As of today:

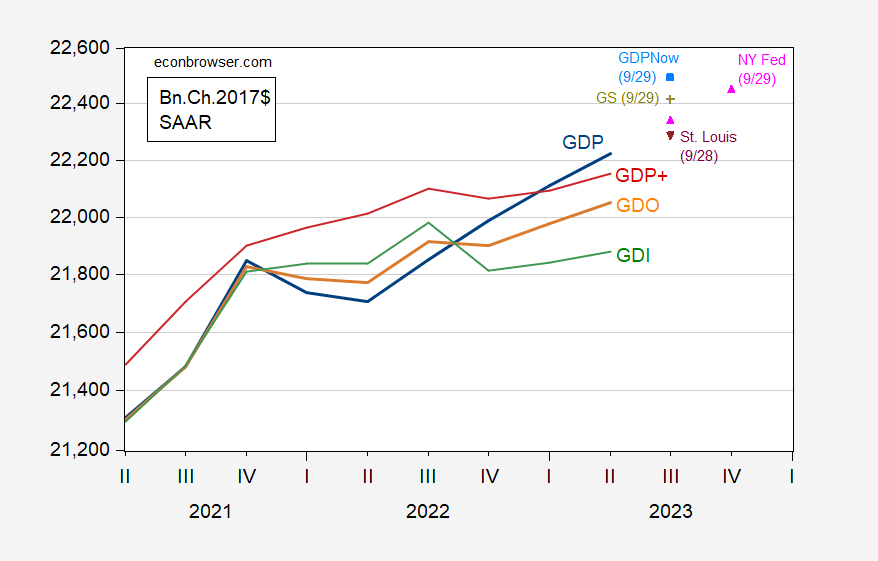

Figure 1: GDP (bold blue), GDI (green), GDO (orange), GDO+ (red), GDPNow of 9/29 (light blue square), NY Fed nowcast as of 9/29 (pink triangles), St. Louis Fed news index as of 9/28 (inverted purple triangle), Goldman Sachs tracking as of 9/29 (chartreuse +), all in bn. Chained 2012$ SAAR. GDP+ based on 2019 GDP level. Source: BEA 2023Q2 3rd release/comprehensive revision, Atlanta Fed, NY Fed, St.Louis Fed, Philadelphia Fed, Goldman Sachs, and author’s calculations.

GDP+ is now much closer to GDP than in the pre-revision data (see this post for comparison of levels pre- and post-comprehensive revision). All the nowcasts tabulated in Figure 1 indicate continued growth in Q3.

Lewis-Mertens-Stock Weekly Economic Index (NY Fed) is at 1.89% y/y growth, using data through 9/232. As late as week ending 5/13, it was as low as 0.74%.

Menzie Chinn,

A lot of volume posting since your “analysis” of ‘Almost Half a Century of the Economic Policy Uncertainty Index’ was shown to be not at the level of an intro econometrics course. Nice job relegating that “analysis” to page2 – four days is quite impressive. Is that something you teach in PA819? It’s akin to the Trump-like approach of filling the void with so much volume that prior errors and bullsh*t are forgotten.

Econned: Do you mean you want me to expound upon why your supposedly superior analysis using multiple dummy variables is better than mine? When I have a free moment (I viewed the comprehensive NIPA revisions as more consequential, and I have other day-job items that require my attention), perhaps I’ll respond. I’ll be sure to alert you.

Menzie Chinn,

There were many issues with you ‘analysis’…

1) you labeled your data incorrectly (which you fixed)

2) you were clearly posting partisan b.s. This evident by the fact that your modeling showed relatively similar uncertainty during the Obama administration relative to the Trump administration but you conveniently chose to focus on the elevated level of uncertainty during the Trump administration

3) your modeling was subjective trash for numerous reasons including ignoring recessions and because of how you specified your COVID dummy variable

4) your comment above is b.s. because you used multiple dummies in one of your models as well (one for Trump and one for a poorly-specified COVID dummy) so please don’t move the goalposts in order to create a trash post in an attempt to boost your ego. Maybe you meant to say “more dummy variables” instead of “multiple dummy variables”? Check Merriam-Webster or the dictionary of your choosing for clarity.

