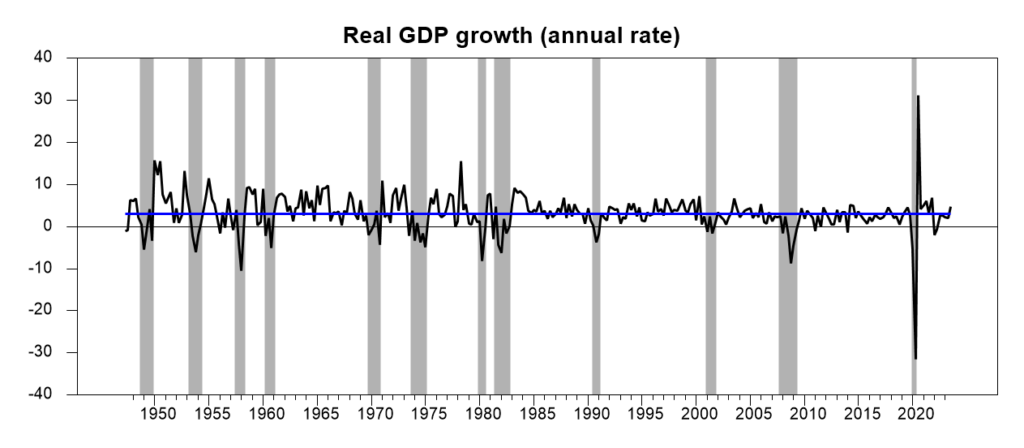

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 4.9% annual rate in the third quarter. That’s well above the U.S. historical average growth rate of 3.1%.

Real GDP growth at an annual rate, 1947:Q2-2023:Q3, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of GDP from the previous quarter.

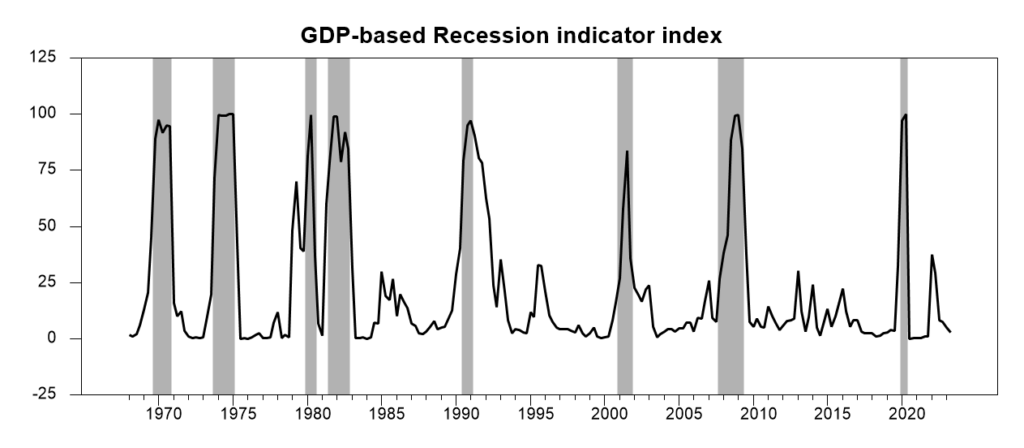

The new data put the Econbrowser recession indicator index at 3.0%. The current U.S. expansion has now continued for over three years, despite some rockiness a year ago.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2023:Q2 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

The drop in GDP last year and rapidly rising interest rates had led our Little Econ Watcher to get rather worried. Some concerns certainly remain, but he doesn’t seem to be feeling quite so glum right at the moment.

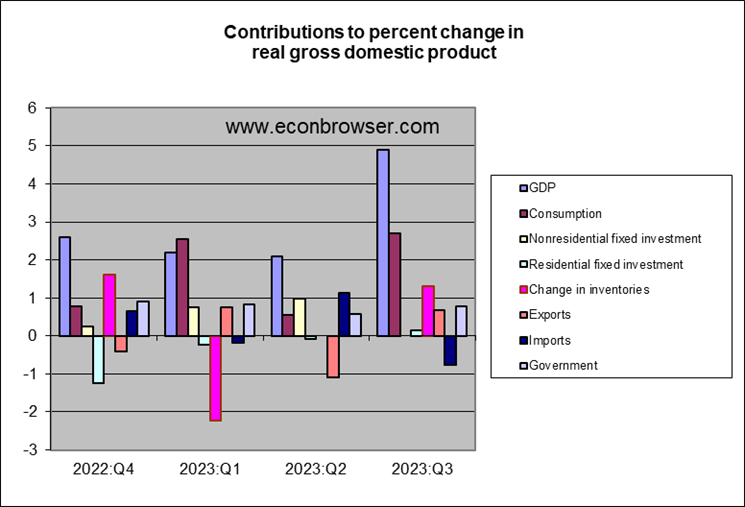

The biggest factor in the strong Q3 GDP growth was consumer spending, likely still supported in part by cash people accumulated from the

