On MarketPlace with Justin Ho, yesterday. I remarked that wage growth (on a 12 month basis) still outstripping inflation.

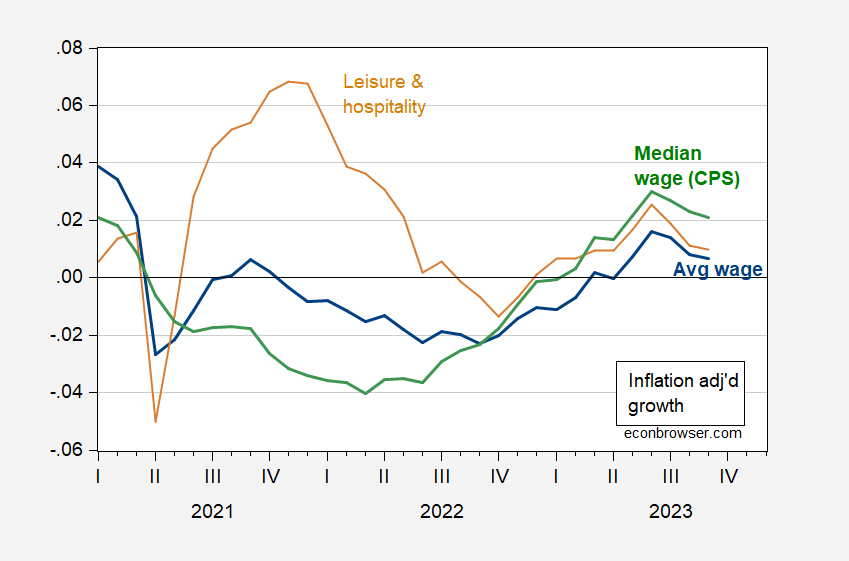

Figure 1: Year-on-Year growth rate of average hourly earnings for private sector production and nonsupervisory workers adjusted by CPI (blue), leisure and hospitality services (tan), median hourly earnings of all workers (green). Source: BLS, Atlanta Fed Wage Growth Tracker, and author’s calculations.

So, over the past year, wages are rising faster than consumer prices, although that is not true for a shorter horizon of three months. To the extent that wages are important for service prices, and services inflation has been more persistent than goods inflation, should we worry?

The October Atlanta Fed Business Inflation Expectations survey measure for unit costs (not quite the same as unit labor costs) over the next 12 months is 2.4%, down from 3.1% in March. The September NY Fed Survey of Consumer Expectations (median) is for 3.7% inflation. So while wage growth is likely to continue, it’s not clear the second round wage-price spiral is going to be a dominant factor.

“So, over the past year, wages are rising faster than consumer prices, although that is not true for a shorter horizon of three months.”

Which is why JohnH has been focused on the last 3 months rather than a longer period. But of course anyone who does otherwise has “moved the goal posts” which Jonny boy has placed on the 30 yard line.

So, First Amendment “no”, Second Amendment “everywhere, all the time”:

https://www.aljazeera.com/news/2023/10/25/florida-governor-ron-desantis-bans-pro-palestine-student-organisation

I guess freedom of speech is woke or something.

https://www.msn.com/en-us/news/politics/senate-voted-to-let-vets-with-mental-issues-keep-guns-hours-before-maine-shooting/ar-AA1iUFLq

So the Senate wants veterans with mental conditions to be allowed to carry military assault weapons. We need to vote the gun lobby out of Congress.

Wait! Isn’t the Senate Democratic controlled? So it is a Dem. desire?

Leave it to you to blame the Democrats and not the Republican Senators who pushed this. CoRev cannot be bothered to make a principled comment on this as little CoRev has no principles.

Florida Governor Ron DeSantis bans pro-Palestine student organisation

Grand Central Station was taken over by a group of Jewish Americans who have the decency to support the Palestinian cause. NYPD allowed this massive protest to go forward and nothing bad happened.

I’m trying to read up on the claim by DeSantis that Students for Justice in Palestine supports Hamas. The are 200 chapters of SJP on the campuses of schools in the US and Canada. One – just one – the chapter at Turfs praised Oct. 7.

This is what DeSantis has? One chapter out of 200? De Santis is such a pathetic little man.

