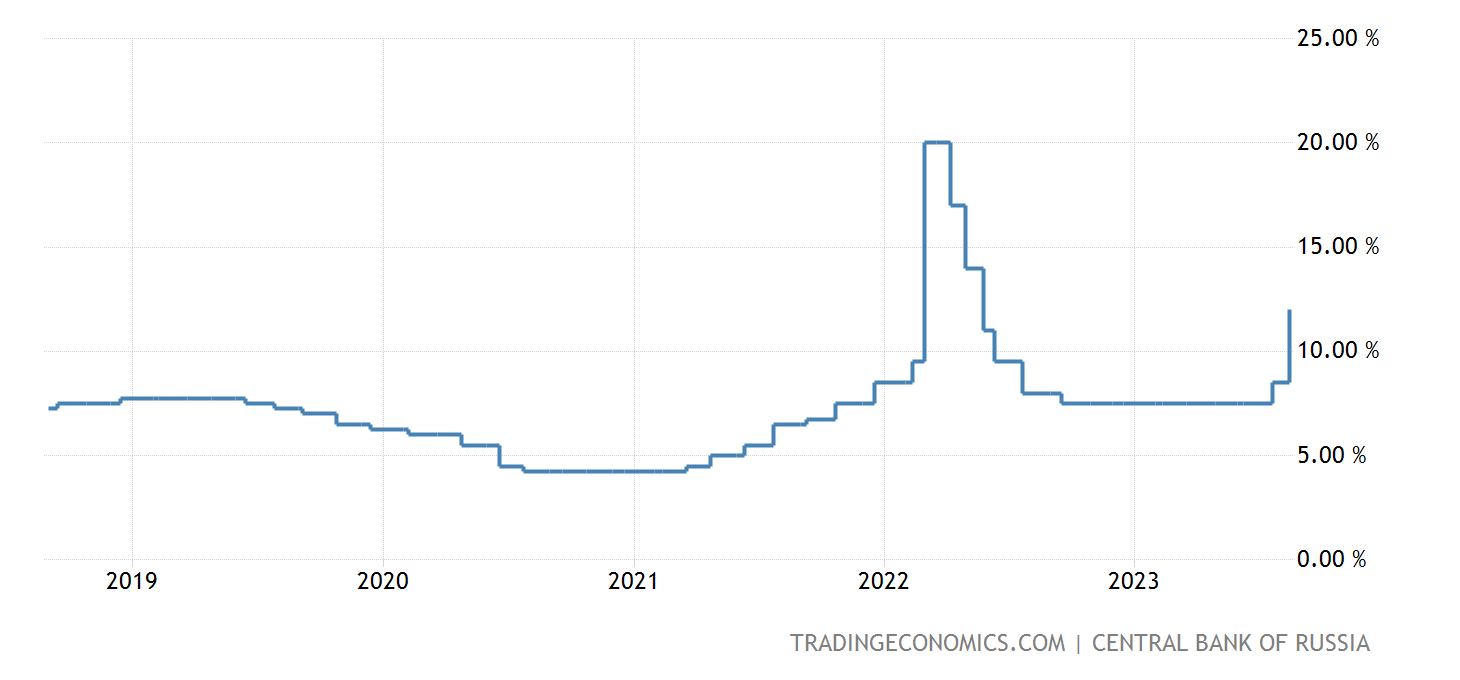

Interest rate up. Presumably more intervention, and reconstituted capital controls — although it’s hard to tell. So, when you see the picture of the ruble rebound…