COVID stimulus packages. Another 1.3% of the 4.9% Q3 annual growth rate came from inventory accumulation. But even subtracting the change in inventories, real final sales grew faster than usual. Even residential fixed investment made a positive contribution, despite 30-year mortgage rates nearing 8%.

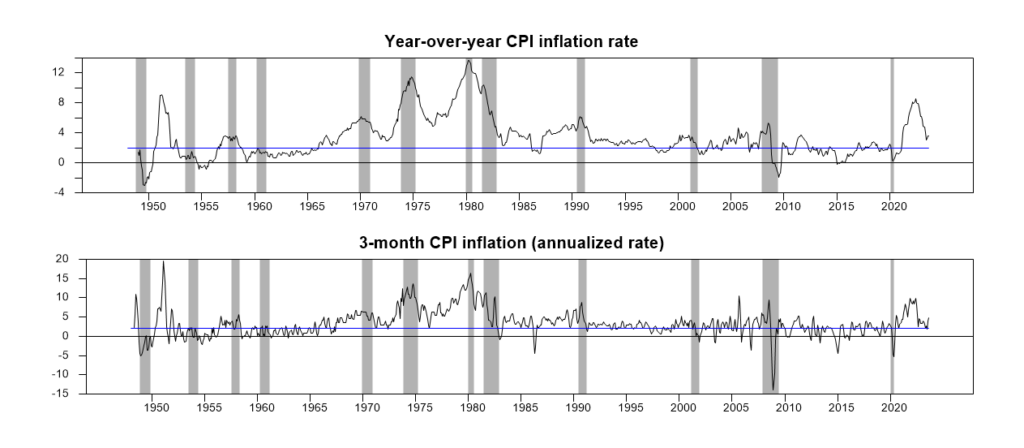

The Fed’s goal in raising rates was to slow the economy enough to bring inflation down. Inflation had been falling up until this summer. But it has been creeping back up since then, averaging 3.6% over the last 12 months.

Two measures of the annual inflation rate. Top panel: 100 times the year-over-year change in the natural logarithm of headline CPI Bottom panel: 400 times the 3-month change. Blue lines correspond to a 2% inflation rate.

That’s well above where the Fed wants inflation to be. Five percent GDP growth and 3.8% unemployment don’t sound like a recipe to bring inflation down. Is the Fed finished raising interest rates? Our Little Econ Watcher would like to know.

“Even residential fixed investment made a positive contribution, despite 30-year mortgage rates nearing 8%.”

Now before interest rate denier little Jonny boy goes crazy, let’s checks the facts. Yea – a very small increase from the previous quarter but this was after a massive decline since 2021QI.

https://fred.stlouisfed.org/series/PRFIC1

Real Private Residential Fixed Investment

“Five percent GDP growth and 3.8% unemployment don’t sound like a recipe to bring inflation down.”

Well what we standard macroeconomic types teach our students does sort of hold up for the real world after all! The very modest growth in 2022 did after all helped to bring down inflation.

Thank you President Biden – competence matters. However, I am concerned that this will make the Fed raise rates rather than lower them. A lot of business loans are adjustable one way or the other. The full effects of rate increases in that area takes 1-3 years to show up. We have barely begun seeing the effects of businesses facing rate increases from 3.5% to 8.5% when their loans reset or need to be renewed. That fugly is still hiding under the carpet.

The Fed is a worry, but…

Lately, the message has been “wait and see” and the rapid rise in long-term borrowing rates means the lagged effects of earlier rate hikes – along with the expectation that the Fed will maintain restrictive rates for a considerable period – are doing the work that rate hikes might otherwise do. In fact, priced-in expecations of the fed funds rate as of December 2024 are lower today than yesterday and a week ago. Treasury yields are down today, too. Apparently, market participants were not spooked by today’s data.

Speaking of the effect of borrowing costs on firms, there are two big issues. One is the cost of borrowing for investment. The other is the increase in interest payment on outstanding debt, as you note. We have evidence that increased borrowing costs have slowed investment. What’s the outlook for refinancing? The best I can do from my data-impoverished vantage point is give a vague impression.

