From the Milwaukee Journal Sentinel today (title not mine):

As much as some may try, we can’t blame any single institution or political party – there are just too many factors contributing to inflation. The $4 trillion federal government spending during the Trump administration propped up prices by allowing individuals and businesses to keep buying goods and services. Meanwhile, the Federal Reserve’s commitment to low interest rates and emergency lending kept the economy afloat at a time when steep price declines could have been disastrous.

The $1.9 trillion American Rescue Plan passed during the Biden administration added to upward pressure on prices. The fiscal policies contributed to much of the acceleration in inflation in 2020 through mid-2021. However, starting in mid-2021, supply chain disruptions and labor market tightness, more related to the pandemic, took on more importance. The oil price increase in the wake of the Russian invasion of Ukraine was particularly important in mid-2022.

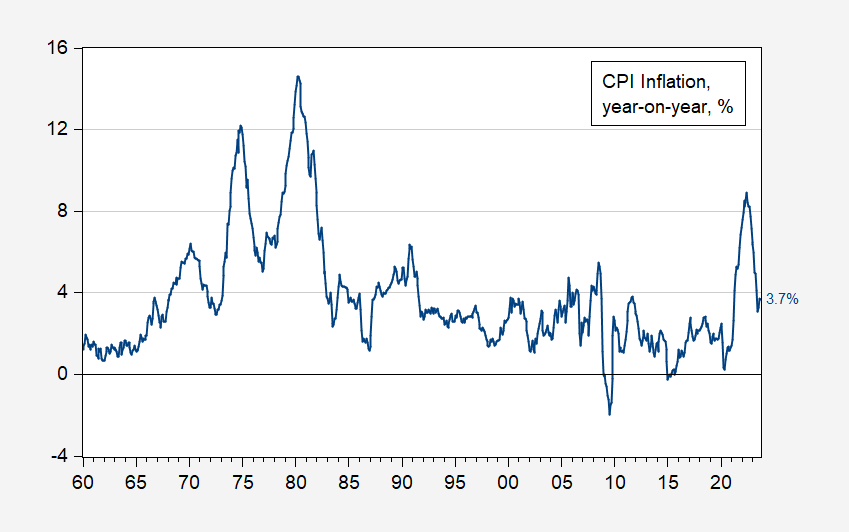

Here’s a picture from the article.

Figure 1: Year-on-Year CPI inflation, % (blue). Source: BLS, author’s calculations.

Looking at the inflation series over a long span highlights the fact that in the end, inflation was transitory. However, it was less transitory and high than many expected.

I argue, in line with most recent analyses (e.g. here), that a combination of supply, cost-push, and demand (fiscal) shocks pushed inflation in recent years. Here’s a detail.

Figure 2: Year-on-Year CPI inflation (blue), instantaneous per Eeckhout (T=12, a=4) CPI inflation at annual rate (tan), and Core CPI (red), %. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

Note that inflation did rise post-ARP. But it also rose in European countries. And certainly European inflation rose in the wake of the expanded Russian invasion of Ukraine. Needless to say, that occurred with a much less expansive fiscal policy in that region.

Looking forward, it looks like inflation is down, but not out, as shown by the persistence in core inflation (keeping in mind that housing costs will exert a negative impact over the next year).

Agreed.

Do not believe that a Fed rate hike in November is completely off the table yet. Still counting on a US recession to start before May 2024 but that is by no means a strong conviction.

“we can’t blame any single institution or political party – there are just too many factors contributing to inflation.”

Sensible people would agree. But not Bruce Alternative Facts Hall. After all he had inflation being 13% and all Biden’s fault. But let’s give lying Brucie boy a break. After all, those people speaking for Jordan to become Speaker told us just today we still have double digit inflation.

In the Faux universe inflation is not counted as an annual increase in prices it is counted as price increases since Biden took office. So they don’t need a bald face lie to arrive at their foregone conclusion – just a gross distortion and revision of what words actually mean. The minions are fooled mostly because they want to be tools.

“In the Faux universe inflation is not counted as an annual increase in prices it is counted as price increases since Biden took office.”

That is precisely how Bruce Hall measures it!

Fox News host Jesse Watters has been slammed after saying there is no difference between Hamas and Palestinians and “they all love killing Jews.”

https://www.msn.com/en-us/news/world/fox-news-host-slammed-for-shameful-claim-there-s-no-difference-between-hamas-and-palestinians/ar-AA1inES2?ocid=msedgdhp&pc=U531&cvid=8d04bf99f1e14843ae81598d13eea151&ei=9

Yea – what Watters said is repugnant. But he is not alone. After all the governor of Florida said essentially the same thing and this racist clown wants to be our next President.