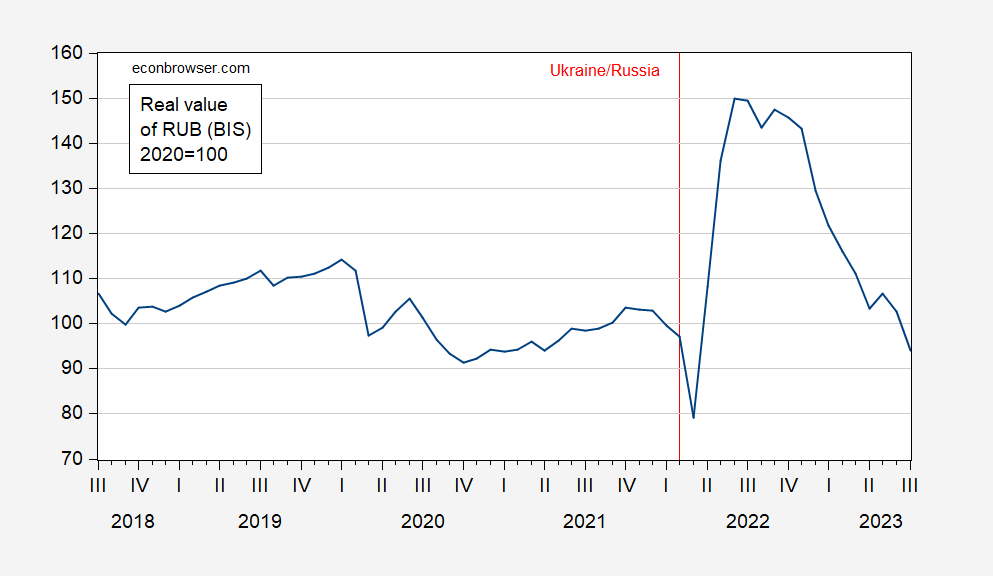

Notes: Higher is weaker RUB.

Remember, the policy rate is up 350 bps, and is coming back to 2014 levels, even if not back to March 2022 levels.

If the interest rate hike combined with capital controls are not sufficient to stabilize the RUB, then the CBR will need to expend forex reserves to purchase RUB. However, the amount of unfrozen forex available for these purchases is, apparently, limited, and getting more limited the more the current account is in deficit (discussed in this post).

As of July (before the latest slide), the real value of the RUB was below that at the onset of the war.

Figure 1: Real value of RUB against a broad basket of currencies, 2020=100 (blue). Higher is stronger RUB. Source: BIS.

More, here. Remember, the interest rate defense implies a lower level of aggregate demand than otherwise would occur (i.e., you might keep the ruble value up, but send the economy into another downturn).

On a somewhat related topic –

Marketplace.org today ran a story about flagging demand from Japan and China for U.S. Treasury debt. Not a bad piece, though short on magnitudes. If one disaggregates the components of the ten-year Treasury yield, the contribution of foreign demand to higher Treasury yields becomes apparent:

https://fred.stlouisfed.org/graph/?g=181fm

You can’t see the direct impact of foreign demand in the picture, but it falls in among the stuff represented in term premium. Term premium and inflation expectations account for very little of the recent rise in Treasury yields. So reduced demand for Treasuries from the rest of the world, including Japan and China, account for very little. Note that the cost of funds has risen more than the ten-year yield since March of last year. The Fed accounts for most of the rise in Treasury yields.

Bill Dudley’s view on federal debt and interest rates: “Goodbye to the Bull Market for US Treasury Bonds”

https://www.washingtonpost.com/business/2023/08/22/goodbye-to-the-bull-market-for-us-treasury-bonds/42185ada-40d6-11ee-9677-53cc50eb3f77_story.html

Considerably more informative and nuanced than Ducky’s simplistic look at past data series…

Bill Dudley? The football player or that Bloomberg oped writer? Yea Jonny boy will cite any fool he stumbles over.

There is a bit of ag news that is of particular importance for poorer, rice-importing countries. All of a sudden, news services are noticing the price of rice:

https://apnews.com/article/rice-prices-shortage-india-ban-a7364dbdb6fd04934090bd2943e24bbd

http://www.cnbc.com/amp/2023/08/22/asia-food-inflation-fears-rise-as-rice-prices-surge.html

http://www.pbs.org/newshour/amp/world/scuttled-grain-deal-extreme-weather-to-blame-for-rice-shortages-higher-food-prices-in-africa

India banned exports of non-basmati white rice on July 20 in response to Russia scuttling the Black Sea shipping deal, and had previously banned exports of broken rice. (There may be a bit of journalistic malpractice in waiting until rice prices have come down from recent highs to report this story, but whatever.)

Rice occupies a fairly small place in most family budgets in the U.S., but over 30% in places like the Philippines.

India isn’t the only source of shock to the rice market. Iraq has its own problems:

https://www.washingtonpost.com/world/2023/08/13/iraq-water-climate-change-rice/

So does China, near term and longer:

https://www.google.com/amp/s/www.cnbc.com/amp/2023/08/14/global-rice-prices-could-rise-more-as-china-flood-risks-loom-fitch-ratings.html

https://www.eastasiaforum.org/2023/08/05/climate-change-threatens-chinas-rice-bowl/

And Texas:

https://www.tpr.org/environment/2023-03-06/texas-rice-farmers-face-another-year-without-colorado-river-water

Not all the news is bad, and who cares about Texas? The USDA forecasts a 27% rise in U.S. output this year (2023-2024 harvest) over last. Where you get your rice really matters right now.

Anyhow, it sucks to be poor when climate change cuts into food production, and when Russia uses food as a weapon.

Global price of Rice, Thailand

https://fred.stlouisfed.org/series/PRICENPQUSDM

The good thing about food is that it is one of the places where substitution actually does work. People will change what they eat if prices go too high or if there is a great deal on an item they don’t usually eat a lot of. However, the current situation has pointed governments to the fact that if a product is essential it is not a good idea to count on someone else to produce it for you. Less trade and more self reliance is worth that fraction of a % of GDP it will cost.