Junk bonds outstanding are down $200 billion over the past two years. That doesn’t mean overall debt is down for junk-grade companies; they have replaced bond borrowing with private credit, and we don’t have much data on private debt roll-over.

That decline in outstanding junk bonds probably helps reduce roll-over needs, but roll-overs are rising, and are quite high in 2024. Junk issuers also carry a higher share of floating rate debt that do investment-grade issuers. That means junk-grade issuers are going to be refinancing at higher rates, bringing the effect of higher interest rates onto their balance sheets.

There is more investment-grade debt than junk in the U.S. Financial debt accounts for over 50% of all outstanding debt, and is mostly investment grade. Junk makes up about 47% of outstanding non-financial debt, perhaps less now. Investment-grade debt is at an all-time high, while junk bonds outstanding have shrunk, as noted.

Investment-grade issuers called a great many bonds during the period of low rates, refinancing at lower yields and long maturities. Out of $10.6 trillion in oustanding U.S. corporate debt, only something like $550 billion to $750 billion in roll-overs are due in the 2023-2027 period. I don’t follow this stuff closely anymore, but my impression is that investment-grade corporations have shielded themselves reasonably well from roll-over risk in the next few years.

I think it was NYT that covered commercial real estate on Manhattan. They are getting a one-two punch of less demand for office space and increased cost because of resetting lending rates. Not sure how big that problem is on a national scale – but it certainly is one of those effects of rate increases that takes a year or more to show up.

The vacancy rate at the end of September was 17.8%, which is quite high:

https://www.commercialedge.com/blog/national-office-report/#:~:text=Up%20120%20basis%20points%20year,for%201.6%25%20of%20existing%20stock

What has raised the vacancy rate recently is completion of new office space, quite a different story from earlier in the Covid era. As the text indicates, some areas, like Boston, are doing better than others, like San Francisco.

Here’s the picture of recent vacancy rates:

https://www.statista.com/statistics/194054/us-office-vacancy-rate-forecasts-from-2010/

In an earlier post Kevin Drum wrote:

The Atlanta Fed’s GDPNow model is currently predicting that Q3 GDP will come in at 5.4% growth (!). The New York Fed is at 2.5%. The “blue chip consensus” has converged on 3.5%.

His next post called the Atlanta FED GDPNow model the winner. Well something tells me that our favorite RECESSION CHEERLEADERS will be mocking the Atlanta FED for being overly optimistic. Forecast errors – ewww corporate shills!

https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&categories=survey#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDNdLCJkYXRhIjpbWyJjYXRlZ29yaWVzIiwiU3VydmV5Il0sWyJOSVBBX1RhYmxlX0xpc3QiLCI1Il1dfQ==

October 26, 2023

Defense spending was 56.3% of federal government consumption and investment in July through September 2023. *

$1,008.1 / $1,790.2 = 56.3%

Defense spending was 21.1% of all government consumption and investment in July through September 2023.

$1,008.1 / $4,774.5 = 21.1%

Defense spending was 3.6% of GDP in July through September 2023.

$1,008.1 / $27,623.5 = 3.6%

* Billions of dollars

Notice that defense spending this last quarter has passed the 1 trillion dollar level on an annual basis. Defense spending levels and increases have significantly bolstered the economy, and should be acknowledged by analysts in looking to the general economic effects of federal spending and incentives.

As for the general model I use:

https://fred.stlouisfed.org/graph/?g=AuPx

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2023

https://fred.stlouisfed.org/graph/?g=AuPM

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2023

(Indexed to 2020)

“Notice that defense spending this last quarter has passed the 1 trillion dollar level on an annual basis. Defense spending levels and increases have significantly bolstered the economy, and should be acknowledged by analysts in looking to the general economic effects of federal spending and incentives.”

In fact, defense spending has been a declining share of GDP since 1952, on trend:

https://fred.stlouisfed.org/series/A824RE1Q156NBEA

To say otherwise is either ignorant or dishonest. Given how often ltr posts links to economic data, it’s hard for her to credibly claim ignorance.

As the picture I link to clearly shows, defense spending is the lowest share of GDP on record in recent quarters. Since the whole point of ltr’s statement is to point out defense spending, and she made a highly misleading claim, we must question her motive. But then, we already know her motive. She is a shill for the Xi regime, and the Xi regime’s expansionist goals a threatened by U.S. military strength, so ltr agitates for lower U.S. defense spending at every opportunity.