5) it’s not about my analysis being superior to yours – it’s about how absolutely poor your ‘analysis’ was if your honest intent was to even half-heartedly asses the impact of a presidential administration on a choice metric of uncertainty. It was sloppy, partisan, and inadequate.

Econned fails as a journal referee as well. That part about labeling has to be a sick joke as you rarely provide needed labels and when people ask you to do so, you bitch about.

Of course you also say something about Bordo (2023) without the title or the name of the co-author or even a damn link. Now I found this paper on Divisa money which was not all that great even if you said it was all the rage. I commented after providing the link you were too lazy to provide but little Econned could not offer a single reply.

Then again – little Econned is totally incompetent at monetary economics so hey!

You could have ended the sentence at “incompetent.”

Stalker gotta stalk.

Love the passive construction – “…was shown to be…” What you’re trying to say without actually saying it is that you called Menzie out and won. You don’t want to have to make that claim outright because only you say so, and you’re…nobody.

That’s the real problem here, isn’t it? Menzie’s CV is stuffed full of accomplishment and yours is…do you have a CV? So you stalk.

Sad little man.

Did this worthless troll ever tell us what he meant “Bordo (2023)”? Didn’t think so but I found the paper and noted how Econned never quite grasped. No reply for my LOUD MOUTH. But that is par for the course for this uppity moron.

there’s no need for any kind of “‘casts” for nearly half of 3rd quarter GDP; we have the precise data already…

((((15,474.6 + 15,482.9) / 2) / 15,343.6) ^ 4 – 1) * ( 15,343.6 / 22,225.4 ) = 0.0246467839

the figures in that calculation are real July and August PCE, 2nd quarter PCE, then 2nd quarter PCE over second quarter GDP, all in 2017$

which tells us that PCE would add 2.46 percentage points to the growth rate of the 3rd quarter, should there be no improvement in September’s real PCE from the July & August average…

One interesting feature of the GDPNow estimate is that every component of GDP is forecast to add to growth in Q3. That’s unusual, and helps account for the above-average growth estimate. If that turns out to be the case, I’m not sure whether “firing on all cylinders” or “fluke” would be the more apt description.

Eurointelligence: “Storytelling with numbers…The French macro research institute Rexrode published a useful metric to assess whether or not there is a structural bias in forecasting errors from various forecasters, including the French government. The table below shows that since 2000 the French government erred on the optimistic side, with 18 out of 23 of their economic forecasts turning out to be too optimistic. But, as Jean Marc Vittori noted on X, formerly Twitter, the other forecasting institutes are not far behind. The least optimistic amongst those 10 institutes still saw 13 out of 23 fall on the optimistic side. More than half of the forecasters never got one forecast right….

As our readers know all too well, we have been critical of the inherent bias in forecasting models. Given their poor outcomes, what is their role other than to assist the government in creating positive narratives that do not need to necessarily have to come true?…Those forecasts thus look more like a cultural exercise in creating narratives that link French aspirations to the future. It is about story-telling, not about getting it right.”

https://www.eurointelligence.com/

This reminds me of a conversation I once had with an econometrician who had recently retired to become a stand-up comedian. My company was in the middle of developing the next year’s budget, so I asked her, “what do you think GDP growth will be next year?” Her answer? “What do you want it to be?” More to the point, she probably should have asked; “what does your boss want it to be?” After all, making your boss happy in everything including forecasts is ultimately what it’s all about. Forecasters seem to have internalized this reality extremely well.

Johnny’s lack of self-awareness is remarkable. Here he is, engaged in exactly the practice he’s criticizing- telling a biased story, over and over.

The West, bad.

Russia, good.

Democrats, bad.

Republicans – good because they aren’t Democrats, never mind that they oppose the policies Johnny pretends to support.

