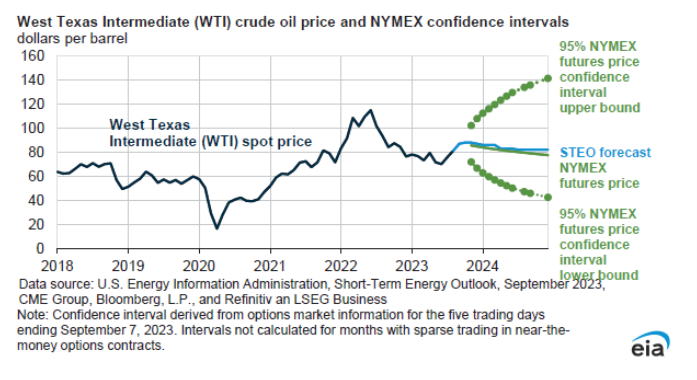

Peak price 2023Q4 at $87.7/bbl (WTI), $92.7/bbl (Brent). WTI forecast below:

Source: STEO, 12 Sep 2023.

Futures imply slightly lower prices than the STEO.

Update, 9/13, noon Pacific:

Reader Steve Kopits notes that futures are typically in backwardation, i.e., futures prices are below current spot prices. That is true. However, as I have observed on many occasions (apparently with little impact on Mr. Kopits), oil futures are about the best predictors of future spot rates, as noted in Coibion and Chinn (2014). See also this post citing more recent literature.

If Mr. Kopits is willing to share his forecasting record, I’m happy to compare his forecasting record against futures, ARIMA, random walk using the standard metrics (ME, RMSE, MAE).

EIA is not forecasting oil prices to be over $100 a barrel. What do they know? After all our two Nobel Prize winners (Princeton Steve and JohnH) guarantee that they will be near $120 a barrel.

And pgl declares that Urals will never reach $100. Here’s the exact quote–“Steve keeps saying the Ural price is headed above $100. No – it is not.” Mark pgl’s words. Given his track record, they’re a pretty good indicator that they will head to $100…

Something else I did not say. Dude – you lies are more pointless than those of Sarah Palin. Of course the Ural price is just over $75 so you are not even close. Per usual.

I think it is important to note that the EIA, as I recall, does not really make short-to-medium term price forecasts as such. In many cases, doing so could be construed as a political act. Imagine if, for example, the EIA forecast $105 Brent for the November elections. Someone would be unhappy.

Instead, the forecast you see there is a stylized view of the futures curve. To wit: the EIA finalized the Sept. STEO on Sept. 7th, for publication on Sept. 12th. The oil price forecast therein will typically be a rounded or smoothed version of the futures curve at that time (bearing in mind that the futures curve moves minute to minute on a daily basis). For this very reason, STEO fundamentals forecasts — oil supply and demand — are at considerable variance to their own price forecasts. The STEO — a fine document, by the way — is weak in the sense that oil fundamentals are not political, while oil price forecasts often are. It’s an institutional limitation. Goldman Sachs also has theirs, just different ones.

Moreover, backwardation does not imply falling prices, as futures must account for the physical and financial cost of carrying crude inventories. So backwardation of around $0.30-$0.35 / barrel from one contract to the next implies stable oil prices. Last week, backwardation was around $0.70 from one contract to the next, implying a draw on inventories and the implication of rising oil prices.

Finally, it is important to bear in mind that the futures curve is an extrapolation, not a forecast. It represents the current consensus view (from the trading perspective) of the projection from current conditions and the monthly increments are driven principally by crude carrying costs, not as month-by-month forecast of anticipated oil prices.

Those ignorant enough to construe forecasts as political statements are not likely to be deterred by extraplolations.

Another perfectly reasonable explanation for EIA publishing extrapolation offitures prices is that, before the fact, such extrapolation are superior to other forecasts.

Our host had to remind little Stevie that he has covered the literature on forecasting oil prices (which I guess little Stevie has chosen not to read). Our host also issued this challenge:

‘If Mr. Kopits is willing to share his forecasting record, I’m happy to compare his forecasting record against futures, ARIMA, random walk using the standard metrics (ME, RMSE, MAE).’

Something tells me that little Stevie will fail to take up this challenge.

You’re joking, right? You don’t think I’ve had these discussions with EIA personnel? I can assure you, I have. There is not one person working in the EIA who relishes being dragged before a Congressional committee to explain why their forecast is so high and so different from the futures curve. Congress controls the EIA’s funding, and no responsible manager is going to put that on the line. I certainly would not.