Not that Ukraine matters anymore, what with Israel and a new House Speaker, but did anyone else notice Zelenskyy saying Russia’s Navy is leaving Crimea? Control of the Sevastopol naval base was a big reason for Russia’s invasion of Ukraine in 2014, so this seems like a big deal.

There has been some chit-chat about Turkey’s application of the Montreux Convention – preventing more Russian war ships from entering the Black Sea – having a role here, but that seems a bit of a formality to me. Ships are expensive. Turkey’s refusal to allow Russian ships into the kill zone looks to me like a great excuse for Russia to avoid more losses.

Anyhow, the claim seems credible, but I haven’t noticed it getting much attention in the press. Anybody have confirmation, or otherwise, of Zelenskyy’s claim?

Never mind on Russia’s Black Sea fleet. I slept through this one. It’s true Russia’s ships have abandoned Sevastopol:

https://www.theguardian.com/world/2023/oct/05/how-ukraine-reclaimed-black-sea-from-russian-forces?CMP=Share_iOSApp_Other

My usual source of detailed and reliable information about the war in Ukraine mentioned a number of Russian ships being withdrawn from Sevastopol

https://www.understandingwar.org/backgrounder/russian-offensive-campaign-assessment-october-4-2023

With the new ATACMS missiles and effective sea drones, it makes sense that Russia was forced to pull both ships and aircrafts further away. It appears that the first batch of ATACMS were used in a heavy surprise attack on an airfield in occupied areas and the Russians are now trying to move ships and aircrafts into Russian territory where Ukraine cannot reach them.

https://www.understandingwar.org/backgrounder/russian-offensive-campaign-assessment-october-17-2023

It seems pretty clear that Russia will not be able to block ships to and from Ukraine in the black sea. The risk to very expensive Navy vessels would be way too high. It is a very short distance from Ukraines most southern black sea harbors into NATO territorial waters where Russia cannot attack. They tried to destroy shipping facilities with missiles, but have given that up after air defense systems were installed.

Off topic, Russia’s central bank has raised its policy rate to 15%:

https://www.cnbc.com/2023/10/27/russia-hikes-key-rate-to-15percent-in-bigger-than-expected-rise.html

The bank cited both fiscal expansion to fund Russia’s war against Ukraine and a weakening currency as causes of inflationary pressure.

The initial defense of the currency in 2022 did manage to reverse losses, but as is common in these cases, the early emergency defense wore off and emergency-level rates are now the norm. Here’s the ruble:

https://tradingeconomics.com/usdrub:cur

With the policy rate now 15%, the central bank anticipates a rise in inflation from the current 6.4% to 7.0% -7.5% next year. Meanwhile, output isn’t doing so well, either:

“According to the World Bank, the International Monetary Fund (IMF) and the Organisation for Economic Cooperation and Development (OECD), 2022 was a bad year for the Russian economy. It is estimated that in 2022, Russia’s gross domestic product (GDP) dropped by 2.1%.

Russia’s economy may continue to shrink in 2023. Its GDP is forecast to decline by 2.5% in the worst-case scenario (OECD) or by 0.2% according to the World Bank. The IMF expects growth in 2023 (0.7%).”

https://www.consilium.europa.eu/en/infographics/impact-sanctions-russian-economy/

But remember, none of this could be happening, because “western economists” don’t understand Russia’s economy.

By the way, Russia accounts for only about 1% of global output, so this hardship for Russia’s populace isn’t much of a threat to global performance.

“With the policy rate now 15%, the central bank anticipates a rise in inflation from the current 6.4% to 7.0% -7.5% next year.”

Now if Nobel Prize winning Princeton Steve reads this, he will go off on how it is impossible for the Russian real interest rate to be anything above zero let also near 8%. After all this mix of fiscal stimulus and tight money never raised real interest rates before. And don’t you dare say this is what happened back in the early 1980’s under Saint Reagan as Stevie will slam you with his suppression thesis!

Before the invasion, a dollar could buy only 64 rubles. Now it can buy 94 rubles. Putin Pet Poodle JohnH must be happy that those dollars he took with him on this move to the Kremlin basement can afford more dog food!