Economists, bad.

Based on? Based on Johnny’s biased account of any topic he addresses. But in Johnny’s world, it’s always the other guy who’s biased.

His Kremlin masters must be so pleased.

I guess Ducky didn’t like the French macro research institute Rexrode’s findings about how bad French economic forecasts are.

If Ducky wanted to enhance the credibility of economists in general, he would insist that anyone who makes a forecast should maintain a track record of the accuracy of past forecasts and publish the results regularly. But he doesn’t. Instead his only response is to attack my “lack of self awareness.” But where is the self awareness of the economists who produce theses predictably wrong forecasts yet don’t take responsibility, undertake any study of lessons learned, and then produce yet more forecasts with the same bias?

It seems that economists who engage in forecasting share the no-accountability umbrella of politicians and neo-con foreign policy experts who constantly get it wrong but never suffer the consequences. Bizarrely they often get cushy jobs as media pundits to trumpet their lack of understanding.

“If Ducky wanted to enhance the credibility of economists in general, he would insist that anyone who makes a forecast should maintain a track record of the accuracy of past forecasts and publish the results regularly.”

Like you and Princeton Steve do? Oh wait – you do not even know what the word forecast means. Oh well!

So, here’s what Johnny wrote:

Johnny guesses what I’m thinking.

Johnny makes the mistaken claim that there is no record-keeping with regard to economists forecasts. He then goes on to make accusations regarding forecasters in general based on his mistaken assumption. Johnny doesn’t know much about economics or the economics profession, but he makes disparaging comments about both economists and economics with complete disregard for his own ignorance. It is often true that arrogance and ignorance go hand in hand.

The truth is that every economist who shares forecasts with Bloomberg is on record for every forecast they ever shared. Bloomberg ranks them by the accuracy of their forecasts. Johnny doesn’t know, but then, he doesn’t care. He’s perfectly willing to carry on endlessly while getting his facts wrong.

Anyone who publishes forecasts but doesn’t contribute their forecasts to Bloomberg (Reuters, Marketplace…) surveys can be checked for accuracy by anyone who cares. Forecast accuracy is NOT a mystery to people who know much about economics.

Johnny is justlying to you. Again.

“The truth is that every economist who shares forecasts with Bloomberg is on record for every forecast they ever shared. Bloomberg ranks them by the accuracy of their forecasts. Johnny doesn’t know, but then, he doesn’t care. He’s perfectly willing to carry on endlessly while getting his facts wrong.”

I may have taken my courses in econometrics over 40 years ago but even back then we knew the forecasting records of any economist who ventures to do these exercises could readily be checked. But not little Jonny boy.

And now little Jonny boy claims economic forecasters could improve their forecast accuracy by reading the garbage little Jonny boy spews? That is like a sober person asking the drunk in the bar to drive him home.

Does Jonny boy have a published forecasting record? It has to be worse than Princeton Steve’s.

By the way everyone who gets basic statistics makes a distinction between estimation bias and partisan bias. But not our little Jonny boy!

duck where are your masters?

I am not going to reveal the addresses of my children.

I am especially not going to reveal their addresses to someone of apparent bad intention, like you.

I am non violent with dr king

Why would I believe you? If you are the “anonymous” you seem to be, you aren’t particularly honest.

You brought MLK into a conversation involving being violent? Dude – you are a disgusting POS.

I might have been nice had you bothered to mention:

Delusions of Success: How Optimism Undermines Executives’ Decisions

by Dan Lovallo and Daniel Kahneman

Of course their explanation is a far cry from Jonny boy’s stupid little tale. How wait – little jonny boy does not know who Kahneman even is EVEN THOUGH he is mentioned in Jonny boy’s link.

Come on Jonny boy – for once in your pathetic little life would it hurt if you read something of substance.

