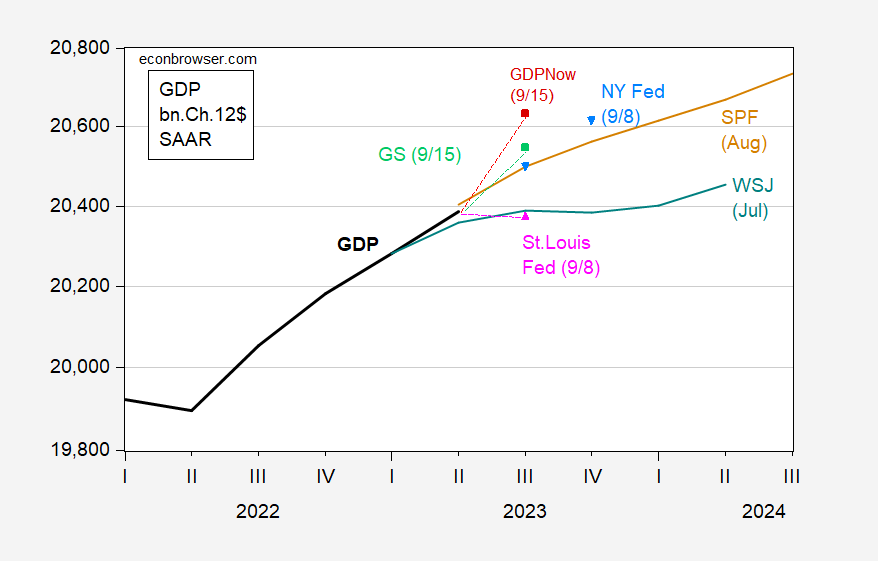

GDPNow Q3 revised slightly down (4.9% SAAR), GS about the same (3.2%).

Figure 1: GDP (bold black), Survey of Professional Forecasters median (tan), WSJ July mean (teal), GDPNow 9/15 (red square), Goldman Sachs 9/15 (light green square), St. Louis Fed Economic News Index 9/8 (pink triangle), NY Fed nowcast 9/8 (light blue triangle), all in billions Ch.2012$ SAAR. Source: BEA 2023Q2 second release, Philadelphia Fed, Atlanta Fed, St. Louis Fed via FRED, NY Fed.

The improvement in perceived prospects is highlighted by the shift from the July WSJ (which was compiled before the advance 2023Q2 release) and the August SPF, compiled after the release. Both level and growth rates increased substantially (the July CBO projection, compiled in June, is close to the WSJ July forecast).

The Atlanta Fed nowcast, despite the drop from about 5.7% SAAR, still outpaces the SPF median, as does the GS tracking.

Upside surprise to August industrial production (+0.4% m/m vs. Bloomberg consensus +0.1%) further supports the outlook of continued growth.

Wait for it. Little Jonny boy is about to whine about you not finding a GDINow Q3 followed by telling everyone that all forecasts suck except those provided by JohnH the Master.

If you are fixated on GDP growth, then you obviously only take forecasts of GDP in to consideration. If you care about the growth of the economy, then one would think that GDI would also be factored in…

Do you wake up every morning trying to prove you are getting dumber by the day. Our host has already told you why your comment was pathetically dumb. And you repeat it? OK Jonny boy – you have won the 2023 troll of year award hands down.

Real GDI has dropped over the past year, and 2Q23 growth was almost flat. If you’re serious about studying the health of the economy, you might take those facts into consideration, instead of simply reveling in bullish GDP forecasts…but we know that pgl is more partisan hack than serious analyst, so he loves bullish GDP forecasts.

And little Jonny boy is hoping it falls even more so he can continue his stupid chirping. I guess little Jonny boy does not realize that it was the decline in profits that led this temporary fall in GDI. Yea – little Jonny boy is that stupid.

pgl

September 17, 2023 at 12:25 pm

You never answered my challenge here Jonny boy. Why not? Oh yea because you can’t. Carry on worthless troll.

“Real GDI has dropped over the past year, and 2Q23 growth was almost flat.”

Real GDI did decline from 2022Q3 to 2023QI but ROSE the quarter before and rose a little last quarter so you LIED:

https://fred.stlouisfed.org/series/a261rx1q020sbea

But let’s take the last 3 quarters a period where the GDP/GDI deflator rose by 2.5%. I guess little Jonny boy does not know how to check BEA data so I did. Compensation rose by 3% in nominal terms so real compensation ROSE.

