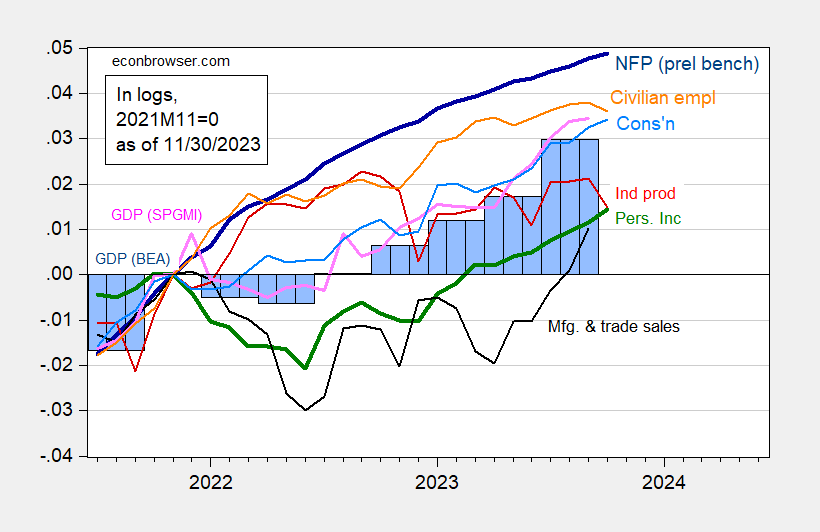

On the last day of the month, we see m/m personal income and consumption coming out at consensus. Here’s the picture of the key indicators followed by the NBER BCDC (of which personal income ex transfers and employment are key), along with SPGMI’s monthly GDP.

Figure 1: Nonfarm Payroll employment incorporating preliminary benchmark (bold dark blue), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP, 2nd release (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, BLS preliminary benchmark, Federal Reserve, BEA 2023Q3 2nd release incorporating comprehensive revisions, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (11/1/2023 release), and author’s calculations.

Latest indications are for continued growth in inflation adjusted personal income ex-current transfers, and consumption spending. When the income and nonfarm payroll trends (even after accounting for preliminary benchmark revision in employment) are taken together, it is hard to see how a recession has hit as of October.

GDPNow as of today is for 1.8% q/q SAAR. We should have a read on monthly GDP tomorrow.

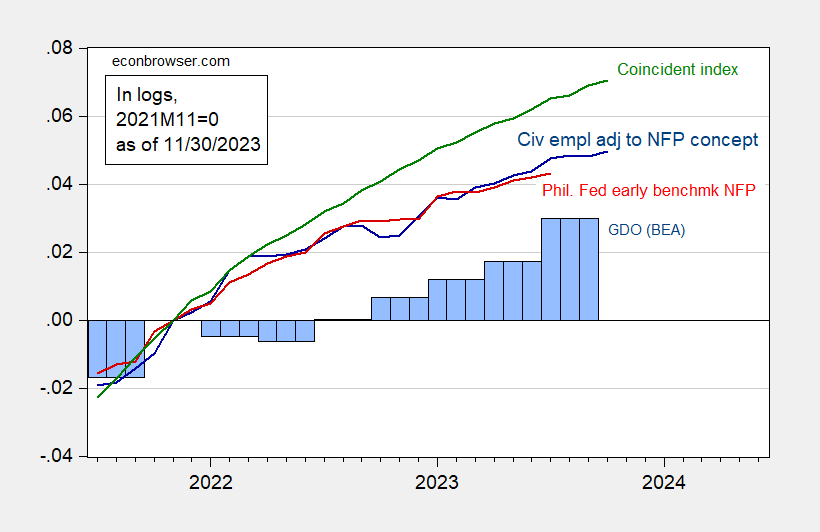

Note that the picture would look a little different using GDO.

Figure 2: Civilian employment from CPS adjusted to NFP concept (dark blue), Philadelphia Fed early benchmark measure of NFP (red), Philadelphia Fed coincident index for US (green), and GDO in bn.Ch.2017$ (blue bars), all log normalized to 2021M11=0. Source: BLS, Philadelphia Fed [1], [2], BEA 2023 Q3 2nd release, and author’s calculations.

While GDO registers slower growth than GDP (3.3% vs. 5.2%, q/q SAAR), all indicators (save industrial production) continue to rise through latest observations.

Another piece on offshore demand for U.S. Treasury debt:

https://www.wsj.com/finance/the-worlds-largest-buyer-of-u-s-debt-isnt-going-away-3b70afd3

Upshot: the biggest offshore holder – Japan – isn’t going anywhere. One thing to note, though. Some Japanese accounts are gigantic, and some make substantial changes to investment policy as frequently as yearly. That means in any go en quarter, it can sure feel like Japan has given up on Treasuries, even if it’s just one account adjusting duration or changing ots hedging strategy.