Whew! Stevie has had discussions with EIA personal. I bet the ranch after these conversations, the EIA personal were laughing themselves silly.

BTW – Stevie is treating the EIA the same way Jack Welch insulted BLS. So Stevie is not only dumber than a rock but insulting as hell too.

Like your “forecasts” are not political acts? Come on Stevie – you would say anything to get on Fox and Friends. Now who among the credible forecasters (FYI – you are not credible) is forecasting Ural prices will exceed $100 a barrel?

I try to let the data lead, but almost all analysts worth their salt tick someone off, so just being a straight-up analyst is often highly political, both in the government and in the corporate setting. Truth to power, that sort of thing. Or at least, reason to management. Really good analysts are rarely popular people in the organizational setting.

Give us a break. What leads your trash is your desperate need to be a guest on Fox and Friends.

“Instead, the forecast you see there is a stylized view of the futures curve.”

Futures are market prices not extrapolations as little Stevie implies. And if little Stevie thinks they have nothing to do with what market participants are forecasting, I bet our host has a future blog post taking down yet another comment from the worst consultant ever.

SHORT-TERM ENERGY OUTLOOK

https://www.eia.gov/outlooks/steo/

Forecast overview

We expect the Brent crude oil price to average $93 per barrel (b) during 4Q23

EIA calls this a forecast. But little Stevie says they are not allowed to provide forecast? Stevie – you are qualified on these matters. They are.

That’s literally the Brent futures curve right now.

As of 10:50 pm eastern:

QAY00 (Cash / October): $92.19 STEO value for October: $93

QAX23 (Nov. contract): $92.30 STEO value for November: $93

QAZ23 (Dec contract): $91.60 STEO value for December: $92

The STEO is literally giving you the value of the Brent futures contract.

https://www.eia.gov/outlooks/steo/

https://www.barchart.com/futures/quotes/QA*0/futures-prices?viewName=main (accessed 10:51 pm eastern)

And your point is??? Never mind – you never had a real point.

You wrote: “EIA calls this a forecast. But little Stevie says they are not allowed to provide forecast?”

That’s the point I’m making. Their forecast is essentially a stylized (rounded) version of the futures curve. That’s a forecast in the sense that rounding a number is a forecast. The EIA has more latitude in longer term forecasts, because in the political world, nobody cares about that.

Steven Kopits

September 14, 2023 at 9:40 am

As I stated – Stevie has no point. QED.

https://www.cmegroup.com/markets/energy/crude-oil/brent-crude-oil.quotes.html#venue=globex

The CME Group publishes future prices for Brent oil. It seems these future prices are not telling us that Brent prices will reach $120 a barrel. Who to trust – this group of little Stevie’s worthless blog posts?

Urals breaks through $75

https://www.princetonpolicy.com/ppa-blog/2023/9/13/urals-breaks-through-75

Wait – you told us it was going over $100. Dude – we keep up with your serial dishonesty. Get used to it!

Keeping up with my daily report on current oil prices:

Brent still below $92 a barrel

Ural discount still above $16

Now Princeton Steve and JohnH are telling us the Ural price will exceed $100 but it seems no one else thinks so.

pgl just has to get it wrong. What I said was that pgl’s declaration that Urals would NOT get to $100 could–given his abysmal forecasting record–actually serve as an indicator that it might well reach $100!

Curiously, what pgl insists on ignoring is that Urals is now priced 20% above the buyer’s cartel price cap, essentially making a mockery of NATO’s ability to enforce its sanctions regime. Putin must be laughing all the way to the bank… https://www.businessinsider.com/russia-ukraine-war-vladimir-putin-income-oil-price-outlook-commodities-2023-9

Dude – I have said this many times. I have made no forecasts. I have reported on current spot prices. Now our host is very good at forecasting.

But it seems little Jonny does not know the difference between reporting on spot prices v. forecasting. So what does little Jonny do? He lies about what I have said. Which is cool I guess since once again little Jonny is too STOOOPID to know what the topic even was.

You know – having a stalker is bad enough but my stalker happens to mentally retarded. Oh well,

“the buyer’s cartel price cap”

Gee – Janet Yellen is now a cartel? I bet she had to laugh out loud at this suggestion as she gets two things: (1) economics; and (2) little Jonny boy is mentally retarded.

Yes, the Fed has created a cartel, in effect, the world’s largest money laundering operation. This is analogous to the way the DEA and war on drugs created the Colombian and Mexican drug cartels.