Does little Jonny boy know why overall real GDI fell? Well profits fell a lot. But little Jonny boy keeps telling us how much profits have increased.

Dude – you are either a serial liar or the dumbest troll ever.

Jonny boy’s comments here answered my question – he does wake up every morning with the sole purpose in his worthless life being to prove he is the dumbest troll ever. Thanks for clarifying that Jonny boy.

“If you care about the growth of the economy, then one would think that GDI would also be factored in”

Let’s take a minute to show how stupid Jonny boy is being with his call for the Atlanta FED to produce some GDINow. After all Jonny boy has no clue how they produce GDPNow nor does this moron know what GDI even means.

Part of GDI is profits which Jonny boy keeps chirping are rising considerably even though the HISTORICAL data from BEA shows profits have fallen each quarter for the last year.

But this post is about forecasting for 2023QIII. Now Jonny boy claims he worked for a corporate 200 firm (that Jonny boy helped go bankrupt) and he is all about audits. Of course corporations report 10-Q filings QUARTERLY (hey Jonny boy – that’s what is a Q) and the 2023QIII filing will be a month after the quarter closes. Since Jonny boy is too stupid to know what a calendar is -the first reporting of QIII profits will be December 1. And yet this moron thinks the Atlanta FED will know as of mid September.

Yea Jonny boy is one stupid troll.

You have to love those forecasts…something for everyone!

Was there a point here? Oh yea – you are still competing for 2023 troll of the year. Relax – you won hands down.

We have a limited UAW strike. Troubling I guess but let’s all be grateful Donald Trump is not the current President:

https://www.msn.com/en-us/money/companies/trump-criticizes-uaw-leadership-amid-strike-warns-auto-workers-jobs-are-moving-to-china/ar-AA1gMk8Z

Trump criticizes UAW leadership amid strike, warns auto workers’ jobs are moving to China

Former President Donald Trump warned that U.S. auto workers’ jobs will move to China and accused the United Auto Workers’ leadership of failing its members.

“The auto workers will not have any jobs, Kristen, because all of these cars are going to be made in China. The electric cars, automatically, are going to be made in China,” Trump told NBC News’ Kristen Welker.

Yea this moron never imagined that American workers could actually assemble EVs. We have had some stupid people in the White House in our long history but damn this former President is dumber than a retarded rock.

It does make you wonder if Biden will have to raise tariffs to protect those Detroit Dinosaurs after UAW pay raises. If so, will any erstwhile free trade fundamentalists notice? Not so long ago, being suspected of harboring doubts about corporate-negotiated “free” trade agreements was enough to get someone labeled a protectionist, which mainstream economists considered tantamount to being a wife beater. Now protectionism has become normalized! Funny how the winds shift…

More tariffs on Chinese EV imports? Careful there troll – Xi will cut you off.

Let’s walk the latest news SLOWLY for little Jonny boy.

Nevada has a lot of lithium. Biden will likely promote a Nevada battery manufacturing plant with union workers. Oh my imports from the Communist state of Nevada. Hey Jonny boy – how high of a tariff on Nevada imports should he impose?

Yea – Jonny boy is so effing stupid that he is calling Lawrence Kudlow to discuss!

Average earnings today are about the same as just before the pandemic

https://jabberwocking.com/average-earnings-today-are-about-the-same-as-just-before-the-pandemic/

Please read the latest from Kevin Drum for two reasons. One it covers a lot of measures of real earnings in a very honest way.

But the real reason Kevin wrote this – and you should read this – is to show the incredibly dishonest rants from the WSJ which reminds me of the serial dishonesty JohnH excels at.

Hilarious! Kevin Drum say, “The reality is that, adjusted for inflation, almost every measure shows that average incomes are about flat.

I said, “Average real hourly earnings are up 0.3% since before the pandemic.”

pgl is trying to make a big deal out of a distinction without a difference. I agree with Drum that “That’s nothing to write home about,”

My point is that wages are stagnating during extraordinarily tight labor markets, conditions under which economists have assured us that real wages should rise.,., something I consider to be a big deal., even though economists here seem quite reluctant to notice or comment. Maybe they would be so kind to answer the following questions: “If real wages won’t rise under these conditions, when will they? What about the theory that they should rise under these conditions? Do they care about stagnant wages, or is it only about GDP, a pretty good proxy for growth of incomes of the top 10%, that they care about?

