Instantaneous (Eeckhout, 2023) PCE and CPI inflation.

Figure 1: Instantaneous PCE deflator inflation (blue), core PCE deflator (tan), per Eeckhout, T=12, a=4 (bold red). Red dashed line at 2% inflation. NBER defined peak-to-trough recession dates shaded gray. Source: BEA via FRED, and author’s calculations.

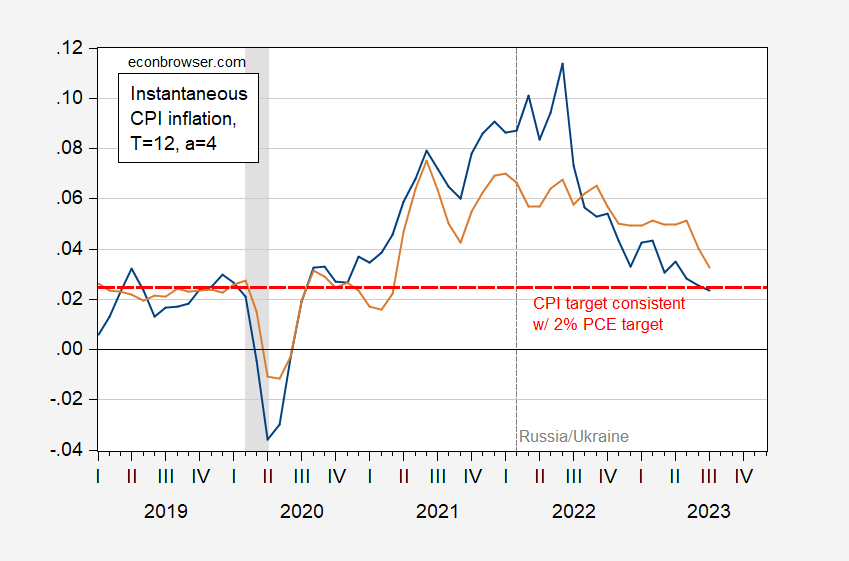

Figure 2: Instantaneous CPI deflator inflation (blue), core CPI deflator (tan), per Eeckhout, T=12, a=4 (bold red). Red dashed line at 2.46% inflation which is consistent with 2% PCE inflation over the 1986-2023 period.NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, and author’s calculations.

Note that if we took Jason Furman’s proposal to go to 3% target, we’d already be (at 2.5%) below target. 3%, by the way, is still lower than the 4% that Blanchard considered a decade ago.

Inflation had more to do with pandemic (supply chain issues, Price gouging) and Putin’s criminal war than any factor influenced by interest rates. But Fed Chair Powell and Larry Summers have proclaimed that the working class – needs to tighten their belts! By the way – has anyone else noticed that Putin’s criminal war on Ukraine is not only killing hundreds a day but also causing economic hardship across the globe. Also, thank you labor movement organizers/workers for the decent pay/shorter hours/5-day work week/health care/pensions – https://www.colorado.edu/today/2023/08/31/what-labor-day-and-why-do-we-celebrate-it

Agreed. Which is why many of us have been calling for the FED to back off from its tight monetary policy

Of course my mentally retarded stalker will likely get all emotional over us calling for lower interest rates even though he would have to admit you got the causes of this temporary spike in inflation correct.

rather than a specific target, a range would be helpful. inflation in the range of 2% to 4% is not really an issue. policy should be adjusted so that as long as inflation appears to be fluctuating in this range, our reactions are muted. a specific 2% target becomes binary. our reaction at 2.1% becomes different than 1.9%. there needs to be a reasonable range of inflation where we don’t react, we simply monitor until something else pushes us to action.

baffling My understanding is that the 2 percent figure is supposed to be a steady state target that does allow for random disturbances above and below that target range. But then again, sometimes talking heads treat the 2 percent target as a ceiling rather than a target.

It wasn’t so very long ago that economists wrung their collective hands over the risk of hitting a zero lower bound that came with a 2 percent target. I’m not sure when or why they quit wringing their hands over the issue. I understand that announcing a higher target when interest rates were at the ZLB might create a credibility problem for the Fed, but resetting the target inflation rate to something like 3 percent ought to have been easier when inflation was running a lot higher. I don’t think there would have been a credibility issue if the Fed had announced a 3 percent target back when inflation was running 6 or 7 percent.

“I don’t think there would have been a credibility issue if the Fed had announced a 3 percent target back when inflation was running 6 or 7 percent.”

agreed. they did not because for somebody to change their mind, indicates weakness, at least in the view of many among us. we seem to have reinforced the idea of a rigid target of 2% by not considering a shift in that target as conditions changed. we missed an opportunity to introduce more flexibility into our goals. I am happy with 3% right now, and in the foreseeable future. and I can live with 4% as well.

