Today, we present a guest post written by David Papell and Ruxandra Prodan, Professor and Associate Instructional Professor of Economics at the University of Houston.

The Federal Open Market Committee (FOMC) maintained the target range for the federal funds rate (FFR) at 5.25 – 5.5 percent in its November 2023 meeting. While the September 2023 Summary of Economic Projections (SEP) projected a range between 5.5 and 5.75 percent by the end of 2023, it clear that the Committee will wait before deciding whether to end the rate hiking cycle or to have one more rate increase at a subsequent meeting.

There is widespread agreement that the Fed fell “behind the curve” by not raising rates when inflation rose in 2021, forcing it to play “catch-up” in 2022. “Behind the curve,” however, is meaningless without a measure of “on the curve.” In the latest version of our paper, “Policy Rules and Forward Guidance Following the Covid-19 Recession,” we use data from the SEP’s from September 2020 to June 2023 to compare policy rule prescriptions with actual and FOMC projections of the FFR. This provides a precise definition of “behind the curve” as the difference between the FFR prescribed by the policy rule and the actual or projected FFR. We analyze four policy rules that are relevant for the future path of the FFR in the post:

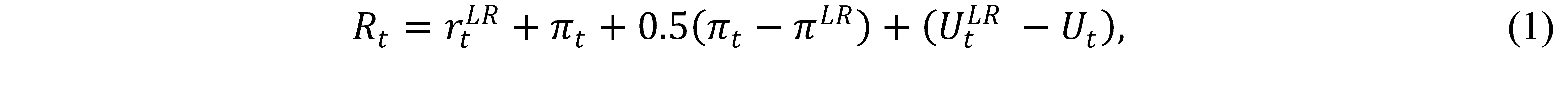

The Taylor (1993) rule with an unemployment gap is as follows,

where Rt is the level of the short-term federal funds interest rate prescribed by the rule, πt is the inflation rate, πLR is the 2 percent target level of inflation, ULRt is the 4 percent rate of unemployment in the longer run, Ut is the current unemployment rate, and rLRt is the ½ percent neutral real interest rate from the current SEP.

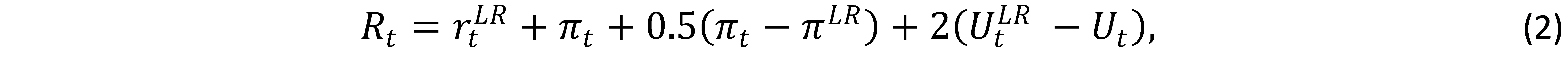

Yellen (2012) analyzed the balanced approach rule where the coefficient on the inflation gap is 0.5 but the coefficient on the unemployment gap is raised to 2.0.

The balanced approach rule received considerable attention following the Great Recession and became the standard policy rule used by the Fed.

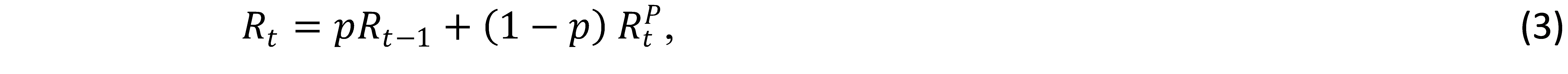

These rules are non-inertial because the FFR fully adjusts whenever the target FFR changes. This is not in accord with FOMC practice to smooth rate increases when inflation rises. We specify inertial versions of the rules based on Clarida, Gali, and Gertler (1999),

where p is the degree of inertia and is the target level of the federal funds rate prescribed by Equations (1) and (2). We set p as in Bernanke, Kiley, and Roberts (2019). Rt-1 equals the rate prescribed by the rule if it is positive and zero if the prescribed rate is negative.

Figure 1 depicts the midpoint for the target range of the FFR for September 2020 to September 2023 and the projected FFR for December 2023 to December 2026 from the September 2023 SEP. Following the exit from the ELB to 0.375 in March 2022, the FFR rose to 5.375 in September 2023 and is projected to rise to 5.625 in December 2023 before falling to 4.875 in December 2024, 3.875 in December 2025, and 2.875 in December 2026. The figure also depicts policy rule prescriptions. Between September 2020 and September 2023, we use real-time inflation and unemployment data that was available at the time of the FOMC meetings. Between December 2023 and December 2026, we use inflation and unemployment projections from the September 2023 SEP. The differences in the prescribed FFR’s between the inertial and non-inertial rules are much larger than those between the Taylor and balanced approach rules.

Figure 1. The Federal Funds Rate and Policy Rule Prescriptions. Panel A. Non-Inertial Rules

Policy rule prescriptions are reported in Panel A for the non-inertial Taylor and balanced approach rules. They are not in accord with the FOMC’s practice of smoothing rate increases when inflation rises. The prescriptions for the two rules are identical at the ELB through March 2021. The FOMC fell behind the curve starting in June 2021 when the prescribed FFR increased from the ELB of 0.125 to 2.625 for the Taylor rule and to 0.375 for the balanced approach rule while the actual FFR stayed at the ELB. The policy rule prescriptions sharply increased through 2021 and peaked in March 2022 to 7.875 for the Taylor rule and 8.125 for the balanced approach rule when the FFR first rose above the ELB to 0.375. The gap also peaked in March 2022 at 750 basis points for the Taylor rule and 775 basis points for the balanced approach rule. The gap narrowed considerably between March 2022 and September 2023 as the FFR rose from 0.375 to 5.375 while the Taylor rule prescriptions fell to 6.125 and the balanced approach rule prescriptions fell to 6.625. Looking forward, the gap between the FFR projections and the policy rule prescriptions reverses in December 2023 and the FFR projections are above the policy rule prescriptions through December 2026.

Figure 1. The Federal Funds Rate and Policy Rule Prescriptions. Panel B. Inertial Rules

Panel B reports the results for the inertial Taylor and balanced approach rules. They are much more in accord with the FOMC’s practice of raising the FFR slowly when inflation rises. The prescriptions for the two rules are identical at the ELB through March 2021 and rise to 0.375 for the Taylor rule in June 2021. The FOMC fell behind the curve starting in September 2021 when the prescribed FFR increased to 0.875 for the Taylor rule and 0.625 for the balanced approach rule while the actual FFR stayed at the ELB. The gap between the policy rule prescriptions and the FFR peaked in March 2022 at 200 basis points when the prescribed FFR was 2.325 for both rules while the FFR first rose above the ELB to 0.375.