Dude – put your stupid trash over at Kevin’s place. I dare you. I’d love to see how his smart readers put you away. Oh wait – we have challenged you to do so before. But you haven’t. Yea – Jonny boy is a little coward.

‘Maybe they would be so kind to answer the following questions: “If real wages won’t rise under these conditions, when will they?”‘

You should be able to answer your own question. You’ve been shown how over and over. Since you don’t bother to try, maybe it’s because you’re a smart-mouth punk who is more interested in making obnoxious noises than in discussing economics. But here, I’ll hold you helpless little hand one more time and show you. I’ll use the measure which you once I sister didn’t exist because bad old economists were hiding it:

https://fred.stlouisfed.org/graph/?g=18XsH

So, if you look toward the right edge of the pretty picture, you’ll see that, by the measles you’ve ranted about, real wages ARE rising. So the premise of your question is dishonest. Again.

As anyone who looks honestly at the graph can see – Johnny, looking honestly at facts is a requirement here – median real weekly income has risen on trend since around 1997.

So not only was the premise of your question dishonest, but a look at history gives reason to understand that your “things are bad, Bad, BAD!!!” shtick is dishonest, too. Outside of extraordinary circumstances, real incomes un the U.S. tend to rise.

Now, there has been a bout of inflation which eroded real income growth for a while. We should understand the causes of that inflation, and we do to a considerable extent. There was the Covid supply shock and the shift to goods consumption among households. There is Mr. Putin’s war, which – along with other factors – has driven up food prices. There is OPEC policy, which – along with other factors – as driven up energy prices. There was a set of very large stimulus measures which kept people out of poverty during the Covid pandemic. There is economic scarring resulting from the pandemic which has lowered potential output.

Oh, and as using on the cake, the distribution of income improved substantially in recent years as a result of some of the same factors which drove up inflation. This improved distribution of income has been the subject of lots of discussion, so let’s not “why aren’t economists talking g about it?”, OK?

https://fred.stlouisfed.org/graph/?g=18Xw2

And by the way, every other “whatabout” idiot question you’ve posed here is equally dishonest. All you’re doing is trying to sow discontent on orders from your Russian masters. Get lost.

Very clever, Tricky Ducky… Yes, personal incomes rose, not because of better pay but because women entered the workforce.

“ Women’s work boosts middle-class incomes but creates a family time squeeze that needs to be eased… We now come to the interesting part of the story about women and middle-class incomes. Without women’s contributions, these gains would have been small to nonexistent. By our estimates, based on a method initially proposed by Heather Boushey at the Center for Equitable Growth and using pre-tax money income in the Current Population Survey, average middle-class household income grew from $57,420 in 1979 to $69,559 in 2018. If the average contribution of women to household income had not changed, most of these gains would not have been seen. Average income would have increased to just $58,502 in 2018. Women therefore accounted for 91 percent of the total income gain for their families.”

https://www.brookings.edu/articles/womens-work-boosts-middle-class-incomes-but-creates-a-family-time-squeeze-that-needs-to-be-eased/

Now maybe Ducky would care to answer the questions I posed: “ If real wages won’t rise under these tight labor market conditions, when will they? What about the theory that they should rise under these conditions? Do economists care about stagnant wages, or is it only about GDP, a pretty good proxy for growth of incomes of the top 10%, that they care about?”

BTW, Tricky Ducky, your Wall Street patrons would be proud of your answer”

Jonny boy is upset that some chick got the job little Jonny boy wasn’t qualified for anyway.

MAY 2020

Did you not notice when this was published? Did you not see that the period examined was from 1979 to 2018? The issue you keep chirping about has been real income from early 2020 to now.

I guess you are so effing stupid to realize that her paper does not address that period. Learn to use a calendar moron.

“personal incomes rose, not because of better pay but because women entered the workforce.” So says Jonny boy who is not very good at reading his own links. Hey Jonny boy – read this:

‘Women’s contributions to family income have risen over this period for two reasons. First, more of them are employed and for longer hours. Second, their average hourly earnings have also risen.’

It seems the ladies are both working more hours but also getting higher wages.

We have been over this before little Jonny boy. Try reading your own links before more of your stupid chirping.

Johnny boy changed the subject on you in so many ways. Jonny boy wants to make a “point” about the economy since early 2020 and he cites a paper by Heather Boushey, traced real income for the period … wait for it … 1979 to 2018.

Yea Jonny boy is THAT STUPID.