So what is pgl saying…that optimism bias has been known about for decades, but nothing has been done to correct for it in forecasts? You would think that it would be relatively easy to identify forecasters affiliated or otherwise invested in the success of a policy or project and discount their forecasts accordingly. Alternatively, if forecasters’ coziness with the outcome of a policy or project is unknown, it should be fairly easy to determine the degree of coziness simply by looking at forecasts vs. outcomes over time.

Back at my Fortune 200 company it fell to division finance people to tease out assumptions and methodologies that project/policy folks used to unjustifiably enhance their forecasts in an attempt to improve the chances of getting approval and funding. The most outrageous forecasts often came from the sales guys, whose historical sales would be rising slowly while forecasts showed a dramatic rise…the technical term was “hockey stick forecast.” The finance folks respectfully received such forecasts, asked a few questions, ignored them, and then created their own that reflected the historical trend line more closely.

Maybe those taking economic forecasts without examining them for forecasters’ optimism bias could learn something here. IOW if there is a pattern of bias in the same direction (think FED inflation and economic growth forecasts,) why wouldn’t you suspect optimism bias, particularly since the Fed has a vested interest in the success of their policies. Unless, of course, economists looking at the forecast has a vested interest in going along to get along and NOT offending the forecaster, in which case overly optimistic forecasts would just get accepted on faith, which seems to be happening a lot!

“So what is pgl saying…that optimism bias has been known about for decades, but nothing has been done to correct for it in forecasts?”

Maybe I should just refer everyone to Macroduck’s comment as to your complete ignorance. Why waste time with a moron who babbles trash endlessly.

“The finance folks respectfully received such forecasts, asked a few questions, ignored them, and then created their own that reflected the historical trend line more closely.”

Jonny boy was of course a sale guy who everyone ignored.

“Maybe those taking economic forecasts without examining them for forecasters’ optimism bias could learn something here.”

What is anyone going to learn from your stupid babbling? Oh yea – what not to program into Alexa. Dude – you are a moron who gets everything wrong.

I have a forecast for little Jonny boy. Florida’s minimum wage will be $15/hour by the fall of 2026:

https://www.wflx.com/2023/09/30/floridas-minimum-wage-rose-1-12-per-hour/

Oh wait – that is already Florida law. Of course little Jonny boy had to make a case study out of Florida to suggest Democrats there did not support a $15 minimum wage. Another case of little Jonny boy being the most dishonest troll ever.

“…but nothing has been done to correct for it in forecasts…”

This is an example of Johnny using two kinds of dishonesty. First, he imposes an obtuse meaning on someone else’s comment. Second, he makes an assertion for which he has no basis. How does Johnny know that no effort has been made to correct economic forecasts? He doesn’t.

Anyone who has worked as a forecaster or paid close attention to forecasting knows that lots of forecasters do, in fact, work to improve their forecasts. All one needs to do, really, is follow some of the links Menzie has provided. Johnny doesn’t bother with those links, because Johnny doesn’t care about the truth. Or, one could look at Menzie’s own repeated posts about various recession forecasting efforts and know that there is a pretty constant effort underway to improve recession forecasting. Or one could read Menzie’s posts about forecasts for recession in 2022 and 2023 which have steadily been pushed back as recession failed (as far as we know) to materialize – hardly a demonstration of the excessive optimism Johnny bemoans.

Oh, and what anecdote does Johnny offer to “prove” that economists don’t try to eliminate bias from their forecasts? He tells a little story about sales guys making optimistic forecasts. Because sales guys and economists are the same people, obviously.

So let’s review:

– Johnny says there is no effort to keep track of economists’ forecasting record. I point out that financial news services keep track of economists’ forecasting records. Johnny doesn’t respond.

– Johnny claims there has been no effort to correct forecasting bias, but offers no evidence for his claim, meanwhile ignoring readily available evidence that there are regular efforts to improve forecasting accuracy.

– Johnny relies on an unsourced anecdote about sales forecasting by “sales guys” as proof that economists make bad economic forecasts.

What’s funny about Johnny accusing economists of not doing anything to correct an optimistic bias is that Johnny is among the most biased commenters on this blog, and has become progressively worse over time. Pot, meet kettle.