The Fed is no longer behind the curve. The gap narrowed steadily and, in September 2023, the FFR was equal to the inertial balanced approach rule prescription and 25 basis points above the inertial Taylor rule prescription. As of the November 2023 meeting, it is unclear whether the FOMC will follow the prescriptions in the September 2023 SEP and raise the FFR to 5.625 or leave it unchanged at 5.375 at the December 2023 meeting. If the FOMC raises the FFR to 5.625, it will be 25 basis points above the balanced approach rule prescription and 50 basis points above the Taylor rule prescription. If the FOMC leaves the FFR unchanged at 5.375, it will be equal to the balanced approach rule prescription and 25 basis points above the Taylor rule prescription.

The inertial rules prescribe a much smoother path of rate increases from September 2021 through June 2023 than that adopted by the FOMC. If the Fed had followed the inertial Taylor or balanced approach rule instead of the FOMC’s forward guidance, it could have avoided the pattern of falling behind the curve, pivot, and getting back on track that characterized Fed policy during 2021 and 2022. Looking forward, the FFR projections from the September 2023 SEP are generally 25 basis points above the policy rule prescriptions through June 2025, equal to the policy rule prescriptions through March 2026, and 25 basis points below the policy rule prescriptions through December 2026. The current and projected FFR is in accord with prescriptions from inertial policy rules.

This post written by David Papell and Ruxandra Prodan.

A couple of questions…

1) This research relies on policy “rules” which are agnostic towards the degree of prior period over/undershooting of inflation. As such, how are the findings of this analysis impacted by the implications of the Committee’s stated regime of FAIT and related objective function when assessing the target rate of interbank lending?

2) Adhering, or not, to some rule does not seem adequate in assessing the proper stance of policy. And, of course, the level of the Fed funds rate (or any rate) is not a proper measure of the appropriateness of policy – regardless of how it may deviate from a rule. So why is this a focus? Why do we care about the fed funds deviation from a rule when assessing if the Committee is “behind the curve”? Is it true that “[a]pparently, old fallacies never die”?

@ Econned

Sorry, in this TV game show, all questions are to be posed in the form of a whiny toned statement. Your questions were utterly meaningless here. You want “Supermarket Sweep” on the Lifetime channel. Your goal will be to put as many diapers in the cart as you can, so you have some place to put your…… stool.

Krugman: “Why Did So Many Economists Get Disinflation Wrong?…

I do think it’s time for quite a few economists to engage in some soul-searching. (Yes, even economists have souls. Some of them, anyway.) I’m not necessarily asking for mea culpas similar to those issued by some of us who got the first phase of this inflation cycle wrong, although it would be nice. Instead, I’d like to see some hard thinking about how so many of my colleagues got this story so wrong, and maybe even a bit of introspection about their motivations.”

https://www.nytimes.com/2023/11/07/opinion/economists-disinflation-economy.html

In particular, it would be nice to know why so many economists rejected outright the possibility that Corporate America could be a driver of inflation? Yes, a bit of introspection and acknowledgement about motivations is in order.

“Yes, even economists have souls. Some of them, anyway.”

…….. said the pro-Russian, pro-murdering of women and children commenter. Then went back to knife stabbing his voodoo doll of Nelson Mandela.

Hilarious. It was Krugman who said “ Yes, even economists have souls. Some of them, anyway.”

But Moses apparently doesn’t understand quotation marks…or he dares not spew his bile on Krugnan.

Hilarious? Jonny boy thinks this is all funny? No Jonny boy – you a joke. Make that a pathetic joke.

“it would be nice to know why so many economists rejected outright the possibility that Corporate America could be a driver of inflation?”

So many rejected this outright? Name one liar. Also – maybe you should note that corporate profits have declined since 2022QII:

https://fred.stlouisfed.org/series/CP/

Sigh…though I posted umpteen times a link to this Chicago Booth survey, which found that that the vast majority of mainstream economist thought that corporations were not a significant factor in inflation, he chose to forget all about it…typical for a corporate shill who promptly forgets anything that puts Corporate America in a bad light. https://www.kentclarkcenter.org/surveys/inflation-market-power-and-price-controls/

The survey identifies each of the mainstream economists who denied Corporate America’s role in denying inflation.

Permit to repeat what the first economist said:

The US has a big business problem, with various pernicious effects. But it is not clear whether this has been a major factor in inflation.

I think this is right and it is not the intellectual garbage you spewed. Move on troll. You misrepresented what Krugman wrote. Which for you is par for the course.

‘I don’t see the logic: U.S. markets have been concentrating for decades but high inflation is < one year old.'

David Autor makes the important point many of us made. But Jonny boy could not answer this point. If you read the actual comments these economists made – they were generally on point and not the garbage Jonny boy spews. But hey – we get it. Jonny boy never learned to read.

Come on Jonny boy – we've been through this before. Trying READING your own damn links before you make such pathetically stupid comments.

Having read what Krugman really wrote – how did little Jonny boy get his message so wrong? Did little Jonny boy once again forget to read his own link? Well here is what Krugman said some economists got wrong:

The Brookings Papers on Economic Activity, a conference held twice a year, is America’s premier forum for relating academic research to “the most urgent economic challenges of the day.” The lead presentation at the September 2022 conference was a paper by Laurence Ball, Daniel Leigh and Prachi Mishra on inflation. And its conclusions were dismal. Harvard’s Jason Furman, one of the assigned discussants, wrote an opinion piece calling it “the scariest economics paper of 2022,” suggesting that to get inflation down to 2 percent “we may need to tolerate unemployment of 6.5 percent for two years.”

Not exactly the spin little Jonny boy gave to this.

True to form, pgl’s comment does absolutely nothing to refute my point that “many economists rejected outright the possibility that Corporate America could be a driver of inflation.” But he bleats anyway.

Let me repeat. You LIED about what Krugman was saying. Hey you lie about everything so hey!

Introspection about motivation is great.

So Johnny, what motivation do you have for routinely lying about the views of other commenters here?

What motivation do you have for lying about the research interests of economists?