“Mr. Biden is trying to avoid the real story, which is that the Census Bureau says median household income adjusted for inflation fell last year by $1,750 to $74,580. It is down $3,670 from 2019. Households in the fourth income quintile—those making $94,000 to $153,000—lost $4,600 in 2022 and $6,700 since 2019. Middle-class Americans who think they’re losing ground are right.”

I fell out of my chair when I read this spin. As Kevin’s graphs show this particular metric is the only one that showed a significant decline. The audacity of the WSJ to pretend they are the ones telling “the real story”.

And of course the WSJ focused on the well to do class. After all – it is the WSJ who never cared about the average Joe or lower income groups.

They have some good journalism in WSJ, but they sure as heck don’t care about the working class in their editorial section, that’s for damned sure.

Iron ore prices are acting a bit like oil prices:

Iron ore rallies to six-month highs on improving fundamentals from China

https://www.msn.com/en-us/money/markets/iron-ore-rallies-to-six-month-highs-on-improving-fundamentals-from-china/ar-AA1gMquC?ocid=msedgdhp&pc=U531&cvid=274cf2b14700471cb0ab5ebebf783642&ei=6

ron ore prices climbed to a five-month high Friday, with the Singapore benchmark posting its biggest weekly gain since June, helped by improving sentiment and China’s move to bolster economic stimulus efforts. Prices have rallied about 8% this week, ahead of an anticipated seasonal pickup in construction that usually lasts until the end of October, while China’s central bank injected cash into markets for the 10th straight month and cut lenders’ reserve requirements for the second time this year. Benchmark October iron ore (SCO:COM) on the Singapore Exchange closed at $121.13/metric ton after rising as much as 2.4% to $123.50, its best level since mid-March, and the most-traded January contract on China’s Dalian Commodity Exchange ended daytime trading +2.3% at 879 yuan/ton ($120.91) after reaching a contract high of 881.50 yuan.

China fundamentals and not Princeton Steve’s claim that higher oil prices are due to hoarding of cheap Russian oil? I look forward to the Princeton Steve blog blaming the high price of iron ore on Janet Yellin.

The rally has been driven by signs that China’s struggling property sector may improving, with new bank loans nearly quadrupling in August to 1.36T yuan from July. Prices also are enjoying a boost from strong import volumes; China, which buys 70% of global seaborne iron ore, imported 106.4M metric tons in August, the most since October 2020.

Interesting piece over at Business Insider: “ Oil prices are surging again, but this time Biden has way less ammunition to bring them down…

-Oil prices are surging again, but the Strategic Petroleum Reserve remains near 40-year lows.

-Last year, the Biden administration drained 180 million barrels from the SPR as oil prices soared.

-Oil’s latest uptick has raised fears of persistent inflation and the possibility of more Fed rate hikes.”

https://markets.businessinsider.com/news/commodities/oil-prices-strategic-petroleum-reserve-joe-biden-inflation-fed-rates-2023-9?op=1

Yet self-proclaimed experts like pgl proclaim that oil prices won’t rise much, even though Biden may not be able to tamp down prices by increasing supply via SPR as he did in the run up to 2022 elections. fact, he might even have to start refilling it…raising prices at the pump…the prospect of which sends chills down the spine of Democratic partisan hacks like pgl.

“Yet self-proclaimed experts like pgl proclaim that oil prices won’t rise much”

Sometime else I never said. Come on – my stalker is not only mentally retarded. He has to lie every time he takes a pee.

A few observations over the fight between the Big 3 and the UAW. UAW wants that whopping 46% increase in nominal pay because these are 4 year contracts without cost of living adjustments. With uncertainty about inflation, of course they want a big increase. But wait – didn’t UAW contracts have cost of living adjustments before the Great Recession? They did but they agreed to get rid of that to help the Big 3 in times of trouble.

UAW contracts used to have pension benefits before the Great Recession. That is something else they gave up. Maybe it is time to go back to the old form of contracts and not these crazy sweet heart deals for the Big 3.

we seem to be in a sweet spot with inflation no longer a major issue, interest rates high enough for savers to collect some cash, low enough for stock to hold their value, and rates just high enough for housing price rises to level off and yet still have somewhat affordable mortgages. bidenomics at work. maganomics gave us the pandemic and runaway inflation. here is hoping the fed holds steady with no rate changes.

