That’s the title of today’s segment on WPR’s Central Time, where I was the Dean Knetter’s guest. In my view, the reason why the economy has proved so durable thus far is in large part attributable to the resilience of the consumer, buoyed by Covid era transfer payments. With the path of disposable income higher than thought just a month ago, consumption has been higher, and — with the saving rate lower in the context of a tight labor market — the cushion of “excess savings” larger.

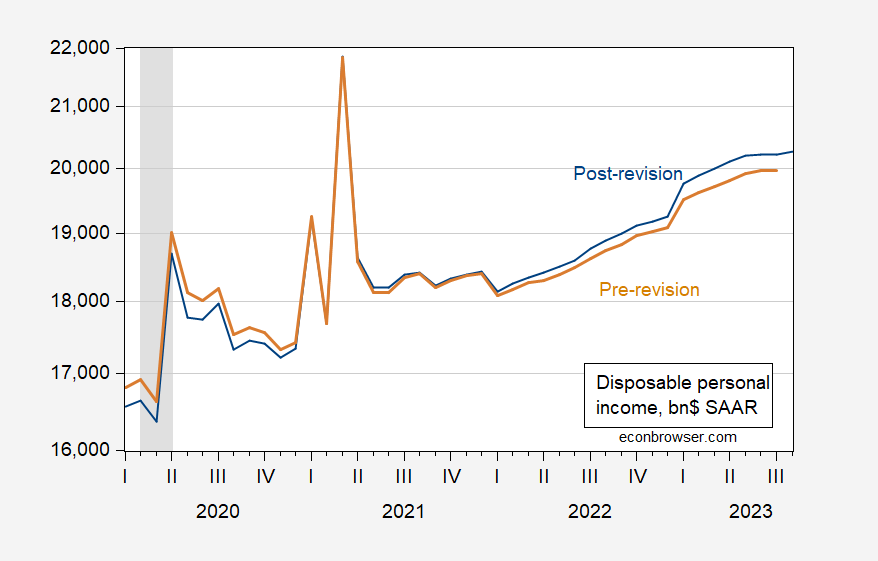

Figure 1: Pre-comprehensive revision disposable income (tan), post-comprehensive revision (blue), in billions $, SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA via ALFRED, NBER.

Wells Fargo estimates “excess savings” at about $1.1 trillion in August using post-revision data, compared to about $340 billion in July, using pre-revision data. How can this be when the cumulative difference in disposable income is about $153 billion, and the cumulative difference in consumption is $453 billion (i.e., post-revision, consumption has been much higher)? The difference arises from the lower assumed saving rate (7.2% vs. prior 9.1%), which defines downward the “normal” level of savings, and hence upward the level of “excess savings”. [update 10/25: for additional analysis, see Jan Groen’s substack post on the implications for “excess savings” in the 9/29 release; see also my June discussion of “excess savings” using pre-revision data]

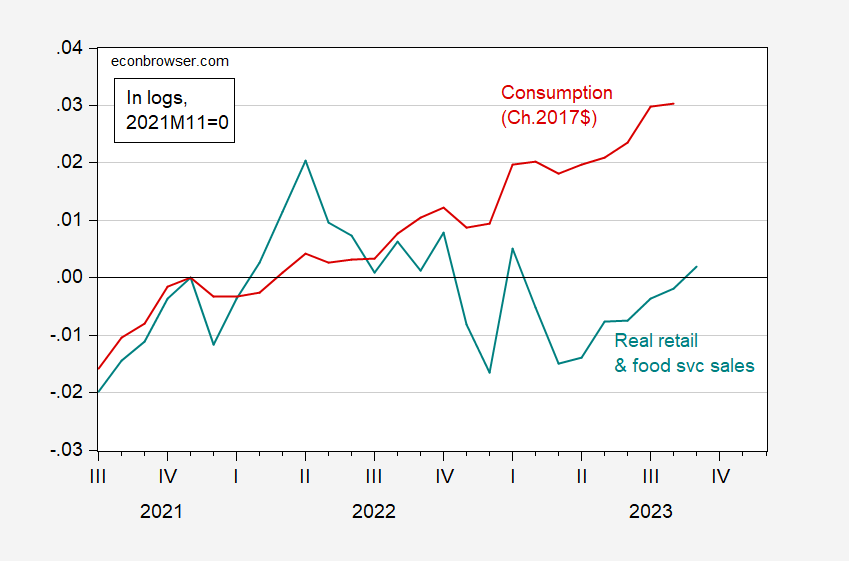

So, continued strength in consumption is not surprising.