With interest-rate instability now a fact of life, and the U.S. generating a lot of debt, this issue won’t go away, and it shouldn’t. However, the political lens through which this issue is often seen has never proven the right one. Nor has the trader-mentality lens been of much use. Every portfolio has its own requirements, and attention to the requirements of the big ones is the best most of us can do to understand international demand for U.S. assets.

A healthy dose of Setser is a good idea before taking anything too seriously.

There’s no doubt that there has been an acceleration in growth this year that can be traced back to the peak in gas prices in June 2022.

As I see it, there have been 3 major contributors to this growth:

1. A 40% decline in gas prices, and a 10% decline in producer commodities generally, creates a gale force tailwind behind the economy.

2.An important part of this is the unlinking of supply chains post-pandemic. (Interestingly, one of the other biggest declines in commodities happened right after the far more deadly Spanish flu pandemic at the end of and after WW1).

3. Consumers spent down 1/3rd of their entire savings between May and September, driving the big Q3 GDP gain. It also helped that ex-shelter, both CPI and PCE inflation are now under 2%.

But, note that all 3 drivers are – ahem – transitory. Inflation ex-shelter bottomed in June, and has been bouncing around Uber 2% since. There are good (but not decisive) reasons to believe we *may* just be passing through a “soft landing.”

“Mfg and trade sales” recent upswing is a good sign. I think the big question for ’24 that I don’t see a lot of discussion about is whether manufacturing can pick up the slack as construction inevitably slumps

Quick question, y’all. How would Venezuela pay for a border war?

Maybe in oil if we stopped blocking their oil industry. But then their people wouldn’t be so poor and they would not need to get out of the country – and then there should be no need for a wall. It’s very complicated.

Oh, I mean a war with Guyana. Venezuela is having a referendum on snatching Guyanese territory, ’cause that’s democracy. And ’cause Guyana is currently the world’s fastest growing economy. Oil, don’t ya know.

Brazil has sent troops to their border near the area in question.

An interesting, though flawed, essay on the sources of wealth:

https://profstevekeen.substack.com/p/putting-energy-back-into-economics

Here’s a basic mistake in Keen’s thinking:

“Smith’s perspective was wrong, because he contemplated that the closed system of the economy could produce more outputs than inputs over time.”

Keen wrote this in response to the first sentence in “The Wealth of Nations”:

“THE annual labour of every nation is the fund which originally supplies it with all the necessaries and conveniences of life which it annually consumes…”

Keen says Smith is wrong because this statement violates the first law of thermodynamics – conservation of energy. Keen might just as well have cited Lavoisier’s Law of the Conservation of Matter, but his essay focuses on energy.

Keen’s mistake is to assume that Smith had in mind the substance of wealth, rather than its value to humans. Labor transforms matter through the use of energy. I suspect Keen has done what many essayists do – he has allowed his eagerness to frame his essay cleverly to keep him from thinking past the framing. His choice of energy over matter adds to my suspicion.

Anyhow, the rest of the essay is worth a read, if only for the use of Cobb-Douglas math. Just ignore the framing.

Oh, as to energy in production, which Keen insists has been ignored, I was taught that energy was part of the natural endowment, “land” for short. He is quite correct that it is left out of many production functions. If you want to work with two factors, you set land aside and think in terms of laborand capital. Look at any good I-O table, though, and energy is there.

Keen’s underlying point, that energy inputs are often taken for granted, is extremely important.

the annualized September construction spending estimate was just revised more than 0.9% higher, from $1,996.5 billion to $2,014.7 billion, while the annual rate of construction spending for August was revised more than 1.1% higher, from $1,988.3 billion to $2,010.1 billion. The combined upward revisions of $40.0 billion to annualized August and September construction spending figures would be averaged over the 3 months of the quarter and increase the annualized 3rd quarter construction figures by around $13.3 billion, before any inflation adjustment, which would suggest an upward revision of about 0.25 percentage points to the relevant components of third quarter GDP when the third estimate is released on December 21st…

So,, if the Israeli government had made proper use of available intelligence, the October 7 attack could have been short circuited:

“Israeli officials obtained Hamas’s battle plan for the Oct. 7 terrorist attack more than a year before it happened, documents, emails and interviews show. But Israeli military and intelligence officials dismissed the plan as aspirational, considering it too difficult for Hamas to carry out.”

https://www.nytimes.com/2023/11/30/world/middleeast/israel-hamas-attack-intelligence.html

No attack, no retaliation. So Gazans are dying due to Israel’s failure to make make good use of available intelligence.

Why, then, is Israel taking this approach to retaliation?::

https://www.972mag.com/mass-assassination-factory-israel-calculated-bombing-gaza/

One possibility comes to mind – Israel is intentionally killing civilians because a plan to target civilians was developed before October 7. No hand-wringing needed within the national security side of the Netanyahu government, because they had already agreed to something like what’s happening if the opportunity arose.

Just a guess.