By the way, in a recent comment, I noted that ltr’s sort of misleading claim could easily be checked by looking at shares of GDP. Here, she shows us a picture of shares of GDP, calling it her “model”, but leaves out military spending as a share of GDP. Duplicitous and clumsy – how quaint.

To say otherwise is either ignorant or dishonest. Given how often — posts links to economic data, it’s hard for her to credibly claim ignorance….

Since the whole point of —– statement is to point out defense spending, and she made a highly misleading claim, we must question her motive. But then, we already know her motive. She is a shill for the Xi regime, and the Xi regime’s expansionist goals a threatened by U.S. military strength, so — agitates for lower U.S. defense spending at every opportunity.

[ Notice the crazily vicious attack.

Always racism, always sexism, always intimidation. ]

Racism would be elevating Han Chinese interests over every other nationality and ethnic group, to the point of lying. Here, ltr has clearly lied about the U.S. economy, and now resorts to her tired old “racism and bullying” routine.

The only way to avoid accusations ofracism and bullying is to allow ltr to lie, unchallenged. This is the same ltr who has denied China’s enslavement of Uyghurs and claimed China is as “benign” regime on the same day that Chinese military vessels rammed Philippine supply vessels in an attempt to snatch Philippine territory.

ltr serves a hegemonic autocrat, one ofthe world’s great bullies and racists, while whimpering “bully” and “racist” at every turn.

Defense spending has declined as measured to GDP.

Per table 1 (line 24) todays release national defense investment and consumption expenditures is +8% yoy seasonally adjusted. DoD must have paid a lot of bills.

Defense spending in real $$ is roughly what is was when Reagan “rebuilt” the US military after the spending decline from Vietnam levels. The ‘peace dividend’ from the break up of the Soviet Union was reversed by G W Bush for the war on terror.

It is not lying measuring defense spending in terms of real $$.

You can go to Hoover to see how to complain about the pentagon losing share of GDP. Their claim is the US is defeated if it spends less than 7% of GDP as at the peak of Vietnam and cold war!

It is lying to claim, as ltr did, the defense spending has “significantly bolstered the economy” when it is a declining share of output.

You are also misrepresenting what ltr wrote when you write “in terms of real $$”. The term “real”, in economic parlance, means adjusted for inflation. ltr’ trillion dollar claim is in nominal dollars, not inflation-adjusted.

But thanks for playing.

You’re welcome.

“It is not lying measuring defense spending in terms of real $$.”

That is debatable: If you want to compare the defence spendings of two countries, real $$ are usually not the way to go, ppp is.

I compare war spending between countries in terms of GAO reports on how old, and low readiness US’ tactical air misses budgeted readiness for years while replacement fail testing and née upgrades.

ltr is sticking to her orders from Beijing, claiming that military spent has “significantly bolstered the economy”. Now, the bad “Anonymous” has joined in. I’ve linked to data showing military spending isa declining share of GDP. ltr, unable to refure the data, has ignored it and called me a racist, because that’s what she does when caught in a lie.

Well, for fun, here’s the same data in a slightly different presentation. This presentation is the contribution to GDP from military spending, exactly the notion ltr is employing with her claim of “bolstering growth”:

https://fred.stlouisfed.org/graph/?g=1aH1c

Uh oh… Military spending only added 0.01% to GDP in 2022 – one hundredth of one percent. In 2021, military spending was a 0.2% DRAG on growth. It was also a drag in every year from 2011 to 2016. Military spending has been a drag on growth in 7 of the past 11 years, and was just about zero last year. In only three ofthe past eleven years is there any truth to ltr’s claim.

That’s ltr’s “significantly bolstering growth”. Cold, hard data. No weasel room. She lied.

https://fred.stlouisfed.org/graph/?g=CYMB

January 30, 2018

Personal Saving as percent of Disposable Personal Income, 2017-2023

https://fred.stlouisfed.org/graph/?g=CYMD

January 30, 2018

Personal Saving as percent of Disposable Personal Income, 2017-2023

(Indexed to 2017)

This strong growth will certainly hearten Krugman and those hyping Biden’s economic record. Ruy Texeira has a different take: “The Fox News Fallacy is the idea that if Fox News (substitute here the conservative bête noire of your choice if you prefer) criticizes the Democrats for X then there must be absolutely nothing to X and the job of Democrats is to assert that loudly and often. The problem is that an issue is not necessarily completely invalid just because Fox News mentions it…

Consider these recent data on voters’ views of the economy.