What motivation do you have for supporting Russia’s war against Ukraine?

May I add one more question for little Jonny boy:

What motivation do you have for misrepresenting what Krugman wrote here?

Yadda…yadda…Tricky Ducky goes ballistic when I point out that mainstream economists failure to understand inflation become so blatant that even Krugman called it out.

What gives you the idea anyone here is waiting for what you point out about mainstream economists….or anything else? The lip imprints on your buttocks are yours.

That’s all you’ve got? You, who question the motivation of others, dodge questions about your own? Putin’s

brave little poser!

Johnny, what’s the point of your sleazy little game, now that everybody has you figured out?

“when I point out that mainstream economists failure to understand inflation become so blatant that even Krugman called it out.”

Krugman was calling out the dire implications that the three economists suggested in their Brookings Paper. I provided a link to it so you could read it but once again Jonny boy failed to do so. Let’s put this simply as we know you’re a moron. No where in what Krugman wrote or what that paper went over did your stupid little thesis ever comes up. For you to suggest Krugman’s oped backs up your trash only shows you are indeed a complete moron.

https://global.oup.com/us/companion.websites/9780190200886/student/chapter10/gline/quotation/

Think hard here and tell us idiot boy, where you forgot the quotation mark.

Folks…….. Andy Beshear won Kentucky tonight. The same state Mitch McConnell calls “home”.

Andy Beshear has been a very good governor.

I wonder if P&P might not take a shot at reverse engineering the Russian inflation rate. Russia’s central bank raised a key interest rate to 15% this past week. Assuming they are using a version of the Taylor Rule, what inflation might this imply for Russia, given that the Russian central bank has stated it expects 7% inflation for 2023.

The Taylor Rule? God you are a moron. Try Irving Fisher’s A Theory of Interest (1907).

what inflation might this imply for Russia, given that the Russian central bank has stated it expects 7% inflation for 2023.

Come on – your question is STUPID. Let’s do this SLOWLY since your IQ is in the single digits. A 15% nominal rate with 7% expected inflation near 7% translates into an 8% real rate.

Yea I get little Stevie believes that the Russian real rate has to be near zero. But we have been over this before. Military Keynesianism of this scale could easily raise the real rate this much.

Oh I’m sorry – I do real economics. Stevie only gets suppression BS.

Kopits, Sept 1, 2014, Obama then current President:

“So, I don’t understand your position. Are you for appeasement? How did that work out last time? So where’s your red line, Slugs? Ukraine? Belarus? Estonia? East Germany? When are you willing to put skin in the game? Personally, I am confident that Putin could be (have been) deterred. His stealth invasion tells us that. If you’re willing to fight a war you think you can win, you don’t need to send soldiers over the border in disguise. He did not want an open war with Europe. Now, he believes that the US and Europe have given him a green light to invade the rest of Ukraine, at a minimum. Do you think he really has a green light? Personally, I have my doubts. But he’ll be well past the intersection by the time the cop blows the whistle to stop him, having decided that, well, the light really should have been red all along.”

Kopits, March 5, 2022 Biden current President:

“I would again like to walk through my Russian proposals”

#3: A Generous Settlement

“In this version, the Russians retreat to their bases, with lines as they existed on February 1st. The Russians purchase the occupied territories of Donbas and Crimea for $625 bn ($25 bn x 25 years), which the Ukrainians sell in a voluntary transaction, thereby, ending territorial disputes and allowing normalization of relations between Russia and Ukraine / Europe. The current round of sanctions are lifted when a deal is reached and the first $25 bn payment is received by Kyiv. The remaining sanctions are lifted in stages over 36 months, such that no sanctions will be left after three years of the signing of the agreement. Ukraine will be formally neutral and will not enter into NATO during the period of the agreement subject to Russia acting in a non-threatening way (as the military defines this). Ukraine will have no nukes on its territory during this period. However, Ukraine can cooperate with and acquire non-nuclear weapons from any provider, including NATO countries during the agreement, and can enter the EU if mutually agreeable. Russian and Ukraine will have normal relations, eg, provision of water to Crimea under normal commercial terms, transit of gas, etc, etc. Russian minorities in Ukraine may be offered certain guarantees (eg, Russian language education, etc.) ”

Nothing like bi-polar whiplash diplomacy from the born with a silver spoon up his ass dunce.

Well, first I appreciate your research skills, Moses.

Second, I stand by every word I said. Entirely prescient.

Personally, I am confident that Putin could be (have been) deterred. His stealth invasion tells us that. If you’re willing to fight a war you think you can win, you don’t need to send soldiers over the border in disguise. He did not want an open war with Europe.

Clearly.

Now, he believes that the US and Europe have given him a green light to invade the rest of Ukraine, at a minimum.

And that’s exactly what happened. And I said it in 2014.

Do you think he really has a green light? Personally, I have my doubts. But he’ll be well past the intersection by the time the cop blows the whistle to stop him, having decided that, well, the light really should have been red all along.

Exactly correct. I believe that Putin would not have started this war if he knew how it was going to turn out. He thought he had a green light, and it turned out he didn’t. I have written a number of times about democracies sucker-punching dictators into invasion which are only resisted after the fact. The Galtieri effect.

So, yes, you can lay the war at Obama’s and Biden’s feet, if you care to do so.

As for a Generous Settlement.

That would have been absolutely fantastic compared to what has transpired. The Russians are now north of 300,000 ‘eliminated’, and Ukraine’s causalities are probably 100,000-150,000. The economic and human damage to Ukraine is comfortably $500 billion. And we are probably only half way through the war. Russian ‘eliminated’ will likely top 500,000 by the Ukrainian count, and Ukraine’s dead and permanently disabled could be half to two-thirds of that amount.

I appreciate that you think war is preferable to a financial settlement, but I categorically and flatly disagree with you. Both Russia and Ukraine would have been vastly better off had Crimean been sold to the Russians in a voluntary transaction.

“I appreciate that you think war is preferable to a financial settlement”

He did not say he preferred you disgusting POS. It was Putin who decided to engage in war crimes. And your claim that giving him money or whatever just shows what an arrogant MORON you really are.

“Both Russia and Ukraine would have been vastly better off had Crimean been sold to the Russians in a voluntary transaction.”

