Lavorgna (SMBC Nikko) and Millar (Barclays) say look to GDI for a better estimate of economic activity. Both argue that GDI might better signal an incipient recession (USAToday):

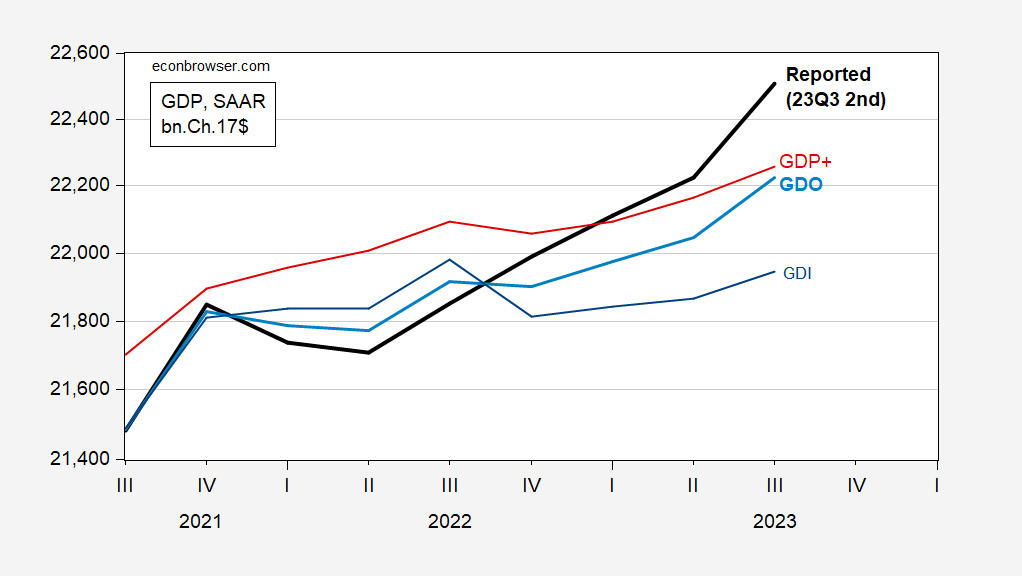

Figure 1: GDP (bold black), GDO (bold light blue), GDP+ (red), GDI (blue), all in bn.Ch.2017$ SAAR. GDP+ level uses GDP+ growth rates iterated on 2019Q4 GDP. Source: BEA 2023Q3 2nd release, Philadelphia Fed, and author’s calculations.

GDI is indeed far below GDP (Zerohedge asserts that GDP will be revised down toward GDI). It’s true that GDI has shrunk by 0.2% y/y; on the other hand, q/q annualized growth was +1.5%. In any case, My reading of the CEA (2015) and Nalewaik and Braun (BPEA, 2011), is that GDO — the arithmetic average of GDP and GDI — is a more accurate measure of final GDP, with GDP reverting more to GDO than otherwise. GDO growth is indeed more modest than GDP growth (3.3% vs. 5.2%, q/q SAAR).

GDP+, published by the Philadelphia Fed, incorporates information regarding the revisions to obtain a more precise estimate of final GDP. One problem with comparing this series is that only growth rates are provided. I iterate the GDP+ growth rates on the 2019Q4 level of GDP (when GDP and GDO matched). The implied level of GDP+ is close to the same level as GDO in 2023Q3, but with yet again more modest growth.

As Jacobs et al. (JBES, 2022) point out (see Jim’s post on GDP++), the statistical approach used in GDP+ makes the latent factor estimate of GDP less volatile than the observed. GDP++ does not incorporate this requirement. In the 2021Q3-22Q2 period, GDP++ growth matches GDO.

From my standpoint, I’d put more weight on GDO than on strictly GDI (or GDP, for that matter). That would imply economic activity is 1.25% lower than indicated by the expenditure side measure (GDP).

