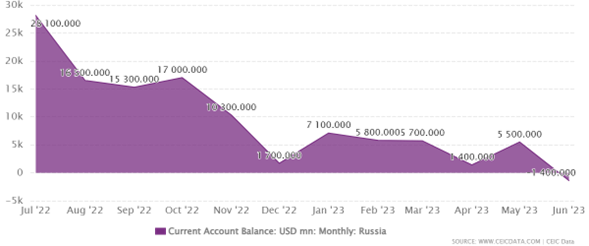

BOFIT also notes the ruble’s weakening. Here’s a picture of the CA through June.

Source: CEIC, accessed 8/21/2023.

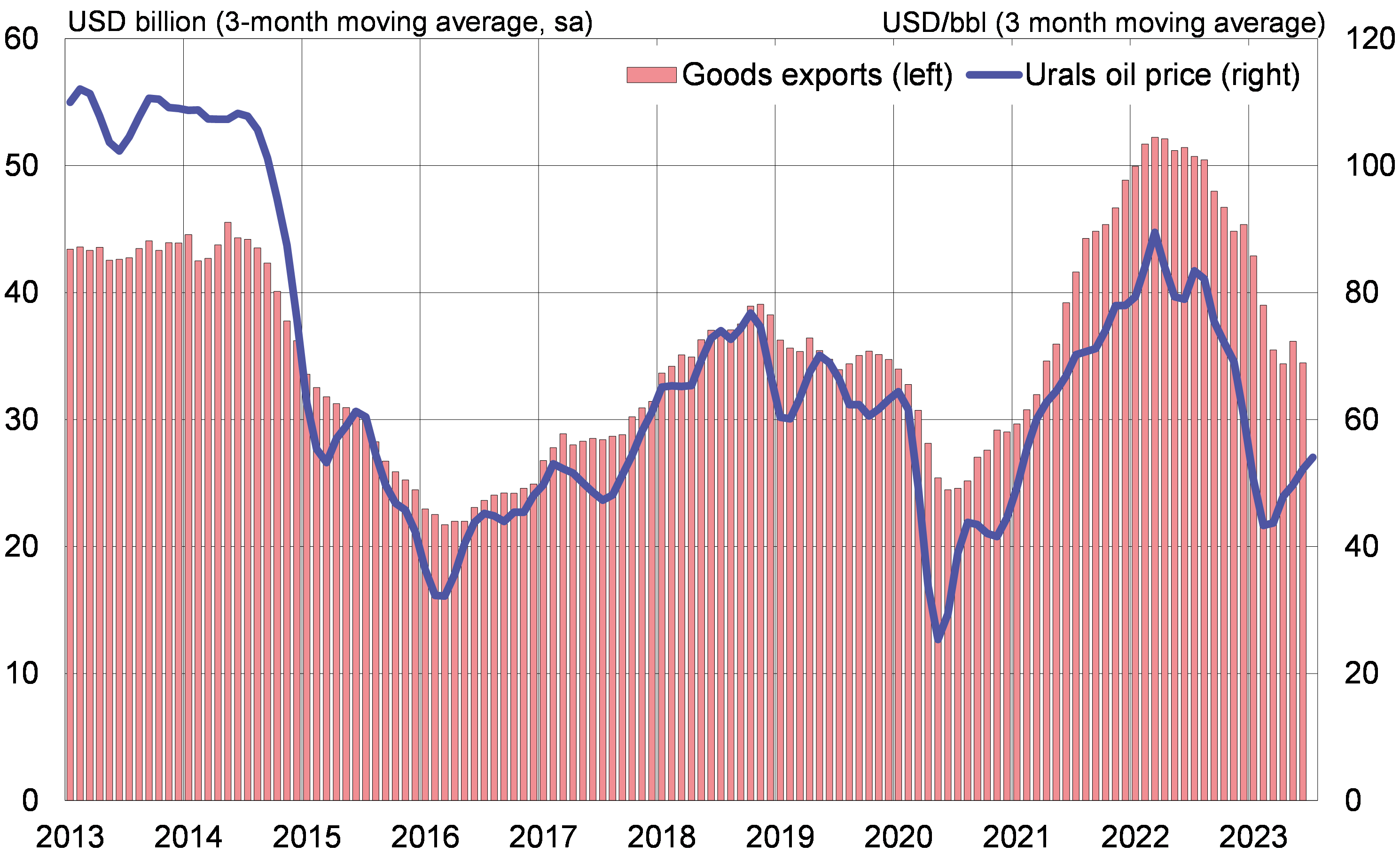

This development is largely driven by the drop in the value of Russian exports:

Source: BOFIT, August 18, 2023.

