As reported yesterday:

Source: EIA.

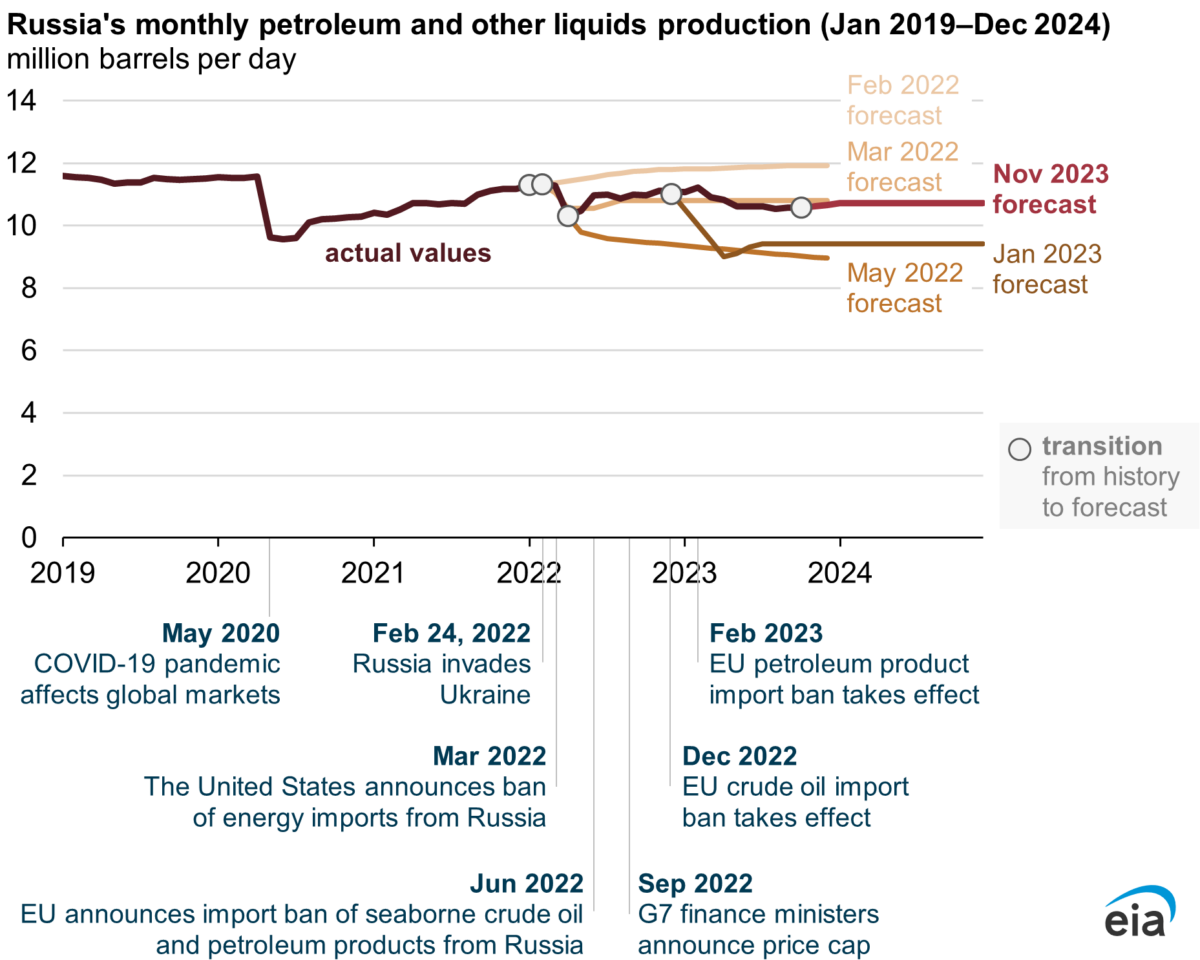

EIA also released yesterday an interesting analysis indicating that sanctions had reduced Russian oil production. No given quantity is expressed, but inferences are made on the basis of the difference between the February 2022 forecast, and actual outcomes.

Source: EIA (2023).

The impact of sanctions is also illustrated by the (continued) discount of Urals vs. Brent:

Source: TradingEconomics.com, accessed 11/8/2023.

The spread is about $11.50 latest.

We need more of this. Enforcement of the sanctions on Russia, even getting tough with our allies.

https://www.rferl.org/a/us-russia-sanctions-military-technology-turken/32667751.html

It’s a predicament, but at the end of the day they are either with America or they are against America, and they need to choose sides. American complacency to our friends throwing us under the bus for cheap oil gets us nowhere.

Gary Gensler (that’s Ashkenazi Irish for, “those who Gander at Geese” (don’t ask me man) , slumming around the worst part of town with some Georgetown lawyer. That’s weird man.

https://www.sec.gov/news/speech/gensler-fall-feelings-20231107

https://www.oxfordreference.com/display/10.1093/acref/9780190245115.001.0001/acref-9780190245115-e-27051

“The impact of sanctions is also illustrated by the (continued) discount of Urals vs. Brent:”

Memo to the most incompetent consultant ever – $11.50 may not be $20 but it ain’t zero either.