Raw data: Hourly pay in the auto industry

https://jabberwocking.com/raw-data-hourly-pay-in-the-auto-industry/

pgl

September 15, 2023 at 10:58 am

We both endorsed this excellent blog post.

Raw data: Hourly pay in the auto industry

https://jabberwocking.com/raw-data-hourly-pay-in-the-auto-industry/

Kevin Drum’s post should be Exhibit 1 from the UAW in these labor negotiations. To the pro-union folks here, this is an informative blog post that covers many of the big issues.

Anonymous

September 15, 2023 at 2:49 pm

First time he and I were on the same page. Please read Kevin’s discussion.

With all of Trump’s chirping about the UAW strike, I checked Kevin Drum’s graph of auto real wages for the period from 2016 to 2020. Real wages were lower in 2020 than they were in 2016. And Trump told these workers back in the day he was on their side. Yea right.

Off topic, rice again –

Remember a few weeks ago a few of us noodled with rice prices in comments here. HSBC has now pitched the rice price story to Bloomberg

https://www.bloomberg.com/news/articles/2023-09-15/surging-rice-prices-raise-specter-of-asian-food-scare-hsbc-says#xj4y7vzkg

Here’s a handful of rice price measures, two domestic and one global:

https://fred.stlouisfed.org/graph/?g=18UOI

Don’t be fooled by “Thailand”. That’s among the most widely quoted prices for rice.

Notice the cooling of domestic rice prices while the Thailand index is still flying. I don’t know whether that’s a reflection of an overall decline in U.S. inflationary pressure. I would draw your attention, though, to the early 2014 rise in PPI rice prices, which showed very little pass-through to CPI rice prices. The rise in PPI rice prices starting in Q4, 2021 fed pretty fully into CPI rice prices. What made the difference? Profits, maybe?

One more thing – the Phillipines is among the top rice importers, sometimes the largest rice importer in the world. Rice is a large part of the consumption basket in the Phillipines. So, any sign of trouble in the Phillipines from rice prices? Capital flight, maybe; there have been substantial outflows from local bond funds, which traders blame on rice prices:

https://www.bloomberg.com/news/articles/2023-09-14/surging-rice-prices-batter-bonds-in-major-importer-philippines#xj4y7vzkg

I noted the rise in the price of rice back when ltr was chirping how the PRC was helping a lot of nations in a lot of ways. Her only reply was that China was producing more for Chinese consumption. I guess itr could care less about the residents of the Philippines.

Auto strike economics –

Mark Zandi estimates that a strike by all 150,000 (more like 146,000) UAW members working for the Big 3 would result in a 0.2% drag on Q4 GDP.

So far, only 13,000 are striking, so…0.002%?

Anyhow, there’s this Gabriel Ehrlich guy from U Michigan, quoted in several articles about the strike, who expects the economic impact to accelerate strongly over time, even if the number of strikers remains constant. Makes sense.

Strikers can’t claim jobless benefits. That’s handy, in a certain way. If we see an uptick in jobless claims, it’s likely to reflect spill-over effects from the strike.

I haven’t seen anything on this, but my guess is that this narrow strike is focused on the highest margin vehicles, inflicting the most damage on auto makers for the least damage to strikers pay and to the strike fund. Reportedly, Ford Broncos, Jeep Wranglers and GMC Canyon pickups are among the vehicle hit first. Striking drive train plants would have even more bang for the buck, but only until auto makers respond with layoffs, as they certainly would.

The strike fund is reportedly big enough to pay out $500 per week plus health benefits for 3 months if all 146,000 workers strike. It has been reported that auto makers’ high margins are part of the thinking behind the strikes; execs aren’t going to want to surrender those margins for too very long. We’ll see how that works out.

https://www.npr.org/2023/09/16/1199599925/uaw-strike-effect-on-economy-big-3-automakers

https://www.cnn.com/2023/09/16/economy/uaw-strike-economic-impact/index.html

https://www.freep.com/story/money/personal-finance/susan-tompor/2023/09/13/uaw-strike-could-cost-economy-billions-but-is-u-s-recession-likely/70823190007/

“I haven’t seen anything on this, but my guess is that this narrow strike is focused on the highest margin vehicles, inflicting the most damage on auto makers for the least damage to strikers pay and to the strike fund.”

The UAW leaders have confirmed that this is part of their strategy.