I see you do know neither what the FED is nor what a cartel is. It would be nice if you learned what the basic terms of economics are before spewing your usual BS.

Treasury

“Russia is pulling in more money from oil sales”

Jonny boy once again cites as authority an article written by a moron. More than what? From the very depressed oil revenues that Moses documented the first time Princeton Steve made this dumb claim that the sanctions did not work. I guess little Jonny was too busy to read what Moses wrote as little Jonny was getting ready for his hot date with little Stevie.

Russian economic development ministry raises 2023 inflation forecast from 5.3% to 7.5%

By 2025-2026, inflation will stabilize at 4%, the document says

https://tass.com/economy/1673909

MOSCOW, September 13. /TASS/. The Russian Economic Development Ministry has raised its inflation forecast for 2023 from 5.3% to 7.5%, the authority said in its social and economic development forecast for 2024 and the planning period of 2025-2026, obtained by TASS. According to the report, inflation in Russia is expected at 7.5% in 2023 and at 4.5% in 2024. By 2025-2026, inflation will stabilize at 4%, the document says. “We raised this year’s inflation forecast. We believe that rate fluctuations, which reached over 40% since the start of the year, will have a certain effect. In this or that form, it will be reflected in prices. But we expect the situation to stabilize, so the next year’s inflation figure will be 4.5%,” a ministry spokesperson has told reporters.

OK expected inflation is 7.5% and nominal rates are near 12%. I would say a 4.5% ex ante real rate is plausible. But something tells me that Princeton Steve will go off on another one of his patented rants.

OMG…pgl reads TASS. And I remember that Menzie once chastised me for linking to an article from RT. How can pgl be so rude?

Gee I thought you wrote that article since you hang out at the Kremlin!

Of course I should have known Jonny boy did not write this as little Jonny does not even know what expected inflation even means. My bad!

Ah little Jonny boy – it seems the Associated Press reported the same thing. Oh wait – the only news source you trust is Faux Business News. Carry on!

I guess TSMC thinks Americans are stupid while the Japanese are smart. Arizona State – what’s up with your STEM programs?

https://www.msn.com/en-us/money/markets/tsmc-eyes-japan-as-it-battles-with-arizona-skills-shortage/ar-AA1gFwt5?ocid=msedgntp&cvid=289af755bf1b43b3b5f221cc8259d274&ei=11

TSMC eyes Japan as it battles with Arizona skills shortage

Anonymous sources with knowledge of the company have revealed TSMC is considering Japan as its next overseas location whilst the chip maker struggles to hire skilled workers for its billion-dollar Arizona site, reports Reuters. TSMC has previously faced difficulty concerning its Arizona plant. In July this year, the chip maker announced that it would postpone a $40bn expansion to the site during its quarterly earnings call which saw profits fall for the first time in four years. The company is already developing a $8.6bn factory on the Japanese island of Kyushu and is anticipated to begin selling chips in 2024, the anonymous sources also revealed to Reuters. Whilst a skills shortage is not unique to the US but rather a global problem, the Semiconductor Industry Association (SIA) has warned that the US chip industry will be short of around 67,000 workers by 2030. This would mean over 58% of design and manufacturing jobs could go unfilled.

Any interest in bond market doings?

Busines Insider is breathless about the level of retail investor demand for T-bills lately. BI reports that retail investors (non-competitive bidders at Treasury auctions) have bought sizable chunks of recent bill auctions:

https://markets.businessinsider.com/news/bonds/us-debt-treasury-bills-short-term-bonds-investors-record-pace-2023-9

Well, if you look at dollar amounts, yeah, they’re buying record volume. At the latest set of bill auctions, non-comps bought $2.898 billion. However, over the past 3 months, Treasury has issued roughly $1 trillion in bills. Remember the debt ceiling? That’s why all these bills are being sold. Anyhow, if non-comps bought $2.898 billion at each auction over the three months (they bought less) during which $1 trillion in bills were issued, that would only account for about $45 billion, or 4% of the total, if my assumptions and math are right.

One reason bills are selling so well is that the curve is deeply inverted – you get lots more yield from a bill than a bond right now. Isn’t a strong retail bid what one would expect when yields are high?

For those not interested in the bond market, pardon the intrusion.

Interested. All investors or economics hobbyists should be interested.

EIA report for week 8 Sep first week this year USA a net importer, with increase in crude import likely cause. As well product export should decline for crude build and price at pump.