“if the Fed has already overly tightened – as the effects of past interest rate increases continue to ripple through the economy – inflation may fall even faster, although perhaps at the cost of a recession.”

I have had the same concern. Of course expressing this concern has led to my annoying little twit stalker (yea – JohnH) to go off on another one of his patented fact free rages declaring that any economist who says a higher cost of capital lowers investment demand is a moron. Jonny boy’s economic guru? A lawyer who loves Bob Dole and George W. Bush who currently works for a group that coddles to rich people – all pretending to care about the little guy. Never mind the fact that real residential investment has declined a lot because little Jonny boy has declared that residential investment in single family housing does not count.

Vitol is a major trader of natural gas so when its CEO speaks, people listen:

https://oilprice.com/Latest-Energy-News/World-News/Trading-Giant-Says-Some-Of-Europes-Natural-Gas-Demand-Is-Lost-For-Good.html

Some of the lost European demand for natural gas due to the energy crisis and record-high prices could never return, Vitol Group’s chief executive Russel Hardy said at the Energy Intelligence Forum in London on Tuesday. “For gas, demand has plummeted in Europe, with double-digit percentage reductions. We expect some of the lost demand to be permanent,” Hardy told the forum. “Gas and power had a terrible year for demand (last year) And it continues to be very difficult in Europe … on the industrial side because of the damage over the last few months of high prices,” said Hardy, the top executive of the world’s largest independent oil trader. “We can expect some of that lost demand to stay lost forever,” according to Hardy.

Europe’s gas demand has trended lower for the past year amid energy savings measures, high prices last year, and demand destruction from slowing industrial activity. The EU has also set a target for member states to reduce gas consumption. European demand for natural gas remained near the bottom of the five-year seasonal levels in August, helping inventories end the month at around 93% full, data from the Joint Organizations Data Initiative (JODI) showed on Monday.

Gas demand in the EU was 12% lower in 2022 than the 2019-2021 average, driven by falling industrial and household gas demand, researchers at Brussels-based think tank Bruegel wrote last week. In 2023, the greater availability of alternative power generation helped with significant gas demand reduction in the power sector, too. In the second quarter of 2023, the EU gas demand was 19% below the 2019-21 average, with gas demand for power generation down by 17%, Bruegel said. Ahead of the 2023/2024 winter, gas storage sites in the EU were 98% full as of October 15, according to data from Gas Infrastructure Europe. Europe hit its target to have storage 90% full by November 1 months in advance.

Well DUH!!!! What else would be expected after a HHUUGGEE supply shock. Alternative energy sources are now identified, established, and preferred. I thought your goals were to eliminate the need for fossil fueled energy. The supply shock in gas has set a new tolerance for high energy prices. Aren’t those your goals? Y’ano doubling electricity prices with renewables and their required backups, subsidies, and grid expansions, are exemplary of this economically and engineering ignorant policy.

CoRev: Since oil prices are determined in world markets, and it was Russia/Ukraine that pushed up prices so much. I’m not sure how much all these things you mention are essential to that point. wow.

Not essential and based on false narratives. Barely coherent without a Russian dictionary. There are no such thing as a “new tolerance for high energy prices”. The switch to the much cheeper renewables would prove that. If the system was tolerant of higher energy prices it would not switch away from natural gas – especially after it quickly came down from the highs. It turns out that electricity produced by renewables are not doubling prices but cutting them in half. CoRev is desperately hanging on to the numbers from 10 years ago because the reality of today is destroying his narratives (and his fossil fuel portfolio).

Mnmazie admits and even names the supply shock: “… it was Russia/Ukraine that pushed up prices so much. ” And yet can not understand their impact while shifting focus to oil, and not gas or even ENERGY. WOW!

Ivan quotes the propaganda: ” The switch to the much cheeper (sic) renewables would prove that.”, while he will not or can not show us an example where any grid has reduced prices due to implementation of the much cheeper (sic) renewables. I’m still waiting for that.

PGL, can not even accept his own rhetoric: ““I thought your goals were to eliminate the need for fossil fueled energy. Wrong troll….” While trolling without any evidence.

It is an amazement!

