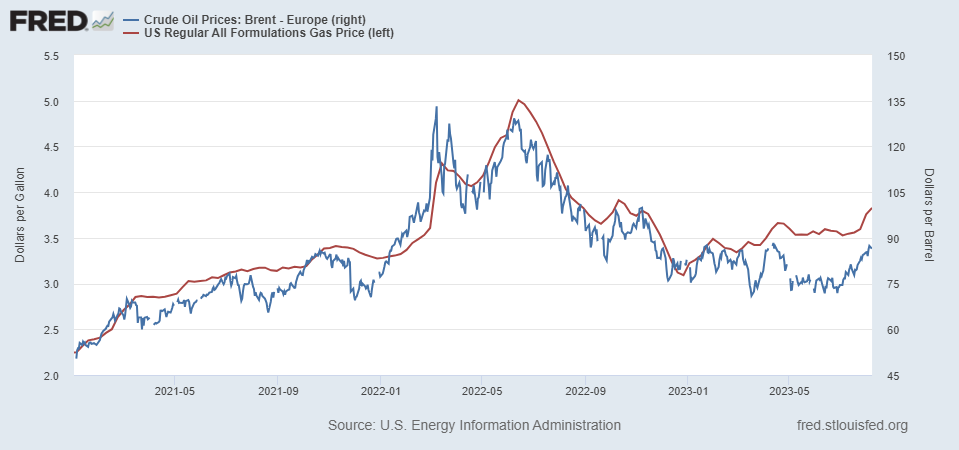

Overall, this release seems largely in line with expectations. The wild card (short term) is likely energy.

Gasoline prices are not likely to fall substantially, so that downward pressure on headline inflation is no longer present.

Update, 8/10/23 noon PT:

CEA Chair Jared Bernstein makes the same note.

Update, 8/10/23, 1pm PT:

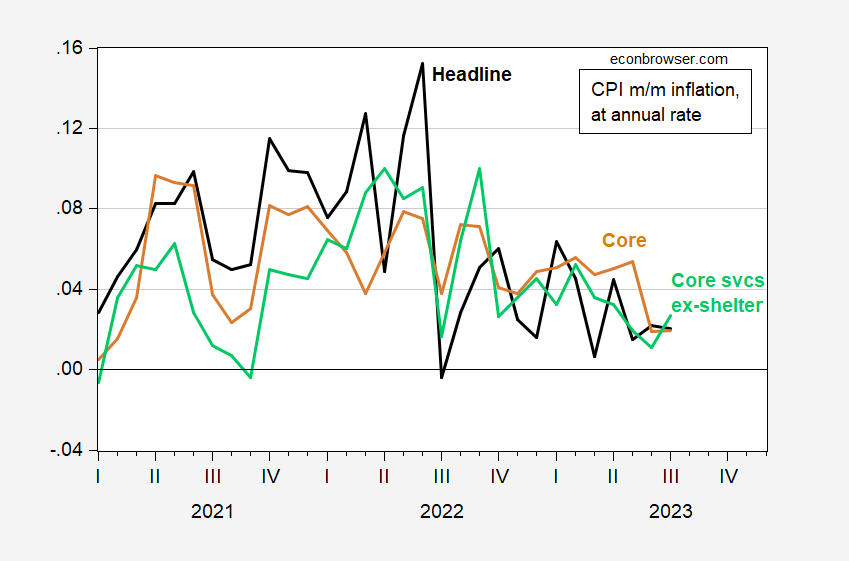

And here’s a modified version of Figure 2, with Pawel Skrzypzcynski’s core svcs ex-shelter inflation rate (m/m).

Figure 3: Annualized month-on-month headline CPI inflation (bold black), core (bold tan), and core services ex-shelter (bold light green). Source: BLS, Pawel Skrzypczynski, and author’s calculations.

“The wild card (short term) is likely energy.”

I think it was Macroduck who earlier note recent rise in energy prices – which is why headline inflation rose a bit even as core inflation remained low.

https://www.eia.gov/petroleum/gasdiesel/

What we pay for in a gallon of:

The refinery margin remains near $0.90 a gallon, which is quite high. Anyone knows whether there has been recent research on this?

Kevin Drum’s post is something Dr. Chinn might appreciate:

https://jabberwocking.com/27800-2/

Adjusted for inflation, the BLS measure of average hourly earnings increased last month at an annualized rate of 3.3%. However, average hours worked continued its downward trend:

Dr. Chinn knows all of this but alas Kevin entitled his post:

‘Weekly earnings remain flat in July’

You see JohnH keeps telling us real wages are not rising even though they are but of course Jonny boy is citing real weekly earnings EVEN THOUGH average hours worked has been declining. This pesky footnote to JohnH’s parade of dishonesty is a point Dr. Chinn has had to make in the past.