In addition, we have to remember that there are multiple competing interests at play. In the interest of switching away from hydrocarbons and save the planet from a climate catastrophe we need oil and natural gas prices to be as high as possible. However, we also want to deprive Russia, one of the worlds largest oil and natural gas producers of the revenue they use to fund their attack on Ukraine. Furthermore, a drastic increase in prices will not just help push us away from use of hydrocarbons but also hurt the economy in the short term. For the longer perspective we eventually want to deprive almost every hydrocarbon producing country of this revenue (there are a lot of hostile regimes that are living off our oil addiction) – and build an economy that is resistant to price swings in hydrocarbons.

Russia has been more able to evade the oil price restrictions than the natural gas restrictions. Europe has been remarkably fast in turning the Russian NG blackmail weapon against Russia and denying them large amounts of revenue. Pipeline NG is far cheaper than conversion to LNG and transport of LNG to end users. Both require substantial investments and time to build facilities. Europe is far along in closing up and never again needing any NG from Russia – and that will be forever. Even if combined cycle NG power plants with carbon capture becomes a clean and viable source of electricity in the medium term – there is little chance that Europe will allow Russia to become a main source of NG.

Reuters, Nov 7: “Oil revenues and tax payments shrink Russia’s budget gap in October…Russia’s budget deficit shrank further in October thanks to higher oil prices, a weak rouble and an inflow of quarterly tax payments, the finance ministry said on Tuesday.

The deficit for the first 10 months of the year stood at 1.24 trillion roubles ($13.45 billion), or 0.7% of gross domestic product (GDP), compared with 1.70 trillion roubles or 1% of GDP a month earlier.: https://www.reuters.com/markets/europe/oil-revenues-tax-payments-shrink-russias-budget-gap-october-2023-11-07/

Moscow Times, Oct 11, 2023: “Meanwhile, the IMF raised Russia’s 2023 growth forecast to 2.2%, up from the 1.5% growth it predicted in July, due to “a substantial fiscal stimulus, strong investment, and resilient consumption in the context of a tight labor market.” Russia’s Economic Development Ministry forecasts 2.8% GDP growth in 2023.” https://www.themoscowtimes.com/2023/10/11/imf-lowers-russias-2024-gdp-growth-forecast-a82724

It’s interesting how little this has been reported in the US. Apparently it’s not consistent with the messaging that Biden and Blinken want to convey,

Johnny has pulled ine of his usual tricks. He has asserted that there is little reporting if some issue, without evidence.

But even if it’s true that the IMF’s forecast for Russia has received little attention in the U.S. press, so what? Has the IMF’s forecast for South Africa, the Philippines, Ireland, Mexico or Egypt received more attention? Johnny is attempting to manufacture outrage, the same as faux news and the right-wing zealots and Dinald Trump.

Johnny has cherry-picked his economics, same as always. He’s a fraud and an apologist for Russian aggression, nothing more.

Let’s give little Jonny boy a wee bit of credit for:

Moscow Times, Oct 11, 2023: “Meanwhile, the IMF raised Russia’s 2023 growth forecast to 2.2%, up from the 1.5% growth it predicted in July, due to “a substantial fiscal stimulus, strong investment, and resilient consumption in the context of a tight labor market.”

Now I get trying to explain basic macroeconomics to Princeton Steve is an impossible task but maybe someone will tell this arrogant moron why this destroys his stupid abuse of the Taylor Rule.

Shocking – the economy is growing in a country at war. Nobody could have predicted that – unless they had taken Econ 101. Not sure why anyone in US would care about the exact speed at which Russia is wasting its resources. The brilliant leadership in the Biden White House understand that there is a strategic advantage to have Putin sink so slowly that he doesn’t realize it until he is in water up to his neck.

The Biden crew made no forecasts for Russia’s GDP. None – but I hear Blinken told his staff to steer clear of your stinky Putin mini skirt as it seems your panties smell.

“But a sharp increase in spending related to the war in Ukraine has forced the government to squeeze other areas of the budget such as healthcare and education. Defence spending will account for almost a third of total budget expenditure in 2024, according to draft plans published in September.”

This is from YOUR OWN link Jonny boy. Did you forget to read it again? What happened to your outrage over guns and butter? Oh that’s right – Putin’s crappy treatment of his own citizens pays for your dog food. Run along little pet poodle.