Wow – each of your attempts at a replay was nothing more than gibberish. CoRev tries to make a point but the little boy once again has no clue what the issues are.

in covids mind, energy prices in Europe would be cheaper today if natural gas was a bigger part of electricity generation on the continent. exactly how does one argue with an idiot without getting covered in crud?

Baffled claims: “in covids mind, energy prices in Europe would be cheaper today if natural gas was a bigger part of electricity generation on the continent.” Where have I claimed that?

What i did say, just above, was: ” Y’ano doubling electricity prices with renewables and their required backups, subsidies, and grid expansions, are exemplary of this economically and engineering ignorant policy.” In respo9nse to the claims that renewables are cheaper than – (never defined base line), but since linked to thermal source, especially gas, price claims, implies cheaper than gas.

I’ve asked for examples of those grids where prices actually went down due to implementations of renewables, but, to date, no one has provided such an example. We all know why!

“I thought your goals were to eliminate the need for fossil fueled energy.”

Wrong troll. Of course any sentence where CoRev claims to have “thought” is an absurdity on its face.

The lasting legacy of Putin’s use of natural gas as a political weapon will be the permanent switch in Europe away from cheep Russian natural gas to alternative energy.

After the sunk in cost of building a solar or wind power plants, the electricity is basically free. For natural gas plants there is a continuing and unpredictable fuel cost to produce the electricity. There will be no “switching back” from alternatives to natural gas.

Natural gas by pipeline is considerably cheeper than the liquified stuff currently being used. The current boom in liquified natural gas will likely become a bust as demand is further lost and pipelines are build. In theory Europe would switch back to Russian pipelines if things normalize – but a lot has been done to increase pipeline deliveries from northern Africa and the north sea. So the potential recovered Russian income from normalization may be much less than expected. The Russian kleptocrats will suffer permanent loses.

Putin’s energy shock also induced a boom in home energy efficiency with hyper insulation and heat pumps. Again something that permanently reduce overall cost after the initial investment.

The overall outcome will be a Europe that has permanently reduced its energy costs, not by getting cheep hydrocarbons from Russia, but by switching to increasingly cheeper alternative energy and taking steps to increase energy efficiency. That will make German manufacturing more competitive – the right way. As with the EV switch the US will be far behind in spite of Biden’s attempts to correct the previous administrations failures.

Thanks for understanding what this is about. Now if you can go give little CoRev a clue, you are a better person than me.

As you can see in his response, giving CoRev a clue would require a magician much better than me.

The good news is that reality will continue to move forward even as fools turn their back to it and scream that we WILL be moving back in time, not forward.

The explosive growth in alternative energy driven by commercial companies is really what matters. Some say that those people don’t know what they are doing and will be sorry they did it – but the fact is that once build, those plants (production + storage) will produce essentially free energy for decades. Every year sees a reduction in cost of both production and storage of energy from alternative sources – no such thing for hydrocarbon energy which gyrates unpredictably with the price of hydrocarbons.

Ivan, you have no understanding of what’s actually occurring. “The overall outcome will be a Europe that has permanently reduced its energy costs, not by getting cheep hydrocarbons from Russia, but by switching to increasingly cheeper (sic at least you’re consistent) alternative energy and taking steps to increase energy efficiency. That will make German manufacturing more competitive – the right way. ”

Actual German industry action: BASF to cut 2,600 jobs as energy crisis puts Germany on track for recession https://www.theguardian.com/business/2023/feb/24/basf-cut-jobs-energy-crisis-germany-recession

and

“BERLIN — Germany’s biggest companies are ditching the fatherland. ” https://www.politico.eu/article/rust-belt-on-the-rhine-the-deindustrialization-of-germany/

And wind’s growth stalls: Blow to Biden as offshore wind auction in Gulf of Mexico fails to stir interest https://www.theguardian.com/us-news/2023/aug/29/us-offshore-wind-lease-sale-gulf-of-mexico

U.K. Offshore Wind Auction Fails as Industry Crisis Blows On https://www.wsj.com/livecoverage/stock-market-today-dow-jones-09-08-2023/card/u-k-offshore-wind-auction-gains-no-bids-as-industry-crisis-spins-on-qvBHmBzv9AlVOtW5xs9u

And solar is a farce when it only can provide electricity at best 1/2 the day: Spanish wind and solar auction ends in big disappointment https://energywatch.com/EnergyNews/Renewables/article14629244.ece

And the latest wind movement is to increase their contract prices ~50 -100% above contract pricing.