Giving up one’s land at the point of a gun is a voluntary transaction in little Stevie’s book? Hey Stevie is this a voluntary transaction?

Two thugs come over to Steve’s house this morning with one demanding to take all of his wife’s jewelry and the other insisting his wife jump in bed with thug 2. But as long as Stevie is allowed to eat his precious bagels, that was a voluntary transaction?

The Russians purchase the occupied territories of Donbas and Crimea for $625 bn ($25 bn x 25 years)

He really wrote this surrender monkey trash? Hey – maybe we can sell the PRC Cape Cod for a huge price if they don’t invade Taiwan. I’m sure little Stevie will not mind becoming a citizen of PRC-West.

A voluntary transaction is not surrender. It is exactly that, a voluntary transaction. I felt $625 bn, four times Ukraine’s pre-war GDP, would have been a fair price. But you can pick another value if you think it more appropriate.

Either way, the outcome we have today is vastly inferior for Ukraine, Russia and the rest of the world than the transaction I proposed.

Further, it is not at all clear that Ukraine can retake either Crimea or Donbas by force. If they can’t, then Ukraine would have been infinitely better off to resolve the matter for an acceptable price, we did for Alaska in 1867.

Stevie has counted up the cost of resistance, but left out the cost of capitulation. Inecinomics, this falls under “opportunity cost”.

Would Russia end hostilities toward Ukraine after a settlement is reached? Stevie doesn’t know that, and ignores the possibility that Russia would continue attacking Ukraine. Stevie has attempted to turn Russia’s 2014 to his rhetorical advantage, ignoring that Russia has repeated its grab for Ukrainian land.

Stevie’s calculus is simple wrong, leaving out anything that doesn’t suit his favored conclusion. Ukraine negotiated for a navy. Russia took it. Ukraine paid for Donna’s and Crimea, Russia took them. Ukraine handed over its nukes in return for a pledge of non-hostility. Russia ignored that pledge. Russia’s domestic politics has been driven by nationalist righties since before the war.

Stevie has smugly declares his correctness, without the slightest hint he knows what he’s talking about. Arrogance and ignorance, hand in glove.

I need to amend my previous comment on Stevie’s arrogant nonsense. What he wrote is actually worse than ignorant. I left out “naive”.

It’s naive, arrogant and ignorant, all mushed up into the sort of pablum that right-wing TV watchers lap up every night. The tone is just what the faux news producer ordered, a pseudo-religious certainty the allows no room for facts or ideas, a certainty utterly at odds with the simple-mindedness of the message.

I’m sure some dark corner of the right-wing echo chamber has a spot for Stevie’s self-congratulatory dreck, since it favors Putin while reducing the future of Ukraine to a unenforceable promise to be better next time. A promise from a man who has broken more promises than Stevie has made predictions.

It’s hard to say that any of Stevie’s strutting, nonsensical declarations of his own rightness is worse than all the rest, but surely none can be worse than this one.

It was always clear that Russia would be prepared to fight for Crimea. So your options were 1) a war or 2) a deal.

You think a war is superior to a deal. You thus believe that the Russians and Ukrainians are living in the best of all worlds. I do not.

And what happens if the Ukrainians are unable to retake Crimea? Will the million dead and crippled on both sides have been worth it? To you, surely. For me, no.

Kopits sees Putin as Don Vito Corleone making Zelensky “an offer he can’t refuse”? (Cue lawyer to fly to Kyiv to seal the deal?)

Ukraine could certainly refuse the offer. We can see the counter-factual. But the reality is that no one ever made the offer. Had the Russians, or any involved stakeholder, made the offer, I am guessing the G7 would have stepped up to encourage Kyiv to take it. To me, it would have been a far superior outcome to the current situation.

Again, you are positing a catastrophic war as the best of all worlds. What kind of person are you?

Steven Kopits: Have you ever heard of the term “Sudetenland”?

Kopits, you’re that naive? You believe that once Putin writes a check that he has no imperial ambition beyond Ukraine? That doing so would preclude another catastrophic war?

As the late Arte Johnson used to declare on the old Laugh In, “unbelieveagable!”

Yes, Hitler absorbed the Sudetenland. There was no purchase offer. Simple conquest. So what?

Have you ever heard of Alaska or the Louisiana territories? You may recall the US purchased both of those, the former from Russia.

Also, the U.S. also tried to buy Texas and what was called “Mexican California” from Mexico, which was seen as an insult by Mexico, before war broke out. Then the war broke out and the US took it by force.

I’d note that it took a World War and 1,000,000 US causalities to get the Sudetenland back.

In fact, here’s what I wrote, Feb. 12, 2022, 12 days before the start of the war:

Russia and Putin are facing the prospect of a lose-lose situation. If they fight and lose, Russia will suffer a historic setback. On the other hand, if Russia backs down, then its hold on Crimea may become increasingly precarious over time, particularly if Ukraine cozies up to the west. At best, the country would be stuck with a problematic status quo. At worst, Ukraine could leverage NATO support to put the squeeze on Moscow.

As a result, Putin finds himself in a situation in which he can neither advance nor retreat without cost, time may not be on his side, and the risks are hard to judge. For the moment, the Germans are dead at the switch, but what of the Biden administration?

Washington has demonstrated weakness in foreign policy, notably by allowing the US to be ignominiously chased out of Afghanistan by a ragtag Taliban at a time when the US was neither taking casualties nor incurring extravagant costs. If the Biden administration exhibits such passivity in Ukraine and NATO sits on the sidelines, then Putin can take Ukraine and perhaps even Belarus and restore most of imperial Russia. But should Washington decide to intervene, the calculus is entirely different. Putin must weigh the risks.

Biden should have been clear upfront: The US would not abide re-writing Europe’s borders in this fashion and would meet the Russians in the field. That might have prevented Putin from investing so much of his and Russia’s prestige into this perilous venture. However, it would not have addressed Russian concerns and, if the US is to veto Russian action, as the global hegemon, America is obligated to find some reasonable accommodation.

It is important to emphasize that the US interest is not anti-Russian or pro-Ukrainian, or vice versa. America’s and NATO’s interest is in stability, normalcy, and peace. The intent is not only to integrate Ukraine into Europe but also to integrate Russia as well, such that its people should enjoy a status similar to that of, say, Hungarians or Poles. Gradual, steady progress towards prosperity in both Russia and Ukraine is the western interest, just as it is the interest of the Russian and Ukrainian people.