Johnny is lying. If he had taken on board evidence of his initial error and modified his claims accordingly, we might not want to accuse him of lying, but instead say that he might merely be ignorant. But Johnny rarely takes account of evidence that he’s wrong – and boy, has there been lots of evidence that he’s wrong about lots of things. Johnny is a liar. He is apparently a motivated liar, always lying in the same direction.

A particularly sad feature of Johnny’s lies is that he mostly lies in order to attack those who support ideas Johnny pretends to support. Johnny pretends to be a progressive, while lying about progressives. He pretends to care about an inequitable distribution of income, while attacking politicians who are working for greater equity in income distribution. Johnny pretends to care about speaking truth to power, but somehow can’t bring himself to criticize Russia’s war on Ukraine or China’s enslavement of Uyghurs.

Johnny relies on debating tricks, lies and innuendo in service of bad people. Johnny serves the interests of a brutal non-democratic autocrat with hegemonic aspirations. Well, actually two brutal non-democratic autocrats, but mostly just Putin. Xi only gets the occasional nod from Johnny. Johnny promotes ignorance on a blog devoted to education.

All well said. But permit me to remind everyone how Jonny boy started his tirade. He sees someone in France tracking the forecasting record of other people in France. Which contradicts his entire premise that we do not bother to track the forecasting records of economists.

Yea Jonny boy is THAT STUPID.

And we thought Econned was a bore

GS breakdown on the Republican government shutdown:

https://www.gspublishing.com/content/research/en/reports/2023/09/27/445d5477-1cfc-4015-b441-932e24472720.html (hat tip to Financial Times)

45 day CR avoids a shutdown for now. McCarthy had to grovel to the Democrats.

Boehner. Ryan. McCarthy?

The man has a spine, after all.

This is the second time he basically gave in to the democrats after his right wing refused to compromise. He is daring the clown caucus to go after his speakership. Now we shall see who got the balls.

I don’t mind working with the other side for a bipartisan solution. I do mind that he waited to the 11th hour so he could continue to suck to the MAGA wing. Bipartisan efforts done right require starting early and working hard on something meaningful. The 45 day thing was needed to avert a disaster but it ain’t exactly the 1986 tax reform or the 1983 Social Security agreement (which the MAGA types want to trash).

From the GS breakdown:

“We have estimated a shutdown would subtract 0.2pp from Q4 GDP growth for each week it lasts (adding the same to 1Q2024, assuming it has ended by then). Regardless of duration, federal employee furloughs should subtract 0.15pp for each week of shutdown. We have estimated the indirect private sector hit at 0.05pp per week, but this is likely to be smaller in a short shutdown, and larger in protracted shutdown lasting many weeks. We expect all data releases from federal agencies to be postponed until after the government reopens, except for releases from the Federal Reserve, which does not rely on congressional funding.”

As a former semi truckdriver I found this article interesting. You can make your own judgements on whether I am biased or not:

https://www.404media.co/self-driving-trucks-california-autonomous-vehicles/

For those interested in the topic of carbon credits:

https://newrepublic.com/article/175773/popular-climate-solution-tank-progress

Completely degenerate Weekend reading (non-economics). But fun read, reminds me of the stuff you used to could find in blogger “Kid Dynamite’s” old blog posts. Much of it nonsense, but you still felt you had sharpened your brain somehow after reading it.

https://thebaffler.com/latest/depravitys-rainbow-ferrer

(Hat tip to Financial Times’ Alexandra Scaggs for all three links)

So I just endured the horrific NYC flooding which wrecked my little place. But as I was trying to stay high and dry I met a woman who worked closely with James Hansen. She was quite opinionated but a delight as she was right on all counts.