In the new CNBC survey, Biden’s approval rating on the economy is an abysmal 32 percent with 63 percent disapproval. This includes some very low ratings among some groups Democrats plan to rely upon in 2024: Just 35 percent among young (18 to 34 year old) voters and among Latinos. And then there’s the working-class problem: 31 percent approval among high school graduates (or less), 34 percent among those with some college and only 32 percent among those who identify as either low income or working class…

Perhaps most alarming of all, among voters who currently say they are undecided between Biden and Trump for 2024, Biden approval rating on the economy is just 13 percent. 13 percent! That doesn’t bode well for moving these undecideds into Biden’s column…

It’s still the case that real hourly wages and weekly earnings are lower now than when Biden took office (though they’re comparable with pre-pandemic levels). The latest income data from the Census Bureau also show continued decline in real median household income in the first two years of the Biden administration, leaving it 4.7 percent lower than its pre-pandemic peak. In contrast, the pre-pandemic years of the Trump administration saw an increase of 10 percent in household income. ”

https://www.liberalpatriot.com/p/the-worst-fox-news-fallacy-of-them

Basically, the problem is that Democrats and their echo chamber of liberal economists largely ignore distribution. They cheer at the top number of 4.9% GDP growth and stop there, refusing to acknowledge that GDP growth is relatively good proxy for the rising incomes of the top 10%, but not of the majority of Americans, whose real weekly earnings have risen by less than 1% over the past three and one half years.

And so, Democrats tell the vast numbers of Americans who are not prospering like the top 10% to “don’t believe your lying eyes,” “happy days are here again,” “don’t worry – be happy”…and vote for Biden. Democrats would be better served by articulating a well thought-out, credible vision of common prosperity, but common prosperity reeks of being a Chinese communist value, anathema to true capitalists and to their stable of mainstream, liberal economists.

Ruy Teixeira is a Senior Fellow at the American Enterprise Institute and co-founder and politics editor of the Substack newsletter, The Liberal Patriot. His forthcoming book, with John B. Judis, is Where Have All the Democrats Gone?

The Liberal Patriot is a dishonest rightwing rag founded by this AEI troll. Jonny boy pretends to be a progressive but he quotes some of the most dishonest far right wing clowns.

Pgl is big on snarks, insults and innuendo, because he is utterly incapable of refuting or even addressing Teixera’s observations and conclusions. Unfortunately for pgl, Teixeira has great Democratic creds, having worked forEPI, for John Podesta at the Century Foundation and as co-chair of Obama’s transition team, among other progressive and liberal positions. https://en.wikipedia.org/wiki/Ruy_Teixeira

Leave it to Democratic partisan hacks like pgl to go low when confronted with inconvenient and uncomfortable truths..

“Basically, the problem is that Democrats and their echo chamber of liberal economists largely ignore distribution.”

Bush the lesser and a Republican-dominated Congress taxes for the rich mostly, but cut taxes a little for the rest to gain support for a tax cut which polling initially showed the public did not want. Obama and a Democratic Congress, faced with the sunsetting of those tax cuts, allowed the tax cuts for the rich to expire but kept the cuts for everybody else.

Reagan cut taxes, mostly for the rich. Then he raised taxes. Bush the greater raised taxes some more. Clinton raised taxes on the top 1.2% ofearners and imposed taxes on some federal benefits for the top quartile andexpanded the Earned Income Tax Credit.

So Johnny is lying about Democrats ignoring distribution.

Minimum wage increases, both federal and state, have mostly been passed by Democrats.

So Johnny is lying about Democrats ignoring distribution.

“Right to work” legislation has never been passed by a majority Democratic legislature.

So Johnny is lying about Democrats ignoring distribution.

“Prevailing wage” provisions in federal contracts have mostly been passed when Democrats hold the majority in Congress.

So Johnny is lying about Democrats ignoring distribution.

The fact that Johnny lies about policy and people and economics and foreign relations iswell established. Nothing new here. His Russian masters have a decided interest in getting Biden out of office. Putin could do pretty much whatever he wanted when Trump was President. Not so with Biden.

Everything Johnny has written is a sort of negative campaign ad against Biden and Democrats. This isn’t economics. It’s partisan blather, written to suit his masters. Same as everything else he writes.

“ The problem is that an issue is not necessarily completely invalid just because Fox News mentions it”

Since when?