Still, Russia’s status can only be normalized pursuant to a settlement of the status of Ukraine’s currently occupied lands. Russia will not give these back. It is a matter of national pride. The occupied lands may yet be lost in war, but no Russian leader—not Putin nor his successor—would willing cede Donbas and Crimea.

What then should be done?

Fortunately, title to property may be settled by means other than force. It may be purchased. The status of the occupied territories could be resolved with appropriate payment. A reasonable price might be set at 1-2% of Russia’s GDP for a quarter-century; call it $0.5 – $1.0 trillion over twenty-five years. This would still be vastly cheaper than an unsuccessful—or even successful—war in Ukraine and present far less risk.

The move would pay for itself with lower costs associated with holding Crimea and through enhanced trade between Russia, Ukraine, and Europe. It would allow Putin to claim a victory for a show of force and see a path back to a normalization of Russia’s status in Europe.

Ukrainians may not be elated, but the reality is this: If Putin does not start a war, there appears no feasible path for Ukraine to reconquer the occupied territories. Neither the US nor NATO will underwrite such a venture. Meanwhile, Russia’s control over these territories will tend to create a fait accompli over decades, if not years. At some point, European leaders will tire of the whole matter and concede Russian hegemony over contested territories.

Therefore, unless one is wildly optimistic about prospects for the re-conquest of occupied territories, Ukraine’s interest is to put a dollar value on the land and take the money. Ukraine’s GDP totals $160 bn/year, a little more than 10% that of Russia. An annual payment of $25 billion from Russia would amount to 16% of Ukraine’s GDP, and resolving the conflict should boost GDP by as much again. Thus, ceding Crimea and other negotiated lands to Russia should boost Ukrainian GDP by perhaps one-third. This would not be a bad deal for Ukraine, all things considered.

Further, for the next quarter-century, ceding occupied lands to Russia through an agreement could be leveraged both to protect Ukrainian sovereignty and Finlandize Ukraine, subject to acceptable behavior from Moscow. That would provide plenty of time for the various parties to become accustomed to the new status quo.

For Russians, such a deal would mean tempering ambitions for reunifying Greater Russia, while Ukrainians would have to accept compensation for territorial losses. It would not be everything, but it is certainly far better than the potential disaster of a European war.

American and NATO interests dictate that the dispute between Ukraine and Russia be settled on reasonable, financial terms rather than through force. Our diplomacy should be geared to support that outcome.

I have not changed my view. But the hopes expressed therein have come to tragedy. There is no road back to Europe for the Russians, I think, for a very long time. Would a financial deal have been the preferred outcome? Of course, unless you think this war is the best of all possible worlds.

https://www.americanthinker.com/articles/2022/02/it_is_possible_for_putin_to_get_crimea_without_force.html

As for the naive part. That depends on the structuring.

If title to Crimea is transferred upon the final payment 25 years down the line, then no, I don’t think Putin would invade. He might reject the deal outright, but then you’re no worse off than with no deal at all and back to where we are now.

On the other hand, if Putin has to wait 25 years for title and is ponying up $25 bn per year, he’s not going to screw up that transaction. He’d just be giving Ukraine a boatload of cash to buy arms against which he’d have to fight later and not receive title to Ukraine because he violated the terms of the agreement.

I saw Menzie use the term Sudetenland (OK, yeah, technically a German word, but we use it sometimes here in weird USA), And I know Professor Chinn was born in America and Menzie is as American as they get. But I keep wonderin’ when white guys like me will learn to use the language as masterfully as Menzie. (No sarcasm).

File this under the file folder “Dumb white guy dreaming”

“Have you ever heard of Alaska or the Louisiana territories? You may recall the US purchased both of those, the former from Russia.”

Seriously Stevie? The Louisiana territories were never owned by Russia. Try France. And we were not threatening to invade France at the time. Or Russia.

Dude – you are a moron. No need to remind us so damn often.

@CapeCodKopits

Gosh, is this a question…… from you?!?!?!? We thought you were going to supply the answers to all the more difficult dilemmas. Or is your “rudder” for Russian “insider information” now lost since your dear defender of Shenandoah Valley passed away?? Baaaaaahahahahaahhaha!!!!!!

Your admirer of Shenandoah Valley said “Well, Kopits really does know a lot about oil”. I’m still looking for the proof, in that you have no idea where oil prices are going, even when outside events are assisting you.

Who or what is Shenandoah Valley?

Are you sure you didn’t get all of your education in Hungary?? I’ll explain to you American Geography 101 if you can tell me how the term Eurotrash originated.

Barkley Rosser while teaching lived in the Valley.

RIP

I am sure he was a great person and his wife and family, and colleagues are still hurting. Our personalities just “clashed”. It’s common.

Here you go moron:

https://shenandoahvalley.org/

Western part of Virginia which is where you might want to go when the citizens of Cape Cod finally kick you out.

Is there any evidence that Russia’s central bank has followed a Taylor rule during the period of the Ukraine war? Or since the 2014 nvasion of Ukraine, which is nearly coincident with Nabiullina’s tenure as head of the bank?

If there is no evidence of reliance on a Taylor rule, then we won’t learn much about Russia’s inflation rate from writing down a Russian Taylor rule. This paper found that a Taylor rule provided a good description of Russian central bank behavior prior to 2015, but not during the period of economic turmoil after the 2014 invasion of Ukraine:

https://www.sciencedirect.com/science/article/pii/S2405473917300594

Russia’s central bank adopted inflation targeting in 2015 and the current (2022-2024) operational plan is to target inflation. To the extent that inflation targeting involves a forecast (7%) rather than a realized inflation gap as do conventional Taylor rules, the Russian central bank does not follow an explicit Taylor rule.

So calculate away, but don’t expect to discover some impoved estimate of the actual inflation rate.

I have to wonder if little Stevie even knows what the Taylor Rule even is. Maybe he can write a blog post on it which the world can read and fall on the floor laughing at how utterly stupid his post is.