Matt Taibbi has a great piece about guns vs. butter…”Putin-Loving Bigots Must Stop Whining About Defense Spending and the Economy

And other deep thoughts, from the New York Times op-ed page…and specifically how “Krugman was once the columnist who most dependably argued that America could afford any amount of social spending. Now, as Covid-era assistance programs like SNAP benefits, child care tax credits, the CHAP housing assistance program wind down, his angle is we can afford more investment in “large-scale conventional warfare,” whose era “isn’t over after all.”

https://www.racket.news/p/putin-loving-bigots-must-stop-whining

Taibbi is spot on…”liberals” advocate lavishing ever more money on a “Defense” Department that can’t pass an audit because it can’t even keep track of most of their assets. Meanwhile they treat average American workers, whose real earnings are stagnating, with benign neglect, and then claim to be mystified at why so many voters, even increasing numbers of Blacks and Latinos, are indicating that they’ll vote for Trump or Kennedy.

With a candidate as corrupt and despicable as Trump, what does it say about how bad the alternative must be, when so many perceive Trump as the lesser of two evils? How bad does it have to get electorally for Democrats to start prioritizing voters’ needs over demands of the national security state and their obsession with being king of the mountain in an increasingly multi-polar world?

Hey Moron – the topic was Russia’s allocation of its GDP. Not what the US is doing. But Jonny boy wants to change the topic because Jonny boy is a lying moron without a single concern for the average Russian citizen.

If Matt Taibbi is suggesting Krugman ever endorsed higher defense spending, then is a disgusting little liar. Oh wait – Jonny boy is a disgusting little liar. No wonder Jonny boy cites Taibbi’s trash.

Tricky Ducky–the evidence is pretty clear…try doing an internet search on Russia’s fiscal deficit and growth and see how many hits you get. Compare that to the widespread, celebratory publicity about Russia’s fiscal deficit at the beginning of the year.

Just because Tricky Ducky keeps his head in the sand about how Russia and China’s woes get trumpeted while their successes get muted doesn’t mean that everyone is so oblivious. Tricky Ducky just doesn’t understand how propaganda works.

WTF? More Jonny boy gibberish as this retarded child goes whining to momma that the grown ups are being mean to him. You are a worthless disgusting POS.

Johnny, you try it. You’re the one making the assertion, with your head planted someplace far less pleasant than the sand.

‘Tricky Ducky just doesn’t understand how propaganda works.’

Yea – Jonny boy’s day job is spewing propaganda for Putin!

Jonny boy did search and he found some Matt Taibbi trash – not on Russian fiscal policy. No – this moron cited a dumb discussion of US fiscal policy. I guess little Jonny boy does not know the difference.

OK – I got bored with Jonny boy so I tried the Google:

https://www.ft.com/content/04bd3730-e8b4-40da-bc10-131843534504

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found at https://www.ft.com/tour.

https://www.ft.com/content/04bd3730-e8b4-40da-bc10-131843534504

Russia has added at least Rbs3.4tn ($37bn) to its budget for this year, further aggravating inflationary risks in an overheated economy and highlighting the ballooning cost of Vladimir Putin’s war in Ukraine.

The finance ministry expects spending to reach Rbs32.5tn in 2023, an increase of almost 12 per cent from the originally planned Rbs29.06tn, according to the latest official data.

The additional spending without a concurrent rise in expected revenues indicates how Putin’s war machine is consuming yet more funds, extending an inflationary spiral that officials admit creates macroeconomic risks for the country.

The increased spending comes despite promises from Russia’s president and other officials that the massive Rbs1.76tn deficit that the Kremlin ran in January was temporary.

Instead, Russia’s budget expenses for October increased by 29 per cent year on year, according to an estimate by Olga Belenkaya, the head of the macroeconomic analysis department at Moscow-based brokerage Finam.

Taking into account how much Russia has already spent, the expenses for November and December could amount to Rbs7.3tn-Rbs8.2tn, or about 23-25 per cent of annual expenses, Belenkaya added.

Without a concurrent rise in revenues, Russia’s deficit is set to increase to Rbs3tn, or 1.8 per cent of gross domestic product, compared to the “one and a bit per cent” deficit that finance minister Anton Siluanov predicted last month.

The new figures are still below the 2 per cent deficit that officials originally planned for this year. That indicates how revenues have recovered recently because of a narrowing of the Urals-Brent discount, a weaker rouble and changes in the taxation of oil exports.

But the budget top-up probably means that the Kremlin has added new, undisclosed spending before next year, when Russia is already planning enormous increases to the defence budget to fund the war.

“Shifting expenditures to the end of the year is a standard curse of the Russian budget system,” said Alexandra Prokopenko, a non-resident fellow at Carnegie Russia Eurasia, adding that this year the finance ministry has sought to solve that problem by moving most of the spending to the first quarter of 2023. But more top-ups were needed.

Imagine how much better the Russians would be doing if they packed up and went home, No more death and destruction of Ukrainians or of their own. Rather than crowing about oil , you should here be saying Russia could end this pointless, futile, wasteful invasion quickly.

That you won’t is obvious.

Oil? Yay, Russia!

Continuing deaths of Ukrainian civilians? Let’s negotiate!

Pathetic.

Exactly.

Well, that would be ideal. So you think Putin will take you up on the offer?