I am exceedingly exceedingly lucky, in that the area of town I live in (in the southern plains USA), has some chance of tornados but rarely, if ever, floods, even after heavy heavy rains. But people can make their own luck. One thing I learned from my Dad is, certainly if you buy your own house, you always check to see where the house is in relation to flood zones (although I always thought my Dad called it “flood plains”). Flood-prone area is another wording you hear. And you do your own damned homework, because realtors will flat out look you straight in the eye and lie to you. Something my father was also wise to. My parents requested, with one bad realtor we had (and dropped soon after to get another realtor without notifying the first one) that they wanted a home outside of the flood plain. She very stupidly took us to a house with water marks on the wall from floods. Do you think we dropped her like a hot potato when we saw that?? She thought if she limited our choices to raggedy homes in flood areas, and homes that were above my father’s budget, we would just buy the homes above my father’s budget. She was left with her jaw open and no commission when she found out my parents had bought the home we wanted with another realtor. My Dad, when making major decisions, didn’t F**k around. He went down to look at the county maps with his own eyes, It was free at that time. I imagine they charge a fee now, I have no idea.

I know you had no way to avoid it with flooding that bad near the east coast pgl, and you have my sympathies and prayers. That was more a tutorial for anyone else reading who might want to know the best way to avoid it (when it is within their power to do so). They want to look at the damned county maps.

Thanks. I have two kids who live in different parts of California. Both married and maybe thinking about having kids. Time to say bye bye NYC as California is the place I ought to be (background music from the Beverly Hillbillies. Just call me Granny!

Without revealing anything jeopardizing your privacy and personal safety I hope you will share what you feel comfortable on decision making and processes on choosing the area you live. Always interested in learning more from people good at decision making. I used to drive a dedicated route in California when I drove semi. Saw some interesting places (including San Mateo which I would guess is even too expensive for you). If it was my choice I would lean towards northern Cali and a bit towards the inland. But a lot of variables there for you. Hope you will share bits and pieces here on the blog.

Water may become a major theme of the senior years of your life. Finding a place in Cali that has a solid supply of water, but at the same time is not in a flash flood area, and the cost of the land/rent is low will be a humongous challenge for you. While I suspect you are in a higher tax bracket then me, if you achieve just those 3 things on a move to Cali, you will have done a man’s job. Aquifers, , Aqueducts, reservoirs, Dams, “water capture”, water “runoff”, “contaminated runoff”, cisterns, water infiltration, etc. will have to become part of your lexicon. To make a good decision you’re going to have to turn yourself into a regular William Mulholland.

https://en.wikipedia.org/wiki/William_Mulholland

https://www.watereducation.org/maps-guides

Yeah, carbon offsets are a scam. Hydrogen fuel is a scam. Carbon capture anywhere but on the stack is a scam – and maybe even on the stack.

There was once a legitimate idea to use market function to reduce carbon emissions – the carbon tax. It has been villified every way to Sunday, because it would work and nobody would make a profit. Every other big-name “market-based” solution has been turned into a scam.

If you have the right price in carbon emissions, some of these other ideas might become legitimate, real technological solutions to the greenhouse gas problem. As long as the cost of negative externalities is not reflected in the price of carbon fuels, carbon schemes are gonna mostly be scams.

By the way, this is as true of electric vehicles as anything else. The carbon cost of making a Tundra-sized vehicle is high, no matter the fuel type. Most electricity has a high carbon cost. The electricity needed to push a non-aerodynamic (F150-shaped) vehicle at 60 mph is vastly greater than that needed to push an teardrop-shaped vehicle at 40 mph, and so on.

We need a carbon tax. The longer we wait, the higher the tax needs to be.

It’s official. My neighborhood got 9 inches of rain in 3 hours. But some say global climate change is a myth? Maybe I should send my repair bills to CoRev.

There’s blind ignorance and there’s PGL’s own extreme ignorance: https://notalotofpeopleknowthat.wordpress.com/2023/10/01/new-york-city-floods/#comments

https://notalotofpeopleknowthat.files.wordpress.com/2023/10/image-4.png

It’s like he has no brain nor aptitude to actually research conditions.

As bad as the clean up is going, it is not nearly as pathetic as your standard CoRev rant. Let me say this politely. EFF OFF.