Did Faux do a 360 when we weren’t looking?

Not even Fox News gets every issue wrong. David, you can count up to one, yes?? Given, two would be a challenge for you.

https://www.npr.org/sections/itsallpolitics/2012/11/07/164586847/video-an-awkward-moment-as-karl-rove-objects-to-foxs-ohio-call

https://www.foxnews.com/politics/biden-wins-presidency-trump-fox-news-projects

Hard to square this imaginative storytelling with actual data.

https://fred.stlouisfed.org/release/tables?rid=332&eid=47150&od=2020-04-01#

https://fred.stlouisfed.org/series/GCEC1

Real Government Consumption Expenditures and Gross Investment

OK we have had a few comments about the alleged rise in defense spending and a lot of BS from the MAGA Republicans about how Biden is spending us into bankruptcy. This series addresses the last intellectual garbage. Yes real government purchases are up from a year ago but notice how much they fell during the early part of Biden’s Presidency.

“ Defense Spending Boosts US Economy With Fastest Rise Since 2019.

https://www.msn.com/en-us/money/markets/defense-spending-boosts-us-economy-with-fastest-rise-since-2019/ar-AA1iTiFN

And that rise is in real, not nominal terms. But pgl, for some strange reason wants to portray that news from MSN as a MAGA conspiracy!!!

And does anyone recall how much Russia was derided for military Keynesianism when—lo and behold!—the U.S. is doing exactly the same thing?

And did anyone notice how Biden touted defense industry profiteering as a justification for additional defense spending?

(I wonder how much of that rise was allocated to assuring that DOD could finally pass an audit and keep track of its assets. My bet is zero…war is a racket!)

Dude – did you have trouble reading that graph in your own link? Let’s help Mr. Magoo out. It falls 5% in one quarter and then rises by less than 5% in the next quarter. Net change? Only a Village Moron like Jonny boy coul conclude this was a huge increase. But thanks for playing.

“Rising outlays to support Ukraine have helped revive the American war machine following a contraction in defense spending from late 2020 to early 2022.”

I’ve been noting how real defense spending fell by over 8% from 2020Q4 to 2022Q3 so I was wondering if this article was too stupid or too dishonest to note this. But the article (Jonny boy’s own link) made this clear statement. Did Jonny boy forget to read his own link again? How stupid.

Or did Jonny boy see this line but decided to not mention. After all Jonny boy excels at dishonesty.

You dispute Eisenhower’s military industrial complex speech of Jan 1961?

Won’t we be better off building schools and hospitals rather than paying for F-35’s that need all kinds of “upgrades”?

You’ve blatently misstated what pgl wrote. If that’s the best you’ve got, you’ve got nothing.

Tricky Ducky steps right in to defend his doppelgänger, Peppa Pigly! And right on cue! They even jump to the same accusation–accusing a commenter of misstatements, lies, etc. instead of trying to refute or counter the points that the accused made. Their puppet masters must be proud!

I see once again little Jonny boy could not be bothered to do the arithmetic. Oh wait – you flunked arithmetic. So let me help little Jonny boy out by calculating real defense spending all the way back to when Trump took office and now through the first 3.75 years of Biden’s term.

Under Trump real defense spending rose by 14.7%. Now we never heard little jonny boy chirping about that at all. But now little Jonny boy is trying to tell us Biden is the big spender here. Really?

Let’s see – real defense spending has declined by 3.7% under Biden. But little Jonny boy does not know that as little Jonny boy has the analytical skills of a retarded dog.

Instead of trying to refute…? When you have ignored my refutation of your lies, you are compounding your lie by clai.ing I haven’t refuted them.

I listed a number of policies, supported by Democrats and opposed by Republicans, which aim at narrowing income disparities. Johnny failed to refute what I have written, as is often the case. To distract from his inability to support his on claim, he offer the bald-faced lie that I haven’t tried to refute his claim. I have tried and succeeded.

Both Johnny and ltr have knee-jerk responses to being caught lying. ltr whimpers about bullying and racism, while Johnny claims that his antagonists behave as he does. He’s a shill for Russia, so anyone who disagrees with him must be a shill for bloody-minded capitalists. He can’t refute facts presented against him, so he claims others haven’t bothered to refute his claims.

If you read this blog to become better informed, ltr, Johnny and a few others are best ignored. If you come to have your own biases reinforced, by all means, read their comments.

Innocent by-standers should be aware that Johnny regularly resorts to claiming that others have

Hey Moron – the year is 2023 not the 1960’s. Duh!