For a war economy to shrink, the underlying economic activity must be very bad. All those weapons and ammo production are a huge stimulus. I guess Biden’s brilliant policies are having the predicted effects. Nothing like having a vice old guy as President instead of an old wrinkled pumpkin from mar-it-logo.

Off topic, Iran in context –

Indian Punchline has its own slant, and tends to pretend to knowledge of motives it doesn’t have. That said, the assertion that Iran is gaining traction seems valid:

https://www.indianpunchline.com/us-diplomacy-lost-traction-in-middle-east-isolating-iran-no-longer-possible/

Let’s remember, Trump’s emotion-based decision to ditch the Iran nuclear deal has set the course for everything that has happened since. Including the Hamas attack and Israel’s too-predictable response.

Trump is, however, pretty good at understanding the reaction of the public. Iran’s decision to stir up more trouble than ever is not a reason to have ended the nuclear deal, but it plays that way. Iran is a case in which sugar, not vinegar, was the right call. Now, it’s too late. Iran is happy to sacrifice Palestinians to its own goals, same as Israel.

https://www.msn.com/en-us/news/national/uaw-reaches-tentative-agreement-with-stellantis-to-end-strike/ar-AA1j0wiT?ocid=msedgdhp&pc=U531&cvid=3650a2d048bc4f9b9ae121a8d4eb7417&ei=8

UAW reaches tentative agreement with Stellantis to end strike

With the strike against Ford and Stellantis, it is time for GM to negotiate in good faith.

Business Inflation Expectations Remain Relatively Unchanged at 2.4 Percent – October 2023

JohnH used to tell us that business people are so much better at this than are households. But wait these smart people are telling us that they expect inflation to be at 2.4% which undermines Jonny boy’s usual unhinged rants on this topic. So wait for it – Jonny boy will soon be telling us why business people have no clue.

Part of Johnny’s game is the assumption that his actual target audience, non-specialists who read blog comments – simply won’t recall from one time to the next what he wrote. The point of his comments is not economic analysis or even advocacy for the little guy. Johnny’ assignment is to drive wedges, to moan and complain about the U.S. and provide cover for Putin. Coherence is not required. It almost seems that Johnny isn’t allowed to be coherent.

Cool news about the auto strike, by the way.

A couple links for my brother-from-another-mother:

https://www.ft.com/content/03c96c8e-596e-4a1e-a7b0-001815284c99

https://www.ft.com/content/d5644952-aa79-48d8-abd0-32686b18d354

Happy reading!!!!

Excellent charts! Thank you.

My only quibble is with the two-waves inflation story. “It happened in the 1970s” is all the rationale offered. What about the economy makes it likely to happen again?

Since every other chart is something we’ve discussed here, there is a certain “aren’t we clever” warmth that comes with seeing these charts.

By the way, I thought you were Uncle Moses. But I will say, if we’re related in two ways, well, I’m living in Tennessee and you live in Oklahoma, so it’s not that unusual.

Yeah, Tricky Ducky still thinks that my months harping on mainstream economists’ denial that Corporate America was a significant factor in driving price inflation was incoherent and misguided, even though it has become fairly widely accepted…at least by those economists whose positions do not depend on corporate largesse. Of course, Ducky probably still thinks that inflation was transitory, the dominant view of this echo chamber for quite some time.

And Tricky Ducky still thinks that reports wage stagnation, largely ignored here, is all a conspiracy dreamed up by evil forces, despite ample evidence from FRED that real wages have risen less than 1% since just before the pandemic. So instead of being an impartial observer who looks at the facts and accepts them, he insists on putting lipstick on the pig (and on the pgly), pushing the Democratic narrative that workers are prospering, and claims to be mystified at why they are not happy. And when I a link and a quote from a well-informed Democratic pollster, who worked for Clinton and Obama and who laid out the sources of worker discontent, it just goes over Ducky’s shallow, expert head!

Jonny boy still thinks profits were rising in 2022 I see. No dude – real compensation rose but real GDI was dragged down by declining profits. But of course your perfect record is solid as you get eveything wrong. Every single thing.

Heeeres Johnny!, pretending to know what I think as a way of diverting attention from his own tricks. Meanwhile, he’s proving my point, moaning about how bad things are, and lying in th process.