Figure 2: Real retail and food service sales (teal), and real consumption (red), both in logs, 2021M11=0. Retail and food service sales (FRED series RSAFS) deflated by Chained CPI (seasonally adjusted by X13). Source: Census, BLS, BEA and author’s calculations.

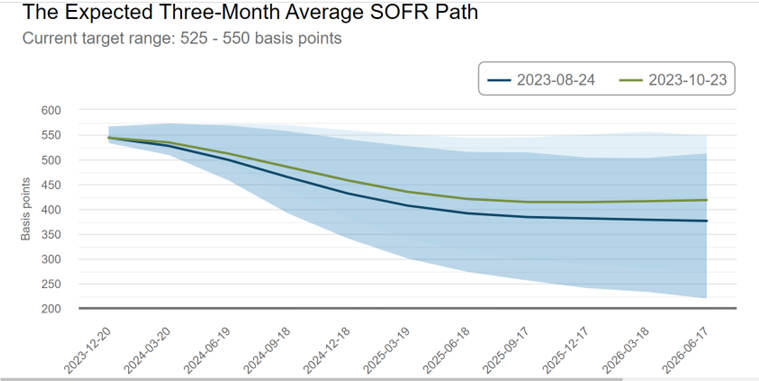

As the resilience of the economy has shown up again and again, and the date of a posited recession gets pushed further back – or cancelled (see this post) – the Fed funds path gets pushed further up. See the path pre-comprehensive GDP revision vs. post, in Figure 3 below.

Figure 3: Implied path of Fed funds, from Atlanta Fed on 8/24 (blue) and 10/23 (green). Source: Atlanta Fed probability tracker, accessed 10/24.

“continued strength in consumption is not surprising”.

Now it would be surprising if anyone who reads an economist blog would call this secular stagnation but that is what Princeton Steve called the current situation. Yea – he is that dumb but be careful because he gets all angry when call out.

The last time, the only time, personal consumption was as large a share of GDP as it is now was during and just after the Great Recession, when the denominator had fallen off a cliff:

https://fred.stlouisfed.org/graph/?g=1aCs4

Personal spending is abnormally high as a share of output. Last time, the rest of the economy caught up. That would be a happy result this time, too, but recession predictors are still elevated. If we actually hace $1.1 trillion in excess saving, consumption could climb to a new high as a share of GDP in case of recession, helping to limit the several of the recession.

Here are shares for a few other categories:

https://fred.stlouisfed.org/graph/?g=1aCya

Government spending and fixed investment in housing and equipment are all low as shares of GDP. Interest rates, among other factors, account for the low share of fixed investment (other than factory structures). The low share for government is merely a return to trend now that Covid programs have expired.

By the way, one ought to check on shares of GDP before assuming that, for instance, weapons transfers to Ukraine are revving up growth or that government discretionary spending is running wild and needs to be put in check, or that interest rates don’t affect investment.

By tI’vehe way, left trade and inventories out of the picture because they swing so hard that they obscure everything else. Feel free to check on them if you’re curious.

https://fred.stlouisfed.org/series/GCEC1

Real Government Consumption Expenditures and Gross Investment

You got me wondering what has happened to real government purchases of late. Republicans love to claim that Biden has been fiscally irresponsible but it seems real government purchases skyrocketed under Trump with a lot of that increased at least for a while during the early Biden years.

As compared to real GDP:

https://fred.stlouisfed.org/graph/?g=1aDR5

“Severity” of recession.

My thumbs and auto-correct have betrayed me again.

Indeed, as I noted right after the release of the August Personal Income & Outlays report on Sep. 29th, excess savings are far from being depleted albeit not as high as Wells Fargo seem to suggest now, see my Substack post (https://janjjgroen.substack.com/p/august-personal-income-and-outlays).

As for why excess savings still are not fully depleted? Two reasons: (1) nominal household income (especially out of wages) grew at an above trend rate in 2023 diminishing the need for households to dip further into their accumulated excess savings, and (2) the trend savings rate is uncertain and time-varying (likely now around 6.5% of disposable income). For more detail see my original excess savings Substack post of Aug 10th (https://janjjgroen.substack.com/p/what-excess-savings).

Jan Groen: Apologies, I was remiss in not mentioning your most recent post (which I missed). Link added.

“Personal income growth out of wages and salaries was revised up significantly for 2023 and runs at a pace that can comfortably sustain a 3.2% PCE inflation for the year ahead.”

A few folks here have noted real labor income has been growing and yet our favorite Know Nothing trolls pretend the opposite. More honest economic reporting is always welcomed!

