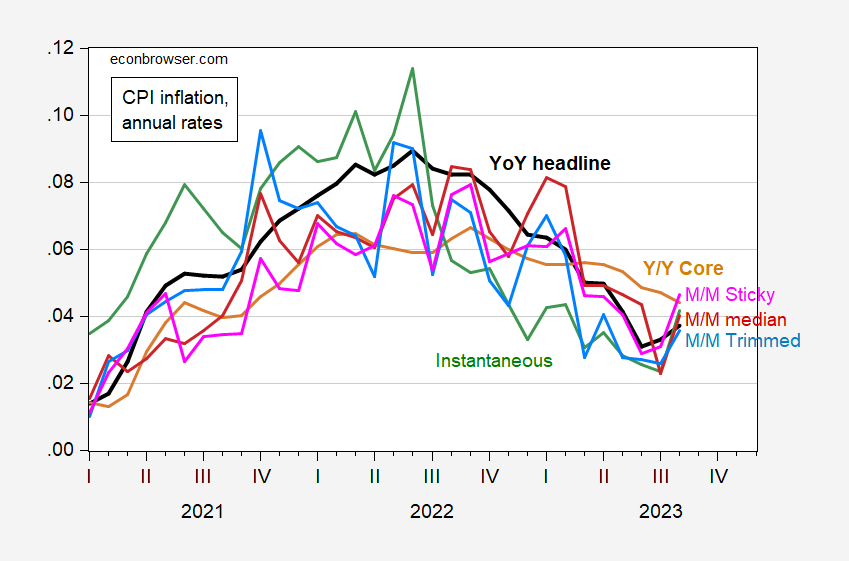

Month-on-month CPI headline (core) at (0.1 ppt above) Bloomberg consensus. Month-on-month PPI 0.3 ppts above consensus of 0.4 ppts. Y/Y core CPI continues to decline, while instantaneous core inflation is flat.

Figure 1: CPI headline y/y inflation (bold black), core y/y inflation (tan), m/m sticky price (pink), m/m median (red), m/m 16% trimmed (sky blue), and instantaneous (per Eeckhout, T=12, a=4) (green) all at annual rates. Source: BLS, Cleveland Fed, Atlanta Fed via FRED, and author’s calculations.

All the month on month series showed an uptick, even ones excluding energy prices.

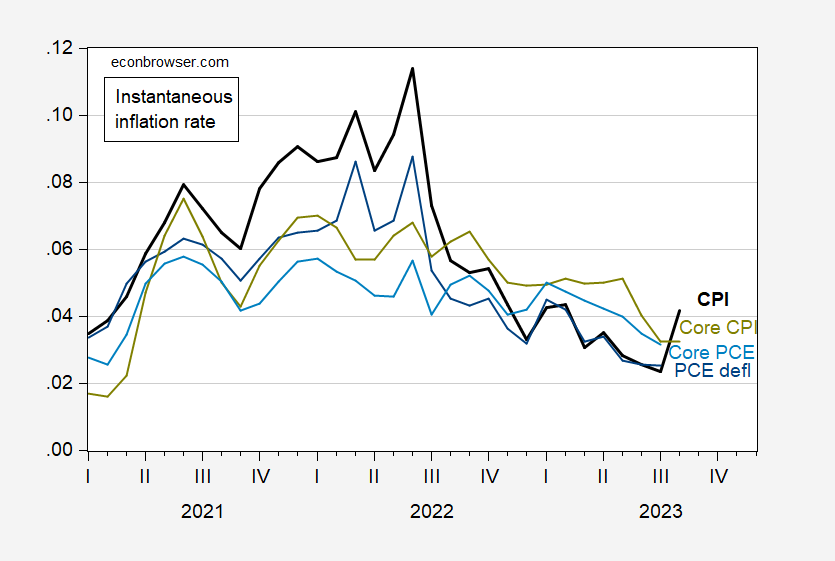

That being said, it’s useful to consult other measures of what the underlying inflation measures, both CPI and PCE deflator, say. In Figure 2, I show instantaneous (per Eeckhout, T=12, a=4) measures.

Figure 2: CPI headline instantaneous inflation (bold black), core CPI inflation (chartreuse), PCE deflator (blue), core PCE deflator (light blue), (per Eeckhout, T=12, a=4), all at annual rates. Source: BLS via FRED, and author’s calculations.

The CPI figures are key inputs into the Cleveland Fed PCE nowcasts. With the latest figures, we have the following instantaneous inflation figures for headline and core PCE.