“ corporate profits jumped in the most recent quarter, although they had been expected to decline. Corporate profits exceeded labor costs in the most recent quarter as part of inflation for the first time in 18 months, according to Mike Konczal, director of macroeconomic analysis at the Roosevelt Institute, a center-left think tank. In the most recent quarter, corporate profits accounted for slightly more than 15 percent of national income, representing a substantial increase from last year, when corporations earned close to $3 trillion in profit.”

https://www.washingtonpost.com/business/2023/12/01/biden-price-gouging-inflation/

Unlike folks here, Biden recognizes the problem! (Though it might amount to nothing more than election year posturing.)

Once again little Jonny boy forgot to mention why GDI fell a while back – a drop in his precious corporate profits. We can always count on little Jonny boy of getting basic facts wrong.

Once again Peppa Pgly forgot to mention that corporate profit margins fell a while back… a little bit to near record highs.” Peppa Pgly never tires of telling us how dreadful results have been for Corporate America…always the coporate shill.

Peppa Pgly? Boy – when you utterly fail to make a point and get caught with your lying little panties around your ankles, you do come up with the most juvenile attempts at insults.

Look Jonny boy – we get that the adults are mean to you. But look in the mirror and see why. You are STOOPID beyond compare, you are a pathetic little liar, and you have no clue how to have an honest informed discussion. So do us all a favor of shut the EFF UP.

Profits added more to inflation than labor costs in Q3? Well, for one thing, as I’ve pointed out before, math and causality aren’t necessarily the same thing. But in Q3, profits actually rose less than labor compensation in dollar terms:

https://fred.stlouisfed.org/graph/?g=1cfsr

Don’t know why Konczal thinks otherwise, but the last time the dollar value of profits rose more than the dollar value of labor compensation was in Q2 of 2022.

It also not clear why Johnny wandered into raising the possibility that Biden is “posturing”, except, Oh Yeah!, Johhny pretends to be a friend to liberal causes but only ever criticizes Democrats. Never Republicans and never, but NEVER Puttin.

Funny how commenters like Ducky lament the lack of increased growth of profits, already at near record highs, but never complain about the stagnation of real wages and how boosting wages would also boost GDI. Of course, we already knew the Ducky and Preppa Pigly are closely aligned with the interests of Big Money,

Johnny lying g agai ,and obviously so. I corrected an error, one Johnny was relying on and didn’t bother to check. I lament nothing!

Let me repeat for lying Jonny’s sake. Since 2022Q2 real compensation has risen by 3.4% while real profits have fallen by 6.75%. I noted that earlier and of course little lying Jonny boy just ignored these fact4s.

“But in Q3, profits actually rose less than labor compensation in dollar terms:”

Let’s see – profits FELL in 2022Q3 and 2022Q4 and rose by a wee bit since. Compensation has risen each quarter over this period. Even Mr. Magoo can see that. But not lying little Jonny boy.

“in Q3, profits actually rose less than labor compensation in dollar terms”

No let’s do this in percentage terms after adjusting for inflation over the period from 2022QII to 2023III. Start off with the fact that the GDP deflator has increased by 4.38% over this period.

Nominal compensation may have increased by 7.93% but in real terms the rise was 3.4%. Not bad and not an explanation for weak real GDI growth.

But take profits which FELL in nominal terms by 2.66%. Oh wait that means real profits fell by 6.75%.

Now little Jonny boy will never admit these facts. You see little Jonny boy is both a serial liar and the dumbest troll God ever created.

“corporate profits accounted for slightly more than 15 percent of national income”

And some MORON names JohnH told us that the figure was 8.5%. Yea – little Jonny boy is that stupid.

BTW corporate profits were way down in late 2022 so it is no surprise they recovered a wee bit.

New Deal Democrat and I have discussed this issue in comments. As he noted, the weakness of real GDI in recent quarters is mostly due to weakness of profits. Here’s a picture of GDI, GDI minus corporate profits, employee compensation and corporate profits (all in nominal terms because I’m lazy):

https://fred.stlouisfed.org/graph/?g=1cet8

More later, ’cause I have other things to do, but two questions seem obvious:

Would the NBER committee call a recession merely because profits, which are quite volatile, have weakened?