Here’s that extra special, only-one-that-matters measure of real income that we hear so much about, median usual real weekly earnings:

https://fred.stlouisfed.org/graph/?g=1aDRO

The only way to argue that this series is not trending highe lately, as it was prior to the Covid recession, is to pick a base period during the extraordinary Covid spike.

Now, we know that some members of the troll choir regularly make duplicitous use of end-points in order to deceive, so no doubt we’ll be hearing again soon that median usual real weekly earnings “prove” that things are bad, bad, bad. Except for investment, which is good, good, good, despite the rise in interest rates.

But in fact, personal consumption is carrying the bulk of economic growth lately, supported, as Ivan noted, by rising employment and income. Other components of growth are less vigorous. Some, like investment in housing and equipment, aren’t vigorous at all.

Core PCE up 3.7% Y/Y

Consumption is the biggest part of the GDP so on first approximation it is a good sign that the increased rates have not (yet?) reduced consumption.

Part of that may be that the low unemployment rates have helped increase income for the consumer class. People who live paycheck-to-paycheck have found themselves with more real income. However, the housing markets have gone in a direction where the idea of owning a house is still out of reach. It also appear that the rental markets are slowing down, so switching from rental to ownership may be less attractive even if you can afford it.

The overall effect is that a group of people who are used to just spend everything they earn, now have more money and are using that money for consumption (because that is what they do).

Another Republican stooge – this time Mike Johnson – will try to get enough votes to become Speaker. Morning Joe featured these clowns running around to the background of Bernie Hill’s theme song.

This is probably the last chance they have for a GOP speaker. He got Trump’s endorsement and played out a plan for the legislative approach to avoid government shut down next month. If they can’t approve this guy they will lose enough centrists (less right wing) GOP members to a deal with the democrats.

Benny Hill. Sorry. And the original from 1963 (just 2 minutes and all clean fun)

Boots Randolph – Yakety Sax

https://www.youtube.com/watch?v=lAJB6HsYiNA

As a high ranking member of the Benny Hill Fan Club, I have to say—shame on you. Used to watch him in a motel room in Lawton Oklahoma around 10:30pm every weekday, with my parents in the same room. Would have been roughly age 9 or 10. They have him on at 11 now and I catch him off and on. Catching some of the meanings of jokes over my head at age 10~~but enjoyed the show back then just because of the general silliness.

The show was great. I just liked the original version of the song. Now how Morning Joe showed the GOP clowns running around made me laugh so hard my side hurt.

They are letting Elise Stefanik openly lie about a parade of nonsense. Trump’s Truth Social tweets are less unhinged. Maybe they should just bar these MAGA nut jobs from the People’s House.

Apologies if I gve the impression that I’m using comments as a warehouse for anti-trust litigation news:

https://www.axios.com/2023/10/23/lawsuit-trial-broker-fees-real-estate-news

Google. Meat producers. Now real estate brokers. This is mostly the Biden Justice Department, so thank you, Merrick Garland. And for the Microsoft tax case, too, though it’s not anti-trust and mostly the IRS.

The Biden administration is getting Gaza all wrong (in public, though perhaps not behind closed doors), but when it comes to taking on corporate bad guys, their record is impressive.

Oh, and 42 states have joined in a lawsuit against Meta for social media kiddie-fiddling; it isn’t an anti-trust case either, but it’s the next best thing.

In an email to Axios, a representative from the NAR said its rules and system benefit consumers and the market. They note that “compensation is always negotiable” and that commissions fluctuate depending on the market.

NAR will tell any lie to protect their market power. Sort of reminds me of those MAGA Republicans.

Johnson 220

Jeffries 2009

We finally have a new Speaker – at least for a little while.

An election denier and one of Trump’s official defense team for his first impeachment. Joh on Idaho g the worst of a bad lot, so naturally he rose to a place of prominence.

McCarthy was terrible. Jordan would have been a disaster. This clown is somewhere in between.

The matter of personal savings is challenging. Figure 4 from Wells Fargo suggests that excess savings will be fully consumed in H2 2024 – H1 2025.

Interestingly, Fig 1 shows DPI remains well below trend.

Wells Fargo adds this commentary on excess savings:

For many households, the excess savings is long gone. For others, especially wealthy ones, it can last much longer.