For the week ending Sept. 1 (the most recent reporting week):

US net crude imports (mbpd): 1.838

US net product imports (mbpd): -4.432

US net exports (mbpd): 2.594

That is, the US imports about 1.8 mbpd of crude net, refines it, and exports 4.4 mbpd of products, for a net balance of 2.6 mbpd of exports. That’s actually a pretty decent level of exports and makes the US the world’s fifth or sixth largest exporter of crude and products collectively.

https://www.eia.gov/petroleum/supply/weekly/

U.S. Petroleum Balance Sheet

WCRNTUS2: Weekly U.S. Net Imports of Crude Oil (Thousand Barrels per Day)

WRPNTUS2 : Weekly U.S. Net Imports of Total Petroleum Products (Thousand Barrels per Day)

Looks like Romney has decided he’d lose a primary fight. Staggs was the only challenger so far, but the current Utah AG, Sean Reyes polls better at 13% vs Romney’s 30% among Republican voters. That 30% does look pretty shakey when the police union, for instance, has come out in support of Staggs.

Romney says he’s too old, but he wasn’t too old until that poll came out. He’s just covering his surrender with a jab at Joe and the Orange Indictee.

“Planetary boundaries” are limits to natural systems beyond which trouble lies for human society, among other things. So this news is not good:

https://www.google.com/amp/s/amp.theguardian.com/environment/2023/sep/13/earth-well-outside-safe-operating-space-for-humanity-scientists-find

The spiral is underway, in case you’d missed it.

Members of the troll choir have insisted that, unless I educate them publicly about these limits, the limits don’t exist. Stupid standard. Stupid attitude toward, well, just about everything.

A story on how inflation in Argentina has gotten really high:

https://www.msn.com/en-us/money/markets/argentine-inflation-keeps-soaring-putting-the-government-on-the-defensive-as-elections-near/ar-AA1gGm4H?ocid=msedgdhp&pc=U531&cvid=59afeb6eadd041a2b119e7314a2c4057&ei=14

Forgive me for not totally remembering but wasn’t their monetary policy discussed here?

My daily reporting on what Princeton Stevie omits from his politically motivated reporting on oil prices:

https://oilprice.com/oil-price-charts/#prices

Yes the Ural price is just over $75 a barrel but that does alone does not say the sanctions are not working as it turns out that the Brent Ural difference is still almost $18 a barrel.

BTW before JohnH starts his usual LYING about what I am forecasting – I have offered no forecasts of oil prices. I’ll leave that to the professionals like our host.

Agree. That differential IS the point. We do not want to starve the world of oil – we want to starve Russia of oil profits. So far that policy has worked brilliantly. Oil at $80-100 is expensive enough to give a substantial incentive for moving towards renewables – but not so expensive that it harms western economies. That will help move the world away from hydrocarbons and permanently deprive OPEC+ countries of funds.

It’s more than that, Ivan. The profits from discounted Russian oil do not disappear. They are transferred to the purchaser of that oil, less the cut to shippers and intermediaries. All of bad things happen because of this. One of them is that buyers will have an incentive to hoard Russian oil, with the result that large volumes will be taken off the market, exactly the topic of my analysis. So, it’s more than just depriving Russia of oil profits. It’s also redirecting those profits back to Ukraine, as well as preventing market distortions.

“The profits from discounted Russian oil do not disappear.”

He nor anyone else said they disappeared jacka$$, He said they were reduced. Now that little feeble attempt to do transfer pricing analysis may have interested you but trust me. This is another area where you have zero competence.

The profits are not reduced, they are merely transferred to a third party. That’s the point.

And I thought you wrote that article since you hang out at the Kremlin!

Of course I should have known Jonny boy did not write this as little Jonny does not even know what expected inflation even means. My bad!

China’s great wall of debt driving ‘unsustainable’ increase in borrowing, IMF warns

https://www.msn.com/en-us/money/markets/china-s-great-wall-of-debt-driving-unsustainable-increase-in-borrowing-imf-warns/ar-AA1gDJO5?ocid=msedgdhp&pc=U531&cvid=db4b7241391842cfa7fa8eccc05505fb&ei=7#image=1

China is driving global debt back towards unsustainable levels amid an “unparalleled” borrowing binge by property developers and local governments, according to the International Monetary Fund. The Fund said debt in the world’s second largest economy rose by 7.3 percentage points to 272pc of gross domestic product (GDP) in 2022. This includes large increases in both public and private debt and contrasts with a 10 percentage point decline in overall global debt levels to 238pc of world GDP. Debt fell globally as economies continued to recover from the pandemic and governments spent less on wage subsidies.