“After the sunk in cost of building a solar or wind power plants, the electricity is basically free.” Except for the required backup costs which NEVER go away because backup is always needed for Wind and Solar. So every ” free” electron produced by wind and Solar is actually the cost of its REQUIRED backup. The “FREE” electrons must also include the prices for their backups, subsidies, and grid expansion/improvements to support them.

Repeating lies does not make them truths, but only points out who are the liars or that they are dumb as rocks. I’ll let you choose.

“you have no understanding of what’s actually occurring”.

Says the troll who has no effing clue what this thread even was.

Gee CoRev just figured out that BASF is a multinational. Their North American operations were running cute commercials even when I was a kid. Speaking of being a kid – someone ask CoRev if he has passed kindergarten yet.

We have given little CoRev lots of time to read BASF’s latest Annual Report. Which of course he was too lazy to do. So let me point out a couple of things in this report that undermine CoRev”s dumbass ramblings.

(1) CoRev claimed that BASF is hiring more people in China and less in Europe. But look at the number of employees per region according to their Annual Report. A few in China but most in Europe. Either BASF is lying or CoRev has once again proven he is one dumb liar.

(2) CoRev went off about the struggles their chemicals division has had. But wait – that division makes up only 17% of total sales. I guess CoRev has no clue what the other six divisions even do.

Yea – CoRev has JohnH disease. But come on CoRev – JohnH still has a huge lead on you for 2023 troll of the year. Do try harder.

PGL, again misquotes: “(1) CoRev claimed that BASF is hiring more people in China…”

and

“(2) CoRev went off about the struggles their chemicals division…”

Here’s your challenges (1): Support your claim with actual references from me.

(2) Answer this challenge: “I’ve asked for examples of those grids where prices actually went down due to implementations of renewables, but, to date, no one has provided such an example. We all know why!”

PGL, epitomizes this: Repeating lies does not make them truths, but only points out who are the liars or that they are dumb as rocks. I’ll let you choose.

CoRev has caught JohnH disease – reading newspapers and not Annual Reports when trying to understand a company like BASF. It’s not like it takes a special talent to find links like these:

https://www.basf.com/global/en/investors/calendar-and-publications/reporting.html

Yea – do not trust CoRev as we know he is a moron. The presentations from the company itself are quite detailed and informative. Which is to say WAY OVER CoRev’s little pea brain.

Europe could drill and pipe its own gas if the greens would allow it.

I doubt your statement that Europe will permanently reduce energy costs. Need to double the green infrastructure to have adequate backup. Not to mention the grid investment.

JMM its much worse than: “Need to double the green infrastructure to have adequate backup.” Doubling current Green infrastructure can not backup anything when the wind stops blowing at night. 0X2=0, even in green math. Adding other REQUIRED backup to Green Energy sources exacerbates their failures, since backup extended periods of Wind & Solar failures is then compounded with needing to backup their backups as they are all short term and inadequately sized.

Current Levelized Cost of Electricity pricing estimates do not include their TOTAL inherent costs. Renewables do not include backup, subsidies, and grid expansion/upgrade costs. As you point out backup minimally doubles their costs per electron they produce.

Then we have the ignorant goal of replacing (dirty, expensive) unwanted fossil fueled thermal source with renewables without considering that simple formulaic fact: 0X2=0, the cost for backup of that original thermal plant include the LOSS of BOTH the thermal output not being replaced by renewables When they are failing to produce. So you have lost thermal output, replaced by renewables plus their backups (all prone to produce much lower than the thermal replaced) on a grid.

If their claims of cheaper than .. are true then such grids would be readily available. Where are they believers?

I’m struggling to find an explanation as to why US urban consumer grain prices — spaghetti, bread, flour,– are up 14-18% YTD in 2023.

I’m not sure either. FRED tells me that the global price of things like wheat, corn, and soybeans spiked last summer (2022) but have moderated since then. Now chocolate lovers be warned that the global price of cocoa is soaring:

https://fred.stlouisfed.org/series/PCOCOUSDM

[ Giggling ]

Spaghetti and bread ! Ask the Italians.

Seriously there has been a big problem with transportation of bulk items on the record low Mississippi river. Barges have been badly restricted and harvests has to some extend been moved onto more expensive modes of transportation. Not sure how much that would have effected prices yet, but it could become a bigger problem down the line.

I enjoyed the Sentinel column, I think it will enhance Wisconsin people’s understanding of semi-complex economic permutations.