This matches anecdotally with comments from various types of retailers. For example, I saw a bit from bicycle retailers who said that the middle class has fled, and revenues are being sustained by sales of high end bikes to wealthy consumers. This suggests the guys at the lower to middle end are being crushed and ‘excess savings’ such as they are, are mostly concentrated in the top ten percent.

https://wellsfargo.bluematrix.com/links2/html/fe0a965d-b94f-4992-bbfa-c7b25e3718b6

https://wellsfargo.bluematrix.com/links2/html/fe0a965d-b94f-4992-bbfa-c7b25e3718b6

https://wellsfargo.bluematrix.com/links2/html/fe0a965d-b94f-4992-bbfa-c7b25e3718b6

And, related, Fig. 2 from the SF Fed shows once again why it is necessary to distinguish between recessions and suppressions.

https://www.frbsf.org/our-district/about/sf-fed-blog/excess-no-more-dwindling-pandemic-savings/

Figure 2 noted their earlier paper:

https://www.frbsf.org/economic-research/publications/economic-letter/2023/may/rise-and-fall-of-pandemic-excess-savings/

Nowhere did the SF FED used your stupid term suppression here either. It was a good paper so maybe you should READ it. Oh wait – this paper does not support your usual stupid babble either.

Come on Stevie – get the fact you have no effing clue what you are babbling about and try reading actual economics rather than boring us with your usual insanity.

Something from little Stevie’s Wells Fargo link:

‘A year ago there was a general consensus among economists and financial markets that a recession was in the offing. Those forecasts have largely been pared, put-off or canceled altogether. To some extent the rationale for these more sanguine assessments is a recognition of the uncanny staying power of the consumer.’

Wait – we did not have a 2022 recession? And I thought little Stevie told us that real income started falling in early 2022. Just another thing the world’s most incompetent consultant got completely wrong.

Y’all know I have a thing about interest rates, right? So, borrowing costs have been rising for the better part of three years, and in that period have risen faster than ever in U.S. history. Monetary policy has a lot to do with this rise, expected inflation far less. Here’s (another) disaggregation of the 10-year yield, except for expected cost of funds:

https://fred.stlouisfed.org/graph/?g=1aCVP

A rise in term premium accounts for most of the recent rise in the ten-year yield. What drives term premium? Pretty much everything except the expected cost of funds and expected inflation, including prudential regulation, portfolio needs, supply, safe-haven demand, and UNCERTAINTY about the cost of funds and inflation.

Here’s a picture of term premia for several maturities of Treasury notes, and the effective fed funds rate:

https://fred.stlouisfed.org/graph/?g=1aCY0

Notice that term premia were never negative until the funds rate reached the (near) zero lower bound. There was also an increase in prudential regulation and safe-have demand in that period. Along with a funds rate at the lower bound came an assurance that the funds rate wasn’t going to change for a long time – no uncertainty about the cost of funds. And since low inflation also tends to mean low inflation variability, there wasn’t much need for a premium to account for uncertainty about inflation.

Show of hands – who feels confident about the fed funds rate in two years time? How about inflation?

Since historically, term premia have generally been positive, and a positively-sloped yield curve is seen as normal largely because positive term premia are seen as normal, we shouldn’t be surprised if term premia remain positive in the coming period.

Positive term premia are the normal state of affairs. A rise in term premia account for most of the recent rise in borrowing rates. The yield curve is inverted largely because the cost of funds is expected to fall soon, but also because term premia, while positive, remain low by pre-zero-rate standards.

Kinda looks like, if the Fed carries through on its “higher for longer” interest rate view, there’s still some upside risk for borrowing costs. Not that anybody couldn’t have guessed that, butnow you have pictures.

“Fig. 2 from the SF Fed shows once again why it is necessary to distinguish between recessions and suppressions”

This SF FED paper did not use your stupid word “suppression”. No sane person would ever use that word. Once again little Stevie babbles on with made up words as little Stevie has no clue what he is babbling about.

I agree with this reasoning in part. But I also dissent in part, so I am am going to highlight that point for purposes of discussion.

First, nominal personal savings (source: FRED) as of August totaled $794.1 billion, which is almost identical to their levels in 2015-17 and below their 2020-21 levels. So I am not sold on the idea that there are still spare stimulus savings left in the aggregate.

Second, your graph is of nominal income per capita. But nominal YoY growth is equal to that during the 1970s, during which there were two severe recessions. So I really think we should be looking at real rather than nominal income. When we do that, we see how big of an inflection point June 2022 was. Bottom line: give me a 40% decline in gas, and a near 10% decline in broad commodity prices, starting from a point where the economy was not already contracting significantly, and I will show you pretty robust growth.

Bottom line: I think growth this year has been more of a supply side rather than demand side story.

Lael Brainard gave a speech at Peterson, either today or yesterday. Not difficult to find online.

Thanks for the heads-up. I scanned the speech. Sounds like she generally agrees with me.