Does anyone have a link to this IMF report? We should see the details before the usual Xi fanboys try to counter this by citing only central government debt relative to GDP. That might not be high but local government debt is an issue and China has some really high private entity debt. This story is representing overall debt and i’m hoping we can learn more about the details from the IMF report.

I did find this from the IMF:

https://www.imf.org/en/Blogs/Articles/2023/09/13/global-debt-is-returning-to-its-rising-trend

China played a central role in increasing global debt in recent decades as borrowing outpaced economic growth. Debt as a share of GDP has risen to about the same level as in the United States, while in dollar terms China’s total debt ($47.5 trillion) is still markedly below that of the United States (close to $70 trillion). As for non-financial corporate debt, China’s 28 percent share is the largest in the world.

The charts before this paragraph show China’s public debt/GDP and its private debt/GDP. The former may be relatively low but the latter has reached approximately 200%.

A lawsuit has been filed seeking to compel Minnesota’s secretary of state to bar the Orange Indictee from the state’s ballot. A similar action was filed last week in Oregon.

Minnesota has 10 delegates. Oregon will have 8 in 2024.

Perhaps someone who knows more than I do could clear up a strategic point. If a secretary of state knows that an issue will end up in court, and wants a particular outcome – barring an insurrectionist from public office, for instance – is it to the secretary’s advantage to ask someone to sue him, rather than to move pre-emptively?

My thought is that if the secretary moves pre-emptively, the plaintiff in a suit to will mount a strong case to keep the seditious on the ballot. If, instead, the plaintiff makes a strong case to bar the seditious, the secretary doesn’t have to mount a strong case. So maybe waiting to be sued tips the scales toward barring the insurrectionist from the ballot?

You may have heard that the UAW may go on strike. MSNBC has been letting faux economist Steve the Charts Rattner babble about the state of companies like General Motors in reference to the negotiation position. Now Dr. Charts claims he is pro-union but he just said GM shareholders have made no income over the past decade. Never mind the fact that GM makes a modest profit margin.

Rattner noted its stock price today is about what it was 10 years ago. Now that may be true but that means no capital gains. A real economist would ask whether GM pays dividends. Guess what? I does. OK its dividend yield is not the greatest in the world but it is not zero.

If Rattner does not understand that dividends are income then why does MSNBC allow him to pretend he is an economist?

David Rosenberg: Who will suffer the spillover from China’s economic downfall

https://financialpost.com/news/economy/who-will-suffer-china-economic-downfall

The Chinese economy has headed into a severe slowdown, with its economy entering deflationary terrain and the property sector remaining in crisis mode. The economic downfall will weigh negatively on the global economy, primarily through trade channels on countries with a high dependency on China.

Article content

The disappointing economic data of late from the world’s second-largest economy (Citi Economic Surprise Index at a depressed -23.1 level) will not only impact the domestic consumer, but also have spillover effects such as a setback in commodity prices and shrinking profit margins for companies with exposure to China’s economy.

Article content

The largest commodity consumer in the world has posted dreadful trade numbers lately: exports (-8.8 per cent year over year in August) have come in negative for the past four months, and, similarly, imports (-7.3 per cent) declined year over year for the sixth consecutive month. The narrowing current account surplus is only one indicator of China’s depressed demand: a minus 22 per cent quarter-over-quarter annualized contraction in the secondary industry (includes manufacturing and construction in the second quarter), the third-largest year-over-year slump in industrial exports (-6.4 per cent in July) since October 2009, and the record-high youth unemployment rate all point to sluggish demand for longer.

With two-way trade making up 40 per cent of gross domestic, slumping exports/imports will inevitably have ripple effects on China’s trading partners. The United States, Japan and South Korea are the top three countries that have the largest trade inflow/outflow with China. With the U.S., we already see evidence of the friend-shoring theme — moving away from China and shifting the factory orders to India, Vietnam, Mexico and Brazil (winners from China’s economic descent). And as the producer price index (PPI) and export prices in China remain in deflationary terrain, this will help China’s trading partners (mainly the U.S.) in their battle against inflation.