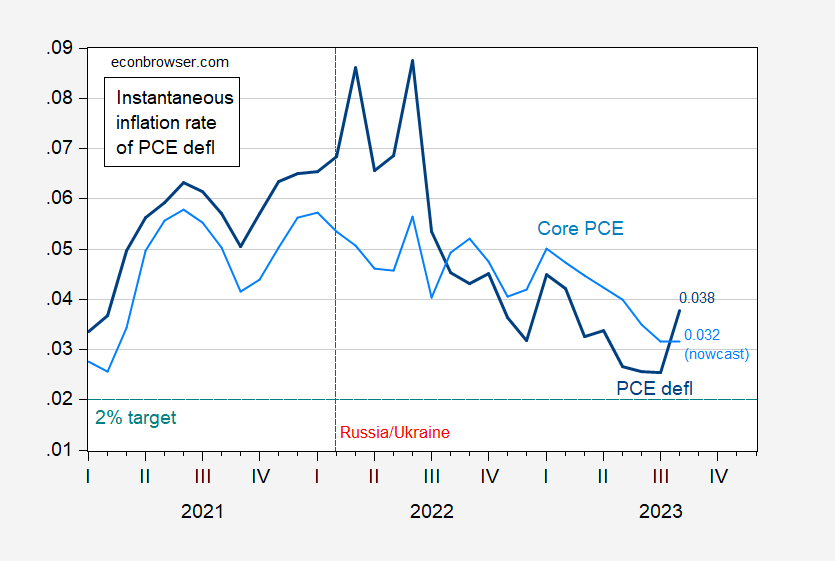

Figure 3: PCE deflator instantaneous inflation (bold blue), and Core PCE deflator inflation (light blue), per Eeckhout, T=12, a=4, at annual rates. August observation is based on Cleveland Fed PCE nowcast. 2% target teal dashed line. Source: BEA via FRED, Cleveland Fed nowcast accessed 9/14/2023, and author’s calculations.

If core PCE is what’s most important, the incoming data buttresses the case that trend inflation has come down, but progress toward further decrease in going to be halting.

Menzie,

I am going to surprise you.

Is it possible to get the 3 month and 6 month trimmed mean ANNUALISED figures. I think in this instance it could give a better indication of where inflation is heading/

P.S. why am I on moderation

Not Trampis: Everyone is on moderation. Believe me, each time I have to approve comments, my wife asks me why I spend so much time on it, and I say — well, everyone’s comments have to be checked. So you are not alone.

Substance: the 3 month and 6 month change annualized figures are not reported, so short answer is, no. Best possible is to get month on month annualized, and for some of them year-on-year (and sometimes only only y/y, e.g., trimmed core).

okay but it seems to me if someone can do a three and six month annualised figure you might get a better handle on where inflation is heading..

so hop to it fellahs someone do it.

FRED will do somethinglike wuhat you want. The only drawback is that it doesn’t do 3 and 6 month, but only quartely and semi-annual frequencies. Not ideal.

Of course, you could dump the data in a spread sheet and have it do the calculation.

Some years ago, Spencer England wrote at Angry Bear that a reliable estimate for full-year core CPI inflation was core CPI inflation through the first 4 (?) months of the year. The reason this rule of thumb works is that businesses typically test price hikes at the beginning of the year and find out if they’ll stick by April. Spencer, if you read this, please correct any error on my part.

Notice that core inflation is now below the pace of the first third of the year. Inflation is not behaving normally. You should be able to tell just by looking, but Spencer’s rule helps put some behavioral heft behind the observation; we are in a disinflationary period right now.

The last Fed Summary of Economic Projections had the funds rate at 5.6% at year-end vs 5.33% (effective rate) now. Markets are pricing in 60% odds of steady rates through year end, 40% odds of a 25 basis point increase. With disunflation evident and lots more tightening in the pipeline, the right answer is steady rates, on the way to easing.

Macroduck Spencer England passed away a few years ago:

https://angrybearblog.com/2020/11/spencer-england-dies-november-8

So sorry to hear that. He was a good guy.

“Spencer, if you read this, please correct any error on my part.”

Since several years ago Spencer England departed for the Great Nerdy Spreadsheet in the Sky, if he replies it will mean something far more important than the status of consumer inflation!

Core inflation substituting the Case Shiller Index for the badly lagging OER has declined from about 4.6% this January to about 2.1% as of June:

https://fred.stlouisfed.org/graph/?g=18TBW

Professor Chinn,

Thanks for posting the terminal month instantaneous inflation values on Figure 3.

It looks like the Cleveland Fed nowcast August value is the same as the actual reported value for July, using the instantaneous inflation algorithm.

I appreciate a look at the answer book.