As are forecasting tool, are profits of much use?

The anser to the first question is an easy one. The second question is more worrying.

Always disaggregate.

“the weakness of real GDI in recent quarters is mostly due to weakness of profits. Here’s a picture of GDI, GDI minus corporate profits, employee compensation and corporate profits”

Basic facts our little Jonny boy once again just ignored.

So, a crude, non-econometric look at corporate profits does not indicate much value for the series as a leading indicator of recession:

https://fred.stlouisfed.org/graph/?g=1cfuD

Instead, there is a clear pattern of sharp declines during recessions, but also some pretty sharp declines midway through business cycles. Too many false positives to be useful. Too noisy to be useful.

So we have an explanation for the recent weakness of real GDI – profits growth has been weak – but no indication (that I can detect by looking) that profitsare a useful leading indicator of recession.

So I’m gonna have to give Livorgna and Millar a pass. They should have looked deeper.

Since 1990 profit margins have declined during recessions and then rebounded to levels higher than before the recession. If the trend holds, they will rebound after the next recession to 20% plus, In the 2010s margins were around 11%. After the pandemic they rose to 16%.

https://fred.stlouisfed.org/series/A466RD3Q052SBEA

But this still isn’t as high as pgl once indicated he wanted–24%. Perhaps it will get there by 2030…after just

2 recessions.

“But this still isn’t as high as pgl once indicated he wanted–24%.”

More blatant lies about what I said. Oh wait real profits have fallen by 6.75% in the last 5 quarters. Yea – every bit of your stupid comment was a lie. Per usual.

“Since 1990 profit margins have declined during recessions and then rebounded to levels higher than before the recession.”

Gee whiz your writing sucks. Yes profits are procyclical which has been true well before the 1990 recession. But of course little Jonny boy could not be expected to know what was going on say 60 years ago as little Jonny boy has to take off his shoes to count past 10.

Now if little Jonny boy thinks we had an upward drift in profit margins for over 30 years, we have not. Yea since Bush43 took over maybe but word has it that little Jonny boy voted for Bush43.

Gee this ratio was 16.7% as of 2022Q3 but by 2023Q1 had retreated to only 15.6%. Everyone noticed except some dumbass named JohnH who still has not noticed that his own damn link clearly shows this decline.

Yea – little Jonny boy is THAT DAMN STUPID.

“the weakness of real GDI in recent quarters is mostly due to weakness of profits.”

Reported profits that is. I wonder if some of the actual profits from US sourced activity has ended up in tax havens via aggressive transfer pricing. We need a measure of national income rather than domestic income that can pick up such things.

We also need a windfall profits tax, something that I have yet to see pgly or Ducky advocate.

I mean, if the Tories can do it, why can’t the Dims?

“The British government said it would use a windfall profits tax on oil and gas companies to help raise funds for direct payments to households, totaling about 15 billion pounds (about $19 billion), to ease the country’s cost-of-living crisis.” https://www.nytimes.com/2022/05/26/business/uk-oil-company-profits-tax.html

What a concept…taxing greedy corporations to ease the cost-of-living crisis. And in a recession, it could raise money for fiscal stimulus!

You haven’t demonstrated why a windfall profits tax is superior to a site tax on profits. I pointed this out and you ignored it. Like he does.

Windfall is in the eye of the beholder. Profit is an accounting measure. All taxes are distotionate, but that’s OK. Windfall profit tax is more distortions. No need.

Now I have long applauded high taxes on oil but Jonny boy says I never have.

Memo to host – CoRev was banned for less than the serial BS from little lying Jonny boy.

“We also need a windfall profits tax, something that I have yet to see pgly or Ducky advocate. I mean, if the Tories can do it”

I just noted I have long advocated such a tax. 40% in the UK, 40% for a long time in Australia, 55% in the UAE and 78% in Norway.