Like he would take up that stupid deal you thought was the cat’s meow?

About as likely as the Ukrainians negotiating the sale of land and believing if they do so, Putin will be forever satisfied and never again invade any other Ukrainian territory.

That is the argument Eisenhower made in Jan 1961 about the early US military industry complex.

As ltr points out, it remains the larger part of federal spending in GDP.

As well classical economists talk waste in that were built and never succeeded.

“As ltr points out, it remains the larger part of federal spending in GDP.”

Wrong dumbass as the transfer payments part of Federal spending are higher than defense spending. Take your worthless comments to some right wing blog where they might be appreciated.

Sometime, rarely, your ad hominem are funny.

What line in the GDP report is the “transfer payments part of Federal spending”.

[What line on Table 3 (26 Oct) or in which table do you refer?]

your ad hominem always deflect.

Some thoughts:

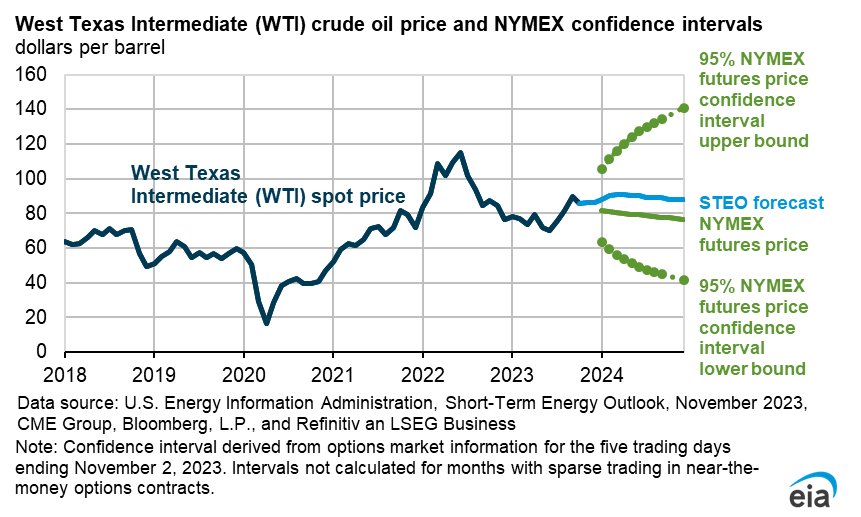

1. Don’t use the EIA for oil price forecasts, for reasons I have already noted. Use instead BoA, GS, JPM, or Standard Chartered, and check it against Citi for a slightly different perspective. That will give you a feel for what professional analysts are really thinking, including those at the EIA.

2. The Urals Discount noted above is not representative. Brent is recorded by US and UK trading systems and therefore is all but real-time. The Urals price is obtained through trader interviews, if I understand correctly. Therefore, the reported Urals price will ordinarily have a lag on Brent. If Brent changes up or down quickly, the Discount may appear to widen or narrow, when in fact it is only capturing reporting delays on Urals price.

3. The Urals Discount is narrowing at 4.75 cents / day if you run a simple linear regression from June or July and, on those trends, might be expected to disappear entirely by the end of 2024. This is, however, technical and not fundamental analysis, and I could — and have — made an argument that the Urals Discount could reach some theoretical minimum in the $6-9 / barrel range. We’ll see.

4. The ESPO discount will disappear entirely in Q1 2024 on current trends.

5. Russia’s monthly oil production is actually a version of a graph I publish every month, less my Black Market forecast from July 2022. The top STEO guys are on my distribution list. The EIA has revised Russia’s production up by 0.1 mbpd in the November STEO. What the EIA really needs now excess inventory analysis. That would help them check their forecasts.

You can find the related analyses here:

Russia Oil Production

https://www.princetonpolicy.com/ppa-blog/2023/11/9/russia-oil-production

Ruble +8% on US dollar, Ukraine support eroding

https://www.princetonpolicy.com/ppa-blog/2023/11/4/ruble-8-on-us-dollar-ukraine-support-eroding

And the Kyiv Post incorporates the note above into an op-ed

https://www.princetonpolicy.com/ppa-blog/2023/11/9/kyivs-pr-strategy-running-out-of-steam

As I have said before, that you have made some argument is irrelevant to to the facts.

And definitely use EIA forecasts, the same as you would use any other. Understand what your reading and use it. The advice to ignore well-founded forecasts, assuming one understands the foundation the forecast, is a recommendation to remain ignorant.

Pros do not use EIA price forecasts as they are not distinct from the futures curve. That is, if you want to use the futures curve as a price forecast, use it. No need to turn to the EIA.

Second, it is quite common, at times typical, that the EIA’s fundamental forecasts do not line up with their oil price forecasts.

For that reason, oil price forecasts from the major banks and consultancies can vary materially from those of the EIA, because the banks will forecast oil prices based on their fundamentals assessment. The EIA just uses the futures curve for STEO forecasts (although not necessarily for the IEO or AEO).