Via Ritholtz an interesting link about 5 main patterns for how people get to have opinions on issue they don’t know much about, and don’t want to spend enough time to become knowledgeable on.

https://gurwinder.substack.com/p/why-you-are-probably-an-npc

Some of the examples can be painful to read when you actually know something on the subject. But the concepts are interesting and worth the pain of reading certain fact challenged passages in the text.

Interesting, though Ritholz got his frqming device wrong. An NPC, a non-player, is not what “we all are”. We’re players. The fact that players and non-players share characteristics doesn’t mean that we’re all NPC’s. Ritholz reached for a clever hook and missed. He’s smart enough to know better, but see, the human mind sometimes takes shortcuts and…whatever.

The rise of botlike behavior over the past decade has led to the creation of a meme: the NPC, or Non-Player Character. Originally a term to describe video game characters whose behavior is completely computer-controlled, it now also refers to real world humans who behave as predictably as video game NPCs, giving scripted responses and engaging in seemingly mindless, automated behaviors.

JohnH’s picture should be placed with this statement!

pgl might like this one: “Economists’ Tribal Thinking…

Cultural anthropology can help explain why the downturn caught everyone by surprise: Experts around the world tend to focus on the same mathematical models, looking for patterns in the same limited number of places….

[On November 8, 2008] “The Queen [of England ]peered at the brightly colored lines. “It’s awful!” she declared, in her clipped, upper-class vowels. “Why did nobody see the crisis coming?” she asked.

In short, the answer is that networks of experts can become captured by silos, in the sense of displaying blinkered thinking and tribal behavior, even if they work in different institutions and countries. “Why did the crisis happen? It was partly about epistemology, the knowledge systems that we used,” Paul Tucker, the deputy governor of the Bank of England, later observed.”

https://www.theatlantic.com/business/archive/2015/09/economists-tribal-thinking/403075/

Fast forward 13 years, and mainsteam economists couldn’t fathom the idea that Corporate America, the folks who set prices, could be responsible at least in part for driving inflation…

You had to reach back 8 years in another desperate attempt to make a point. But poor little Jonny totally missed the point of his own link (once again).

The article was about the Great Recession and the pathetically slow recovery in the UK under Cameron’s stupid fiscal austerity. Oh wait – Jonny boy was and still is Cameron’s chief cheerleader.

Now had little Jonny boy bothered to read the blog posts back then by Simon Wren Lewis – little Jonny boy would have seen some very good economics. But I guess the author of Jonny boy’s latest link is as clueless as little Jonny boy is.

Hey Jonny boy – thanks for the “effort”. It only goes to prove my point – you sir are the dumbest troll God ever created.

“Fast forward 13 years, and mainsteam economists couldn’t fathom the idea that Corporate America, the folks who set prices, could be responsible at least in part for driving inflation…

2015 + 13 = 2028 not 2023. Or is little Jonny boy do long-run forecasting? Nah – this moron cannot do preK arithmetic.

Now Jonny boy must be still living in 2022 as corporate profits have FALLEN for the past 3 quarters as our host has noted many times. So either Jonny boy does not know what year or when are in or just maybe falling profits are leading to declining inflation.

But don’t ask Jonny boy as this moron thinks the calendar says 2028.

https://www.msn.com/en-us/money/markets/russia-raises-key-interest-rate-again-as-inflation-and-exchange-rate-worries-continue/ar-AA1gLrrG?ocid=msedgntp&cvid=2b112820d4eb43efa6677923be4453aa&ei=13

MOSCOW (AP) — The Central Bank of Russia raised its key lending rate by one percentage point to 13% on Friday, a month after imposing an even larger hike, as concerns about inflation persist and the ruble continues to struggle against the dollar. The increase comes as annualized inflation rose in September to 5.5% and the bank said it expected it would reach 6%-7% by the end of the year.

Yea I noted the fact that the Central Bank’s forecast of inflation was 6.5% yesterday and it seems the reporting agency I used offended my mentally retard stalker. I guess JohnH will be offended that the Associated Press reports the same thing as little Jonny boy has no effing clue what expected inflation even means.

It is interesting that they have to go that much higher than the actual inflation rate. That is a very high real interest rate – why?

I noted earlier that Russia is a redux of that toxic Reagan fiscal policy and Volcker monetary restraint. Real rates in the US back in 1982 were this high as well.

Now I noted this to our village idiots Princeton Steve and JohnH but something tells me neither one caught the simple point.

I don’t think they are raising rates to tame inflation. Maybe they are raising them to incentivize against capital flight. Defending the Ruble before it turns into rubble?

“Defending the Ruble before it turns into rubble?”

That’s awesome. I’m bookmarking this one!