I noted this recently and of course my lying mentally retarded stalker forgot to mention that. Come on Jonny boy – you are one retarded little liar.

Well, Costco was full today. Consumers seem comfortable spending right now. But lot of bargain shopping, too. Just bought 8 dozen Srixon Q-Star Tour balls for $108. Mint condition from Lost Golf Balls. Even if a few have slight marks, doesn’t affect my level of play which varies from GOLF to FLOG. Better than $35/dozen at Dick’s Sporting Goods. By the way, Costco vodka rated pretty highly; bargain sized bottle. https://www.nytimes.com/wirecutter/reviews/best-vodka/

Merry Christmas.

Yea – little Brucie boy loves the cheap vodka!

Happy Kwanza, Merry Festivus.

Remember, you don’t have to spend the most to get the best. But go ahead if it makes your day.

if your skill as a golfer allows you too utilize a lake soaked golf ball, by all means save the money and do so. and if you have anything other than a used 10 year old set of clubs, wasted money as well.

Happy Kwanza from our resident member of the KKK? Hey Brucie – you are not fooling anyone.

Did you happen to notice who was doing the shopping–people from the affluent 20% who are driving spending…or people from the bottom 70%, whose spending has increased more slowly.

Another application for a tax increase…suck some spending power from affluent folks to speed disinflation!

did the affluent suddenly decide to consume more eggs and drive up their prices? not sure you can show that the wealthy are the ones driving up inflation. it mostly shows you simply have a jealous bone against those that have earned more than you, Johnny. I did notice that walmart is packed as well.

Answered my own question: “Since then(1993), the company (Costco) targeted relatively affluent and college-educated customers,” the very folks who have increased their expenditures the fastest, both in absolute and in percentage terms. https://www.investopedia.com/articles/insights/061516/whats-average-costco-consumer-cost.asp

I won’t bore you with links, since Tricky Ducky and Peppa Pgly will accuse me of lying, no matter how robust the evidence I have.

I don’t know what “evidence” you are providing Johnny. Costco is not recently busy. it has ALWAYS been busy. it is a well run company with a terrific business model. you have not provided any “robust” evidence of anything Johnny. what you have pointed out is that wealthier folks still like to purchase quality merchandise at a discount. wow! what an insight Johnny. you deserve the Nobel in economics for this piece of original work.

Thank you for responding to my mentally retarded stalker as I have grown bored reading his BS.

And we thought giving the 1/6 tapes to Tucker Carlson was a bad idea!

https://www.msn.com/en-us/news/us/pathetic-pandering-experts-astonished-by-mike-johnson-running-cover-for-j6-rioters/ar-AA1l2Riy?ocid=msedgdhp&pc=U531&cvid=ff10bc20572443b1adb69dd6a371eddb&ei=18

House Speaker Mike Johnson (R-LA) raised eyebrows Tuesday by saying he intended to obscure the identities of U.S. Capitol rioters when he orders the release of more security footage from the attack. The Louisiana Republican emphasized that more batches of the videos were coming, but he said the rioters’ faces would be blurred to prevent them from being identified. “As you know, we have to blur some of the faces of persons who participated in the events of that day because we don’t want them to be retaliated against and to be charged by the DOJ,” Johnson said.

We certainly don’t want criminals to be identified and charged with their crime – the new GOP. A fairly big number of these insurrectionists have been identified by private citizen groups, that then handed the information over to FBI. So the excuse that the police can always request the unblurred tapes, is not going to undo the fact that the house GOP leader is playing politics with criminal justice to protect criminals among his supporters. Just like Tucker Carlson who sanitized the tapes of any and all violence to dupe the morons that follow him into thinking they were just tourist and the inured officers had just accidentally slipped.

we have stooopid commenters on this sight like covid, bruce, rick, econned, Johnny, etc that actually believe the insurrectionists were just peaceful visitors to the capital that day. it is why the threat to democracy is real today from the maga crowd. I used to believe this kind of stuff only happened in the banana republics. I was naive to believe it could not happen in the usa. you can’t fix stooopid. but you can throw it in jail.