Professionals? Which professionals? And what are non-professionals to do? If I want a biased estimate, then your suggestion is OK, I suppose. But if I want an unbiased estimate, I want the futures curve, with an understanding of whether the curve is in backwardation or contango.

The idea that everyone is a “professional” in some relevant discipline, orthat all professionals have the same data needs, is silly.

Get over yourself.

I meant the analysts at the major banks and major consultancies like Rystad or Energy Aspects, among others.

Steve, I think Macroduck “has your number”. One of many reasons I feel like Macroduck is my half brother, and the better half of me has closer genetics to him.

Gee Stevie – you and little Jonny boy as singing the same tune here. Since Jonny is a Putin fan boy – I guess we can chalk you up as cheering on Putin’s war crimes.

Russia Oil Production

That has the be the worst labeled graph in the history of time. Then again it was drawn by the most incompetent consultant ever. OK I’ll take a shot – it seems you are noting Russian oil production has declined a lot. But who knows as your graph looks like it was drawn by a retarded dog.

Deficient reading skills. A theme here.

My reading skills are fine. Your chart is still a pathetic joke. Learn to provide clear labels. Oh wait – you are the world’s most incompetent consultant so never mind.

Read it again.

Steven Kopits

November 9, 2023 at 2:24 pm

Read it again.

Why? It was stupid the first time, the second time, and it is still stupid. Hey troll – you need to get something simple. Your writing sucks.

@CapeCodKopits

Yours is another donalod trump “theme”~~~accusing others of your worst crimes.

Can you, Kopits, please tell us all, what you SPECIFICALLY meant, and where the “reading error” was made?? PLease, very specific.

Actually I would prefer it if this moron did not pollute this blog even more.

You accusing some one of ‘deficient reading skills’ is hoot given that you do not know the difference between what Irving Fisher wrote in 1907 v. what John Taylor wrote in 1993.

Face it Stevie – you are utter dunce when it comes to even basic macroeconomics.

The Bank has stated that it is anticipating 7% inflation for 2023. This seems implausible. Russia’s central bank probably uses some version of the Taylor Rule, which would imply inflation in the 12-14% range for a 15% interest rate.

As we have noted over and over – you have no effing clue what you mean by the Taylor Rule. And you link to some Atlanta FED discussion? Hey moron – READ it. Not that you will understand it.

“The Urals Discount noted above is not representative.”

But little Stevie’s worthless blog posts reports on this discount. Go figure.

Once again, your reading skills are deficient.

I wrote “The Urals Discount noted above is not representative.” This spread noted above in Menzie’s post is “about $11.50”. The underlying discount should be about $13.30 / barrel. A decline to $11.50 would indicate a change of regime. Were Brent steady, this could certainly be possible. However, with Brent dropping like a stone in the last few days, this apparent compression to $11.50 is likely an artefact arising from timing differences between the reporting of Brent, in near real time, and Urals, reported after a few days.

If Brent steadies, we would expect the reported Urals discount to expand back to around that $13.30 range, less 4.75 cents per day.

Oh wait – so Dr. Chinn was understating the discount. And you claim the sanctions do not work? Damn your stupidity burns.

Yes, he was understating the discount, in all likelihood. Try reading the text before commenting.

Steven Kopits

November 9, 2023 at 2:24 pm

Dude – everytime I read your trash, I lose brain cells. Excuse me for not wanting to read your intellectual trash more than once.

News reports are saying the ruble has devalued but Stevie says it has appreciated. Gee – what does the data say:

https://markets.businessinsider.com/index/us-dollar-index

Yea – Stevie lied.

The ruble is trading at 92.2 / USD, and has been in this range for about a week.

A month ago, the ruble was trading around 100 / USD. So, yes, we can say the ruble has been appreciating against the dollar, and quite markedly.

A number of observers were calling for the collapse of the ruble in August. I demurred. Oil prices were rising, suggesting improving terms of trade for Russia. In addition, the BoR raised interest rates, first to 13% — which probably had a good deal to do with stabilizing the ruble — and now to 15%, mostly likely the result of higher inflation, just as the BoR has stated.

Lord you are dumb. Inflation affecting nominal exchange rates is generally considered a long term issue. Exchange rates are volatile responding to all sorts of news. Which mean that looking at the most recent week is not exactly a refutation of my first sentence.

How effing stupid are you anyway? Don’t answer that as we all know you are an utter moron.

The title of the piece is quite literally “Ruble +8% on US dollar…”

And if that’s not clear enough for you, here’s the text:

Ordinarily, high inflation should lead to currency devaluation, but in fact, the ruble has appreciated by 8% on the US dollar in just the last few weeks. This is in part due to rising Russian interest rates, but also attributable to the collapse of the Price Cap and Russia’s blended oil export price holding near $80 / barrel. Thus, Russia faces disparate trends, with elevated domestic inflation contrasting with substantially improving terms of trade internationally. I had stated earlier that I thought late summer hype about a collapsing ruble was likely overstated, and so it proved. Should Brent resume its rise, expect the ruble to appreciate further.