I’ve tried to keep up on what has been increasing oil prices of late. Now never mind oil prices have been even higher over the past few years. Oil prices are volatile after all. But the recent rise is the hot topic and the explanations seems to be standard demand and supply:

(1) OPEC made the decision that its members should cut back on production;

(2) With all the recession talk from our Village Morons like Princeton Steve – the US economy remains strong; and

(3) With all the fuss over China’s economy, its economy still seems to be growing.

Not that a word of this was mentioned in the latest from our self styled oil expert Princeton Steve:

https://www.princetonpolicy.com/ppa-blog/2023/9/14/the-price-cap-is-keeping-oil-prices-high

No – this clown has a long winded rant that Yellin’s $60 cap on Ural prices has led to massive hoarding. Never mind the fact that he failed to document inventories are necessarily that high. Never mind this clown also told us the cap was totally ineffective. After all – this clown is the world’s worst consultant.

https://www.msn.com/en-us/money/markets/european-central-bank-hikes-interest-rates-again-as-inflation-persists/ar-AA1gJdUI?ocid=msedgdhp&pc=U531&cvid=bfe9338b28a04d0b90854ea50f81c7a0&ei=28

The ECB has decided to raise interest rates to curb European inflation. OK the rate is now 4% which is far lower than the 13% rate we see in Russia. Yea = part of this difference may be that the Russian central bank forecasts 6.5% inflation in Russia but part of this may be higher ex ante real rates in Russia v. Europe.

We recently had one of his uninformed rants from Princeton Steve who apparently cannot imagine high ex ante real rates. Of course his BFF JohnH runs to Stevie’s defense even though Jonny boy never had a clue what any of these terms even mean.

Ukraine has destroyed several Russian ships near Crimea. Now Ukraine’s chirping that Russia is not producing any replacement ships as Russia could just buy more ships. So how is that working out?

https://www.rferl.org/a/russia-shoigu-navy-new-ships/32594218.html

Russian Defense Minister Sergei Shoigu said on September 15 that the Russian Navy has received two new ships this year and is to receive another 12 by the end of 2023, Russian state news agency RIA Novosti reported. TASS, another state news agency, quoted Shoigu as saying that the country was developing new nuclear submarines and undersea drones. In July, Russian President Vladimir Putin said that the navy would receive 30 new ships in 2023. In his comments, Shoigu did not give a reason for the sharp decrease in expected deliveries.

So Russia is losing more ships in this way that it is acquiring. And with no Russian production of ships – its navy is depreciating away. But have no fear – JohnH has been ordered by the Kremlin to conduct an audit!

There is no way they will get another 12 if they only got 2 so far. Russian mil bloggers are complaining that there is so much lying that it is going to lose them the war. Those who deliver bad news are automatically punished for being incompetent, so they lie. If local commanders don’t dare to tell higher ups how bad things are going, then the soldiers won’t get what they need. The higher ups also will not have information to distribute resources where they are most needed.

I wonder what the bottleneck is. They should have iron enough for the hull and deck. Do they have enough workers. Can they get their hands on the sophisticated electronics for a modern warship. Are the specialized facilities to build the weapons stretched thin. So far the ships have not been involved much in battles because Ukraine don’t have a navy. But they have been used as movable missile launch platforms.

ships are expensive. and the current military is utilizing consumables such as tanks, artillery and soldiers at amazing rates. these need to be replaced before a ship can be built, and these replacements are also expensive. so that is probably a primary cause of delay. and yes to all of your thoughts on enough workers, sophisticated electronics, etc. a lot of young men left russia as war broke out. the workforce drought will be impactful to russia in the long run. if you start to hear stories about women entering the workforce as replacements for male dominated jobs, then you will know the impact has become critical.

“Those who deliver bad news are automatically punished for being incompetent, so they lie.”

Yep. Putin is indeed Trump’s mentor!

Speaking of ships, the world’s most expensive military is mothballing half a $billion of crappy ships:

“One Navy secretary and his allies in Congress fought to build more littoral combat ships even as they broke down at sea and their weapons systems failed. The Navy wound up with more ships than it wanted, at an estimated lifetime cost that could reach $100 billion or more.

The Navy’s haste to deliver ships took precedence over combat ability. Without functioning weapons systems the vessels are like a “box floating in the ocean,” one former officer said.

Sailors and officers complained they spent more time fixing the ships than sailing them. The stress led many to seek mental health care.

Top Navy commanders placed pressure on subordinates to sail the ships even when the crews and vessels were not fully prepared to go to sea.