I have never claimed to be mystified by worker dissatisfaction – that’s simply another of Johnny’s lies. And, by the way, workers are prospering. Employment has risen very strongly, a fact which Johnny routinely ignores . And his ne-time favorite income measure which he no longer wants to talk about is rising steadily. Here are both measures over the last two years:

https://fred.stlouisfed.org/graph/?g=1aLq3

I went back to April 16, 2023 when little Jonny boy opened his babbling with:

‘JohnH

April 16, 2023 at 10:53 am

It’s laudable that the Atlanta Fed has taken the initiative to ask “business executives” about their inflation expectations.’

The Atlanta FED clearly started doing this back in Feb. 2014 but little Jonny boy thought his was a new effort. And OK – he does not think all executives are good at forecasting – just those finance managers. His evidence that finance managers are adept at forecasting inflation? He has none.

pgl just can’t get it right! I never said that business people are any better at forecasting inflation than households. In fact CEOs are just as clueless. But the finance folks, who oversee budgets and financial plans do have an interest in inflation, but for some strange rease, they aren’t usually asked. Better yet would be to ask the finance folks how much they plan to raise prices…which is part of any budget. Collecting data on Corporate America’s pricing plans would provide invaluable insights into future inflation, since it is Corporate America that sets prices, a basic fact that economists love to overlook…

Jonny boy even lies about what Jonny boy has said in the past. Dude – if you do not want to mock your serial stupidity, then never post another comment again. The world would be a better place.

https://fred.stlouisfed.org/series/DSPIC96

Oh yea – you tried to tell us that real disposable income has been falling this year. Another Jonny boy patented lie that Jonny boy is now denying. But you lie about so many things, it takes a program to keep up.

This is really getting tedious. Johnny keeps pretending that pgl is a corporate shill, that he knows what pgl thinks, clearly lying about both. Johnny doesn’t have a coherent economic story. He just wants to pretend things are worse than they are, and that Democrats are the villains in his made-up story about the betrayal of the working class.

pgl is a lefty. An economic lefty. A labor lefty. An anti-monopoly left. Clear as the nose on your face. Johnny simply lies about who pgl is, also clear as the nose on your face.

A lefty who exposes multinationals who shift profits to tax havens. Oh wait – I know how to read those 10K filings at http://www.sec.gov but little Jonny boy does not.

OK that makes me a corporate shill! My bad!

BTW I have my doubts that Jonny boy has ever worked in a real corporation since this moron has no clue what a CFO does. CFOs handle financing decisions such as debt v. equity. But Jonny boy thinks they set prices.

Oh wait – Jonny did work for a Fortune 200 company in the past – one he cannot name for some reason. I bet this company went bankrupt in part because the CEO was dumb enough to hire little Jonny boy.

“Collecting data on Corporate America’s pricing plans would provide invaluable insights into future inflation”

Macroduck exposed an organization that does that in the food sector. But wait – that encourages companies to collude and exploit oligopoly power. So little Jonny boy just told us he does not like price competition.

Hey Jonny – you are the corporate shill here. But we all knew that a long time ago.

Off topic, dictators –

Branko Milanovic has reviewed…:

https://branko2f7.substack.com/p/there-is-no-exit-for-dictators

…a paper by Kaushik Basu…:

https://academic.oup.com/ooec/article/doi/10.1093/ooec/odad002/7036634

…which gives a game-theoretical explanation for dictators’ reluctance to leave power. Basu argues that, in each period, the new crime needed to remain in power is preferable to the likely retribution for crimes committed in prior periods. Each period brings new crimes, each of which provides a new motive to remaining power. Each decision to remain in power requires yet more crimes. It’s a positive feedback loop.

Milanovic points out that, while Basu’s internal logic is good, it’s unlikely that most dictators ever consider leaving power. Power is reason enough to cling to power.

Neither Basu nor Milanovic mentions China’s Xi, but both offer reasonable explanations for Xi’s corruption of China’s post-Mao system of power transfer. Moises Naim, on the other hand, names both Xi and Putin as dictators who are clinging to power, with no exit in sight:

https://english.elpais.com/opinion/the-global-observer/2023-06-13/dictators-without-an-exit.html%3foutputType=amp

Basu’s is not the first effort to model dictator behavior. For instance:

https://www.sciencedirect.com/science/article/abs/pii/S0749597805001330

Notable, dictator games nearly always show a strong likelihood that dictators will cling to power.