While Kevin’s title is JohnH level dishonesty – at least Kevin bothers to check the details.

I don’t see why you think Kevin’s title is dishonest:

Weekly earnings = average hourly earnings * average hours worked

So it’s perfectly fair to state that weekly earnings remained flat although average hours worked decreased, as long as average hourly earnings increased roughly enough to offset the hour decrease, and that’s what happened.

The last plot in his post shows that weekly earnings have indeed remained flat.

Don’t we normally think of real wages in terms of compensation per hour. That has been rising. Weekly compensation may be flat because people are spending more time doing other things.

A public service announcement for the poor souls who have endured the endless stupidity from JohnH. Yea – the world dumbest troll recently suggested real interest rates are derived from TIPS breakeven rates. Now I know all of you realize just how idiotic that statement was but let’s check this out:

https://www.treasurydirect.gov/marketable-securities/tips/

Treasury Inflation Protected Securities (TIPS)

We sell TIPS for a term of 5, 10, or 30 years. As the name implies, TIPS are set up to protect you against inflation. Unlike other Treasury securities, where the principal is fixed, the principal of a TIPS can go up or down over its term.

When the TIPS matures, if the principal is higher than the original amount, you get the increased amount. If the principal is equal to or lower than the original amount, you get the original amount. TIPS pay a fixed rate of interest every six months until they mature. Because we pay interest on the adjusted principal, the amount of interest payment also varies. You can hold a TIPS until it matures or sell it before it matures.

In short – TIPS is a real interest rate. Of course little Jonny boy does not know that. He apparently knows nothing including the most basic definitions.

Gee, pgl, thanks for telling us what we already knew. But forecasting something doesn’t magically bestow it reality…as the lousy TIPS breakeven forecasts have demonstrated for the past few years now.

Associating the word “real” with events that have yet to happen is to engage is misleading, deceptive behavior. TIPS prices are no less subject to Keynes beauty contest type behavior than any other traded asset.

Good job offering a fake argument. Again.

First, pgl isn’t “telling us what we already knew” if “we” includes you. You’ve been making a mess of this topic since you first wrote about it in comments here. Undoing damage to public knowledge- damage that people like you do – is a useful endeavor.

“Real” is shorthand for “adjusted for inflation ecpectations”. If you feel misled, perhaps that’s because you have a hard time with abstraction. Maybe you should spend your time on less challenging subjects.

Speaking of challenging topics – Jonny’s mother still has to tie his shoe laces.

If you already knew that then why did you write this:

‘JohnH

August 7, 2023 at 12:42 pm

Funny me! And here I was led to believe that real interest rates were derived from TIPS breakeven forecasts.’

Oh yea because you are stupid. After all you wrote this:

“TIPS prices are no less subject to Keynes beauty contest type behavior than any other traded asset.”

Lord – your stupidity is off the charts.

https://english.news.cn/20230809/04e705afe49c45faac1d2f22d689532a/c.html

August 9, 2023

China’s CPI logs monthly increase as consumer demand recovers

BEIJING — China’s consumer price index (CPI), a main gauge of inflation, registered a monthly increase of 0.2 percent in July thanks to continued recovery of consumer demand, the National Bureau of Statistics (NBS) said Wednesday.

In breakdown, food prices declined 1 percent month on month, but the prices of non-food items rose 0.5 percent on a monthly basis.

Among the non-food items, services prices rose 0.8 percent month on month, widening 0.7 percentage points compared with that in June.

Services prices were mainly driven by a rise in the prices of travel services following significant increases in summer travel, said NBS statistician Dong Lijuan.

The prices of air tickets, tourism and hotel accommodation rose by 26 percent, 10.1 percent and 6.5 percent, respectively, on a monthly basis.

The prices of industrial consumer goods rose 0.3 percent month on month, reversing a 0.4-percent decline in the previous month.

On a yearly basis, the country’s CPI declined 0.3 percent due to a high base in the corresponding period of 2022, according to Dong.

The core CPI, deducting food and energy prices, rose 0.8 percent year on year, with the pace of increase widening by 0.4 percentage points compared with that in June.

The average CPI from January to July increased by 0.5 percent year on year.

According to Dong, the year-on-year decline of the CPI will likely prove a short-term phenomenon.

With sustained economic recovery, steady market demand expansion, continuous improvement of supply and demand, and gradual elimination of the impact of the high base in the corresponding period of last year, the country’s CPI is expected to gradually rise, said Dong.

China’s economic growth continues apace despite challenges at home and abroad, and the country is extending support measures to boost confidence, ensure sustained recovery and promote high-quality development.