Several major breakdowns in 2016 exposed the limits of the ships and their crews, each adding fresh embarrassment to a program meant to propel the Navy into a more technologically advanced future.”

https://www.propublica.org/article/how-navy-spent-billions-littoral-combat-ship

Alexander Cockburn, Responsible Statecraft: “The $850 billion chicken comes home to roost. The military industrial complex is not designed to actually fight wars. If so, you wouldn’t see Ukraine struggling right now to win one.:” https://responsiblestatecraft.org/2023/07/18/the-850-billion-chicken-comes-home-to-roost/

Then there’s the F-35. NY Times: “The F-35 is a boondoggle. Yet we’re stuck with it.” https://www.nytimes.com/2021/03/12/opinion/f-35-fighter-jet-cost.html

Wait! There’s more…”Boondoggles: Where Did the Billions Spent on America’s Wonder Weapons Go? An utter waste.”

https://nationalinterest.org/blog/buzz/boondoggles-where-did-billions-spent-americas-wonder-weapons-go-131957

But you’ll never hear pgl utter an unkind word about the “defense” department, even though a more accurate moniker might be “Department of Boondoggles!”

BTW, I wonder how the BEA calculates depreciation on boondoggles…

Littoral Combat Ship (LCS) kept two shipyards in the green. Who can blame one of them for using dissimilar metal fasteners in a salt air environment? The navy should have read the drawings!

There are two classes of LCS one for each ship yard. They were supposed to have rotatable ‘mission module’ e.g.: air defense, mine clearing, littoral bombardment. The logistics of the 3 modules and how/when to change out was never clear.

LCS is an expensive PT boat! With huge corrosion and engine problems.

F-35 is 20 plus years in full engineering and manufacturing development, and as they add new, updated mission systems to replace outdated 30 year old designs they over burden the already unreliable engine…. The Gov’t Accountability Office identified over 20 out of 40 sustainment criteria the F-35 fails to provide and cause it to be unsuited to go into operational tests. The deliveries are going out under waivers to passing OT&E before selling off 10% of the planned force. GAO 23 106047, GAO 22 105995. There are more!

European F-16 donors are getting F-35!

We could review Ford class aircraft carriers but that is piling on.

The suppliers are all making profit no matter that the deliveries are not ready for war.

Any one in the South Carolina area seen an F-35, one of the pentagon’s aircraft seems to be missing after the pilot ejected, thankfully he is safe.

He is OK. And they finally located the plane. Scary scene for a while.

“But you’ll never hear pgl utter an unkind word about the “defense” department”

I do all the time. But my mentally retarded stalker needed his hourly quotient of lying. Now we need not worry that there is a shortage of ships since your new home – the PRC – has massively overinvested in this sector. Of course Jonny boy will not admit this as Xi has him on a short lease.

“Littoral combat ships were supposed to launch the Navy into the future. Instead they broke down across the globe and many of their weapons never worked. Now the Navy is getting rid of them. One is less than five years old.”

I bet Putin wants these ships since Ukraine is taking out the Russian fleet. Hey Jonnny boy – arrange the deal and ask Putin for doggy treats as your commission! n

littoral ships were a risky proposition from the beginning. but that is because you were asking to build performance in an operating arena that is extremely punishing for a ship. the ship needs to be light and shallow draft. but light also means higher stresses, and all of the resulting failures. nevertheless, littoral operating conditions is where a future in naval battles will take place. just like the days of battleships was replaced with different tactics. littoral battlefields will be a part of the future, because that is where inferior forces can even up the battle. nobody can face off directly against aircraft carriers and their fleets. but they can conduct guerrilla warfare from littoral areas.

the LCS is/was an experiment, although a costly one. but the need persists. just look at how things unfold in persian gulf waters to appreciate their needs. those who want us to simply drop the LCS concept are those that wish us to fail in our deterence efforts in many dangerous parts of the world.

and for those who take issue with the f35, understand there is no air force in the world that is interested in taking up a direct battle against that fleet. the f35 wins its battles 100 miles away, before the enemy even knows that it is targeted and dead. again, deploying technology will have its issues. but you measure a warfighter based on its lethality. and nothing comes close to the f35 right now as a fleet.

An informed comment on this topic for a change! Now one would think little Jonny boy could tell the whole story but he never does.

https://www.msn.com/en-us/news/world/attack-on-sevastopol-photos-of-damaged-russian-rostov-appear-online/ar-AA1gTzmA?ocid=msedgdhp&pc=U531&cvid=8b21203ebc1d455a8d42d000834e1fcb&ei=13

Attack on Sevastopol: Photos of damaged Russian Rostov appear online

Gee – Jonny boy. Tell us your estimate of the depreciation of this ship. What – the Kremlin will not let you? I get it as you need them for your doggy treats.