Some encouraging news on climate change

https://www.bbc.com/news/science-environment-67544977

We are slowing hydrocarbon use and increasing alternative energy use at a faster rate than expected. Some countries will within 1-3 years find that purchase of electric mid size cars will be cheeper than the equivalent cars with ICE drivetrain. The drastically reduced fuel and repair cost will then make the EV purchase the only sensible choice. The good news on methane is that since it only remains in the air for about a decade, reductions in its release would have fairly quick effects on the total greenhouse gas burden. Yes its going to be hard – but there may be a path to avoid a climate disaster for our children and grand children.

“Tomorrow morning years of politically-motivated upward drift in US economic “data” will get their come to Jesus moment of gravitational reacquaintance”

You know – Tyler Durden is almost as pathetic as JohnH writing this kind of trash.

That is indeed the Faux news approach – if you don’t like reality, distort, deny, dismiss.

Remaining delusional is so much easier that way. When the predicted “come to Jesus moment” doesn’t appear as predicted, you can just go back to the old DDD. Your narratives are forever safe, even if your investments go down the drain.

Yes Virginia this is indeed fascism and they have a plan ready for it:

https://www.nytimes.com/2023/12/05/us/politics/trump-kash-patel-journalists.html

“Donald Trump, who has already promised to use the Justice Department to “go after” his political adversaries, is expected to install Mr. Patel in a senior role if he returns to power”

And what does this good man Kash Patel have to say?

“We will go out and find the conspirators, not just in government but in the media,” Mr. Patel said. “Yes, we’re going to come after the people in the media who lied about American citizens, who helped Joe Biden rig presidential elections — we’re going to come after you. Whether it’s criminally or civilly, we’ll figure that out.” He added: “We’re actually going to use the Constitution to prosecute them for crimes they said we have always been guilty of but never have.”

It’s just one paper, but it finds that solar energy has reached a tiiping point and is likely to become the dominant source of electricity, even without additional poicy support. Glad to hear it, but how much CO2 will be released along the way? How many degrees of further warming will occur? Additional policy support seems like a really good idea to me.

https://www.nature.com/articles/s41467-023-41971-7

We are even at a point where smart countries will compete for switching over to solar the fastest. Solar can soon produce energy at half the price. Since many industries use a lot of energy, the country that use more solar can offer energy at the lowest price, making them more competitive. I would not be surprised to see industrial energy users build their own solar farms on roofs, over parking lots and on available adjacent land. Solar is perfect if your business is producing only during day hours.

Simon Johnson is not a “neocon” by any reasonable definition of the term. Jihnson says it’s time for Western firms to leave China:

https://www.project-syndicate.org/commentary/american-firms-should-leave-china-by-simon-johnson-et-al-2023-12

Heck of a statement. His argument is as much geopolitical as economic.Opening western economies to China was meant to move China in out direction. The result has been more in the other direction. That seems right. Unintended consequence will always arise, good or bad is hard to know.

Let’s help Kevin Drum out:

https://jabberwocking.com/economic-growth-last-quarter-was-probably-a-fairly-ordinary-3-or-so/

“Why does it take a month longer to release GDI than GDP? Does anyone know? Anyway, GDI is Gross Domestic Income, and it’s an alternate way of calculating economic output. In theory, GDI and GDP should be identical, but thanks to measurement issues they’re usually a little different. Lately, though, they’ve been way different, and they were way different once again in Q3”

The adult readers of this blog know it takes more time to report profits. The adult readers of this blog also know it was thd drop in measured profits that caused GDI growth to lag GDP growth.

Which is to say that lying morons like JohnH need not help out a smart blogger like Kevin Drum.