The country’s economy expanded 6.3 percent in the second quarter of the year, accelerating from 4.5 percent in the previous quarter. It grew 5.5 percent in the first half of the year, above the government’s target of around 5 percent set for 2023.

A slew of policy pledges, targeting specific sectors ranging from consumption, private economy, and the property market, to the capital market and forex market, have been made public after a key meeting of the top leadership vowed to strengthen counter-cyclical regulation and make more policy options available….

“With sustained economic recovery, steady market demand expansion, continuous improvement of supply and demand…”

In other words, if China performs better than a good many analysts expect, then things will be dandy. On the other hand, if China’s economy continues to fall short of expectations, things won’t be dandy.

Dong works for the Chinee government, so just may be unreliable in his comments regarding China’s outlook. The unreliability of Chinese statistics and the suppression of honest comment on China’s economy was the point of this post, among others:

https://econbrowser.com/archives/2023/08/first-thing-we-do-lets-gag-all-the-economists

You posted several comments to that post, not one of which addressed China’s suppression of honest economic commentary.

pgl: “I think it was Macroduck who earlier note recent rise in energy prices – which is why headline inflation rose a bit even as core inflation remained low.

No, it wasn’t energy prices that caused headline inflation to rise. It was a simple mathematical replacement of July 22 of 0.0% with July 23 of 0.2% in the annual sum of inflation. 0.2% isn’t a rise in inflation. 0.2% or slightly less is pretty much what the Fed wants to see for every month.

Non-seasonally adjusted energy was 0.3 and seasonally adjusted was just 0.1. Energy total wasn’t a big contributor to the July number, although the natural gas sub-component was up.

Instead, big contributors last month were again, shelter — in addition to auto repair which feeds into auto insurance, which are likely lingering supply chain issues for auto parts.

Thanks for the clarification. Year to year comparisons can be misleading.

Thank you for countering popular narratives with insightful information. You are “value added “to this blog.

https://www.imf.org/en/Publications/WEO/weo-database/2023/April/weo-report?c=924,134,534,158,111,&s=PCPIPCH,&sy=1980&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2023

Inflation Rate for China, Germany, India, Japan and United States, 1980-2022

2007

China ( 4.8)

Germany ( 2.3)

India ( 6.2)

Japan ( 0.0)

United States ( 2.9)

2010

China ( 3.2)

Germany ( 1.1)

India ( 10.5)

Japan ( – 0.7)

United States ( 1.6)

2015

China ( 1.5)

Germany ( 0.7)

India ( 4.9)

Japan ( 0.8)

United States ( 0.1)

2017

China ( 1.5)

Germany ( 1.7)

India ( 3.6)

Japan ( 0.5)

United States ( 2.1)

2018

China ( 1.9)

Germany ( 1.9)

India ( 3.4)

Japan ( 1.0)

United States ( 2.4)

2019

China ( 2.9)

Germany ( 1.4)

India ( 4.8)

Japan ( 0.5)

United States ( 1.8)

2020

China ( 2.5)

Germany ( 0.4)

India ( 6.2)

Japan ( – 0.0)

United States ( 1.3)

2021

China ( 0.9)

Germany ( 3.2)

India ( 5.5)

Japan ( – 0.2)

United States ( 4.7)

2022

China ( 1.9)

Germany ( 8.7)

India ( 6.7)

Japan ( 2.5)

United States ( 8.0)

https://fred.stlouisfed.org/graph/?g=SwEq

January 4, 2018

Average Hourly Earnings of All Private and Production & Nonsupervisory Workers, * 2007-2023

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=Qe7j

January 4, 2020

Real Average Hourly Earnings of All Private and Production & Nonsupervisory Workers, * 2020-2023

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=17JNA

January 4, 2018

Real Average Hourly Earnings of Private Production & Nonsupervisory Workers and Nonfarm Business Productivity, * 2000-2023

* Real Output Per Hour of All Persons

(Indexed to 2000)

“Why Averages are Often Wrong…”it is often best to use the median to represent central tendency measurements instead of the average or mean because it’s less impacted by outliers.”

https://towardsdatascience.com/why-averages-are-often-wrong-1ff08e409a5b

This is particularly true with wages, since wages for top earners are rising faster than wages for the bottom 90%. Even limiting the average to production and non-supervisory workers is fraught, since it includes sole contributors in STEM and finance–occupations that are highly compensated …and their share of the workforce is rising while manufacturing employment is declining.

But it is easy to see why those with a certain partisan bias like to use average wages because they put a positive spin on how the median American family is faring.

“Even limiting the average to production and non-supervisory workers is fraught, since it includes sole contributors in STEM and finance–occupations that are highly compensated …and their share of the workforce is rising while manufacturing employment is declining.”