One cannot specify a Taylor Rule without some measure of the Natural Rate of Interest. OK Stevie has no clue what I just said so here goes:

https://www.federalreserve.gov/econres/notes/feds-notes/measuring-the-natural-rate-of-interest-the-role-of-inflation-expectations-20200619.html

June 19, 2020

Measuring the Natural Rate of Interest: The Role of Inflation Expectations

David Lopez-Salido, Gerardo Sanz-Maldonado, Carly Schippits, and Min Wei

Introduction and Motivation

The “natural” or equilibrium real rate of interest is an important concept in macroeconomics. On the one hand, the natural (real) rate provides a description of the real interest rate path consistent with the eventual full capacity of utilization of available resources in the context of low and stable inflation. On the other hand, the natural rate is also an important “reference” for monetary policy, since it is a key determinant of a variety of simple policy rules that are often used to characterize monetary policy.

In an important contribution to the literature, Laubach and Williams (2003, henceforth LW) and Holston, Laubach, and Williams (2017, henceforth HLW) use a simple aggregate demand and aggregate supply model of the economy to estimate the natural rate of interest in the U.S. over the past 60 years.

***

I’ll stop here and leave it to the informed adults to read the rest of this article. But seriously – does little Stevie think the natural rate of interest in Russia in 2023 is the same as the natural rate of interest when this article was written?

Nothing like Fed gossip for giggles:

https://www.ft.com/content/d71673a2-ce56-40c5-a8c3-31384c2731f7

https://www.federalreserve.gov/monetarypolicy/files/FOMC20131016confcall.pdf

OK – it seems our Village Moron Princeton Steve has not read this important paper yet but let me call attention to the real natural rate for the US since 1960. Notice has this rate spikes during periods when the US runs military Keynesianism (Vietnam war. Iraq war, and yes Reagan’s fiscal stimulus).

Russia’s fiscal policy now is similar. But little Stevie cannot imagine the Russian real rate rising above 2%. Yea little Stevie is dumber than a rock.

This is interesting paper that talks about the challenges of replicating what Taylor was suggesting for the US as applied to a developing nation such as Russia. The paper also notes:

In addition to the interest rate rule, we also estimate the money supply rule introduced by McCallum (1988). The McCallum rule is defined in nominal terms. McCallum, 1988, McCallum, 2000 suggests that the central bank should react to nominal output growth deviations from the target rate. This way, the policy would not be biased in the short run to errors arising when separating the realized nominal output growth into real growth and inflation. We follow McCallum, 1988, McCallum, 2000, and use base money growth as a policy instrument, because it is the monetary aggregate the central bank has full control over. The estimated McCallum rule is also formulated to consider the possible policy reactions to exchange rate and oil price changes, as well as to account for policy smoothing.

Now I really doubt little Stevie has no clue who McCallum even was.

If a central bank, including the Russian central bank, targets inflation at any level, then there has to be some model of causal linkage. I think most banks use some variant of the Taylor Rule, as do P&P above. That includes the Balanced Approach, which is materially identical to the Taylor Rule in this case.

My sense is that the Russian central bank is professionally managed, and its leadership is well aware of the Taylor Rule and some variants. The literature supports this view. Iikka Korhonen and Riikka Nuutilainen write in the Russian Journal of Economics (2017) that a “variant of the Taylor rule depicts Bank of Russia’s monetary policy over the past decade well.”

Russia’s pre-war inflation target was 4%, which would imply a real rate less than that, say, 2%. We do not know Russia’s real target rate today, which could be a function of balancing the public’s tolerance for inflation with the need to print money to fund the war.

If I put I the numbers into my particular version of the Taylor Rule, then a 15% interest rates implies inflation of about 12-14%. If the bank is willing to tolerate higher inflation to fund the war, then the inflation rate could be, say, 15-18%. Both of these estimates are comfortably twice the reported Russian inflation rate of 7% for 2023.

https://rujec.org/article/27999/

https://www.cbr.ru/eng/dkp/#:~:text=Its%20priority%20is%20to%20ensure,that%20is%2C%20sustainably%20low%20inflation.&text=The%20Bank%20of%20Russia%20maintains,policy%20is%20called%20inflation%20targeting.

https://tradingeconomics.com/russia/interest-rate

https://tradingeconomics.com/russia/inflation-cpi

Russia’s central bank is aware of the Taylor rule. Check the 2022-2024 operational plans, available on the bank’s website. If you were actually aware of how the Russian central bank operates, you wouldn’t need to speculate about awareness of the Taylor rule. There are facts out there, if you’d just bother to find them.

Beyond that, you’ve just used a bunch of words to hide the fact that your Idea of backing out a useful inflation figure from a Taylor rule exercise is simply wrong. I’ve explained why it’s wrong. If you can’t comprehend the explanation, you have no place in grown-up discussions. If you’ve understood what I wrote and are trying to bluff your way out of admitting your error, well that’s the Stevie we all know.

Plugging numbers into an equation doesn’t tell you anything, if it’s the wrong equation. This is not “garbage in – garbage out” – it’s “casting seeds on barren ground”. The Taylor rule doesn’t work that way. Run all the numbers you want, it won’t back out a useful inflation rate if the central bank doesn’t use THAT PARTICULAR Taylor rule, and the Russian central bank doesn’t use any Taylor rule, at all, to set policy. The bank says so. The evidence of empirical research says so. You put your foot in your mouth when you suggested otherwise.

You write: “Is there any evidence that Russia’s central bank has followed a Taylor rule during the period of the Ukraine war?”

And then you answer your own question: “Russia’s central bank is aware of the Taylor rule. Check the 2022-2024 operational plans, available on the bank’s website.”

And then: “Run all the numbers you want, it won’t back out a useful inflation rate if the central bank doesn’t use THAT PARTICULAR Taylor rule, and the Russian central bank doesn’t use any Taylor rule, at all, to set policy.”

Well, I presume the Bank of Russia is using some rule. The obvious candidate is some variant of the Taylor Rule. Pretty much any of those will yield an implied inflation rate of 12-14%, perhaps 3-5% higher if the Bank is being particularly accommodative of inflation. But, okay, give us your view of what rule you think the BoR might be using and what it implies about the inflation rate there.

“If I put I the numbers into my particular version of the Taylor Rule, then a 15% interest rates implies inflation of about 12-14%.”