Once again, your reading skills are deficient.

I know what the title said. I know what you wrote. Both are dumber than rocks.

“Ordinarily, high inflation should lead to currency devaluation, but in fact, the ruble has appreciated by 8% on the US dollar in just the last few weeks.”

Oh brother. Stevie’s title seemed wrong but now I get it. Deep down in one of his patented worthless blogs, we see he is looking over the last couple of weeks ignoring the massive devaluation since the war started. And we accused JohnH of being dishonest this way!

Yes, if I chose the right beginning and ending date I can easily “prove” that in 2023 the stock market gained at an annual rate of 400%. That may fly with some Faux News audience members – but not with anybody else. By dishonest presentation and cherry-picking data to support his narratives, Steven just prove the opposite. Most adults understand what it means when someone have to sink that deep to find “support” – they are up the neck in shit.

Please see the graph “Ruble / US Exchange Rate and Index of Value”

You can see there the ruble / dollar exchange rate and relative appreciation / depreciation since December 2020, that is, two months before the start of the war.

https://www.princetonpolicy.com/ppa-blog/2023/11/4/ruble-8-on-us-dollar-ukraine-support-eroding

Dec 2021

Hey dumbass – we all can read reliable graphs of the exchange rate ala FRED. We do not need your incompetent graphing. And we all get your writing sucks so stop claiming we do not know to read. No – we can read quite well. You are the clown who excels in writing gibbersih.

Stevie has adopted a lot of JohnH’s tricks!

Off topic but I’m finally hearing what the GOP clowns said last night. Tim Scott claimed that 75% of voters support his idea to have a national ban on abortions after 15 weeks. WTF did he get this claim as it sounds incredibly off.

Now to Nikki Lightweight’s claim that Trump was the right President at the right time. Now she did say with the massive Federal debt we need someone else now. Excuse me Nikki but wasn’t Trump who ran up that debt.

Oh wait Nikki – was Trump right to give the Dobbs decision? After all you claim to be pro-woman (even if you support a Federal ban on abortions).

And come on Nikki – foreign policy was supposed to be your forte. Undermining NATO and cuddling up to Putin. Was Trump right to do that?

Yea I skipped last night’s clown show and I’m glad I did.

I have no intention of voting in the GOP primary – so that clown show didn’t get my attention either. The 75% is likely a number coming from a poll designed to pump up the narrative of a national 15 week ban as a compromise. They may have conducted it in a hot red state or selected respondents in some other way. Also possible he just pulled the number out of his ass and didn’t care about being able to cite a source, if asked.

The GOP is desperately trying to find a way out of its abortion predicament. The abortion (baby killing) narrative was a perfect tool to get low information voters to support the party of tax cuts for multi-millionaires. Unfortunately, those moron voters swallowed that narrative – bait, hook, line and sinker. They really do believe that God has defined life as beginning at conception (or first cardiomyocyte contraction) – so to them, abortions are murder. The base will likely see a compromise and allowing “murder” up to 15 weeks past conception as a betrayal. The relatively few abortion conducted after 15 weeks are either about the health of the woman, or about the ability of the fetus to develop into a viable human baby. The worst horror stories currently being collected from abortion ban states, are about cases past 15 weeks. So few pro choice voters will be impressed by a 15 weeks ban.

Trump openly admits he will use the DOJ against political enemies:

https://www.cnn.com/videos/politics/2023/11/10/donald-trump-weaponize-doj-univision-intv-cnntm-vpx.cnn

This would be a great piece for political advertisement against him. A lot of right and center right people are scared of government overreach.

https://jabberwocking.com/hollywood-strikes-are-all-over/

All the Hollywood strikes are over

SAG-AFTRA did not immediately disclose terms of the agreement, but the committee said the three-year contract was “valued at over $1 billion.” The details are expected to be released after SAG-AFTRA’s national board reviews the contract on Friday. The proposed contract — which also still must be ratified by the union’s members — boosts minimum pay for members, increases residual payments for shows streamed online and bolsters contributions to the union’s health and pension plans. It also establishes new rules for the use of artificial intelligence, a major source of concern for actors. SAG-AFTRA said it won “unprecedented provisions for consent and compensation that will protect members from the threat of AI.”

It’s funny how really smart people can also be humble. Here’s Claudia Sahm, recognizing that her recession rule can go awry, and may well in the messed-up Covid era:

https://www.bloomberg.com/opinion/articles/2023-11-07/one-highly-accurate-recession-indicator-could-be-wrong-this-time

Humility fosters rationality, and is why one might take Sahm seriously while ignoring chest-thumping consultants and outrage manufacturers.