Leave it to CoRev to tell us we got only 5 inches of rain. My neighbor got 9 inches in just 3 hours. CoRev – heartless SOB who not only lies all the time but is dumb than the rocks that clogged my drain.

Hey CoRev – go EFF your little self. And we all know it is very little.

‘Rainfall at Central Park was 5.48”.’

This is what little CoRev cites for the rainfall in Brooklyn. Dude – learn to read a map. Damn!

If you had made a point, we could consider your point. You haven’t. But you’ve made noise, so job done, I guess.

CoRev So let’s get this straight. Over the last 154 years the Central Park station saw ten days with at least five inches of rain, but of that total half of those days occurred in the most recent 24 years. In other words, Central Park has seen as many five-inch rainfall days over the last 24 years as seen in the previous 134 years. And you don’t think that’s evidence of climate change???

2slugs,thanks for the mathematical proof the CLIMATE CHANGES! I’m proud of you. Now for this locale and its rain history, please do your due diligence to show us how much of this climate phenomenon is caused by man? How much is due to CO2? How much is caused by anthropogenic CO2? And, more importantly, how much impact on CLIMATE CHANGE will changing any of these ?causes??

Remember, it is you and your fellow believers that want to STOP the CLIMATE from CHANGING. I have never claimed that there is no CLIMATE CHANGE, but I have commented that your CLIMATE CHANGE claims are unsupported and wrong.

Failure to answer those above question tr: causes will just show the weakness of your arguments and beliefs.

I’ll continue to wait for your proofs as I am still waiting for them from prior requests.

Worn out pointless drivel that has been addressed many times. Now little CoRev cannot refute those LSE take downs of his Mark Harwood as they were so many.

You started off with a fraud written by a serial huckster and now you think you have the right to change the subject and ask more stupid questions? No little liar – we ain’t playing.

I bet you did not know I was going to check up on your Paul Homewood (accountant and serial climate change denier):

https://www.desmog.com/paul-homewood/

Credentials

According to Bob Ward, Policy and Communications Director at the London School of Economics’ Grantham Research Institute on Climate Change and the Environment, Homewood has “no professional qualifications or training in meteorology or climate”.

https://www.lse.ac.uk/granthaminstitute/news/climate-change-deniers-trying-to-fool-the-public-again-about-extreme-weather/

Climate change deniers trying to fool the public again about extreme weather

Read more from someone who is honest and knows this issue as we know CoRev is neither.

CoRev Let’s just see if there’s no difference between the recent past and the distant past. In the 130 years beginning in 1869 thru 1998 there were five rainfall events greater than five inches. So that’s a probability of 5 / 130 = 3.846% each year. Crunching those numbers thru a binomial calculator tells us that there’s a 56.3% chance that there will be five or more such rainfall events over that 130 year period. But since 1999 thru 2023 we’ve also seen five such rainfall events in only 25 years. What are the odds given a probability of 3.846% per year? Crunching the numbers we find there is only a 0.235% chance of seeing five rainfall events of five inches or more. Looks to me like there’s quite a difference between the 1869 thru 1998 period and the 1999 through 2023 period. Clearly it’s no longer true that the annual chance is 3.846%. Wouldn’t you agree?

Yep, frequencies of rare weather events go up when you have global warming. That is what the models have been saying for decades and now reality is saying it also. But certain peoples narratives say something else so they will continue to deny reality and math. But I appreciate a good number crunching – so thanks.

what are your alpha and beta risks?

EFF OFF troll. We are tired of your pointless changing the subject.

Anonymous Not really relevant here. We’re not talking about hypothesis testing. This is just a simple application of a binomial probability given an input probability of 3.846% per year, which is what CoRev apparently believes is a time invariant value. He’s simply wrong about that.

2slugs: “Anonymous Not really relevant here. We’re not talking about hypothesis testing.” Actually not true. Climate

Catastrophists are living examples of failure to test their hypotheses. If you can not answer the above questions hypotheses impacts, then answer with a list of successful CLIMATE CHANGE predictions from the scientific adherents.