One of the most disruptive aspect of Fed rate increases comes from how fast they change them. There may be times when a huge increases over a short period of time is justified by out of control increases in inflation. However, we are way past that time. Currently they can easily afford to obey their own postulates of letting the data drive their decisions. The full effects of increases in the past year have not yet been seen so unless someone can argue that inflation is going up, there is no justification (within their mandate) for another rate increase. If they give us one anyway then it is clear that their rate setting is not based on priorities from their mandates, but driven by issues they should not get involved in. Then we should consider whether they all need to be fired and replaced with competent people who can do the job.

While yr/yr or mo/mo fluctuations is of keen interest to economists and the government, the “average Joe” has a different perspective which may be why Biden’s bragging about the economy is met with so much ridicule. This is a few months old, but still tells the tale.

https://www.cnbc.com/2023/04/14/charts-how-much-inflation-increased-since-2021.html

Did Kelly Anne Conway rehire you Brucie? Back your claim that inflation is 13%? Seriously?

I guess Brucie got worried over JohnH’ stupid rants and had to get back into the race of 2023 troll of the year.

“Overall, prices are some 13% higher than they were two years ago

Percent change in the U.S. consumer price index since April 2021”

Wow – your first graph is almost as dumb as you are Bruce. OK over a two year period CPI rose 12% to 13%. Did you bother to see how much nominal income has risen? Of course not. It is not ZERO dumbass.

Try over 16%. So real income has risen by 3% to 4% over the same period.

Brucie – this is an economist blog. Dumbass rants like this one are not appropriate here.

when aging engineers talk!

of course, you are accurate in your number as it is defined.

but does the ‘average joe’ get the same rise of real income as you? or elon musk? or me?

here is real median household income in usa:

https://fred.stlouisfed.org/series/MEHOINUSA672N/

an old engineer, contemporary and classmate of mine, sometimes says: ‘you may know the significant digits but do you know the significance of the number……’ usually talking to a young un never exposed to slide rule calculations.

Your series is annual data through 2021. The discussion at hand involved monthly data through April 2023. I guess you are so old your engineering did not notice this little dating issue.

Funny how Brucey missed – ignored? – this:

https://econbrowser.com/archives/2023/08/the-sensitivity-of-economic-sentiment-to-partisan-affiliation

Any time someone claims that “the average Joe” or”the public” or “Murcans” are dissatisfied with Biden’s performance pr handling of the economy, they have misspoken. Republicans are dissatisfied. “Joe public, excluding Republicans” is moderately happy.

And please don’t be misled by all the “voters are unhappy” malarkey in general. Consumer moods have increased considerably since the time of Brucey’s article, despite Republican voters (Brucey’s people) having their heads planted firmly in…the sand:

https://fred.stlouisfed.org/graph/?g=18rcO

Brucey did not miss this. He was ordered by Kelly Anne Conway to ignore it.

Bruce is probably still looking for the 470,000 votes Tudor Dixon needed to unseat Gretchen Whitmer, the unpopular Democratic governor in Michigan.

Bruce Hall Check the date on your link. It’s from last April.

Voters in Michigan were so upset that Gretchen Whitmer won Re-election by only 10.6 %.

Nikki Haley has a word for Gretchen Whitmer. SOCIALISM. Nikki calls anyone who dares question Nikki’s ‘credentials’ a socialist or OLD.

Well Bruce used to define the inflation rate as the change in CPI over 18 months. Now it is over two years. Next up Brucie will be using the change in CPI over the last century.

“Oil Reaches New 2023 High” Actually, they’re the highest since last November.

https://oilprice.com/Energy/Crude-Oil/Oil-Reaches-New-2023-High.html

Inflation isn’t over yet…

A relative price change is inflation. JohnH goes all Stephen Moore!

https://fred.stlouisfed.org/series/DCOILWTICO/

Never mind the fact that this price was over $120 a barrel last summer. Jonny’s new job is moving the goal posts every other hour.

1) Who said inflation is over?

2) Inflation is a general rise in prices. A rise in oil prices is not Inflation.

So Johnny mischaracterizes the discussion (again) and gets economics wrong (as always).

And then there’s this tidbit: “The price of Russia’s flagship crude grade, Urals, averaged $74 per barrel in August, slightly down from August 2022, but way above the G7 price cap of $60 and higher than the July average of $64.37 a barrel, according to data released by the Russian Finance Ministry on Friday.”

https://oilprice.com/Latest-Energy-News/World-News/Russias-Urals-Crude-Rises-Well-Above-The-60-Price-Cap.html

Though the official narrative still celebrates how well sanctions are working, cracks are starting to appear in the facade, and an alternative narrative is emerging: “The sanctions against Russia aren’t working, says the foreign minister of Germany”

https://finance.yahoo.com/news/eu-slapped-11-rounds-sanctions-133627799.html

Of course, some had this figured out a year and a half ago: “”Russia’s economy hasn’t cratered since Putin ordered the invasion of Ukraine — even though Wall Street thought it was inevitable…It’s not easy to get a prediction dead wrong — especially on a matter of global importance — but in this case, a whole handful of banks called it wrong on the trajectory for Russia’s economy.