Yeah I know.

Nothing in economics is the same as when us boomers were being raised.

Do you think all that real money going to DoD contracts is well spent, and could not represent opportunities missed?

https://www.fxstreet.com/news/us-treasury-secretary-yellen-rise-in-yields-reflects-a-strong-us-economy-202310261755

US Treasury Secretary Yellen: Rise in yields reflects a strong US economy

US Treasury Secretary Janet Yellen, stated on Thursday that she wouldn’t be surprised if the economy grows by 2.5% in 2023. Data released earlier showed that during the third quarter, the Gross Domestic Product expanded at an annualized rate of 4.9%, above the 4.2% of market consensus. During an interview with Bloomberg TV, Yellen said the economy is performing well, with strong consumer spending. However, she acknowledged that many Americans are concerned about the economy, noting that a significant portion of the population has not experienced meaningful income growth. Regarding yields, Yellen mentioned that the recent surge is not connected to deficits and does not indicate an impending recession. Instead, it reflects the strength of the US economy. When asked about the fiscal deficit, Yellen expressed that plans should keep the deficit manageable.

She as always is right. Bond yields up are reflecting a strong economy. Of course fiscal stimulus is part of the reason why the economy is strong.

Funny…Yellen is always right. And what did she note? That “ a significant portion of the population has not experienced meaningful income growth,” something that you’ll never catch any of the partisan hacks here…like Peppa Pgly and Tricky Ducky…willing to acknowledge. And Peppa Pgly even went so far as trashing Ruy Teixeira for detailing the same facts and their deleterious potential impact on Democrats’ prospects…don’t worry, be happy, vote Democratic!

Johnny is lying again. I’ve never said everyone’s income has improved. I’ve simply corrected Johnny when he has lied about income gains. Johnny’s job is to lie, to make things seem worse than they are, and to blame Democrats. I call him out, and he throws tantrums. Rinse and repeat..

Little Jonny boy decides to mock Dr. Yellen’s credentials when it comes to income distribution? Seriously?

I guess Mr. Know Nothing has not read her Yale dissertation which was supervised by James Tobin. FYI troll – it addressed the intersection of macroeconomics and the labor market. Or maybe little Jonny boy missed her work on the gender wage gap or her contributions to efficiency wage models.

Oh I’m sorry – I’m talking about economics. Something little Jonny boy never cared about.

Oh my goodness an increase in mean and/or median of an economic parameter covers populations of increase and populations of decrease. What an astounding insight – for a 5’th grade math chat. How about you go back there and post this kind of stuff. At this blog there is a presumption that everybody understands that 2+2=4 and gravity applies – nobody expects that such trivial basics need to be mentioned.

This is simply matter of fact, entirely correct and entirely relevant:

https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&categories=survey#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDNdLCJkYXRhIjpbWyJjYXRlZ29yaWVzIiwiU3VydmV5Il0sWyJOSVBBX1RhYmxlX0xpc3QiLCI1Il1dfQ==

October 26, 2023

Defense spending was 56.3% of federal government consumption and investment in July through September 2023. *

$1,008.1 / $1,790.2 = 56.3%

Defense spending was 21.1% of all government consumption and investment in July through September 2023.

$1,008.1 / $4,774.5 = 21.1%

Defense spending was 3.6% of GDP in July through September 2023.

$1,008.1 / $27,623.5 = 3.6%

* Billions of dollars

I should not be prejudicially attacked for this entirely correct post.

It wasn’t for this that I correctly called you a liar. And you clearly know it, since you’ve tried this bit ofcheap misdirection. I didn’t object to your parade of numbers. I called you a liar, rightly, for your claim that “Defense spending levels and increases have significantly bolstered the economy” when military spending is on a long-term downward trend as a share of GDP.

Here’s the picture again, since you ignored itthe first time:

https://fred.stlouisfed.org/series/A824RE1Q156NBEA

Go ahead, tell us this is a racist ratio. Go ahead.

https://econbrowser.com/archives/2023/10/strong-gdp-growth-and-consumer-spending#comment-306235

October 26, 2023

To say otherwise is either ignorant or dishonest. Given how often — posts links to economic data, it’s hard for her to credibly claim ignorance….

Since the whole point of —– statement is to point out defense spending, and she made a highly misleading claim, we must question her motive. But then, we already know her motive. She is a shill for the Xi regime, and the Xi regime’s expansionist goals a threatened by U.S. military strength, so — agitates for lower U.S. defense spending at every opportunity.