I’ll continue to wait. You might collaborate with Ducky, another blind believer in the CLIMATE CHANGE hypotheses.

CoRev It’s obvious from your reply that you don’t understand any of the discussion or the kind of hypothesis testing referred to with alpha and beta risks. I simply reported the results from a binomial probability. There is no hypothesis to test. Apparently you never took probability theory. My advice is to quit embarrassing yourself by displaying your quantitative ignorance.

2slugs, you are again “ducking” the request to answer those above questions. If you blindly believe without being able to answer basic questions regarding that belief you are just another religious zealot, and NOT science.

I’ll continue to wait for your answers supporting your CLIMATE CHANGE hypotheses, while to continue ignoring your deflections.

Just remember, that one meteorological station was bad, for reasons, and that means every data set on which climate modeling is based is part of a Soros scheme to promote world government. With jackboots.

Hey I needed Jackboots when that rain was pouring down. My running shoes are still wet.

America the Beautiful:

https://www.bigtechontrial.com/p/how-to-hide-a-2-trillion-antitrust

Amit Mehta sided with Big Pharma in this case:

http://freepdfhosting.com/9f12cc13ab.pdf

In May 2018, the Department of Health and Human Services (“HHS”) issued a policy statement titled “Blueprint to Lower Drug Prices and Reduce Out-of-Pocket Costs” (“the Blueprint”). 83 Fed. Reg. 22,692 (May 16, 2018). The Blueprint’s stated purpose was to halt rising drug prices and to lower out-of-pocket expenses that Americans pay for pharmaceutical products. See id. at 22,692. As one possible action, HHS announced that it would “[c]all on [the

Food and Drug Administration (“FDA”)] to evaluate the inclusion of list prices in direct-to-consumer advertising.” Id. at 22,695. Direct-to-consumer advertising is one of the most important ways pharmaceutical manufacturers communicate with consumers to inform them of new products, raise disease awareness, and encourage consultation with health care providers. Compl., ECF No. 1 [hereinafter Compl.], ¶ 34.

In short a sensible rule coming out the Trump White House that would have prices of drugs made more transparent. Big Pharma did not want this as it would enhance competition. So they found the one Obama appointed judge who hates competition. Which is why Google loves this judge.

just fyi, the revisions to first quarter GDP, widely cited as “final” just three months ago, were pretty sharp…

The growth rate of the first quarter of 2023, which had last been reported at 2.0% when we reviewed the 3rd estimate of 1st quarter GDP three months ago, was revised to a 2.2% growth rate after this revision, as an upward revision to upward revision to nonresidential fixed investment was only partly offset by a downward revision to consumer spending…the first quarter’s PCE growth rate was revised from 4.2% to 3.8%, on a downward revision in the goods consumption growth rate from 6.0% to 5.1% and a downward revision of personal services growth from 3.2% to 3.1%…on the other hand, the contraction rate of first quarter gross domestic investment was revised from -11.9% to -9.0%, as fixed domestic investment was revised from shrinking at a 0.4% rate to growing at a 3.1% rate, while the quarter’s shrinkage of inflation adjusted inventories was revised from -$133.0 billion in 2012 dollars to -$124.7 billion in 2017 dollars…. meanwhile, the growth of first quarter exports was revised from a 7.8% rate to a 6.8% growth rate, while the growth rate of first quarter imports was revised from a 2.0% rate to a 1.3% rate…at the same time, the growth of the federal government was revised from a 6.0% rate to a 5.2% rate, while the state and local growth was revised from a 4.4% rate to a 4.6% rate…furthermore, the PCE price index for the first quarter was revised from +4.1% to +4.2%, which would thus account for part of the downward revision to PCE….

Great rundown. Thanks.

Honestly I think some of this has been a tad to the melodramatic side. But it seems it is supposed to make the numbers more accurate. If it makes the numbers more accurate then I am all for it.