Ford has announced layoffs, and GM has predicted layoffs next week:

https://www.npr.org/2023/09/16/1199999878/ford-and-gm-announce-hundreds-of-temporary-layoffs-with-no-compensation-due-to-s

So far, the number of layoffs discussed is around 2,600, do not large enough to move the needle on the economy much. Lock-outs don’t seem a likely tactic for auto makers right now.

A sizable Chinese property developer has defaulted on off-shore debt:

https://www.cnn.com/2023/09/15/investing/sino-ocean-china-property-debt-intl-hnk/index.html

“The developer and its financial and legal advisers, Houlihan Loukey and Sidley Austin, did not immediately respond to requests for comment on how long the restructuring process might take, whether its onshore debt payments would be affected and what legal implications it may face.”

Houlihan Loukey and Dookie? Years ago I had to deal with these clowns who make money by blatantly misrepresenting everything they ever were asked to value. Do not get me started on how inept and corrupt this advisors are.

America Just Hit the Lithium Jackpot

The world’s largest known deposit was just discovered in Nevada. What does that mean?

By Ross Andersen

https://www.theatlantic.com/technology/archive/2023/09/nevada-lithium-geopolitics/675325/

What does this mean? US automobile companies hope to build EVs here have a domestic source for a key ingredient in those batteries. Which means when Donald Trump told us that only China can make EVs – he was showing what a complete moron he really is.

Donald Trump Is Siding With Auto Bosses Against Workers

https://www.msn.com/en-us/news/politics/donald-trump-is-siding-with-auto-bosses-against-workers/ar-AA1gOHy7?ocid=msedgdhp&pc=U531&cvid=11113cc604934b75a6fa9f060a01fdb8&ei=17

By attacking the United Auto Workers and mischaracterizing the stakes of the union’s contract campaign and strike, self-styled populist Donald Trump is standing with the corporate elite against workers.

share

more

Jacobin

Jacobin

Donald Trump Is Siding With Auto Bosses Against Workers

Story by Paul Prescod •

4h

By attacking the United Auto Workers and mischaracterizing the stakes of the union’s contract campaign and strike, self-styled populist Donald Trump is standing with the corporate elite against workers.

Donald Trump speaks at the Monument Leaders Rally in South Dakota, September 8, 2023. (Scott Olson / Getty Images)

Donald Trump speaks at the Monument Leaders Rally in South Dakota, September 8, 2023. (Scott Olson / Getty Images)

© Provided by Jacobin

Former president Donald Trump has an opinion on the United Auto Workers (UAW) strike against the Big Three auto manufacturers that began at midnight on Friday. Surely the self-styled populist, whose political brand rests on claiming to champion American manufacturing workers, extends his full-throated support to the union, right? Think again.

Instead, Trump framed workers’ economic fight against corporate giants Ford, General Motors, and Stellantis as a partisan skirmish, lumping the UAW in with Joe Biden. In a statement delivered late last month, Trump railed against UAW leadership, claiming, “Autoworkers are getting totally ripped off by crooked Joe Biden and also their horrendous leadership. Because these people are allowing our country to do these electric vehicles that very few people want.”

Trump went onto to claim only China can make EVs. I guess this moron has not kept up with developments such as upcoming lithium mining in Nevada and what the Big Three have been doing to ramp up US production of EVs. Or does this moron think Americans are too stupid to make EVs?

Which date issue or month is the hardcopy Jacobin on that article?? I’m gonna pick up “Old Farmer’s Almanac” at the bookstore soon and I might as well pick that Jacobin up too. Should I pick up a “Mad” magazine too or will the teenage clerks giggle at the old man picking up a publication for 12 year olds?? Damn it, it’s tough being stuck in incurable arrested maturity.

Forbes is reporting that Russia has spent $167 billion on the invasion of Ukraine so far. That would be about 9.8% of one year’s GDP but of course the war started 18 months ago. So on an annualized basis only 7% of GDP.

Now one might ask – what was the US defense/GDP ratio during the late 1960’s and that Vietnam build up. Turns out this was over 8%. Of course some of us took to the streets during this war and during the needless 2003 invasion of Iraq. Now if JohnH claims he did back in the day – it turns out he’d be lying as usual.

The reports is “according to Forbes calculations based on data from the General Staff of the Armed Forces of Ukraine.” No propaganda there!

https://forbes.ua/war-in-ukraine/za-pivtora-roku-rosiya-vitratila-na-viynu-z-ukrainoyu-blizko-1673-mlrd-z-nikh-tilki-tekhniki-na-ponad-34-mlrd-rozrakhunki-forbes-16092023-16050

And if anyone can cook the books, it’s officials of the Ukrainian kleptocracy.