[ This person, who I have never ever addressed, has repeatedly horribly attacked me, calling me by animal names and far worse to frighten me. ]

You spread propaganda for a regime which engages in slavery, threatens its neighbor, denies rights to its own citizens. You accuse anyone who disagrees with you of racism, while you provide cover for one of the world’s most racist regimes. Anything I say about you is too mild for what you are.

Oh, come on. Anybody who is “frightened” by being called a shill for some large organization or another, especially one who repeatedly posts long, laudatory peans to that organization on the internet, has a serious problem and should probably just stay off the internet until it’s better. I also failed to note any racism or sexism in the use of the word “shill,” which was the only demeaning word in M-Duck’s comment.

You write this absurd stuff, but you seem to think most of us will seriously consider your ridiculous whinging instead of just saying “there goes ltr again…” and moving on to the next comment. Unless you get paid per comment, you’d be just as effective if you didn’t write it and spent your time doing something – anything – else.

The value of ltr comments have steadily declined. The only thing left is that it gives some idea of the Xi regimes misinformation approaches. Macroduck and others who comment, help create a “library” for countering the false narratives that are being spewed out of Chinese troll farms. I used to skim ltr postings now even that is to low yield to waste my time on.

Federal Government: National Defense Consumption Expenditures and Gross Investment

https://fred.stlouisfed.org/series/FDEFX

Can we have FRED help us call out the persistent lies from JohnH and ltr? This is nominal defense spending which fell during Biden’s first term. Remind me – haven’t we seen a rather significant rise in the price level of late?

OK the cumulative increase in nominal defense spending since Biden took office has been 11.3%. Hey Jonny boy – are you telling us the price level has not increased since then?

Come on people – at least try to appear to be credible as you lie 24/7.

Caveat the nominal DoD spending with the caution none of it passes any audit, GAAP or otherwise.

Some of the root causes includes certifying propriety of a delivery w/o meeting some or all of the product technical specs.

All DoD investment and consumption activity booked in GDP is bills paid in quarter for items delivered that do not pass audit review.

DoD has tried for a number of years to get a handle on military equipment valuation, acronym MEV.

To get near a clean audit.

As you read this – remember the NYPost is a right wing rag:

https://www.msn.com/en-us/news/world/biden-must-stop-using-defense-partnerships-as-an-excuse-to-cut-pentagon-spending/ar-AA1iR1HW

Biden must stop using defense partnerships as an excuse to cut Pentagon spending

I thought the MAGA hatters wanted to cut Federal spending. But NO according to these clowns – Biden is wrong to cut defense spending. Of course we have a couple of MAGA hatters (aka JohnH and lir) who think Biden has massively increased defense spending. The facts say otherwise but that never stopped these two liars.

Claudia Sahm, being her usual, wonderful self, has written a blog post about “potential growth” which is essential reading for anyone who wants to understand the thinking behind monetary policy, and how fragile the assumptions involved can be. Here’s a taste:

“The evolution in thinking after the Great Recession is also evident in the Summary of Economic Projections. In late 2011, the central tendency for long-term growth among FOMC members was 2.4 to 2.7 percent. By the end of 2019, that range had fallen to 1.8 to 2.0 percent. A swing that large within such a short period should caution against believing we know trend growth now. Of course, trying to quantify potential is a useful endeavor. Models and data back these estimates, but especially now, we should be cautious in using them to guide policymaking.”

I particularly like this bit because it confirms one of my own views, that Covid disruptions and the policy resposes to those disruptions mean extraordinary caution is necessary in assessing economic trends right now.

You’ll get some late 20th century economic history, some clear explanation of how things work, an assessment of what it is possible to know in economics without a fairly long historical perspective, and good writing.

By the way, I’d add one thing to the part about Greenspan’s growth experiment in the 1990s. Greenspan thought foster growth was worth a risk because it would build work skills and habits among those who might otherwise miss the opportunity, thereby raising long-term productivity and potential GDP. Powell should take note.

Well, I am not sure I can make sense of it all. 8% mortgage rates and house prices through the roof? No one can afford anything except prices say that luxury goods are in high demand. And blue collar labor hasn’t had it this good since the 1960s. At the same time, China seems to be withdrawing from global trade and that seems like it’s great for the US economy! I don’t get it.

I will, however, reiterate that the notion of suppressions vs recessions merits close thinking. Keep in mind that the Roaring ’20’s followed the Spanish Influenza. So maybe that’s the model.