Like I said – you have no clue what the Taylor rule even is. If you think the real natural rate of interest in Russia is only 2%, you have to be the dumbest troll ever. Stop commenting using terms you do not remotely understand.

“But, okay, give us your view of what rule you think the BoR might be using and what it implies about the inflation rate there.”

The Taylor Rule is a model predicting monetary policy not expected inflation. Now the market sets nominal interest rates at the expected inflation rate plus the real interest rate as explained in 1907 by Irving Fisher’s A Theory of Interest.

Yes nominal rates = 15%. Now if one is stupid enough to believe Russian real rates are only 2% then OK expected inflation = 13%. But no sane person would believe real rates are that low. If they are plausibly 8%, then expected inflation = 7%.

It is that simple. But little Stevie is an insane moron so he makes up garbage and pollutes this blog with his insanity. If he does not stop – ban the moron. Damn!

Deficient reading again.

The Taylor Rule is literally written down in the post above.

You think the real interest rate target in Russia is 8%? That’s hilarious. But go ahead, support your assertion with data.

“Steven Kopits

November 9, 2023 at 1:53 pm

Deficient reading again.

The Taylor Rule is literally written down in the post above.”

I read it. I understood it. You do not understand it. Of course we do not understand a damn thing. Stop wasting everyone’s time with your stupid insanity.

Steven Kopits

November 9, 2023 at 2:18 pm

You think the real interest rate target in Russia is 8%? That’s hilarious. But go ahead, support your assertion with data.

I have many times moron. But of course you were too stupid to get my point. It’s not complicated except from a complete moron like you.

I think I’ll go to the park and deal with the dead trees and retarded dogs. both of which are 10 times smarter than you will ever be.

And we thought little Stevie forecasted inflation using the Quantity Theory of Money. Never mind little Stevie never figured out the variability of GDP/Money. What’s the matter Stevie? Don’t you know what is happening to the Russian money supply? And don’t you have some advance mean reverting equation for Russian velocity?

QTM, last I checked, would suggest 20% inflation in Russia.

“Anonymous

November 9, 2023 at 1:54 pm

QTM, last I checked, would suggest 20% inflation in Russia.”

Are you trying to be even more retarded than little Stevie? You do realize that inflation in Russia has been in the single digits of late?

The abstract and a link to the entire paper Krugman noted for the adults here who might be interested in reading it (as we know little Jonny boy will not do so):

LAURENCE BALL – Johns Hopkins University

DANIEL LEIGH – International Monetary Fund

PRACHI MISHRA – International Monetary Fund

Understanding US Inflation during the COVID-19 Era

https://www.brookings.edu/wp-content/uploads/2022/09/BPEA-FA22_WEB_Ball_Leigh_Mishra_updated.pdf

This paper analyzes the dramatic rise in US inflation since 2020,

which we decompose into a rise in core inflation as measured by the weighted

median inflation rate and deviations of headline inflation from core. We explain

the rise in core inflation with two factors: the tightening of the labor market as

captured by the ratio of job vacancies to unemployment, and the pass-through

into core inflation from past shocks to headline inflation. The headline shocks

themselves are explained largely by increases in energy prices and by supply

chain problems as captured by backlogs of orders for goods and services.

Looking forward, we simulate the future path of inflation for alternative paths

of the unemployment rate, focusing on the projections of Federal Reserve

policymakers in which unemployment rises only modestly to 4.4 percent. We

find that this unemployment path returns inflation to near the Federal Reserve’s

target only under optimistic assumptions about both inflation expectations and

the Beveridge curve relating the unemployment and vacancy rates. Under less

benign assumptions about these factors, the inflation rate remains well above

target unless unemployment rises by more than the Federal Reserve projects

Recommended reading:

America’s Real China Problem

Daron Acemoglu and Simon Johnson

https://www.project-syndicate.org/commentary/us-china-problem-economic-institutions-implications-for-stability-american-interests-by-daron-acemoglu-and-simon-johnson-2023-11

The title is not enlightening about the article’s substance. The gist is that China has had a comparative labor advantage because of a domestic power imbalance – workers are maltreatment, cheated, endangered and bullied as a way to keep labor costs down. U.S. firms take advantage of this imbalance, as well as of tax arbitrage, increasing profits by shipping jobs overseas. This, the authors assert, is not what Ricardo meant by “comparative advantage”.

The first assertion is not new. It is very much like Summers’ point about emerging economies exporting environmental quality to developed economies, which is in fact one of China’s comparative advantages. Whether Ricardo was unaware of labor abuses in his own time, I do not know, but it seems unlikely.

Which is not to say the article is in any way bad. Rather, the article is a reorganization of existing knowledge of the world to make a point. It’s a good point.

“The answer, in each case, involves institutions. Who has secure property rights and protections before the law, and whose human rights can or cannot be trampled? The reason the US South supplied cotton to the world in the 1800s was not merely that it had good agricultural conditions and “cheap labor.” It was slavery that conferred a comparative advantage to the South. But this arrangement had dire implications. Southern slaveowners gained so much power that they could trigger the deadliest conflict of the early modern era, the US Civil War.”

Dani Rodrik would be impressed as they are paying tribute to his Economists Rules – which is a must read. Thanks for this insightful discussion.

To be in the court room right now:

https://www.newsweek.com/ivanka-trump-carved-during-testimony-former-trump-biographer-1841852

Ivanka Trump is likely to be “cornered and carved up” by the New York Attorney General’s lawyers during her appearance in court for her father’s fraud trial on Wednesday, Donald Trump biographer Tim O’Brien said.

Following the testimonies of her brothers Donald Jr. and Eric Trump last week, Ivanka Trump is expected to take the stand on Wednesday in a case that sees her father Donald Trump and his organization accused of scheming to inflate the value of his assets. This was to secure financial benefits including more favorable loan and insurance policy terms.

Ivanka is unindictable for her activities as an officer of the Trump organization due to the statute of limitations. Her brothers remain indictable. All three are subject to perjury laws. Ivanka’s Incentives are different than her brothers’, probably simpler.

True but she is doing the “I do not recall” act. Hopefully the prosecutors do hammer daddy’s girl hard.

No really, Ivanka had to leave the room right before all the important businesss was discussed because “Daddy” was doing his “Grab’em by the p*ssy” jokes.