Fraught? Fraught with what, exactly? (That’s how “fraught is conventionallt used, after all. “Fraught with…”) And why does a change in the composition of the workforce over time make median wage a better measure than mean wage?

I’m perfectly willing to entertain the notion that median wage data are useful, but your argument here seems loopy. I don’t think even you understand your point.

Check out Dr. Chinn’s latest post. Once again – little Jonny forgot to check the facts.

“I don’t think even you understand your point.”

his point is to simply muddy the waters.

the reality is median and average both have value in discussions. neither one is really better. and unless you are informed about the actual distribution of wages, you cannot fairly argue that either is a better representation of the data. remember, this is simply a measure of the central tendency of the distribution. it is one number used to represent millions of data points. of course there is going to be an ability to misrepresent the data, the question is whether that is intentional or not. John automatically assumes any misrepresentation is either intentional or out of ignorance. usually it is neither. it is simply a desire to describe a complex issue with a single number. otherwise the issue cannot be discussed coherently at all.

Maybe you should READ Dr. Chinn’s latest post. It seems the data contradicts you once again!

I feel the need to clear up a point about “schadenfreude”.

Recently, one of the less capable but more bumptious commenters accused me of schadenfreude because I noted risks to China’s economic outlook. Regular readers of comments here may have noticed that I point out risks to the U.S. economy, European economies, developing economies, human welfare, democracy and honesty. Apparently, China must be set apart and left unexamined.

Now, let me show you real schadenfreude. This is from NPR

“In a brief statement today, the Supreme Court ordered attorneys for the U.S. Trustee Division of the DOJ, Purdue Pharma and the Sacklers to prepare arguments on one question:

“Does US bankruptcy code allow courts to approve deals, as part of a Chapter 11 filings, that extinguish claims against third parties that aren’t bankrupt?

“Legal experts say this case could set precedents affecting other controversial bankruptcy deals involving wealthy companies and individuals.”

Eeee-Freakin’-Haaaa! This is great news. Rich bastards trying to create a precedent of immunity from tort action just ran into a Supreme Court oopsie!

That’s schadenfreude.

By the way, the commenter in question seems to think using fancy language gives the impression of intelligence. Well, if one feels the need to give that impression, one ought not misuse big words; it ruins the effect.

“the commenter in question seems to think using fancy language gives the impression of intelligence.”

Let’s start a Go Fund Me page so we can buy Jonny boy a decent dictionary. Not that this troll will ever understand even simple concepts.

schadenfreude – pleasure derived by someone from another person’s misfortune.

Isn’t that what Jonny boy gets every time Putin shows Jonny boy film of Ukrainians being killed by Russian soldiers?

it’s being widely reported that inflation rose for the first time in 12 months…for instance

Inflation rises for first time in 12 months – CNBC

Politico: U.S. inflation rises for the first time in a year to 3.2% rate

CBS Moneywatch: Inflation rose 3.2% in July, marking the first increase after a year of falling prices

Progress on inflation stalled in July as prices nudged up – Washington Post

NY Times: CPI Report Live Updates: Inflation Picks Up to 3.2%

“after a year of falling prices”

Wow. There guy who wrote that headline has no idea what it means.

Headlines are clickbait. Sometimes lies and sometimes just dishonest, but always designed to get peoples attention. The actual relevant information (what inflation number, how much it changed, why it changed, and whether this was a likely outlier or a likely change in trend) is sometimes found in the articles but often ignored. Having fooled the morons to think there is something there, its hard to then admit that there isn’t.

the reason YoY inflation “rose” in July 2023 was that July 2022 inflation was zero…the reason that YoY inflation fell sharply in May and June 2023 was that May and June 2022 CPI were up 1.3% and 1.0%, and those figures were dropped out of the comparison in those months….when reporting YoY figures, you’re always removing the change of the same month of the prior year…unless you explain that, monthly YoY figures should not be compared…

the content of the articles i cited above was as innumerate as the headlines…

here is WSJ Pro being equally innumerate…

But a monthly report on US inflation showed a reacceleration higher after 12 consecutive months of easing, as the annual CPI rate rose to 3.2% in July versus 3.0% in June. That began to trigger some worries that a trend toward higher inflation may be stirring, one that could lead to more demand-destroying Fed action. (dan.molinski@wsj.com)

https://www.wsj.com/articles/oil-futures-edge-lower-in-likely-technical-correction-ea482fa7

i have argued on this site for a while, once inflation drops below 4% it becomes a non issue and should be ignored. Rates between 2% and 4% are not detrimental, and may actually be net positive. inflation fluctuating around 3.2% is normal, and should not get any headline news whatsoever.

baffling,

Well said.

ppi just posted:

https://www.bls.gov/news.release/ppi.nr0.htm