I’ll tell you what I find fascinating about this right now. Your argument about some prices going down helping to increase demand is interesting. Especially when we are sometimes told that inflation causes people to increase immediate purchases, for fear that the item they want will be cost-prohibitive if they don’t purchase it now (“loss of purchasing power”). Funny how so many Economics arguments exist (“consumers need to” or “are” purchasing now) because…… and the arguments that they “need to” or “are” purchasing more now coincide together in a world where whether prices are going up or going down they STILL need to run out and purchase something.

Rarely are we told that a nation might have less waste and be more resource rich, if they just tried to keep a dollar in their pocket, or quit purchasing junk American cars to trade in four years later, and mobile phones with planned obsolescence. Why not buy the quality Japanese car and keep it 15 years?? Why not keep the Apple phone or Apple laptop and tell them and tell Tim Cook if he stops putting out software updates on “old” phones “you’ll” be switching to Samsung phones. Nope. Consume, consume, consume. Waste, waste, waste. It’s the “only way” our economy and GDP can “grow”.

It’s obvious, I think, that Israel’s impending invasion of Gaza, like Russia’s repeated invasion of Ukraine, will destabilize regional relations, domestic and international. We hear mostly about Israel, Lebanon and Iran, but Egypt has a huge role in maintaining Gaza as a giant internment camp and seemsto me extremely vulnerable to unrest in response to the situation in Gaza.

Egypt’s government is not popular. For most Middle Eastern governments, popularity is not the point. They aren’t popularly elected, after all. They are adept at dealing with dissent. The Arab Spring has come and gone.

Now, however, there is a new Mohamed Bouazizi, or rather two million Mohamed Bouazizis. Hamas may be ugly even to the average Egyptian, Jordanian or Saudi Arabian, but Egyptians have always felt a connection to Palestinians, and Egyptians’ falling standard of living may increase their sense of brotherhood with Gazans.

Hamas, meanwhile, is too anti-establishment for Sisi’s liking, and a step-child of the Muslim Brotherhood, too boot. So, on top of declining economic circumstances, Egyptians may now see themselves at odds with Sisi over Palestine. Why isn’t Rafa Gate open to Palestinians? Why isn’t Sisi putting pressure on Netanyahu over Palestinian deaths? Morsi wanted to treat Gaza like any other state, allowing trade, migration and travel. When Sisi deposed Morsi, all those ideas died; back to supporting internment of 2 million fellow Muslims.

Saudi Arabia, Jordan, the UAE, all face similar, though probably less strident demands from their populace to support Gazans and, for that matter, West Bank Palestinians. Iran will to use public disaffection over lack of support for Palestinians to cause trouble for majority Sunni governments. There is a bit of irony here, since Iran has of late been the poster child for oppressive, anti-democratic Middle Eastern regimes.

So while we rightly focus on the bleeding headlines about Gazans’ lcka of food, water and medicine, the hundreds dying daily from Israeli bombs, there is the potential for a far wder set of conflicts.

That Middle Eastern governments do not serve the interests of their citizens is a fact of life. It is also a critical weakness. Shocks like Covid, climate change and the willful slaughter of helpless Palestinians risk destabilizing the region. This is one more urgent reason to press Israel to seek a path other than the deaths of innocent Palestinians in its quest for revenge against Hamas.

Has Netanyahu translated this: Caedite eos. Novit enim Dominus qui sunt eius, yet?

https://econbrowser.com/archives/2023/10/guest-contribution-chinas-great-leap-backward#comment-306140

October 24, 2023

Xi! Xi! Xi! Hey Jonny boy – does — like your cheerleader miniskirt?

Xi! Xi! Xi! Hey Jonny boy – does — like your cheerleader miniskirt?

Xi! Xi! Xi! Hey Jonny boy – does — like your cheerleader miniskirt?

[ Please notice the crazily racist and sexist viciousness that persists even when I do not comment at all. The point is always to intimidate and use any possible form of prejudice in intimidating. ]

https://econbrowser.com/archives/2023/10/guest-contribution-chinas-great-leap-backward#comment-306124

October 24, 2023

Alas – this will likely be met with the usual worthless babble from —.

Alas – this will likely be met with the usual worthless babble from —.

Alas – this will likely be met with the usual worthless babble from —.

[ The point is always but always unconscionable intimidation. ]

https://www.bea.gov/news/2023/gross-domestic-product-third-quarter-2023-advance-estimate

Gross Domestic Product, Third Quarter 2023 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 4.9 percent in the third quarter of 2023 (table 1), according to the “advance” estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.1 percent.