But peppa pgly will eagerly grasp at any straws to sustain his wishful thinking…

In other news, “Kyiv dismisses 7 top defense officials; Zelensky to address U.N., Congress.” peppa pgly will probably assure us that this is exactly what winning teams do!!! https://www.msn.com/en-us/news/world/ukraine-live-briefing-kyiv-dismisses-7-top-defense-officials-zelensky-to-address-un-congress/ar-AA1gSbdc

Awww Jonny boy – what’s the matter. No film in the Kremlin this evening of Ukrainian old ladies being raped by your Russian war criminals. Oh well – at least Putin gave you a doggy treat.

Ukrainian kleptocracy? Like that story about Zelensky’s wife buying a $5 million mansion in Egypt that Jonny boy was spreading. It was a lie. Then again everything little Jonny boy spews is a lie.

Watching Sean Penn on Face The Nation:

https://www.theguardian.com/film/2023/aug/24/first-trailer-for-sean-penns-ukraine-documentary-superpower-released

First trailer for Sean Penn’s Ukraine documentary Superpower released

‘We are just ordinary people who want to live in our country,’ says President Volodymyr Zelenskiy in activist actor’s forthcoming documentary

Must see documentary!

Hope they put it in DVD form for this old codger.

Interesting statistic on UAW wages. Over the 4 year life of the contract that just expired, nominal wages grew by only 6%. Over the same period, CPI rose by 19%.

Yes boys and girls, the old contract has no COLA provisions. The new contract must increase the starting wage a lot and restore COLA.

Or indexed to profits or to labor productivity. In any case, situation in which each factor of production tries to benefit at the cost of the others is barbaric.

A funny thing about corporate decision making in a capitalist society – internal decisions aren’t made in a market setting. Capitalism is suspended within corporations. One of the main jobs of corporate structure is to supplant competition with cooperation in production. But we single out workers and treat them as enemies, meant to be cut off from cooperative decision making.

Well said!

Putin has lost Armenia as an ally:

https://www.cnn.com/2023/09/17/world/armenia-russia-kremlin-us-intl/index.html

https://www.ft.com/content/43f904eb-fb6a-4567-b8ee-a69cc16c7538

https://www.kentclarkcenter.org/wp-content/uploads/2023/09/RESULTS-2023-09-13-Survey-10.pdf

I get Biden is old but damn he is competent at these things:

https://www.msn.com/en-us/news/world/5-detained-americans-freed-from-iran-us-official-confirms/ar-AA1gSiPP?ocid=msedgdhp&pc=U531&cvid=2ea45b71c1e54db28699cc262827a22a&ei=13

The U.S. has received confirmation that five American citizens freed as part of a deal between the U.S. and Iran are now on a plane headed out of the country to Doha, Qatar, a senior Biden administration official said Monday.

Bribing to get people back is not “competence”. Neither is it “diplomacy”. It encourages more abductions. Which will happen

Health Care Statistics Updated With Improved Drug Price Data

September 18, 2023

https://www.bea.gov/news/blog/2023-09-18/health-care-statistics-updated-improved-drug-price-data

The Bureau of Economic Analysis today updated its supplemental health care statistics with an improved methodology that shows the growing role of prescription drug rebates over two decades. After subtracting the rebates, BEA’s estimate of health care spending in 2020 was reduced by $158 billion, or 5.3 percent, from the previous estimate for 2020.

From 2022QIII to 2023QII, we have seen:

Real GDP rise from near $20.0 trillion to near $20.4 trillion but

Real GDI fell from near $20.25 trillion to near $20.0 trillion

JohnH has been chirping about this even as he chirps about rising profits. The thing little Jonny boy either does not get or will not tell you is that real compensation over this same period has increased by 0.5%. Now that is only one factor of income with rents and profits being the others. Rents have increased too.

So what is going on? Don’t ask little Jonny boy as he does not know and even if he did – he would not be honest about. You see – reported profits have fallen a lot over this period.

Of course this is how BEA reports the data. Wait for it – little Jonny boy is about to spread the rumor that there has been a vast conspiracy to hide hundreds of billions of dollars of profits. Or course if that were true – then actual real GDI has been increasing. But of course little Jonny boy has been harping that it has been falling. Yea – his serial lying often bites little Jonny boy in the rear end.