China and India are increasingly of that view. They account for about 36% of global population. China is a net importer of food. India a net exporter.

@ Macroduck

Careful, inside some of these statements could be Xi’s answer to a dramatic turnaround in some parts of the Chinese economy. I’d rather the man swim around in futility. Think John Deere, Kubota, GEA Group, etc. It’s hard to cure stupid anyway~~let’s just let them take some herbal medicine and let it play out before we give Xi any wild ideas. Best to let sleeping giants rest.

Putin and his poodles are desperately trying to sell the narrative that Ukraine and the west is running out of options and Russia can afford to just wait it out. Turns out it is all projection. Russia doesn’t have a lot of time before the consequences of its attack on Ukraine starts biting very seriously. Saudi Arabia and China are seeing that, and desperately trying to avoid taking a lot of collateral damage. But Putin is living in his own deluded universe either not being told or refusing to believe that things are indeed as bad as they are.

this is why the current gop discussion about limiting ukrainian support is treasonous. biden is going to fight the russians and win, without losing an american life in the process. unless the gop sabotage the effort. in what reagan party would members openly limit the opportunity to defeat the russians? maga world unhinged!

Are real wages up or have they fallen. Kevin Drum asks could both be true?

https://jabberwocking.com/wages-for-new-hires-are-either-way-up-or-way-down/

He notes how the WSJ argued real wages are down per some questionable sources only JohnH could love. CNN on the other hand says real wages are up according to some New York FED survey. To be fair, I have yet to read this survey. If anyone else has – please tell us what they really found.

Neither Kevin Drum nor CNN told us exactly what NY FED survey they were referring to but I think this is it:

https://www.newyorkfed.org/microeconomics/sce/labor#/

Maybe the ever insightful pgl could cite chapter and verse from that NY FED survey where it talks about real wages…

Yea – Jonny boy is too lazy to read this. Per usual.

My God! Jonny boy cannot even numbers in large fonts. OK they noted the nominal wage in July 2023 v. in July 2022. And the nominal increase was a mere 7.92%.

Now Jonny boy was so sure the price-level would rise by more than this. OK – BLS said it rose by a mere 3%. But little Jonny boy knows more than the BLS.

Yea – Jonny boy is a genius in his own warped little mind.

There may not even be a way to defend the Rubble

The simplistic, wrong-on-the-evidence story carried un much of the press is that the Fed is reaponsible for bringing inflation down. Since inflationis at 3% rather thanth holy grail of 2%, the Fed must still have a ways to go. Here is an article from Barron’s which takes a skeptical view of this story:

https://www.barrons.com/articles/fed-jobs-inflation-models-recession-forecast-17981edf

Note the article is written by a full-employment crusader, not Barron’s staff. Anyhow, the article must be right, because it agrees with what I’ve been saying g for quite some time.

Preston Mui is a senior economist at Employ America, an organization that conducts research and advocacy in support of full employment.

Good catch. I must read more of his work.

Picked up 1/3rd tank gasoline at $3.29 which only left a small amount of free space in the tank (maybe 1/8th). Unless gasoline is super super low I don’t fill up the tank ‘cuz it gives you flexibility on when to fill up. Picked up some cheap summer clothes on clearance at Walton’s screw-athon. The most expensive was a hoodie shirt with some Japanese written characters and some kind of animé print on it (It was $24, I figure I had to pay $4 extra for the licensed image). You know one of those flashy shirts with wild colors (black background) that when I walk by younger people they mumble “Doesn’t he know he can’t ‘pull off’ that look anymore??”. I like to annoy the natives as much as I can. That and my facial peach fuzz keeps the suburban douches at a distance. Take notes people. Long sleeved “almost dress shirt” with pockets $13, a thick T-shirt $7. Army green colored sweat pants $20 (PRO TIP: Always check to make sure the sweat pants are made with cloth that doesn’t make annoying swooshy noises when you walk. Almost Picked up a “scary clown” T-shirt, but it was size 3XL and I just couldn’t con myself into having a shirt that went to just above my knees.

That’s today’s “Inflation Update” from Biffy.

“Scary clown” T-shirt was $6.98. It looked cool but the clown was a generic image, so no licensing fee attached.

Ziprecruiter appear to be WSJ’s main source, though they quote other private owned in the article. It could be cherry picking. I have no thoughts myself whether that is a good source or a bad source, although it could be closer to “as it happens” data then we might get from the Fed or other government agencies. Welcome anyone’s thoughts on time relevance of the Ziprecruiter data vs gov agencies etc.