Sahm quotes Julia Coronado’s observations about the increase in the labor force in explaining how the Sahm rule could go wrong. Here’s a picture of the labor force and payroll employment, showing that while employment gains have slowed recently (though still strong), growth in the labor force has accelerated:

https://fred.stlouisfed.org/graph/?g=1bbLc

(Note the two series are on different scales, for easier comparison. )

Here’s a picture of the Sahm rule alongside the change in payroll employment (inverted for clarity):

https://fred.stlouisfed.org/graph/?g=1bbNO

When the Sahm rule has in the past been as high as it is now, employment growth is typically much slower than has recently been the case. The unemployment rate nearly always begins to rise while job gains continue, due to the natural increase in participation, but job gains slow prior to recession. This time, both job growth and participation are rising strongly, not normally the case prior to recession, though job gains have slowed.

So Sahm’s point about this time being different is borne out in the data. She notes that labor market weakness tends to create a positive feedback, inducing additional weakness, which is what makes the Sahm rule work. Absent labor market weakness, it’s an open question whether it will work this time.

On the point about labor market weakness leading to more weakness, it is common for labor compensation gains to slow pretty dramatically early in recession. That’s a big part of the feedback mechanism. As of Q3, compensation growth is still healthy, so feedback is still stimulative to consumer spending and job gains.

I failed getting around the paywall, which is a little odd, because I had great luck going around the paywall lately. I have some tips on that, but I am afraid if I tell people then FT will close those up.

Good luck:

https://www.ft.com/content/3213f700-26a7-4d84-aca0-d7cc5bf11484

They had an interview recently with Sahm in FT as well. I will try to hunt down the link and put it nearby in this part of the blog thread. I really haven’t been a big fan of hers but lately I find my views of her softening slightly. Getting weak-minded in my middle age.

I’m in a very good mood today. It’s about 53 degrees outside (Autumn is my favorite time of year). And some Al-kee-haul near to the keyboard here. Certainly helps my general view of the world. No telling when “the dark side” here hits with some more slurping of the drinky here. But really feeling the blablabuhduhbuhduhbuhduh biological/physiological affects of the al-kee-haul chemicals in the bloodstream here. These things should just be permanently embedded in the blood at birth. Seems like some kind of “God Error”, er something. (joke)

And keep in mind that Claudia Sahm’s purpose in creating the recession indicator was not so she could win some economist pissing contest about being first (looking at you Larry Summers and fellow egotistical **sholes). Her purpose was to create a coincident indicator as a trigger for automatic stabilizers like extended unemployment and payments to households without the political risks of waiting for Congress to act.

https://jabberwocking.com/debate-roundup-trophies-for-all/

Kevin Drum covers last night debate so we don’t have to. For me the real howlers were the economic claims made by this cast of morons. But does Nikki Lightweight really want to invade Mexico as she bans all trade with China?

Joe Manchin announces he will not run for reelection. Happy days!

Not sure about that. He won the seat with 49.6% to 46.3% of the votes and mainly because he was proven very pro-coal. I am not sure that the Democrats can find a candidate who will be able to hold that Democratic Senate seat in this blood red state. With all the flaws that Manchin has, he is still better than any GOP senator.

I know very little about that region of the country (outside blasting through in a semi truck). But I have to say, very sincerely, that’s a very very very interesting question “Who is better, Manchin, or unknown “Candidate X”?? It;s a fascinating question.

“Devil you know vs…… “??

pgl: “Joe Manchin announces he will not run for reelection. Happy days!”

That’s pretty dumb. So you are happy that West Virginia will be handed over to a Republican, just about guaranteeing Republicans a Senate majority?

Trump won in West Virginia 69% to 30%, more than 2 to 1, the biggest margin in the entire US. It is a miracle that any Democrat won the Senate in West Virginia, yet Manchin was able to figure it out. Good luck for any other Democrat.

Yea – I figured I’d get hammered for this. My understanding is that Manchin realized he could not beat this Republican opponent so this seat may have been lost either way.

I am as pissed at Manchin as the next guy. But one narrative I have heard is that he fell on his sword when he backed Biden’s inflation reduction act. Although he did get some pork for his own state it also contained a lot of stuff that the GOP could attack him on. So he didn’t stand a chance of getting reelected. Any democrat who want to stand a chance would actually have to attack Manchin from the right – and still not have a chance unless GOP nominate a MAGA extremist.

Without immigration the US population will top next year and fall to 2/3 of that by year 2100. Tear down that wall !!!!!

https://www.calculatedriskblog.com/2023/11/census-us-population-projected-to-begin.html

By 2100, the total population in the middle series is projected to reach 366 million compared to the projection for the high-immigration scenario, which puts the population at 435 million. The population for the middle series increases to a peak at 370 million in 2080 and then begins to decline, dropping to 366 million in 2100. The high-immigration scenario increases every year and is projected to reach 435 million by 2100. The low-immigration scenario is projected to peak at around 346 million in 2043 and decline thereafter, dropping to 319 million in 2100. Though largely illustrative, the zero-immigration scenario projects that population declines would start in 2024 in the complete absence of foreign-born immigration. The population in this scenario is projected to be 226 million in 2100, roughly 107 million lower than the 2022 estimate. – Census

People like Trump and Princeton Steve advocate that zero immigration scenario. Fewer people means they do not have to deal with Asian, Muslims, or even Hispanics. And under another thread CoRev and Econned are blaming liberals for anti-Asian hate. Go figure.