There are a few exceptions to the rule. The emperor Diocletian and the Haitian dictator “Baby Doc” come to mind. The former retired to his villa by choice; the latter was “persuaded” to exit Haiti for a luxurious life in France. What makes the “Baby Doc” case so interesting is that he unexpectedly left the luxury of France for a godforsaken Haiti, where he surely must have known that his crimes would come back to haunt him.

Nixon tried to be a dictator but he failed. At least he had the Gerald Ford get out of jail for free card.

Look at Trump. His presidency dragged his crimes into the light, and so he committed more crimes in an attempt to stay in power.

All this “it’s just too dangerous to hold politicians to account for their crimes” whinging we’ve heard ignores the danger of not holding them to account. We cannot afford to become like Haiti or Uganda, much less like Russia or China.

This is what kills me about House Republicans. They keeping loaning the orange bastard power he doesn’t have. Engoron is setting a powerful example of how to treat donald trump~~like the infantile child that he is. If more Republicans had done this from the start (talking to YOU Liz Cheney, talking to YOU New York DAs/AGs) much of this could have and would have been avoided.

What’s his name from Uganda, too. He and Baby Doc both used escape hatches to get around the problem Basu outline.

This is a long, but very interesting, article on how the civil service exam system in China – usually displayed proudly as a meritocracy element – is destroying creativity and holding autocracy in place. It may be the ultimate reason why China will never develop up to the cutting edge of western societies. Maybe they will forever be doomed to be the “executors” of brilliant new cutting edge revolutionary ideas, never the producers?

“The Keju curriculum was formidable and required memorising close to 400,000 characters. Is there spare residual energy, capacity and curiosity left to pursue other mentally taxing activities, such as ideation of new thoughts, new politics, and discoveries of natural phenomena?”

We are unfortunately moving a little in the same authoritative direction – where memorizing enormous amounts of information is what gets you into the gateways of upwards mobility. However, we still have alternative pathways where the Bill Gate’s of our society can sit in a garage and sow the seeds of huge leaps forward.

https://aeon.co/essays/why-chinese-minds-still-bear-the-long-shadow-of-keju?ref=thebrowser.com

“…memorizing enormous amounts of information is what gets you into the gateways of upwards mobility”

Well, that and choosing the right parents.

Certainly some are born inside the gateways – but for the rest….

I was wondering why JohnH was ducking this post. Oh wait – Jonny boy kept lying over and over about how real wages were falling. But the facts prove otherwise. So Jonny boy decides to take a lame and irrelevant slander on Macroduck and Jonny boy also denies his previous comments on expected inflation.

I used to think no one lied more than Donald Trump but I was wrong. Jonny boy lies way more often than Trump.

Remember back when banks were falling over, Johnny pointed out that banks weren’t passing along higher rates to depositors? Now that he’s decided higher rates are irrelevant to economic performance, he tells us higher rates increase wealth. So confusing.

Jonny boy at the end of the day is a gold bug. Which is why he did not want the monetary stimulus after the start of the Great Recession. Jonny boy also praised Cameron’s fiscal austerity in the UK, which made kept aggregate demand too weak for too long contributing a massive decline in UK real wages. Oh yea – Jonny boy told us those real wages rose. Yea he lied about that over and over.

Jonny boy also told readers of Mark Thoma’s place that the gold standard and fixed exchange rates of the 19th century were great for economic performance. Never mind the fact that we had one massive recession after another. Jonny boy tried to deny that too.

If Jonny boy had his way Stephen Moore would head the Federal Reserve and we would go back on the gold standard.

“he tells us higher rates increase wealth.”

No need to be confused once one figures out two very basic things:

(1) For every financial asset held by one person, there is the corresponding financial liability issued by another person. So yea the first person may enjoy more income if the real interest rate is higher, but the second person has less net income. Now if Jonny boy does not know that – then he is the biggest moron of all time.

(2) If one holds real assets with a stream of expected cash flows, then the value of those real assets is reduced by a higher discount rate. This is the basic concept of Discounted Cash Flows. But then we cannot expect little Jonny boy to understand even the most basic financial economics.