The Price Cap is keeping oil prices high

https://www.princetonpolicy.com/ppa-blog/2023/9/14/the-price-cap-is-keeping-oil-prices-high

“During 2018-2019, oil markets were largely in balance and inventories were at historical averages in the OECD. We can assume that inventories were similarly balanced during this stretch in the non-OECD and use this as a baseline for subsequent changes. We can then adjust for subsequent builds or draws using EIA supply and demand data, deducting reported OECD inventories. The result can be seen on the graph below.”

Your chart is as much BS as your entire discussion. Even if inventories were at historical averages during 2018-19, little Stevie does not show what inventories were then. Why not Stevie? Given your serial dishonesty it would follow that showing inventories over a longer period of time would undermine your worthless blog post.

I am not presenting inventories, I am presenting excess inventories. Different statistic. As I write, excess inventories were essentially zero during that period.

Excess inventories? Oh that’s right – you worked for the morons at Deloitte Hungary. That’s up there when their incompetent transfer pricing morons defined “excess profits”.

Stevie – please learn to write in the English language someone day. Damn!

Two huge problems with Stevie’s thesis:

(1) Stevie wants us to believe that the price cap is ineffective but then turns around and states the cap is inducing actors to hoard inventories. Can’t have to both ways unless one is the most incompetent consultant ever.

(2) The price cap was put into effect in Dec. 2022 but Stevie’s alleged hoarding started BEFORE the price cap.

Yea – Stevie did not think this through but I guess his ancient version of ChatGPT kept writing anyway.

The Price Cap was set with an upper limit of $60. Clearly, the Urals price, today near $76, has blown through that limit. Similarly, ESPO (via Sokol), Russia’s eastern oil export price, is around $88. So the $60 Price Cap is not binding, and is clearly a failure in that sense.

Similarly, the Urals discount was around $23 / barrel before the Price Cap, and is now $16. So that can’t be considered a success either.

Further, Russia’s crude export price (either Urals or ESPO) averaged $56 / barrel from 2015-2021, so at near $76, Urals is currently almost $20 higher than during the seven years prior to the start of the war. Also, Urals is within $1 of its high for the week since 2015, so no success there either.

It is true, however, that the Urals discount is still greater than zero, so that may be considered some faint success. Overall, though, a pretty resounding failure of the Price Cap, and right now, no one is talking about it. That is, the Biden administration has conceded defeat, for all practical purposes.

“the Urals discount is still greater than zero”

Boy are you stupid. There would be a small discount in the absence of those quotas. And we thought your expertise was the oil sector.

BTW $16 is FAR above zero. You know – I have more productive conversations talking to retarded rocks that dealing with your lame babbling.

Did you bother to read that Business Insider link from your new BFF JohnH? I did:

‘Saudi Arabia slashed its output by 1 million barrels a day back in July, with the restrictions expected to last until the end of October according to a recent survey of commodities traders and analysts.’

So it is supply reductions from the Saudis that is driving up oil prices. Much better explanation than the one who cooked up.

Now I get why Jonny boy wants to be your minnie me but maybe you two could do a better job of coordinating your stupid comments.

i don’t know when business insider was written.

i know that this week KSA oil minister said their crude cut will be extended for 90 days. Russia said same, they will take some crude out of the smuggling.

while USA has ‘dishoarded’ crude by release from the start petrol reserve.

last week eia shows crude down yoy, but gasoline, diesel, and kerosene up yoy. USA crude is down largely bc release from spr but comm’l is down 2% yoy which is not common in recent reports.

that said natural gas storage in europe is full, maybe that is hoarding?

You are once again out of your depth and confusing stocks with flows.

As I write in The Price Cap is keeping oil price high (Sept. 14):

Today, oil demand is running well ahead of supply, pushing oil prices up and putting sufficient pressure on the Biden administration to prompt the U.S. Department of Energy, as Reuters notes, to approach oil producers and refiners to ensure stable fuel supplies at a time of rising gasoline prices.

So that’s the flow part.

In the very next sentence, however, I write this:

Notwithstanding, the non-OECD has an absolute ocean of excess inventory, available if the Urals and ESPO discounts dissipate, or more precisely, are properly restructured.

I am not debating S/D balances, but pointing out that there is a vast store of excess inventory in the non-OECD which could knock oil prices down for quite a while, through the election, if I want to take the Biden administration’s view.

https://www.princetonpolicy.com/ppa-blog/2023/9/14/the-price-cap-is-keeping-oil-prices-high

I put some sources on oil price forecast by central banks, and its failure, in the following article :

https://theshiftproject.org/en/article/energy-inflation-dangerous-liaisons/