PGL, why the need to lie? “And under another thread CoRev and Econned are blaming liberals for anti-Asian hate.” I never addressed Asian hate but, anti-Semiticism. Even in that thread you claimed I blamed Biden, even though his name was not mentioned. Not by me, at least.

Why this obvious need t lie t make a point?

https://tradingeconomics.com/russia/currency

Since February 1, 2022, the ruble has devalued by 25.6% in nominal terms with respect to the dollar. But Princeton Steve is trying to tell us that the ruble appreciated in real terms. Given the inflation rate for the US is not exactly negative, it would take an enormous increase in the Russian price level to justify little Stevie’s recent claim.

Oh wait Stevie is saying Russia is undergoing high inflation even though no index has been presented to verify this. Yea Stevie is confused by the data. But that’s not the real problem. Stevie never heard of Irving Fisher so the basic international Fisher equivalent is way beyond Stevie’s little brain.

How did I miss this?

Russian inflation is raging at 60%, not the reported 3.6%, thanks to the ruble’s ‘freefall’, top economist Steve Hanke say

https://markets.businessinsider.com/news/currencies/russia-economy-inflation-60-percent-falling-ruble-steve-hanke-2023-7

I might mock JohnH with this claim but then Princeton Steve could come back and gloat how he was right about Russian inflation. But wait – Steve Hanke? WTF would consider this clown a top economist?

Hanke got Argentina so right. How could he be wrong about this?

Is Russia so closed that it’s impossible to get spot checks on a basket of retail prices? We can’t expect much precision, but claims about order of magnitude should be easy enough to verify.

The point made in the article about import prices is true in the abstract, but my understanding is that imports are a far smaller share of consumer spending for the average Russian since the war began than prior to the war. Imports are luxury goods, mostly, and Russians have cut back on luxury.

https://markets.businessinsider.com/news/currencies/dollarization-only-way-out-of-argentinas-death-spiral-steve-hanke-2023-8

Dollarization is the only way for Argentina to stop its ‘death spiral’, economist Steve Hanke says

I saw this kind of stuff a while back and noted how dollarization was tried in Argentina over 30 years ago with chaotic results.

https://www.anderson.ucla.edu/faculty/sebastian.edwards/Debate.pdf

The great exchange rate debate after Argentina. Sebastian Edwards, 2002

I understand Hanke wrote something around 2002 but this paper is the classic discussion.

https://en.wikipedia.org/wiki/Historical_exchange_rates_of_Argentine_currency

Argentina’s various currencies with respect to the US$ dating back to 1914!

The 1992 dollarization put this exchange rate near 1 for a decade but the superfixed exchange rate was abandoned for good reason in 2002. A dollar can buy 367 pesos now.

Russian prices could be checked here, for instance:

https://www.selinawamucii.com/insights/prices/russia/

https://tradingeconomics.com/russia/inflation-cpi

Russian’s inflation rate has been rather high since January 2022 but the average inflation rate has not exceeded the 26% devaluation of the Russian ruble over this 22 month period. I would think this would be obvious to any one who even remotely understood the data.

But one of Princeton Steve’s recent worthless blog posts suggested that the ruble has appreciated in real terms. Well over the last week maybe but not over the past 22 years. Of course this economic Know Nothing is now accusing others of having a reading comprehension problem. No Stevie’s writing sucks almost as badly as his ability to do even the most elementary analysis.

War criminal Putin has failed in all his strategic goals in Ukraine. He failed to topple President Zelenskyy and he can’t dock his yacht in Crimea anymore because of long-range Storm Shadow missiles. He squats like a poisoned toad in burned out Donetsk and Zaporizhzhia sending his troops into “meat grinder” assaults and hoping the GOP-MAGAs and corrupt traitor and would be dictator Trump gets back in power. Meanwhile he has lost 300,000+ troops (at a current burn rate that may hit 500,000 next year) and lost 10,000s of various military equipment. He has caused the EU to switch to LNG and increase renewable energy use and lost his number one market for most valuable commodity NG – forever. https://www.eia.gov/analysis/studies/naturalgas/ And with 300,000+ dead and another estimated 1 million who have fled Russia to avoid conscription – the demographics and economy future for Russia looks even bleaker than it was (BTW- this is what the GOP calls smart leadership https://www.economist.com/europe/2023/03/04/russias-population-nightmare-is-going-to-get-even-worse ) Russia has dropped out of top ten GDPs and looks set to fall behind both Canada and Mexico next year https://en.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal) (Side note – Mexico’s economy is growing – why don’t we tear down our useless wall with them and allow more free travel and trade like we do with Canada? It would be beneficial to both countries.)