The BEA comprehensive revisions combined with August data changes the business cycle picture somewhat. The downturn in personal income ex-transfers and manufacturing and trade industry sales in 2022H1 look a lot bigger.

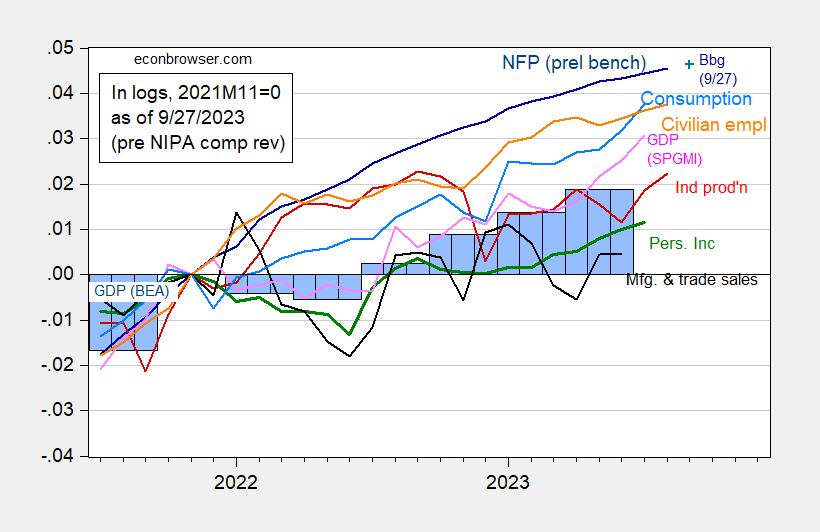

First, the pre-comprehensive revision outlook (but incorporating the preliminary benchmark revision for employment).

Figure 1: Nonfarm Payroll employment incorporating preliminary benchmark (dark blue), implied September NFP incorporating Bloomberg 9/27 consensus (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, BLS preliminary benchmark, Federal Reserve, BEA 2023Q2 second release via FRED, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (9/1/2023 release), and author’s calculations.

And here is the post-revision picture:

Figure 2: Nonfarm payroll employment incorporating preliminary benchmark (dark blue), implied September NFP incorporating Bloomberg 9/27 consensus (blue +), hcivilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2017$ (green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, BLS preliminary benchmark, Federal Reserve, BEA and Census via FRED, BEA 2023Q2 3rd release via FRED, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (9/1/2023 release), and author’s calculations.

All in all, while personal income and manufacturing and trade industry sales dropped more in 2022H1, the subsequent growth in those series (particularly income) now looks more robust.

Thank goodness for transfers. And I suppose the contribution of transfers to support income now looks like a smaller contributor to inflation?