Wall Street giants had predicted Russia’s economy to resemble a trainwreck in the aftermath of Western sanctions.” Ditto some economists…

https://www.businessinsider.com/russias-economy-crash-markets-banks-wall-street-predict-goldman-jpmorgan-2022-8?utm_medium=referral&utm_source=yahoo.com

Too much war frenzy, wishful thinking, and patriotic groupthink propagated by experts pretending to have deep understanding and serious analysis of Russia?

War frenzy describes that Kremlin movie last night showing the murders of children in Ukraine. Jonny boy loved that so much that his tail went all wagging for Putin’s pleasure.

“Though the official narrative still celebrates how well sanctions are working…”

There’s Johnny, doing his “narrative” shtick again. Johnny treats “narrative” like a license to make stuff up. Remember the old joke about lawyers poinding on the facts when the facts are on their side, pounding on the law when the law is other side, and when neither one is on their side, they pound on the table? That’s what Johnny is doing, with “narrative” Johnny’s table of choice.

Actually, Johnny has more than one table to pound in. He has done this “Nyah! Nyah! Economists are wrong!” thing endlessly, while ignoring the fact that Russia is fighting a war on Ukrainia soil, has killed tens of thousands of Ukraunian, used food as a weapon, allowed rape, torture, kidnapping and murder of Ukrainians, all in the name of Putin’s Russia.

Johnny, which matters more, mistaken forecasts or war crimes?

Jonny boy conveniently omitted this from his own link:

Between January and August 2023, the average price of Urals was $56.58 per barrel, compared to an average of $82.13 a barrel for the same period of 2022, the ministry’s data showed.

Wait – the average price was well below the $60 figure? Oh – it was above this figure for one whole month. I guess Jonny boy left out this because he was told by Putin to misrepresent the data. Jonny boy has a habit of doing such dishonest things.

Urals oil up over 2% today…trending in the right direction for Russia.

Personally, I’d take the German foreign minister Baerbock’s unexpected comments that sanctions are not working over the official US narrative: Her comments are definitely out of line for a top official of a US ally.

On the other hand you get the standard drivel elsewhere–“US Official Says Russian Oil Price Cap Is Working Despite Rally” https://www.bloomberg.com/news/articles/2023-09-04/us-official-says-russian-oil-price-cap-is-working-despite-rally#xj4y7vzkg

There are definitely two narratives now. Of course, Ducky denies the very existence of narrative…he probably still believes that Saddam had WMDs, because that is what Bush, Cheney, Judy Miller, and the NY Times told him to believe!

A 2% rise? Whoopie. The Ural discount is still 16%. Oh wait – you have no clue what I just said. Never mind.

Jonny boy celebrates the fact that Ural crude oil price has recently increased. BEST PRICE EVER for people locked in the Kremlin bubble I guess. Of course it took 2 seconds to find this:

https://tradingeconomics.com/commodity/urals-oil

Huh – in early 2022 the Ural crude oil price was near $100 a barrel. But of course little Jonny boy would rather have $70 than $100. Yea – he is THAT STUPID!

If Jonny boy wanted a serious discussion on this issue, he might check out this series (which even the world’s worst consultant Princeton Steve follows):

Difference between Urals and and Brent oil price from December 31, 2021 to August 1, 2023(in U.S. dollars per barrel)

https://www.statista.com/statistics/1298092/urals-brent-price-difference-daily/

Yea – I would rather this discount be $20 a barrel but $16 a barrel is still costing the Kremlin the money they need to buy Jonny boy his dog food.

JohnH, pom poms in both hands, leads cheers for Russia. OK, 7th graders, he yells, gimme an R, gimme a U…

2 bits, 4 bits, 6 bits, a Ruble!

US month inflation decrease to 0.2% according to https://www.wecobook.com/

Professor Chinn,

I wonder if I could check the answer book.

I calculated the instantaneous CPI all item inflation at 2.3% as of July 2023.

I calculated the instantaneous core PCE at 3.2%, as of July 2023.

Interesting NY Fed Inflation Report.

https://www.newyorkfed.org/research/policy/mct#–:mct-inflation:trend-inflation

Conservatives seem to have utterly lost their minds on the topic of ‘inflation’, doing everything from citing the heavily debunked ‘Shadowstats’ to debating exclusively by anecdote to claiming the world was more prosperous 40, 70, or 110 years ago than today.

Here is a video (first of a 3-part series) that chronicles this meltdown :

https://youtu.be/mJBkHNCLtIo