…….. She’d heard them all before sitting on Daddy’s lap and felt bored. Plus Jared is much more crude and Daddy’s p*ssy jokes just don’t have the punch they did when she was 9.

Remember when Trump was on Howard Stern lusting after Ivanka’s rear end. I bet if he ever raped his own daughter – the Dobbs restrictions on abortions would not apply to the Trump family.

“Compensate the Losers?” Economic Policy and Partisan Realignment in the US

Ilyana Kuziemko, Nicolas Longuet Marx & Suresh Naidu

October 2023

https://econbrowser.com/archives/2023/11/guest-contribution-the-fed-approaches-the-end-of-the-rate-hiking-cycle#comments

We argue that the Democratic Party’s evolution on economic policy helps explain partisan realignment by education. We show that less-educated Americans differentially demand “predistribution” policies (e.g., a federal jobs guarantee, higher minimum wages, protectionism, and stronger unions), while more-educated Americans differentially favor redistribution (taxes and transfers). This educational gradient in policy preferences has been largely unchanged since the 1940s. We then show the Democrats’ supply of predistribution has declined since the 1970s. We tie this decline to the rise of a self-described “New Democrat” party faction who court more educated voters and are explicitly skeptical of predistribution. Consistent with this faction’s growing influence, we document the significant growth of donations from highly educated donors, especially from out-of-district donors, who play an increasingly important role in Democratic (especially “New Democrat”) primary campaigns relative to Republican primaries. In response to these within-party changes in power, less-educated Americans began to leave the Democratic Party in the 1970s, after decades of serving as the party’s base. Roughly half of the total shift can be explained by their changing views of the parties’ economic policies. We also show that in the crucial transition period of the 1970s and 1980s, New Democrat-aligned candidates draw disproportionately from more-educated voters in both survey questions and actual Congressional elections.

Opposition to “predistribution” sounds a little like indifference to distribution. Only if redistribution works at least as well as predistribution in flattening distribution is it good for the less fortunate – ignoring growth implications, but we’ll get to that.

Redistribution, at least by dictionary definition, allows for the possibility of upward distribution and of reduced economic efficiency. The period of reduced predistribution has famously involved an upward distribution of wealth and income. That same period has also involved a trend slowing in economic growth and in total factor productivity:

https://fred.stlouisfed.org/graph/?g=1b8lD

We’re talking about a shift from “New Deal” Democrats to “Democratic Leadership Council” Democrats. From Kennedy to Clinton.

Ivanka is testifying by claiming she does not recall certain things where she was a clear player. Like father, like daughter. Lie on the stand! This news is making me wonder why the shareholders of Deutsche Bank are not suing management.

https://abcnews.go.com/US/live-updates/trump-fraud-trial/deutsche-bank-supported-trumps-loans-presidency-say-reports-103927575?id=103642561

Deutsche Bank’s internal credit reports related to Donald Trump’s loans offered a positive — at times glowing — assessment of his assets, evidence presented in court showed. “The general conclusion is that the hotel will become the most elite hospitality establishment in Washington, DC, once stabilized,” a report said about the Trump International Hotel in Washington, D.C., for which Deutsche Bank financed over $100 in debt. That same report suggested that the “highest levels” of Deutsche Bank’s management supported the bank’s relationship with Trump as he began to campaign for president, defense attorney Jesus Suarez told the court. “Relationship has been reviewed and supported from a Management Board perspective in connection with the Guarantor’s candidacy for president of the United States,” Deutsche Bank’s 2016 credit report said. Deutsche Bank executive Nicholas Haigh testified that the bank’s “own analysis” supported approving Trump’s loans, despite that analysis often suggesting that Trump’s reported asset valuations were off by hundreds of millions of dollars.

It seems the bank loaned to Trump at very low interest rates because Trump personally guaranteed the loans and the bank wanted to make sure Trump has at least $2.5 billion in asset value so his guarantee meant something. Of course if his assets were worth only $1 billion – this fraud cost the bank as it would have charge Trump higher interest rates. But it seems upper management may have been in on this fraud.

Gotta love how two faced Trump is (Kentucky edition):

https://www.msn.com/en-us/news/politics/trump-throws-daniel-cameron-under-the-bus-after-loss-in-kentucky-couldn-t-lose-the-stench-of-mitch-mcconnell/ar-AA1jBGvD

Donald Trump threw Daniel Cameron, the GOP’s candidate for governor in Kentucky, under the bus less than 24 hours after he lost and just days after the former president praised him for proving that he wasn’t a disciple of Senate Minority Leader Mitch McConnell (R-KY).

“Daniel Cameron lost because he couldn’t alleviate the stench of Mitch McConnell. I told him early that’s a big burden to overcome,” declared Trump on Truth Social Wednesday morning. “McConnell and [Mitt] Romney are Kryptonite for Republican Candidates. I moved him up 25 Points, but the McConnell relationship was ‘too much to bear.’ Tate Reeves, on the other hand, surged to a win for Governor in Mississippi after my involvement. Congratulations to Tate!”

Trump’s lamentation of Cameron’s relationship with McConnell was a far cry from what he had to say about the candidate prior to his loss to incumbent Democrat Andy Beshear.

“Wow, Daniel Cameron of Kentucky has made a huge surge, now that they see my strong Endorsement, and the fact that he’s not really ;a McConnell guy,’” argued Trump on Saturday. “They only try to label him that because he comes from the Great State of Kentucky. Anyway, Go Daniel, great future for you and your State—You will bring it to new levels of success, and I will help you!”

The East Indian guy embarrassed himself tonight for donald trump. I keep wondering how they are going to explain this to their grandkids, or anyone really, 20 years from now when trump is just another Joe McCarthy Judas to his own nation.

I choose once again to watch the clown show. Did Nikki Lightweight and Uncle Tom Scott really get into a debate over the size of her stupid heels?

I know this— Tom Scott is more an optimist about SECTIONS of America than I am, because he thought he would become President as a Black man??? Or was Tom Scott PURELY going for book sales like the East Indian guy is reaching for donald trump VP?? It’s really hard not to think the worst of people, because they keep proving me right.

Scott thinks he is clever with the word smithing. That 15 week abortion ban is not a ban after all. It is a 15 week abortion limit. And these clowns do not understand the recent elections in places like Kentucky and Ohio.