Heli Simola at BOFIT has a good overview of current and prospective conditions facing Russia. One interesting passage (based on my GoogleTranslate output):

Russia’s goal has also been to alleviate the problems caused by lost imports by increasing domestic production. However, no investments have been made in the necessary production capacity. Total investments did increase in Russia last year as well, but the growth was mainly directed to other than import-substituting industrial production: transport infrastructure, construction and the real estate sector, and extractive production. On the other hand, in the automotive industry, investments collapsed and contracted clearly also in e.g. the manufacture of electrical equipment. The share of the machinery, equipment and automotive industry in total investment has halved over the past decade and was only one percent last year.

See also this earlier post on output available for nonmiitary use, here.

Interesting but not surprising. Now let’s sit back and wait for the latest excuses from Putin’s pet poodle!

Whatever you want to say about the morality of assisting Putin in the mass murders of innocent people in Ukraine, and his own army, you can’t help but give Nabiullina respect in the smarts dept and ability dept, for staring out with a poker hand of 2-7 offsuit, and managing to keep tossing poker chips in the pot as she keeps her bluff. It’s still a losing hand, but she sure did play it as well as it could be played. And if I do take morality out of the equation, I have to confess I admire that part of her.

“give Nabiullina respect in the smarts dept and ability dept”

She is managing to handle Putin’s disaster as best she can. The last time I remember a government leader and a Central Bank head battling so much was Volcker v. St. Reagan and that 1981/82 toxic mix of fiscal irresponsibility and tight money.

“Russia’s export earnings in the first half shrank considerably from last year’s record highs. According to preliminary CBR figures, the value of goods exports in January-June was a third less than a year earlier. Export revenues were hurt most by lower prices due to global market developments and sanctions on Russian exports. The volume of Russian natural gas exports has also contracted sharply with Russia’s decision to cease supplying pipeline natural gas to many EU countries. The value of goods exports is nowhere near the historical lows of the past decade, but hovering around the same level as in the first half of 2019.”

I note that this decline in net exports came from a fall in exports whereas the US current account deficit is more from high imports attributable to a strong US economy. Russia’s export decline lowers its aggregate demand.

Now I get the adults here get all of this – something to do with expenditure-switching v. expenditure-adjusting.

But wait for it – we will have to endure the usual Jonny boy excuses as Jonny boy never understood even basic international macroeconomics.

‘Source: CEIC, accessed 8/21/2023.’

I took their reporting of Russia’s current account back 10 years. Lots of volatility which should not surprise anyone given how Russia’s exports are oil driven and the price of oil is quite volatile.

At the beginning of the war, the current account temporarily spiked but that is likely due to the spike in oil prices.

Heli Simola:

‘The war and sanctions also quickly caused a sharp drop in demand in the Russian economy. In spring 2022, the Russian economy contracted sharply as the uncertainty caused by the war cut domestic demand and import restrictions imposed by Western countries reduced export demand. At the same time, export restrictions imposed by Western countries and foreign companies’ own decisions to withdraw from the Russian market caused problems for production. Russian imports declined sharply and Western goods were less available than before.’

As I noted, expenditure adjusted events depress domestic demand but shows up in terms an improved trade balance which as party of the story for that current account surplus back in early 2022.

She continues:

“the longer-term effects of the war and sanctions are beginning to be felt in the Russian economy. Bottlenecks in domestic supply are increasingly constraining growth. The growth potential of the Russian economy has been modest for years. The workforce has declined, there has been insufficient investment in production capacity and productivity has been low. As a result of the war, labour shortages are an even more pressing problem in Russia. Hundreds of thousands of people have left the labour market as a result of frontline recruitments or emigration. According to official data, 300,000 men were sent to the front in the partial mobilisation carried out in Russia last autumn. The number of emigrants is estimated at 800,000–900,000[1]. In total, this corresponds to a contraction of about 1.5 per cent in the labour force.”

Simply put – a supply side disaster.

Yes 300,000 workers lost to war (either fighting it or victims of it) and 900,000 running away from the war/country. That is a lot of productive ability not being used. Add that a lot of those 900,000 are exactly the young and highly educated people who would be needed to build a modern economy. Very few of those war refugees will come back to Russia – why would they. Russias long term problems may be worse than their short term problems.

” Add that a lot of those 900,000 are exactly the young and highly educated people who would be needed to build a modern economy.”

A crucial point. I was just waiting for Putin’s pet poodle JohnH to suggest having less people takes the pressure off the Russian pension systems. But the troops aren’t people in the 60’s or they?

All around mess. There’s no supply. Demand will fall as people pull in their horns and stop buying what little is available. Ruble is potato.

Hey – I had a baked potato as part of my dinner!